Abstract

We analyse the drivers of total factor productivity of Spanish banks from early 2000, including the last financial crisis and the post-crisis period. This allows us to study changes in productivity following a major restructuring process in the banking sector such as the one experienced in Spain. Overall, we find that following a period of continued growth, productivity declined after the height of the crisis, though large banks were less affected. We also find that risk, capital levels, competition and input prices were important drivers of the differences in productivity change between banks. Finally, our results suggest that, by the end of our sample period, there was still some room for potential improvements in productivity via exploiting scale economies and enhancing cost efficiency. These opportunities appear to be generally greater for the smaller banks in our sample.

Similar content being viewed by others

Notes

This effect on bank efficiency after merger and acquisition processes was also recently identified in Colombian banks by Galán et al. (2015).

When compared to other banking sectors, Spanish banks’ productivity has been found to be relatively lower. Pastor et al. (1997) use a nonparametric approach to compute the differences in productivity between banking sectors of different countries. They conclude that the relatively poor performance of Spanish banks is a consequence of their high capitalization, possibly as a prudent response to a high risk economic national environment.

A discussion on the advantages of a translog functional form in the estimation of scale economies in banking is presented in Berger and Humphrey (1992).

This includes ordinary shares, retained earnings, preferred stocks, undisclosed reserves, asset revaluation reserves, general provisions, general loan loss reserves, debt/equity capital instruments and subordinated term debt.

This variable is equal to 1 for saving banks and 0 otherwise.

The delta method of convergence of transformed random variables is used to assess the significance of the derivatives.

Demsetz and Strahan (1997) also find evidence of risk-decreasing diversification in US bank holding companies using an assets pricing model.

In particular, the authors find large banks benefit more from taking higher credit and market risk.

Banks are classified into small and large banks based on their total assets, where small banks are those below the 25th percentile, medium banks are those between the 25th and the 75th percentile, and large banks are those above the 75th percentile. This classification for large banks coincides with the banks identified as O-SIIs (Other Systemic Important Institutions) in 2017 by Banco de España (BdE 2016) plus Banesto during the period 2000–2008.

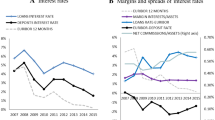

Mortgage securitisation in Spain between 2000 and 2007 grew at annual rates greater than 40% on average (BdE 2017c).

As an example, based on information by the National Union of Credit Cooperatives (UNACC), in Spain commercial and saving banks employ 8 workers per €100 million of assets while this proportion rises to 12 in cooperative banks.

In Figure A1 it is observed that banks transferring bad assets to SAREB experienced an earlier reduction of risk and consequently an earlier recovery of TFP than other banks.

References

Aigner D, Lovell CAK, Schmidt P (1977) Formulation and estimation of stochastic frontier production models. J Econ 6:21–37

Allen L, Rai A (1996) Operational Efficiency in Banking: An Intemational Comparison. J Bank Financ 20:655–672

Amel D, Barnes C, Panetta F, Salleo C (2004) Consolidations and efficiency in the financial sector: A review of the international evidence. J Bank Financ 28:2493–2519

Altunbas Y, Molyneux P (1996) Economies of scale and scope in European banking. Appl Financ Econ 6:367–375

Banco de España (BdE) (2016) Banco de España designates the systemically important institutions in 2017 and sets their capital buffers. Press release 7 November 2016. Banco de España, Madrid

Banco de España (BdE) (2017a) Annual Report 2016. Banco de España, Madrid

Banco de España (BdE) (2017b) Financial Stability Report. Banco de España, Madrid

Banco de España (BdE) (2017c) Report on the financial and banking crisis in Spain, 2008–2014. Banco de España, Madrid

Battese G, Coelli T (1992) Frontier production, function, technical efficiency and panel data: With application to paddy farmers in India. J Prod Anal 3:153–169

Bauer PW (1990) Decomposing TFP growth in the presence of cost inefficiency, nonconstant returns to scale, and technological progress. J Prod Anal 1:287–299

Berger AN, Humphrey DB (1991) The dominance of inefficiencies over scale and product mix economies in banking. J Monet Econ 28:117–148

Berger AN, Humphrey DB (1992) Measurement and Efficiency Issues in Commercial Banking. In: Output Measurement in the Service Sectors, edited by Griliches, Z, National Bureau of Economic Research, University of Chicago Press

Berger AN, Humphrey DB (1997) Efficiency of Financial lnstitutions: International Survev and Directions for Future Research. Eur J Oper Res 98(2):175–212

Berger AN, Mester LJ (1997) Inside the Black BOX: What Explains Differences in the Efficiencies of Financial Institutions? J Bank Financ 21(7):895–947

Bertay A, Demirgüç-Kunt A, Huizinga H (2013) Do we need big banks? Evidence on performance, strategy and market discipline. J Financ Intermed 22:532–558

Bos JWB, Koetter M (2011) Handling losses in translog profit models. Appl Econ 43(3):307–312

Casu B, Girardone C (2006) Bank Competition, Concentration and Efficiency in the Single European Market. Manch Sch 74(4):441–468

Cavallo L, Rossi SP (2001) Scale and scope economies in the European banking systems. J Multinatl Financ Manag 11:515–531

Cuesta RA, Orea L (2002) Mergers and technical efficiency in Spanish savings banks: A stochastic distance function approach. J Bank Financ 26:2231–2247

Denny M, Fuss M, Everson C, Waverman L (1981) Estimating the Effects of Diffusion of Technological Innovations in Telecommunications: The Production Structure of Bell Canada. Can J Econ 14:24–43

Demsetz RS, Strahan PE (1997) Diversification, size, and risk at bank holding companies. J Money, Credit, Bank 29:300–313

European Central Bank (ECB) (2017) Financial Stability Review. European Central Bank, Frankfurt am Main

Fiorentino E, De Vicenzo A, Heid F, Karmann A, Koetter M (2009) The effects of privatization and consolidation on bank productivity: comparative evidence from Italy and Germany, Banca D’Italia, Working Paper, n° 722

Galán JE, Veiga H, Wiper MP (2015) Dynamic effects in inefficiency: Evidence from the Colombian banking sector. Eur J Oper Res 240:562–571

Grifell-Tatjéb E, Lovell CAK (1997) The sources of productivity change in Spanish banking. Eur J Oper Res 98(2):364–380

Hughes JP, Lang W, Mester LJ, Moon CG (2000) Recovering risky technologies using the almost ideal demand system: an application to US banking. J Financ Serv Res 18(1):5–27

Hughes JP, Mester LJ, Moon CG (2001) Are scale economies in banking elusive or illusive? Evidence obtained by incorporating capital structure and risk-taking into models of bank production. J Bank Financ 25:2169–2208

Hughes JP, Mester LJ (2013) Who said large banks don’t experience scale economies? Evidence from a risk-return-driven cost function. J Financ Intermed 22:559–585

Humphrey DB (1992) Flow versus stock indicators of banking output: Effects on productivity and scale economy measurement. J Financ Serv Res 6(2):115–135

Humphrey DB (1993) Cost and technical change: effects from bank deregulation. J Prod Anal 5:9–34

Humphrey DB, Pulley LB (1997) Banks' responses to deregulation: Profits, technology and efficiency. J Money Credit Bank 29:73–93

International Labor Office (ILO) (2013) Resilience in a downturn: The power of financial cooperatives. In: International Labour Organization. ILO Publications, Geneva

Jimenez G, Lopez JA, Saurina J (2013) How does competition affect bank risk-taking? J Financ Stab 9:185–195

Kashyap AK, Stein JC, Hanson S (2010). An analysis of the impact of 'substantially heightened' capital requirements on large financial institutions. University of Chicago and Harvard Working Paper

Kovner A, Vickery J, Zhou L (2014) Do big banks have lower operating costs? Federal Reserve Bank of New York Economic Policy Review

Kumbhakar SC, Lozano-Vivas A, Lovell CAK, Iftekhar H (2001) The effects of deregulation on the performance of financial institutions: The case of Spanish saving banks. J Money, Credit, Bank 33(1):101–120

Kumbhakar SC, Lozano-Vivas A (2005) Deregulation and Productivity: the case of Spanish banks. J Regul Econ 27(3):331–351

Laeven L, Ratnovski L, Tong H (2014) Bank Size and Systemic Risk. IMF Staff Discussion Note, International Monetary Fund

Lozano-vivas A (1998) Efficiency and technical change for Spanish banks Efficiency and technical change for Spanish banks. Appl Financ Econ 8:289–300

Lozano-Vivas A, Pasiouras F (2014) Bank Productivity Change and Off-Balance-Sheet Activities Across Different Levels of Economic Development. J Financ Serv Res 46:271–294

Martín-Oliver A, Ruano S, Salas V (2013) Why high productivity growth of banks preceded the financial crisis. J Financ Intermed 22:688–712

Maudos J (1996) Eficiencia, cambio tecnológico y productividad en el sector bancario español: una aproximación de frontera estocástica. Investig Econ XX(3):339–358

Mester LJ (1993) Efficiency in the Savings and Loan Industry. J Bank Financ 17:267–286

Modigliani F, Miller M (1958) The Cost of Capital, Corporation Finance and the Theory of Investment. Am Econ Rev 48:261–297

New Economic Foundation (NEF) (2013) Cooperative banks: international evidence. NEF's stakeholder banks series

Panzar J, Willig R (1977) Economies of Scale in Multi-Output Production. Q J Econ 91(3):481–493

Pastor JM, Pérez F, Quesada J (1997) Efficiency analysis in banking firms: An international comparison. Eur J Oper Res 98:395–407

Salas V, Saurina J (2003) Deregulation, market power and risk behaviour in Spanish banks. Eur Econ Rev 47:1061–1075

Sarmiento M, Galán JE (2017) The influence of risk-taking on bank efficiency: Evidence from Colombia. Emerg Mark Rev 32:52–73

Sealey C, Lindley J (1977) Inputs, outputs and a theory of production and cost at depository financial institutions. J Financ 32:1252–1266

Tabak B, Tecles P (2010) Estimating a Bayesian stochastic frontier for the Indian banking system. Int J Prod Econ 125:96–110

Tortosa-Ausina E (2003) Nontraditional activities and bank efficiency revisited: a distributional analysis for Spanish financial institutions. J Econ Bus 55:371–395

Tortosa-Ausina E, Grifell-Tatjé E, Armero C, Conesa D (2008) Sensitivity Analysis of efficiency and Malmquist productivity índices: an application to Spanish savings banks. Eur J Oper Res 184:1062–1084

Vander Vennet R (2002) Cost and Profit Efficiency of Financial Conglomerates and Universal Banks in Europe. J Money Credit Bank 34(1):254–282

Wheelock DC, Wilson PW (2012) Do large banks have lower costs? New estimates of returns to scale for U.S. banks. J Money Credit Bank 44(1):171–199

Acknowledgements

This paper is the sole responsibility of its authors. The views represented here do not necessarily reflect those of the Bank of Spain or the Eurosystem.

We are grateful to Jesús Saurina and Javier Mencía for their comments and encouragement during earlier phases of this work. We thank the participants of the internal seminar of the Financial Stability Department of Banco de España and the 6th International Conference of the Financial Engineering and Banking Society for the comments received. We specially thank Sonia Ruano for her contributions to a previous document which was the starting point for this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: The probability of distress model

We obtain a composite ex-ante risk measure by means of the estimation of the following conditional logit model:

where, D is a binary variable representing the occurrence of a distress event within a two-year horizon. The occurrence of a distress event is defined as the intervention of a bank, its need of recapitalization with public funds, or capital needs derived from stress tests; x is a vector of bank characteristics and macroeconomic factors including the following variables:

-

i.

total assets, included in logs;

-

ii.

NPLs, measured as the ratio of non-performing loans from governments, credit institutions and other sectors to total loans;

-

iii.

the annual growth rate of the NPL ratio;

-

iv.

liquidity ratio, computed as the ratio of liquid assets to total assets, where liquid assets are defined as cash and balances with central banks and debt securities issued by resident and non-resident governments;

-

v.

solvency ratio, computed as CET1 capital divided by total assets, where CET1 capital includes ordinary shares, noncumulative preferred stock and disclosed reserves;

-

vi.

net interest margin, measured as the ratio of net interest income to earning assets;

-

vii.

the annual real GDP growth rate; and,

-

viii.

the annual growth rate of short-run nominal interest rates.

The probability of distress (pd), used as a composite ex-ante risk measure, is a prediction of the probability of a bank experiencing an event of distress, as defined above, within the following two years. Results of estimations are available upon request.

Appendix 2

Rights and permissions

About this article

Cite this article

Castro, C., Galán, J.E. Drivers of Productivity in the Spanish Banking Sector: Recent Evidence. J Financ Serv Res 55, 115–141 (2019). https://doi.org/10.1007/s10693-019-00312-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-019-00312-w