Abstract

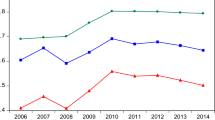

We examine the effects of the 2008 financial crisis on the cross-market efficiency of the Hong Kong and Shanghai stock markets. Our results show a sharp decline in the cross-market efficiency during the financial crisis. We investigate whether this is due to lower internal market efficiency or higher market co-movement. The results show no evidence that the internal market efficiency dropped in Hong Kong or Shanghai during the crisis. In contrast, we document a strong increase in the market co-movement during the crisis. These results suggest that the decline in cross-market efficiency during the financial crisis is due to increased market co-movement and not a decline in internal market efficiency.

Similar content being viewed by others

Notes

The concept of internal market efficiency refers to predicting future price movement based on current market information, while cross-market efficiency relates to predicting future price movement based on current information in another market.

A market is internally efficient if past price movements cannot be used to predict the future price movements, and markets are cross-efficient if the past price movement in one market cannot be used to predict the future price in another market.

An increase in internal market efficiency should make future returns less predictable based on past returns in each market. This implies that for a given co-movement, the investor should be less able to predict future return in one market given past information in the other, making the markets more cross-efficient. However, this relationship became weak during the crisis and changes in internal market efficiency had little impact on cross-market efficiency.

See Darbellay and Wuertz (2000) for a detailed discussion of the use of entropy to measure dependency in time–series.

The normalized entropy ranges between 0 and 1. Without normalization, the entropy is given by:

\(h\left( X \right) =-\sum f_X \left( x \right) \hbox {log}\left( {f_X \left( x \right) } \right) \).

Entropy and mutual information are well established and have been used in other areas such as physics, engineering and mathematics.

While we use the contemporaneous daily returns to construct the mutual information, Hong Kong stock exchange closes at 4:00 p.m. which is an hour after Shanghai exchange is closed (3:00 p.m.). Thus, if the markets are cross efficient, information from the Shanghai exchange cannot be used to predict returns on the Hong Kong exchange after Shanghai closes and, hence, closing returns on Shanghai should not be related to the closing returns on Hong Kong. In contrast, if the two exchanges are cross inefficient, information from the Shanghai exchange can be used to predict returns on the Hong Kong exchange, and the closing returns on the two exchanges will be correlated.

Although it is suggested by many researchers that the mother wavelet of Daubechies with a scale of 4–8 is appropriate for financial time series analysis, in this study, the mother wavelet of Morlet is manipulated since smoothing operators are specially designed for calculating wavelet coherence. The program for calculating squared wavelet coherence is based on the work of Grinsted et al. (2004).

This calculation is based on the work of Peng (2007).

The matlab program of calculating the entropy and the mutual information are based on the work of Peng (2007).

We also define financial crisis from July 1, 2007 to March 31, 2009 and the results are qualitatively similar.

References

Ackert, F., & Tian, S. (2001). Efficiency in index options markets and trading in stock baskets. Journal of Banking and Finance, 25, 1607–1634.

Aslanidis, N., Osborn, D. R., & Sensier, M. (2009). Co-movements between US and UK stock prices: The role of time-varying conditional correlations. International Journal of Finance and Economics, 15, 366–380.

Beine, M., Cosma, A., & Vermeulen, R. (2010). The dark side of global integration: Increasing tail dependence. Journal of Banking & Finance, 34, 184–192.

Bowman, R. G., Chan, K. F., & Comer, M. R. (2010). Diversification, rationality and the Asian economic crisis. Pacific-Basin Journal, 18, 1–23.

Boyer, B. H., Kumagai, T., & Yuan, K. (2006). How do crises spread? Evidence from accessible and inaccessible stock indices. Journal of Finance, 61, 957–1003.

Brissaud, J. (2005). The meanings of entropy. Entropy, 7, 68–96.

Brockman, P., Liebenberg, I., & Schutte, M. (2010). Comovement, information production and the business cycle. Journal of Financial Economics, 97, 107–129.

Brunetti, M., & Torricelli, C. (2007). The internal and cross-market efficiency in index option markets: An investigation of the Italian market. Applied Financial Economics, 17, 25–33.

Chiang, T. C., Tan, L., & Li, H. (2007). Empirical analysis of dynamic correlations of stock returns: Evidence from Chinese A-share and B-share market. Quantitative Finance, 7, 651–667.

Christoffersen, P., Errunza, V., & Langlois, H. (2012). Is the potential for international diversification disappearing? A dynamic copula approach. Review of Financial Studies, 25, 3711–3751.

Darbellay, G. A., & Wuertz, D. (2000). The entropy as a tool for analysing statistical dependencies in financial time series. Physica A, 287, 429–439.

Forbes, K. J., & Rigobon, R. (2002). No contagion, only interdependence: Measuring stock market comovements. Journal of Finance, 57, 2223–2261.

Grinsted, A., Moore, J. C., & Jevrejeva, S. (2004). Cross wavelet and wavelet coherence. http://www.pol.ac.uk/home/research/waveletcoherence/.

Gulko, L. (1999). The entropic market hypothesis. International Journal of Theoretical and Applied Finance, 2, 293–329.

Kühl, M. (2010). Bivariate cointegration of major exchange rates, cross-market efficiency and the introduction of the Euro. Journal of Economics and Business, 62, 1–19.

Peng, H. (2007). Mutual information computation. Retrieved December 2011 from Matlab Central: http://www.mathworks.com/matlabcentral/fileexchange/14888.

Phylaktis, K., & Xia, L. (2009). Equity market comovement and contagion: A sectoral perspective. Financial Management, 38, 381–409.

Rua, A., & Nunes, L. C. (2009). International co-movement of stock market returns: A wavelet analysis. Journal of Empirical Finance, 16, 632–639.

Vipul, (2008). Cross-market efficiency in the Indian derivatives market: A test of put-call parity. Journal of Futures Markets, 28, 889–910.

Author information

Authors and Affiliations

Corresponding author

Appendix A

Appendix A

The wavelet transformation function is described by the following equation:

where \(W\left( {\tau ,a} \right) \) is the wavelet transform, \(f\left( t \right) \) is the inner product of the function, and \(\psi _{\tau ,a} \left( t \right) \) is the analyzing wavelet. The family of wavelet vectors is obtained by translation \(\tau \) and dilatation a:

Energy normalization across the different scales is achieved with the factor\(a^{-1/2}\). A common way to build wavelets of order n is to successively differentiate a smoothing function. A popular family of wavelets uses the Gaussian function:

The advantage of the Gaussian wavelet is that it can be shown that the analyzing wavelet \(\psi \) is the Nth derivative of the Gaussian function, where the order of the differentiation is related to the scale a :

The wavelet transform is a well-adapted tool for studying scaling processes. The wavelet transform of a stochastic process with long-range dependence properties or self-similar processes satisfies the following: the wavelet coefficients at a fixed scale are stationary; the wavelet coefficients have short-range correlation. Therefore, the greater the number of wavelet vanishing moments, the shorter the correlations. Thus, when the number of vanishing moments is large enough, the wavelet coefficients are uncorrelated, and the \(q-\)order moment \(M_q \left( a \right) \) of the wavelet coefficients at scale a reproduces the scaling property of the process.

Rights and permissions

About this article

Cite this article

Asem, E., Baulkaran, V., Yalamova, R. et al. Internal Market Efficiency, Market Co-movement, and Cross-Market Efficiency: The Case of Hong Kong and Shanghai Stock Markets. Asia-Pac Financ Markets 24, 253–267 (2017). https://doi.org/10.1007/s10690-017-9232-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-017-9232-3