Abstract

Carbon pricing systems have emerged in Canada at provincial and federal levels to reduce CO2 emissions. However, cross-border electricity trade with the U.S. is already extensive, and although Canada is currently a net exporter, policy changes could alter these trade dynamics. Since CO2 emissions are currently unregulated in many U.S. states, there is a concern that this incomplete regulatory coverage will lead to emissions leakage, as electric generation and emissions shift toward these unregulated regions. This paper examines potential power sector emissions leakage and distributional implications across provinces from Canadian carbon pricing. Using an integrated model of electric sector investments and operations with detailed spatial and temporal resolutions, the analysis demonstrates how emissions leakage through trade adjustments can be non-trivial fractions of the intended emissions reductions even in the presence of leakage containment measures. Magnitudes of long-run leakage rates from Canadian carbon pricing depend on market and policy assumptions (e.g., natural gas prices, projected load growth, long-run demand elasticities, timing of future U.S. CO2 policy), ranging from 13% (high gas price scenario with border carbon adjustments) to 76% (lower gas price scenario without antileakage measures), which are higher than reported literature values for national policies. When leakage containment measures are implemented, net emissions and leakage rates decrease, but gross emissions in Canada and policy costs increase. Leakage persists in alternate scenarios with constrained transmission expansion, higher natural gas prices, lower load growth, higher price elasticities of demand, and U.S. adoption of carbon pricing, but leakage rates decrease under these conditions.

Similar content being viewed by others

Notes

This article uses “carbon” as shorthand for carbon dioxide (CO2). All prices and emissions values are presented in CO2 terms.

The guiding principle in this selection, following Merrick and Weyant (2019), is to choose an approach that, for the question asked, satisfactorily trades off inclusion of relevant features with avoidance of extraneous detail.

For instance, the 2007 British Columbia Energy Plan lists “electricity self-sufficiency” as a goal in light of broader objectives to decrease emissions through strategies like electrification while ensuring that the province has sufficient capacity to meet its needs (https://www.bchydro.com/content/dam/hydro/medialib/internet/documents/info/pdf/2008_ltap_appendix_b1.pdf).

This stylized scenario assumes that the OBPS applies to all provinces. Note that Alberta has different performance benchmarks in its large-emitter plan that are uniform for all generators, which includes subsidies for zero-emitting resources.

Note that this scenario and the “Tax (Local Gen)” scenario require separate counterfactual “reference” scenarios to evaluate the incremental impact of a Canadian carbon pricing policy (the focus of the analysis) in a true ceteris paribus experiment.

Leakage rates in 2030 are qualitatively similar across scenarios as the 2050 rates. The high leakage rates in 2030 also indicate that leakage is problematic even with anticipated but delayed future U.S. policy, though the absolute leakage magnitudes after 2030 indicate that earlier policy harmonization could lower cumulative emissions.

The higher coal generation before 2030 in the OBPS scenario also leads to higher cumulative SO2 and NOx emissions relative to the tax scenario without antileakage measures.

Note that this figure shows generation differences between the reference and Canadian carbon policy scenarios over time. Time-series data for generation levels under high and low gas price scenarios can be found in “Appendix 4”.

Note that a metric like changes in macroeconomic consumption, for instance, would be a more comprehensive measure of societal economic impacts but requires a computable general equilibrium model to evaluate. Such assessments are left for future work along with distributional impacts of carbon pricing and leakage reduction provisions across households.

References

Babiker M (2005) Climate change policy, market structure, and carbon leakage. J Int Econ 65(2):4214–4245

Bistline J (2019) Turn down for what? The economic value of operational flexibility in electricity markets. IEEE Trans Power Syst 34(1):527–534

Bistline J, Rose S (2018) Social cost of carbon pricing of power sector CO2: accounting for leakage and other social implications of subnational policies. Environ Res Lett 13(1):014027

Bistline J, Young D (2019) Economic drivers of wind and solar penetration in the U.S. Environ Res Lett 14(12):1–11

Bistline J, Comello S, Sahoo A (2018) Managerial flexibility in levelized cost measures: a framework for incorporating uncertainty in energy investment decisions. Energy 151:211–225

Blanford G, Merrick J, Bistline JET, Young D (2018) Simulating annual variation in load, wind, and solar by representative hour selection. Energy J 39(3):183–207

Böhringer C, Balisteri E, Rutherford T (2012a) The role of border carbon adjustment in unilateral climate policy: overview of an energy modeling forum study (EMF 29). Energy Econ 34:S97–S110

Böhringer C, Carbone J, Rutherford T (2012b) Unilateral climate policy design: efficiency and equity implications of alternative instruments to reduce carbon leakage. Energy Econ 34(S2):S208–S217

Böhringer C, Landis F, Reaños T, Angel M (2017) Economic impacts of renewable energy promotion in Germany. Energy J 38:189–209

Borenstein S (2005) The long-run efficiency of real-time electricity pricing. Energy J 26(3):93–116

Caron J, Rausch S, Winchester N (2015) Leakage from sub-national climate policy: the case of California’s cap-and-trade program. Energy J 36:167–190

Chan N, Morrow J (2019) Unintended consequences of cap-and-trade? Evidence from the regional greenhouse gas initiative. Energy Econ 80:411–422

Chen Y (2009) Does a regional greenhouse gas policy make sense? A case study of carbon leakage and emissions spillover. Energy Econ 31:667–675

Cosbey A, Droege S, Fischer C, Munnings C (2019) Developing guidance for implementing border carbon adjustments: lessons, cautions, and research needs from the literature. Rev Environ Econ Policy 13(1):3–22

Craig P, Gadgil A, Koomey J (2002) What can history teach us? A retrospective examination of long-term energy forecasts for the United States. Annu Rev Energy Environ 27:83–118

Curtis J, Di Cosmo V, Deane P (2014) climate policy, interconnection, and carbon leakage: the effect of unilateral UK Policy on electricity and GHG emissions in Ireland. Econ Energy Environ Policy 3(2):145–158

de Cendra J (2006) Can emissions trading schemes be coupled with border tax adjustments? An analysis vis-à-vis WTO Law. Rev Eur Commun Int Environ Law 15:131–145

Droege S (2011) Using border measures to address carbon flows. Clim Policy 11:1191–1201

Eichner T, Pethig R (2015) Unilateral consumption-based carbon taxes and negative leakage. Resour Energy Econ 40:127–142

Environment and Climate Change Canada (2017) Technical paper on the federal carbon pricing backstop. https://www.canada.ca/content/dam/eccc/documents/pdf/20170518-2-en.pdf. Accessed April 2019

EPRI (2018a) U.S. National Electrification Assessment. EPRI, Palo Alto

EPRI (2018b) US-REGEN model documentation. Electric Power Research Institute, Palo Alto

Fell H, Maniloff P (2015) Beneficial leakage: the effect of the regional greenhouse gas initiative on aggregate emissions. Colorado School of Mines Division of Economics and Business Working Paper Series

Fischer C, Fox A (2012) Comparing policies to combat emissions leakage: border carbon adjustments versus rebates. J Environ Econ Manag 64(2):199–216

Fowlie M (2009) Incomplete environmental regulation, imperfect competition, and emissions leakage. Am Econ J Econ Policy 1:72–112

Government of Canada (2018) Pricing carbon pollution for large industry: backgrounder. https://www.canada.ca/en/environment-climate-change/services/climate-change/pricing-pollution-how-it-will-work/output-based-pricing-system/large-industry-backgrounder.html. Accessed 14 March 2019

Hoel M (1991) Global environmental problems: the effects of unilateral actions taken by one country. J Environ Econ Manag 20(1):55–70

Indepedent Electricity System Operator (2018) 2018 Technical planning conference. Indepedent electricity system operator. http://www.ieso.ca/en/Sector-Participants/Planning-and-Forecasting/Technical-Planning-Conference. Accessed April 2019

Kuik O, Hofkes M (2010) Border adjustment for European emissions trading: competitiveness and carbon leakage. Energy Policy 38(4):1741–1748

Mai T, Bistline J, Sun Y, Cole W, Marcy C, Namovicz C, Young D (2018) The role of input assumptions and model structures in projections of variable renewable energy: a multi-model perspective of the U.S. Electricity System. Energy Econ 76:313–324

Merrick J, Weyant J (2019) On choosing the resolution of normative models. Eur J Oper Res 279(2):511–523

National Energy Board (2016) Canada’s energy future 2016: Energy supply and demand projections to 2040. National Energy Board

Ocasio-Cortez et al (2019) Recognizing the duty of the Federal Government to create a green new deal. https://www.congress.gov/116/bills/hres109/BILLS-116hres109ih.pdf. Accessed 17 February 2019

Paul A, Palmer K, Woerman M (2015) Incentives, margins, and cost effectiveness in comprehensive climate policy for the power sector. Clim Change Econ 6(4):1–27

Reed A, Ericson S, Bazilian M, Logan J, Doran K, Nelder C (2019) Interrogating uncertainty in energy forecasts: the case of the shale gas boom. Energy Transit 3:1–11

Rose S et al (2017) The Paris agreement and next steps in limiting global warming. Clim Change 142(1–2):255–270

Santen N, Bistline J, Blanford G, de la Chesnaye F (2017) Systems analysis in electric power sector modeling: a review of the recent literature and capabilities of selected capacity planning tools. EPRI, Palo Alto

Sauma E (2012) The impact of transmission constraints on the emissions leakage under cap-and-trade program. Energy Policy 51:164–171

U.S. Energy Information Administration (2018) Annual energy outlook 2018 with projections to 2050. U.S. Energy Information Administration

Winchester N, Rausch S (2013) A numerical investigation of the potential for negative emissions leakage. Am Econ Rev 103(3):320–325

Young D, Bistline J (2018) The costs and value of renewable portfolio standards in meeting decarbonization goals. Energy Econ 73:337–351

Acknowledgements

The authors would like to thank anonymous reviewers for their helpful feedback and Steve Wan for his research assistance. All errors are our own. The views expressed in this paper are those of the authors and do not necessarily reflect those of EPRI or its members.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Model Description

The electric sector only version of EPRI’s North American Regional Economy, Greenhouse Gas, and Energy (NA-REGEN) model represents detailed capacity planning and dispatch decisions simultaneously with state-based regions (Fig. 1). Each customizable-length time step (often 5-year intervals) includes capacity investment, retrofit, and retirement decisions as well as dispatch for installed capacity over representative intra-annual hours. The intertemporal optimization structure of NA-REGEN determines investment and operational choices through 2050 while representing regional resource endowments, costs, inter-regional transmission, demand, and regulations. This appendix summarizes the main features and assumptions of the model, especially those relating to the experiments in this paper. Additional detail about the NA-REGEN is provided in EPRI (2018a, b).

NA-REGEN provides customizable state or regional resolution, accounting for differences in policy, transmission, and demand. The regional configuration used for this study is shown in Fig. 1. Although the model includes endogenous investments in inter-regional transmission and segment-level electricity trade across regions, NA-REGEN does not represent intra-regional transmission constraints.

Hourly renewable output and resource potentials are based on analysis and data by EPRI, AWS Truepower, and NASA’s MERRA-2 dataset (Blanford et al. 2018; EPRI 2018a, b), which give synchronous time-series values with load. Figure 15 shows Canadian wind speed data on the MERRA-2 grid (0.625° longitude by 0.5° latitude).

Technological cost and performance assumptions come from EPRI’s Integrated Generation Technology Options report with more frequent updates for technologies like solar and wind. Default capital cost assumptions are shown in Fig. 16, and other cost assumptions are detailed in the REGEN documentation (EPRI 2018a, b).

NA-REGEN uses a bottom-up representation of capacity grouped into technology blocks within a region based on heat rates and dispatches these blocks across a range of intra-annual time segments. Joint variation in load, wind, and solar across regions is captured through the selection of so-called “representative hours” using an approach described in Blanford et al. (2018). This novel feature more accurately captures the spatial and temporal variability of power systems, which are critical for evaluating asset investments and operations especially under higher renewable deployment scenarios. Power plant data come from the ABB Velocity and were last updated in June 2018, which includes projects in the development pipeline like variable renewable projects and the Site C Dam in British Columbia. Announced retirements for plants in the U.S. and Canada are also included. REGEN includes a reserve margin constraint, where the sum of firm capacity must be greater than or equal to the peak residual load plus a reserve margin (which is set at 15% by default). Contributions from renewable resources and dispatchable technologies vary by hour and season, and residual load (i.e., grid-supplied load less variable renewable output) is determined endogenously and varies by region, load shape scenario, and levels of wind and solar deployment.

Note that this analysis uses an electric sector only version of the REGEN model, so end-use sectors and their interactions with load shapes are not modeled explicitly. All hourly time-series data, including load and variable renewable resources, come from 2015. Annual load over time is exogenous for most scenarios and is based on values from U.S. Energy Information Administration’s Annual Energy Outlook 2018 (U.S. Energy Information Administration 2018) for U.S. states and the National Energy Board’s Canada’s Energy Future 2016 (National Energy Board 2016) for Canadian provinces.

Appendix 2: Scenario Assumptions

This appendix provides additional detail about scenario assumptions.

Fuel price trajectories come from the U.S. Energy Information Administration’s Annual Energy Outlook 2018 (U.S. Energy Information Administration 2018). Fuel prices are not responsive to changes in demand for these runs, though such feedbacks are possible using the integrated version of NA-REGEN. Delivered gas prices in the model include region-specific adders, which are calibrated to observed 2016 values and assumed to decline over time (Fig. 17).

Transmission between regions can be endogenously added with an assumed cost of $3.85 million per mile for a notional high-voltage line to transfer 6400 MW of capacity. Note how, due to changes in flows across regions (with associated transmission losses) and different levels of new transmission investments, total national generation may vary across scenarios.

The Canadian federal carbon pricing backstop is implemented as a carbon levy on upstream fuels (Environment and Climate Change Canada 2017). For Canadian nuclear units (primarily in Ontario), announced retirement and refurbishment schedules are incorporated into the analysis. All Pickering units retire by 2025, and Bruce units 1 and 2 retire in 2043. Refurbishment schedules are taken from IESO data (Indepedent Electricity System Operator 2018), and refurbished units are assumed to unavailable during these years.

Appendix 3: Emissions Intensity Calculation for Border Carbon Adjustments

Many measures have been proposed to reduce leakage associated with climate policy. The principal measures are border carbon adjustments, where imports from non-regulated (or under-regulated) jurisdictions are taxed at the emissions price of the regulated region (Hoel 1991). Border carbon adjustments are often relied on as tools when production in unregulated regions have higher emissions intensities and when a regulated region is a net exporter (Fell and Maniloff 2015). Other measures to reduce leakage include trade constraints, output-based allocations, and exemptions for trade-exposed industries. The literature suggests that it is difficult to rank order these anti-leakage measures, since their effectiveness is highly context-dependent and depends on considerations like relative emissions rates, elasticities of substitution, and consumption volumes (Fischer and Fox 2012). Border carbon adjustments can be attractive in leakage reduction and cost-effectiveness terms, which comes at the expense of equity considerations (Böhringer et al. 2012b).

As described in Sect. 2.2, the leakage mitigation sensitivity that imposes a border carbon adjustment uses a tariff rate that is dynamically updated over time based on Canadian carbon price and emissions rate from a new NGCC unit. There are many methods and considerations for calculations emissions intensities on imported power, including whether marginal versus average rates are used (the former more accurately represent emissions rates, but the latter are simpler to calculate), dynamic versus static rates (the former adjust over time based on changing conditions, while the latter are easier to calculate), and temporal granularity for assessment (regardless of the method chosen, emissions intensities could be calculated on a sub-hourly basis, hourly basis, or something more aggregated). Different combinations for the above conditions are possible, but most entail tradeoffs between accuracy and administrative simplicity/cost (Cosbey et al. 2019). An additional question is whether to include export subsidies in addition to import tariffs. The border carbon adjustment used here includes only import tariffs given the uncertain legal status of export subsidies under the World Trade Organization’s General Agreement on Tariffs and Trade (GATT) (Cosbey et al. 2019; de Cendra 2006) and due to the fact that the literature indicates measures with import adjustments only capture most of the BCA leakage reduction benefits (Böhringer et al. 2012a; Fischer and Fox 2012).

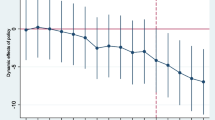

A uniform benchmark based on a new NGCC plant emissions rate is administratively simple and, as suggested by the calculations below, aligns with the marginal emissions intensity of U.S. generation. Table 2 shows changes in U.S. emissions and emissions intensity between the reference case without Canadian carbon pricing and the treatment scenario with Canadian policy. The marginal CO2 intensity of power imports is the ratio of incremental U.S. CO2 emissions to incremental U.S. generation between these two scenarios. Increased exports from the U.S. to Canada are mostly be supported by incremental NGCC output under reference gas prices, as shown in the left panel of Fig. 7. An implicit assumption in this scenario is that U.S. exporters do not adjust the composition of generation to lower emissions liabilities associated with trade to the regulated region as firms might if exposed to the import tariff in the scenario with the border carbon adjustment.

Note that using the NGCC-based benchmark means that the intensity does vary across time (supporting a dynamic adjustment) and is in some cases higher than the NGCC intensity. Figure 7 shows that a portion of Canadian imports in early years are supported by coal and combustion turbine generation in addition to NGCC, which leads to higher intensities in 2020 and 2025. However, increased NGCC output represents the bulk of the response in the near years, and almost all the response in the out years. Thus, using an intensity based on the emissions rate from a new NGCC unit to set the benchmark captures ex-post values well and is considerably easier to administer than a dynamically updated intensity calculated in real time.

Appendix 4: Additional Results

This section provides additional reporting related to the analysis.

Figure 18 shows Canadian generation by technology over time across the five core policy scenarios under high gas price conditions. Relative to the reference gas price scenario (Fig. 3), Canadian NGCC generation falls, while generation from renewables rises.

Figure 19 shows the U.S. generation mix across the five main scenarios assuming reference gas prices. Canada’s CO2 emissions intensity of generation is roughly a third of U.S. values in 2015. New capacity additions over time are dominated by natural gas units (specifically NGCC without carbon capture), wind, and solar. Figure 20 shows the same scenarios with higher gas prices, which leads to higher wind and solar generation.

The main text focuses on cumulative emissions metrics over time. Figures 21 and 22 show CO2 emissions trajectories by scenario for Canada and the sum of Canada and U.S., respectively.

The generation mixes in the U.S. and Canada exhibit considerable variation when a U.S. carbon tax is adopted, as shown in Fig. 23. The middle panel provides a counterfactual scenario (“U.S. Only Tax”) where the U.S. adopts a unilateral carbon tax with the timing and stringency in Fig. 2. Without carbon pricing in Canada, gas and wind generation increase, and the unilateral U.S. policy leads to higher U.S. imports from Canada (5.3% of U.S. energy for load in 2030 and 2.9% in 2050). When a Canadian tax is simultaneously adopted (“U.S./Canada Tax”), U.S. imports drop and emissions increase, while Canadian generation decreases, especially from gas-fired units. These changes lead to lower Canadian emissions but higher U.S. emissions relative to the U.S. unilateral policy scenario. Figure 24 shows cumulative CO2 emissions changes and leakage under cases with and without U.S. federal carbon pricing. The second bar in Fig. 24 compares emissions in the “U.S./Canada Tax” scenario in Fig. 23 with the corresponding counterfactual without a Canadian carbon tax (“U.S. Only Tax” in Fig. 23).

Rights and permissions

About this article

Cite this article

Bistline, J.E.T., Merrick, J. & Niemeyer, V. Estimating Power Sector Leakage Risks and Provincial Impacts of Canadian Carbon Pricing. Environ Resource Econ 76, 91–118 (2020). https://doi.org/10.1007/s10640-020-00421-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-020-00421-4