Abstract

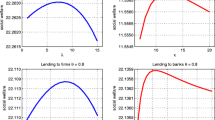

This study extends Hirano and Yanagawa (Rev Econ Stud 84(1):406–443, 2017) to an asymmetric two-country model and examines bubbles effects on each country’s long-run economic growth rate. This study also provides numerical examples with respect to the relationship between each country’s growth rate and their financial frictions in the balanced growth equilibria with bubbles and without bubbles. It shows that foreign bubbles have positive and negative effects on both countries’ growth rates, and which effect dominates depends on the level of financial development in both countries. In this study, the positive effect of bubbles tends to dominate when the total level of financial frictions in both countries is relatively low. When the total effect of bubbles on the growth rate is positive, the burst of foreign bubbles leads to a decrease in the growth rate in both countries. This implies that there is a positive correlation between foreign bubbles and the domestic as well as the foreign country’s growth rate.

Similar content being viewed by others

Notes

A bubble is defined as the actual asset price in excess of its fundamental price. Thus, if a useless asset, whose fundamental price is zero, has a positive price, the asset is said to contain a bubble.

Typical examples of early studies on bubbles are Tirole (1985) and Weil (1987), whom I call the first generation. They show that asset bubbles can exist only when the competitive equilibrium without bubbles is dynamically inefficient. It should be emphasized that in their models the presence of asset bubbles crowd out capital accumulation and thus a collapse of a bubble stimulates investment. This theoretical prediction is evidently inconsistent with recent empirical observations. In contrast, the studies mentioned in the main text, which can be called the second generation, propose models showing a positive relationship between asset prices and investment. The critical difference between the two generations is the nature of the financial market. In models of the first generation, the financial market is assumed to be perfect, while in the models of the second generation the financial market has frictions such as credit constraints of households or investors.

Many studies show that financial frictions have an important role in dynamic macroeconomic modeling following the pioneering works of Kiyotaki and Moore (1997), Bernanke and Gertler (1989) and Matsuyama (2007). Hirano and Yanagawa (2017) also follow this stream. Likewise, an open macroeconomic modeling with financial frictions is widely analyzed (e.g., Sakuragawa and Hamada 2001; Matsuyama 2004; Kikuchi and Stachurski 2009; Ho 2017). The present study is related to this stream.

Concretely speaking, they show that if the degree of financial frictions is higher than a critical level, the positive effect dominates and bubbles stimulate economic growth, which means that a burst of bubbles slows down economic growth.

Of course, because the structure of my model is essentially the same as Hirano et al. (2015) and, Hirano and Yanagawa (2017), bubbles have both negative and positive effects on growth. I restrict my attention to the case in which the positive effect dominates the negative effect because the degree of financial frictions is high.

When H-entrepreneurs are not bounded by borrowing constraints this model is equal to a model without financial frictions and bubbles cannot emerge.

Hirano and Yanagawa (2017) assume risky bubbles.

Of course, the equilibrium where bubbles arise in both counties exists in this model. For example, consider p = pf, in this case, bubbles exist in both countries in the equilibrium.

This result is the same as Hirano and Yanagawa’s (2017) closed economy model.

Of course, when bubbles exert a negative effect, the burst of bubbles leads to an increase in growth rates in both countries in the long run.

References

Aoki, K., Benigno, G., Kiyotaki, N.: Adjusting to capital account liberalization. CEPR Discussion Paper No. 8087. (2010)

Aoki, K., Nakajima, T., Nikolov, K.: Safe asset shortages and asset price bubble. J. Math. Econ. 53, 164–174 (2014)

Aoki, K., Benigno, G., Kiyotaki, N.: Monetary and Financial Policies in Emerging Markets. Mimeo, Tokyo University, London School of Economics, and Princeton University, New York (2016)

Bernanke, B., Gertler, M.: Agency costs, net worth, and business fluctuations. Am. Econ. Rev. 79, 14–31 (1989)

Caballero, J.R., Krishnamurthy, A.: Bubbles and capital flow volatility: causes and risk management. J. Monet. Econ. 53, 35–53 (2006)

Farhi, E., Tirole, J.: Bubbly liquidity. Rev. Econ. Stud. 79, 678–706 (2012)

Hart, O., Moore, J.: A theory of debt based on the inalienability of human capital. Q. J. Econ. 109, 841–879 (1994)

Hirano, T., Inaba, M., Yanagawa, N.: Asset bubbles and bailout. J. Monet. Econ. 76, 71–89 (2015)

Hirano, T., Yanagawa, N.: Asset bubbles, endogenous growth, and financial frictions. Rev. Econ. Stud. 84(1), 406–443 (2017)

Ho, W.-H.: Financial market globalization, nonconvergence and credit cycles. Ann. Finance 13, 153–180 (2017)

Ikeda, D., Phan, T.: Asset bubbles and global imbalances. SSRN 2310811, (2015)

Kiyotaki, N., Moore, J.: Credit cycles. J. Polit. Econ. 105, 211–248 (1997)

Kikuchi, T., Stachurski, J.: Endogenous inequality and fluctuations in a two-country model. J. Econ. Theory 144, 1560–1571 (2009)

Kocherlakota, N.: Bursting bubbles: consequences and cures. Mimeo. University of Minnesota, New York (2009)

Korinek, A., Sandri, D.: Capital controls or macroprudential regulation? J. Int. Econ. 99, 27–42 (2016)

Martin, A., Ventura, J.: Economic growth with bubbles. Am. Econ. Rev. 102, 3033–3058 (2012)

Martin, A., Ventura, J.: The international transmission of credit bubbles: theory and policy. J. Monet. Econ. 76, 37–56 (2015)

Martin, A., Ventura, J.: Managing credit bubbles. J. Eur. Econ. Assoc. 14, 753–789 (2016)

Matsuyama, K.: Financial market globalization, smmetry-breaking and endogenous inequality of nations. Econometrica 72, 853–884 (2004)

Matsuyama, K.: Credit traps and credit cycles. Am. Econ. Rev. 97, 503–516 (2007)

Motohashi, A.: Economic growth with asset bubbles in a small open economy. Theor. Econ. Lett. 6, 942–961 (2016)

Sakuragawa, M., Hamada, K.: Capital flight, north-south lending, and stages of economic development. Int. Econ. Rev. 42, 1–24 (2001)

Tirole, J.: Asset bubbles and overlapping generations. Econometrica 53, 1499–1528 (1985)

Weil, P.: Confidence and the real value of money in an overlapping generations economy. Q. J. Econ. 102, 1–22 (1987)

Author information

Authors and Affiliations

Corresponding author

Additional information

Ryosuke Shimizu: Research Fellow of Japan Society for the Promotion of Science.

I am deeply grateful to Akihisa Shibata. This work was supported by Japan Society for the Promotion of Science KAKENHI Grant No. JP16J10895.

Rights and permissions

About this article

Cite this article

Shimizu, R. Bubbles, growth and imperfection of credit market in a two-country model. Ann Finance 14, 353–377 (2018). https://doi.org/10.1007/s10436-018-0320-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-018-0320-9