Abstract

This study examines the effect of fractional volatility on option prices. To this end, we develop an approximation method for the pricing of European-style contingent claims when volatility follows a fractional Brownian motion. Through extensive numerical experiments, we confirm that the decrease in the smile amplitude under fractional volatility is much slower than that under the standard stochastic volatility model. We also show that the Hurst index under fractional volatility has a crucial impact on option prices when the maturity is short and speed of mean reversion is slow. On the contrary, the impact of the Hurst index on option prices reduces for long-dated options.

Similar content being viewed by others

Notes

See Mandelbrot (1997) for the introduction of fBMs in finance.

Alos and Yang (2014) derive an approximation formula of European option prices by using a different methodology when volatility follows a fractional Heston model.

To consider the long-memory feature of volatility, we restrict ourselves to the case that \(0.5 \le H <1\) under the physical measure \(\mathbb {P}\) until Sect. 3.2.

It seems reasonable to assume a mean-reverting process for the evolution of volatility over a long period of time under the physical measure.

To be precise, this formulation is a truncated version of the Mandelbrot–Van Ness representation of fBMs. In the next section, we consider its full version. See Comte and Renault (1998) for details.

Alternatively, as a market practice, assuming that \(\bar{\eta }_t\) is a deterministic function (e.g., piecewise constant) of time t, \(\bar{\eta }_t\) can be used to fit the option prices observed in the market.

They consider the mean-reverting volatility process as \(\mathrm{d}\sigma _t = \kappa (\widetilde{\theta }- \sigma _t ) \mathrm{d}t + \gamma \sigma _t \mathrm{d}w_t\). Hence, the parameter \(\theta \) in our model corresponds to \(\kappa \widetilde{\theta }\) in their model.

However, because the convergence speed is very slow in the fractional Monte Carlo simulation, we stop our simulations with 1,000,000 trials. The Monte Carlo simulation for fBMs is difficult to perform because of the non-Markovian nature (see, e.g., Kijima and Tam 2013).

This observation suggests that the fractional volatility model may have a strong impact on the prices of path-dependent options such as Asian and barrier options.

References

Alòs, E., Yang, Y.: A closed-form option pricing approximation formula for a fractional Heston model. Working Paper (2014)

Backus, D.K., Zin, S.E.: Long-memory inflation uncertainty: evidence from the term structure of interest rates. J Credit Bank 25, 681–700 (1993)

Baillie, R.T., Bollerslev, T., Mikkelsen, H.O.: Fractionally integrated generalized autoregressive conditional heteroskedasticity. J Econom 74, 3–300 (1996)

Bayer, C., Friz, P., Gatheral, J.: Pricing under rough volatility. Quant Finance 16, 887–904 (2016)

Benth, F.E.: On arbitrage-free pricing of weather derivative based on fractional Brownian motion. Appl Math Finance 10, 303–324 (2003)

Cheridito, P.: Arbitrage in fractional Brownian motion models. Finance Stoch 7, 533–553 (2003)

Comte, F., Renault, E.: Long memory continuous time models. J Econom 73, 101–149 (1996)

Comte, F., Renault, E.: Long memory in continuous-time stochastic volatility models. Math Finance 8, 291–323 (1998)

Comte, F., Coutin, L., Renault, E.: Affine fractional stochastic volatility models. Ann Finance 8, 337–378 (2012)

Fukasawa, M.: Asymptotic analysis for stochastic volatility: martingale expansion. Finance Stoch 15, 635–654 (2011)

Funahashi, H.: A chaos expansion approach under hybrid volatility models. Quant Finance 14, 1923–1936 (2014)

Funahashi, H., Kijima, M.: A chaos expansion approach for the pricing of contingent claims. J Comput Finance 18, 27–58 (2015)

Gatheral, J., Jaisson, T., Rosenbaum, M.: Volatility is rough. Working Paper (2014)

Hagan, P.S., Kumar, D., Lesniewski, A.S., Woodward, D.E.: Managing Smile Risk: London: Wilmott Magazine (2002)

Heston, S.L.: A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev Financ Stud 6, 327–343 (1993)

Hu, Y., Öksendal, B.: Fractional white noise calculus and applications in finance. Quantum Probab Relat Top 6, 1–32 (2003)

Hull, J., White, A.: The pricing of options on assets with stochastic volatilities. J Finance 42, 281–300 (1987)

Jäckel, P.: Stochastic volatility models - past, present and future. In: Wilmott, P. (ed.) The Best of Wilmott 1: Incorporating the Quantitative Finance Review, pp. 355–377. Wiley, Chischester (2004). https://leseprobe.buch.de/images-adb/ca/97/ca97d440-3cc4-4020-b3be-039dd4d93f7f.pdf

Kijima, M., Tam, C.M.: Fractional Brownian motions in financial models and their Monte Carlo simulation. In: Chan, V. (Wai Kin) (ed.) Theory and Applications of Monte Carlo Simulations. InTech (2013). doi:10.5772/53568

Mandelbrot, B.B.: Fractals and Scaling in Finance, Discontinuity, Concentration, Risk: New York: Springer (1997)

Nualart, D.: The Malliavin Calculus and Related Topics, 2nd edn: Berlin: Springer (2006)

Rogers, L.C.G.: Arbitrage with fractional Brownian motion. Math Finance 7, 95–105 (1997)

Schöbel, R., Zhu, J.: Stochastic volatility with Ornstein–Uhlenbeck process: an extension. Eur Finance Rev 4, 23–46 (1999)

Scott, L.: Option pricing when the variance changes randomly: estimation and an application. J Financ Quant Anal 22, 419–438 (1987)

Sottinen, T.: Fractional Brownian motion, random walks and binary market models. Finance Stoch 5, 343–355 (2001)

Xiao, W.L., Zhang, W.G., Zhang, X.L., Wang, Y.L.: Pricing currency options in a fractional Brownian motion with jumps. Econ Model 27, 935–942 (2010)

Acknowledgements

The authors thank anonymous referees for careful reading our manuscript and for giving helpful comments. Kijima is grateful for the research grant funded by the Grant-in-Aid (A) (#21241040) from Japan’s Ministry of Education, Culture, Sports, Science and Technology.

Author information

Authors and Affiliations

Corresponding author

Appendix: A chaos expansion approach

Appendix: A chaos expansion approach

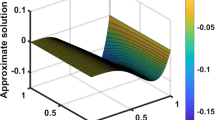

In this appendix, we apply the Wiener–Ito chaos expansion approach to obtain an approximation formula for the pricing of European-style contingent claims.

First, note that (2.7) is a special case of Eq. (2.2) in Funahashi (2014). Therefore, according to Proposition 3.2 in Funahashi (2014), the following result can be obtained.

Lemma 1

Let \(X_t:=\frac{S_t}{F(0,t)} - 1\). Then,

where

Here, \(f_0(t) = f(V(0,t))\), \(f^{(n)}_0(t) = \partial ^{(n)}_x f(x) |_{x=V(0,t)}\), and

Note that \(a_1(t)\) in Lemma 1 follows a normal distribution with zero mean and variance

Then, by applying the following result, an approximation of the density function of \(X_t\) can be obtained. The proof is found in Funahashi and Kijima (2015) under a general setting.

Lemma 2

Let us denote the density function of \(X_t\) by \(f_{X_t}(x)\). Then, the probability density function of \(X_t\) is approximated as

where n(x; a, b) denotes the normal density function with mean a and variance b.

The conditional expectations in Lemma 2 can be evaluated explicitly by a standard argument. In other words, we obtain

where

and

Here, we define

and

By substituting the conditional expectations into (5.1), the approximate density function, denoted by \(\tilde{f}_{X_t}(x)\), can be expressed as

where \(h_n(x)\) denotes the Hermite polynomial of order n defined by

with \(h_0(x)=1\).

Rights and permissions

About this article

Cite this article

Funahashi, H., Kijima, M. Does the Hurst index matter for option prices under fractional volatility?. Ann Finance 13, 55–74 (2017). https://doi.org/10.1007/s10436-016-0289-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-016-0289-1