Abstract

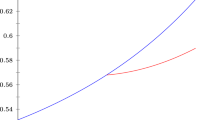

We analyze the problem of selling shares of a divisible good to a large number of buyers when demand is uncertain. We characterize equilibria of two popular mechanisms, a fixed price mechanism and a uniform price auction, and compare the revenues. While in the auction truthful bidding is a dominant strategy, we find that bidders have an incentive to overstate their demand in the fixed price mechanism. For some parameter values we find that the fixed price mechanism outperforms the auction.

Similar content being viewed by others

References

Back K, Zender JP (1993) Auctions of divisible goods: on the rationale for the treasury experiment. Rev Financ Stud 6(4): 733–764

Benveniste LM, Wilhelm WJ (1990) A Comparative Analysis of IPO proceeds under alternative regulatory environments. J Finan Econ 28: 173–207

Biais B, Faugeron-Crouzet AM (2000) IPO Auctions: English, Dutch,. . ., French and Internet. Working Paper

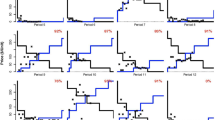

Bierbaum J, Grimm V (2002) Uniform price auctions vs. fixed price mechanisms: a numerical analysis. Working Paper

Bierbaum J, Grimm V (2004) Selling Shares to Retail Investors: auction vs. Fixed Price, IVIE Working paper WP-AD 2004–08

Blonski M (2001) Equilibrium characterization in large anonymous games. Working Paper

Bulow J, Klemperer P (1997) The winner’s curse and the failure of the law of demand, Research Paper No. 1465. Graduate School of Business, Stanford University

Fudenberg D, Tirole J (1998) Game Theory. MIT Press, Cambridge

Gilbert R, Klemperer P (2000) An equilibrium theory of rationing. RAND J Econ 31(1): 1–21

Grimm V, Kovarik J, Ponti G (2005) Fixed Price plus Rationing. An Experiment. CORE Discussion Paper No. 2005/39

Herrero C, Villar A (2001) The three musketeers. Four classical solutions to bankruptcy problems. Math Soc Sci 42: 307–328

Jackson M, Kremer I (2004a) The relationship between the allocation of goods and a seller’s revenue. J Mathe Econ 40: 371 – 392

Jackson M, Kremer I (2004b) The relevance of a choice of auction format in a competitive environment. Mimeo Caltech and Stanford University

Kandel S, Sarig O, Wohl A (1999) The demand for stocks: an analysis of IPO Auctions. Rev Finan Stud 12(2): 227–247

Kremer I, Nyborg K (2004) Divisible-Good Auctions: the Role of Allocation Rules. RAND Journal of Economics, 35(1): 147–159

Moulin H (2000) Priority rules and other asymmetric rationing methods. Econometrica 68(3): 643–684

Nautz D (1995) Optimal bidding in multi-unit auctions with many bidders. Econ Let 48(3): 301–306

Nautz D, Oechssler J (2003) The repo auctions of the European central bank and the vanishing quota puzzle. Scand J Econ 105: 207–220

Nautz D, Wolfstetter E (1997) Bid shading and risk aversion in multi-unit auctions with many bidders. Econ Let 56(2): 195–200

Sherman AE (2000) Global trends in IPO methods: book building vs. auctions. Working Paper, University of Minnesota

Sherman AE, Titman S (2000) Building the IPO order book: underpricing and participation limits with costly information. NBER Working Paper No. 7786, Cambridge

Swinkels JM (2001) Efficiency of large private value auctions. Econometrica 69(1): 37–68

Wilson R (1979) Auctions of Shares. Q J Econ 93: 675–698

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bierbaum, J., Grimm, V. Selling shares to retail investors: auction vs. fixed price. Rev. Econ. Design 10, 85–112 (2006). https://doi.org/10.1007/s10058-006-0007-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10058-006-0007-y