Abstract

This paper investigates the realized covariance forecasting and liquidity effects on the covariance. The realized covariance is calculated based on the high frequency data of CSI 300 stock index and futures, and nonlinear support vector regression (SVR) approach is employed to evaluate the out-of-sample forecasting ability of HAR-type models. Then, we propose the hybrid method, named the weighted average windows (WAveW) method based on both OLS and SVR forecasts, to accommodate model uncertainty. The empirical results find that the performance of the WAveW method based on SVR forecasts obtains more accurate forecasting than the OLS and SVR methods, and the incorporation of liquidity helps to improve the forecasting ability. From the portfolio selection perspective, we show that our new method achieves higher economic value, which further confirms the effectiveness of our proposed hybrid method. The results are robust under alternative rolling windows, liquidity, covariance and cojumps.

Similar content being viewed by others

Data availability statement

The data that support this study are available from the corresponding author upon reasonable request.

Notes

Zhang et al. (2020) claim that the out-of-sample performance of models estimated using AveW is robust to the choice of estimation windows. Here different values of \(w_{\min }\) and n are tested for each prediction, it is found that the prediction effect is optimal when \(w_{\min } = 800\) and n = 11.

The detailed jump testing procedure can be found in Lee and Mykland (2008).

References

Akkoc U, Civcir I (2019) Dynamic linkages between strategic commodities and stock market in Turkey: evidence from SVAR-DCC-GARCH model. Resour Policy 62:231–239

Abdi F, Ranaldo A (2017) A simple estimation of bid-ask spreads from daily close, high, and low prices. Social Science Electronic Publishing, Rochester

Amihud Y (2002) Illiquidity and stock returns: cross-section and time-series effects. J Financ Mark 5(1):31–56

Andersen TG, Bollerslev T (1998) Answering the skeptics: yes, standard volatility models do provide accurate forecasts. Int Econ Rev 39:885–905

Andersen TG, Bollerslev T, Diebold FX, Labys P (2003) Modeling and forecasting realized volatility. Econometrica 71:529–626

Andersen TG, Bollerslev T, Diebold FX, Verga C (2007) Realtime price discovery in stock, bond, and foreign exchange markets. J Int Econmet 73:251–277

Andersen TG, Bollerslev T, Huang X (2011) A reduced form framework for modeling volatility of speculative prices based on realized variation measures. J Economet 169:176–189

Barndorff-Nielsen OE, Shephard N (2004) Power and bipower variation with stochastic volatility and jumps. J Financ Economet 2(1):1–37

Bauer GH, Vorkink K (2011) Forecasting multivariate realized stock market volatility. J Economet 160(1):93–101

Becker R, Clements AE, Doolan M, Hurn S (2015) Selecting volatility forecasting models for portfolio allocation purposes. Int J Forecast 31:849–861

Bollerslev T, Patton AJ, Quaedvlieg R (2018) Modeling and forecasting (un) reliable realized covariances for more reliable financial decisions. J Economet 207(1):71–91

Bollerslev T, Meddahi N, Nyawa S (2019) High-dimensional multivariate realized volatility estimation. J Economet 212(1):116–136

Cavalcante RC, Brasileiro RC, Souza VL, Nobrega JP, Oliveira AL (2016) Computational intelligence and financial markets: a survey and future directions. Expert Syst Appl 55:194–211

Chen YX, Ma F, Zhang YJ (2019) Good, bad cojumps and volatility forecasting: New evidence from crude oil and the U.S. stock markets. Energy Econ 81:52–62

Clements A, Scott A, Silvennoinen A (2019) Volatility-dependent correlations: further evidence of when, where and how. Empir Econ 57:505–540

Chiriac R, Voev V (2011) Modelling and forecasting multivariate realized volatility. J Appl Economet 26(6):922–947

Corsi F (2009) A simple long memory model of realized volatility. J Financ Economet 7:174–196

Ciarreta A, Muniain P, Zarraga A (2020) Realized volatility and jump testing in the Japanese electricity spot market. Empir Econ 58:1143–1166

Corsi F, Peluso S, Audrino F (2015) Missing in asynchronicity: a kalman-em approach for multivariate realized covariance estimation. J Appl Economet 30(3):377–397

Corwin SA, Schultz P (2012) A simple way to estimate bid-ask spreads from daily high and low prices. J Financ 67(2):719–760

Dangl T, Halling M (2012) Predictive regressions with time-varying coefficient. J Financ Econ 106(1):157–181

Dumitru AM, Urga G (2012) Identifying jumps in financial assets: a comparison between nonparametric jump tests. J Bus Econ Stat 30:242–255

Engle R (2002) Dynamic conditional correlation: a simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J Bus Econ Stat 20(3):339–350

Fong KYL, Holden CW, Trzcinka CA (2017) What are the best liquidity proxies for global research? Rev Financ 21(4):1355–1401

Fu SB, Li YW, Sun SL, Li HT (2019) Evolutionary support vector machine for RMB exchange rate forecasting. Physica A 521:692–704

Gamba-Santamaria S, Gomez-Gonzalez JE, Hurtado-Guarin JL, Melo-Velandia LF (2019) Volatility spillovers among global stock markets: measuring total and directional effects. Empir Econ 56:1581–1599

Gao M, Liu YJ, Wu W (2016) Fat-finger trade and market quality: the first evidence from China. J Futur Mark 36(10):1014–1025

Gong X, Lin B (2018) Structural breaks and volatility forecasting in the copper futures market. J Futur Mark 38(3):290–339

Goyenko RY, Holden CW, Trzcinka CA (2009) Do liquidity measures measure liquidity? J Financ Econ 92(2):153–181

Hansen PR, Lunde A, Nason JM (2011) The model confidence set. Econometrica 79(2):453–497

Haugom E, Ray R (2017) Heterogeneous traders, liquidity, and volatility in crude oil futures market. J Commod Mark 5:36–49

Jiang YH, Jiang C, Nie H, Mo B (2019) The time-varying linkages between global oil market and China’s commodity sectors: evidence from DCC-GJR-GARCH analyses. Energy 166:577–586

Jin JY, Han LY, Wu L, Zeng HC (2020) The hedging effect of green bonds on carbon market risk. Int Rev Financ Anal 71:101509

Jin X, Maheu JM (2013) Modeling realized covariances and returns. J Financ EcoNomet 11(2):335–369

Lee SS, Mykland PA (2008) Jumps in financial markets: a new nonparametric test and jump dynamics. Rev Financ Stud 21:2535–2563

Li Z, Zhang WG, Liu YJ (2018) European quanto option pricing in presence of liquidity risk. North Am J Econ Financ 45:230–244

Li Z, Zhang WG, Liu YJ, Zhang Y (2019) Pricing discrete barrier options under jump-diffusion model with liquidity risk. Int Rev Econ Financ 59:347–368

Lin H, Wu CC, Zhou GF (2018) Forecasting corporate bond returns with a large set of predictors: an iterated combination approach. Manag Sci 64(9):4218–4238

Ma F, Yao Y, Zhang YJ, Cao Y (2019) Harnessing jump component for crude oil volatility forecasting in the presence of extreme shocks. J Empir Financ 52:40–55

Pástor L, Stambaugh RF (2003) Liquidity risk and expected stock returns. J Polit Econ 2111(3):642–685

Peng Y, Albuquerque PHM, Sá JMCD, Padula AJA, Montenegro MR (2018) The best of two worlds: forecasting high frequency volatility for cryptocurrencies and traditional currencies with support vector regression. Expert Syst Appl 97:177–192

Pesaran MH, Timmermann A (2007) Selection of estimation window in the presence of breaks. J Economet 137(1):134–161

Piccotti LR (2018) Jumps, cojumps, and efficiency in the spot foreign exchange market. J Bank Financ 87:49–67

Qiao GX, Teng YX, Li WP, Liu WW (2019) Improving volatility forecasting based on Chinese volatility index information: evidence from CSI 300 index and futures markets. North Am J Econ Financ 49:133–151

Qiao GX, Teng YX, Xu YY, Wang L (2020) The cross-market dynamic effects of liquidity on volatility: evidence from Chinese stock index and futures markets. Appl Econ 52(1):85–99

Roll R (1984) A simple implicit measure of the effective bid-ask spread in an efficient market. J Financ 39(4):1127–1139

Sapankevych NI, Sankar R (2009) Time series prediction using support vector machines: a survey. IEEE Comput Intell Mag 4(2):24–38

Sun H, Yu B (2019) Forecasting financial returns volatility: a GARCH-SVR model. Comput Econ. https://doi.org/10.1007/s10614-019-09896-w

Tian J, Anderson HM (2014) Forecast combinations under structural break uncertainty. Int J Forecast 30(1):161–175

Vapnik VN (1995) The nature of statistical learning theory. Springer, Berlin

Wang Y, Hao X, Wu C (2020) Forecasting stock returns: a time-dependent weighted least squares approach. J Financ Markets. https://doi.org/10.1016/j.finmar.2020.100568

Xu YD, Taylor N, Lu W (2018) Illiquidity and volatility spillover effects in equity markets during and after the global financial crisis: an MEM approach. Int Rev Financ Anal 56:208–220

Xu YY, Huang DS, Ma F, Qiao GX (2019) The heterogeneous impact of liquidity on volatility in Chinese stock index futures market. Physica A 517:73–85

Yamauchi Y, Omori Y (2019) Multivariate stochastic volatility model with realized volatilities and pairwise realized correlations. J Bus Econ Stat 38:839–855

Zhang YM, Ding SS (2018) Return and volatility co-movement in commodity futures markets: the effects of liquidity risk. Quant Financ 18(9):1471–1486

Zhang YM, Ding SS, Scheffel E (2018) Policy impact on volatility dynamics in commodity futures markets: evidence from China. J Futur Mark 38(10):1227–1245

Zhang HW, He Q, Jacobsen B, Jiang FW (2020) Forecasting stock returns with model uncertainty and parameter instability. J Appl Economet 1–16. https://doi.org/10.1002/jae.2747

Zhang Y, Wei Y, Liu L (2019) Improving forecasting performance of realized covariance with extensions of HAR-RCOV model: statistical significance and economic value. Quant Financ 19(9):1425–1438

Zhang, GX, Qiao, GX (2021) Out-of-sample realized volatility forecasting: does the support vector regression compete combination methods. Appl Econ, 53(19):2192-2205

Acknowledgements

The work is supported by the National Natural Science Foundation of China grant (72001180), Humanities and Social Science Fund of Ministry of Education of China (17YJC790119), the Fundamental Research Funds for the Central Universities (2682021ZTPY077).

Author information

Authors and Affiliations

Contributions

Gaoxiu Qiao: Conceptualization, Methodology, Writing-Reviewing and Editing, Funding acquisition. Yangli Cao: Data curation, Methodology, Software, Visualization, Writing. Feng Ma: Writing-Reviewing and Editing Weiping Li: Supervision.

Corresponding author

Ethics declarations

Conflict of interest

The author declares that he has no potential conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by the author.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Qiao, G., Cao, Y., Ma, F. et al. Liquidity and realized covariance forecasting: a hybrid method with model uncertainty. Empir Econ 64, 437–463 (2023). https://doi.org/10.1007/s00181-022-02248-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-022-02248-y

Keywords

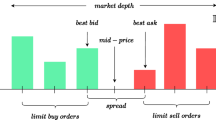

- Liquidity

- Realized covariance

- CSI 300 index and futures markets

- Model uncertainty

- Weighted average windows method