Abstract:

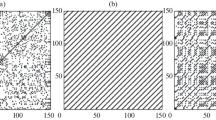

Several economical time series such as exchange rates US$/British Pound, USA Treasure Bonds rates and Warsaw Stock Index WIG have been investigated using the method of recurrence plots. The percentage of recurrence REC and the percentage of determinism DET have been calculated for the original and for shuffled data. We have found that in some cases the values of REC and DET parameters are about 20% lower for the surrogate data which indicates the presence of unstable periodical orbits in the considered data. A similar result has been obtained for the chaotic Lorenz model contaminated by noise. Our investigations suggest that real economical dynamics is a mixture of deterministic and stochastic chaos. We show how a simple chaotic economic model can be controlled by appropriate influence of time-delayed feedback.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Received 13 October 2000

Rights and permissions

About this article

Cite this article

Hołyst, J., Żebrowska, M. & Urbanowicz, K. Observations of deterministic chaos in financial time series by recurrence plots, can one control chaotic economy?. Eur. Phys. J. B 20, 531–535 (2001). https://doi.org/10.1007/PL00011109

Issue Date:

DOI: https://doi.org/10.1007/PL00011109