Abstract

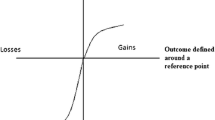

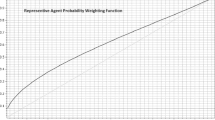

Finite first-order gambles are axiomatized. The representation combines features of prospect and rank-dependent theories. What is novel are distinctions between gains and losses and the inclusion of a binary operation of joint receipt. In addition to many of the usual structural and rationality axioms, joint receipt forms an ordered concatenation structure with special features for gains and losses. Pfanzagl's (1959) consistency principle is assumed for gains and losses separately. The nonrational assumption is that a gamble of gains and losses is indifferent to the joint receipt of its gains pitted against the status quo and of its losses against the status quo.

Similar content being viewed by others

References

Aczél, J. (1966).Lectures on Functional Equations and their Applications. New York: Academic Press.

Choquet, G. (1953–1954). “Theory of Capacities,”Annales de l'Institut Fourier 5, 131–295.

Cohen, M., and L. Narens. (1979). “Fundamental Unit Structures: A Theory of Ratio Scalability,”Journal of Mathematical Psychology 20, 193–232.

Edwards, W. (1962). “Subjective Probabilities Inferred from Decisions,”Psychological Review 69, 109–135.

Fishburn, P. C. (1982) “Nontransitive Measurable Utility,”Journal of Mathematical Psychology 26, 31–67.

Fishburn, P. C. (1988).Nonlinear Preference and Utility Theory. Baltimore, MD: Johns Hopkins Press.

Fishburn, P. C. (unpublished). “Continuous Nontransitive Additive Conjoint Measurement,” Preprint, AT&T Bell Laboratories.

Gilboa, I. (1987). “Expected Utility with Purely Subjective Non-Additive Probabilities,”Journal of Mathematical Economics 16, 65–88.

Kahneman, D., and A. Tversky. (1979). “Prospect Theory: An Analysis of Decision Under Risk,”Econometrica 47, 263–291.

Keeney, R. L., and H. Raiffa. (1976).Decisions with Multiple Objectives: Preferences and Value Tradeoffs. New York: Wiley.

Keller, L. R. (1985). “The Effects of Problem Representation on the Sure-Thing and Substitution Principles,”Management Science 31, 738–751.

Krantz, D. H., R. D. Luce, P. Suppes, and A. Tversky. (1971).Foundations of Measurement, vol. I. New York: Academic Press.

Luce, R. D. (1988). “Rank-Dependent, Subjective Expected-Utility Representations,”Journal of Risk and Uncertainty 1, 305–332.

Luce, R. D. (In press (a)). “Rank- and Sign-Dependent Linear Utility Models for Binary Gambles,”Journal of Economic Theory.

Luce, R. D. (In press (b)). “Where Does Subjective Expected Utility Fail Descriptively?”Journal of Risk and Uncertainty.

Luce, R. D., and L. Narens. (1985). “Classification of Concatenation Structures According to Scale Type,”Journal of Mathematical Psychology 29, 1–72.

Narens, L. (1981). “A General Theory of Ratio Scalability with Remarks About the Measurement-Theoretic Concept of Meaningfulness,”Theory and Decision 13, 1–70.

Pfanzagl, J. (1959). “A General Theory of Measurement—Applications to Utility,”Naval Research Logistics Quarterly 6, 283–294.

Quiggin, J. (1982). “A Theory of Anticipated Utility,”Journal of Economic Behavior and Organization 3, 324–343.

Schmeidler, D. (1989). “Subjective Probability and Expected Utility Without Additivity.”Econometrica 57, 571–587.

Slovic, P. (1967). “The Relative Influence of Probabilities and Payoffs upon Perceived Risk of a Gamble,”Psychonomic Science 9, 223–224.

Slovic, P., and S. Lichtenstein. (1968). “Importance of Variance Preferences in Gambling Decisions,”Journal of Experimental Psychology 78, 646–654.

Tversky, A. (1967). “Additivity, Utility, and Subjective Probability,”Journal of Mathematical Psychology 4, 175–201.

Yaari, M. E. (1987). “The Dual Theory of Choice Under Risk,”Econometrica 55, 95–115.

Wakker, P. P. (1989).Additive Representations of Preferences. Boston: Kluwer.

Author information

Authors and Affiliations

Additional information

Reprints may be obtained from either author. Luce's work was supported, in part, by the National Science Foundation grant IRI-8996149 to the University of California, Irvine.

Rights and permissions

About this article

Cite this article

Luce, R.D., Fishburn, P.C. Rank- and sign-dependent linear utility models for finite first-order gambles. J Risk Uncertainty 4, 29–59 (1991). https://doi.org/10.1007/BF00057885

Issue Date:

DOI: https://doi.org/10.1007/BF00057885