Abstract

The multi-fractal analysis has been applied to investigate various stylized facts of the financial market including market efficiency, financial crisis, risk evaluation and crash prediction. This paper examines the daily return series of stock index of NASDAQ stock exchange. Also, in this study, we test the efficient market hypothesis and fractal feature of NASDAQ stock exchange. In the previous studies, most of the technical analysis methods for stock market, including K-line chart, moving average, etc. have been used. These methods are generally based on statistical data, while the stock market is in fact a nonlinear and chaotic system which depends on political, economic and psychological factors. In this research we modeled daily stock index in NASDAQ stock exchange using ARMA-GARCH model from 2000 until the end of 2016. After running the model, we found the best model for time series of daily stock index. In next step, we forecasted stock index values for 2017 and our findings show that ARMA-GARCH model can forecast very well at the error level of 1%. Also, the result shows that a correlation exists between the stock price indexes over time scales and NASDAQ stock exchange is efficient market and non-fractal market.

Similar content being viewed by others

Introduction

Stock price index was firstly used in the USA in 1884. This index was obtained in the railway industry from the simple average of eleven companies. Generally, stock price index in all financial markets of the world has great importance as one of the most important criteria for measuring performance of stock exchange. Perhaps the most important reason for this increasing attention is that the mentioned index is obtained from aggregation of stock price movements of all companies or a special category of the companies existing in the market, and thus, makes it possible to investigate about the direction and size of price movements in stock market. In fact, expansion of financial theories and innovations over the last one to two decades has been associated with an increasing tendency toward calculation and examination of movement process of such indexes, based on the central role of attention to the general move of the market (Khosravi Nejad and Shabani Sadr Pishe, 2014; [3, 3, 9, 11, 12, 15, 16, 18, 37, 48, 53, 55, 73, 90, 97].

In countries where their capital market has been developed and the number of accepted companies in them is high relative to the number of active companies in the country, their capital market is fully representative of the economic situation of that country, and the stock exchange index is considered as an economic indicator, that by predicting this indicator, the status of the country’s liquidity can be understood and managed and also appropriate investment strategies can be applied to it. For example, in periods when the index takes an ascending trend for a long time, it causes the liquidity to come from other parallel markets such as currency, gold coins, and housing, to this market. In this case, investors usually take purchase and maintenance strategies and invest with long-term views. On the contrary, when the index takes a descending trend for a long time, liquidity is usually transferred to markets parallel to the capital market, and investors in the capital market take short-term investment strategies. Therefore, forecasting of index as an economic indicator has always been paid attention by investors and economic officials of a country [4, 5, 7, 8, 13, 14, 16,17,18, 34, 40, 45, 57, 68, 70, 71, 72, 73, 79, 80, 82, 83, 89, 106].

In this study, we test time series method on daily return series of stock index of NASDAQ stock exchange. Time series are an important category of data in empirical analysis. These series are a series of data which are collected discretely in equal time intervals. Time series test are used in many fields, such as economics, business and commerce, engineering sciences, natural sciences and social sciences. Time series are modeled under different templates. These models are divided into two general categories. The first category is static models and the second one is non-static models. Static models are the models in which the mean and dispersion are constant over time; otherwise the model is considered non-static. In these models, the current data are defined based on previous data in addition to a random error factor.

Many series, such as business and industrial dependent data, show non-static behavior, especially in financial matters. This means that the data do not fluctuate around a constant mean. These series have trends in their data that the data fluctuate around them over time. These models can turn to static models by the dth differentiation of the data [6]. A common category of non-static models of time series is the models of the moving average integrated auto-regression. This model consists of three main parameters including parameter of auto-regression p, parameter of moving average q, and parameter of differentiation d,and through putting the two parameters of q and d as equal to zero, they turn to static auto-regression model by [20].

In time series discussion, future observations and past observations are of the same type, and there are certain relationships between them. Predicting the future values of these series is of great importance. The estimated model of observations can be the basis for predicting future observations. This modeling approach in the issue of prediction of future observations is often useful when there is little information about the method of production of observations in order for prediction. In recent years, several studies have been conducted in order to improve prediction of future observations. Most researchers believe that financial markets follow a nonlinear trend [94]. Therefore, through linear predictions, appropriate results for examining future path of financial variables may not be obtained. In recent years, among the most important nonlinear models which has been used in financial markets and also achieved good results, is GARCH model. Furthermore, GARCH models have been used much in order to predict time series in non-static conditions of variables, lack of justification of classical methods, or complexity of time series.

Although technical and structural models have much been used in prediction of stock market, but the results of studies indicate that these methods have not been successful enough to predict stock market. With the advance of science, researchers have used time series and artificial neural networks models in order for better predictions [58]. In single-variable time series model, it is assumed that the examined variable is a sequence of observations over time that, according to its past values, and future values of the sequence can be predicted [87]. In this study for investigating market efficiency and fractal feature of NASDAQ stock exchange, we used ARMA-GARCH model. The advantage of GARCH model is that in some cases, we replace a GARCH model instead of a high-order ARCH model that in this case the principle of saving is observed more and its estimation is also easier.

Literature review

In economic researches, the most used prediction models have been econometric methods, variance-auto-covariance, correlation analyses and, in general, causal analysis. In financial matters, Box-Jenkins methods and smoothing or multivariate regression for causal analyses in issues such as corporate profit prediction, companies’ stock price, and prediction of balance sheet items have been mostly used in commercial matters and financial issues. In recent years, new approaches, such as neural networks and fuzzy neural networks methods have been used in various types of prediction issues and in various financial, economic, and commercial sciences, and they have been cited in various researches. Several studies have been proposed in order to compare prediction methods. Particularly in the last decade, this comparison has been proposed and made between neural networks, fuzzy neural networks, econometric or Box-Jenkins methods.

In recent years, in the area of time series forecasting, many studies investigated forecasting of time series of the economic and financial variables. Time series is a branch of statistics and probability science which is widely used in other fields of science. Using past information of variables creates the possibility of predicting future values, that this is a key factor in planning, policy making, and management of financial and economic systems. Given that most of the series that are being analyzed are non-static, in order to fit a suitable pattern to them, the non-static factor in them must be eliminated [74].

An investigation for stock price forecasting started from the mid-1970s, and especially since 1980 began extensive efforts about prediction ability of stock prices using new mathematical methods, long time series, and a more advanced tool such as artificial intelligence, and performed many tests on price information and stock index in countries such as UK, USA, Canada, Germany, and Japan in order to show the existence or lack of a certain structure in stock price information, and in order to break the hypothesis of random steps in this way. Gujarati [42] in his econometrics book has pointed out to the uses of time series as a powerful and widely used tool in economic and financial data. Given the nature of time series data and importance of prediction in these issues, many researchers have predicted future observations of time series in financial issues.

Chan et al. [23] tried to predict financial time series using artificial neural networks of daily data of Shanghai stock exchanges. In order to have higher speed and convergence, they used descending gradient algorithm and multiple linear regressions in order to determine the weights. They concluded that neural network can predict time series better and satisfactorily, and the method of selecting the weights in their method led to lower computational costs.

Kim and Han [56] used a neural network modified by genetic algorithm (GA) to predict stock index. In this case, genetic algorithm was used in order to reduce future complexity of price time series.

Lendasse et al. [59] tried to predict the index using neural networks. Their data given to the network included two types of exogenous and endogenous data that exogenous economic data included international stock price indices, exchange rates, and interest rate, and endogenous data included historical values of index. They concluded from their research that using neural networks acts better than linear methods.

Egeli et al. [33] tried to predict the daily index of Istanbul stock market. Their network input included Dollar/Lire exchange rate on the previous day, the index value in the previous days, overnight interest rate, and five virtual variables for five days of a week. The result of their research was that neural networks do a more accurate prediction of 5-day and 10-day moving average.

Potvina et al. [77] using genetic programming capabilities have tried to recognize the relationships and regulations of business and trade from information of companies existing in Canadian stock exchange, and using that, have modeled the fluctuations existing in financial markets.

Lensberg et al. [60] using genetic programming have tried to investigate and analyze financial bankruptcy. According to the research results, it has been observed that the model has a desirable accuracy in predicting and distinguishing between bankrupt and non-bankrupt enterprises.

Marcellino et al. [63] have examined repeated empirical prediction of one-variable and two-variable auto-regression models with economic time series data of USA in 170 months between 1959 and 2002.

Etemadi et al. [36] also has used modeling based on genetic programming to predict bankruptcy of stock companies, and according to the results, it has been observed that the model has a desirable accuracy in this regard.

Boyacioglu and Avci [2] have developed a model based on adaptive neural fuzzy inference system in order to predict stock return in Istanbul stock exchanges. Using six macroeconomic variables and three stock indexes as input variables, they predicted stock return variable as the output and dependent variable. Examining the results shows desirable accuracy of the model.

Piscopo [75] in a study has modeled and predicted time series of bank deposits in Italy, and has used ARIMA time series model for this purpose. According to the research results, it has been observed that modeling of time series of bank deposits, using ARIMA, has been able to predict the changes and time trends of volume of deposits and their seasonal pattern, well.

Chen et al. [25] in a study has tries to predict gold price, using ARIMA and GARCH models. This research has been conducted during the period 1971 to 2010 using monthly data for predicting gold price. In other study, Giordani and Villani [41] have proposed a mixed dynamic non-Gaussian model for prediction in econometrics.

Guresen et al. [43] have used models based on artificial neural networks in order to predict stock index. They have used models based on multilayer artificial neural networks, and autoregressive correlation models, and according to the results of the research, it has been observed that artificial neural network model has had more accuracy than other combinative models.

Dai et al. [30] combining nonlinear components analysis and artificial neural networks, have predicted the indexes of Asian stock companies, and have used the data from Japan and China stocks for this purpose, and it has been observed that using the above modeling approach has increased the accuracy of predictions. Sermpinis et al. [88] using modeling based on genetic programming have tried to predict Euro/Dollar exchange rate,and comparing the results of genetic programming model with neural networks and ARIMA time series model, have showed that modeling based on genetic programming has a better performance in this regard.

Wanga et al. [99] have used various types of combinative models of time series, artificial neural networks and genetic algorithm to predict stock index, and finally, by comparing the accuracy of different models, they have concluded that modeling based on hybrid and dual approach with different models, has improved the accuracy of results.

Araujo [10] has presented a sustained self-corrective approach to predict financial data sustainably. The mentioned approach has eliminated the problems of random stroke processes in financial time series.

Table 1 has provided a brief overview of the subject literature in order to clarify the status of this research among the recent researches in this area.

In financial time series, instability of changes in profit or return has an important role in economic decision-making. Autoregressive time series models with unstable conditional variance (or ARCH model), and autoregressive with generalized unstable conditional variance (or GARCH model) have been created in order for modeling the changes and instabilities of time series. GARCH model has many applications in the areas of risk management, securities management, asset allocation, and so on. Despite the wideness and variety of the existing models for prediction of time series, this area still has attracted the attention of many researchers. Existence of nonlinear behavior, noise nature of data, and non-static and chaotic behavior of time series makes it very difficult to obtain a proper model for the system and prediction of future behavior of system only by using its past information and behavior. In the meantime, the prediction accuracy of the series should also be very high and this is one of the important issues in the area of predicting financial time series.

In recent years, many researchers have predicted future observations of time series in financial issues by using GARCH type models.

Naseem et al. [69] have examined the volatility of Pakistani stock market over the period of 1 January 2008 to 30 June 2018 via different GARCH type model such as symmetric (GARCH & GARCH-M) and asymmetric (EGARCH & TGARCH) models. According to the research results, GARCH-M (1, 1) depicts a positive significant at 1% results in Std. and GED which indicates the existence of risk premium and insignificant in rest of the distribution on. Also, EGARCH and TGARCH both are found to leverage effect significant at 1% level.

Mohsin et al. [65] in a study has modeled the volatility of exchange rate using GARCH type models such as PGARCH, TGARCH, CGARCH and ACGARCH. According to the research results, it has been observed that except of PGARCH and TGARCH, the summation of ARCH and GARCH value is more than one.

Salamat et al. [85] have developed a model based on utilizing the symmetric (GARCH 1,1) and asymmetric (EGARCH, TGARCH, PGARCH) model of GARCH family for cryptocurrencies volatility. According to the research results, the results for an explicit set of currencies for entire period provide evidence of volatile nature of cryptocurrency and in most of the cases, the PGARCH is a better-fitted model with student’s t distribution.

This paper used ARMA-GARCH model for forecasting daily return series of stock index of NASDAQ stock exchange. Furthermore, we investigate the efficiency and fractal feature of NASDAQ stock exchange to study its effects on efficiency and fractal perspectives in NASDAQ stock exchange, which has theoretical and practical significance in the application of effective market hypothesis (EMH) in NASDAQ stock exchange.

Efficient market hypothesis (EMH)

The efficient market hypothesis suggests that stock prices reflect all available information and in this market a stock price is equal to its intrinsic value [51]. Under the efficient market hypothesis, option‐implied forward variance forms a martingale and changes in forward variance follow a random walk [50]. Most empirical evidence suggests that the efficient market hypothesis, stating that spot and futures prices should cointegrate with a unit slope on futures prices, does not hold [100]. In its fundamental formation, the EMH states that the price of an actively traded asset is an optimal forecast of the asset's fundamental value. Thus, in an EMH, change in asset prices cannot be predicted [26]. But there is striking evidence that stock prices do not follow random walks and possess some degree of predictability, and there is a lack of strong alternative theoretical explanations to the EMH [62].

The main implication of the EMH is that traders should not be able to “beat” the market and make abnormal profits [22]. In weak-form efficiency, future prices cannot be predicted based on the analysis of their past performance [98]. The markets that cannot reject the EMH may be just less inefficient [46]. The relatively less inefficient markets are mainly located in Europe and America, and the relatively more inefficient mainly in the Middle East [66]. To relate the research on survivability to issues with respect to the efficient markets hypothesis, it is better to endow agents with the ability to forecast market prices and dividends [95]. In mathematical finance the efficient market hypothesis is formulated as the martingale property of price processes of tradable assets such as stocks [27, 32, 44, 92].

Fractal market hypothesis (FMH)

Fractal markets hypothesis is a hypothesis for analysing financial time series based on the principles of fractal geometry, specifically the self-affine properties of stochastic fields.

The Fractal market hypothesis uses fractals and other chaos theories to explain the behaviors of the stock market given the daily randomness and turbulence. Due to the movement of stock prices in fractals (fragments), and the repeatable attributes of fractals, FMH analyzes and gives explanation to stock market trends.

Fractal markets hypothesis analyzes the daily randomness of the market—a glaring absence in the widely utilized efficient market hypothesis. Fractal market hypothesis is tightly connected to multifractality and long-range dependence in financial time series [21]. Financial market time series exhibit high degrees of nonlinear variability, and frequently have fractal properties. When the fractal dimension of a time series is non‐integer, this is associated with two features [81]: (1) inhomogeneity—extreme fluctuations at irregular intervals, and (2) scaling symmetries—proportionality relationships between fluctuations over different separation distances.

Methods

The population of this research includes all firms listed in NASDAQ stock exchange from 2000 until the end of 2016.The current study modeled time series stock index in NASDAQ stock exchange over a period from 2000 to 2016 using ARMA-GARCH model. In next step, we forecasted stock index values for 2017 and then compared it with real values. Also, in this study, we investigate the efficiency and fractal feature of NASDAQ stock exchange over a period from 2000 to 2016 using ARMA-GARCH model.

ARMA model

ARMA model is a linear model for static time series. This model was proposed by Box–Jenkins [93]. In this model, estimation is based on the previous observations and the previous estimation errors.\({\text{ X}}_{{\text{t }}}\) process is an ARMA(p,q) process, if \({\text{ X}}_{{\text{t }}} { }\) is static and for each t we have:

So that \({ }\left\{ {{\text{Z}}_{{\text{t}}} } \right\}\sim {\text{WN}}\left( {0,{\upsigma }^{2} } \right){ }\) and \(~~\emptyset \left( z \right) = 1 - \emptyset _{1} z - \ldots - \emptyset _{p} z^{{~p}} ,~\;\theta \left( z \right) = 1 + \theta _{1} z + \ldots + \theta _{q} z^{{~q}}\) polynomials would not have a common factor. ARMA(p,q) illustration based on these polynomials is as follows:

B is the backshift operator \({ }\left( {{\text{B}}^{{\text{j}}} {\text{X}}_{{\text{t}}} = {\text{X}}_{{{\text{t}} - {\text{j}}}} { };{\text{B}}^{{\text{j}}} {\text{ Z}}_{{\text{t}}} = {\text{Z}}_{{{\text{t}} - {\text{j}}}} { }} \right).\) If \(\theta \left( z \right) = 1\), then \({\text{X}}_{{\text{t}}}\) time series is the p order auto regression process or AR(p) and if \(\emptyset \left( {\text{z}} \right) = 1\), \({\text{X}}_{{\text{t}}}\) time series is the q order moving average process or MA(q).

The static series is important in using ARMA model for a time series. This model has the appropriate applicability for modeling the series if the time series observations are static. In other words if the assumed rules of the process are changed during its transfer in time, these changes will not change the model and as a result the system applicability in time series estimations will decrease considerably. Therefore before the practice of an ARMA model to the data of a time series, being static is always investigated [61].

GARCH model

The process {\(y_{t}\)} follows the generalized autoregressive model conditioned to variance instability GARCH ( p,q), if:

In the above equations f (t-1, X) represents the predictable and definite part of the model; \(\varepsilon_{t}\) denotes the random part of the model; \({\upsigma }_{{\text{t}}}^{2}\) is observation conditional variance in the condition of previous observations at the moment t. \(\left\{ {{\upvarepsilon }_{{\text{t}}} } \right\}\sim {\text{IID}}\left( {0,1} \right)\) and also \(\varepsilon_{t}\) is independent for each t of \(\left\{ {{\text{y}}_{{{\text{t}} - {\text{k}}}} ,{\text{k}} \ge 1} \right\}\). In order to ensure that the conditional variance of the model is positive, the following constraints must be considered:

Also, in order for the model to be static, it is necessary that the sum of \(b_{i}\) and \(c_{j}\) is less than one.

This model was firstly introduced in 1986 by Bollerslev as the generalization of ARCH model. ARCH model or conditional autoregressive model with non-sustainable dispersion was introduced by Engle in 1982. In this model, conditional variance of observations is a linear function of the second exponent of past observations of the series.

In this model also in order to be sure about positivity of the model’s conditional variance, the coefficients must be \(a \ge 0,b_{i} \ge 0\). As can be seen, the difference between the ARCH model and the GARCH model is in the method of modeling the conditional variance of time series observations.

This model, in particular the simpler GARCH (1,1) model, has become widely used in financial time series modeling and is implemented in most statistics and econometric software packages. GARCH (1,1) models are favored over other stochastic volatility models by many economists due to their relatively simple implementation: since they are given by stochastic difference equations in discrete time, the likelihood function is easier to handle than continuous-time models, and since financial data are generally gathered at discrete intervals.

ARMA-GARCH model

ARMA-GARCH model is a combination of ARMA and GARCH models. In this model the conditional average if the observations has ARMA model and the conditional variance of the observations has GARCH model which is conditional to the previous observations [6]. In other words if the { \({\text{y}}_{{\text{t}}}\)} process is true in these relations, this process has ARMA-GARCH model:

All the GARCH model terms are considered here.

Results

Table 2 shows the descriptive statistics of daily stock index on annual basis for firms that listed on NASDAQ Stock Exchange over a period 2000 to 2016.

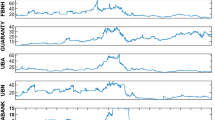

Figures 1 and 2 present the time series plots of stock index and stock index changes for 17 years from 2000 until 2016.

In regression modeling, if an autoregressive moving average model (ARMA) is assumed for the error variance, the model is a generalized autoregressive conditional heteroskedasticity (GARCH) model. Consider the following regression model for the index value:

For \({\text{t}} = 1, \ldots ,{\text{n}}\) (number of observations). The GARCH (1,1) model is the regression model with the following specification:

Now consider an ARMA model with GARCH errors. Specifically, we consider an ARMA(1,1) + GARCH(1,1) which has form:

where \({\uptheta }_{1}\) is the autoregressive (AR) component parameter, and \({\uptheta }_{2}\) is the moving average (MA) component parameter.

When specifying the error distribution, in above, we took normal distribution. However, there are situations where a heavier tail alternative to the normal, such as the student-t distribution must be used. In such cases an ARMA(1,1) + GARCH(1,1) model with student-t error term has form:

where \({\upnu }\) is the shape parameter and shows the degrees of freedom of the error model.

Output of fitting ARMA(1,1) + GARCH(1,1) with student-t distributed error term using fGarch package in R, we extracted Table 3.

According to the p-values, all parameters are significant at level 0.001, except the mean parameters \(\mu\) and \(\omega\). Hence, the final time series model has for:

In order to check the goodness of fit, the Q-Q plot is shown in Fig. 3.

Standardized residual (stresi) tests also confirm the goodness of our fit. The stresi plot is also displayed in Fig. 4.

The results indicate an overall improvement in forecasting of stock index using ARMA-GARCH model from 2000 until the end of 2016. Based on our results, the new measure of capital market efficiency is introduced. The efficiency measure is taken as a distance from an ideal efficient market situation. Hypothetically, the methods for describing correlations and hierarchical relationships between stock indexes presented in this review could be used to construct investment portfolios and reduce exposure to risk.

Discussion

In this study, in the literature review we have reviewed many studies about financial time series forecasting and modeling, and we have discussed about efficient market hypothesis (EMH) and fractal market hypothesis (FMH) and have showed that how the stock markets could be efficient. In recent years, researchers have found some empirical evidences about the importance of financial time series variables in explaining the abnormal returns on portfolios consisting of various diversified assets in it. Therefore, financial time series forecasting and modeling are an important category in empirical analysis of financial time series variables. Also, by comparison different studies about market efficiency and fractal feature of the stock markets, the results show that predominantly in developed stock markets, it is found that developed stock markets are efficient.

The main contribution of this paper is to shed light on the question whether the NASDAQ stock exchange efficient and non-fractal. For response to this question, we have focused on time series of daily return series of stock index from 2000 until the end of 2016, and forecasted stock index values for 2017 and then compared it with real values.

Based our results, in the previous sections, the proposed model that named ARMA-GARCH model, it can forecast very well the time series of daily return series of stock index at the error level of 1%. The results of ARMA(1,1) + GARCH(1,1) model that we have shown in Table 3, show that all parameters are significant at level 0.001.

The goodness of fit ARMA-GARCH model have shown in Fig. 3, and further statistical analysis of our model with standardized residual (stresi) tests, also confirm the goodness of fit ARMA-GARCH model, is shown in Fig. 4.

Consequently, our findings suggest that investors should view the trend of time series of daily return series of stock index for each market independently since different markets experience contrasting levels of predictability, which are related to market conditions. Also, our findings provide important implications regarding the evolution of market efficiency in the stock markets and the associated fractal structure and dynamics of the stock prices over time. Furthermore, the study findings imply that there is a high importance for considering efficiency feature of the stock market while considering investment decision in the NASDAQ stock exchange.

Conclusions

With continuous development of economy in the society, a rapid rise has happened in emergence of capital markets in the world. Today, investing in stock market forms an important part of economy of the society. This is why prediction of stock price has become of great importance to the shareholders, so that they can gain the highest return on their investment. Sustainable prediction is very important in financial data, since accurate predictions will have significant effects on profits. Therefore, using traditional analysis tools to make accurate decisions about stocks is very difficult. In addition, there is a significant difference in analysis of the results obtained by individuals using the same tools, which indicates that all of them are not suitable to be used by ordinary investors without professional knowledge and experience.

In this research, we modeled daily return series of stock index in NASDAQ stock exchange using ARMA-GARCH model from 2000 until the end of 2016. After running the model, we found the best model for time series of daily return series of stock index. In next step, we forecasted daily return series of stock index values for 2017 and our findings show that ARMA-GARCH model can forecast very well at the error level of 1%. Also, the result shows that a correlation exists between the stock price indexes over time scales and based on our results about efficiency and fractal feature of NASDAQ stock exchange, we found that NASDAQ stock exchange is efficient market and non-fractal market.

Based on our finding, from a practical view, improving the general apprehending of multifractal behavior and time-varying efficiency in emerging stock markets permits investors to optimize their decision-making process. As well, it may be of great interest for policymakers to enhance the financial market infrastructure and curtail speculative tendencies in stock market which in turn spurs investment and economic growth.

Additionally, the findings of the study may also provide important implications for further study on the dynamic mechanism and efficiency in stock market and help regulators and policymakers effectively control the market risk and achieve more effective resource allocation. Also, these findings have several important implications for asset allocations by investors in US stock markets. As a technical recommendation, the model capability based on genetics algorithm, neural network, and nonlinear regression models and fractal models as common types of nonlinear models for predicting chaotic series could be investigated.

Availability of data and materials

The datasets used or analyzed during the current study are available from the corresponding author on reasonable request.

Abbreviations

- ARMA:

-

Autoregressive moving average

- GARCH:

-

Generalized autoregressive conditional heteroskedasticity

- GA:

-

Genetic algorithm

- ARIMA:

-

Autoregressive integrated moving average

- PCA:

-

Principal component analysis

- GARCH-M:

-

Generalized autoregressive conditional heteroskedasticity in mean

- EGARCH:

-

Exponential general autoregressive conditional heteroskedastic

- TGARCH:

-

Threshold generalized autoregressive conditional heteroskedasticity

- PGARCH:

-

Periodic generalized autoregressive conditional heteroskedasticity

- CGARCH:

-

Component generalized autoregressive conditional heteroskedasticity

- ACGARCH:

-

Asymmetric component generalized autoregressive conditional heteroskedasticity

- EMH:

-

Efficient market hypothesis

- FMH:

-

Fractal market hypothesis

- STDEV:

-

Standard deviation

- Std. Error:

-

Standard error

References

Abbaszadeh MR, Jabbari Nooghabi M, Rounaghi MM (2020) Using Lyapunov’s method for analysing of chaotic behaviour on financial time series data: a case study on Tehran stock exchange. Natl Account Rev 2(3):297–308

Acar Boyacioglu M, Avci D (2010) An adaptive network- fuzzy inference system (ANFIS) for the prediction of stock market return: the case of the Istanbul stock exchange. Exp Syst Appl 37(12):7908–7912

Adekoya OB, Oduyemi GO, Oliyide JA (2021) Price and volatility persistence of the US REITs market. Future Bus J. https://doi.org/10.1186/s43093-021-00102-8

Aderajo OM, Olaniran OD (2021) Analysis of financial contagion in influential African stock markets. Future Bus J. https://doi.org/10.1186/s43093-021-00054-z

Alduais F (2020) An empirical study of the earnings–returns association: an evidence from China’s A-share market. Future Bus J. https://doi.org/10.1186/s43093-020-0010-8

Ali Zadeh SH, Safabakhsh R (2008) Forecasting of financial time series using the ARMA-GARCH-GRNN model. The 14th Annual National Conference of Iranian Computer Society, Amirkabir University of Technology, pp. 33–45

Alshubiri F (2021) The stock market capitalisation and financial growth nexus: an empirical study of western European countries. Future Bus J. https://doi.org/10.1186/s43093-021-00092-7

Anjum S (2020) Impact of market anomalies on stock exchange: a comparative study of KSE and PSX. Future Bus J. https://doi.org/10.1186/s43093-019-0006-4

Anolick N, Batten JA, Kinateder H, Wagner N (2021) Time for gift giving: abnormal share repurchase returns and uncertainty. J Corp Finan. https://doi.org/10.1016/j.jcorpfin.2020.101787

Araujo RDA (2012) A robust automatic phase-adjustment method for financial forecasting. Knowledge-Based Syst 27:245–261

Badshah I, Bekiros S, Lucey BM, Uddin GS (2018) Asymmetric linkages among the fear index and emerging market volatility indices. Emerg Mark Rev 37:17–31

Batten JA, Kinateder H, Szilagyi PG, Wagner NF (2019) Time-varying energy and stock market integration in Asia. Energy Econom 80:777–792

Bekiros S (2007) A neurofuzzy model for stock market trading. Appl Econ Lett 14(1):53–57

Bekiros S, Gupta R (2015) Predicting stock returns and volatility using consumption-aggregate wealth ratios: a nonlinear approach. Econ Lett 131:83–85

Bekiros S, Gupta R, Majumdar A (2016) Incorporating economic policy uncertainty in US equity premium models: a nonlinear predictability analysis. Financ Res Lett 18:291–296

Bekiros S, Hernandez JA, Hammoudeh S, Nguyen DK (2015) Multivariate dependence risk and portfolio optimization: an application to mining stock portfolios. Resour Policy 46:1–11

Bekiros S, Jlassi M, Naoui K, Uddin GS (2017) The asymmetric relationship between returns and implied volatility: evidence from global stock markets. J Financ Stab 30:156–174

Bekiros S, Nguyen DK, Uddin GS, Sjö B (2015) Business cycle (de) synchronization in the aftermath of the global financial crisis: implications for the Euro area. Stud Nonlinear Dyn Econom 19(5):609–624

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Economet 31(3):307–323

Box GEP, Jenkins GM, Reinsel GC (1994) Time series analysis, forecasting and control. Prentice-Hall international, Inc

Budinski-Petković L, Lončarević I, Jakšić ZM, Vrhovac SB (2014) Fractal properties of financial markets. Physica A 410:43–53

Caporale GM, Alana LG, Plastun A, Makarenko I (2016) Intraday anomalies and market efficiency: a trading robot analysis. Comput Econ 47(2):275–295

Chan, M. C., Wong C. C., Lam C. C. (2000). Financial time series forecasting by Neural Network using Conjugate Gradient Learning and Multiple Linear Regression. Weight initialization. Department of computing, the Hong Kong Ploy technique university, Kowloon, Hong Kong, pp. 81–91.

Chao Z, Hua- Sheng H, Wei-Min B, Luo-ping Z (2008) Robust recursive estimation of auto-regressive updating model parameters for real-time flood forecasting. J Hydrol 349:376–382

Chen P, Lin C, Su YC (2010) Asymmetric GARCH Value at Risk of QQQQ. http://papers.ssrn.com

Choudhry T (2018) Stock prices’ interdependence during the South Sea boom and bust. Int J Financ Econ 23(4):628–641

Chowdhury MAM, Haron R (2021) The efficiency of Islamic banks in the southeast Asia (SEA) region. Future Bus J. https://doi.org/10.1186/s43093-021-00062-z

Croux C, Gelper S, Fried R (2008) Computational aspects of robust holt-winters smoothing based on Mestimation. Appl Math 53:163–176

Croux C, Iren G, Koen M (2010). Robust forecasting of non-stationary time series. Center Discussion Paper

Dai W, Wuc JY, Lu CJ (2012) Combining nonlinear independent component analysis and neural network for the prediction of Asian stock market indexes. Expert Syst Appl 39(4):4444–4452

Denby L, Martin RD (1979) Robust estimation of the first-order autoregressive parameter. J Am Stat Assoc 74:140–146

Dutta KD, Saha M (2021) Do competition and efficiency lead to bank stability? Evidence from Bangladesh. Future Bus J. https://doi.org/10.1186/s43093-020-00047-4

Egeli B (2003) stock market prediction using Artificial Networks. web: www. hicbusiness. Org, pp. 95–116

Eldomiaty TI, Anwar M, Magdy N, Hakam MN (2020) Robust examination of political structural breaks and abnormal stock returns in Egypt. Future Bus J. https://doi.org/10.1186/s43093-020-00014-z

Engle R (1982) Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50(4):987–1007

Etemadi H, Anvary Rostamy AA, Farajzadeh Dehkordi H (2009) A genetic programming model for bankruptcy prediction: empirical evidence from Iran. Exp Syst Appl 36(2):3199–3207

Fonou-Dombeu NC, Mbonigaba J, Olarewaju OM, Nomlala BC (2022) Earnings quality measures and stock return volatility in South Africa. Future Bus J. https://doi.org/10.1186/s43093-022-00115-x

Gagne C, Duchesne P (2008) On robust forecasting in dynamic vector time series models. J Statistical Plan Inference 138:3927–3938

Gelper S, Fried R, Croux C (2010) Robust forecasting with exponential and holt-winters smoothing. J Forecast 29:285–300

Ghadiri Moghadam A, Jabbari Nooghabi M, Rounaghi MM, Hafezi MH, Ayyoubi M, Danaei A, Gholami M (2014) Chaos process testing (time-series in the frequency domain) in predicting stock returns in Tehran stock exchange. Indian J Sci Res 4(6):202–210

Giordani P, Villani M (2010) Forecasting macroeconomic time series with locally adaptive signal extraction. Int J Forecast 26:312–325

Gujarati DN (2004) Basic econometrics. 4th Edition, McGraw-Hill Companies

Guresen E, Kayakutlu G, Daim TU (2011) Using artificial neural network models in stock market index prediction. Exp Syst Appl 38(8):10389–10397

Hafsal K, Suvvari A, Durai SRS (2020) Efficiency of Indian banks with non-performing assets: evidence from two-stage network DEA. Future Bus J. https://doi.org/10.1186/s43093-020-00030-z

Haroon Shah M, Ullah I, Salem S, Ashfaq S, Rehman A, Zeeshan M, Fareed Z (2021) Exchange rate dynamics, energy consumption, and sustainable environment in Pakistan: new evidence from nonlinear ARDL cointegration. Front Environ Sci 9:1–11

Huang YC (2017) Exploring issues of market inefficiency by the role of forecasting accuracy in survivability. J Econ Interac Coord 12(2):167–191

Hyndman RJ, Ullah MS (2007) Robust forecasting of mortality and fertility rates: a functional data approach. Comput Stat Data Anal 51:4942–4956

Jahanshahi H, Sajjadi SS, Bekiros S, Aly AA (2021) On the development of variable-order fractional hyperchaotic economic system with a nonlinear model predictive controller. Chaos, Solitons Fractals. https://doi.org/10.1016/j.chaos.2021.110698

Jiang J, Shang P, Zhang Z, Li X (2017) Permutation entropy analysis based on Gini-Simpson index for financial time series. Physica A 486:273–283

Jiang GJ, Tian YS (2012) A random walk down the options market. J Futur Mark 32(6):505–535

Jovanovic F, Andreadakis S, Schinckus C (2016) Efficient market hypothesis and fraud on the market theory a new perspective for class actions. Res Int Bus Financ 38:177–190

Karmarkar US (1994) A robust forecasting technique for inventory and lead time management. J Oper Manag 12:45–54

Khan K, Zhao H, Zhang H, Yang H, Haroon Shah M, Jahanger A (2020) The impact of COVID-19 pandemic on stock markets: an empirical analysis of world major stock indices. J Asian Finance, Econom Bus 7:463–474

Kharin Y (2011) Robustness of the mean square risk in forecasting of regression time series. Commun Statistics- Theory and Methods 40:2893–2906

Khosravi Nejad AA, Pishe SS, M. (2014) Evaluation of linear and nonlinear models in predicting stock price index in the Tehran stock exchange. J Econom Sci 27:51–65

Kim KJ, Han I (2000) Genetic algorithms approach to feature discrimination in artificial neural networks for the prediction of stock price index. Exp Syst Appl 19:125–132

Lahmiri S, Bekiros S, Avdoulas C (2018) Time-dependent complexity measurement of causality in international equity markets: A spatial approach. Chaos, Solitons Fractals 116:215–219

Lawrence R (1997) Using neural networks to forecast stock market prices. pp. 1–12

Lendasse A, Debodt E, Wertz V, Verleysen M (2000) Non-Linear financial time series forecasting application to Bel20 stock market index. Eur J Econom Soc Syst 14(1):81–91

Lensberg T, Eilifsen A, McKee T, E. (2006) Bankruptcy theory development and classification via genetic programming. Eur J Oper Res 169(2):677–697

Li W, Luo Y, Zhu Q, Liu J, Le J (2008) Applications of AR*-GRNN model for financial time series forecasting. Neural Comput Appl 17(5–6):441–448

Manahov V, Hudson R, Urquhart A (2019) High-frequency trading from an evolutionary perspective: financial markets as adaptive systems. Int J Financ Econ 24(2):943–962

Marcellino M, Stock JH, Watson MW (2006) A comparison of direct and iterated multistep AR methods for forecasting macroeconomic time series. Journal of Econometrics 135:499–526

Martin RD, Yohai VJ (1985) 4 Robustness in time series and estimating ARMA models. Handbook Statist 5:119–155

Mohsin M, Naseem S, Muneer S, Salamat S (2019) The volatility of exchange rate using GARCH type models with normal distribution: evidence from Pakistan. Pacific Bus Rev Int 11(12):124–129

Mohti W, Dionísio A, Ferreira P, Vieira I (2019) Frontier markets’ efficiency: mutual information and detrended fluctuation analyses. J Econ Interac Coord 14(3):551–572

Moradi M, Jabbari Nooghabi M, Rounaghi MM (2021) Investigation of fractal market hypothesis and forecasting time series stock returns for Tehran stock exchange and London stock exchange. Int J Financ Econ 26(1):662–678

Musneh R, Abdul Karim MR, Arokiadasan Baburaw CGA (2021) Liquidity risk and stock returns: empirical evidence from industrial products and services sector in Bursa Malaysia. Future Bus J. https://doi.org/10.1186/s43093-021-00106-4

Naseem S, Fu GL, Mohsin M, Zia-ur-Rehman M, Baig S (2018) Volatility of pakistan stock market: a comparison of Garch type models with five distribution. Amazonia Investiga 7(17):486–504

Neslihanoglu S, Bekiros S, McColl J, Lee D (2020) Multivariate time-varying parameter modelling for stock markets. Empirical Econom 61:947–972

Nomran NM, Haron R (2021) The impact of COVID-19 pandemic on Islamic versus conventional stock markets: international evidence from financial markets. Future Bus J. https://doi.org/10.1186/s43093-021-00078-5

Ola MR, Jabbari Nooghabi M, Rounaghi MM (2014) Chaos process testing (using local polynomial approximation model) in predicting stock returns in Tehran stock eExchange. Asian J Res Banking and Finance 4(11):100–109

Parab N, Reddy YV (2020) A cause and effect relationship between FIIs DIIs and stock market returns in India: pre- and post-demonetization analysis. Future Bus J. https://doi.org/10.1186/s43093-020-00029-6

Pinches GE (1970) The random walk hypothesis and technical analysis. Financial Anal J 26(2):104–110

Piscopo G (2010) Italian deposits time series forecasting via functional data. Banks and Bank Syst 5(1):65–69

Podsiadlo M, Rybinski H (2016) Financial time series forecasting using rough sets with time-weighted rule voting. Exp Syst Appl 66:219–233

Potvina JY, Sorianoa P, Vallee M (2004) Generating trading rules on the stock markets with genetic programming. Comput Oper Res 31(7):1033–1047

Pradeepkumara D, Ravia V (2017) Forecasting financial time series volatility using particle swarm optimization trained quantile regression neural network. Appl Soft Comput 58:35–52

Raei R, Mohammadi S, Fenderski H (2015) Forecasting of stock price index using neural network and wavelet transformation. Sci Res J Asset Manag Financial Support 1:55–74

Raifu IA, Kumeka TT, Aminu A (2021) Reaction of stock market returns to COVID-19 pandemic and lockdown policy: evidence from Nigerian firms stock returns. Future Bus J. https://doi.org/10.1186/s43093-021-00080-x

Richards GR (2004) A fractal forecasting model for financial time series. J Forecast 23(8):586–601

Rounaghi MM, Abbaszadeh MR, Arashi M (2015) Stock price forecasting for companies listed on Tehran stock exchange using multivariate adaptive regression splines model and semi-parametric splines technique. Physica A 438:625–633

Rounaghi MM, Nassir Zadeh F (2016) Investigation of market efficiency and financial stability between S&P 500 and London stock exchange: monthly and yearly forecasting of time series stock returns using ARMA model. Physica A 456:10–21

Rousseeuw PJ, Yohai VJ (1984) Robust regression by means of S estimators, robust and nonlinear time series analysis. Lecture Note in Statistics 26:256–272

Salamat S, Lixia N, Naseem S, Mohsin M, Zia-ur-Rehman M, Baig SA (2020) Modeling cryptocurrencies volatility using GARCH models: a comparison based on normal and student’s T-Error distribution. Entrepreneurship and Sustain 7(3):1580–1596

Salibian-Barrera M, Yohai VJ (2006) A fast algorithm for S-regression estimates. J Comput Graph Stat 15:414–427

Seiler MJ, Rom W (1997) A historical analysis of market efficiency: Do historical returns follow a random walk? J Financ Strateg Decis 10(2):49–57

Sermpinis G, Laws J, Karathanasopoulos A, Dunis CL (2012) Forecasting and trading the EUR/USD exchange rate with gene expression and psi sigma neural networks. Exp Syst Appl 39(10):8865–8877

Shahriari H, Shariati N, Moslemi A (2012) Presentation of a method for sustainable forecasting of time series with application in financial matters using robust method. Sci Res J Financial Knowl Securities Anal 15:97–114

Shahzad SJH, Arreola-Hernandez J, Bekiros S, Shahbaz M, Kayani GM (2018) A systemic risk analysis of Islamic equity markets using vine copula and delta CoVaR modeling. J Int Finan Markets Inst Money 56:104–127

Stratimirovic D, Sarvan D, Miljkovic V, Blesic S (2018) Analysis of cyclical behavior in time series of stock market returns. Commun Nonlinear Sci Numer Simul 54:21–33

Takeuchi K, Takemura A, Kumon M (2011) New procedures for testing whether stock price processes are martingales. Comput Econ 37(1):67–88

Tang Z, Almeida CD, Fishwick PA (1991) Time series forecasting using neural networks vs. Box- Jenkins Methodol Simulation 57(5):303–310

Thomaidis NS (2007) Efficient statistical analysis of financial time-series using neural networks and GARCH models. https://ssrn.com/abstract=957887

Tsao CY, Huang YC (2018) Revisiting the issue of survivability and market efficiency with the santa fe artificial stock market. J Econ Interac Coord 13(3):537–560

Tzouras S, Anagnostopoulos C, McCoy E (2015) Financial time series modeling using the hurst exponent. Physica A 425:50–68

Wang N, Haroon Shah M, Ali K, Abbas S, Ullah S (2019) Financial structure, misery index, and economic growth: time series empirics from Pakistan. J Risk and Financial Manag 12(2):100

Wang Y, Wu C (2013) Efficiency of crude oil futures markets: New evidence from multifractal detrending moving average analysis. Comput Econ 42(4):393–414

Wanga JJ, Wanga JZ, Zhang ZG, PoGuo S (2012) Stock index forecasting based on a hybrid model. Omega 40(6):758–766

Westerlund J, Narayan P (2013) Testing the efficient market hypothesis in conditionally heteroskedastic futures markets. J Futur Mark 33(11):1024–1045

Wu B (1995) Model-free forecasting for nonlinear time series (with application to exchange rates). Comput Stat Data Anal 19:433–459

Xu M, Shang P (2018) Analysis of financial time series using multiscale entropy based on skewness and kurtosis. Physica A 490:1543–1550

Ye, F., Zhang, L., Zhang, D., Fujita, H., Gong, Z. (2016). A novel forecasting method based on multi-order fuzzy time series and technical analysis. Information Sciences, 367(C), 41–57.

Ying Wei L (2016) A hybrid ANFIS model based on empirical mode decomposition for stock time series forecasting. Appl Soft Comput 42:368–376

Yu L, Wanga S, Keung Lai K (2009) A neural-network-based nonlinear meta modeling approach to financial time series forecasting. Appl Soft Comput 9:563–574

Zahedi J, Rounaghi MM (2015) Application of artificial neural network models and principal component analysis method in predicting stock prices on Tehran stock exchange. Physica A 438:178–187

Acknowledgements

Note applicable.

Funding

The authors have not received any funding from any source.

Author information

Authors and Affiliations

Contributions

MA contributed the central idea, conceived and designed this research, supervised the study, provided mathematical and model derivation, and wrote the initial draft of the paper. MMR contributed to refining the ideas, performed the data and statistical analysis, wrote the initial draft of the paper, carrying out additional analyses and coordination and finalizing this manuscript. Both authors wrote, corrected and agreed to the published version of the manuscript. Both authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Ethical approval and consent to participate

Note applicable.

Consent for Publication

Note applicable.

Competing interests

All authors declare no conflicts of interest in this paper.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Arashi, M., Rounaghi, M.M. Analysis of market efficiency and fractal feature of NASDAQ stock exchange: Time series modeling and forecasting of stock index using ARMA-GARCH model. Futur Bus J 8, 14 (2022). https://doi.org/10.1186/s43093-022-00125-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s43093-022-00125-9