Abstract

We propose a unique method of nowcasting and forecasting GDP growth based on a forward-looking measure of unemployment (FLUR) and Okun’s law that offers a number of advantages over current leading indicators of the Swiss business cycle. The following investigation, covering the period from 1991/1 to 2021/4, demonstrates that our approach outperforms an AR(1) model of GDP growth equally well as the popular Business Cycle Index of the Swiss National Bank and the KOF Barometer with respect to year-to-year growth, but less so in regard to quarter-to-quarter changes. Our findings suggest that our approach offers a reliable and useful indicator to policymakers seeking easily compiled information on the current and future course of the Swiss economy at monthly time intervals.

Similar content being viewed by others

1 Introduction

Two indexes stand out in a list of leading indicators of the business cycle in Switzerland: the Business Cycle Index (BCI) of the Swiss National Bank (SNB) and the KOF Barometer of the KOF Swiss Economic Institute at the Swiss Federal Institute of Technology (ETH) in Zürich.Footnote 1 Both indicators have much in common. Both focus on quarterly GDP growth. Both employ state of the art methodologies, utilizing factor models that treat business conditions as a latent variable linked to observable economic quantities. Both draw from a very broad set of data, the KOF Barometer incorporating over 200 data series and the BCI encompassing some 650. And both are released at monthly intervals, providing timelier information on the course of the economy than the quarterly GDP reports that first appear some two months after a quarter’s end and then only as preliminary estimates.

The strengths of both indicators are offset by certain weaknesses, however. For one, constructing and updating the business cycle indicators are quite cumbersome due to the complexity of the underlying models. For another, the results rest on a myriad of cross-correlations whose intertemporal stability is uncertain. And finally, data underlying the indicators are subject to revisions and are “noisy” necessitating filtering. Consequently, the values of the indicators at the near end of the series often fluctuate from one release to the next, creating uncertainties that detract from the indicators’ gains in timeliness.

In the following study, we propose and develop a novel business cycle indicator without these drawbacks. Its computation is straightforward, requiring no more than spreadsheet calculations. It draws from a single data source that is not subject to revisions. And its construction does not rest on historic correlations of uncertain temporal stability, depending instead on a mathematical law that always applies, be it appropriate for forecasting purposes or not. The approach consists in combining a forward-looking unemployment rate (FLUR) based on the mathematical theory of absorbing Markov chains with Okun’s law to produce a monthly leading indicator of current and future GDP growth.Footnote 2

We test the predictive capabilities of our approach over the sample period from 1991/Q1 to 2021/Q4Footnote 3 by comparing the capacity of our indicator to outperform an AR(1) model of GDP growth with the ability of SNB’s BCI and the KOF Barometer to do likewise. This is a commonly employed approach to test the forecasting capabilities of competing leading indicators.

Our results indicate that all three indicators outperform the AR(1) model equally well in nowcasting and forecasting year-to-year GDP growth, but that our approach falls somewhat short in regard to quarter-to-quarter changes.

Our paper unfolds as follows. Section 2 explains the construction of FLUR and examines its forecasting ability with regard to observed unemployment. Section 3 develops the Okun relationship linking FLUR with GDP growth. Section 4 investigates to what extent our indicator contains statistically significant predictive information with regard to GDP growth not captured by the BCI or the KOF Barometer and presents our nowcasting and forecasting test results. Section 5 summarizes our findings and suggests avenues for future research.

2 Forward-looking unemployment rate (FLUR)

2.1 Computation

The calculation of the forward-looking unemployment rate (FLUR) rests on the key insight that the stock of unemployed at any point in time consists of the remaining members of current and past cohorts of individuals that entered unemployment. We define Ut as the stock of unemployed at the end of a given period t; Nt-k as the number of individuals that entered unemployment k periods prior to period t; and p(k)t as the proportion of those members of the same cohort, still unemployed at the end of period t − 1, that remain unemployed in period t as well. p(k)t thus represents the single-period continuation or survivor rate of those individuals that entered unemployment k periods prior to period t.

Based on the above notation, the observed stock U of unemployed at the end of a given period t is defined as follows:

As the indices clearly indicate, the stock of unemployed observed at any point in time is principally backward looking, mainly reflecting past employment opportunities captured in N and p.

To make (1) forward looking, we replace the historical values of the size N of entering cohorts and the survival rates p appearing in (1) with their values in the given period t, yielding

where S(τ)t represents the survivor function based on the duration-specific survival rates p(k)t prevailing in period t. T denotes the duration of the longest completed unemployment spell, taken to be 48 months.Footnote 4 In the following, we measure both elapsed time τ and calendar time t in calendar months.

Dividing Ut* by the size of the labor force LFt prevailing in period t yields FLUR.Footnote 5

The first term in the product appearing to the right of the last equals sign represents the risk of becoming unemployed for an average labor-force member and the second term, the expected duration of the subsequent spell of unemployment.Footnote 6 That the sum of the values of the survivor function equals the expected length of a completed spell of unemployment is readily seen by noting that the kth value of the survivor function S(τ) equals the share of cohort members that will experience a kth month of unemployment. Thus summing across all T + 1 duration intervals of uniform length of one month yields the total expected time that a cohort member will spend in unemployment or, equivalently, since the survivor rates apply just to month t, the expected future duration of completed spells begun in month t.Footnote 7

Taken at face value, FLUR represents the unemployment rate that current survivor rates and the rate of entry into unemployment imply. In so doing, it yields a timelier picture of on-going labor market developments than observed unemployment appearing in (1). At the same time, however, and based on the mathematical theory of absorbing Markov chains developed by Kemeny and Snell (1960), FLUR is also equal to the long-term or steady-state unemployment rate to which the observed unemployment rate would converge were current survivor rates and the rate of entry into unemployment to remain unchanged in the future.Footnote 8 It is in this sense that FLUR is forward looking despite the fact that it simultaneously reflects current labor market conditions. And it is this aspect of FLUR that underlies our approach.Footnote 9

Calculation of FLUR is straightforward and, given the data, requires no more than 15 min to compute. It merely necessitates calculating duration-specific survivor rates for the unemployed by breaking down the current month’s stock of unemployed by elapsed spell duration measured in months. The electronic unemployment registration system (AVAM) of the State Secretariat for Economic Affairs (Seco), containing panel data on each individual who registers at an unemployment office, serves as our data source. Calculation of the survivor rates for a given calendar month t proceeds as followsFootnote 10:

U(τ - 1)t−1 represents the observed number of unemployed persons who at the end of calendar month t − 1 had been unemployed for τ − 1 months, and U(τ)t denotes the number of the same individuals still unemployed at the end of the following month t. The calculation of survivor rates thus rests on intracohort comparisons between adjoining months.Footnote 11 Note that U(0) and the size N of an entering cohort are equivalent expressions. Note also that exits from unemployment do not necessarily imply new hires. This has important policy implications but need not detract from the nowcasting and forecasting capabilities of FLUR.

As can be seen, FLUR has two advantages over common business cycle indicators. For one, its construction is straightforward and does not depend on historic correlations of uncertain temporal stability but rather on the mathematical laws of absorbing Markov chains that always hold whether they are appropriate in a certain setting or not. For another, FLUR draws its required information from a single data source that is not subject to subsequent revisions.Footnote 12

2.2 Prediction capabilities

Since observed unemployment is known to lag behind GDP growth, FLUR needs to lead the observed unemployment rate to have any hope of predicting future GDP growth. In the following, we investigate to what extent this is in fact the case.

To begin, we explore the causal structure existing between FLUR and the observed unemployment rate (UR) employing Granger causality tests. Our findings appear in Table 1. The P-values listed there indicate that the assumption of two-way causality cannot be ruled out at commonly accepted levels of statistical significance. At the same time, however, they show that the direction of causality running from FLUR to UR is far stronger than the other way around. Note that Granger causality tests investigate whether the excluded variable contains information affecting the dependent variable not already captured by the latter. It is only in this sense that two-way causation cannot be completely dismissed.

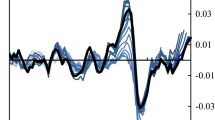

To determine at which lag length (x) the current value of FLUR best predicts the future observed unemployment rate (UR), we next run a simple regression of UR(t) on FLUR(t + x) and follow the time path of R2 as the lead time x of FLUR increases. The results of this endeavor appear in Fig. 1. As the chart indicates, R2 reaches a maximum of 95 percent when FLUR is lagged by five months or almost two quarters. Since FLUR and UR share a common mean, 1 − R2 (or 5%) corresponds to the relative mean squared error resulting from forecasting UR(t) with FLUR(t − 5).

The results presented in Fig. 1 imply that shifting the time path of FLUR five months into the future should yield a close correspondence with the time path of UR. As Fig. 2 demonstrates this is indeed the case. The time path of FLUR lagged by five months closely traces out the time path of the observed unemployment rate, while managing to predict every turning point correctly.

We extend our investigation of the predictive capabilities of FLUR in predicting future observed unemployment further by repeating the same exercise for the average duration of completed spells of unemployment. As pointed out above, the sum appearing in (2) and (3) corresponds to the expected duration (DSS) of completed spells of unemployment begun in a given month t. In the following we compare this value with the observed duration (D) of completed spells of unemployment ending in some initially unknown future month t + x.Footnote 13 Demographically speaking, our analysis corresponds formally to investigating whether life expectancy at birth can predict the future average observed age at death.

We again begin by examining the Granger causal structure existing between DSS and D. Our findings appear in Table 2. As the results indicate, DSS at best Granger causes D at a 10% level of significance, whereas the opposite holds true at a far higher level of significance.

Next, Fig. 3 investigates which lagged value of DSS best reproduces the time path of D in analogy to Fig. 1. The results show that this is achieved with a DSS lagged by 15 months or roughly five quarters. At this lag length, R2 reaches a maximum of 94%. It seems remarkable how well the expected duration of beginning spells of unemployment is able to forecast the average length of completed spells of unemployment 15 months in advance. The fact that its long-range forecasting capabilities greatly surpass those of FLUR implies that shifts in the survivor function have a more lasting effect on unemployment than changes in the risk of becoming unemployed.

Next, Fig. 4 presents the fit between the time paths of D(t) and D(t − 15). Here again the correspondence is very high as Fig. 3 would lead one to expect. And once again our forecast correctly predicts all turning points 15 months in advance, once again an impressive feat.

In concluding, we thus see that FLUR clearly leads observed unemployment. Consequently, it seems justified to expect FLUR to have the potential to predict GDP growth even though observed unemployment lags behind the latter.

The predictive potential of FLUR is also plausible from a theoretical perspective. The fact that FLUR leads observed unemployment means that it predicts the future level of labor utilization, which, taking supply-side effects into consideration, should in turn have an impact on future economic growth.

3 Okun relationship

In order to test the ability of FLUR to predict current and future GDP growth, we need first to convert FLUR into GDP. To this end, we turn to Okun’s law, which posits a negative relationship between changes in unemployment and real GDP growth. We calibrate our Okun relationship employing the following regression equationFootnote 14

where y denotes the log of real GDP and \(\varepsilon\) is an zero expected value error term uncorrelated with the regressor. t denotes quarters. However, depending on the chosen value of i, the changes appearing in (5) can represent both quarter-to-quarter (i = 1) and year-to-year changes (i = 4).Footnote 15 Further below we test the predictive power of FLUR with regard to both periodicities and explain why.

Estimation of (5) using quarter-to-quarter changes for the period 1991/Q1 to 2021/Q4 yields the following results, where the figures in parentheses represent Newey-West t-values.

Running the same regression with year-to-year changes delivers the following findings, where again the figures in parentheses represent Newey-West t-values.

As both sets of results indicate, we find a statistically highly significant linear relationship and coefficient estimates with the expected sign. However, Bai-Perron (2003) tests of the intertemporal stability of (5) point to shifts in the coefficients at the end of the 1990s based on quarter-to-quarter changes (Table 3) and at the end of the 1990s and during the financial crisis in 2008 based on year-to-year changes (Table 4).

Various explanations exist to explain the instability of the Okun equation in the 1990s. For one, the last 30 years have seen a trend shift in employment from industrial jobs to service positions (especially in health and education), where employment is less susceptible to cyclical swings. For another, Switzerland completely overhauled its public job placement services in 1996/97 to accelerate job placement and extended the waiting period for receiving unemployment benefits from 1 week to 6 months for those individuals (principally persons exiting the education system) with insufficient contributions to the unemployment insurance system. All of these events should have weakened the impact (= 1/β) of swings in GDP growth on registered unemployment, and, indeed, the absolute value of β rises from on average 0.775 in the years 1991 to 1999 to 2.367 between 2000 and 2021 (see Fig. 5 below) leading to a decrease in 1/β.

Time-varying estimates of the intercept and slope of logistic Okun Eq. (6)

Unfortunately, the break model does not suit our out-of-sample testing procedure we conduct in the next section. We need a model that potentially holds for the entire sample period. Moreover, it is implausible that a sudden break occurs in a certain quarter. Instead, it is far more likely that the coefficients change gradually over time. We take account of this by modeling the adjustment process as the following logistic function of calendar time t. This approach offers a high degree of flexibility and necessitates the estimation of just two additional parameters (γ1 and γ2) to calibrate the logistic function.

Table 5 presents the results from estimating (6). We see that, compared to the linear equation, both R2 and the precision of our estimates of α and β increase considerably.

Figure 5 shows the time path of the intercept and slope of the Okun equation based on the estimates appearing in Table 5. As expected, α and β change the most during the 1990s before converging to their final values.Footnote 16 The increasing constancy of the parameters from the 2000s on implies that our Okun relationship currently provides a stable basis for translating changes in FLUR into changes in GDP.

4 Comparative performance of our approach

4.1 Exploratory analysis

The first issue arising in a comparative analysis of the performance of leading indicators is the target or reference series to predict. We choose fully revised as opposed to real-time GDP as our target because policymakers are interested in reality, which fully revised figures aim to reflect, and not in the best estimate of reality in real time, which many comparative indicator studies seem to prefer. Note that in the case of FLUR the distinction between real-time and final-release data does not play a role because unemployment data are not subject to revisions. That is a decisive advantage that FLUR has over other leading indicators whose true values remain uncertain in real time due to possible future adjustments to the data on which they rest.

The next issue pertains to periodicity. Should growth apply to quarter-to-quarter or to year-to-year changes? The advantage of using quarterly growth rates is that they register cyclical swings sooner than annual growth rates as Fig. 6 demonstrates in the case of the financial crisis in 2008/2009 and the pandemic in 2020–2021. On the other hand, however, quarterly growth rates tend to exaggerate yearly growth rates when annualized inasmuch as their large swings never materialize in the annual growth rates, which the chart also reveals. In addition, quarterly changes are subject to seasonal and idiosyncratic effects, necessitating filtering to extract the cyclical and trend effects of interest. Such adjustments have the drawback that they generally rest on moving averages, which have difficulty distinguishing seasonal effects from trend reversals at the near end of data since leading data are by definition missing at the near end. For this reason, adjusted data tend to fluctuate from one report to the next generating uncertainty and detracting from the gains in timeliness that a higher periodicity offers. With year-to-year changes, this problem does not arise because year-to-year differencing tends to eliminate seasonal and idiosyncratic effects, thereby obviating the need for further filtering. Given these pros and cons, we choose to base our comparison of the performance of leading indicators both on quarter-to-quarter and year-to-year GDP growth rates to increase the robustness of our results.

We pick the Business Cycle Index (BCI) of the Swiss National Bank (SNB) and the KOF Barometer as our basis of comparison as they appear to be the most established among business cycle leading indicators in Switzerland. Moreover, both indicators also target quarterly GDP growth. The two series appear in Fig. 7 along with the quarterly GDP growth rate and our FLUR-Okun indicator based on (6) and the parameter estimates appearing in Table 5. All four series are standardized to allow comparison. As can be seen, all three indicators seem to track GDP growth roughly equally well.

The impression conveyed in Fig. 7 is confirmed in Table 6, which presents the cross-correlations of the series appearing in Fig. 7. As the table shows, all three indicators correlate strongly with quarterly GDP growth (gGDP), the strongest correlation existing between quarterly GDP growth and the SNB leading indicator (SNB-BCI), followed by the FLUR-Okun indicator and then the KOF Barometer (KOF Bar). This suggests that the SNB indicator would outperform the two other leading indicators in nowcasting quarterly GDP growth. The table also indicates that our FLUR-Okun indicator correlates less with the KOF Barometer than with the BCI of the SNB, suggesting that our indicator and the BCI share more common variation.

In a further step, we find that a regression of quarterly GDP growth on the three indicators, as presented below,Footnote 17fails to find a statistically significant effect of the KOF Barometer on quarterly GDP growth when paired with the other two indicators, implying that the KOF Barometer contains little relevant variation not already captured by the two other measures.

Finally, we also investigate the causal structure existing among the three indicators and quarterly GDP growth using VAR models. VAR models have the advantage that they offer a more general overall view of casual structures prevailing among variables. We estimate both bivariate models, pairing each indicator individually with quarterly GDP growth (Table 7), and multivariate models, which include all four variables (Table 8). Note that the presence of Granger causality means that one or more given variables (“excluded variables” in Table 8 and 9) contain predictive information with regard to a target variable (“dependent variable”) that is captured by neither the latter nor the non-excluded variables.

Based on the P-values appearing in Table 7, the FLUR-Okun indicator appears to have a statistically more pronounced Granger causal effect on quarterly GDP growth (gGDP) than the other two leading indicators. Or, to put it differently, only the FLUR-Okun indicator seems to provide a statistically significant improvement over an optimally lagged AR forecast model of quarterly GDP growth.

Combining all three indicators together with quarterly GDP growth in a single VAR model (Table 8) reveals, however, that the other two indicators also contribute statistically significantly to an AR forecast model of GDP growth, both taken together (“all 3”) and individually. The latter result implies that each indicator contains unique statistically significant predictive information in regard to GDP growth not captured by the other indicators.

Interestingly, the P-values also indicate that the three leading indicators are more likely to Granger cause GDP growth than the other way around, as one would expect from leading indicators, and, more importantly, that GDP growth is the least likely to Granger cause our FLUR-Okun indicator, further underscoring the predictive potential of FLUR.

4.2 Comparative analysis

In the following, we compare the nowcasting and forecasting capability of FLUR with that of the SNB-BCI, the KOF Barometer and an AR(1) model of GDP growth. In so doing, we proceed as follows. To begin, we model FLUR and the two leading indicators as AR(1) processes as well to place them on equal footing with our GDP growth model. Bai-Perron tests across the complete sample period from 1991/Q1 to 2021/Q4 imply that the AR(1) specifications are both appropriate and stable. Next, to translate the nowcasts and forecasts that these AR(1) processes generate into GDP growth rates, we make use of bridge equations. Our Okun relationship (6) serves this purpose in the case of FLUR. For the other two indicators, we specify simple linear regressions, which Bai-Perron tests also find to be appropriate and stable.

That done, we start by estimating AR(1) models for all four variables as well as bridge equations for each indicator using an initial sample set from 1991/Q1 to 1997/Q4 and then, beginning in 1998/Q1, calculate cumulative forecasts for zero to four-quarter horizons. This exercise is repeated with increasing sample size up to the last quarter of 2021 resulting in 96 forecast errors (= 24 years × 4 quarters) for each variable and horizon. We then compare the quality of the nowcasts and forecasts of the various predictions using the root-mean-squared error (RMSE) criterion.

To place all indicators on equal footing, one should re-estimate the BCI of the SNB and the KOF Barometer at each step in this iterative process. But due to the complexity of the indicators’ construction this is not feasible. And unrevised vintage series are not available for our complete sample period, which we wish to keep uniform for all indicators to allow direct comparisons. Hence, we are forced to use revised values for these two indicators throughout. Note that this puts them at a decided advantage since predicting the growth rate of adjusted GDP using vintage values, as we in effect do in the case of FLUR, would undoubtedly yield less accurate results.

The root-mean-squared errors (RMSE) obtained from our out-of-sample testing strategy based on quarter-to-quarter changes appear in Table 9. As the table indicates, RMSE yielded by each of the three leading indicators is lower than that stemming from the AR(1) quarterly growth model, with the exception of the FLUR-Okun indicator three quarters ahead. The largest relative reduction in RMSE of 38 percent on average is achieved by the nowcasts. In other words, the forecasts yield smaller relative decreases in RMSE.

The BCI achieves the best improvement in accuracy overall, lowering the RMSE across all horizons by 31 percent on average, followed by the KOF Barometer with a reduction of 17 percent and FLUR with a 10 percent mean drop. The decreases generated by FLUR are seldom statistically significant, however.

Table 10 reports our results with regard to year-to-year GDP growth. To generate year-to-year changes for the SNB’s BCI and the KOF Barometer, we sum their values from the previous four quarters.Footnote 18 As the table indicates, the relative reduction in RMSE is less than that in the case of quarter-to-quarter changes amounting to just 13 percent on average overall. The greatest improvement in accuracy is again achieved by the BCI with a drop in RMSE on average of 16 percent, followed by FLUR with a relative decrease of 13 percent and the KOF Barometer with a decline of 10 percent. We thus see that all indicators perform equally well with regard to year-to-year GDP growth.

Interestingly, the improvement in accuracy that predictions with FLUR achieve varies little across periodicities, lowering the RMSE by 10 percent in the case of quarter-to-quarter growth and by 13 percent in the case of year-to-year growth, whereas the other two leading indicators perform far better with respect to quarter-to-quarter growth. We suspect that this is because these indicators are calibrated specifically to track quarterly GDP growth, whereas FLUR is completely open in this respect.

It is also important to note that the performance of the SNB’s BCI and the KOF Barometer in our study rests on their revised values. If one were instead to use real-time values of these indicators to predict adjusted GDP growth as we in effect do with FLUR, their accuracy would most likely decrease. Otherwise, it would make little sense to update the indicators.

5 Conclusion

In summary, we point out that our analysis has shown that FLUR leads the observed unemployment rate in Switzerland by roughly two quarters. This is an important result as the observed unemployment rate commonly lags GDP growth. Were FLUR to lag GDP growth as well, attempts to employ it as a leading indicator of GDP growth would be futile.

Furthermore, we found through VAR modeling and block exogeneity tests of Granger causality that our FLUR-Okun indicator contains information that contributes to the prediction of GDP growth and yet is not captured by the BCI or the KOF Barometer. This underscores the potential contribution of our leading indicator.

Finally, we demonstrated by means of a horse race that the nowcasting and forecasting accuracy of FLUR exceeds that of an AR(1) process of GDP growth, whether the latter is measured in quarter-to-quarter or year-to-year changes. In the latter case, FLUR performs no worse than the SNB’s BCI or the KOF Barometer. It is only in respect of quarter-to-quarter changes in GDP that FLUR falls short. As the performance of FLUR, unlike that of the other two indicators, varies little across periodicities, we suspect that the superior performance of the BCI and the KOF Barometer is due partially to their being specifically tailored to track quarterly GDP growth.

The superior performance of the BCI and the KOF Barometer also arises from the fact that we use final-release values for these indicators. Were we to employ real-time data for them, their performance would most likely decline. Otherwise it would make little sense to recalibrate the indicators when revised figures for the series on which they are based become available.Footnote 19

The greater accuracy that the BCI and KOF Barometer provide with regard to quarter-to-quarter changes in GDP must also be weighed against the far greater effort that the calculation and maintenance of these two indicators entail. Viewed in this way, FLUR offers a huge gain in efficiency.

In their evaluation of business cycle indicators for the Swiss economy, Glocker and Kaniovski (2019) list four requirements that in their mind an ideal business cycle indicator should fulfill. These consist of (1) a high contemporary or leading correlation with the reference series, (2) timely availability, (3) temporal stability and (4) a low proneness to revisions. To our mind, FLUR meets all of these demands. As our VAR findings show, FLUR exhibits high contemporary and leading correlations with the reference series, i.e., GDP growth. It is timely given its monthly periodicity in combination with its forecasting capabilities. It exhibits high temporal stability, resting as it does on a mathematical law instead of empirical correlations. And the data underlying FLUR, unlike those on which the BCI of the SNB and the KOF Barometer rest, are not subject to revisions, being based on administrative records that are not subject to change.

Our paper also opens up avenues for future research. For one, the finding that our indicator contains information that contributes to the prediction of GDP growth and is not captured by the BCI or the KOF Barometer suggests that it would be advantageous to incorporate FLUR in the construction of these leading indicators. It could also prove to be worthwhile to repeat our horse race procedure using real-time instead of final-release values for the BCI or the KOF Barometer in order to assess the advantages of having a leading indicator not subject to subsequent revisions. Any finally, it could also be of interest to compare the performance of FLUR with the other two leading indicators during the financial and COVID-19 crises when the demand for timely information on economic conditions was at its greatest.

Yet even without the benefits of further research, the evidence presented in this paper already suggests that FLUR can provide a useful measure for policymakers seeking easily compiled and reliable information on the current and future course of the Swiss economy at short time intervals.

Availability of data and materials

Values for the FAI Indicator were generated by the authors from raw data drawn from the electronic unemployment registration system of the State Secretariat for Economic Affairs in Berne, Switzerland. The raw data are available under permission from the State Secretariat for Economic Affairs. Values for GDP and the Business Cycle Indicator are available online at the Internet website of the Swiss National Bank, while those for the KOF Barometer can be found on the website of the KOF Swiss Economic Institute.

Notes

Kaufmann (2020) also incorporates underemployment data, specifically short-time work, in a forecast model of economic growth. However, her focus is narrower than ours as she does not develop a full-blown leading indicator but simply investigates whether including information on labor market conditions could have aided in predicting Swiss GDP growth during the COVID-19 pandemic.

Beginning the sample period in 1991 stems from the fact that the KOF Barometer starts then.

T is set to 48 months as virtually no one remains registered as unemployed any longer. The choice of 48 months is innocuous, however, as the value of the survivor function in the 47th month equals the product of 48 probabilities (τ = 0, 1, …, 47) and hence is close to zero.

Sider (1985) also suggests calculating the unemployment rate in the manner presented in (3). However, his aim is to estimate the duration of unemployment, equal to the sum appearing in (3), without having to assume that observed unemployment is always in a steady state as was common at the time. When observed unemployment is in a steady state, the duration of unemployment, based on (2), is simply equal to Ut/Nt. More importantly, however, Sider overlooks the forecasting potential of (3), which is the focus of our approach.

Nt, the number of new entries into unemployment, is often used as a leading indicator in the USA. In contrast, FLUR incorporates both new entries and the expected length of those beginning spells. Hence, it contains more predictive potential.

From a demographic perspective, the expected duration of unemployment is formally equivalent to life expectancy at birth, which also rests on current, albeit age-specific survival rates.

See also Sheldon (2020).

Note, however, that the use of FLUR as a leading indicator in no way assumes that current survivor rates and the rate of entry into unemployment will remain unchanged in the future. The constancy assumption merely serves to explain why FLUR can be viewed as forward looking. In fact, survivor rates and the rate of entry into unemployment generally do not remain constant through time but rather fluctuate from month to month. Were they not to, FLUR would be useless as a leading indicator since it would not react to cyclical swings.

We correct inconsistencies in individual unemployment histories beforehand to avoid obtaining survival rates greater than one.

We thus ignore unemployment spells that start and end within a calendar month. The reason, for one, is that such short spells often prove to constitute errors in the data. For another, spells beginning and ending within a calendar month are not included in the official stock of unemployed, which is compiled on the last day of a month and is the focus of FLUR.

To be exact, (2) is not subject to revisions, but (3) or FLUR is, albeit to minor changes. These result from the fact that the size of the labor force (LF) used to calculate the official unemployment rate is only updated officially at discrete (until 2010 at ten-year) intervals. The last revision occurred in 2022 and in 2017 before that. To update the labor force between revisions, we simply multiply the size of the labor force by the factor 1.00077 from month to month. 0.077 percent is the average monthly rate at which the labor force rose from both 1970 and 1990 to the present.

Note that DSS and D do not pertain to a single cohort. This is of no significance, however, as it is also true of DSS as a comparison of the indices t and τ in (2) and (4) reveals. DSS and D are period-specific, not cohort-specific.

To be clear, t denotes frequency and i periodicity.

As inspecting (5) reveals, α corresponds to the GDP growth rate required to hold FLUR constant. Hence, not only has FLUR become less reactive to cyclical swings, it also requires greater growth than in the 1990s to avoid increasing.

Newey-West t-values appear in parentheses below the coefficient estimates.

It is of course well possible that the BCI and the KOF Barometer would yield different predictions where they specifically tailored to track year-to-year instead of quarter-to-quarter GDP growth.

KOF, for example, revises its Barometer every September after the release of the previous year’s GDP data by the Swiss Federal Statistical Office, thereby dropping some variables previously included and incorporating others previously left out. See Abberger et al. (2014).

Abbreviations

- AR:

-

Autoregression

- AVAM:

-

Electronic unemployment registration system of Seco

- BCI:

-

Business Cycle Index

- ETH:

-

Swiss Federal Institute of Technology

- FLUR:

-

Forward-looking unemployment rate

- GDP:

-

Gross domestic product

- KOF:

-

Konjunkturforschungsstelle

- LF:

-

Labor force

- RMSE:

-

Root-mean-squared error

- Seco:

-

State Secretariat for Economic Affairs, Berne, Switzerland

- SNB:

-

Swiss National Bank

References

Abberger, K., Graff, M., Siliverstovs, B., Sturm, J.-E. (2014). The KOF economic barometer, version 2014: A composite leading indicator for the Swiss Business Cycle, KOF working paper, Nr. 353. KOF Swiss Economic Institute.

Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of Applied Econometrics, 18(1), 1–22.

Chamberlain, G. (2011). Okun’s law revisited. Economic & Labour Market Review, 5(2), 20–31.

Diebold, F., & Mariano, R. (1995). Comparing predictive accuracy. Journal of Business and Economic Statistics, 13, 253–265.

Galli, A. (2018). Which indicators matter? Analyzing the Swiss business cycle using a large-scale mixed-frequency dynamic factor model. Journal of Business Cycle Research, 14(2), 179–218.

Glocker, C., Kaniovski, S. (2019). An evaluation of business cycle indicators for the Swiss economy. Grundlagen für die Wirtschaftspolitik, Nr. 6. State Secretariat of Economic Affairs.

Kaufmann, S. (2020). COVID-19 outbreak and beyond: The information content of registered short-time workers for GDP now- and forecasting. Swiss Journal of Economics and Statistics, 156, 12.

Kemeny, J., & Snell, L. (1960). Finite Markov Chains. Princeton.

Okun, A. (1962). Potential GNP: Its measurement and significance. Reprinted as Cowles Foundation Paper 190.

Sheldon, G. (2020). Unemployment in Switzerland in the wake of the covid-19 pandemic: An intertemporal perspective. Swiss Journal of Economics and Statistics, 156, 8.

Sider, H. (1985). Unemployment duration and incidence: 1968–82. American Economic Review, 75(3), 461–471.

Acknowledgements

We thank the referees and editors for helpful comments and suggestions.

Funding

This research was not supported by external funding.

Author information

Authors and Affiliations

Contributions

The authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Kugler, P., Sheldon, G. A monthly leading indicator of Swiss GDP growth based on Okun’s law. Swiss J Economics Statistics 159, 11 (2023). https://doi.org/10.1186/s41937-023-00115-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s41937-023-00115-w