Abstract

While digital finance and renewable energy consumption (REC) are two timely issues, it remains unclear whether the former affects the latter, especially in developing economies. This paper examines the impact of digital finance on China’s REC between 2011 and 2018 and explores the underlying mechanisms. Results show that digital finance, along with its coverage breadth and usage depth, significantly improved REC in China and that digital finance in the area of credit has had the most significant impact. Additionally, the results show that loan scale and income level are the main mediation variables, through which digital finance affects REC. The findings also suggest that economic growth and technological progress have increased REC in China, while carbon dioxide emissions have had no meaningful effect on this consumption. The results further indicate that policymakers must pay close attention to the role of digital finance when formulating policies on REC. To promote REC and environmental sustainability, developing economies like China should strengthen the breadth and depth of digital finance development, focus on the influence channels of digital finance, and promote economic growth and technological progress.

Similar content being viewed by others

Introduction

Energy is not only necessary for the survival and development of human society; it also has a significant impact on the stability and development of national economies (Guo et al. 2021). However, traditional energies such as fossil fuels are associated with issues of supply security, resource depletion, and environmental degradation (Mendonça et al. 2020). In addition, the carbon dioxide released by fossil fuel combustion has become the primary driver of global warming (Guo et al. 2021). In recent years, the world has reached a consensus on the reduction of carbon dioxide emissions, largely due to several imperatives, including the new 2030 Agenda for Sustainable Development (Fuso Nerini et al. 2018) and the Paris Agreement (Assi et al. 2021). Among important actions adopted, REC is an essential way of reducing carbon dioxide emissions for ensuring sustainability (Uzar 2020a; Akintande et al. 2020; Khribich et al. 2021; Chica-Olmo et al. 2020). However, the global consumption of renewable energy is still far from the target set by the Paris Agreement; therefore, increasing the consumption of renewable energy is necessary (Churchill et al. 2021).

Producing renewable energy requires massive investments (Hashemizadeh et al. 2021). Thus, many investors are reluctant to invest in renewable energy due to the high costs involved (Tsao et al. 2021). The decline in costs might play a significant role in the expansion of renewable energy technologies and the deployment of renewables (Timilsina 2021). Cost is considered one of the fundamental complications in choosing renewable energy (Hashemizadeh et al. 2021). Financially speaking, renewable energy projects are capital-intensive; thus, REC is constrained by financing sources (Ji and Zhang 2019). Furthermore, public investments cannot provide the funds required by renewable energy projects (Wang et al. 2021a). Therefore, REC is financial development driven in the long run (Eren et al. 2019).

In the past decade, financial services have undergone rapid innovations due to technological developments (Lucey et al. 2018; Xu et al. 2010, 2012). Digital finance technologies (e.g., the blockchain-facilitated services emphasized by the European Union and other global organizations) have made financial systems more accessible (Aziz and Naima 2021; Xu et al. 2019; Zhao et al. 2016). Among others, information technology (IT) is one type of technology that has facilitated market transformation (e.g., Chen et al. 2021; Lang and Li 2013; Lang et al. 2015; Pelaez and Lang 2016). In China, for example, digital finance has undergone rapid development in the past decade due to advancements in Big Data, cloud computing, and other forms of IT (Yu et al. 2020; Li et al. 2020). Between 2009 and 2018, the volume of China’s third-party mobile payment transactions increased from 39 billion yuan to 190.5 trillion yuan (Dong et al. 2020). Digital finance has not only become an indispensable part of China’s financial system (Li et al. 2020), it also helps decrease the degree of information asymmetry, increase trust between borrowers and savers, reduce borrowing costs, improve the availability of financial services, and narrow financing gaps (Qadir et al. 2021; Assi et al. 2021). Studies have also shown that access to digital finance can significantly increase household consumption (Song et al. 2020; Li et al. 2020).

However, to our knowledge, only a few studies have examined the impacts of digital finance on REC. Digital finance is not a supplementary tool for traditional finance methods; rather, it is a kind of facilitator that helps increase people’s motivation and capability in new types and targets of consumptions (Barbesino et al. 2005; Gomber et al. 2017; Hasan et al. 2020; Li et al. 2020; Ma and Liu 2017), such as REC. Thus, this topic should be researched systematically from diverse disciplines and economies at different life stages. To fill the research gap, the current study examines the impacts of digital finance on REC in China from 2011 to 2018, as well as deeply explores the influencing mechanisms involved. We adopted a two-way fixed effects model for the analyses.

The remainder of the paper is organized as follows. Literature review and theoretical mechanism section presents the relevant literature and theoretical mechanisms related to the connection between renewable energy consumption and digital finance. Data and methodology section describes the data and the research methodology. Empirical results section presents the empirical results. Conclusion section provides the conclusions.

Literature review and theoretical mechanism

Renewable energy consumption and its impacts

Most of the energy consumed by human society comes from fossil fuels, which are expected to continue to dominate the global energy structure for at least the next 30 years. However, the emission of carbon dioxide from fossil fuel consumption appears to be a major challenge to environmental sustainability (Assi et al. 2021). In the past two decades, the energy market has undergone a progressive energy transition (Creti and Nguyen 2018), and many countries are increasing their production of renewable energy (Guo et al. 2021). Various forms of renewable energy, such as wind, geothermal, solar, and biomass, are all strategic choices for achieving sustainable development goals (Burke and Stephens 2018; Cai and Menegaki 2019; Khribich et al. 2021). With significant global policy support and the reduction of associated costs, the share of renewable energy in the total energy consumed has increased year on year (Creti and Nguyen 2018; Berk et al. 2020).

As REC continues to increase, the nexus between such consumption and the economic impacts has attracted much research attention (Wang et al. 2021a). Related to this, Hamit-Haggar (2016) reported a cointegrated relationship between REC and economic growth. Akram et al. (2021) examined the heterogeneous impacts of energy efficiency and REC on the economic growth of the BRICS countries, that is, Brazil, Russia, India, China, and South Africa and found that economic growth is affected by REC and vice versa. Sharma et al. (2021) argued that the transition to renewable energy is not economically feasible in the short term; however, REC has a positive impact on economic growth after a certain period. Apart from its economic impacts, REC is crucial to reducing carbon dioxide emissions, fog, and haze, and can also promote green industrial development (Liu et al. 2021; Zeng et al. 2021). Moreover, renewable energy can reduce conventional energy use and help solve the global energy crisis (Zahari and Esa 2016; Elavarasan 2019).

Renewable energy consumption and its determinants

Many studies have focused on the determinants of REC. Macroeconomic and environmental variables, such as economic growth and carbon emissions, are essential factors that affect REC (Hashemizadeh et al. 2021; Uzar 2020b). Li and Leung (2021) have found that economic growth can increase REC in the long run, while Assi et al. (2021) have shown that economic growth increases REC when renewable energy activities drive economic growth. Past studies have also found conflicting results regarding the effect of carbon dioxide emissions on REC. In particular, some studies have reported that rising carbon dioxide emissions increase this consumption (e.g., Nguyen and Kakinaka 2019), while others have shown the opposite (e.g., Khan et al. 2020).

Social factors also affect REC. For instance, social development contributes significantly to REC in the long run (Khribich et al. 2021), while human capital has a significantly positive impact on REC in OECD economies (Yao et al. 2019). According to Uzar (2020b), institutional quality positively affects REC. Churchill et al. (2021) investigated income inequality and REC for a panel of 17 nations between 1995 and 2002 and found a negative relationship between the two.

Renewable energy can be considered a normal commodity, and the reduction in renewable energy generation cost has attracted private players to join the market (Tsao et al. 2021). Knowledge of renewable energy, environmental education, household income, and financial beliefs have been shown to be positively associated with renewable energy deployment, thus shaping the future of renewable energy adaptation (Liu et al. 2013; Fleiß et al. 2017; Al-Marri et al. 2018; Skordoulis et al. 2020). Enhancing knowledge and understanding of renewable energy environmental benefits is conducive to increasing renewable energy use. In fact, studies have shown that residents with higher income levels and greater financial belief about low-cost renewable energy use are more likely to use renewable energy (Liu et al. 2013; Fleiß et al. 2017).

However, financing is a significant hurdle in realizing the transition to renewable energy and climate change mitigation (Qadir et al. 2021; Elie et al. 2021). Renewable energy deployment requires massive financial support due to the high start-up costs and long payback periods of renewable energy projects (Asongu and Odhiambo 2021). Related to this, the development of the financial market can remove the constraints that restrict the financing of renewable energy and facilitate the transition from fossil fuels to renewable energy (Kimura et al. 2016; Best 2017). Thus, in the long run, REC is driven by financial development and increases with the availability of financial services and additional foreign capital flows into the economy (Eren et al. 2019; Qamruzzaman and Jianguo 2020). However, there is no consensus in the literature on the impacts of financial development on REC.

Among some studies that investigated this topic, Kim and Park (2016) concluded that improvements in financial sectors are a significant determinant of renewable energy deployment. Ji and Zhang (2019) reported that financial development is critical to the growth of renewable energy in China, with a contribution rate of 42.42%. Asongu and Odhiambo (2021) concluded that financial development can promote economic growth and, therefore, promote REC. Zhao et al. (2020) indicated that financial development is an essential factor driving REC in China, while Anton and Afloarei Nucu (2020) reported that the banking sector, bond market, and capital market have a positive impact on REC. Meanwhile, foreign direct investments (FDIs) are generally recognized as an essential source of financing (Paramati et al. 2016). In particular, Yilanci et al. (2019) reported that FDI inflows boost REC in China, while Paramati et al. (2016) found that both FDI inflows and the development of the stock market have a significant positive impact on REC. However, Wang et al. (2021a) and Assi et al. (2021) reported that financial development negatively impacts REC. Furthermore, Hashemizadeh et al. (2021) found a negative relationship between public debt and REC.

As mentioned previously, financial development is an important factor affecting REC. Financial development can fund research and development activities in the renewable energy field, which, in turn, encourage the development of innovations to find new sources of renewable energy, thus increasing REC (Assi et al. 2021; Wang et al. 2021a). Financial development reduces the investment costs of renewable energy investment projects (Shahbaz et al. 2021), making it possible to offer debt and equity funding to finance the renewables industry at lower costs. Furthermore, financial development is positively correlated with the volume of renewable energy investments (Köksal et al. 2021), thereby boosting the demand for renewable energy (Lahiani et al. 2021; Anton and Afloarei Nucu 2020). Financial development also plays an important role in allocating capital to the renewable energy sector, which can further promote constructing renewable infrastructures and increase REC (Assi et al. 2021).

Digital finance and renewable energy consumption

Digital finance is a convenient financial service that can be accessed via a mobile phone, a personal computer, or any other Internet-connected device (Ozili 2018; Gomber et al. 2017). With the deep integration between Internet technology and finance, and driven by emerging technologies such as Big Data and artificial intelligence, digital finance is gradually becoming an indispensable part of the financial system (Li et al. 2020; Yu et al. 2020). Digital finance includes various innovative products, such as online loans, mobile payments, Internet insurance, and Internet investment, thus affecting household consumption in many ways. Several studies have focused on the connection between digital finance and household consumption. Among others, digital finance enables the cascade of information to be strengthened through direct access to social networks (Meoli and Vismara 2021), increases the possibility of matching the financial demand side with the financial supply side, expands the channels for obtaining funds, and relieves households from credit constraints, thus increasing household consumption. It also promotes household consumption in other ways. For example, it combines emerging digital payment technology with mobile phone technology (Aziz and Naima 2021), which improves payment efficiency and reduces transaction time and costs. Additionally, digital finance upgrades the traditional insurance service mode and improves insurance accessibility. It can also expand the range of investment, increase the rates of investment returns, and promote the growth of household wealth (Li et al. 2020; Bollaert et al. 2021; Muganyi et al. 2021). Furthermore, Li et al. (2020) concluded that digital finance promotes household consumption. Similarly, Song et al. (2020) demonstrated that it promotes household consumption more than traditional finance and that it has the most significant impact on durable consumption.

The Chinese government has backed the opening of the power retail market since 2015. This strategy has benefited distribution generators, including solar photovoltaics (PV) producers (Zhang 2016). The proportion of distributed solar PV systems to the total cumulative capacity increased from 13% in 2016 to 31% in 2019 (Wang et al. 2021b). At present, there are three business models for household solar PV projects in China: self-sufficiency, selling electricity to the Power Grid, and selling the surplus to the Power Grid after consumption (Shuai et al. 2019). The investment costs for distributed solar PVs include initial investment costs, inverter replacement costs, and maintenance costs (Yang et al. 2020). Having a better economic situation that can afford the relatively high costs of distributed solar PV systems can provide a solid foundation for REC (Wang et al. 2021b). Related to this, digital finance provides an excellent channel for the public to invest in distributed solar PV projects (Zhang 2016), thus promoting REC.

However, there is a lack of research on the relationship between digital finance and REC. Furthermore, only a few empirical studies have explored the effects of economic growth, technological progress, and carbon emissions on REC in China. Therefore, this study aims to fill these research gaps. Its main objective is to empirically investigate whether digital finance promoted REC in China between 2011 and 2018 using a two-way fixed effects model. To make our results comparable to the literature, we use control variables, including economic growth, technological progress, and carbon dioxide emissions, to capture the effects of economics, technology, and the environment on REC. We demonstrate that digital finance is a crucial determinant of REC apart from economic, technological, and environmental factors. Digitization can bring new financial resources to the financial system and help increase the accessibility of financial services (Arner et al. 2020). Furthermore, it can reduce the cost of financial services and expand the breadth and depth of financial services. Therefore, we argue that digital finance reduces the financing constraints for renewable energy enterprises and consumers; thus, the development of digital finance can promote the use of renewable energy in China.

Theoretical mechanism

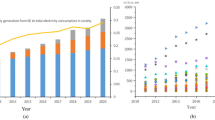

At present, renewable energy can be generated at households, villages, and buildings. The renewable energy supply depends heavily upon the rapid emergence of distributed energy systems (Tsao et al. 2021; Wolsink 2020). However, renewable energy products may not always be affordable to low-income households (IRENA and CPI 2020). Related to this, digital finance may influence REC via the following two pathways (Fig. 1).

First, digital finance boosts REC by increasing loan scale. Chinese residents cannot easily obtain loans via traditional financial markets and often face liquidity constraints (Zhang et al. 2021). The FinTech has been found to provide new capital forms through digital loans (Croutzet and Dabbous 2021). Digital finance changed the traditional mode of credit services, relieved Chinese residents from the constraints of credit, and stimulated consumption (Li et al. 2020; Song et al. 2020). Meanwhile, one of the biggest obstacles to deploying renewable energy is its high upfront capital costs (Kim and Park 2016). A household’s ability to invest in and have access to renewable energy has been shown to increase with the widespread availability of credit (Kara et al. 2021). Developments in credit markets can increase the demand for renewable energy (Shahbaz et al. 2021). Therefore, digital finance can provide loans for people who are excluded from the traditional financial market, thereby boosting their ability to engage in REC.

Second, digital finance increases REC by improving income levels. The development of digital finance has greatly reduced information asymmetry, lowered transaction costs, improved the efficiency of financial services, and significantly promoted the upgrade of traditional financial companies. Digital finance can also increase the rate of return on investment and provide channels for residents to increase their property incomes (Li et al. 2020). Even though higher start-up and operating costs are financial obstacles that must be overcome in renewable energy investments (Eren et al. 2019), digital finance development can encourage renewable energy investment and renewable energy generation (Li et al. 2021). Citizen participation is also important in decentralized renewable energy infrastructures, especially within the context of solar and onshore wind energy (Yildiz 2014). Income is expected to contribute significantly to renewable energy investment and consumption. Therefore, by increasing residents’ disposable income, the development of digital finance promotes REC.

Data and methodology

Sample and data

In recent decades, China’s economic development has achieved remarkable results, and energy-intensive industries have played a vital role in this development (Huang et al. 2021). However, to achieve rapid economic growth, China consumes large amounts of fossil energy and emits massive amounts of carbon dioxide (Pei et al. 2019; Xue and Wang 2021). In 2007, China surpassed the United States to become the world’s largest emitter of carbon dioxide. Environmental pollution has thus become increasingly prominent in China, and the subsequent ecological deterioration causes large economic losses to the country every year (Han et al. 2021). Therefore, maintaining environmental sustainability has become a fundamental challenge for China (Gan et al. 2020). Meanwhile, the reduction of the country’s carbon emissions has become a focus of the international community. In response, Chinese policymakers have implemented a series of measures to reduce carbon dioxide emissions (Wang et al. 2018). For example, on June 30, 2015, the Chinese government implemented the “Enhanced Actions on Climate Change” policy, which aims to reduce China’s carbon intensity in 2030 by about 60–65% lower than that in 2005 (Hou et al. 2018). REC plays a prominent role in China’s strategy for reducing carbon emissions (Bao and Xu 2019). Since 2000, the Chinese government has accelerated the adoption of renewable energy and has identified the renewable energy industry as one of its seven “strategic emerging industries” (Cheng and Yao 2021; Yu et al. 2021b; Cui et al. 2021). With the development of China’s renewable energy industry, the country has increased its exportation of renewable energy products (Jing et al. 2020). However, the diffusion of renewable energy technologies in the country remains slow, investments in renewable energy are relatively low compared to most developed countries, and the share of renewable energy remains small (Chen and Lin 2020). Thus, the national government has pledged to increase the share of renewable energy in the country to 50% by 2030 (Wang et al. 2021a). Indeed, there is an urgent need to promote the development of renewable energy in China, as increasing its share in total energy consumption is essential for reducing carbon dioxide emissions and maintaining long- and short-term sustainable development (Wang et al. 2021a; Zaman et al. 2021). Therefore, this paper selects China as its sample country.

For this study, we use panel data from 30 Chinese provinces, autonomous regions, and municipalities (except for Tibet, Hong Kong, Macao, and Taiwan) from 2011 to 2018. The sample period of 2011–2018 is selected based on the availability of digital finance data. The sample provinces include Beijing, Fujian, Guangdong, Hainan, Hebei, Jiangsu, Liaoning, Shandong, Shanghai, Tianjin, Zhejiang, Anhui, Guangxi, Heilongjiang, Henan, Hubei, Hunan, Inner Mongolia, Jiangxi, Jilin, Shanxi, Chongqing, Gansu, Guizhou, Ningxia, Qinghai, Shanxi, Sichuan, Xinjiang, and Yunnan.

The explained variable is the per capita REC. The total electricity generation (kWh) from renewable energy, including solar, wind, and nuclear power, is used to measure REC. Data on REC and population are collected from the China Energy Statistics Yearbook (various issues) and China Statistical Yearbook (various issues).

The core explanatory variable is digital finance. We use the provincial digital finance indexes developed by the Institute of Digital Finance of Peking University, the Shanghai Finance Institute, and the Ant Financial Services Group to reflect the development of digital finance in China (Li et al. 2020; Guo et al. 2020). Given that digital finance in the country has three levels, we not only examine the impact of the general index of digital finance (GDF) on REC but the impacts of different indexes of digital finance on REC as well. We achieve the latter by using second-level indexes, including coverage-breadth index of digital finance (BDF) and a use-depth index of digital finance (DDF), and third-level indexes, including a payment index of digital finance (PDF), a credit index of digital finance (CDF), and an insurance index of digital finance (IDF).

Economic growth and technological progress are used as control variables, as these are the primary factors that affect REC. When regional economic growth is higher, the economic cost required to develop renewable energy is more likely to decrease, which is conducive to the promotion of REC (Wang and Wang 2020). Technological progress is a significant driver of the increase in renewable energy supply and is crucial for the development and consumption of renewable energy (Zheng et al. 2021). In this study, the per capita GDP (PGDP) and the number of patent applications (TP) are used to measure economic growth and technological progress, respectively. These figures are collected from the China Statistical Yearbook (various issues).

Additionally, as higher carbon dioxide emissions may lead to better emissions reduction policies, which encourage REC (Nguyen and Kakinaka 2019), we use carbon dioxide emissions as another control variable for REC. Carbon dioxide emissions data are collected from the China Emission Accounts and Datasets.

Loan scale and income level are used as mediation variables. Specifically, the per capita loans and per capita disposable income of residents are used to depict loan scale and income level, respectively. The data on loans, per capita disposable income, and population are collected from the China Statistical Yearbook (various issues). As the data on the per capita disposable income of residents are incomplete, we replace them with data on the per capita disposable income of urban residents.

Table 1 shows a summary of the descriptive statistics of the variables. For example, REC ranges 0–4134.078, with a mean of 422.164 and a standard deviation of 628.879, while the GDF ranges 18.33–377.73, with a mean of 188.186 and a standard deviation of 84.980.

According to previous studies, REC is influenced by digital finance, economic growth, technological progress, and carbon dioxide emissions. To ensure data stability, all data are processed logarithmically. Table 2 shows the results of the multicollinearity analyses of lnREC, lnGDF, lnPGDP, lnTP, and lnCO2; the correlations are small and acceptable, and there is no multicollinearity problem in the data. Moreover, lnBDF, lnDDF, lnPDF, lnCDF, and lnIDF have no multicollinearity problems with lnREC, lnPGDP, lnTP, and lnCO2.

Methodology

The optimal model of panel data estimation is selected by the F-test and Hausman’s specification test. F-tests are performed to identify the suitable model (pooled regression vs. fixed effects) for estimation. The values of the F-tests are significant at the 1% level, and the fixed effects model is a better estimation. Hausman’s tests are performed to identify the suitable model (fixed effects vs. random effects) for estimation. The null-hypothesis of difference in coefficients is not systematic (random effects) in the Hausman test and is thus rejected. The results show that the fixed effects model best fits the data. Therefore, we use the following basic model to test the impact of digital finance on REC:

where the subscripts i and t denote the province and year, respectively; β1, β2, β3, and β4 are the parameters to be estimated; β0is a constant; μi represents an unknown province-specific constant; γi represents an unknown year-specific constant; and εit is a random error term that captures factors not included in the model variables, which affect REC. The results are estimated with a two-way fixed effects model that accounts for individual and year fixed effects.

Next, the following mediating model is constructed to further test whether digital finance can promote REC by affecting the loan scale and income level:

In the mediating models (2–4), loan scale and income level are mediation variables; β1 and λ1 represent the total impact and the direct impact of digital finance on REC, respectively; α1 measures the impact of digital finance on loan scale and income level; and λ2 measures the impact of loan scale and income level on REC after controlling for digital finance. If the value of λ1 is lower than β1, loan scale and income level may serve as mediators in digital finance to boost REC. Furthermore, this indicates that there is a partial mediation effect.

Empirical results

Main estimation results

Table 3 reports the regression results for digital finance and REC in which the fixed effects model has been chosen by the F-test statistics and Hausman’s statistics. As shown in Table 3, the coefficient of digital finance significantly influences REC. In column (1), the coefficient of GDF is 0.968, indicating that digital finance promotes REC in China.

We also use the second- and third-level indexes of digital finance to examine the impact of digital finance on REC. The second-level indexes results are shown in columns (2) and (3). As can be seen, the coefficients of the BDF and the DDF are 0.632 and 1.289, respectively. This shows that the coverage breadth and usage depth of digital finance can promote REC.

The results for the third-level indexes are shown in columns (4)–(6). As can be seen, the coefficient of PDF is significant at 0.637. This indicates that digital finance facilitates the use of payment services, thus promoting REC. The coefficient of CDF is significant at 0.769. This indicates that digital finance promotes the acquisition of credit services, thereby promoting REC. The coefficient of IDF is significant at 0.005, thereby indicating that digital finance in insurance has little impact on REC. Overall, these results indicate that digital finance in credit has the most significant impact on REC.

The coefficients of PGDP are all significant and positive; thus indicating, that economic growth significantly improves REC. Furthermore, the higher the GDP per capita, the higher the level of REC will be. The coefficients of technological progress are all positive and significant, suggesting that technological progress can promote REC. However, the coefficients of CO2 are insignificant, as shown in columns (1)–(5), suggesting that the impact of carbon dioxide emissions on REC is non-existent.

Mechanism results

This section explores the possible channels and mechanisms through which digital finance may affect REC. The results shown in Main estimation results section indicate that, overall, digital finance has a positive impact on REC. Digital finance may influence REC through two channels: one is driven by loan scale, and the other is driven by income level. The larger the scale of credit, the better access companies and consumers are likely to have to avail of less costly financial capital. In turn, this can relieve them from the constraints of finance and boost the demand for renewable energy. Furthermore, as the development of digital finance broadens investment channels, this leads to higher-yielding digital financial products that promote investment and income for residents and subsequently increase REC. Therefore, we choose loan scale and income level as the mediation variables.

We use Eqs. (2–4) to estimate the mediation effect. The results are shown in Table 4. In general, digital finance is shown to indirectly affect REC via loan scale and income level. Columns (1–3) show the loan scale mediation effect, while columns (4–6) show the income level mediation effect. As can be seen, the coefficients of digital finance on REC (1.385, column [1]) and loan scale (0.128, column [2]) indicate that digital finance has positive impacts on REC and loan scale, respectively. Furthermore, the coefficient of digital finance on REC in column (3) is 1.109 (lower than that in column [1]), indicating that loan scale has a partial mediation effect. The result of the Sobel mediation effect test shows that 19.96% of the effect of digital finance on REC occurs through the scaling-up of loans. The coefficients of digital finance on income level (1.385 and 0.157 in columns [4] and [5], respectively) both indicate that the former positively affects the latter. The coefficient of digital finance on REC in column (6) is 1.108 (lower than that in column [4]), which shows that income level has a partial mediation effect. The result of the Sobel mediation shows that 20% of the effect of digital finance on REC is due to increasing income. Therefore, the mechanism results prove that loan scale and income level serve as mediation variables in the promoting effect of digital finance on REC.

Robustness checks

In this section, wind energy consumption is used as an alternative to REC for robustness testing. As data on wind energy consumption in China are only available from 2013, we examine the impact of digital finance on wind energy consumption from 2013 to 2018. The regression results are shown in Table 5. Columns (1–3) show the impacts of GDF, BDF, and DDF on wind energy consumption, respectively. As can be seen, the regression coefficients in columns (1–3) are all significantly positive, indicating that the higher the level of digital finance development, the higher the consumption of wind energy. Columns (4–6) show the impacts of PDF, CDF, and IDF on wind energy consumption. The results indicate that the regression coefficient of credit is significantly positive, whereas the regression coefficients of payment and insurance are insignificant. Thus, credit has the most significant impact on wind energy consumption. The results are consistent with Main estimation results.

Conclusion

The transition to renewable energy is essential in reducing the environmental pollution and climate change caused by fossil fuel consumption (Fan and Hao 2020; Huang et al. 2020). Public acceptance of renewable energy technologies and the consumption of renewable energy are affected by many factors (Irfan et al. 2021). Related to this, the development of finance plays a vital role in the consumption of renewable energy (Ali et al. 2018). The development of science and technology promotes the integration of finance and digital information. In recent years, digital finance has developed rapidly and has brought tremendous changes to human lives. Understanding the impact of digital finance on REC may provide an opportunity to promote the consumption of renewable energy. Therefore, this paper examines the influence of digital finance on REC in China from 2011 to 2018 and the underlying mechanisms. The results suggest that digital finance, as well as its coverage breadth and usage depth, significantly improved REC in China over the study period and that digital finance in the area of credit had the most significant impact. Moreover, the findings suggest that loan scale and income level are the main mediation variables, through which digital finance affects REC. These findings can help policymakers in developing economies, such as China, conceptualize strategies to promote the development of the renewable energy sector and the deployment of renewable energy, especially via digital finance.

We use a two-way fixed effects model to examine the impact of digital finance on REC. The results show that digital finance, as well as its coverage breadth and usage depth has a substantial positive impact on REC and that credit-based digital financial services have a greater impact on it than payment and insurance-based digital financial services. Thus, our findings reinforce the benefits of developing digital finance by indicating that such development can overcome the challenges of financing renewable energy and increasing REC. The results also suggest that the government should implement digital finance policies to acquire additional funding for renewable energy projects, which can increase REC. Additionally, the government should increase digital financial support for renewable energy projects and design innovative digital financial products to promote the development and consumption of renewable energy through efficient and low-cost financing channels (Yu et al. 2021a; Wang et al. 2021a; Polzin and Sanders 2020). Moreover, given the uneven development of digital finance across China, the government must promote the rapid development of digital finance in underdeveloped areas (Bai et al. 2021).

We use mediating models with loan scale and income level as mediation variables to investigate the mechanism and channels through which digital finance improves REC. The results show that the development of digital finance stimulates REC by increasing digital loans for the latter. Furthermore, the development of digital finance promotes the growth of residents’ incomes by expanding their available investment channels, thereby increasing REC. Hence, it may be beneficial for policymakers and governments to collaboratively develop policies that can increase digital loans and residents’ income, which, in turn, can lead to increased REC.

We also demonstrate that economic development and technological progress positively affect REC, suggesting that maintaining moderate economic growth and promoting technological progress is of great significance in promoting the latter. The demand for renewable energy is expected to increase in the future alongside economic development and technological progress. Therefore, governments must promote economic growth and increase the demand for renewable energy. Governments should also provide incentives to promote renewable energy technologies and remove the technical barriers that prohibit consumers from consuming renewable energy (Mendonça et al. 2020; Olanrewaju et al. 2019).

Notably, cost may be another mediating variable explaining the effect of digital finance on REC. However, due to the lack of cost data, cost is not analyzed in the mediating effect mechanism in this paper. Thus, we will select a more appropriate cost indicator of the mediating effect mechanism in our future research. Furthermore, we recommended future studies to incorporate heterogeneity analyses, which may produce more accurate results.

Availability of data and materials

Data can be requested from the first author.

Abbreviations

- REC:

-

Renewable energy consumption

- IT:

-

Information technology

- FDI:

-

Foreign direct investments

- PV:

-

Photovoltaics

References

Akintande OJ, Olubusoye OE, Adenikinju AF, Olanrewaju BT (2020) Modeling the determinants of renewable energy consumption: evidence from the five most populous nations in Africa. Energy 206:117992

Akram R, Chen F, Khalid F, Huang G, Irfan M (2021) Heterogeneous effects of energy efficiency and renewable energy on economic growth of BRICS countries: a fixed effect panel quantile regression analysis. Energy 215:119019

Ali Q, Khan MTI, Khan MNI (2018) Dynamics between financial development, tourism, sanitation, renewable energy, trade and total reserves in 19 Asia cooperation dialogue members. J Clean Prod 179:114–131

Al-Marri W, Al-Habaibeh A, Watkins M (2018) An investigation into domestic energy consumption behaviour and public awareness of renewable energy in Qatar. Sustain Cities Soc 41:639–646

Anton SG, Afloarei Nucu AE (2020) The effect of financial development on renewable energy consumption. A panel data approach. Renew Energy 147:330–338

Arner DW, Buckley RP, Zetzsche DA, Veidt R (2020) Sustainability, FinTech and financial inclusion. Eur Bus Organ Law Rev 21:7–35

Asongu SA, Odhiambo NM (2021) Inequality, finance and renewable energy consumption in Sub-Saharan Africa. Renew Energy 165:678–688

Assi AF, Zhakanova Isiksal A, Tursoy T (2021) Renewable energy consumption, financial development, environmental pollution, and innovations in the ASEAN + 3 group: evidence from (P-ARDL) model. Renew Energy 165:689–700

Aziz A, Naima U (2021) Rethinking digital financial inclusion: Evidence from Bangladesh. Technol Soc 64:101509

Bai C, Yan H, Yin S, Feng C, Wei Q (2021) Exploring the development trend of internet finance in China: perspective from club convergence. N Am J Econ Finance 58:101505

Bao C, Xu M (2019) Cause and effect of renewable energy consumption on urbanization and economic growth in China’s provinces and regions. J Clean Prod 231:483–493

Barbesino P, Camerani R, Gaudino A (2005) Digital finance in Europe: competitive dynamics and online behaviour. J Financ Serv Mark 9:329–343

Berk I, Kasman A, Kılınç D (2020) Towards a common renewable future: the system-GMM approach to assess the convergence in renewable energy consumption of EU countries. Energy Econ 87:103922

Best R (2017) Switching towards coal or renewable energy? The effects of financial capital on energy transitions. Energy Econ 63:75–83

Bollaert H, Lopez-de-Silanes F, Schwienbacher A (2021) Fintech and access to finance. J Corp Finan 68:101941

Burke MJ, Stephens JC (2018) Political power and renewable energy futures: a critical review. Energy Res Soc Sci 35:78–93

Cai Y, Menegaki AN (2019) Fourier quantile unit root test for the integrational properties of clean energy consumption in emerging economies. Energy Econ 78:324–334

Chen Y, Lin B (2020) Slow diffusion of renewable energy technologies in China: an empirical analysis from the perspective of innovation system. J Clean Prod 261:121186

Chen K, Li X, Luo P, Zhao JL (2021) News-induced dynamic networks for market signaling: understanding impact of news on firm equity value. Inf Syst Res. https://doi.org/10.1287/isre.2020.0969

Cheng Y, Yao X (2021) Carbon intensity reduction assessment of renewable energy technology innovation in China: a panel data model with cross-section dependence and slope heterogeneity. Renew Sustain Energy Rev 135:110157

Chica-Olmo J, Sari-Hassoun S, Moya-Fernández P (2020) Spatial relationship between economic growth and renewable energy consumption in 26 European countries. Energy Econ 92:104962

Churchill SA, Ivanovski K, Munyanyi ME (2021) Income inequality and renewable energy consumption: time-varying non-parametric evidence. J Clean Prod 296:126306

Creti A, Nguyen DK (2018) Energy and environment: transition models and new policy challenges in the post Paris Agreement. Energy Policy 122:677–679

Croutzet A, Dabbous A (2021) Do FinTech trigger renewable energy use? Evidence from OECD countries. Renew Energy 179:1608–1617

Cui Y, Khan SU, Li Z, Zhao M (2021) Environmental effect, price subsidy and financial performance: evidence from Chinese new energy enterprises. Energy Policy 149:112050

Dong J, Yin L, Liu X, Hu M, Li X, Liu L (2020) Impact of internet finance on the performance of commercial banks in China. Int Rev Financ Anal 72:101579

Elavarasan RM (2019) The motivation for renewable energy and its comparison with other energy sources: a review. Eur J Sustain Dev Res 3:em0076

Elie L, Granier C, Rigot S (2021) The different types of renewable energy finance: a bibliometric analysis. Energy Econ 93:104997

Eren BM, Taspinar N, Gokmenoglu KK (2019) The impact of financial development and economic growth on renewable energy consumption: empirical analysis of India. Sci Total Environ 663:189–197

Fan W, Hao Y (2020) An empirical research on the relationship amongst renewable energy consumption, economic growth and foreign direct investment in China. Renew Energy 146:598–609

Fleiß E, Hatzl S, Seebauer S, Posch A (2017) Money, not morale: the impact of desires and beliefs on private investment in photovoltaic citizen participation initiatives. J Clean Prod 141:920–927

Fuso Nerini F, Tomei J, To LS, Bisaga I, Parikh P, Black M, Borrion A, Spataru C, Castán Broto V, Anandarajah G, Milligan B, Mulugetta Y (2018) Mapping synergies and trade-offs between energy and the sustainable development goals. Nat Energy 3:10–15

Gan T, Liang W, Yang H, Liao X (2020) The effect of economic development on haze pollution (PM2.5) based on a spatial perspective: urbanization as a mediating variable. J Clean Prod 266:121880

Gomber P, Koch J, Siering M (2017) Digital finance and FinTech: current research and future research directions. J Bus Econ 87:537–580

Guo F, Wand J, Wang F, Kong T, Zhang X, Cheng Z (2020) Measuring China’s digital financial inclusion: index compilation and spatial characteristics. China Econ Q (in China) 19(4):1401–1418

Guo Y, Yu C, Zhang H, Cheng H (2021) Asymmetric between oil prices and renewable energy consumption in the G7 countries. Energy 226:120319

Hamit-Haggar M (2016) Clean energy-growth nexus in sub-Saharan Africa: evidence from cross-sectionally dependent heterogeneous panel with structural breaks. Renew Sustain Energy Rev 57:1237–1244

Han J, Miao J, Shi Y, Miao Z (2021) Can the semi-urbanization of population promote or inhibit the improvement of energy efficiency in China? Sustain Prod Consum 26:921–932

Hasan MM, Yajuan L, Khan S (2020) Promoting China’s inclusive finance through digital financial services. Glob Bus Rev. https://doi.org/10.1177/0972150919895348

Hashemizadeh A, Bui Q, Kongbuamai N (2021) Unpacking the role of public debt in renewable energy consumption: new insights from the emerging countries. Energy 224:120187

Hou J, Teo TSH, Zhou F, Lim MK, Chen H (2018) Does industrial green transformation successfully facilitate a decrease in carbon intensity in China? An environmental regulation perspective. J Clean Prod 184:1060–1071

Huang J, Li W, Guo L, Hu X, Hall JW (2020) Renewable energy and household economy in rural China. Renew Energy 155:669–676

Huang H, Wang F, Song M, Balezentis T, Streimikiene D (2021) Green innovations for sustainable development of China: analysis based on the nested spatial panel models. Technol Soc 65:101593

IRENA and CPI (2020) Global landscape of renewable energy finance. International Renewable Energy Agency, Abu Dhabi

Irfan M, Hao Y, Ikram M, Wu H, Akram R, Rauf A (2021) Assessment of the public acceptance and utilization of renewable energy in Pakistan. Sustain Prod Consum 27:312–324

Ji Q, Zhang D (2019) How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 128:114–124

Jing S, Leng Z, Cheng J, Shi Z (2020) China’s renewable energy trade potential in the “Belt-and-Road” countries: a gravity model analysis. Renew Energy 170:1025–1035

Kara A, Zhou H, Zhou Y (2021) Achieving the United Nations’ sustainable development goals through financial inclusion: a systematic literature review of access to finance across the globe. Int Rev Financ Anal 77:101833

Khan H, Khan I, Binh TT (2020) The heterogeneity of renewable energy consumption, carbon emission and financial development in the globe: A panel quantile regression approach. Energy Rep 6:859–867

Khribich A, Kacem RH, Dakhlaoui A (2021) Causality nexus of renewable energy consumption and social development: evidence from high-income countries. Renew Energy 169:14–22

Kim J, Park K (2016) Financial development and deployment of renewable energy technologies. Energy Econ 59:238–250

Kimura F, Kimura S, Chang Y, Li Y (2016) Financing renewable energy in the developing countries of the East Asia Summit region: introduction. Energy Policy 95:421–426

Köksal C, Katircioglu S, Katircioglu S (2021) The role of financial efficiency in renewable energy demand: evidence from OECD countries. J Environ Manage 285:112122

Lahiani A, Mefteh-Wali S, Shahbaz M, Vo XV (2021) Does financial development influence renewable energy consumption to achieve carbon neutrality in the USA? Energy Policy 158:112524

Lang KR, Li T (2013) Business value creation enabled by social technology. Int J Electron Commer 18(2):5–10

Lang KR, Shang R, Vragov R (2015) Consumer co-creation of digital culture products: business threat or new opportunity? J Assoc Inf Syst 16(9):766–798

Li R, Leung GCK (2021) The relationship between energy prices, economic growth and renewable energy consumption: evidence from Europe. Energy Rep 7:1712–1719

Li J, Wu Y, Xiao JJ (2020) The impact of digital finance on household consumption: evidence from China. Econ Model 86:317–326

Li M, Hamawandy NM, Wahid F, Rjoub H, Bao Z (2021) Renewable energy resources investment and green finance: evidence from China. Resour Policy 74:102402

Liu W, Wang C, Mol APJ (2013) Rural public acceptance of renewable energy deployment: the case of Shandong in China. Appl Energy 102:1187–1196

Liu X, Zhao T, Chang C, Fu CJ (2021) China’s renewable energy strategy and industrial adjustment policy. Renew Energy 170:1382–1395

Lucey BM, Vigne SA, Ballester L, Barbopoulos L, Brzeszczynski J, Carchano O, Dimic N, Fernandez V, Gogolin F, González-Urteaga A, Goodell JW, Helbing P, Ichev R, Kearney F, Laing E, Larkin CJ, Lindblad A, Lončarski I, Ly KC, Marinč M, McGee RJ, McGroarty F, Neville C, Hagan-Luff O, M, Piljak V, Sevic A, Sheng X, Stafylas D, Urquhart A, Versteeg R, Vu AN, Wolfe S, Yarovaya L, Zaghini A, (2018) Future directions in international financial integration research—a crowdsourced perspective. Int Rev Financ Anal 55:35–49

Ma Y, Liu D (2017) Introduction to the special issue on crowdfunding and FinTech. Financ Innov 3:1–4

Mendonça AKDS, de Andrade Conradi Barni G, Moro MF, Bornia AC, Kupek E, Fernandes L, (2020) Hierarchical modeling of the 50 largest economies to verify the impact of GDP, population and renewable energy generation in CO2 emissions. Sustain Prod Consum 22:58–67

Meoli M, Vismara S (2021) Information manipulation in equity crowdfunding markets. J Corp Finan 67:101866

Muganyi T, Yan L, Sun H (2021) Green finance, fintech and environmental protection: evidence from China. Environ Sci Ecotechnol 7:100107

Nguyen KH, Kakinaka M (2019) Renewable energy consumption, carbon emissions, and development stages: some evidence from panel cointegration analysis. Renew Energy 132:1049–1057

Olanrewaju BT, Olubusoye OE, Adenikinju A, Akintande OJ (2019) A panel data analysis of renewable energy consumption in Africa. Renew Energy 140:668–679

Ozili PK (2018) Impact of digital finance on financial inclusion and stability. Borsa Istanbul Rev 18:329–340

Paramati SR, Ummalla M, Apergis N (2016) The effect of foreign direct investment and stock market growth on clean energy use across a panel of emerging market economies. Energy Econ 56:29–41

Pei Y, Zhu Y, Liu S, Wang X, Cao J (2019) Environmental regulation and carbon emission: the mediation effect of technical efficiency. J Clean Prod 236:117599

Pelaez A, Lang KR (2016) Communication messages and pattern in IT-enabled markets. J Manag Syst 25(4):35–52

Polzin F, Sanders M (2020) How to finance the transition to low-carbon energy in Europe? Energy Policy 147:111863

Qadir SA, Al-Motairi H, Tahir F, Al-Fagih L (2021) Incentives and strategies for financing the renewable energy transition: a review. Energy Rep 7:3590–3606

Qamruzzaman M, Jianguo W (2020) The asymmetric relationship between financial development, trade openness, foreign capital flows, and renewable energy consumption: fresh evidence from panel NARDL investigation. Renew Energy 159:827–842

Shahbaz M, Topcu BA, Sarıgül SS, Vo XV (2021) The effect of financial development on renewable energy demand: the case of developing countries. Renew Energy 178:1370–1380

Sharma GD, Tiwari AK, Erkut B, Mundi HS (2021) Exploring the nexus between non-renewable and renewable energy consumptions and economic development: evidence from panel estimations. Renew Sustain Energy Rev 146:111152

Shuai J, Cheng X, Ding L, Yang J, Leng Z (2019) How should government and users share the investment costs and benefits of a solar PV power generation project in China? Renew Sustain Energy Rev 104:86–94

Skordoulis M, Ntanos S, Arabatzis G (2020) Socioeconomic evaluation of green energy investments. Int J Energy Sect Manag 14:871–890

Song Q, Li J, Wu Y, Yin Z (2020) Accessibility of financial services and household consumption in China: evidence from micro data. N Am J Econ Finance 53:101213

Timilsina GR (2021) Are renewable energy technologies cost competitive for electricity generation? Renew Energy 180:658–672

Tsao Y, Vu T, Lu J (2021) Pricing, capacity and financing policies for investment of renewable energy generations. Appl Energy 303:117664

Uzar U (2020a) Is income inequality a driver for renewable energy consumption? J Clean Prod 255:120287

Uzar U (2020b) Political economy of renewable energy: does institutional quality make a difference in renewable energy consumption? Renew Energy 155:591–603

Wang Q, Wang L (2020) Renewable energy consumption and economic growth in OECD countries: a nonlinear panel data analysis. Energy 207:118200

Wang B, Wang Q, Wei Y, Li Z (2018) Role of renewable energy in China’s energy security and climate change mitigation: an index decomposition analysis. Renew Sustain Energy Rev 90:187–194

Wang J, Zhang S, Zhang Q (2021a) The relationship of renewable energy consumption to financial development and economic growth in China. Renew Energy 170:897–904

Wang Y, He J, Chen W (2021b) Distributed solar photovoltaic development potential and a roadmap at the city level in China. Renew Sustain Energy Rev 141:110772

Wolsink M (2020) Distributed energy systems as common goods: socio-political acceptance of renewables in intelligent microgrids. Renew Sustain Energy Rev 127:109841

Xu M, Chen X, Kou G (2019) A systematic review of blockchain. Financ Innov 5:1–14

Xu W, Zuo M, Zhang M, He R (2010) Constraint bagging for stock price prediction using neural networks. In: Proceedings of the 2010 international conference on modelling, identification and control, pp 606–610

Xu W, Sun D, Meng Z, Zuo M (2012) Financial market prediction based on online opinion ensemble. In: Proceedings of Pacific Asia conference on information systems (PACIS), pp 1–12

Xue X, Wang Z (2021) Impact of finance pressure on energy intensity: evidence from China’s manufacturing sectors. Energy 226:120220

Yang Y, Campana PE, Yan J (2020) Potential of unsubsidized distributed solar PV to replace coal-fired power plants, and profits classification in Chinese cities. Renew Sustain Energy Rev 131:109967

Yao Y, Ivanovski K, Inekwe J, Smyth R (2019) Human capital and energy consumption: Evidence from OECD countries. Energy Econ 84:104534

Yilanci V, Ozgur O, Gorus MS (2019) The asymmetric effects of foreign direct investment on clean energy consumption in BRICS countries: a recently introduced hidden cointegration test. J Clean Prod 237:117786

Yildiz Ö (2014) Financing renewable energy infrastructures via financial citizen participation—the case of Germany. Renew Energy 68:677–685

Yu L, Zhao D, Xue Z, Gao Y (2020) Research on the use of digital finance and the adoption of green control techniques by family farms in China. Technol Soc 62:101323

Yu B, Fang D, Meng J (2021a) Analysis of the generation efficiency of disaggregated renewable energy and its spatial heterogeneity influencing factors: a case study of China. Energy 234:121295

Yu B, Zhao Z, Zhao G, An R, Sun F, Li R, Peng X (2021b) Provincial renewable energy dispatch optimization in line with Renewable Portfolio Standard policy in China. Renew Energy 174:236–252

Zahari AR, Esa E (2016) Motivation to adopt renewable energy among generation Y. Procedia Econ Finance 35:444–453

Zaman QU, Wang Z, Zaman S, Rasool SF (2021) Investigating the nexus between education expenditure, female employers, renewable energy consumption and CO2 emission: evidence from China. J Clean Prod 312:127824

Zeng J, Tong W, Tang T (2021) How do energy policies affect industrial green development in China: renewable energy, energy conservation, or industrial upgrading? Chin J Popul Resour Environ. https://doi.org/10.1016/j.cjpre.2021.04.020

Zhang S (2016) Innovative business models and financing mechanisms for distributed solar PV (DSPV) deployment in China. Energy Policy 95:458–467

Zhang J, Zhang H, Gong X (2021) Mobile payment and rural household consumption: evidence from China. Telecommun Policy 46:102276

Zhao JL, Fan S, Yan J (2016) Overview of business innovations and research opportunities in blockchain and introduction to the special issue. Financ Innov 2:1–7

Zhao P, Lu Z, Fang J, Paramati SR, Jiang K (2020) Determinants of renewable and non-renewable energy demand in China. Struct Chang Econ Dyn 54:202–209

Zheng S, Yang J, Yu S (2021) How renewable energy technological innovation promotes renewable power generation: evidence from China’s provincial panel data. Renew Energy 177:1394–1407

Acknowledgements

Fu-Sheng Tsai acknowledges a (visiting) distinguished professorship from the NCUWREP.

Funding

The Project of Philosophy and Social Science Research of Universities in Jiangsu Province (2021SJA1269), the Major Program Project of the National Social Science Fund of China (No: 19ZDA055), Zhejiang Provincial Natural Science Foundation of China (Q22G037055), Major projects of Humanities and Social Sciences in Zhejiang Province (21096054-F), and Zhejiang Sci-Tech University Scientific Research Fund (No: 21092117-Y).

Author information

Authors and Affiliations

Contributions

All authors contributed equally in all parts of the paper. All authors read and approved the final manuscript.

Corresponding authors

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Yu, M., Tsai, FS., Jin, H. et al. Digital finance and renewable energy consumption: evidence from China. Financ Innov 8, 58 (2022). https://doi.org/10.1186/s40854-022-00362-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40854-022-00362-5