Abstract

Several studies have focused on the behaviour of consumers towards organic wine, finding varying and sometimes conflicting results. Some scholars have noted that consumers may perceive wine labelled as organic to be of a lower quality, whereas others have found that consumers are willing to pay a premium price for it. Starting from these discrepancies found in the literature, this study seeks to investigate how the organic certification influences consumers when purchasing a bottle of red wine, evaluating the possible presence of attribute non-attendance (ANA) behaviour. A choice experiment was carried out on a sample of Italian wine consumers. Findings highlight that although, on average, consumers do not prefer organic wine, there is a relevant niche in the market consisting of consumers who benefit from purchasing it. Moreover, we have found that the majority of the sample ignores the organic attribute when choosing a bottle of wine, which reveals ANA behaviour.

Similar content being viewed by others

Introduction

The production and sales of organic wine worldwide have shown a considerable positive trend. According to Willer and Lernoud (2019), the world’s organic grape-growing area increased from 87,655 ha in 2004 to 403,047 ha in 2017. At the same time, global consumption of organic still wine increased by 48.3% during the period from 2012 to 2017 (IWSR 2018). Countries with the highest global organic wine consumption are Germany (with a share of 23.9%), France (16.4%) and the UK (10.2%). Italy covers a lower position in this ranking with a share of 2.4%.

These generally positive trends demonstrate a keen interest in sustainable and organic wine on the part of both producers and consumers (Santini et al. 2013; Sellers-Rubio and Nicolau-Gonzalbez 2016; Schäufele and Hamm 2018; Dominici et al. 2019a). In Europe, “organic” certification indicates wine produced in accordance with the European Commission Implementing Regulation (EU) No. 203/2012, i.e., a wine made from grapes that have been farmed organically (without the use of synthetic fertilizers, pesticides, GMOs or other practices prohibited by the regulation) and only authorized adjuvants and additives.

Organic farming is a relevant production method since it combines both environmental benefits and economic gains by reducing chemical inputs and giving winemakers the market opportunity to diversify their product range (Peigné et al. 2016). In addition, consumers are more willing to pay a premium price for food products made with fewer chemicals, perceiving these to be healthier and more ethical (Hughner et al. 2007; Mann et al. 2012; Michaud et al. 2013). The relevance of the wine market and growing consumer demand for organic produce have attracted scholarly attention. In fact, several studies have focused on consumer behaviour towards organic wine, analysing attitudes, motivations and estimation of the willingness to pay (Wiedmann et al. 2014; Bonn et al. 2016; D'Amico et al. 2016; Abraben et al. 2017; Di Vita et al. 2019). However, these studies have found contrasting results. Some highlight the positive impact of organic certification on consumer wine preferences (see, for example, Brugarolas Mollá-Bauzá et al. 2005; Di Vita et al. 2019), but other studies have produced opposing results, indicating consumer indifference to organic certification on wine bottles or negative perceptions of these (see, for example, Delmas and Grant 2014; Abraben et al. 2017).

These discrepancies highlight the need for greater insights into consumer preferences for organic wine. This article intends to present an in-depth study of the issues related to consumer preferences for organic wine and has three main goals: (i) to study how the organic certification on average influences the choices made by wine consumers, (ii) to identify the market segments in which the organic method of production is a determinant of choice and (iii) to evaluate the extent to which organic certification is ignored by wine consumers. The third goal stems from evidence of the general assumption that (when choosing one product over others) consumers evaluate all available product information before making their final decision. More specifically, consumers may only pay attention to some attributes without taking other attributes into consideration (Hensher et al. 2005). This behaviour is known as attribute non-attendance (ANA) (Scarpa et al. 2009). In recent years, several studies of food preferences have increasingly investigated consumer ANA behaviour (see among the most recent, Ballco et al. (2020), Caputo et al. (2018), Mohanty et al. (2018) or Van Loo et al. (2018)). Among these, an investigation of ANA behaviour related to wine was from Thiene et al. (2013).

In order to answer the above research questions, we carried out a single experiment and analysed the data using three types of econometric models. In particular, we investigated the preferences of Italian wine consumers by means of a discrete choice experiment (DCE), using the inferred valuation method (Lusk and Norwood 2009a, b) to mitigate hypothetical bias. We applied a random parameter logit (RPL) model to account for heterogeneity in consumer preferences. We also performed a latent class model (LCM) to investigate homogenous consumer segments, which can be defined according to their preferences for wine attributes. Finally, ANA consumer behaviour was investigated by implementing a latent class mixed logit model.

In the design of choice experiments, the selection of attributes and their levels are crucial because they closely represent real purchasing scenarios without omitting relevant cues for consumers (Caputo et al. 2017). In order to comply with these criteria, we included some of the attributes for wine choice found relevant by the recent literature (e.g., Troiano et al. 2016; Boncinelli et al. 2019; Dominici et al. 2019b). Specifically, in our choice experiment, the bottle options are characterized by the presence (or absence) of organic certification, typology of geographic indication, producer (famous and non-famous) and price. Increasing knowledge about organic wine is important to producers and shoppers since both can then take advantage of this additional means of product differentiation. Producers can also thus increase their competitiveness. Developing knowledge of consumer preferences for organic wine is also relevant for policymakers seeking to implement public policies supporting the development of sustainable agricultural practices. In addition, enlarging the analysis of consumer behaviour to ANA can help to compel an additional factor behind the choice of organic wine. Finally, new knowledge on ANA can aid in shaping private and public design policies to further develop the organic sector.

The Italian wine market is a suitable case study since trends of organic wine production and consumption in this country are in line with international patterns of behaviour. Indeed, Italy has seen growth in terms of both organic wine production, ranked the second largest producer of organic grapes in the world in 2017 behind Spain (Willer and Lernoud 2019), and consumer demand. From 2012 to 2016, Italian agricultural land devoted to certified organic grapes almost doubled, increasing from 57,347 to 103,545 hectares (Eurostat 2019). At the same time, the Wine Monitor of Nomisma (2018) using Nielsen data, reports that in the first 2 months of 2018 sales of organic wine in Italy reached a value of €21.6 million in supermarkets alone, with an increase of 88% compared to the same period the previous year. A similar trend can be seen in market shares: organic wine constituted 1.2% of the Italian market in the first two months of 2018, whereas it only accounted for 0.7% in the same period in 2017.

The next section of this paper includes a brief literature review of consumer behaviour relating to organic wine. This is followed by details of the methodology used, including descriptions of the DCE, survey and econometric model. Outputs are presented in the results section, and findings are discussed in the final section along with insights and implications for the development of marketing strategies.

Consumer preferences for organic wine

Compliance with the production standards in EU Regulation No. 203/2012, guaranteed by the organic logo on the wine label, contributes to a positive perception of the wine made with this production method. In fact, as noted by Bernabéu et al. (2008) and Schäufele and Hamm (2017), consumers consider organic wine to be a higher quality product, compared to conventional wine, and, in some cases, to have a better taste (Wiedmann et al. 2014; Kim and Bonn 2015). The purchasing context may also affect the attention paid by consumers to the organic claim on labels. Boncinelli et al. (2019) have shown that consumers particularly focus on the organic claim when purchasing wine intended as a gift, considering organic wine to be a sign of quality.

The literature reports environmental safeguard is a factor that positively affects organic wine purchases. Indeed, consumers are motivated by the reduced use of chemicals and implementation of sustainable practices in vineyards and cellars (Bonn et al. 2016; D'Amico et al. 2016). The ban on the use of synthetic pesticides contributes to a perception of the positive health effects of consuming organic wine, which also satisfies the increasing demand for food safety (Fotopoulos et al. 2003; Grogan 2015; Bonn et al. 2016). In this sense, reduced the use of sulphites contributes to the idea among consumers that organic wines are healthier than conventional ones (Costanigro et al. 2014; D'Amico et al. 2016; Amato et al. 2017). In general, the positive perception of organic wine means that consumers are willing to pay more for organic wine than conventional ones (Brugarolas Mollá-Bauzá et al. 2005; Pagliarini et al. 2013; Wiedmann et al. 2014; Di Vita et al. 2019).

However, other scholars have reported contrasting results relating to consumer perceptions of organic wine. Corsi and Strøm (2013), Schmit et al. (2013) and Abraben et al. (2017) have pointed out that consumers may perceive wine labelled as organic to be of lower quality or constituting less value for money (Delmas and Grant 2014). These findings seem to be confirmed by the results of Delmas and Lessem (2017), who have found that consumers prefer an organically labelled wine over a conventional one when the wine price is lower, which could be read as an indication that consumers perceive organic wine to be of lower quality. In addition, Abraben et al. (2017) have shown that consumers elicit a price premium for organic wine when this information is not disclosed, while no effect was found on the price of organic wine when consumers knew that the wine was organically produced and was labelled as such. The benefits of organic wine production without labelling have been confirmed by the research of Delmas and Grant (2014), who demonstrated that organically certified wine without an organic logo on the label increases the willingness of consumers to pay 13% more than they would for conventional wine, whereas an organically certified wine with an “eco-label” (such as language and/or symbols on the labels that identify producers’ organic method) reduces the price by 20%.

A possible explanation for these discrepancies could be the hypothesis that organic wine is a niche within the larger wine market. In effect, some studies on consumer segments have identified the presence of a niche of consumers who consistently prefer organic wine. In a seminal study, Remaud et al. (2008) found a consumer segment with a share of 14% of the sample, which receives utility from organic wine and is willing to pay a premium price for this attribute. In later research, Mueller and Remaud (2010) replicated the choice experiment of Remaud et al. (2008), demonstrating 2 years later that the importance of the organic certification had further increased. Another recent study has observed that an increasing market niche is interested in buying organic wine, representing a segment of 27% of consumers (Troiano et al. 2016). These findings indicate the need for segmentation studies to investigate this market.

Finally, another possible reason for the contrasting results in previous literature could be that earlier studies did not consider the issue of attribute non-attendance, i.e., the possibility that consumers systematically ignore certain characteristics of wine (namely, under our hypothesis, the organic certification). Indeed, choosing a bottle of wine can be a demanding cognitive process since the consumer is faced with an array of cues on a wine label, which describe and distinguish the product. Given that consumers are not able to taste wine before purchasing it, they choose the “right” bottle, examining the product features which individuals consider relevant (Scozzafava et al. 2016).

ANA behaviour is relatively unexplored in wine literature. Thiene et al. (2013) have investigated it in relation to wine choice by looking at two attributes of sparkling wine: price and certification of origin. Their results show that ANA for these two attributes is definitely modest, i.e. very small for price and approximately a 6% probability for certification of origin. Despite its limitations, the study confirms that consumers do indeed pay attention to certification of origin and price—attributes identified in the literature as being two of the overriding criteria when it comes to making wine-purchasing decisions (Remaud et al. 2008; Scozzafava et al. 2018). The influence of these attributes on consumers is such that, in some cases, price, region of origin and geographical indication (GI) take precedence over the organic certification (Bernabéu et al. 2008; Mueller and Remaud 2010; Mann et al. 2012; Troiano et al. 2016). Given the lack of studies on this topic, understanding whether consumers ignore or pay attention to the “organic” attribute when purchasing a bottle of wine is a unique element of this article.

Data and methodology

The experiment

The data used for this study were collected in October 2017 by conducting an online survey. A questionnaire was completed by 318 Italian wine consumers (all over 18 years of age) who had bought at least one bottle of wine in the previous year.

We gathered information related to wine choice behaviour by carrying out a DCE (Louviere et al. 2000; Adamowicz and Swait 2011). This technique, commonly used in consumer studies of wine (see, among others, Scozzafava et al. 2018; Costanigro et al. 2019; Gallenti et al. 2019), simulates a purchasing situation where respondents have to choose from different hypothetical alternatives in a sequence of choice tasks. Our choice experiment involved a 0.75-l bottle of red wine. Participants were asked to choose a wine for a personal, everyday occasion. Apart from the organic certification, other attributes were selected by reviewing previous literature, as listed in Table 1. Four levels of price were selected for the experiment (€5, €8, €11 and €14), which range from premium wine (€5–€8) to super premium wine (€8–€14) (Castriota 2015). The four GI levels selected consist of the three indications established by the Italian classification system (in accordance with European Union regulations) plus an option without a GI. In particular, the Italian GI classification recognizes within the PDO (protected designation of origin) certification wine DOCG (Controlled and Guaranteed Designation of Origin) and DOC (controlled designation of origin), while PGI (protected geographical indication) certification corresponds to the Italian IGT (indication of geographical typicality). DOCG and DOC indications are subjected to a quality discipline, and DOCG wines are featured by stricter rules, compared to the others. The study includes two levels in relation to the organic attribute, i.e., organic or no indication on the label. According to Spawton (1990)’s study, the name of the producer is one of the key brand elements in the wine “brand hierarchy” (Keller 2013). Since the notion of brand in the wine market is something that generates confusion among consumers (Viot and Passebois-Ducros 2010), we prefer the term “producer” rather than “brand”, considering it to be a dichotomous variable based on the fame of the producer (famous vs. not non-famous).

We performed a D-efficient design and obtained six choice sets. In each choice set, respondents were faced with two wine bottles and a “No-Buy” option. The design was created using the DCREATE module included in the STATA 14.2 software.

Instead of directly asking respondents which red wine bottle (0.75 l), they would choose out of those presented to them, we applied the inferred evaluation method where participants were asked to predict which bottle a “typical” consumer would buy for his/her personal consumption. This technique of indirect questioning, proposed by Lusk and Norwood (2009a, b), was implemented to mitigate social desirability and hypothetical bias. During experiments, participants tend to try to create a positive impression on the researcher by overstating their true preferences and willingness to pay. However, respondents do not have the same reasons to portray other people in the best possible light. In this sense, the inferred valuation method represents a technique to reduce these biases (Norwood and Lusk 2011). The text that introduced the experiment (translated from Italian) was, “You will see six purchasing scenarios of two red wine bottles (0.75 l) and a “no-buy” option. The wine bottles differ in price, organic certification, geographical indication and fame of the brand (famous vs non-famous). For each scenario, please indicate, in your opinion, which wine bottle a “typical” consumer would buy for his/her personal consumption”.

The econometric models

According to Lancaster’s Consumer Theory (1966) and the Random Utility Theory of McFadden (1974), the utility that consumer i obtains when purchasing a bottle of wine j in a choice situation t is as follows:

where Xijt is a vector of the observed attributes of the bottle of wine j, β is vector of taste parameters and εijt is the idiosyncratic error term that captures all unobserved factors.

Different specifications of the choice models can be used to analyse experimental data according to assumptions on functional form and distribution of an error term. The basic model is the multinomial logit model (MNL) specification where βs are assumed homogenous across respondents and error terms respect the independence of irrelevant alternatives (IIA) property. Using our attributes, the MNL specification of Eq. (1) is as follows:

where No_Buy is an alternative-specific constant representing the no-buy alternative in each choice set; IGT, DOC and DOCG are dummy variables indicating the GIs of the wine; ORGANIC and FAMOUS_PRODUCER are dummy variables assuming a value of 1 if they are present in option j; and PRICE represents the price levels offered to the respondent at which the bottle of wine can be purchased. Finally, εijt is the stochastic error term. βn (n = 1,…, 6) are coefficients associated with the attributes.

Equation (2) was estimated using three econometric models that relax the restricted assumptions of homogenous taste and IIA of error term such as RPL and LCM. The RPL model was used with freely correlated random parameters (Train 1998). Correlations between the parameters were inserted after performing a log-likelihood ratio (LR) test. The result (χ2(13) = 24.4) confirms that the correlation between parameters is statistically significant. Furthermore, an LCM was performed to explore preference heterogeneity among the respondents (Greene and Hensher 2003).

Finally, we investigate the effect of the non-attendance of organic attribute in consumer wine choice. The ANA studies aim to fill the fully compensatory DCE standard assumption so that we can incorporate the heuristic behavioural decision process into our experiment (Hensher et al. 2015). Relaxing the fully compensatory assumption has the main advantages of obtaining unbiased coefficient estimates and a more realistic representation of consumer decision rules.

We implemented a third model to account for ANA behaviour in the DCE by using an inferred approach (Hensher et al. 2012), which is one of two methods used to study this consumer behaviour. A different strategy, called stated ANA, consists of directly asking respondents during the DCE which attributes they did not attend to in the choice task. We decided to opt for inferred ANA since it can be implemented in the absence of self-reported information on attendance. This reduces the burden for respondents (Campbell et al. 2015), and the potential bias that can arise from informing respondents that the focus of the study is ANA behaviour (Van Loo et al. 2018). The strategy typically used to account for inferred ANA in the model estimation relies on LCM where “non-attended” attributes are fixed at zero, while attended attributes have coefficients with the same values across classes (Scarpa et al. 2009). The classes, therefore, represent different attribute-processing strategies (Hole et al. 2013). However, taste heterogeneity can be confounded with attribute-non-attendance. Using LCM approach, a respondent with a low sensitivity for an attribute can be wrongly allocated to a non-attendance class, consequently resulting in an overestimation of ANA. To bridge over this issue, Hess et al. (2013) suggest running a latent class mixed logit model which allows jointly for attribute non-attendance and for continuous taste heterogeneity. This model combines latent class model and random parameters model. Therefore, a continuous distribution of model parameters will be estimated within each ANA class.

Considering the attributes and their levels selected in our DCE, there are 24 possible permutations, which correspond to 16 classes that simultaneously test all ANA combinations. Therefore, we need to run a model with a limited number of latent classes to represent the ANA to only those attribute combinations considered plausible. The need for the researcher to choose the number of latent ANA classes and structure of preferences is the main drawback of inferred ANA (Scarpa et al. 2012).

We base the class selection following the criteria proposed by Hensher et al. (2015) and Caputo et al. (2018): (i) a data-driven process that involves the evaluation of the classes with a good probability membership along with the consideration of BIC and AIC (Caputo et al. 2018); (ii) we set to zero those attribute combinations considered plausible, according to the literature on consumer wine behaviour and on the basis of the RPL and LCM results (Hensher et al. 2015).

Therefore, following the abovementioned indications, and after having tested several specifications, we selected a model consisting of six classes. In particular, we considered a class with a full attribute attendance, a class with total non-attendance and four classes with partial non-attendance ignoring organic or organic combined with other attributes. The three models were all estimated using NLOGIT 6.0 software.

Results

Table 2 reports the socio-demographic and economic characteristics of the sample.

The number of female participants is almost equal to that of the men. The most represented age categories are those between 18 and 34 years old, with a lower percentage of respondents who were more than 54 years old. Of the respondents, 52.8% had a tertiary education; thus, the more educated proportion of the general population might be slightly overrepresented. Income distribution (measured as self-assessment of family economic situation, considering all available incomes) and occupational status were heterogeneous among the respondents. Finally, analysis of the self-reported wine knowledge of respondents (measured on a ten-point scale) shows that the median value is 5 and almost 33.6% of respondents were classified as “wine experts” (those who gave themselves a score greater than 6).

The estimates of the RPL model are presented in Table 3. The coefficients relate to a 0.75-l bottle of red wine with no organic certification, from a producer who is not famous and without presenting a GI. According to our expectations, the negative and statistically significant coefficient of the price parameter indicates that consumer utility decreases when price increases. The negative and statistically significant estimate of the No-Buy option implies that respondents take greater utility from purchasing one of the alternatives shown. All the standard deviations from the parameters are statistically significant, indicating the presence of preference heterogeneity among consumers for the attributes included in the experiment. Consumers’ utility increases when purchasing wine from a famous producer or with a GI. In particular, DOC appellation is the most preferred, followed by DOCG and IGT appellations. Wine from a famous producer is also positive and significant, suggesting that consumers consider this attribute to be a sign of quality.

The organic attribute is the only coefficient that is not statistically significant. Therefore, on average, consumers’ utility is not affected by the presence of an organic certification. However, as already mentioned, the standard deviation for the organic attribute is statistically significant and its magnitude indicates a high level of heterogeneity among consumers in relation to organic wine. This is a cue indicating that the consumption of a niche group of respondents could be positively influenced by the organic attribute. In other words, it also indicates the presence of consumer segments with a preference for this attribute and the need for further investigation with an LCM.

Table 4 presents the LCM results with three classes. The number of classes was identified based on two information criteria, i.e. the Akaike information criterion (AIC) and the Bayesian information criterion (BIC). The solution with three classes provides the best fit for our data since the BIC reaches the minimum value for these classes. In particular, the BIC decreases when passing from two (BIC = 2842.292) to three classes (BIC = 2820.103), before increasing when additional segments beyond three are added (BIC = 2820.784). In addition, there is a smaller decrease in the AIC value when passing from three to four classes, as opposed to when passing from two to three classes.

The classes are presented according to their size. Class 1 is the largest group, comprising 65.1% of the sample. For these respondents, the organic coefficient is not statistically significant. Instead, they prefer wine produced by a famous winemaker. Price coefficient is statistically significant with a negative sign. Class 2 comprises 19.1% of the participants. Only the individuals in this market segment gain utility from the organic attribute. Estimates for the No-Buy parameter in classes 1 and 2 are significant, suggesting that consumers belonging to these classes prefer to choose their wine. Class 3 (15.8% of the respondents) is characterized by attributes that are not statistically significant, becoming a “mixed class” with different types of behaviour. These results confirm those of the RPL, i.e. most respondents do not prefer organic wine. However, there is a niche of individuals within the market who consistently show a strong preference for this kind of wine.

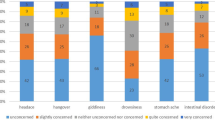

Starting from the hypothesis that all respondents do not consider all the product attributes when they make their choice (Erdem et al. 2015), we implemented a latent class mixed logit model to study ANA (Hess et al. 2013). Following the approaches described above, we created a model with six classes under the hypothesis that respondents ignore organic, GI appellations, price attributes and some combinations of them. The selected six classes are as follows: first class (full attendance), no attribute is set to zero; second class (ANA on organic attribute), organic attribute set to zero; third class (ANA on GIs), all GI attributes set to zero; fourth class (combined ANA of GIs and organic), all GIs and organic attributes set to zero; fifth class (ANA of all attributes but the price), all GIs, famous producer, and organic attributes set to zero; and sixth class (ANA of all attributes), all attribute set to zero. Table 5 shows the results of the latent class mixed logit model model.

The probability that respondents consider all attributes in the experiment is 24.7% (class 1). This result demonstrates that only a quarter of consumers attend all attributes. Class 2, with an estimated class membership probability of 36.6%, is the largest class in terms of size and represents those who consider all attributes except the organic claim. Respondents who do not solely consider the GI appellations belong to class 3 with a probability of 2.9%. Class 4 (10.2%) is the second largest in size and represents respondents who do not consider both the organic and GI appellations. Consumers who only consider the price attribute, ignoring the others, represent 11.8% of the sample (class 5). Class 6, accounting for about 13.8% of membership probability, suggests the presence of a group that does not consider any attributes taken into account in this DCE.

Focusing on the organic attribute, we can observe a combined estimated membership probability of 72.4% of respondents who ignored this claim during the choice tasks. This result is in line with the findings of the LCM, showing that a segment of consumers is interested in organic wine and the remaining respondents do not consider this attribute.

Discussion and conclusion

The findings of this study provide a deeper insight into consumer behaviour in relation to organic wine and provide more empirical evidence to support the debate on this topic. The results of the RPL highlight that the organic production method does not affect the likelihood of consumers buying a bottle of wine. However, this finding hides the evidence that consumers show a heterogeneous taste for this attribute. In other words, there are significant market segments with a high preference for organic wine. Indeed, the results of the LCM have identified the existence of a group of consumers (19.1% of the sample) willing to buy organic wine. Although not in the majority, this niche of respondents represents a relevant part of the sample and is numerically in line with previous research (Remaud et al. 2008; Mueller and Remaud 2010; Troiano et al. 2016). Organic wine producers, therefore, need to consider targeted marketing strategies aimed at addressing the needs of this market niche.

The results of the ANA analysis clearly show that the general hypothesis of rational consumers who attend to all available information largely fails, since the class with full attendance is only one quarter of the sample. In sum, most of wine consumers ignore at least one attribute when choosing a bottle of wine, possibly due to the high number of attributes that are associated with wine.

Furthermore, the results of the ANA analysis confirm that a significant proportion of consumers prefer organic wine. Indeed, the class of consumers who attend to organic certification is almost equal in size to the class of consumers identified by the LCM as receiving utility from choosing an organic bottle of wine.

However, the key finding of our study derives from the latent class mixed logit model. We demonstrated that most consumers (72.4% of the sample) do not pay attention to organic certification on a wine label, compared with other attributes. The overall impression emerging from this finding does not mean that consumers receive a disutility in choosing an organic wine, but it demonstrates that individual focused during the purchasing act towards other wine attributes. This result shows, for the first time in wine consumer behaviour studies, this non-attendance behaviour by consumers towards organic certification. Furthermore, we are in line with the findings of Thiene et al. (2013) that consumers put greater attention to other attributes such as GIs and price, despite their experiment was context-specific and used different preference data compared to this study.

There are significant implications behind the identification of this non-attendance behaviour in relation to organic production method. Firstly, ignoring the presence of this behaviour might lead to distorted estimates of purchasing parameters and consumers’ willingness to pay (Scarpa et al. 2009). The second implication concerns some aspects of marketing. A consumer attitude of indifference towards organic wine does not necessarily equate to an attitude of disutility or zero utility. In other words, the wine market is not split between organic wine consumers and conventional wine consumers but rather between those consumers who do or do not attend to organic attributes. In this sense, stakeholders interested in developing the organic wine market can focus on marketing strategies for enlarging the group of people who attend to such claims. Furthermore, if a large number of consumers ignore organic attributes, producers can emphasize organic production methods on their wine labels without jeopardizing the purchasing intentions of consumers who are “not organic”. For example, winemakers could add an “organic wine” claim or make the organic certification logo clearly visible on the front label. Such claims or logos are often relegated to the back label, written in small print or in a way that is not particularly prominent.

As previously observed by Caputo et al. (2017), the design of choice experiments (i.e., typology and numbers of attributes) affects respondents’ choice behaviour since some attributes can be used as cues for other missing product characteristics. Therefore, the preferences for the organic claim observed in this study might be affected by the attributes selected in the experimental design (producer and geographical indication) and by the missing attributes. Our results are similar to other studies that included organic certification in combination with other wine features (e.g., Troiano et al. 2016; Boncinelli et al. 2019; Dominici et al. 2019b). However, if additional or different attributes were added in the experimental design with the organic certification, the consumption of each wine alternative would have changed.

LCM estimation indicated a group of consumers with a set of attributes that were not statistically significant, suggesting a probable, well-established preference for a specific wine, which they had tasted or purchased previously. This result accords with the class elicited by the latent class mixed logit model (class 6), characterized by non-attendance to all attributes under consideration. Indeed, it is plausible that these consumers, when faced with a vast array of products on the supermarket wine shelf, will take the bottle they are intent on purchasing without examining the available alternatives.

The findings of this study suggest that wineries will have a greater likelihood of success if they implement marketing strategies that influence the behaviour and decision-making of individuals in relation to organic wine. The evidence for consumers’ non-attendance behaviour towards organic certification also has clear implications for retail managers and policymakers in terms of understanding organic wine preferences and patterns of behaviour. Several supermarkets currently display organic wine on the same shelves as conventional wine, without clear signage to distinguish between these different products. To attract consumer attention and further develop the organic market, retailers could set up a concession inside their stores, specifically for organic wine.

Increasing the number of consumers who buy organic products will also have positive environmental consequences. Policymakers who want to increase the sustainability of viticulture should, therefore, take the opportunity to promote organic wines through specific campaigns aimed at encouraging more consumers to engage with this attribute.

The main limits of this study are the small sample size and use of the choice experiment that included GIs but not the name and origin of the wine. In other words, the attribute presented in the choice set was only “DOCG” wine rather than, for instance, “DOCG Brunello di Montalcino”. Not giving this information is a limitation since there are currently no wine bottles on the market which report GIs without the name of that specific denomination. Further research is needed to confirm the results of this study, investigating ANA behaviour with different non-attendance techniques or eye-tracking equipment used during the DCE. Moreover, a real choice experiment, including wine tasting, could provide a better understanding of consumer preferences for organic wine. Consumer segmentation based on ANA behaviour and a class profiling according to personal environmental and health attitudes might provide a more accurate explanation of taste heterogeneity. Another topic to be explored in future research could be the comparison of ANA behaviour on different buying occasions, such as the purchase of wine for personal every day consumption, for a dinner with friends or for gift-giving purposes.

Availability of data and materials

All data were acquired and elaborated by the authors. The dataset used and analysed during this study is available from the corresponding author on request.

Abbreviations

- AIC:

-

Akaike information criterion

- ANA:

-

Attribute non-attendance

- BIC:

-

Bayesian information criterion

- DCE:

-

Discrete choice experiment

- DOC:

-

Controlled designation of origin

- DOCG:

-

Controlled and Guaranteed Designation of Origin

- GI:

-

Geographical indication

- IGT:

-

Indication of Geographical Typicality

- IIA:

-

Independence of irrelevant alternatives

- LCM:

-

Latent class model

- LR:

-

Log-likelihood ratio

- MNL:

-

Multinomial logit model

- PDO:

-

Protected designation of origin

- PGI:

-

Protected geographical indication

- RPL:

-

Random parameter logit

- SE:

-

Standard error

References

Abraben LA, Grogan KA, Gao Z (2017) Organic price premium or penalty? A comparative market analysis of organic wines from Tuscany. Food Policy 69:154–165

Adamowicz W, Swait J (2011) Discrete choice theory and modeling. In: Lusk JL, Roosen J, Shogren J (eds) The Oxford handbook of the economics of food consumption and policy. Oxford University Press, Oxford, pp 119–151

Amato M, Ballco P, López-Galán B, De Magistris T, Verneau F (2017) Exploring consumers’ perception and willingness to pay for “Non-Added Sulphite” wines through experimental auctions: a case study in Italy and Spain. Wine Econ Policy 6(2):146–154

Ballco P, Caputo V, de-Magistris T (2020) Consumer valuation of European Nutritional and Health claims: do taste and attention matter? Food Qual Prefer 79:103793

Bernabéu R, Brugarolas M, Martínez-Carrasco L, Díaz M (2008) Wine origin and organic elaboration, differentiating strategies in traditional producing countries. Brit Food J 110(2):174–188

Boncinelli F, Dominici A, Gerini F, Marone E (2019) Consumers wine preferences according to purchase occasion: personal consumption and gift-giving. Food Qual Prefer 71:270–278

Bonn MA, Cronin JJ Jr, Cho M (2016) Do environmental sustainable practices of organic wine suppliers affect consumers’ behavioural intentions? The moderating role of trust. Cornell Hosp Q 57(1):21–37

Brugarolas Mollá-Bauzá M, Martinez-Carrasco L, Martínez-Poveda A, Pérez MR (2005) Determination of the surplus that consumers are willing to pay for an organic wine. Span J Agric Res 3(1):43–51

Campbell D, Boeri M, Doherty E, Hutchinson WG (2015) Learning, fatigue and preference formation in discrete choice experiments. J Econ Behav Organ 119:345–363

Caputo V, Scarpa R, Nayga RM Jr (2017) Cue versus independent food attributes: the effect of adding attributes in choice experiments. Eur Rev Agric Econ 44(2):211–230

Caputo V, Van Loo EJ, Scarpa R, Nayga RM Jr, Verbeke W (2018) Comparing serial, and choice task stated and inferred attribute non-attendance methods in food choice experiments. J Agr Econ 69(1):35–57

Castriota S (2015) Economia del vino. EGEA S.p.A, Milano

Corsi A, Strøm S (2013) The price premium for organic wines: estimating a hedonic farm-gate price equation. J Wine Econ 8(1):29–48

Costanigro M, Appleby C, Menke SD (2014) The wine headache: consumer perceptions of sulfites and willingness to pay for non-sulfited wines. Food Qual Prefer 31:81–89

Costanigro M, Scozzafava G, Casini L (2019) Vertical differentiation via multi-tier geographical indications and the consumer perception of quality: the case of Chianti wines. Food Policy 83:246–259

D'Amico M, Di Vita G, Monaco L (2016) Exploring environmental consciousness and consumer preferences for organic wines without sulfites. J Clean Prod 120:64–71

Delmas MA, Grant LE (2014) Eco-labeling strategies and price-premium: the wine industry puzzle. Bus Soc 53(1):6–44

Delmas MA, Lessem N (2017) Eco-premium or eco-penalty? Eco-labels and quality in the organic wine market. Bus Soc 56(2):318–356

Di Vita G, Pappalardo G, Chinnici G, La Via G, D’Amico M (2019) Not everything has been still explored: further thoughts on additional price for the organic wine. J Clean Prod 231:520–528

Dominici A, Boncinelli F, Gerini F, Marone E (2019b) Consumer preference for wine from hand-harvested grapes. Brit Food J. https://doi.org/10.1108/BFJ-04-2019-0301

Dominici A, Boncinelli F, Marone E (2019a) Lifestyle entrepreneurs in winemaking: an exploratory qualitative analysis on the non-pecuniary benefits. Int J Wine Bus Res 31(3):385–405

Erdem S, Campbell D, Hole AR (2015) Accounting for attribute-level non-attendance in a health choice experiment: does it matter? Health Econ 24(7):773–789

Eurostat (2019) Organic crop area by agricultural production methods and crops (from 2012 onwards). Eurostat, Luxembourg https://ec.europa.eu/eurostat/web/agriculture/data/database. Accessed 03 July 2019

Fotopoulos C, Krystallis A, Ness M (2003) Wine produced by organic grapes in Greece: using means-end chains analysis to reveal organic buyers’ purchasing motives in comparison to the non-buyers. Food Qual Prefer 14(7):549–566

Gallenti G, Troiano S, Marangon F, Bogoni P, Campisi B, Cosmina M (2019) Environmentally sustainable versus aesthetic values motivating millennials’ preferences for wine purchasing: evidence from an experimental analysis in Italy. Agric Food Econ 7(1):12

Greene WH, Hensher DA (2003) A latent class model for discrete choice analysis: contrasts with mixed logit. Transport Res B-Meth 37(8):681–698

Grogan KA (2015) The value of added sulfur dioxide in French organic wine. Agric Food Econ 3(1):19

Hensher DA, Rose J, Greene WH (2005) The implications on willingness to pay of respondents ignoring specific attributes. Transportation 32(3):203–222

Hensher DA, Rose JM, Greene WH (2012) Inferring attribute non-attendance from stated choice data: implications for willingness to pay estimates and a warning for stated choice experiment design. Transportation 39(2):235–245

Hensher DA, Rose JM, Greene WH (2015) Applied choice analysis, 2nd edn. Cambridge University Press, Cambridge

Hess S, Stathopoulos A, Campbell D, O’Neill V, Caussade S (2013) It’s not that I don’t care, I just don’t care very much: confounding between attribute non-attendance and taste heterogeneity. Transportation 40(3):583–607

Hole AR, Kolstad JR, Gyrd-Hansen D (2013) Inferred vs. stated attribute non-attendance in choice experiments: a study of doctors’ prescription behaviour. J Econ Behav Organ 96:21–31

Hughner RS, McDonagh P, Prothero A, Shultz CJ, Stanton J (2007) Who are organic food consumers? A compilation and review of why people purchase organic food. J Consum Behav 6(2-3):94–110

IWSR (2018) The global organic wine market 2012-22. https://www.vinavisen.dk/vinavisen/website.nsf/pages/IWSR.pdf/$file/IWSR.pdf. Accessed 12 Dec 2019.

Keller KL (2013) Strategic brand management. Building, measuring, and managing brand equity. Pearson, Harlow

Kim H, Bonn MA (2015) The moderating effects of overall and organic wine knowledge on consumer behavioral intention. Scand J Hosp Tour 15(3):295–310

Lancaster KJ (1966) A new approach to consumer theory. J Polit Econ 74(2):132–157

Louviere JJ, Hensher D, Swait JD (2000) Stated choice methods: analysis and applications. Cambridge University Press, Cambridge

Lusk JL, Norwood FB (2009a) An inferred valuation method. Land Econ 85(3):500–514

Lusk JL, Norwood FB (2009b) Bridging the gap between laboratory experiments and naturally occurring markets: an inferred valuation method. J Environ Econ Manag 58(2):236–250

Mann S, Ferjani A, Reissig L (2012) What matters to consumers of organic wine? Brit Food J 114(2):272–284

McFadden D (1974) Conditional logit analysis of qualitative choice behavior. In: Zarembka P (ed) Frontiers in econometrics. Academic, New York, pp 105–142

Michaud C, Llerena D, Joly I (2013) Willingness to pay for environmental attributes of non-food agricultural products: a real choice experiment. Eur Rev Agric Econ 40(2):313–329

Mohanty SK, Balcombe K, Bennett R, Nocella G, Fraser I (2018) Attribute specific impacts of stated non-attendance in choice experiments. J Agr Econ 70(3):686–704

Mueller S, Remaud H (2010) Are Australian wine consumers becoming more environmentally conscious? Robustness of latent preference segments over time. In: Proceedings of the 5th International Academy of Wine Business Research Conference, Auckland, February 2010

Nomisma (2018) Nomisma wine monitor: è bio boom anche nel vino, la consumer base di vino bio sale al 41% degli italiani. https://nomisma.it/wp-content/uploads/2019/11/CS_Nomismea_Vino_BIO_2018.pdf. Accessed 12 Dec 2019.

Norwood FB, Lusk JL (2011) Social desirability bias in real, hypothetical, and inferred valuation experiments. Am J Agr Econ 93(2):528–534

Pagliarini E, Laureati M, Gaeta D (2013) Sensory descriptors, hedonic perception and consumer’s attitudes to Sangiovese red wine deriving from organically and conventionally grown grapes. Frontiers Psychol 4:896

Peigné J, Casagrande M, Payet V, David C, Sans FX, Blanco-Moreno JM, Cooper J, Gascoyne K, Antichi D, Bàrberi P, Bigongiali F, Surböck A, Kranzler A, Beeckman A, Willekens K, Luik A, Matt D, Grosse M, Heß J, Clerc M, Dierauer H, Mäder P (2016) How organic farmers practice conservation agriculture in Europe. Renew Agr Food Syst 31(1):72–85

Remaud H, Mueller S, Chvyl P, Lockshin L (2008) Do Australian wine consumers value organic wine? In: Proceedings of the International Conference of the Academy of Wine Business Research, Siena, 17–19 July 2008

Santini C, Cavicchi A, Casini L (2013) Sustainability in the wine industry: key questions and research trends. Agric Food Econ 1:9

Scarpa R, Gilbride TJ, Campbell D, Hensher DA (2009) Modelling attribute non-attendance in choice experiments for rural landscape valuation. Eur Rev Agric Econ 36(2):151–174

Scarpa R, Zanoli R, Bruschi V, Naspetti S (2012) Inferred and stated attribute non-attendance in food choice experiments. Am J Agr Econ 95(1):165–180

Schäufele I, Hamm U (2017) Consumers’ perceptions, preferences and willingness-to-pay for wine with sustainability characteristics: a review. J Clean Prod 147:379–394

Schäufele I, Hamm U (2018) Organic wine purchase behaviour in Germany: exploring the attitude-behaviour-gap with data from a household panel. Food Qual Prefer 63:1–11

Schmit TM, Rickard BJ, Taber J (2013) Consumer valuation of environmentally friendly production practices in wines, considering asymmetric information and sensory effects. J Agr Econ 64(2):483–504

Scozzafava G, Boncinelli F, Contini C, Romano C, Gerini F, Casini L (2016) Typical vine or international taste: wine consumers’ dilemma between beliefs and preferences. Recent Pat Food Nutr Agr 8(1):31–38

Scozzafava G, Gerini F, Dominici A, Contini C, Casini L (2018) Reach for the stars: the impact on consumer preferences of introducing a new top-tier typology into a PDO wine. Wine Econ Policy 7(2):140–152

Sellers-Rubio R, Nicolau-Gonzalbez JL (2016) Estimating the willingness to pay for a sustainable wine using a Heckit model. Wine Econ Policy 5(2):96–104

Spawton A (1990) Marketing planning for wine. Eur J Wine Marketing 1(2):6–48

Thiene M, Scarpa R, Galletto L, Boatto V (2013) Sparkling wine choice from supermarket shelves: the impact of certification of origin and production practices. Agr Econ 44(4–5):523–536

Train K (1998) Recreation demand models with taste differences over people. Land Econ 74(2):230–239

Troiano S, Marangon F, Tempesta T, Vecchiato D (2016) Organic vs local claims: substitutes or complements for wine consumers? A marketing analysis with a discrete choice experiment. New Medit 15(2):14–22

Van Loo EJ, Nayga RM Jr, Campbell D, Seo HS, Verbeke W (2018) Using eye tracking to account for attribute non-attendance in choice experiments. Eur Rev Agric Econ 45(3):333–365

Viot C, Passebois-Ducros J (2010) Wine brands or branded wines? The specificity of the French market in terms of the brand. Int J Wine Bus Res 22(4):406–422

Wiedmann KP, Hennigs N, Henrik Behrens S, Klarmann C (2014) Tasting green: an experimental design for investigating consumer perception of organic wine. Brit Food J 116(2):197–211

Willer H, Lernoud J (eds) (2019) The world of organic agriculture. Statics and emerging trends 2019. Research Institute of Organic Agriculture FiBL, Frick and IFOAM-Organics International, Bonn

Acknowledgements

Not applicable.

Funding

This study was entirely sponsored by the authors.

Author information

Authors and Affiliations

Contributions

The work is the result of the full collaboration of all the authors. All the authors have made substantial contributions to the conceptualization of the study, the design of research and the critical review of the manuscript. However, FB contributed to write the “Introduction” and “Results” sections. AD contributed to write the “Data and Methodology” and “Results” sections. FG contributed to write the “Consumer preferences for organic wine” and “Data and methodology” sections. EM contributed to write the “Introduction” and “Discussion and conclusion”. The authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Boncinelli, F., Dominici, A., Gerini, F. et al. Insights into organic wine consumption: behaviour, segmentation and attribute non-attendance. Agric Econ 9, 7 (2021). https://doi.org/10.1186/s40100-021-00176-6

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40100-021-00176-6