Abstract

This paper examines the relationship between the logarithms of carbon dioxide (CO2) emissions and real Gross Domestic Product (GDP) in China by applying fractional integration and cointegration methods. These are more general than the standard methods based on the dichotomy between stationary and non-stationary series, allow for a much wider variety of dynamic processes, and provide information about the persistence and long-memory properties of the series and thus on whether or not the effects of shocks are long-lived. The univariate results indicate that the two series are highly persistent, their orders of integration being around 2, whilst the cointegration tests (using both standard and fractional techniques) imply that there exists a long-run equilibrium relationship between the two variables in first differences, i.e. their growth rates are linked together in the long run. This suggests the need for environmental policies aimed at reducing emissions during periods of economic growth.

Similar content being viewed by others

Introduction

China has been experiencing very rapid economic growth in recent decades, and its share of global gross domestic product had risen to 17.39% by the end of 2019; its growth has relied mainly on fossil fuels (coal and oil) that generate greenhouse CO2 (carbon dioxide) emissions and as a result China is now the largest carbon dioxide emitter in the world (Gregg et al., 2008; Guan et al., 2009; IEA, 2020). Given both its economic size and the level of its CO2 emissions, this country represents a particularly interesting case to analyse the relationship between economic growth and the environment. This is often understood in terms of the so-called environmental Kuznets curve (EKC) with its typical U-shape (as in the case of the original curve describing the relationship between income inequality and GDP (gross domestic product) per capita—see Kuznets, 1955). The basic idea is that emissions in countries in the early stages of development are low and therefore environmental qualities indicators are good; the subsequent industrialization process initially damages the environment, but as income per capita increases environmental legislation is introduced to reduce emissions and pollution (see Grossman & Krueger, 1991 and Shafik & Bandyopadhyay, 1992, among others).

The relationship between economic growth and CO2 emissions in China has been analysed in numerous papers using a variety of approaches (e.g. Du et al., 2012; Haisheng et al., 2005; Jalil & Mahmud, 2009; and Jalil & Feridun, 2011; Wang et al., 2011a, Wang et al., 2011b; Xie et al., 2018; Xu et al., 2014) as discussed in the literature review below. However, these have focused on factors that affect CO2 emissions or examined the evidence on the EKC, whilst the present study analyses the persistence of the two series and their linkages using fractional integration and cointegration methods, respectively.

Thus, its contribution is threefold. First, it improves on earlier works on the relationship between CO2 emissions and GDP in China by applying fractional integration and cointegration methods that are more general than those based on the classical stationary I(0) (integrated of order 0) v. non-stationary I(1) (integrated of order 1) dichotomy which had been previously used. In the standard framework the order of integration of the variables d can only be an integer, which is a rather restrictive assumption; the setup used in the present paper is instead much more general and flexible since this parameter is also allowed to take fractional values and as a result a much wider range of stochastic behaviours can be modelled. Whether a variable is stationary or not matters a great deal since in the former case the effects of shocks are only temporary whilst in the latter they are permanent and therefore a variable, if hit by a shock, will not revert to its long-run equilibrium, regardless of any policy measures. The more general framework used for the analysis in this paper also sheds light on intermediate cases when equilibrium is eventually restored, but deviations from it resulting from exogenous shocks are long-lived. Second, it is informative about both the dynamics and the long-run equilibrium, and it shows that both series of interest are highly persistent, but linked together in the long run. Thirdly, it provides important implications for both academics and policymakers. Specifically, to the former it suggests an interesting avenue for future research, namely investigating in greater depth the functional form of the relationship that has been established empirically in order to gain a better understanding of the issues of interest; to the latter it highlights the need for appropriate environmental policies during periods of economic growth. In particular, environmental innovation measures aimed at reducing carbon emissions, increasing energy efficiency and promoting green development have been shown also to provide growth opportunities for entrepreneurship in China (Chen & Lee, 2020; Zhang et al., 2017a, 2017b).

The layout of the paper is as follows. “Literature review” Section reviews the relevant literature. “Methodology” Section outlines the empirical framework. “Results and discussion” Section describes the data and discusses the empirical findings, while “Conclusions” Section offers some concluding remarks.

Literature review

Carbon dioxide (CO2) emissions are the main cause of climate change and global warming, and therefore they are among the most used indicators of environmental degradation (Apergis & Payne, 2009; Du et al., 2012; Lean & Smyth, 2010; Shahbaz et al., 2013, 2016; Tiwari et al., 2013). Higher CO2 levels in the Earth’s atmosphere are a serious issue as they can cause greenhouse effects and higher air temperature (Bacastow et al, 1985; Hofmann et al., 2009; IPCC, 2015; Liu et al., 2016). If the burning of fossil fuels continues, atmospheric CO2 concentration will double sometime during this century and air temperature will rise by 1.5–5 °C by 2100 (Baes et al., 1977; Kraaijenbrink et al., 2017; Mahlman, 1997). Carbon dioxide is associated with economic and other human activities, and accounts for three-quarters of Global Greenhouse Gas (GHG) emissions (Huaman & Jun, 2014; IPCC, 2015).

The linkage between economic growth and environmental degradation is examined in many studies providing mixed evidence. Some of them find that the relationship between CO2 emissions and economic growth is negative (Ajmi et al., 2015; Azomahou et al., 2006; Baek & Pride, 2014; Dogan & Aslan, 2017; Roca et al., 2001; Salahuddin et al., 2016), or that it is initially positive but then turns negative (Riti et al., 2017; Shahbaz et al., 2014, 2016). Other papers report instead a positive relationship (Ahmad & Du, 2017; Bakhsh et al., 2017; Chaabouni et al., 2016; Ma et al., 2016; Nasir & Rehman, 2011; Ozturk & Acaravci, 2013; Saidi & Mbarek, 2016). Some more recent research has used the autoregressive distributed lag (ARDL) model and a nonlinear version of the same to analyse the relationship between economic growth and CO2 emissions and has concluded that there is a positive long-term relationship between these two variables (Ahmad et al., 2018; Akalpler & Hove, 2019; Chen et al., 2019a, 2019b; Cosmas et al., 2019; Dong et al., 2018; Gill et al., 2018; Khan et al., 2019; Riti et al., 2017; Toumi & Toumi, 2019). Differences in terms of sample period, country-specific characteristics, model specifications, econometric methods and pollution indicators are possible reasons for the mixed results of those papers.

The environmental Kuznets curve (EKC), analogous to the inverted U-shaped curve originally used by Kuznets (1955) to model the relationship between income inequality and income levels, has become the most common framework to study the linkages between CO2 emissions and economic growth, either in single countries or in groups of countries. Early studies include Grossman and Krueger (1991, 1995), Stern and Common (2001) and Dinda (2004) and later Friedl and Getzner (2003), Dinda and Coondoo (2006) and Managi and Jena (2008). The results are mixed, some studies supporting the existence of an EKC (Ahmad, 2016; Ang, 2007; He & Richard, 2010; Iwata et al., 2010; Katz, 2015; Lau et al., 2014; López-Menéndez et al., 2014); others not finding any evidence for it (Jia et al., 2009; Liu et al., 2007a, 2007b; Magazzino, 2014a, 2014b, 2015; Pao et al., 2012; Riti & Shu, 2016); some reporting an N-shaped relationship (Kijima et al., 2010). Mikaylov et al. (2018) use a variety of cointegration methods (Johansen, ARDL, DOLS (dynamic ordinary least squares), FMOLS (fully modified ordinary least squares) and CCR (correlation regression estimator)) to test for the existence of an EKC in Azerbaijan and find that economic growth has a positive and statistically significant long-run effect on emissions which implies that the EKC hypothesis does not hold. Ru et al. (2018) apply a recently developed methodology based on the long-term growth rates (Stern et al., 2017) to model the income–emission relationship for four sectors (power, industry, residential, and transportation) and three difference types of pollutants (SO2 (sulfur dioxide), CO2, and BC (black carbon)); the analysis uses data for various countries from the global emission inventory developed at Peking University and finds that the results are both sector and pollutant specific. Barassi and Spagnolo (2012) estimate a VAR-GARCH (vector autoregression—generalized autoregressive conditional heteroskedastic) model and find evidence of both mean and volatility spillovers between per capita economic growth and carbon dioxide emissions in Canada, France, Italy, Japan, UK (United Kingdom) and USA (United States of America) over the period 1870–2005.

Panel studies supporting the validity of the EKC hypothesis include Martínez-Zarzoso and Bengochea-Morancho (2004) for 22 OECD countries; Farhani et al. (2014) for 10 Middle East and North African (MENA) countries; Gao and Zhang (2014) for 14 sub-Saharan African countries; Kasman and Duman (2015) for 15 countries which were Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Iceland, Latvia, Lithuania, FYR of Macedonia, Malta, Poland, Romania, Slovak Republic, Slovenia, and Turkey; Pao and Tsai (2011) for Brazil, Russia, India and China; Osabuohien et al. (2014) for 50 African countries; Kim (2019) for newly industrialized Asian countries; Apergis and Payne (2009) for six Central American countries; Anastacio (2017) for Canada, the and Mexico.

Panel studies not finding evidence of an EKC include instead Onafowora and Owoye (2014) for Brazil, China, Egypt, Japan, Mexico, Nigeria, South Korea, and South Africa (only finding evidence of an EKC in Japan and South Korea); Mallick and Tandi (2015) for Bangladesh, India, Nepal, Pakistan, and Sri Lanka; Zoundi (2017) for 25 countries; Wang (2012) for 98 countries. These contradictory results reflect the issue of heterogeneity in the context of panels.

Among single country studies, the following support the existence of an EKC: Ozturk and Oz (2016) for Turkey; Latifa et al. (2014) for Algeria; Khan et al. (2019) and Shahbaz et al. (2012) for Pakistan; Sothan (2017) for Cambodia; Yazdi and Mastorakis (2014) for Iran; Saboori et al. (2016) for Malaysia; Can and Gozgor (2017) for France; Saboori et al. (2012) for Malaysia; Khalid (2014) for Mongolia; Shahbaz et al. (2015) for Portugal.

Those not finding any evidence for an EKC include Saleh and Abedi (2014) and Saboori and Soleymani (2011) for Iran; Ghosh et al. (2014) and Amin et al. (2012) for Bangladesh; Friedl and Getzner (2002) for Austria; Boopen and Vinesh (2011) for Mauritius; Alkhathlan et al. (2012) for Saudi Arabia; Saboori et al. (2012) for Indonesia; Dogan and Turkekul (2016) for the USA. In this case, differences in the results can be attributed to the different pollution indices, model specifications, estimation techniques and sample period used.

A few studies carry out fractional integration/cointegration methods to analyse CO2 emissions. For instance, Galeotti et al. (2009) implement such tests for 24 OECD (Organisation for Economic Cooperation and Development) countries and find only limited evidence supporting the EKC hypothesis. Barassi et al., 2018 use this approach to examine stochastic convergence of relative per capita CO2 emissions; according to their results this is relatively weak in the case of the OECD countries whilst there is stronger evidence in the case of the BRICS (Brazil, Russia, India, China, and South Africa); in addition, the former cannot be attributed to the presence of structural breaks. Gil-Alana et al. (2017) analyse the stochastic behaviour of CO2 emissions applying a long-memory approach with nonlinear trends and structural breaks to a long span of data for the BRICS and G7 countries (USA, UK, France, Italy, Germany, Japan and Canada). They conclude that shocks to CO2 emissions have permanent effects in most cases, except in Germany, the US and the UK. Compared to theirs the present paper, though considering only China rather than various countries, goes one step further since it also carries out fractional cointegration tests to establish whether there exist any long-run linkages between the growth rates of GDP and CO2 emissions.

Several other studies have focused on China given the size of its economy and the high level of its CO2 emissions. Some of them analyse the factors driving the latter, such as economies of scale, population and energy structure (Xie et al., 2018; Xu et al., 2014), and economic activity and energy intensity (Jalil & Mahmund, 2009; Liu et al., 2007a, 2007b; Zhang et al., 2009) (Wang et al., 2005). Using SDA (structural decomposition analysis) Peters et al. (2007) conclude that in China the growth in CO2 emissions from infrastructure construction, household consumption in cities, the urbanization process and lifestyle has been greater than the savings from efficiency improvements. On the other hand, Li and Wei (2015) find that the impact of the industrial structure on carbon dioxide emissions is gradually changing from positive to negative and that the main driver of the reduction of CO2 emissions in China is carbon intensity. Zhang et al. (2015) use SDA to investigate the factors that influence China's pollutants and conclude that increasing efficiency and intensity of emissions are important in reducing industrial pollution.

As for studies on the EKC in China, some find evidence for it (Haisheng et al., 2005; Jalil & Mahmud, 2009; and Jalil & Feridun, 2011); others do not (Du et al., 2012; Wang et al., 2011a, 2011b); others find an inverted N-shaped relationship between CO2 and GDP (Fang et al., 2019; Kang et al., 2016; Onafowora & Owoye, 2014) (Wang et al., 2019); some report the existence of an N trajectory (Dinda et al., 2000; Friedl & Getener, 2003; Lipford & Yandle, 2010; Martinez-Zarzoso & Begonchea-Morancho, 2004; Onafowora & Owoye, 2014). Finally, Riti et al. (2017) analyse the relationship between emissions, economic growth and energy consumption in China using a variety of econometric techniques such as ARDL, FMOLS and DOLS that produce similar results providing support for an EKC, but finding a different turning point compared to other studies.

The inconclusiveness of the results discussed above makes the design of appropriate environmental policies difficult for the Chinese authorities who have been under increasing pressure to deal more effectively with climate change issues. The aim of the present study is to obtain more robust evidence informing policy choices; this is achieved by applying fractional integration and cointegration methods whose features are outlined below.

Methodology

The order of integration of a time series is the differencing parameter required to make it stationary I(0). Specifically, a covariance stationary process [xt, t = 0, ± 1, …} is said to be I(0) if the infinite sum of all its autocovariances, defined as γu = E[(xt-Ext)(xt+u-Ext)] is = −finite, i.e.

However, many processes do not satisfy (1); when the sum of the autocovariances is infinite, the process is said to exhibit long memory or long-range dependence, so-named because of the high degree of association between observations which are far apart in time. Within this category, the fractional integration or I(d) (integrated of order d) framework is one of the most widely used. Specifically, a process is said to be integrated of order d or I(d) if it can be represented as:

where L is the lag operator (Lkxt = xt-k), and ut is I(0). One can use a Binomial expansion in Eq. (2) such that then, if d is fractional, xt can be expressed as

In other words, xt is a function of all its past history, and the higher its value is, the higher is the level of dependence between observations distant in time. Thus, the parameter d measures the degree of persistence of the series. A very interesting case occurs when d belongs to the interval (0.5, 1), which implies non-stationary but mean-reverting behaviour, with shocks having transitory but long-lived effects. The fact that d might be a fractional value allows for a higher degree of flexibility compared to the standard models based on d = 0 for stationary series and d = 1 for non-stationary ones; in particular, it is more suitable to shed light on whether or not the series is mean-reverting, with shocks having longer lasting effects as the parameter d approaches 1. In a similar way, fractional cointegration allows to test for the existence of a long-run equilibrium relationships within a more general framework.

To estimate d for the individual series, we use the Whittle function in the frequency domain (Dahlhaus, 1989) following the procedure described in Robinson (1994) (see also Gil-Alana & Robinson, 1997). The bivariate analysis is based on the concept of fractional cointegration, and uses the two-step approach of Engle and Granger (1987) extended to the fractional case as in Cheung and Lai (1993) and Gil-Alana (2003) as well as the FCVAR (fractional cointegration vector autoregressive) model proposed by Johansen and Nielsen (2010, 2012).

The latter approach is an extension of the CVAR (Cointegrated Vector AutoRegressive) model (Johansen, 1996) to the fractional case, and it allows for series that are integrated of order d and cointegrate with order d–b, with b > 0. It considers the following model:

where \(\,L_{b} \, = \,\,\,(1\,\, - \,\Delta \,^{b} )\) and ∆ is the first difference operator, i.e. (1–L), and Xt is the vector of the time series under examination. Β is a matrix whose columns are the cointegrating relationships in the system, that is to say the long-run equilibria, while Γi is the parameter that governs the short-run behaviour of the variables. The coefficients in α represent the speed of adjustment to the long-run equilibrium in response to temporary deviations from it and the short-run dynamics of the system.

Results and discussion

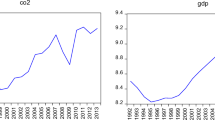

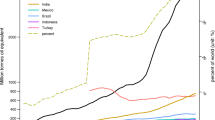

We use quarterly data on real GDP and CO2 emissions in China, from 1978 to 2015, obtained from the Eikon database, which merges data from different sources into a single platform. Figure 1 contains plots of these two series, both of which appear to be upward trended, and also, as additional information, of CO2 intensity (kg per kg of oil equivalent energy use), for the period 1971–2015 (source: the World Bank)—this series is also upward trended but has started to decline most recently.

As a first step we examine the orders of integration of the two individual series under examination, i.e. of the logs of CO2 emissions and real GDP, respectively. For this purpose, we consider the following model:

and test the null hypothesis:

in (4) for do-values of − 2, − 1.99, …. − 0.01, 0, 0,01, …, 1.99 and 2 under two alternative assumptions for the I(0) error term ut, namely that it follows a white noise and a weakly autocorrelated process as in the exponential spectral model of Bloomfield (1973), respectively. The latter fits extremely well in the framework suggested by Robinson (1994) and it is stationary for all values unlike the AR (autoregressive) case (see e.g. Gil-Alana, 2004). As for the deterministic terms, we consider the three cases of (i) no terms, (i) a constant, and (iii) a constant and a linear time trend, and choose the specification with statistically significant coefficients. The results are displayed in Table 1.

The two individual series appear to be highly persistent. In the case of white noise residuals the estimated values of d are 1.87 and 1.92, respectively, for the log CO2 and log GDP series, and a significant positive time trend is found in the latter case. When allowing for autocorrelation, the estimated values are 1.91 and 1.82, and the null hypothesis of I(2) (integrated of order 2) behaviour cannot be rejected since the 95% confidence intervals include the value of 2 for both series. These values indicate high persistence with shocks having permanent or long-lasting effects both on the levels and the growth rates of the series.

Table 2 displays the estimates of d using the “local” Whittle semi-parametric approach of Robinson (1995). It is semi-parametric in the sense that no specific model is assumed for the I(0) error term. This method (Robinson, 1995) was later extended and improved by Phillips and Shimotsu (2005) and Abadir et al. (2007) among others, but the latter approaches require other user-chosen parameters in addition to the bandwidth and the results are very sensitive to those. When using this method, the estimates must be in the range (− 0.5, 0.5), and therefore we carry out the analysis using the second differences. The null of I(0) behaviour cannot be rejected in any case regardless of the bandwidth parameter. Thus, both the parametric and semi-parametric results indicate that the two series are non-stationary with orders of integration around 2 with shocks having permanent effects and producing changes in the level-trend structure of the data.

Next we examine the possibility of fractional cointegration by using in the first instance the method suggested by Gil-Alana (2003), which is an extension of the Engle and Granger (1987) approach to the fractional case. Thus, in the first step, we test for the order of integration of the two variables (in first differences). Since the previous results imply that they are I(1), in the second step, we regress one variable against the other and test whether the residuals are integrated of order d–b, these two parameters corresponding to the orders of integration of the two variables of interest. We display in Tables 3 and 4 the results for the two cases of uncorrelated and autocorrelated errors for three different estimation approaches for the coefficients in the regression model:

(i) OLS (ordinary least squares) in the time domain, i.e.

(ii) OLS in the frequency domain, i.e.

where λj = 2πj/T, j = 1, …, T are the Fourier frequencies, and where for arbitrary sequences, wt and vt, we define the cross periodogram and periodogram, respectively, as

\(I_{wv\,} (\lambda )\,\,\, = \,\,\,\,\omega_{w} (\lambda )\,\,\omega_{v} ( - \lambda )^{T} \,;\) and \(I_{w} (\lambda )\,\,\, = \,\,\,I_{w\,w} (\lambda )\,\,,\)

with \(\omega (\lambda )\,\) being the discrete Fourier transform of wt: \(\omega_{w} (\lambda )\,\,\, = \,\,\,\,\frac{1}{{\sqrt {2\,\pi \,T} \,}}\,\sum\limits_{t = 1}^{T} {w_{t} \,e^{i\,\lambda \,t} } \,;\)

(iii) finally, we also employ a NBLS (narrow band least squares) estimator, which is related to the band estimator proposed by Hannan (1963), and which is given by

where 1 ≤ m ≤ T/2, sj = 1 for j = 0, T/2 and sj = 2 otherwise, the motivation for this third approach being that, since cointegration is a long-run phenomenon, when estimating the slope coefficient in the regression model once might be concentrating only on the low frequencies, which are those corresponding to the long-run, hence neglecting information about the high frequencies, which might distort the estimation results (see Gil-Alana & Hualde, 2009).

In the first of these cases, the estimated values of d are 0.83 and 0.87, respectively, and while the I(1) hypothesis cannot be rejected with autocorrelated errors, it is rejected in favour of I(d, d < 1) with white noise residuals, i.e. in the latter case we find mean reversion and fractional cointegration, though with a very slow rate of adjustment; however, when using the frequency domain least squares estimator, the values are much smaller, providing evidence of fractional cointegration in the two cases of uncorrelated and autocorrelated errors; finally, when using the NBLS estimator in (7) the estimates are very sensitive to the choice of the bandwidth parameter and with m = (T)0.5 the null of standard cointegration, i.e. d = b = 1, cannot be rejected. Thus, the results seem to be very sensitive to the estimation method used for the cointegrating regression and the bandwidth parameter, but in all cases there is a reduction in the degree of integration in the long-run equilibrium relationship.

Given the lack of robustness of the above results, we also apply the FCVAR method of Johansen and Nielsen (2010, 2012), first under the assumption that d = b, these two parameters being the order of (fractional) integration of the individual series, which implies that the cointegrating errors will be I(d–b) = I (0). Their estimated order of integration is 1.024, which supports the hypothesis of classical cointegration, with the individual series being I(1) and the cointegrating errors I(0). Further, the null d = b cannot be rejected by means of a LR (likelihood ratio) test, which again implies standard cointegration. This finding is in contrast to the previous test results, which implied that standard cointegration should be rejected in favour of fractional cointegration (i.e. d–b > 0), and suggests that the earlier tests might be biased in favour of higher degrees of integration because of the method used for the estimation of the coefficients in the cointegrating regression (see Gil-Alana, 2003; Gil-Alana & Hualde, 2009). Classical cointegration between the two series, is also supported by the tests of Johansen (1988, 1996) and Johansen and Juselius (1990) (these test results are not reported for reasons of space). Therefore, there is evidence of a stable long-run equilibrium relationship between the growth rates of CO2 emissions and real GDP in China, implying long run co-movement between the two variables.

Concerning the implications of our findings in the context of existing research, one should notice that the previous literature predominantly focused on the causal relationship between energy consumption and economic growth, the determinants of CO2 emissions or the EKC hypothesis, whereas the present study provides novel evidence on the persistence and the link between the growth rates of CO2 emissions and real GDP in China. As for the limitations of our analysis, it should be stressed that it does not investigate the functional form of the equilibrium relationship that has been identified, and also the possible presence of non-linearities and structural breaks; future work could examine these issues by carrying out appropriate tests. Seasonal patterns and turning points could also be relevant in this context and should be a special focus of attention in future research.

Conclusions

This paper has analysed the relationship between the logarithms of CO2 emissions and real GDP in China by applying fractional integration and cointegration methods. These are more general than the standard methods based on the dichotomy between stationary and non-stationary series, allow for a much wider variety of dynamic processes, and provide information about the persistence and long-memory properties of the series and thus on whether or not the effects of shocks are long-lived. For all these reasons, our study makes a novel contribution to the literature. In particular, the univariate results indicate that the two series are non-stationary and highly persistent, their orders of integration being around 2, whilst the cointegration tests (using both standard and fractional techniques) imply that there exists a long-run equilibrium relationship between the two variables in first differences, i.e. their growth rates are linked together in the long run.

Our results also have important policy implications. Specifically, they suggest to policymakers the need for environmental policies aimed at reducing emissions during periods of economic growth: if China wants to be on a sustainable development path, decisive environmental policies appear to be necessary. In particular, the Chinese government should adopt more environmental innovation measures, especially to increase energy efficiency through energy consumption restructuring, to promote social awareness of the advantages of a low-carbon economy and of environmental protection, and to ensure the implementation of environmental protection legislation and compliance; this type of green development also offers new opportunities for entrepreneurship.

Availability of data and materials

Data are available from the authors upon reasonable request.

Abbreviations

- CO2 :

-

Carbon dioxide

- EKC:

-

Environmental Kuznets curve

- GDP:

-

Gross Domestic Product

- I(0):

-

Integrated of order 0

- I(1):

-

Integrated of order 1

- GHG:

-

Greenhouse gas

- ARDL:

-

Autoregressive distributed lag (ARDL) model

- DOLS:

-

Dynamic ordinary least squares

- FMOLS:

-

Fully modified ordinary least squares

- CCR:

-

Correlation regression estimator

- SO2 :

-

Sulfur dioxide

- BC:

-

Black carbon

- VAR-GARCH:

-

Vector autoregression—generalized autoregressive conditional heteroskedastic model

- USA:

-

United States of America

- UK:

-

United Kingdom

- OECD:

-

Organisation for Economic Cooperation and Development

- BRICS:

-

Brazil, Russia, India, China, and South Africa

- G7:

-

USA, UK, France, Italy, Germany, Japan and Canada

- SDA:

-

Structural decomposition analysis

- I(d):

-

Integrated of order d

- FCVAR:

-

Fractional cointegration vector autoregressive model

- CVAR:

-

Cointegration vector autoregressive model

- AR:

-

Autoregressive

- I(2):

-

Integrated of order 2

- OLS:

-

Ordinary least squares

- NBLS:

-

Narrow band least squares

- LR:

-

Likelihood ratio

References

Abadir, K. M., Distaso, W., & Giraitis, L. (2007). Nonstationarity-extended local Whittle estimation. Journal of Econometrics, 141, 1353–1384.

Ahmad, N., & Du, L. (2017). Effects of energy production and CO2 emissions on economic growth in Iran: ARDL approach. Energy, 123, 521–537.

Ahmad, M., et al. (2018). Does financial development asymmetrically affect CO2 emissions in China? An application of the nonlinear autoregressive distributed lag (NARDL) model. Journal Carbon Management, 9(6), 631–644.

Ahmad, N. (2016). Modelling the CO2 emissions and Economic growth in Croatia: Is there any Environmental Kuznets Curve? Energy, 123, 164–172.

Ajmi, A. N., Hammoudeh, S., Nguyen, D. K., & Sato, J. R. (2015). On the relationships between CO2 emissions, energy consumption and income: the importance of time variation. Energy Economics, 49, 629–638.

Akalpler, E., & Hove, S. (2019). Carbon emissions, energy use, real GDP per capita and trade matrix in the Indian economy-an ARDL approach. Energy, 168, 1081–1093.

Alkhathlan, K., Alam, M. Q., & Javid, M. (2012). Carbon dioxide emissions, energy consumption and economic growth in Saudi Arabia: a multivariate cointegration analysis. British Journal of Economics, Management & Trade, 2(4), 327–339.

Amin, S. B., Ferdaus, S. S., & Porna, A. K. (2012). Causal relationship among energy use, CO2 emissions and economic growth in Bangladesh: an empirical study. World Journal of Social Sciences, 2(4), 273–290.

Anastacio, J. A. (2017). Economic growth, CO2 emissions and electric consumption: is there an environmental Kuznets curve? An empirical study for North America countries. International Journal of Energy Economics and Policy, Econjournals, 7(2), 65–71.

Ang, J. (2007). CO2 Emissions, energy consumption and output in France. Energy Policy, 35, 4772–4778.

Apergis, N., & Payne, J. E. (2009). Energy consumption and economic growth in Central America: Evidence from a panel cointegration and error correction model. Energy Economics, 31, 211–216.

Azomahou, T., Laisney, F., & Van, P. N. (2006). Economic development and CO2 emissions: A nonparametric panel approach. Journal of Public Economics, 90, 1347–1363.

Bacastow, R. B., et al. (1985). Seasonal amplitude increases in atmospheric CO2 concentration at Mauna Loa, Hawaii, 1959–1982. Journal of Geophysical Research, 90, 529–540.

Baek, J., & Pride, D. (2014). On the income-nuclear energy-CO2 emissions nexus revisited. Energy Economics., 43, 6–10.

Baes, C. F., Jr., Goeller, H. E., Olson, J. S., & Rotty, R. M. (1977). Carbon dioxide and the climate: The uncontrolled experiment. American Scientist, 65, 310.

Bakhsh, K., Rose, S., Ali, M., Ahmad, N., & Shahbaz, M. (2017). Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: New evidences from 3SLS. Journal of Environmental Management, 196, 627–632.

Barassi, M. R., & Spagnolo, N. (2012). Linear and nonlinear causality between CO2 emissions and economic growth. The Energy Journal, 33, 23–38.

Barassi, M. R., Spagnolo, N., & Zhao, Y. (2018). Fractional integration versus structural change: testing the convergence of CO2 emissions. Environmental and Resource Economics, 71, 923–968.

Bloomfield, P. (1973). An exponential model in the spectrum of a scalar time series. Biometrika, 60, 217–226.

Boopen, S., & Vinesh, S. (2011). On the relationship between carbon dioxide emissions and economic growth: A Mauritian experience (pp. 1–23). University of Mauritius.

Can, M., & Gozgor, G. (2017). The impact of economic complexity on carbon emissions: Evidence from France. Environmental Science and Pollution Research, 24(10), 16364–16370.

Chaabouni, S., Zghidi, N., & Mbarek, M. B. (2016). On the causal dynamics between CO2 emissions, health expenditures and economic growth. Sustainable Cities and Society, 22, 184–219.

Chen, J., Shen, L., Shi, Q., Hong, J., & Ochoa, J. J. (2019a). The effect of production structure on the total CO2 emissions intensity in the Chinese construction industry. Journal of Cleaner Production, 213, 1087–1095.

Chen, Y. L., Wang, Z., & Zhong, Z. Q. (2019b). CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renewable Energy, 131, 208–216.

Chen, Y., & Lee, C.-C. (2020). Does technological innovation reduce CO2 emissions? Cross-country evidence. Journal of Cleaner Production, 263(1), 121550.

Cheung, Y. W., & Lai, K. S. (1993). A Fractional Cointegration Analysis of Purchasing Power Parity, Journal of Business. Economics and Statistics, 11, 1.

Cosmas, N. C., Chitedze, I., & Mourad, K. A. (2019). An econometric analysis of the macroeconomic determinants of carbon dioxide emissions in Nigeria. Science of the Total Environment, 675, 313–324.

Dahlhaus, R. (1989). Efficient parameter estimation for self-similar process. Annals of Statistics, 17, 1749–1766.

Dinda, S. (2004). Environmental Kuznets curve hypothesis: a survey. Ecological Economics, 49, 431–455.

Dinda, S., Coondoo, D., & Pal, M. (2000). Air quality and economic growth: An empirical study. Ecological Economics, 34(3), 409–423. https://doi.org/10.1016/S0921-8009(00)00179-8

Dinda, S., & Coondoo, D. (2006). Income and emission: A panel data-based cointegration analysis. Ecological Economics, 57, 167–181.

Dogan, E., & Turkekul, B. (2016). CO2 Emissions, real output, energy consumption, trade, urbanization and financial development: Testing the EKC hypothesis for the USA. Environmental Science and Pollution Research, 23(2), 1203–1213.

Dogan, E., & Aslan, A. (2017). Exploring the relationship among CO2 emissions, real GDP, energy consumption and tourism in the EU and candidate countries: evidence from panel models robust to heterogeneity and cross-sectional dependence. Renewable and Sustainable Energy Reviews, 77, 239–245.

Dong, K., Sun, R., & Dong, X. (2018). CO2 emissions, natural gas and renewables, economic growth: Assessing the evidence from China. Science of the Total Environment, 640–641, 293–302.

Du, L., Wei, Ch., & Cai, S. (2012). Economic development and carbon dioxide emissions in China: Provincial panel data analysis. China Economic Review, 23(2), 371–384.

Engle, R. F., & Granger, C. W. (1987). Co-integration and error correction: representation, estimation, and testing. Econometrica, 55, 251–276.

Fang, D., Hao, P., Wang, Z., & Hao, J. (2019). Analysis of the influence mechanism of CO2 emissions and verification of the environmental Kuznets curve in China. International Journal of Environmental Research and Public Health, 16(6), 944. https://doi.org/10.3390/ijerph16060944

Farhani, S., Chaibi, A., & Rault, C. (2014). CO2 emissions, output, energy consumption, and trade in Tunisia. Economic Modelling, 38, 426–434.

Friedl, B., & Getzner, M. (2003). Determinants of CO2 emissions in a small open economy. Ecological Economics, 45, 133–148.

Friedl, B., and Getzner, M. 2002. Environment and growth in a small open economy: an EKC case-study for Austrian CO2 emissions. Discussion Paper, No:2002/2. College of Business Administration, University of Klagenfurt.

Galeotti, M., Manera, M., & Lanza, A. (2009). On the Robustness of Robustness Checks of the Environmental Kuznets Curve Hypothesis. Environmental and Resource Economics, 42, 551–574.

Gao, J., & Zhang, L. (2014). Electricity consumption–economic growth–CO2 emissions nexus in Sub-Saharan Africa: Evidence from panel cointegration. African Development Review, 26, 359–371.

Gil-Alana, L. A., & Robinson, P. M. (1997). Testing of unit roots and other nonstationary hypotheses in macroeconomic time series. Journal of Econometrics, 80, 241–268.

Gil-Alana, L. A. (2003). Testing of fractional cointegration in macroeconomic time series. Oxford Bulletin of Economic and Statistics, 65(4), 517–529.

Gil-Alana, L. A. (2004). The use of Bloomfield model as an approximation to ARMA processes in the context of fractional integration. Mathematical and Computer Modelling, 39, 429–436.

Gil-Alana, L. A., & Hualde, J. (2009). Fractional integration and cointegration: An overview and an empirical application. In T. C. Mills & K. Patterson (Eds.), Palgrave handbook in applied econometrics (pp. 434–469). Palgrave Macmillan UK.

Gil-Alana, L. A., Cunado, J., & Gupta, R. (2017). Persistence, Mean-Reversion and Non-linearities in CO2 Emissions: Evidence from the BRICS and G7 Countries. Environmental and Resource Economics, 67, 869–883.

Gill, A. R., Viswanathan, K. K., & Hassan, S. (2018). A test of environmental Kuznets curve (EKC) for carbon emission and potential of renewable energy to reduce green house gases (GHG) in Malaysia. Environment, Development and Sustainability, 20, 1103–1114.

Ghosh, B. C., Nirob, K. J. A., & Osmani, M. A. G. (2014). Economic growth, CO2 emissions and energy consumption: The case of Bangladesh Bikash. International Journal of Economics and Business Research, 3(6), 220–227.

Gregg, J. S., Andres, R. J., & Marland, G. (2008). China: Emissions pattern of the world leader in CO2 emissions from fossil fuel consumption and cement production. Geophysical Research Letters, 35, L08806.

Grossman, G. M., and Krueger, A. B. 1991. Environmental Impacts of a North American Free Trade Agreement. National Bureau of Economic Research Working Paper 3914.

Grossman, G. M., & Krueger, A. B. (1995). Economic Growth and the Environment. The Quarterly Journal of Economics, 110, 353–377.

Guan, D., Peters, G. P., Weber, C. L., & Hubacek, K. (2009). Journey to world top emitter: An analysis of the driving forces of China’s recent CO2 emissions surge. Geophysical Research Letters, 36, L04709.

Haisheng, Y., Jia, J., Yong Zhang, Z., & Shugong, W. (2005). The Impact on environmental Kuznets curve by trade and foreign direct investment in China. Chinese Journal of Population Resources and Environment, 3, 14–19.

Hannan, E. J. (1963). Regression for time series. In M. Rosenblatt (Ed.), Time series analysis (pp. 17–37). John Wiley.

He, J., & Richard, P. (2010). Environmental Kuznets curve for CO2 in Canada Author links open overlay panel. Ecological Economics, 69(5), 1083–1093.

Hofmann, D. J., Butler, J. H., & Tans, P. P. (2009). A new look at atmospheric carbon dioxide. Atmospheric Environment, 43(12), 2084–2086. https://doi.org/10.1016/j.atmosenv.2008.12.028

Huaman, R. N. E., & Jun, T. X. (2014). Energy related CO2 emissions and the progress on CCS projects: A review. Renewable and Sustainable Energy Reviews, 31, 368–385.

IEA. (2020). CO2 emissions from fuel combustion: overview. IEA.

IPCC. (2015). Climate change 2014, synthesis report, 978–92-9169-143-2. IPCC.

Iwata, H., Okada, K., & Samreth, S. (2010). Empirical study on the environmental Kuznets curve for CO2 in France: The role of nuclear energy. Energy Policy, 38(8), 4057–4063.

Jalil, A., & Mahmud, S. M. (2009). Environment Kuznets curve for CO2 emissions: A cointegration analysis for China. Energy Policy, 37, 5167–5172.

Jalil, A., & Feridun, M. (2011). The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Economics, 33, 284–291.

Jia, J., Deng, H., Duan, J., & Zhao, J. (2009). Analysis of the major drivers of the ecological footprint using the STIRPAT model and the PLS method—A case study in Henan Province. China. Ecological Economics, 68(11), 2818–2824.

Johansen, S. (1988). Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control, 12, 231–254.

Johansen, S. (1996). Likelihood-based inferences in cointegrated vector autoregressive models. Oxford University Press.

Johansen, S., & Juselius, K. (1990). maximum likelihood estimation and inference on cointegration with application to the demand for money. Oxford Bulletin of Economics and Statistics, 52, 169–210.

Johansen, S., & Nielsen, M. Ø. (2010). Likelihood inference for a nonstationary fractional autoregressive model. Journal of Econometrics, 158, 51–66.

Johansen, S., & Nielsen, M. Ø. (2012). Likelihood inference for a fractionally cointegrated vector autoregressive model. Econometrica, 80, 2667–2732.

Kang, Y. Q., Zhao, T., & Yang, Y. Y. (2016). Environmental Kuznets curve for CO2 emissions in China: A spatial panel data approach. Ecological Indicators, 63, 231–239.

Khalid, A. (2014). Environmental Kuznets curve for CO2 emission in Mongolia: An empirical analysis. Management of Environmental Quality: An International Journal, 25(4), 505–516.

Khan, I., Khan, N., Yaqub, A., & Sabir, M. (2019). An empirical investigation of the determinants of CO2 emissions: Evidence from Pakistan. Environmental Science and Pollution Research, 26, 9099–9112.

Kasman, A., & Duman, Y. S. (2015). CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: A panel data analysis. Economic Modelling, 44, 97–103.

Katz, D. (2015). Water use and economic growth: Reconsidering the environmental Kuznets curve relationship. Journal of Cleaner Production, 88, 205–213.

Kraaijenbrink, P., Bierkens, M., Lutz, A., et al. (2017). Impact of a global temperature rise of 1.5 degrees Celsius on Asia’s glaciers. Nature, 549, 257–260. https://doi.org/10.1038/nature23878

Kijima, M., Nishide, K., & Ohyana, A. (2010). Economic models for the environmental Kuznets curve: A survey. Journal of Economic Dynamics and Control, 34(7), 1187–1201.

Kim, S. (2019). CO2 emissions, energy consumption, GDP and foreign direct investment in ANICs countries. Contemporary Issues in Applied Economics, 1(1), 343–360.

Kuznets, S. (1955). Economic growth and income inequality. American Economic Review, 45, 1–28.

Latifa, L., Yang, K. J., & Xu, R. R. (2014). Economic growth and CO2 emissions nexus in algeria: a Co-integration analysis of the environmental Kuznets curve. International Journal of Economics Commerce and Research., 4(4), 1–4.

Lau, S. S., et al. (2014). Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: Do foreign direct investment and trade matter? Energy Policy, 68, 490–497.

Lean, H. H., & Smyth, R. (2010). CO2 emissions, electricity consumption and output in ASEAN. Applied Energy, 87, 1858–1864.

Li, H., & Wei, Y. M. (2015). Is it possible for China to reduce its total CO2 emissions? Energy, 83, 438–446.

Lipford, J. W., & Yandle, B. (2010). Environmental Kuznets curves, carbon emissions, and public choice. Environment and Development Economics, 15(4), 417–438.

Liu, L. C., Fan, Y., Wu, G., & Wei, Y. M. (2007a). Using LMDI method to analyze the change of China’s industrial CO2 emissions from final fuel use: An empirical analysis. Energy Policy, 35, 5892–5900.

Liu, X., Heilig, G. K., Chen, J., & Heino, M. (2007b). Interactions between economic growth and environmental quality in Shenzhen, China’s first special economic zone. Ecological Economics, 62, 559–570.

Liu, M., Zhu, X. Y., Pan, C., Chen, L., Zhang, H., Jia, W. X., & Xiang, W. N. (2016). Spatial variation of near-surface CO2 concentration during spring in Shanghai. Atmospheric Pollution Research, 7(1), 31–39. https://doi.org/10.1016/j.apr.2015.07.002

Lopez-Menendez, A. J., Suarez, R. P., & R. and Moreno Cuartas, B. . (2014). Environmental costs and renewable energy: Re-visiting the environmental Kuznets curve. Journal of Environmental Management, 145(1), 368–373.

Ma, X. W., Ye, Y., Shi, X. Q., & Zou, L. L. (2016). Decoupling economic growth from CO2 emissions: A decomposition analysis of China’s household energy consumption. Advances in Climate Change Research, 7, 192–200.

Magazzino, C. (2014a). The relationship between CO2 emissions, energy consumption and economic growth in Italy. International Journal of Sustainable Energy, 35(9), 844–857.

Magazzino, C. (2014b). A Panel VAR Approach of the Relationship Among Economic Growth, CO2 Emissions, and Energy Use in the ASEAN-6 Countries. International Journal of Energy Economics and Policy, 4(4), 546–553.

Magazzino, C. (2015). Economic growth, CO2 emissions and energy use in Israel. International Journal of Sustainable Development & World Ecology, 22, 89–97.

Mahlman, J. D. (1997). Uncertainties in projections of human-caused climate warming. Science, 278, 1416–1417.

Mallick, L., & Tandi, S. M. (2015). Energy consumption, economic growth, and CO2 emissions in SAARC countries: Does environmental Kuznets curve exist? The Empirical Econometrics and Quantitative Economics Letters, 4(3), 57–69.

Managi, S., & Jena, P. (2008). Environmental productivity and Kuznets curve in India. Ecological Economics, 65(2), 432–440.

Martínez-Zarzoso, I., & Bengochea-Morancho, A. (2004). Pooled mean group estimation of an environmental Kuznets curve for CO2. Economics Letters, 82, 121–126.

Mikayilov, J. I., Galeotti, M., & Hasanov, F. J. (2018). The impact of economic growth on CO2 emissions in Azerbaijan. Journal of Cleaner Production, 197(1), 1558–1572. https://doi.org/10.1016/j.jclepro.2018.06.269

Nasir, M., & Rehman, F. U. (2011). Environmental Kuznets curve for carbon emissions in Pakistan: An empirical investigation. Energy Policy, 39, 1857–1864.

Onafowora, O., & Owoye, O. (2014). Bounds testing approach to analysis of the environment Kuznets curve hypothesis. Energy Economics, 44, 47–62.

Osabuohien, E. S., Efobi, U. R., & Gitau, C. M. W. (2014). Beyond the environmental Kuznets curve in Africa: evidence from panel cointegration. Journal of Environmental Policy & Planning, 16, 517–538.

Ozturk, Z., & Oz, D. (2016). The relationship between energy consumption, income, foreign direct investment, and CO2 emissions: The case of Turkey. Çankırı Karatekin University Journal of the Faculty of Economics & Administrative Sciences, 6(2), 269–288.

Ozturk, I., & Acaravci, A. (2013). The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Economics, 36, 262–267.

Pao, H. T., & Tsai, C. M. (2011). Multivariate granger causality between CO2 emissions, energy consumption, FDI and GDP: Evidence from a panel of BRIC countries. Energy, 36, 685–693.

Pao, H. T., Fu, H. C., & Tseng, C. L. (2012). Forecasting of CO2 emissions, energy consumption and economic growth in China using an improved grey model. Energy, 40(1), 400–409.

Peters, G. P., Weber, C. L., Guan, D., & Hubacek, K. (2007). China’s growing CO2 emissions a race between increasing consumption and efficiency gains. Environmental Science & Technology, 41, 5939–5944.

Phillips, P. C., & Shimotsu, K. (2005). Exact local Whittle estimation of fractional integration. Annals of Statistics, 33, 1890–1933.

Riti, J. S., & Shu, Y. (2016). Renewable energy, energy efficiency, and eco-friendly environment (R-E5) in Nigeria. Energy, Sustainability and Society, 6(1), 1–16.

Riti, J. S., Song, D., Shu, Y., & Kamah, M. (2017). Decoupling CO2 emission and economic growth in China: Is there consistency in estimation results in analyzing environmental Kuznets curve? Journal of Cleaner Production, 166, 1448–1461.

Robinson, P. M. (1994). Efficient tests of nonstationary hypotheses. Journal of the American Statistical Association, 89(428), 1420–1437.

Robinson, P. M. (1995). Gaussian semi-parametric estimation of long range dependence. Annals of Statistics, 23, 1630–1661.

Roca, J., Padilla, E., Farre, M., & Galletto, V. (2001). Economic growth and atmospheric pollution in Spain: Discussing the environmental Kuznets curve hypothesis. Ecological Economics, 39, 85–99.

Ru, M., Shindell, D. T., Seltzer, K. M., Tao, S., & Zhong, Q. (2018). The long-term relationship between emissions and economic growth for SO2, CO2, and BC. Environmental Research Letters. https://doi.org/10.1088/1748-9326/aaece2

Saboori, B., & Soleymani, A. (2011). CO2 emissions, economic growth and energy consumption in Iran: A co-integration approach. International Journal of Environmental Sciences, 2(1), 44–53.

Saboori, B., Sulaiman, J. B., & Mohd, S. (2012). An empirical analysis of the environmental Kuznets curve for CO2 emissions in Indonesia: The role of energy consumption and foreign trade. International Journal of Economics and Finance, 4(2), 243–251.

Saboori, B., Sulaiman, J., & Mohd, S. (2016). Environmental Kuznets curve and energy consumption in Malaysia: A cointegration approach. Energy Sources, 11(9), 861–867.

Saidi, K., & Mbarek, M. B. (2016). Nuclear energy, renewable energy, CO2 emissions, and economic growth for nine developed countries: Evidence from panel Granger causality tests. Progress in Nuclear Energy, 88, 364–374.

Salahuddin, M., Alam, K., & Ozturk, I. (2016). The effects of Internet usage and economic growth on CO2 emissions in OECD countries: A panel investigation. Renewable and Sustainable Energy Reviews, 62, 1226–1235.

Saleh, I., & Abedi, S. (2014). A panel data approach for investigation of gross domestic product (GDP) and CO2 causality relationship. Journal of Agricultural Science and Technology, 16(5), 947–956.

Shafik N. and Bandyopadhyay, S. 1992. Economic growth and environmental quality: time series and cross-country evidence. Policy, research working papers; no. WPS 904. World development report. Washington: World Bank.

Shahbaz, M., Lean, H. H., & Shabbir, M. S. (2012). Environmental Kuznets curve hypothesis in Pakistan: cointegration and granger causality. Renewable and Sustainable Energy Reviews, 16(5), 2947–2953.

Shahbaz, M., Ozturk, I., Afza, T., & Ali, A. (2013). Revisiting the environmental Kuznets curve in a global economy. Renewable and Sustainable Energy Reviews, 25, 494–502.

Shahbaz, M., Sbia, R., Hamdi, H., & Ozturk, I. (2014). Economic growth, electricity consumption, urbanization and environmental degradation relationship in United Arab Emirates. Ecological Indicators, 45, 622–631.

Shahbaz, M., Dube, S., Ozturk, I., & Jalil, A. (2015). Testing the environmental Kuznets curve hypothesis in Portugal. International Journal of Energy Economics and Policy, 5(2), 475–481.

Shahbaz, M., Mahalik, M. K., Shah, S. H., & Sato, J. R. (2016). Time-varying analysis of CO2 emissions, energy consumption, and economic growth nexus: Statistical experience in next 11 countries. Energy Policy, 98, 33–48.

Sothan, S. (2017). Causality between foreign direct investment and economic growth for Cambodia. Cogent Economics & Finance, 5(1), 1277860–1278127.

Stern, D. I., & Common, M. S. (2001). Is There an environmental Kuznets Curve for sulfur? Journal of Environmental Economics and Management, 41(2), 162–178.

Stern, D. I., Gerlagh, R., & Burke, P. J. (2017). Modeling the emissions–income relationship using long-run growth rates. Environment and Development Economics., 22, 699–724.

Tiwari, A. K., Shahbaz, M., & Hye, Q. M. A. (2013). The environmental Kuznets curve and the role of coal consumption in India: Cointegration and causality analysis in an open economy. Renewable and Sustainable Energy Reviews, 18, 519–527.

Toumi, S., & Toumi, H. (2019). Asymmetric causality among renewable energy consumption, CO2 emissions, and economic growth in KSA: Evidence from a non-linear ARDL model. Environmental Science and Pollution Research, 26, 16145–16156.

Wang, K.-M. (2012). Modelling the nonlinear relationship between CO2 emissions from oil and economic growth. Economic Modelling, 29(5), 1537–1547.

Wang, R., Liu, W. J., Xiao, L. S., Liu, J., & Kao, W. (2011a). Path towards achieving of China’s 2020 carbon emission reduction target—a discussion of low-carbon energy policies at province level. Energy Policy, 39, 2740–2747.

Wang, C. et al. (2005). Decomposition of energy-related CO2 emission in China: 1957–2000. Energy, 30(1), 73–83.

Wang, S., Li, C. & Zhou, H. (2019). Impact of China's economic growth and energy consumption structure on atmospheric pollutants: Based on a panel threshold model. Journal of Cleaner Production, 236, 117694.

Wang, S. S., Zhou, D. Q., Zhou, P., & Wang, Q. W. (2011b). CO2 emissions, energy consumption and economic growth in China: A panel data analysis. Energy Policy, 39, 4870–4875.

Xie, R., Zhao, G., Zhu, B. Z., & Chevallier, J. (2018). Examining the factors affecting air pollution emission growth in China. Environmental Modeling & Assessment, 23, 389–400.

Xu, S. C., He, Z. X., & Long, R. Y. (2014). Factors that influence carbon emissions due to energy consumption in China: Decomposition analysis using LMDI. Applied Energy, 127, 182–193.

Yazdi, S. K., & Mastorakis, N. E. (2014). The dynamic links between economic growth, energy intensity and CO2 emissions in Iran. Recent Advances in Applied Economics, 10, 140–146.

Zhang, M., Mu, H. L., & Ning, Y. D. (2009). Accounting for energy-related CO2 emission in China, 1991–2006. Energy Policy, 37, 767–773.

Zhang, W., Wang, J. N., Zhang, B., Bi, J., & Jiang, H. Q. (2015). Can China comply with its 12th five-year plan on industrial emissions control: A structural decomposition analysis. Environmental Science and Technology, 49, 4816–4824.

Zhang, N., Yu, K., & Chen, Z. (2017a). How does urbanization affect carbon dioxide emissions? A cross-country panel data analysis. Energy Policy, 107, 678–687.

Zhang, Y. J., Peng, Y. L., Ma, C. Q., & Shen, B. (2017b). Can environmental innovation facilitate carbon emissions reduction? Evidence from China. Energy Policy, 100, 18–28.

Zoundi, Z. (2017). CO2 emissions, renewable energy and the environmental Kuznets curve, a panel cointegration approach. Renewable and Sustainable Energy Reviews, 72, 1067–1075.

Acknowledgements

We are grateful to the Editor and two anonymous reviewers for their insightful comments and suggestions.

Funding

Luis A. Gil-Alana gratefully acknowledges financial support from the Ciencia, Innovación y Universidades (ECO2017-85503-R).

Author information

Authors and Affiliations

Contributions

All authors have contributed equally to all aspects of the research. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Consent for publication

Not applicable.

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Caporale, G.M., Claudio-Quiroga, G. & Gil-Alana, L.A. Analysing the relationship between CO2 emissions and GDP in China: a fractional integration and cointegration approach. J Innov Entrep 10, 32 (2021). https://doi.org/10.1186/s13731-021-00173-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s13731-021-00173-5

Keywords

- Carbone dioxide (CO2) emissions

- Gross Domestic Product (GDP)

- China

- Persistence

- Fractional integration

- Fractional cointegration