Abstract

Taking back the end-of-life products from customers can be made profitable by optimizing the combination of advertising, financial benefits for the customer, and ease of delivery (product transport). In this paper we present a detailed modeling framework developed for the cost benefit analysis of the take back process. This model includes many aspects that have not been modeled before, including financial incentives in the form of discounts, as well as transportation and advertisement costs. In this model customers are motivated to return their used products with financial incentives in the forms of cash and discounts for the purchase of new products. Cost and revenue allocation between take back and new product sale is discussed and modeled. The frequency, method and cost of advertisement are also addressed. The convenience of transportation method and the transportation costs are included in the model as well. The effects of the type and amount of financial incentives, frequency and method of advertisement, and method of transportation on the product return rate and the net profit of take back were formulated and studied. The application of the model for determining the optimum strategies (operational levels) and predicting the maximum net profit of the take back process was demonstrated through a practical, but hypothetical, example.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Taking back used products is the first step in most of the end of life (E.O.L) recovery options which include remanufacturing, refurbishment, reuse, and recycling. "Take back" includes all the activities involved in transferring the used product from the customers' possession to the recovery site. In general optimizing of the take back (also called product acquisition) has received limited attention in research and operations. Guide and Van Wassenhove categorized take back processes into two groups: waste stream and market driven [1]. In a waste stream process, the collecting firm cannot control the quality and quantity of the used products: all the E.O.L. products will be collected and transferred. In a market driven process, customers are motivated to return the end of life product by some type of financial incentive. This way, the (re)manufacturer can control the quantity and quality of the returned products through the amount and type of incentives and increase its profit [2–4].

In general the taking-back firm can control the process by setting strategies regarding financial incentives, advertisement, and collection/transportation methods [2, 3, 5–8]. Usually, offering higher incentives (in the form of cash or discounts toward purchasing new products) will increase the return rate and lead to acquisition of higher quality used products. Higher incentives sometimes can encourage the customers to replace their old products with a new one earlier [9]. Another way to control the quality of the used product is to have a system for grading the returned products based on their condition and age and paying the financial incentives accordingly [4]. Proper advertisement and providing a convenient method for the customers to return the E.O.L product can increase the return rate as well [9].

In the existing models of the take back process all the involved costs are bundled together as the take back cost and the return rate is modeled as a linear function of the take back cost [9] or as a linear function (with a threshold) of the financial incentive [4]. We developed a market driven model of a take back process by considering different aspects of take back including financial incentives, transportation methods, and advertisement separately to provide more theoretical insights about the process. Three different types of financial incentives (cash, fixed value, and percentage discount) were modeled. This includes considering the effect of discount incentives on the sale of new (or remanufactured) products and allocating the relevant costs and revenues among the take back process and the sale process of the new products. The relation between the incentives and return rate is considered as a market property reflecting consumers' willingness to return products. This should be measured or estimated. The model enables operational level decisions over a broader choice of variables and options compared to existing approaches. A practical example is used to show how this modeling framework can determine the optimum options and values of the take back process and provide significant insights for analyzing and also managing the take back process.

Model

We consider three important aspects of take back in our model: the financial incentives, the transportation and the advertisement. Each of these aspects incurs a cost to the process, and in return, can increase the revenue by increasing the number and average quality of returned products. Some of the take back costs are associated with each individual product and so are scaled with the number of returned products and some are fixed costs associated with the whole take back process. The value of a returned product at the recovery site is termed a. a is the price that the recovery firm is willing to pay for the used product at the site. If the take back is performed by the recovery firm then a would be a transfer price [10, 11] which separates the cost benefit analysis of the take back from the rest of the recovery process. We modeled the net profit of take back during a certain period of time. If the take back process is intended for a period of time, this period could be the entire time of the take back process, and if it is intended to be a long lasting process, this period is a time window large enough to average out the stochastic fluctuations in the return rate.

Financial incentives

Three strategies were considered for motivating the customers to return their used products:

1- Paying a cash value $c.

2- Offering a discount of value $d, for purchasing new products (usually of similar type).

3- Offering a percentage discount of %p, for purchasing new products.

These incentives affect the total cost, the number of return, and the average quality of the returned products. Increasing these incentives may increases the net profit by increasing the number of returned products and their average quality, or may decrease the net profit by increasing the cost of take back. Therefore, it is an optimization problem to find the type and amount of incentive to maximize the net profit. It is reasonable to expect the number of returns, N R , varies by the amount of incentives and also varies differently for different types of incentives:

However, we may assume that N R is a function of a more general variable called motivation effectiveness, which is considered as the amount of motivation induced in the customers by a motivation strategy. The magnitude of motivation effectiveness, mte, is defined as the equivalent amount of cash that generates the same level of motivation in the customers to return the used product. Therefore, we may simply write:

Different customers respond differently to the same amount of mte. A customer returns the used product if the motivation effectiveness of the incentive (mte) is higher than his or her threshold motivation effectiveness for returning the used product. Therefore, N R (mte) represents the number of customers that their threshold motivation effectiveness is less than mte (the cumulative density function for the threshold motivation effectiveness among the customers).

The attractiveness of the discount is less than or equal to the same amount of cash, because the discount can be used only to buy specific products [12–16]. We define c d as the cash equivalent of discount d; the number of customers that return the used product with discount incentive d is equal to the number of customers that return the used product with cash incentive c d . Then we define α, the ratio of cash to discount incentive, via:

The value of α depends on the new products that the discount is applicable to and varies between 0 and 1. Generally, if customer X has a higher cash incentive threshold than customer Y to return the used product, he has most likely a higher discount incentive threshold as well. Therefore, it is reasonable to assume a linear regression between the d and c d and replace α (d) by its average value simply termed α. Therefore mte for three different motivation strategies is modeled by:

where A is the average price of the new products to which the discount can be applied.

Transportation

Once a customer is motivated to return the used product, the product must be transported to the recovery site. Gathering the used product from the customers can be very costly. In many situations, it may be possible to reduce the transportation cost by asking the customer to contribute partially or fully to the transportation of their products. This usually comes at the cost of reducing the motivation effectiveness of the financial incentives because it requires the customers to spend time and energy to return the used product. Therefore, the motivation effectiveness depends on the convenience of the transportation in addition to the financial incentives. To quantify the convenience of the transportation, we introduce the parameter f, termed the convenience factor of transportation method. In general mte is assumed as a function of f in our modeling framework:

Transportation imposes a cost termed TC to the take back process. Transportation cost is a function of the number of returns. A linear relation [17] between the transportation cost and the number of returns is the simplest method for modeling this cost [18]:

where t is the transportation cost per returned item (slope of the variable cost) and tg is the fixed cost of transportation (does not scale with the number of returns).

Advertisement

Advertisement includes any action for informing the customers about the take back policy. Optimum advertisement strategy depends on many social and psychological factors which are beyond the scope of this paper. Here, we only determine the aspects of advertisement that are important for cost benefit analysis of the take back procedure. Advertisement cost is categorized into two groups: W 1, the one-time cost of advertisement associated with preparing and designing the ad., including its content and its presentation (e.g. posters, audio clips or video clips), and W 2, cost of running the ad. (e.g. posting, publishing, distributing or broadcasting). We may refer to W 2 as the advertisement expenditure.

Among all the customers that possess the used product, only the ones that are aware of the take back procedure may return the used product (if they are motivated enough). Therefore, we may rewrite the number of returns as:

Where N is the total number of customers holding the used product, Ω is the fraction of total customers that are informed by the advertisement and Γ is the fraction of informed customers that return the used product in response to motivation effectiveness of the take back procedure. Ω depends on the frequency of running the advertisement and therefore, is a function of W 2. Equation (7) implicitly assumes that the demography of the informed customers and consequently how they respond to the motivation effectiveness is independent of the number of informed customers. The following expression was derived as an estimate for the Ω function (see Appendix):

W sc and Ω ss are characteristic parameters of advertisement method; they are different for different advertisement options. The Ω function presented in equation (8) is derived analytically for a general advertisement method. More accurate functions may be derived by fitting the empirical data (if available) for each specific advertisement method. Other advertisement models like Vidale-Wolfe model [19], Lanchester model [20], or empirical models [21] may be used as well.

Advertisement, if designed accordingly, can have a motivating effect by informing the customers about the environmental and global benefits of their product return effort including reducing waste and reducing the consumption of energy and natural recourses. To quantify the motivation effect of advertisement, we introduce the parameter g. Therefore, mte can be written in general as a function of financial incentive, the convenience factor of transportation and the motivation effect of advertisement.

A suggested model for motivation effectiveness

mte should be determined for all the possible combinations of the financial incentive, the convenience factor of transportation and the motivation effect of advertisement, for the three financial incentive strategy. However, this requires extensive amount of data points and makes the calibration procedure very expensive and even impractical. In this section we rationalize a simple model for mte without further empirical validation. Alternative models may be used based on empirical data.

In equation (4) we modeled the motivation effect of the three financial incentives by estimating the cash equivalent of a discount incentive. In order to quantify the convenience of the transportation, we should first determine its effect on the motivation effectiveness. If a customer participates partially in transporting the used product, he or she has to spend some time and energy which reduces the effective value of the financial incentive. Defining mte t as the reduction in motivation effectiveness associated with the transportation method we may write:

The energy and time that a customer has to spend on transportation is almost the same for different customers, but different customers value their time and energy differently. Usually the customers that return their used product at higher financial incentives are busier or less interested in returning their product and so are more sensitive to the convenience of transportation. Therefore a correlation between mte t and mte is expected. Assuming a linear relation between mte t and mte:

we may rewrite equation (10) as:

where β represents the inconvenience of transportation and varies between 0 and 1; it is zero if the take back firm undergoes all the transportation activities. The convenience factor of transportation, f, may be quatified as:

And consequently the equation (12) can be rewritten as:

In contrast, there is no reason to believe a significant correlation between the motivation effect of the advertisement and the motivation effect or the type of the financial incentive. Therefore, we may assume that g represents the average increase in the motivation effectiveness associated with the advertisement. Therefore, equation (14) can be rewritten as:

In general g depends on the quality of the ad and providing a more effective ad usually costs more. Therefore, the motivation effect of advertisement may be considered as a function of W 1:

Cost model

In the discount incentive strategies the cost benefit analysis of take back and the sale of new products are coupled together. Therefore, the cost model of the cash incentive strategy differs substantially from the cost model of discount incentive strategies. In the following, different cost models were derived for different incentive strategies.

Cash incentive strategy

The cost that is scaled with the number of returns (cost per returned item) consists of the amount of cash incentive, c, and the transportation cost, t. The revenue which is generated by the value of returned product, a, also scales with the number of returns. Advertisement costs, W 1 and W 2 and the fixed cost of transportation, tg, do not scale with the number of returns. Therefore, the net profit of take back, Ψ c , can be modeled as:

Where tb is the implementation cost of take back, modeled as a fixed cost. A variable term may be considered for the implementation cost as well; for example larger number of returns usually corresponds to larger capacity of the take back process and consequently higher implementation cost. In this model a is the average value of taken back products. Taken back products are expected to have better quality (in average) at higher incentives [4]. To include this effect, we considered a as a function of mte in the model. Note that the decision of customers for returning their used product depends on the all the incentives which are included in the motivation effectiveness, mte. Substituting for number of returns from equation (7) and for mte from equation (15) the net profit in a cash incentive strategy is:

Discount incentive strategies

If the take back is performed by the OEM (Original Equipment Manufacturer) firm, the financial incentives may be offered in the form of discount (fixed value of percentage) toward buying a new product. The discount incentive reduces the net profit of the new products by selling a fraction of them at the discounted price. On the other hand, the discounted price makes the product affordable for some additional customers and may increase the net profit by increasing the number of sales or redistributing the sale profile toward more profitable products. As both changes in the net profit of new products are caused by the take back procedure, the reduction of profit, associated with reduced price, is considered as a take back cost and the extra revenue associated with the increased amount of sales is considered as take back revenue. To model the effect of discount coupons on the sale profile of new products we first categorize the customers who would return their used product into the following groups:

1- Current customers who planned to buy a certain product (with or without the discount). These customers simply use the coupon to pay less for the new product they would have bought anyway.

2- New customers who have been motivated by the discount incentive to return their used product and buy a new product at discounted price. Their choice of new product may or may not depend on the amount of discount incentive.

3- Customers who returned their used product but for any reason do not buy any new product to redeem their coupon.

Customers of group 1 are the less favorable customers for the take back procedure and do not bring any extra revenue to the company as a consequence of the take back strategy. Customers of group 2 are new customers that are motivated by the discount and so any generated revenue associated with their purchase can be attributed to the take back procedure. Finally customers of group 3 do not impose any motivation cost on the take back procedure.

The motivation cost, MC, in this method can be assumed as the total value of redeemed coupons minus the extra generated revenue in the sale of new products caused by discount motivation:

where M is the total number of discountable products referred by index j; s j is the sale profit of new product j; n j is the change in number of sale of the new product j, caused by discount incentive; m j is the number of discount coupons used for the new product j. Including the motivation cost the net profit of discount incentive strategy is:

The customers' decision regarding returning the used product depends on the motivation effectiveness, but, once the customers returned the product their decisions for choosing the new product depend only on the amount of discount. We define η i as the proportion of the discount coupons that are used for the new product j. Therefore:

Assuming that η o and m o show the proportion and the number of coupons that are not used (customers of group 3), respectively:

Note that the number of issued coupons is the same as the number of returned products, NR. We also define ξ j as the proportion of the sale of each new product without the take back procedure. Usually, the discount incentives of the take back procedure increase the sale of new product and we define Λ as the ratio of the new customers (estimated by the increased in the number of sale) to the total customers who buy a new product with coupon. Therefore, number of new customers (who buy a new product because of discount) is (N R -m o ) Λ and the number of customers that would have bought a new product without the discount is (N R -m o )(1-Λ).

n j and m j are related to each other for each new product j. For each new product j, n j is m j minus the number of customers that would have bought a new product without discount. These customers were distributed proportional to ξ j before discount incentive, so:

Substituting equations (15), (21), (22) and (23) in equation (20), the net profit in discount incentive strategy can be rewritten as:

Therefore, to include the effect of discount in the net profit, we need to estimate Λ, the proportion of new customers and η i , the distribution of discount coupons among the new products. These parameters are measurable once the take back procedure is implemented. However, in order to use the model for feasibility analysis of the take back procedure, accurate estimates of Λ and η i is required. In equation (24) it is implicitly assumed that the number of new customers increases proportionally by the number of returns, and consequently the fraction of new customers is modeled with a constant number. For a more accurate model, Λ may be considered as a function of mte. However, this accuracy comes at the cost of more complex model calibration.

Comparing equation (24) with equation (17) helps to understand how changing the financial incentive from cash to discount affects the net profit of the take back. First the cash incentive cost, c, is replaced by the discount incentive cost. The discount incentive, d, is reduced by a constant factor to account for the unused coupons. As discussed before, changing the incentive from cash to discount decreases the profit by reducing the motivation of customers to return the used product and increases the net profit by increasing the sale of new products. Scaling down the discount incentive by parameter α is how the first effect appeared in the cost model. It reduces the number of returns and consequently the net profit of take back. The second effect appeared as a summation term in the right side of equation (24). The term inside the square brackets is difference between the sale (for each new product) of new products with and without the coupon. The number of sale without the coupon is the number of customers that would have purchased the product without the coupon, (1-Λ), distributed among the new products.

The net profit of take back for the percentage discount strategy, ψ p , can be derived using a similar approach as for the fixed discount strategy. With a percentage discount, the amount of discount is not fixed and depends on the sale price of new products. The motivation cost, MC, is:

where v j is the sale price of new product j and p is the percentage of discount. Therefore, the net profit of take back with a percentage discount is:

Similar to a fixed value discount, m j can be modeled as:

The average price of discountable products, A, can be determined as:

We used A previously to estimate the motivation effectiveness of a percentage discount. In the percentage discount strategy, buying more expensive products is more motivated compared to the fixed value discount strategy as the amount of discount increases by the price of product. Therefore, the η j functions and Λ are different from the fixed value discount and need to be estimated or measured separately. The relationship between m j and n j is the same as in the fixed value discount strategy. The net profit of a percentage discount strategy can be rewritten using equations (23) and (28) as:

Note that in general A is a function of p. A list of all model variables is provided in Table 1. This list also includes intermediate variables that do not appear in the final equations of the net profit.

Results

The model developed in previous sections provides a general framework to optimize the take back procedure by determining the type and amount of financial incentives, optimum options of transportation and advertisement, and the optimum spending on advertisement. In this section we present a hypothetical real world take back problem that is characterized in this general framework. The model will be used to estimate the net profit of the take back and determine optimum values and choices of parameters.

Take back problem and its characteristic parameters

Cellular phones are among the products considered suitable for multiple life cycles [22]. Our goal is to outline a take back procedure for collecting a particular type of used hand set from the market for a recovery firm. The optimum recovery option and marketing the recovered product (or material) is out of the scope of this problem. In the following we explain the parameters and options we considered. Although, the parameter values are hypothetical and are not measured for a specific case, they represent a set of possible options and values.

It is assumed that the recovery firm is willing to pay from $30 to $50 for each used handset at the recovery site based on the average condition. The average value of returned product, a, is modeled as:

Three transportation options have been considered:

1- Pick up from the customers convenient location (residential or business location).

2- Providing the customers with the postage paid envelopes.

3- Asking the customers to hand deliver their handsets at particular locations.

The transportation costs, t and tg and the convenience factor, f, of each method is summarized in Table 2.

Five options have been considered for advertisement:

1- Broadcasting a video clip on a T.V. channel

2- Broadcasting a vocal clip on a radio channel

3- Internet advertisement

4- Advertising in local newspapers

5- Announcing (by LCD panels or posters) in related retail stores

Characteristic parameters of each method of advertisement are given in Table 3. The values of the advertisement parameters are roughly estimated based on the available data on costs (e.g. air time rates) and estimates of the number of people that will be impacted by the ad.

N, the total number of customers that posses the used handset is assumed to be 70,000 and the Γ function is modeled as:

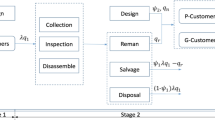

This function is drawn in Figure 1. This estimate of the Γ function is based on the following assumptions: 1-with no financial incentive still a small fraction of customers (~2%) who are motivated by the overall environmental aspects of take back would return their hand sets. 2-incentives up to $4 would have no significant motivation effect and the return rate would start to increase for incentives of $5 or more. 3-return rate increases almost linearly in the beginning and then yields toward a saturation value. 4-$25 motivation effectiveness is a fair exchange value and about half of the customers would return their handsets at this price.

Proportion of the customers that return their used product, Γ, as a function of motivation effectiveness, mte , estimated for the practical example of this paper. The analytical expression of this function is given by equation (23).

For discount strategies it is assumed that the customer can buy 3 new handsets (Table 4) with their discount. The η j proportions are assumed to vary linearly (after an initial threshold, x ts ) with the amount of discount:

where x is the amount of discount (d or p). When the discount is small it does not affect the customers' decision for selecting the new product and the discounts are distributed among the new products proportional to their global sale distribution, ξ j . The proportion of customers who have returned the used product without using their discount coupon is assumed to decline exponentially:

Parameters of the η j functions are provided in Table 5. Finally the fraction of new customers, Λ, is assumed to be 0.5 and the ratio of cash to discount incentive, α, is assumed to be 0.8.

Model prediction for the optimum strategy and net profit

Finding the optimum strategy in this problem involves determining the type of financial incentive (cash, fixed value or percentage discount), the amount of financial incentive, the optimum transportation method, the optimum advertisement method and the optimum volume of advertisement (W 2 ) to maximize the profit. The advertisement cost, W 2 , and the amount of incentives, x (c, d, or p), are continuous parameters. Therefore, for each combination of incentive strategy, transportation method, and advertisement method, we calculated the profit of take back, ψ, as a 2D function of x and W 2 and determined the maximum amount of net profit, ψ, and its associated W 2 and x. These maximum profits were compared to find the maximum net profit of the take back and its associated incentive strategy, transportation and advertisement methods.

Figure 2 shows the net profit of take back, ψ, and the number of returns, N R , as a function of advertisement cost, W 2 and percentage of discount, p, for a percentage discount incentive, method 2 of advertisement (radio advertisement) and method 2 of transportation (postage paid mailing). Increasing the amount of advertisement (W 2 ) and percentage of discount incentive, initially increases the profit because of increasing the amount of returns, and after a maximum point, decreases the profit because of increased costs of motivation or advertisement. It has a maximum shown by the black circle over the 2D domain of its two variables. The number of returns increases monotonically (as expected) by increasing the amount of advertisement and incentive and approaches a maximum value. The net profit of take back of all 15 combinations of advertisement method and transportation method is shown in Figure 3 for cash, fixed value discount, and percentage discount incentives in panels A, B and C respectively. Quantitative comparison of these net profits concludes that a percentage discount incentive, method 2 of advertisement, and method 2 of transportation generates the maximum net profit of about $685,000 in a year (time duration of modeling) based on the estimated values we chose for the parameters of this problem. The maximum net profit of fixed value discount and percentage discount strategies are close to each other (panels B and C) which means that the type of discount does not have a significant effect on the net profit. The maximum net profit of cash incentive strategy is significantly lower than the discount strategies. This means that a significant portion of the profit in discount strategies is resulted from the sale of new products, particularly to the new customers. The maximum net profit in cash incentives is about $404,000 associated with method 2 of advertisement and method 2 of transportation. For each combination of incentive strategy, advertisement method, and transportation method, the maximum net profits resulted from an optimum advertisement cost and an optimum amount of incentives. Figure 4 shows the optimum W 2 and d, and the resultant number of returns N R , for the fixed value discount strategy. Comparing these optimum values provides more insight on how different transportation and advertisement methods can maximize the profit. For example the optimum cost of TV advertisement (method 1) is much larger than other plans clearly because TV advertisement is more expensive. This method of advertisement, however, can generate a net profit more than many other advertisement plans. This extra cost is compensated partly by better motivation effect of an ad, which enables lowering the financial incentives (Figure 4 panel A), and partly by increasing the number of returns (Figure 4 panel C), as it covers a broader number of customers. Also it is noticeable that the resultant optimum number of returns does not vary significantly in different transportation methods but varies significantly by advertisement methods. This means that if a transportation method is less convenient for customers the firm has to compensate for that by increasing the financial incentives (Figure 4 panel A) to increase the motivation effectiveness in order to reach a certain number of returns.

Net profit of take back, Ψ (panel A), and number of returns, N R (panel B), as functions of advertisement cost W 2 and amount of incentives, p , for percentage discount strategy and method 2 of advertisement and method 2 of transportation. Black circles show the optimum W 2 and p and the resultant maximum profit (panel A) and number of returns (panel B).

Maximum net profit for different combinations of discount strategy, advertisement method and transportation method. In this problem, cash incentive (panel A) generates less profit compared to discount incentive (panels B and C). Also, the maximum profit of fixed value discount (panel B) and percentage discount (panel C) are close for any combination of advertisement method and transportation method. For all combinations of advertisement method and incentive strategy, the method 2 of transportation is the optimum method and for all combinations of transportation method and incentive strategy method 2 of advertisement is the optimum method.

As would be the case in a practical example, many of the characteristic parameters of the procedure are estimated. The model predictions for the maximum net profit and optimum values of parameters are estimates as well. Using this model we can predict sensitivity of the maximum profit to any characteristic parameter of the take back procedure for analyzing the associated risk. In this example we simulated the sensitivity of maximum profit with respect to three characteristic parameters: W sc , α and Λ. Figure 5 shows how the maximum net profit and the optimum financial incentive vary by varying W sc and α over a large range. Panel A shows net profit as a function of W sc when method 2 of advertisement is considered. A 10 times increase of W sc from ($10,000 to $100,000) reduces the net profit by less than 40%. Note that the estimated value of W sc is $40,000 in Table 3. Interestingly, this large variation of W sc does not affect the optimum type and amount of financial incentive (panel B). It means that if the number of customers that are informed by each run of advertisement are less than what has been estimated (i.e. the actual W sc is larger than its estimated value), the optimum compensation strategy would be to inform more customers by increasing the amount of advertisement, W 2 , rather than to increase the financial incentives and motivate more (of the informed) customers to return their used product. Panels C and D (Figure 5) show the maximum net profit and the optimum financial incentive for different values of α (the ratio of cash to discount incentive). If α is less than about 0.35 the cash incentive is the optimum strategy and therefore, net profit and amount of incentive do not vary with α (gray segments). If α is larger than 0.35, percentage discount is the optimum strategy. By increasing α the net profit increases (up to about 70% in this example) and the optimum amount of discount decreases. Increase of the net profit is caused partially by reduction in the discount incentives and partially by the increase of the number of returns and sale of new products. Note that although an optimum value of p reduces (by increasing α) the motivation effectiveness, and consequently the number of returns increases.

Sensitivity of the maximum profit and the optimum amount of incentive with respect to the cost scale of advertisement, W sc (panels A and B) and the ratio of cash to discount incentive, α (panels C and D). Optimum type and amount of incentive is not sensitive to W sc (panel B), but is sensitive to α (panel D). Change in total net profit is minor with respect to both parameters (panels A and C). Note both W sc and α vary over a very large range.

The sensitivity of the model respect to Λ is shown in Figure 6. If there is no new customer (Λ <0.03) the cash incentive is the optimum strategy and the maximum profit is about $404,000 which corresponds to about $14 cash incentive (Figure 6B) and $105,000 advertisement (Figure 6C). However, even if there is a small fraction of new customers (Λ >0.03) the discount incentives strategies are more profitable. For 0.03< Λ <0.65 the percentage discount and for Λ >0.65 the fixed value discount is the optimum type of financial incentive. The net profit increases almost linearly by increasing Λ and is more sensitive to Λ than to α and W sc . At Λ = 0.65, where the optimum incentive strategy switches from percentage discount to fixed value discount, there is a jump in the optimum advertisement cost (Figure 6C) which causes the jump in the number of returns (Figure 6D). At Λ = 0.65 the global minimum switches from one local minimum to another local minimum, where the same profit (Figure 6A) can be achieved through larger number of returns (Figure 6D) that justifies the significant increase in the advertisement cost (Figure 6C). Therefore, if the estimated value of Λ is around 0.65 then the optimum amount of advertisement would be sensitive highly to Λ; it should be either $125,000 to set the take back process for the smaller number of returns (18,000) or $500,000 to set the process at the larger number of returns (24,500). Note that the financial incentive does not change significantly across this jump (Figure 6B).

Sensitivity of the maximum profit (panel A) and the optimum amounts of incentive (panel B), advertisement cost (panel C) and number of returns (panel D) with respect to the fraction of new customers, Λ. The optimum incentive strategy changes from cash incentive (light gray) to percentage discount incentive (dark gray) at Λ = 0.03, and from percentage discount to fixed value discount incentive (black) at Λ = 0.65.

Discussion

Determining the number of returns and its variation with respect to different parameters of the take back procedure is required in a cost benefit analysis of a take back problem. Number of returns depends on many parameters and in general should be measured or estimated for all combinations of these parameters (i.e. in a multidimensional domain of variables), which is not practical. In a simple model, the number of returns may be considered simply as a function of one variable [4, 9] usually termed the financial incentive or more generally the take back cost per returned product. Such a simple model, although provides overall theoretical insights about he take back process, but is not sufficient for many practical applications. It is not clear how the number of returns, which is a function of several variables, can be calibrated in terms of one variable. For example, increasing either the transportation cost or the financial incentive by $5, increases the take back cost by $5, but the resultant change in the number of returns can be significantly different. To overcome this limitation of the simple models, we first determined a set of factors that can significantly affect the number of returns like the transportation method, advertisement expenditure, and type and amount of financial incentives. Based on a solely theoretical analysis of the take back process, we derived a more detailed model for take back process that present several aspects of take back process. We tried to keep the model as simple as possible by imposing some reasonable assumptions. This model provided a general framework for different aspects of take back process and determined what empirical data is required for model calibration/validation.

Number of returns is modeled in terms of two functions; it is equal to the number of customers that are informed about the take back policy times the proportion of informed customers that return their used product. Number of informed customers depends on the method and volume of advertisement and is modeled as the Ω function. Proportion of informed customers that would return their used product depends on financial incentives and transportation method in addition to the method of advertisement; it is modeled as the Γ function. Γ function is a market characteristic of the take back process and should be determined using function approximation methods and the data obtained through surveys or pilot implementations. A general form of the Ω function was derived based on a basic analysis of advertisement. It should be mentioned that a detailed analysis of the advertisement is out of the scope of this paper; we only identified a set of parameters that are associated with advertisement and affect the number of returns through Ω or Γ functions. To determine Γ function, we first introduced the concept of motivation effectiveness, mte, and modeled Γ as a function of mte and then quantified and modeled the effect of different parameters of the take back (e.g. convenience of transportation and type of financial incentives) in terms of how they change the motivation effect of financial incentive. For example we assumed that offering financial incentive in the form of discount scales down the motivation effect of financial incentive (compared to equal amount of cash) by an average factor termed α. This enabled estimating Γ as a simplified single variable function while effects of other significant factors are included. Depending on the nature of the take back problem this model can be modified for the specific conditions of the problem. For example assume that the recovery firm requires the number of used products to be between N min and N max . This means that the number of taken back products should be larger than N min and the taken back products beyond N max does not generate any revenue. Therefore, in equations (10), (16) and (21) the value of used product, a should be multiplied by the minimum of N R and N max and in determining the maximum profit at each combination of reward strategy, advertisement method, and transportation method the domain of advertisement cost (W 2 ) and financial incentive (c, d or p) should be limited to the regions where N R is greater than N min .

Although as pointed out by Guide et al. [4], offering multiple incentives based on the condition of product can potentially increase the profit, it may not be the optimum strategy in all take back problems. In many practical cases customers may not be able to determine the condition of their used product and make their own decision about the return without knowing what they get in exchange. This usually affects the return rate adversely and may reduce the profit. However, most likely, the average quality of the returned products increases by increasing the incentive. This effect is included in the model by assuming the average value of returned products is a function of motivation effectiveness.

In this modeling framework the mutual effect between take back procedure and new product sale in discount strategies has been dissected and included in determining the net profit of take back. We allocated the total amount of discount as a cost to the take back procedure. We also allocated the increase in the profit of new product sale (because of discount) as revenue to the take back procedure. In doing this it is implicitly assumed that the take back and recovery procedures are performed by different segments of the same firm. However, even if the take back is offered by a different firm, the discount strategy can be considered as a financial incentive. Generally the take back firm should be able to purchase the new products from the new product manufacturer below their retail value at a wholesale price and resell them to the take back customers at a discounted price. The cost model is applicable to this case as well; the value of Λ should be set to one and the sale profits are the difference between the retail price of new product and the wholesale price minus any handling fee associated with the resell.

Conclusion

The amounts and types of advertisement and transportation can significantly affect the net profit of take back. The type and amount of financial incentive is similarly influential. The developed modeling framework enables the determination of the optimum strategies for advertisement and transportation. It also compares cash and discount incentives, and determines if the extra sale of new product associated with the discounts can generate sufficient revenue to compensate for the reduced motivation of discount incentives (compared to cash). For the take back process studied in this paper, the model predicts that the maximum profit of the discount incentive strategy is about 70% higher than the cash incentive strategy, even though it requires a higher amount of financial incentives. The model also provides insights about the take back process and can be used for sensitivity analysis and feasibility study. For example, for the take back problem presented, the model predicts that the return rate and consequently the net profit are initially more sensitive to the frequency of advertisement (or advertisement cost W 2 ) than the amount of financial incentive (Figure 2). Therefore, if the system parameters and consequently the optimum advertisement cost are unspecified, it would be a wise operational decision to implement the take back process initially with a higher advertisement frequency, until more accurate data is acquired.

Appendix

An estimate can be found for the number of customers that are exposed to the advertisement (Ω function) based on available information about the statistics of advertisement method. Assume N ad is the number of customers (or in general people) that are exposed to the advertisement at least one time. Not all customers can be reached by a specific advertisement method. For example, the customers who do not read the newspaper containing the ad, or do not watch or hear the TV or radio program that broadcasts the ad, will not be exposed to the ad independent of the number of the times the ad posts or broadcasts. The maximum number of customers that are potentially exposed to the ad over frequent postings or broadcasts is defined as N ss . Also the average fraction of customers that are exposed to the ad in one run is defined by λ*. Both N ss and λ* are statistical parameters of the advertisement method and are assumed to be known.

As N ad is the number of customers that have seen the ad (after a known number of iterations) at least once, the number of customers that have not seen the ad, and may be exposed to the ad in the next iteration is N ss - N ad . Therefore, ΔN ad , the change in N ad after each iteration of the ad is:

The advertisement cost W 2 is proportional to the number of times the ad is broadcast or published. Let's assume that the cost of running the ad is ΔW 2 per each run. We may rewrite equation (A1) as:

where λ is defined as:

Although N ad is a discrete function, when λ << 1 we may approximate it by a continuous function of W 2 and write:

and therefore:

where W sc is defined as the reciprocal of λ and from a physical point of view is the cost of the advertisement that is required to inform about 63% (1-e-1) of the potential audience of the advertisement method. Dividing both sides by N we can find an estimate for Ω:

where Ω ss is the maximum fraction of customers that can be informed by this method of advertisement. Ω ss and W sc are the two parameters that are different for different advertisement methods.

References

Guide VDR, Van Wassenhove LN: Managing Product Returns for Remanufacturing. Production and Operations Management 2001, 10: 142–155.

Guide VDR, Srivastava R: Inventory Buffers in Recoverable Manufacturing. Journal of Operations Management 1988, 16: 551–568.

Guide VDR, Srivastava R, Kraus M: Product Structure Complexity and Scheduling of Operations in Recoverable Manufacturing. International Journal of Production Research 1997, 35: 3179–3199. 10.1080/002075497194345

Guide VDR, Teunter RH, Van Wassenhove LN: Matching Demand and Supply to Maximize Profits from Remanufacturing. Manufacturing & Service Operations Managements 2003, 5: 303–316. 10.1287/msom.5.4.303.24883

Galbreth MR, Blackburn JD: Optimal Acquisition and Sorting Policies for Remanufacturing. Production and Operations Management 2006, 15: 384–392.

Guide VDR: Production Planning and Control for Remanufacturing: Industry Practice and Research Needs. Journal of Operations Management 2000, 18: 467–483. 10.1016/S0272-6963(00)00034-6

Gupta SM, Nakashima K: Optimal ordering policy for product acquisition in a remanufacturing system. Book Optimal ordering policy for product acquisition in a remanufacturing system (Editor ed.^eds.). City 2008, Paper 85.

Nakashima K, Gupta SM: Analysis of remanufacturing policy with consideration for returned products quality. Book Analysis of remanufacturing policy with consideration for returned products quality (Editor ed.^eds.), vol. Paper 11. City 2010, 486–491.

Klausner M, Hendrickson C: Reverse-Logistic Strategy for Product Take-Back. INTERFACES 2000, 30: 156–165. 10.1287/inte.30.3.156.11657

Edlin AS, Reichelstein S: Specific Investment Under Negotiated Transfer Pricing: An Efficiency Result. Accounting Review 1995, 70: 275–292.

Vaysman I: A Model of Negotiated Transfer Pricing. Journal of Accounting & Economics 1988, 25: 349–385.

Jeffrey SA, Shaffer V: The Motivational Properties of Tangible Incentives. COMPENSATION & BENEFITS REVIEW 2007, 39: 44–50.

List JA, Shogren JF: The Deadweight Loss of Christmas: Comment. The American Economic Review 1998, 88: 1350–1355.

Ruffle BJ, Tykocinski O: The Deadweight Loss of Christmas: Comment. The American Economic Review 2000, 90: 319–324. 10.1257/aer.90.1.319

Waldfogel J: The Deadweight Loss of Christmas. The American Economic Review 1993, 83: 1328–1336.

Wei KC: Modeling the impact of incentives on vehicle sales volume. Control Applications; Sep 05–07, 2001; Mexico City, Mexico 2001, 1135–1140.

O'Sullivan A, Sheffrin SM: Economics: Principles in Action. Pearson Prentice Hall; 2007.

Vidal CJ, Goetschalckx M: A global supply chain model with transfer pricing and transportation cost allocation. European Journal of Operational Research 2001, 129: 134–158. 10.1016/S0377-2217(99)00431-2

Vidale ML, Wolfe HB: An Operations Research Study of Sales Response to Advertising. Operations Research 1957, 5: 370–381. 10.1287/opre.5.3.370

Erickson GM: Dynamics Models of Advertising Competition: open- and closed-loop extensions. Norwell, Massachusetts: Kluwer Academic Publishers; 1991.

Cowling K, Cable J, Kelly M, McGuinness T: Advertising and Economic Behaviour. London, UK: The McMillan Press LTD; 1975.

Kerr W: Remanufacturing and eco-efficiency: A case study of photocopier remanufacturing at Fuji Xerox Australia. In Book Remanufacturing and eco-efficiency: A case study of photocopier remanufacturing at Fuji Xerox Australia (Editor ed.^eds.). City: IIIEE Communications; 2000:2005.

Acknowledgements

Authors are thankful to Dr. Garry Brandenburger and Dr. Guy Genin for their insightful comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Competing interests

The authors declare that they have no competing interests.

Authors' contributions

N.G. reviewed the literature of product acquisition and had the leading role in developing the model. She designed the practical example and wrote the code for the computer simulations. M.J. defined the research subject and directed the research from the start to the end. He provided important advices throughout the study and helped in editing the manuscript. A.N. served as a consultant in developing the theoretical model and helped in writing and revising the manuscript and preparing the figures. All authors read and approved the final manuscript.

Authors’ original submitted files for images

Below are the links to the authors’ original submitted files for images.

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License (https://creativecommons.org/licenses/by-nc/2.0), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

Ghoreishi, N., Jakiela, M.J. & Nekouzadeh, A. A cost model for optimizing the take back phase of used product recovery. Jnl Remanufactur 1, 1 (2011). https://doi.org/10.1186/2210-4690-1-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/2210-4690-1-1