Abstract

Information and communication technology (ICT) and economic complexity are two concepts that have been extensively used in the recent literature. However, studies linking these two concepts are still at a premature stage and few existing studies have focussed on the role of the internet in a short-term context. Indeed, ICT measures the percentage of the population with access to the internet while economic complexity quantifies the set of productive capabilities and know-how embedded in the production process. This study aims to examine for the first time the long-term effect of ICT (quality and quantity) on economic complexity in a large panel of 112 countries over the period 1986–2017. The detailed analysis explores the long run and directional relationships using the homogeneity test, the cross-sectional dependence test, stationary tests in the presence of cross-sectional dependence, the panel cointegration test, dynamic OLS (DOLS), fully modified OLS (FMOLS), and the Granger panel causality test. The study finds long-run relationships between ICT, economic complexity, per capita GDP, government spending, and natural resources. Cointegration regression shows that the quality and especially the quantity of ICT, economic growth, and government spending have a positive and significant effect on economic complexity in the long run. Similarly, the results show that natural resource rent significantly impedes economic complexity. Finally, the results of the Granger causality test confirm the existence of a bidirectional relationship between ICT and economic complexity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Do ICTs affect a country's ability to produce and export a wide range of sophisticated products in the long run? There are at least two main reasons for this main question that this study tries to answer. On the one hand, the observed evolution and importance of ICTs in improving macroeconomic indicators. However, to predict and determine future economic growth, nations must diversify their economies and, in particular, make them more complex.

In the opinion of experts, developed countries, and particularly developing countries heavily affected by the COVID-19 pandemic, can rely on ICTs to start rebuilding their economies. Indeed, all components of ICT are growing exponentially (Stanley et al. 2018), although the pace of growth varies from one region to another. Regarding these components, the internet is the most important technology with a rapid growth rate. For example, between 2000 and 2021, the number of people using the internet grew from only 361 million to over 4.9 billion (IUT 2021). In terms of numbers, China and Japan lead the way, with 854 and 118 million people using the internet in 2021 respectively (see Fig. 2).

This ever-growing evolution of ICTs has led policy makers and researchers alike to take a greater interest in the effects of ICTs on different aspects of socio-economic and political life. Thus, it has been demonstrated in the literature, although not exhaustive, that ICTs have positive effects, on employment (Mbongo and de Berquin 2019; Kılıçaslan and Töngür, 2019), trade (Abeliansky et al. 2021); industrialisation (Njangang and Nounamo 2020); environment quality (Avom et al. 2020; Asongu et al. 2018; Higón et al. 2017); corruption reduction (Sassi and Ali 2017; Kanyam et al. 2017); democracy (Ali 2020); health outcomes (Dutta et al. 2019); education (Asongu et al. 2021); poverty reduction (Ofori et al. 2021); income inequality reduction (Asongu and Odhiambo 2019), and most importantly economic growth (Sawng et al. 2021; Appiah-Otoo and Song 2021; Hong 2017; Ofori and Asongu 2021; Ofori et al. 2022). Despite this dynamic and extensive literature, very few studies have looked at the effect of ICT on economic complexity. Thus, this study endeavours to enrich the literature by answering the following question: what is the effect of ICT on economic complexity?

Since the work of Hidalgo and Hausmann (2009), the explanation of the wealth differential between rich and poor countries has reached a new level. For these authors, economic complexity refers to the capacity of countries to produce sophisticated products. In other words, the economic complexity index (ECI) measures a country's ability to produce and export a wide range of products competitively (high diversity) that only a few countries on average are able to produce and export competitively (low ubiquity). This capacity depends on the amount of productive knowledge and capacities that firms accumulate by learning through action and use. Thus, a country's ability to diversify its basket of goods at the expense of other countries explains why some countries are poor and others are rich (Hartmann et al. 2017; Hausmann and Hidalgo, 2011). The observation of Fig. 1 tends to confirm this conclusion. We can see that the countries with the least sophisticated economies are mostly developing countries and especially low-income countries (that is poor countries).

To date, numerous studies have examined the determinants of a country's economic sophistication, highlighting factors such as human capital, foreign direct investment, innovation, financial development, remittances, birthplace diversity, intellectual property, intelligence, institutional quality, financial openness, foreign aid, colonisation, individualism, IMF programmes or conditionality and gender equality (Sweet and Maggio 2015; Coccia 2017, 2020, 2021; Valette 2018; Lapatinas and Litina 2019; Chu 2020; Kannen 2020; Bahar et al. 2020; Nguyen et al. 2020; Saadi 2020; Njangang et al. 2021; Keneck-Massil and Nvuh-Njoya 2021; Nguyen 2021; Kamguia et al. 2022; Vu 2022; Demir 2022; Maurya and Sahu 2022). However, studies examining the role of ICTs are very limited in number.

The study by Lapatinas (2019) is probably one of the first to analyse the direct effect of ICT on economic complexity. Based on a panel of 100 countries, the author shows that the internet is positively related to economic sophistication. One year later, Gnangnon (2020) analyses the effect of the internet, this time on the diversification of services exports. The author shows that better access to the internet, through its positive effects on the level of innovation, merchandise exports, and foreign direct investment (FDI) inflows, improve the diversification of service exports. We have to wait for the study of Atasoy (2021) to review a study that analyses, among other things, the role of the internet in economic complexity. He finds that exports become more sophisticated as digitalisation progresses. Recently, Ha (2022) empirically shows that the digitalisation of the business sector positively influences economic complexity.

This study differs from previous studies and contributes to this emerging literature by making at least three novel contributions to knowledge. First, previous studies directly related to this study, namely Lapatinas (2019) and Atasoy (2021), analyse the average effects of ICT measured for the internet on economic complexity. This study goes beyond an average effect by examining for the first time the long-term effect of ICT on economic complexity. Second, this study, unlike previous ones, uses two new indicators of ICT, namely ICT quality and quantity. In the literature on ICT-economic complexity, the internet is the most widely used measure of ICT, certainly because of its availability to a large number of countries. However, it should be noted that having access to the internet does not guarantee its quality, especially in terms of connection speed in many developing countries. Abeliansky and Hilbert (2017) already pointed out that the problem of the internet does not arise in developed countries in the same way as it does in developing countries. For these authors, developing countries are at a disadvantage because they are far from the technological frontier of communication in terms of data speed. Therefore, for developing countries, the quality of data speed is most important, whereas for developed nations, the number of subscriptions matters more. To take this into account, we use the measures of ICT quality and quantity recently proposed by Hilbert (2019) in this study. Third, to address the problems of cross-sectional dependence, heterogeneity of slope and the endogeneity issue, this paper employs the CIPS and CADF unit root tests, the Westerlund panel cointegration test, the fully modified OLS, dynamic OLS estimators, and the Granger panel causality test to analyse the long-run effect of ICT on economic complexity.

To sum up, this study provides robust evidence suggesting that both the quality and quantity of ICT improve the amount of productive knowledge embedded in each country’s productive structure. This result remains robust to many alternative specifications. The rest of the paper is organized as follows: Sect. 2 presents the theoretical background explaining how ICT affects economic complexity. Section 3 describes the data and methodology used. Section 4 presents and discusses the empirical results along with some robustness tests. Finally, Sect. 5 concludes the paper with some useful policy implications and avenues for future research.

Theoretical framework

Foreign direct investment channel

There are good reasons to believe that ICT development provides an attractive environment for the inflow of foreign direct investments (Gholami et al. 2006; Latif et al. 2018). A plausible explanation behind this hypothesis can be found in the works of Hitt (1999), who posits that the development of ICTs reduces the cost of information and thus facilitates communication between a company and its branches abroad, improves marketing information and increases the efficiency of industrial production. All these, at least to a certain extent, provide a favourable environment for the inflow of foreign direct investment (Gholami et al. 2006). More importantly, Coccia (2020) argues that technology generates industrial and corporate changes. On the other hand, the literature on the effects of foreign direct investment on economic complexity seems to show a consensus that FDI improves economic complexity (Antonietti et al. 2015; Antonietti and Franco 2021). This can be achieved through several mechanisms, such as the direct transfer of tacit knowledge, know-how, and efficiency through the transfer of skilled personnel from the sea-based firm to the branches in the host countries (Antonietti and Franco 2021). Another effect is the collaboration and imitation of foreign firms, which produce more technology- and knowledge-intensive goods and services than local firms (Aitken and Harrison 1999). Finally, foreign companies create an environment conducive to competition that stimulates innovation, a key determinant of economic complexity. Thus, we postulate that ICT improves economic complexity through FDI attraction.

Human capital channel

It is generally agreed in the economic literature that ICTs development improves human capital accumulation and particularly educational outcomes and school attendance (Livingstone 2012; Fernández-Gutiérrez et al. 2020). A plausible explanation to justify this claim is that ICTs development facilitates the dissemination of and access to knowledge through online libraries, computers, etc. All these at least partially screw up human capital by making knowledge widely available and at a lower cost. In addition, ICT makes the world a global village by creating a bridge form of knowledge and literacy, and they intersect places of learning-home, school, work and community. More importantly, recent literature highlights human capital as an important determinant of economic complexity (Zhu and Fu 2013; Lapatinas 2019). Improving human capital and particularly educational outcome and attendance is an important predictor of economic complexity for at least two reasons. Firstly, human capital accumulation enhances endogenous knowledge creation which favours economic complexity (Fu and Gong 2011). Secondly, countries with a high level of human capital have the ability to quickly and better understand the skills needed to produce complex goods (Zhu and Li 2017). Therefore, we can conclude that ICT by improving the quality of human capital creates a favourable condition for economic complexity.

Institution quality channel

There exists some evidence to support that the development of ICTs improves the quality of institutions particularly by reducing corruption and improving democracy (Balkin 2017; Bhattacherjee and Shrivastava 2018; Ali 2020). This result is supported by the virtue of ICTs which have the ability to monitor, track, record, analyse, and share vast amounts of information and thus help countries identify and prosecute criminals, and deter future corruption. Moreover, ICTs can improve the quality of institutions by automating governmental procedures and processes, reducing the involvement of officials and bureaucracy and thus corruption too. Furthermore, ICT development also contributes to making it easier to report administrative abuses, corruption and register complaints, which can improve “people power” and the impact of individual actions. On the other hand, the idea that the quality of institutions is important for economic prosperity is not new (North 1990). The literature on the institutional quality-economic complexity nexus though limited in number unravels a strong and robust positive and statistically significant effect suggesting that the quality of institutions improves the level of economic complexity (Vu 2022). For example, Vu (2022) argues that better institutions provide a good environment for innovative and entrepreneurial activities, property rights protections, and enforced laws and regulations (Licht and Siegel 2006). All these at least to a certain extent are prerequisites for the production of complex goods. Thus, by improving the quality of institutions, ICT positively affects economic complexity.

Study design

Sample and measures of variables

This paper investigates the effect of ICT quality and quantity on the economic complexity index (ECI) using a large sample of 112Footnote 1 countries over the period 1986–2017. The countries selected and the study period is chosen according to the availability and reliability of data.

-

Dependent variable: Economic complexity index (ECI)

The dependent variable of this study is economic complexity, measured by the economic complexity index (ECI), collected from the Observatory of Economic Complexity.Footnote 2 Economic complexity measures the capability of a country to produce and export complex (sophisticated) and knowledge-based products (Coccia 2021; Wang et al. 2022; Ajide 2022; Gnangnon 2022). Making a sophisticated product requires specific tacit knowledge (rather than explicit knowledge), which involves specialization and innovation (Coccia 2020). The difficulty in transferring tacit knowledge is the constraint that nations face in the accumulation of productive capabilities. Capabilities can be seen here as any factor of production that contributes to the production and export of any good or service. The economic complexity index is built on international data that connects countries to what they export. Hausmann and Hidalgo (2011) assume that the productivity knowledge of a country is reflected by the diversity and ubiquity of the products that it makes. The former component measures the number of products that a country can produce and export competitively (or with revealed comparative advantage) while the latter measures the number of countries that can produce and export a product competitively (or with revealed comparative advantage (RCAFootnote 3)). The index is calculated using an algorithm that operates on a binary country-product matrix M with elements Mcp, indexed by country c and product p.

The RCA is calculated using the Balassa index, given by

where \(x_{{cp}}\) is the value of product p manufactured by country c. The country’s diversity and product ubiquity are obtained by summing the elements across the rows and columns of M and are defined as follows:

Hidalgo and Hausmann (2009) use the “method of reflection” in which each product is weighted proportionally to its ubiquity on the market, and each country is weighted proportionally to the country’s diversity. They introduce the ECI as an eigenvector \({K}_{c}\) on the matrix \(\tilde{M}_{{cc^{\prime}}}\) associated with the second largest eigenvalue.

The economic complexity index (ECI) is then calculated according to the following formula:

where \({\widetilde{K}}_{c}\) is the average of \({K}_{c}\) and \(\sigma \left({K}_{c}\right)\) is the standard deviation of \({K}_{c}\).

For robustness purposes, this paper uses the economic fitness proposed by Tacchella et al. (2012; 2013). Economic Fitness (EF) is both a measure of a country’s diversification and its ability to produce complex goods on a globally competitive basis. Countries with the highest levels of EF have the capability to produce a diverse portfolio of products, the ability to upgrade into ever-increasing complex goods, tend to have more predictable long-term growth, and the ability to attain a good competitive position relative to other countries. Countries with low EF levels are more likely to suffer from poverty, low capabilities, less predictable growth, low value-addition, and difficulty upgrading and diversifying at a faster rate than other countries. EF is calculated in a non-linear and iterative Fig. 1 way that shows how the basket of goods exported by different countries is linked to their industrial competitiveness.

-

ICT measues

Drawing on the recent ICT literature (Njangang et al. 2022; Abeliansky et al. 2021), we use the newly constructed database on the quality and quantity of ICTs (Hilbert 2019). ICT quality is measured by the average quality of subscription (bandwidth in kbps) and ICT quantity is captured by the number of subscriptions (see Abeliansky and Hilbert 2017, p.4 for more details on the construction of both ICT quality and ICT quantity). To assess Fig. 2Footnote 4 the robustness of our results, we constructed an ICT index based on the two previous measures (ICT quality and ICT quantity) using principal component analysis (PCA). Figures 3 and 4 depict a positive relationship between ICT (quality and quantity) and economic complexity. However, because correlation does not mean causation, this relationship will be looked at empirically in the next part.

-

Control variables

To substantiate this relationship and avoid omission variable bias, we include three control variables in our model. The control variables are selected according to the literature on the determinants of economic complexity.

The wealth and the size of the economies are accounted for in this study by gross domestic product (GDP), collected from the world development indicators. The economic literature has well documented that GDP provides income for the government to supply public goods and the population with income to afford the cost of education and improve institutional quality. At least to a certain extent, all these things can improve the level of economic complexity. We follow Lapatinas and Litina (2019), Chu (2020) and Gnangnon (2020) to expect a positive effect of the gross domestic product on economic complexity.

Government spending is considered in this study to account for the government's size. The data is from the world development indicators. It is well established in the economic literature that large governments will impede economic complexity because of government inefficiency, corruption, and weak institutions, which are all detrimental to economic complexity (Afonso and Jalles 2016; Bajo-Rubio 2000). However, government spending is likely to improve economic complexity through external benefits and the provision of public goods such as public schools, access to water and sanitation, and electricity, which are fundamental inputs in the production of complex goods.

Total natural resource rents collected from the world development indicators are used in this study to account for the natural luck of countries. The resource curse, which describes the fact that resource-rich countries have paradoxically very poor macroeconomic conditions, has been extended to many sectors of the economy since the seminal works of Sachs and Warner (1995). No study, to the best of our knowledge, has extended the resource curse to economic complexity. Based on the detrimental effects of total natural resource rents on human capital accumulation, economic growth, and the quality of institutions, we have good reasons to expect that total natural resources will impede economic complexity. While Table A1 in the appendix presents the summary statistics, Table A2 in the appendix displays the correlation matrix, and the definition and source of data are presented in Table A3 in the appendix.

Models and data analysis procedure

This paper provides an empirical investigation of the effect of ICT quality and quantity on economic complexity. Therefore, as shown in Eq. (6), the relationship under investigation is:

where X is a set of control variables.

As scholars indicate (Shahbaz and Lean 2012), the empirical evidence obtained by a log–linear specification is considerably more efficient and reliable than that of a simple linear specification. All the variables are transformed into natural–log forms to avoid possible structural problems and error term distribution.

where the subscript \(i\) denotes country and \(t\) is year, \({\beta }_{0}\) is the constant, \({\beta }_{1}\) and \({\beta }_{2}\) are the parameters to be estimated, and \({\varepsilon }_{it}\) is a random error term. ECI stands for economic complexity index. ICT represents ICT quality or ICT quantity, X denotes a series of three control variables, which are selected after a thorough investigation of the existing literature on the determinants of economic complexity: Per capita GDP (GDP), government spending (GOV), and natural resources (TNR). Equation (7) can be therefore rewritten as follows:

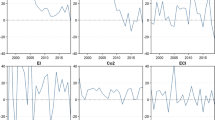

To analyse the long-run effect of ICT (quality and quantity) on economic complexity, we follow six steps analysis (see Fig. 5): in step1, the cross-sectional dependence tests are conducted; in step 2 we implement the slope homogeneity test; step 3 performs two-panel unit root tests under cross-sectional dependence; step 4 is devoted to the analysis of the existence of a cointegration relation between the variables; in step 5, two robust panel estimators are used to estimate the long-run parameters; and finally, in step 6, the causality relation is investigated.

-

Cross-sectional dependence tests

As many scholars indicate, any panel data analysis must be preceded by a cross-sectional dependence test (Tugcu 2018). Therefore, ignoring cross-sectional dependence would likely create inconsistent estimates and lead to misleading information (Grossman and Krueger 1995). The most well-known cross-sectional dependence test is the Breuch-Pagan (1980) Lagrange Multiplier (LM) test statistic and is calculated as follows:

where \({\widehat{\rho }}_{ij}\) represents the coefficient of pair-wise correlation. In The Breuch-Pagan LM test, the null hypothesis of no cross-sectional dependence H0 is tested against the alternative hypothesis of cross-sectional dependence H1.

Pesaran et al. (2008) have proposed a standardised version of the LM statistic, called the Pesaran scaled LM test, which is appropriate for Large N and T and is calculated as follows:

-

Slope homogeneity test

Due to the strong cross-sectional dependence, the economic development dynamic of countries may be similar (Shahbaz et al. 2018). We, therefore, investigate the homogeneity of the slope coefficient using Pesaran and Yamagata (2008) slope homogeneity tests. Pesaran and Yamagata (2008) is an extension of the Swamy test and is given as follows:

where \(\widetilde{S}\) is the Pesaran and Yamagata slope homogeneity test statistic (i.e., adjusted Swamy test), \({\widehat{\beta }}_{i}\) represents the pooled OLS coefficient. For the case of small samples, the following \(\widetilde{\Delta }\) and adjusted \(\widetilde{\Delta }\) test are used:

-

Panel unit root test

This study continues in this section by analysing the stationary properties using cross-sectional augmented Dickey-Fuller (CADF) and cross-sectional augmented IPS (CIPS) tests developed by Pesaran (2007). It has been shown in the literature that, in the presence of cross-sectional correlation, conventional panel unit root tests such as LLC, IPS, ADF, and PP that do not take cross-sectional dependence into account are subject to significant distortions (Strauss and Yigit 2003; De Silva et al. 2009). This often leads to an excessive rejection of the null unit root hypothesis in favour of an inversion of the mean or trend (Cerrato and Sarantis 2002). To overcome these limitations, in this study we use unit root tests that take into account cross-sectional dependence such as CADF and CIPS tests. Cross-sectional augmented Dickey-Fuller (CADF) regression is expressed as follows:

where \(\Delta\) is difference operator, Y is analysed variable, \({\overline{Y} }_{t}=\frac{1}{N}\sum_{i=1}^{N}{Y}_{it}\), \(\Delta {\overline{Y} }_{t}=\frac{1}{N}\sum_{i=1}^{N}\Delta {Y}_{it}\), and \({u}_{it}\) represents the error term.

CIPS is calculated through the average individual CADF test statistic for the whole panel and is calculated by the following equation:

-

Westerlund panel cointegration test

After the verification of the unit root properties of the variables, we proceed to the next step of the verification of the existence of a cointegration relation between the variables. Several cointegration methods have been used in the literature, such as Johannsen and Juselius (1990), Kao et al. (1999) and Pedroni (2004) cointegration tests. However, to overcome the issues of both slope heterogeneity and cross-sectional dependence, we use in this paper the panel cointegration test proposed by Westerlund (2005). The Weserlund cointegration test includes four test statistics, namely: Gt, Ga, Pt, Pa. While Gt and Ga are the group statistics, which are independent of the pooled information of the error-correction mechanism, Pt and Pa depend on the information collected from the error-correction term as well as the cross-sectional units. In the Westerlund cointegration test, the null hypothesis of no cointegrating relationship versus the null hypothesis of a cointegrating relationship exists for at least one cross-sectional unit for the group statistics and countries with full cross-sectional dependence for the panel tests. The criteria for calculating the Westerlund cointegration test are given as follows:

where \(t=1,\dots ,T\) and \(i=1,\dots ,N\), \({d}_{t}\) represents the deterministic components, while \({p}_{i}\) and \({q}_{i}\) denote the lag and lead orders which can vary across individual country. In the first step, OLS is estimates for each unit \(i\), while in the next step, for the two group-mean tests, the ratio of variance estimators for \({\widehat{v}}_{it}\) and \(\Delta {y}_{it}\) are obtained where \({\widehat{v}}_{it}=\sum_{j=-{q}_{i}}^{{p}_{i}}{\widehat{\varphi }}_{ij}\Delta {x}_{i\left(t-j\right)}+{\widehat{u}}_{it}\). The two group-mean tests \({G}_{t}\) and \({G}_{\alpha }\) are given by:

where the variance ratio is \({\widehat{\alpha }}_{i}(1)\) and \(SE\left({\widehat{\alpha }}_{i}\right)\) is the standard error of \({\widehat{\alpha }}_{i}\). For the two-panel tests, we estimate in the second step the common error-correction parameter \(\widehat{\alpha }\) as follows: \(\widehat{\alpha }={\left(\sum_{i=1}^{N}{\sum }_{t=2}^{T}{\widetilde{y}}_{i(t-1)}^{2}\right)}^{-1}\sum_{i=1}^{N}{\sum }_{t=2}^{T}\frac{1}{{\widehat{\alpha }}_{i}(1)}{\widetilde{y}}_{i(t-1)}\Delta {\widetilde{y}}_{it}\) and the standard error of \(\widehat{\alpha }\) are given by \(SE(\hat{\alpha }) = \left( {\left( {\frac{1}{N}\sum\nolimits_{i = 1}^{N} {\frac{{\hat{\sigma }_{i} }}{{\hat{\alpha }_{i} \left( 1 \right)}}} } \right)^{ - 1} \sum\nolimits_{i = 1}^{N} {\sum\nolimits_{t = 2}^{T} {\tilde{y}_{{i\left( {t - 1} \right)}}^{2} } } } \right)^{{{1 \mathord{\left/ {\vphantom {1 2}} \right. \kern-0pt} 2}}}\)

Given the values of \(\widehat{\alpha }\) and \(SE\left(\widehat{\alpha }\right)\), the two-panel test statistics are estimated as follows:

-

Long run estimations: FMOLS and DOLS

In this paper, we use the FMOLS method (Phillips and Hansen 1990), and the DOLS method (Stock and Watson 1993) to assess the long –run effect of ICT quality and quantity on economic complexity. The fundamental difference between FMOLS and DOLS lies in the way autocorrelation is corrected in the regression. While FMOLS uses a non-parametric correction term to solve the problems of serial correlation and endogeneity, the DOLS augments the cointegrating equation with the lead and lagged differences of the regressors to eliminate the asymptotic endogeneity and serial correlation.

The panel FMOLS can be defined as follows:

where \(\Delta \varepsilon \mu\) stands for serial correlation correction term, and to achieve the endogeneity correction \({y}_{it}^{+}\) is used to represent the transformed variable of \({y}_{it}\).

The panel dynamic OLS (DOLS) is estimated again in other to check for the vigorousness of the results and is estimated as follows:

where \({Z}_{it}=\left({x}_{it}-{\overline{x} }_{i},\Delta {x}_{i},t-q,\dots ,\Delta {x}_{i,t-ki},\dots ,\Delta {x}_{i,t+ki}\right)\) is vector of regressors and \({\widehat{w}}_{it}{=w}_{it}-{\overline{w} }_{i}\)

Results and discussion

Cross-sectional dependence, slope homogeneity, Panel unit root and cointegration tests

Our empirical analysis begins with the cross-sectional dependence and the slope homogeneity tests. The results of the Breuch-Pagan LM and Pesaran and Yamagata slope homogeneity tests are reported in Table A4 in the appendix. Looking at the Breuch-Pagan LM, the null hypothesis of no cross-sectional dependence is rejected at the 1% level for all the statistics in columns 1 and 2. This output suggests that a shock that arises in one of the sample countries may spill over to the other countries. Additionally, the results show that the null hypothesis of the slope homogeneity test still presented in columns 3 and 4 of Table A4 in the appendix is rejected.

Using non-stationary variables can lead to spurious regression and thus bias the results. Assuming that the majority of economic variables are non-stationary, before any econometric estimation, we test the stationarity of the variables. To examine whether the variables used are stationary, this paper uses two widely known and widely used cross-sectional tests, namely: the cross-sectional augmented Dickey-Fuller (CADF) and the cross-sectional augmented Im, Pesaran, and Shin (CIPS). The results of the unit root tests are presented in Table A5 in the appendix. Both the CADF and the CIPS tests give the consistent conclusion that all variables used in this study are stationary at their first difference, suggesting that the variables are integrated and we can therefore investigate the cointegration among them.

After exploring the unit root properties of all variables, the next task is the estimation of cointegration among variables. For this purpose, we undertake the Westerlund (2005) panel cointegration test. The results of the four Westerlund test statistics are reported in Table A6 in the appendix. The results show that the null hypothesis of no cointegration can be rejected by two-panel statistics. Therefore, we can conclude that ICT quality and quantity, Economic complexity, per capita income, government spending and natural resources share a long-run equilibrium relationship.

ICT and economic complexity: Baseline results

After presenting the results of the different tests, we now present the main results of this study. We first employ the fully modified OLS (FMOLS) (Phillips and Hansen 1990), and then the dynamic OLS (DOLS) (Stocks and Watson, 1993). The estimated results are presented in Table 1 and Table 2 for the first and second models, respectively. The estimation results show that coefficients associated with the ICT, both quality and quantity, in Tables 1 and Table 2, respectively, are positive and statistically significant at the 1% level, regardless of the estimation method used. This result suggests that improvements in ICT (both quality and quantity) favour economic complexity. A plausible explanation for this result is that ICT encourages the inflow of foreign direct investment by lowering communication costs (Latif et al. 2018), which brings with it more sophisticated production techniques (Antonietti and Franco 2021). Moreover, ICT facilitates the diffusion of knowledge through online libraries and thus improves the level of human capital (Fernández-Gutiérrez et al. 2020). There is empirical evidence to support that well-educated people have the necessary capacity to learn and easily master complex production processes which then improves the level of economic complexity (Zhu and Li 2017). Furthermore, ICT development improves the quality of institutions precisely by reducing corruption and increasing democracy (Ali 2020), and literature establishes that strong and transparent institutions are very important to the sophistication process of an economy since they protect property rights (Vu 2022).

Regarding the control variables, they all exhibit expected signs. Indeed, the coefficients associated with GDP per capita are positive and statistically significant at the 1% level, suggesting that per capita GDP increases economic complexity. This result can be explained by the fact that economic growth provides the government with enough income to supply public services such as schools and individuals with enough income to afford the cost of education. This improves human capital accumulation, which is an important determinant of economic complexity. Moreover, it is widely acknowledged in the literature that economic growth provides the economy with enough income to afford the high cost relative to the implantation of high-tech industries. This result is consistent with that of Lapatinas and Litina (2019), Chu (2020), and Bahar et al. (2020). Moreover, we found that government spending has a positive and significant effect on economic complexity. A plausible explanation for this result is that government spending can favour economic complexity through beneficial externalities and the provision of public goods such as public schooling, public order, and efficient legal systems (Colombier 2009; Ghali 1999). Furthermore, we found that total natural resource rents impede economic complexity. In other words, high income from the sale of natural resources leads to lower levels of economic complexity. This result is corroborated by facts as we can see countries such as Congo, RDC, and Tchad that have important income from natural resources but still have the lowest indicators in terms of economic complexity. This has been commonly described in the literature as the "Dutch disease." Gylfason (2001) explains that the export of natural resources can lead to an appreciation of the national currency, which by nature renders the other sectors of the economy less competitive and thus reduces economic complexity.

Robustness check

In this subsection, we establish the robustness of our results following various specifications. Firstly, we construct an alternative measure of ICT and, secondly, we use an alternative measure of economic complexity, which is economic fitness.

-

Alternative measure of ICT

We first test the robustness of our results with the use of an alternative measure of ICT. We construct this alternative ICT index based on the two previous measures (ICT quality and ICT quantity) using principal component analysis (PCA). The results of this exercise are presented in Table 3. We found that the coefficient associated with the new measure of ICT remains positive and statistically significant at a 1% significance level suggesting that this new indicator of ICT improves economic complexity. An increase in ICT by 10 percent leads to an improvement in economic complexity by 1.56% and 1.13% when we apply the FMOLS and DOLS, respectively. The coefficients of GDP and government spending remain positive and statistically significant, while those of total natural resource rents remain negative and statistically significant as above. Our results are therefore robust to the use of an alternative measure of ICT.

-

Alternative measure of ECI

In this subsection, we continue to check the robustness of our results using an alternative measure of economic complexity, which is economic fitness. The results are presented in Table 4 and Table 5, when we use ICT quality and quantity, respectively. We find that the coefficients associated with the measures of ICT quality and quantity positively and significantly affect economic fitness at a 1% significance level. In other words, increases in both ICT quality and quantity improve the level of economic complexity measured here by economic fitness. Moreover, we find that the coefficient associated with economic growth and government spending remains positive and statistically significant, suggesting that GDP and government spending improve the level of economic complexity. However, the coefficient of total natural resource rents remains negative and statistically significant, meaning that natural resource rents are detrimental to economic complexity. This result is supported by the Dutch disease discussed above (see Sachs and Warner (1995) for more explanations). We can then conclude that our results hold up even if we use a different measure of economic complexity.

Results of panel causality test

The results obtained in Tables 1 and 2 provide a view of the long-term relationship between ICT (quality and quantity) and economic complexity. However, these results do not provide any information on the direction of the relationship between the different variables. To examine the causal relationship between our variables, we apply the pair-wise Granger causality panel tests, and the results are summarized in Table 6. This test reports the results for both unidirectional and bidirectional causality between variables. Our results provide empirical proof supporting the existence of a bidirectional causality between ICT and economic complexity in the long run in both models at a 1% significance level. These results mean that a change in ICT (both quality and quantity) leads to variations in the level of economic complexity, and as a result, economic complexity causes ICT (i.e., the feedback effect). In other words, ICT (both quality and quantity) can predict economic complexity, and economic complexity can predict ICT (both quality and quantity) too. Moreover, there exists a bidirectional causality between economic complexity and economic growth in the long run at a 1% significance level. This result suggests that changes in economic complexity affect economic growth in the long run and vice versa. Furthermore, there is empirical evidence to support the existence of bidirectional causality between government spending and economic complexity at a 1% significance level. This result implies that changes in government spending have significant effects on economic complexity and the other way round. Furthermore, we fail to accept the hypotheses of no causality from economic complexity to total natural resource rents. This means that, in the long run, economic complexity can predict total natural resource rents. Moreover, there is proof of bidirectional causality between ICT and GDP in the long run, which demonstrates that ICT can predict GDP and GDP can also predict ICT in the long run. There exists a unidirectional long-run causality running from ICT to government spending, but there is no evidence of the inverse direction. The results indicate that ICT supports government spending in the long run. There exists empirical proof of bidirectional causality between ICT quality and total natural resource rents in the long run. Besides, it is noteworthy that there is bidirectional causality between government spending and economic growth in the long run. At a 1% significance level, there is also a bidirectional causality between total natural resource rents and economic growth. The bidirectional causality is also found for total natural resource and government spending at a 1% significance level, suggesting that total natural resource rents can predict government consumption and government spending can also predict total natural resource rents in the long run.

Conclusion and policy recommendations

The lack of empirical studies that investigated the relationship between ICT (both quality and quantity) and economic complexity motivated this study to examine the effect of ICT on economic complexity in 112 countries over the period 1986–2017. To address the problems of cross-sectional dependence, heterogeneity of slope, and the endogeneity issue, this paper employs the CIPS and CADF unit root tests, the Westerlund panel cointegration test, fully modified OLS, dynamic OLS estimators, and pair-wise Granger panel causality tests. The following results are established: First, the results suggest that the data is strongly cross-sectionally dependent across countries because of growing economic interdependencies and that slope heterogeneity is confirmed. Second, the Westerlund panel cointegration test shows that ICT, economic complexity, per capita GDP, government spending, and total natural resource rents are cointegrated. Third, the fully modified OLS and dynamic OLS estimators reveal that ICT (both quality and quantity), economic growth, and government spending are positively correlated with economic complexity, while natural resource rents are negatively correlated with economic complexity. This result is robust to the use of an alternative measure of economic complexity. Four, pair-wise Granger causality panel tests show proof of the existence of bidirectional causality between ICT (both quality and quantity) and economic complexity in the long run.

Based on the following results, we have formulated some policies that will assist policymakers in the process of increasing the sophistication of their economies. In view of the positive effects of ICT on economic complexity, governments in the selected sample should implement a series of policies to improve both the quality and quantity of ICT to promote the sophistication of their economies. In addition, the two-way causality between ICT and economic complexity may be a suggestion to policymakers that the targets of improving the quality and extending the use of ICT and improving ECI are compatible and linked to each other.

Our study is not without limits. First, the analysis uses a limited number of variables to determine economic complexity. Future research should include other variables that influence economic complexity, such as official development assistance and urbanization. Secondly, future research can further analyse the non-linear relationship between ICT and economic complexity using a more appropriate method such as Panel Smooth Transition Regression (PSTR). This could help improve the understanding of the effect of ICT on economic complexity. Finally, this study focuses on the cross-country link between ICT and economic complexity. However, there are significant variations in ICT (both quality and quantity) and economic complexity across regions within a country. Subsequent studies, therefore, may focus on a single country to explore the link between ICT (quality and quantity) and the ECI thus taking into account each country’s specificity.

Availability of data and materials

The datasets used during and/or analysed during the current research are available in the DataStream, WDI: World Development Indicators: https://databank.worldbank.org/source/worlddevelopment-indicators. OEC: Observatory of Economic complexity: http://atlas.media.mit.edu. V-DEM: varieties of democracies: https://www.v-dem.net/vdemds.html. World Bank Catalog: https://databank.worldbank.org/source/economic-fitness. PolityIV Project: http://www.systemicpeace.org/inscrdata.html. The ICT at: https://osf.io/qyagv/.

Notes

The list of countries is presented in table A7 in the appendix.

This data can be freely accessed here:http://atlas.media.mit.edu.

Hausmann et al. (2011), states that “a country has revealed a comparative advantage in a product if it exports more than its ‘fair’ share, that is, a share that is equal to the share of total world trade that the product represents.”.

References

Abeliansky AL, Hilbert M (2017) Digital technology and international trade: Is it the quantity of subscriptions or the quality of data speed that matters? Telecommun Policy 41(1):35–48

Abeliansky AL, Barbero J, Rodriguez-Crespo E (2021) ICTs quality and quantity and the margins of trade. Telecommunications Policy 45(1):102056

Afonso A, Jalles JT (2016) Economic performance, government size, and institutional quality. Empirica 43(1):83–109

Aitken BJ, Harrison AE (1999) Do domestic firms benefit from direct foreign investment? Evi Venez Am Econ Rev 89(3):605–618

Ajide FM (2022) Economic complexity and entrepreneurship: insights from Africa. IJDI 21(3):367–388

Ali MSB (2020) Does ICT promote democracy similarily in developed and developing countries? A linear and nonlinear panel threshold framework. Telemat Inf 50:101382

Antonietti R, Franco C (2021) From FDI to economic complexity: a panel Granger causality analysis. Struct Chang Econ Dyn 56:225–239

Antonietti R, Bronzini R, Cainelli G (2015) Inward Greenfield FDI and innovation. Econ Polit Ind 42(1):93–116

Appiah-Otoo I, Song N (2021) The impact of ICT on economic growth-Comparing rich and poor countries. Telecommun Policy 45(2):102082

Asongu SA, Odhiambo NM (2019) How enhancing information and communication technology has affected inequality in Africa for sustainable development: An empirical investigation. Sustain Dev 27(4):647–656

Asongu SA, Le Roux S, Biekpe N (2018) Enhancing ICT for environmental sustainability in sub-Saharan Africa. Technol Forecast Soc Chang 127:209–216

Asongu S, Amari M, Jarboui A, Mouakhar K (2021) ICT dynamics for gender inclusive intermediary education: minimum poverty and inequality thresholds in developing countries. Telecommun Policy 45(5):102125

Atasoy BS (2021) The determinants of export sophistication: Does digitalization matter? Int J Financ Econ 26(4):5135–5159

Avom D, Nkengfack H, Fotio HK, Totouom A (2020) ICT and environmental quality in Sub-Saharan Africa: Effects and transmission channels. Technol Forecast Soc Chang 155:120028

Bahar D, Rapoport H, Turati R (2020) Birthplace diversity and economic complexity: Cross-country evidence. Res Pol. https://doi.org/10.1016/S0165-1765(00)00220-2

Bajo-Rubio O (2000) A further generalization of the Solow growth model: the role of the public sector. Econ Lett 68(1):79–84

Balkin, J. M. (2017). Digital speech and democratic culture: A theory of freedom of expression for the information society In Paul Schiff Berman (Eds) Law and Society Approaches to Cyberspace. Routledge, (pp. 325–382)

Bhattacherjee A, Shrivastava U (2018) The effects of ICT use and ICT Laws on corruption: a general deterrence theory perspective. Gov Inf Q 35(4):703–712

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253

Cerrato, M., & Sarantis, N. (2002). The cross sectional dependence puzzle. London Guildhall University.

Chu LK (2020) The effects of financial development on economic sophistication: evidence from panel data. Appl Econ Lett 27(15):1260–1263

Coccia M (2017) Sources of technological innovation: Radical and incremental innovation problem-driven to support competitive advantage of firms. Technol Anal Strat Manage 29(9):1048–1061

Coccia M (2020) Asymmetry of the technological cycle of disruptive innovations. Technol Analy Strateg Manage 32(12):1462–1477

Coccia M (2021) Technological Innovation. Innovations 11:I12

Colombier C (2009) Growth effects of fiscal policies: an application of robust modified M-estimator. Appl Econ 41(7):899–912

De Silva S, Hadri K, Tremayne AR (2009) Panel unit root tests in the presence of cross-sectional dependence: finite sample performance and an application. Economet J 12(2):340–366

Demir F (2022) IMF conditionality, export structure and economic complexity: The ineffectiveness of structural adjustment programs. J Comp Econ 50(3):750

Dutta UP, Gupta H, Sengupta PP (2019) ICT and health outcome nexus in 30 selected Asian countries: Fresh evidence from panel data analysis. Technol Soc 59:101184

Fernández-Gutiérrez M, Gimenez G, Calero J (2020) Is the use of ICT in education leading to higher student outcomes? Analysis from the Spanish Autonomous Communities. Comput Educ 157:103969

Fomba Kamga B, Talla Fokam DND, Nchofoung TN (2022) Internet access and innovation in developing countries: some empirical evidence. Trans Corp Rev. https://doi.org/10.1080/19186444.2022.2082227

Fu X, Gong Y (2011) Indigenous and foreign innovation efforts and drivers of technological upgrading: evidence from China. World Dev 39(7):1213–1225

Ghali KH (1999) Government size and economic growth: evidence from a multivariate cointegration analysis. Appl Econ 31(8):975–987

Gholami R, Tom Lee SY, Heshmati A (2006) The causal relationship between information and communication technology and foreign direct investment. World Econ 29(1):43–62

Gnangnon SK (2020) Effect of the internet on services export diversification. J Econ Integr 35(3):519–558

Gnangnon SK (2022) Effect of economic complexity on services export diversification: do foreign direct investment inflows matter? Int J Dev Issues. https://doi.org/10.1108/IJDI-01-2022-0023

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377

Gylfason T (2001) Natural resources, education, and economic development. Eur Econ Rev 45(4–6):847–859

Ha LT (2022) Digital business and economic complexity. J Comput Inform Syst 2:1–14

Hartmann D, Guevara MR, Jara-Figueroa C, Aristarán M, Hidalgo CA (2017) Linking economic complexity, institutions, and income inequality. World Dev 93:75–93

Hausmann R, Hidalgo CA, Bustos S, Coscia M, Simoes A (2011) The atlas of economic complexity: mapping paths to prosperity. Center for International Development/MIT Media Lab, Cambridge, MA

Hidalgo CA, Hausmann R (2009) The building blocks of economic complexity. Proc Natl Acad Sci 106(26):10570–10575

Higón DA, Gholami R, Shirazi F (2017) ICT and environmental sustainability: A global perspective. Telemat Inform 34(4):85–95

Hilbert, M. (2019). Digital Data Divide Database. Available at SSRN 3345756. Rochester, NY: Social Science Research Network. https://osf.io/qyagv/.

Hitt LM (1999) Information technology and firm boundaries: Evidence from panel data. Inf Syst Res 10(2):134–149

Hong JP (2017) Causal relationship between ICT R&D investment and economic growth in Korea. Technol Forecast Soc Chang 116:70–75

IUT (2021). International Telecommunication Union (ITU). (2021). Measuring digital development: Facts and figures 2021: https://www.itu.int/en/ITU-D/Statistics/Pages/facts/default.aspx

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration—with applications to the demand for money. Oxford Bull Econ Stat 52(2):169–210

Kamguia B, Tadadjeu S, Miamo C, Njangang H (2022) Does foreign aid impede economic complexity in developing countries? Intl Econ 169:71–88

Kannen P (2020) Does foreign direct investment expand the capability set in the host economy? A Sectoral Analysis. World Econ 43(2):428–457

Kanyam DA, Kostandini G, Ferreira S (2017) The mobile phone revolution: have mobile phones and the internet reduced corruption in Sub-Saharan Africa? World Dev 99:271–284

Kao C, Chiang MH, Chen B (1999) International R&D spillovers: an application of estimation and inference in panel cointegration. Oxford Bull Econ Stat 61(S1):691–709

Keneck-Massil J, Nvuh-Njoya Y (2021) Did colonisation matter for comparative economic complexity? Econ Lett 203:109851

Kılıçaslan Y, Töngür Ü (2019) ICT and employment generation: evidence from Turkish manufacturing. Appl Econ Lett 26(13):1053–1057

Kouladoum JC, Wirajing MAK, Nchofoung TN (2022) Digital technologies and financial inclusion in Sub-Saharan Africa. Telecommun Policy 46(9):102387

Lapatinas A (2019) The effect of the Internet on economic sophistication: An empirical analysis. Econ Lett 174:35–38

Lapatinas A, Litina A (2019) Intelligence and economic sophistication. Empir Econ 57(5):1731–1750

Latif Z, Latif S, Ximei L, Pathan ZH, Salam S, Jianqiu Z (2018) The dynamics of ICT, foreign direct investment, globalization and economic growth: Panel estimation robust to heterogeneity and cross-sectional dependence. Telemat Inform 35(2):318–328

Licht AN, Siegel JI (2006) The Social Dimensions of Entrepreneurship. In: Anuradha B, Mark C, Nigel W, Bernard Y (eds) The Oxford Handbook ofEntrepreneurship. Oxford University Press, Oxford

Livingstone S (2012) Critical reflections on the benefits of ICT in education. Oxf Rev Educ 38(1):9–24

Maurya G, Sahu S (2022) Cross-country variations in economic complexity: The role of individualism. Econ Model 115:105961

Mbongo LDBE, de Berquin L (2019) ICT diffusion and employment in Africa’’. Economics Bulletin 39(1):521–532

Nchofoung TN, Asongu SA (2022) ICT for sustainable development: Global comparative evidence of globalisation thresholds. Telecommun Policy 46(5):102296

Nguyen CP (2021) Gender equality and economic complexity. Econ Syst 45:100921

Nguyen CP, Schinckus C, Su TD (2020) The drivers of economic complexity: International evidence from financial development and patents. Int Econ 164:140–150

Njangang H, Nounamo Y (2020) Is information and communication technology a driver of industrialization process in African countries? Econ Bull 40(4):2654–2662

Njangang H, Asongu S, Tadadjeu S, Nounamo Y (2021) Is financial development shaping or shaking economic sophistication in African countries? SSRN J. https://doi.org/10.2139/ssrn.3806772

Njangang H, Beleck A, Tadadjeu S, Kamguia B (2022) Do ICTs drive wealth inequality? Evidence from a dynamic panel analysis. Telecommun Policy 46(2):102246

North DC (1990) Institution, institutional change and economic performance. Cambridge University Press, Cambridge

Ofori IK, Asongu SA (2021) ICT diffusion, foreign direct investment and inclusive growth in Sub-Saharan Africa. Telemat Inform 65:101718

Ofori IK, Armah MK, Taale F, Ofori PE (2021) Addressing the severity and intensity of poverty in Sub-Saharan Africa: how relevant is the ICT and financial development pathway? Heliyon 7(10):e08156

Ofori IK, Osei DB, Alagidede IP (2022) Inclusive growth in Sub-Saharan Africa: Exploring the interaction between ICT diffusion, and financial development. Telecommun Policy 46(7):102315

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Economet Theor 20(3):597–625

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Economet 22(2):265–312

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econom 142(1):50–93

Pesaran MH, Ullah A, Yamagata T (2008) A bias-adjusted LM test of error cross-section independence. Economet J 11(1):105–127

Phillips PC, Hansen BE (1990) Statistical inference in instrumental variables regression with I (1) processes. Rev Econ Stud 57(1):99–125

Saadi M (2020) Remittance inflows and export complexity: New evidence from developing and emerging countries. Journal Dev Stud 56(12):2266–2292

Sachs, J. D., & Warner, A. (1995). Natural resource abundance and economic growth.

Sassi S, Ali MSB (2017) Corruption in Africa: What role does ICT diffusion play. Telecommun Policy 41(7–8):662–669

Sawng YW, Kim PR, Park J (2021) ICT investment and GDP growth: Causality analysis for the case of Korea. Telecommun Policy 45(7):102157

Shahbaz M, Lean HH (2012) Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 40:473–479

Shahbaz M, Shahzad SJH, Mahalik MK, Sadorsky P (2018) How strong is the causal relationship between globalization and energy consumption in developed economies? A country-specific time-series and panel analysis. Appl Econ 50(13):1479–1494

Stanley TD, Doucouliagos H, Steel P (2018) Does ICT generate economic growth? A meta-regression analysis. J Econ Surv 32(3):705–726

Stock JH, Watson MW (1993) A simple estimator of cointegrating vectors in higher order integrated systems. Econom J Econom Soc 61:783–820

Strauss J, Yigit T (2003) Shortfalls of panel unit root testing. Econ Lett 81(3):309–313

Sweet CM, Maggio DSE (2015) Do stronger intellectual property rights increase innovation? World Dev 66:665–677

Tacchella A, Cristelli M, Caldarelli G, Gabrielli A, Pietronero L (2012) A new metrics for countries’ fitness and products’ complexity. Sci Rep 2:723

Tacchella A, Cristelli M, Caldarelli G, Gabrielli A, Pietronero L (2013) Economic complexity: conceptual grounding of a new metrics for global competitiveness. J Econ Dyn Control 37(8):1683–1691

Tugcu CT (2018) Panel data analysis in the energy-growth nexus (EGN). The economics and econometrics of the energy-growth nexus. Elsevier, Academic Press, pp 255–271

Valette J (2018) Do migrants transfer productive knowledge back to their origin countries? J Develop Stud 54(9):1637–1656

Vu TV (2022) Does institutional quality foster economic complexity? The fundamental drivers of productive capabilities. Empir Econ 63:1–34

Wang B, Zhao W, Yang X (2022) Do economic complexity and trade diversification promote green growth in the BRICTS region Evidence from advanced panel estimations. Econ Res Ekonom Istraži. https://doi.org/10.1080/1331677X.2022.2142148

Westerlund J (2005) New simple tests for panel cointegration. Economet Rev 24(3):297–316

Zhu S, Fu X (2013) Drivers of export upgrading. World Dev 51:221–233

Zhu S, Li R (2017) Economic complexity, human capital and economic growth: empirical research based on cross-country panel data. Appl Econ 49(38):3815–3828

Acknowledgements

we would like to thank Dr Henri Njangang, Dr Sosson Tadadjeu, Dr Brice Kamguia and Mr Tii Nchofoung for their constructive comments, which enabled us to improve considerably the earlier version of this article. All errors are our responsibility.

Funding

No funding was received for this research.

Author information

Authors and Affiliations

Contributions

HTO Proofreading and Editing. RD Conceptualization, Methodology, Software, Data curation, Validation, Formal analysis, Writing- Original draft preparation, Writing- Reviewing and Editing. AMN Proofreading and Editing.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflicts of interest.

Ethical approval

The Authors declare that this research article complies with the ethical standard.of this journal.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Oumbé, H.T., Djeunankan, R. & Ndzana, A.M. Does information and communication technologies affect economic complexity?. SN Bus Econ 3, 92 (2023). https://doi.org/10.1007/s43546-023-00467-8

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-023-00467-8