Abstract

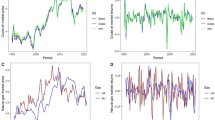

This study examines the effect of exchange rate fluctuation on non-oil export by focusing on both manufactured exports and agriculture exports in Nigeria between 1970 and 2019. The study employs the vector error correction framework, the impulse response and variance decomposition analyses to analyse data on agriculture exports, manufacturing exports, exchange rate, interest rate, and inflation rate. Findings suggest that long run relationship exists among the variables. The vector error correction analysis reveals that exchange rate depreciation positively impacts agriculture exports but negatively impacts manufacturing exports in Nigeria. However, both the impulse response and variance decomposition analyses confirm that exchange rate fluctuation has a higher significance on manufacturing exports than agriculture exports by accounting for the largest forecast error variance in manufacturing exports than in agriculture exports over the forecast horizon. We conclude that fluctuations in exchange rate significantly impact the non-oil exports in Nigeria. Hence, to enhance the non-oil exports, government could consider enhancing the local capacity to produce for exports by reducing tariffs for manufactured inputs. They can also set up modular mechanised farms for agriculture graduates and farmers to boost agriculture exports and stabilize the exchange rate.

Similar content being viewed by others

Data availability

The data for the study would be made available upon request from the journal editors.

References

Adeosun OT, Gbadamosi II (2021) Impact of non-oil sectors on GDP/capita in selected African countries: evidence from panel analysis. World J Sci Technol Sustain Dev 18(3):274–284

Akinlo AE, Adejumo VA (2014) Exchange rate volatility and non-oil exports in Nigeria: 1986–2008. Int Bus Manag 9(2):70–79

Alagidede P, Ibrahim M (2017) On the causes and effects of exchange rate volatility on economic growth: evidence from Ghana. J Afr Bus 18(2):169–193

Arize AC (1998) The effects of exchange rate volatility on US imports: an empirical investigation. Int Econ J 12(3):31–40

Aro-Gordon S (2017) Econometric analysis of exchange rate and export performance in a developing economy. Asian Econ Financ Rev 7(4):334–348

Boltho A (1996) The assessment: international competitiveness. Oxf Rev Econ Policy 12(3):1–16

Bryan R, Hopper P, Mann C (1993) Evaluating policy regimes: new empirical research in empirical macroeconomics. Brookings Institution, Washington

Central Bank of Nigeria (2021) Annual statistical bulletin. https://www.cbn.gov.ng/documents/statbulletin.asp. Accessed 06 July 2021

Charles A, Mesagan E, Saibu M (2018) Resource endowment and export diversification: implications for growth in Nigeria. Stud Bus Econ 13(1):29–40

Chatterjee A, Dix-Carneiro R, Vichyanond J (2013) Multi-product firms and exchange rate fluctuations. Am Econ J Econ Policy 5(2):77–110

Chenery HB (1975) The structuralist approach to development policy. Am Econ Rev 65(2):310–316

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econom J Econom Soc 55(2):251–276

Engle R, Granger C (1991) Long-run economic relationships: readings in cointegration. Oxford University Press, Oxford

Eregha PB, Mesagan EP (2016) Oil resource abundance, institutions and growth: evidence from oil producing African countries. J Policy Model 38(3):603–619

Fang W, Lai Y, Miller SM (2005) Export promotion through exchange rate policy: exchange rate depreciation or stabilization? University of Connecticut, Department of Economics, working paper series

Hasanov F, Samadova I (2010) The impact of real exchange rate on non-oil exports: The case of Azerbaijan. ECO Econ J 2(1):23–39

Hassan A, Dantama YU (2017) Determinants of exchange rate volatility: new estimates from Nigeria. East J Econ Financ 3(1):1–12

Hoang T, Thi V, Minh H (2020) The impact of exchange rate on inflation and economic growth in Vietnam. Manag Sci Lett 10(5):1051–1060

Ireland PN (2010) Monetary transmission mechanism. Monetary economics. Palgrave Macmillan, London, pp 216–223

Isola WA, Mesagan PE (2014) Impact of oil production on human condition in Nigeria. West Afr J Monet Econ Integr 14(1):84–102

Kazerooni A, Feshari M (2010) The impact of the real exchange rate volatility on non-oil exports: the case of Iran. J Int Econ Stud 36:9–18

Kollmann R (2005) Macroeconomic effects of nominal exchange rate regimes: new insights into the role of price dynamics. J Int Money Financ 24:275–292

Kromtit MJ, Kanadi C, Ndangra DP, Lado S (2017) Contribution of non oil exports to economic growth in Nigeria (1985–2015). Int J Econ Financ 9(4):253

Lütkepohl H (2005) New introduction to multiple time series analysis. Springer Science & Business Media, Berlin, p 63

Lv X, Lien D, Chen Q, Yu C (2018) Does exchange rate management affect the causality between exchange rates and oil prices? Evidence from oil-exporting countries. Energy Econ 76:325–343

Mahmoud E (1984) Accuracy in forecasting: a survey. J Forecast 3(2):139–159

McNees SK (1986) Forecasting accuracy of alternative techniques: a comparison of US macroeconomic forecasts. J Bus Econ Stat 4(1):5–15

Mesagan EP (2021) Efficiency of financial integration, foreign direct investment and output growth: policy options for pollution abatement in Africa. Econ Issues 26(1):1–19

Mesagan EP, Shobande OA (2016) Role of apex banks: the case of Nigerian economy. J Econ Bus Res 22(2):171–186

Mesagan EP, Alimi OY, Yusuf IA (2018) Macroeconomic implications of exchange rate depreciation: the Nigerian experience. Int Res J 16(3):235–258

Mesagan E, Unah A, Idowu O, Alamu A (2019a) Oil resource abundance in Nigeria and Iran: contrapuntal effect on social and economic welfare. BizEcons Q 4:3–22

Mesagan PE, Yusuf AI, Ogbuji AI (2019b) Natural resource endowment and output growth: How crucial is deficit financing in managing resource-rich African economies? J Soc Econ Dev 21:353–369

Mesagan EP, Akinyemi AK, Yusuf IA (2021) Financial integration and pollution in Africa: the role of output growth and foreign direct investment. Int J Big Data Min Glob Warm 3(1):1–21

Mishkin FS (1995) Symposium on the monetary transmission mechanism. J Econ Perspect 9(4):3–10

Mishkin FS (1996) The channels of monetary transmission: lessons for monetary policy (No. w5464). National Bureau of Economic Research

Mordi CNO (2006) Challenges of exchange rate volatility in economic management in Nigeria. CBN Bullion 30(3):17–25

Nwodo OS, Asogwa FO (2017) Global integration, non-oil export and economic growth in Nigeria. Acad J Econ Stud 3(1):59–57

Omojolaibi JA, Mesagan EP, Adeyemi OS (2015) the impact of non-oil export on domestic investment in Nigeria. Empir Econom Quant Econ Lett 4(3):15–29

Orji A, Ogbuabor JE, Okeke C, Anthony-Orji OI (2018) Another side of the coin: exchange rate movements and the manufacturing sector in Nigeria. J Infrastruct Dev 10(1–2):63–79

Oyelami LO, Ajeigbe OM (2021) Exchange rate volatility and sectoral analysis of non-oil export in Nigeria. Zagreb Int Rev Econ Bus 24(1):21–36

Ribeiro RS, McCombie JS, Lima GT (2020) Does real exchange rate undervaluation really promote economic growth? Struct Chang Econ Dyn 52:408–417

Sala-i-Martin X, Subramanian A (2013) Addressing the natural resource curse: an illustration from Nigeria. J Afr Econ 22(4):570–615

Singhal S, Choudhary S, Biswal PC (2019) Return and volatility linkages among international crude oil price, gold price, exchange rate and stock markets: Evidence from Mexico. Resour Policy 60:255–261

Taylor JB (1995) The monetary transmission mechanism: an empirical framework. J Econ Perspect 9:11–26

United States Trade Representatives (2012) Trade summary and policies in Nigeria. https://ustr.gov/sites/default/files/Nigeria_0.pdf. Accessed 22 Nov 2019

Vieira FV, MacDonald R (2016) Exchange rate volatility and exports: a panel data analysis. J Econ Stud 43(2):203–221

Waheed R, Sarwar S, Dignah A (2020) The role of non-oil exports, tourism and renewable energy to achieve sustainable economic growth: What we learn from the experience of Saudi Arabia. Struct Chang Econ Dyn 55:49–58

World Development Indicators (2021) World Bank Databank. https://databank.worldbank.org/reports.aspx?source=world-development-indicators. Accessed 05 July 2021

Yildirim Z, Arifli A (2021) Oil price shocks, exchange rate and macroeconomic fluctuations in a small oil-exporting economy. Energy 219:119527

Yildirim Z, Ivrendi M (2016) Exchange rate fluctuations and macroeconomic performance: evidence from four fast-growing emerging economies. J Econ Stud 43(5):678–698

Acknowledgements

We claim responsibility for all notable flaws and the entire content.

Funding

There is no funding received for this study.

Author information

Authors and Affiliations

Contributions

EPM: the drafting and writing of the paper (65%). KK: data collection and analysis (20%). DIU: literature review, and editorial (15%).

Corresponding author

Ethics declarations

Conflict of interest

There are no conflict of interests in the paper.

Rights and permissions

About this article

Cite this article

Mesagan, E.P., Kushimo, K. & Umar, D.I. Do fluctuations in exchange rate hinder non-oil export? An analysis of agriculture and manufacturing in Nigeria. SN Bus Econ 1, 151 (2021). https://doi.org/10.1007/s43546-021-00156-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-021-00156-4