Abstract

This paper examines the role played by the entrepreneurial, firm-specific and external environment-related parameters in impacting the competitiveness of Indian high-tech start-ups, considering start-up survival as a milestone and using survival analysis techniques for the analysis. The study uses primary data collected from 175 Indian high-tech start-ups that are headquartered across the country, using a semi-structured questionnaire and in-depth interviews with the top-level management of the sample firms for analysis. Among the firm-related factors, sales and R&D capabilities of the start-ups have shown to be of paramount importance in influencing the competitiveness of high-tech start-ups. Further, among the external environment-specific attributes, the SDP growth in the region is shown to have significant influence on the competitiveness of high-tech start-ups (borderline significant). This paper makes a key contribution to the existing literature by empirically identifying the key entrepreneur-specific, firm-specific and external environment-specific factors of a firm that influence the competitiveness of high-tech start-ups that are in pre-growth stage in a developing economy. The findings of the study will help start-up owners and policy-makers to make adjustments in their policy-making and strategy to enhance the competitiveness of the technology-based startups operating in India.

Similar content being viewed by others

Introduction

As nations transition into knowledge driven economies, technology-based entrepreneurship has emerged as a credible instrument of job creation, innovation and wealth creation (Kirchhoff and Spencer, 2008). Entrepreneurial leaders and their new business models that exploit the changes in the external environment have been the key drivers of this transition. New technologies, inventions and their rate of proliferation into the masses has exponentially accelerated in the past five decades. As a result of this rapid technological change, new entrepreneurial opportunities have emerged, leading to creation of new products, new processes and new ways of servicing people’s needs (Start-up Genome Report, 2012). Bailetti (2012) defined technology entrepreneurship as “an investment in a project that assembles and deploys specialized individuals, heterogeneous scientific and technological knowledge-based assets for the purpose of value creation and capture for a firm”. Numerous technology-based start-ups have surfaced as entrepreneurs across the world seek to operationalize their ideas into new products and services.

India is no exception to this trend. Although still at a very nascent stage, India has emerged as the third-largest startup ecosystem in the world in terms of the number of startups (NASSCOM Start-up Report, 2019). India has seen a steady rise in the number of start-ups created over the past decade, with about 9000 technology-based start-ups operational in the country, growing between 12 and 15% year on year. The Indian start-up ecosystem attracted more than 390 active institutional investors who funded deals worth over $4.4 billion in just the first nine months of 2019. There are about 24 active unicorns (startups that have been assessed with a valuation exceeding USD 1 billion) operating out of India as of 2019 and the sector has created about 60,000 direct jobs and about 150,000 indirect jobs (NASSCOM Start-up Report, 2019).

At a macro-level, the above developments of technology-based entrepreneurship appear to be very promising. However, it is to be noted that failure rate among the technology-based start-ups is very high, and most technology-based start-ups do not see the light of the day beyond the first couple of years of operations (Certo, 2003; Stinchcombe, 1965). Ajitabh and Momaya (2004) noted that survival and success of businesses in the twenty-first century increasingly depend on their competitiveness. Prior research has observed that tech-start-ups need to deal with a lot of uncertainty across many different dimensions in their early days. Therefore, it is appropriate to assume that all the contributions that are attributed to the technology-based start-up sector emanate from those few start-ups who are able to navigate through the multiple challenges in their initial years of operation, survive and emerge successful (Bala Subrahmanya, 2017; Krishna, 2019).

The above observation brings to fore the importance of competitiveness in influencing the survival and success of technology-based start-ups. The competitiveness of a firm refers to its capacity to viably compete in a given market, leading to an increase of the firm’s market share, and subsequently make an entry into operations at international markets by way of exports, resulting in the achievement of sustainable and long-term growth and profitability (Cetindamar and Kilitcioglu, 2013). Wu et al. (2008) described firm-level competitiveness as the ability of the firm to optimally deploy and mobilize its assets and capabilities to derive competitive advantage in the market. The onset of COVID-19 pandemic and its aftermath resulting in nations increasingly looking to reduce external country reliance in strategic areas (Koleson, 2020; Viola, 2020) also increase the onus on how technology-based startups can help increase India’s competitiveness.

A review of extant literature indicates very little empirical research has been done to examine this phenomenon. This study aims to address this gap. By considering start-up survival as a milestone of achievement of a minimum threshold level of competitiveness, this study is conducted to identify the key factors (entrepreneur or founder-specific, firm-specific and external entrepreneurial environment-related) that inhibit or accelerate the competitiveness of technology-based start-ups operating in India.

Literature Review

Competitiveness is reviewed in prior literature as a multidimensional construct, and is generally explored as an output measure in the context of technology-based start-ups (Ajitabh and Momaya, 2004; Acquaah and Yasai-Ardekani, 2008; Singh and Gaur, 2018. Competitiveness has been studied at three different levels—national, regional or industry and firm level. There is established literature dealing with national competitiveness and annual global competitiveness studies and reports, such as the Global Competitiveness Index (GCI) from World Economic Forum (WEF), Yearbook from International Institute for Management Development (IMD), National Competitiveness Report (NCR), from Institute of Professional Studies (IPS) are published once every 1 or 2 years to assess the same (Schwab, 2019; IMD, 2020; Momaya, 2019). Meyer-Stamer (2008) defined regional competitiveness as ‘the ability of a locality or region to generate high and rising incomes and improve livelihoods of the people living there’. Momaya (2001) described the key tenets of industrial competitiveness using the Assets, Processes and Performance model and in the process explained how certain industries contributed significantly to the competitiveness of their respective countries.

In the context of technology-based start-ups, the firm-level competitiveness has been explained as being influenced by the three dimensions namely, entrepreneurial or founder-specific, firm-specific and external entrepreneurial environment (ecosystem) related factors (Wiklund et al., 2009; Cader and Leatherman, 2011). It is therefore pertinent to examine the micro factors related to the above dimensions and comprehend the factors that influence technology-based start-ups’ competitiveness. Entrepreneurship research in its early years focused heavily on using the behavioral aspects and characteristics of the entrepreneur for studying any kind of output measures of firms, such as performance, competitiveness among others (Brockhaus, 1982; McClelland, 1961; Ronstadt, 1988; Storey, 1982). Later on, Brüderl et al. (1992) observed that the education background and credentials of the lead entrepreneur, the general and industry-specific work experience of the founders of technology-based start-ups greatly enhanced the survival of the start-ups. However, over the recent years, factors, such as prior start-up experience (Politis, 2008) and entrepreneurial orientation of entrepreneur (Caliendo and Kritikos, 2010; Wiklund et al, 2019), have garnered much attention. The entrepreneur’s age (Furdas and Kohn, 2011) has been discussed as another key factor influencing the competitiveness of technology-based start-ups.

As regards the firm-related factors influencing competitiveness of technology-based startups, Kim et al. (2006) and Criaco et al. (2014) described the benefits of human resources as being the enabler for the start-ups to address and mitigate the challenges related to funding (because highly educated entrepreneurs can relatively easily raise funds for their new venture), marketing (skilled founders can recognize the market needs better than their counterparts and therefore can create a market niche), formation of a close-knit network (on account of their higher social standing accrued due to their educational pedigree). There is unanimity in the prior literature regarding R&D investments and R&D capabilities influencing the technology-based start-up lifecycle and competitiveness (Adler et al., 2019; Cefis and Marsili, 2006).

Lloyd-Ellis and Bernhardt (2000) noted that many a times founders would complain about lack of availability and access to funding or finance mostly to cover up for their inadequacies in the technical and managerial functions of their firms. Estrin et al. (2006) and Giraudo et al., (2019) observed that financial constraints are not to be viewed as a barrier for achieving competitiveness, particularly from start-ups at their inception and survival stage. They noted that financial support was more critical to technology-based start-ups at the time of scaling up of their businesses as against in the start-up creation or survival of newly established firms.

From a perspective of external environment factors influencing competitiveness of technology-based startups, Millan et al. (2012) noted the role of government actions in ensuring the equilibrium of choice of occupation among the workforce. Cader and Leatherman (2011) deduced that sector-specific policies and conditions are more favourable to encourage survival of the technology-based firm, whereas agglomeration economies hinder the survival chances of these firms. Audretsch and Lehmann (2004) established that funding and availability of venture capital as another relevant aspect in impacting the technology-based start-up competitiveness in the pre-growth stages.

In summary, the above facets of literature review bring to fore the contribution of entrepreneur-specific, internal firm-related factors that influence the competitiveness of technology-based start-ups. Furthermore, the review indicates that certain external environment factors influence the firm-level competitiveness. Each of the above studies reviewed in the study examine the influence of individual factors on the competitiveness. It is well established that competitiveness is a multi-dimensional construct and individual factors alone cannot completely explain in entirety the phenomenon of firm-level competitiveness. Therefore, this study tries to address this gap by leveraging an integrative conceptual framework to examine firm-level competitiveness in the context of technology-based start-ups, considering start-up survival as a milestone for analysis of competitiveness.

There is growing evidence on the importance of technology-based start-ups in driving the productivity and competitiveness around the world (WEF Global Competitiveness Report, 2019). While there are some studies in examining the competitiveness of technology-based start-ups in other emerging countries (Mesquita et al., 2007; Acquaah et al., 2008), there is a scarcity of studies in the Indian context. India now ranks third across the globe in the number of start-ups—and therefore the lack of empirical investigation in this region deprives cross-country comparisons and hinders development of new knowledge which could benefit similar economies as India. It is for the above reason the present study assumes importance.

Two models of firm-level competitiveness have influenced the development of the conceptual framework required for the present study. Cetindamar and Kilitcioglu (2013) proposed a model of three pillars based on resource-based theory to assess firm-level competitiveness. The first pillar contained four outcome-based indicators—growth of the firm, export performance, value added and profit, and customer centricity and societal value generated. The second pillar contained input metrics (in Resource Based View (RBV) terminology) that represents the firm-specific factors, namely human resources, technology, innovation and design capabilities and financial resources. The third pillar accounted for the managerial processes and capabilities—largely a proxy for entrepreneurship and leadership characters exhibited by the senior leadership team and founders or co-founders.

Chikan (2008) proposed a generalized model to interlink and connect the national and firm competitiveness. At the national level, the output goal of the model was to increase the welfare of the citizens, while at the firm level, the output goal was to increase the productivity of firms involved in the ecosystem. Macro-level entities and factors, such as public institutions, government, macroeconomic policy and social norms, were depicted to work closely with firm-specific aspects, such as firm strategy, factor inputs, firm capabilities among others, to achieve the firm-level goal of achieving customer satisfaction with profits. The conceptual framework for the study was derived building on both of these models from the literature review.

Conceptual Framework

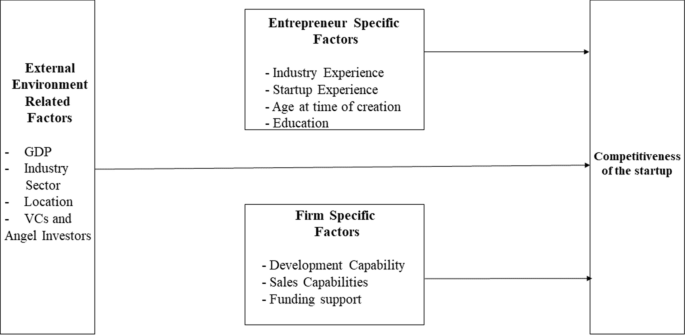

The conceptual framework used for the analysis of the data for the study is depicted in Fig. 1.

The conceptual framework captures the entrepreneur-specific capabilities (individual factors), the firm-based resources and the external environment-related factors impact the technology-based start-ups competitiveness. For the entrepreneur-specific capabilities, aspects, such as entrepreneur’s age, founders’ education, entrepreneur’s prior start-up and work experience, are considered for the analysis of this study. The financial capital or resources of the firm, the R&D and sales capabilities or resources of the firm are leveraged to characterize the firm-specific factors in this study. The State Domestic Product (SDP) of the region, the number of Venture Capital (VC) deals and the presence of VCs and angel investors in the region are considered as representatives of the external environment-related factors for the purposes of analysis of this study.

Research Design

This study is based out of India from the perspective of geography and regional context. Data from technology-based start-ups that are operating in the software products or services in the information technology sector are considered for the study. This implies that technology-based start-up firms including software engineering start-ups that deal with DevOps and business operations facilitation start-ups that have an established office including headquarters in India, and that have R&D investments in India (including start-up firms that have global offices) are also considered. Further, we restrict our study to cover start-ups that started operations after the year 2005. This restriction allows us to get a good spread of start-ups that initiated operations for a reasonable period of time.

Description of Variables and Measures

The dependent variable, independent variables and control variables used for the statistical analysis are tabulated in Table 1.

Data Description and Methods of Data Collection and Analysis

The study uses data collected from 175 Indian technology-based start-ups that are headquartered within the country for the analysis. Survival analysis (Aalen et al., 2008) of the data is performed using Cox proportional hazards model (Cox, 1972) to deduce the factors that impact the survival of the start-up and the degree to which they influence the competitiveness of the start-up. To collect data from the target audience, a questionnaire was used as the research instrument for this study. The collected data were homogenized to enable assessment across the data points. Secondary data collection was used to collect external environment-specific factors for each of the start-up in our sample.

As there is no solitary repository or database of technology-based startups in the areas chosen for the study, an aggregation of different credible data sources related to technology-based startups was made to create a master list of start-ups operating in this sector. Sources such as Indian Software Product Industry Round Table (iSPIRT) and National Association for Software and Services Companies (NASSCOM), which are the two most credible industry associations were contacted for identification of the total start-up population. Further, many government-funded incubators and corporate accelerators operating in the country were also contacted with a request to share the list of start-up firms in the country. After the aggregation and removal of redundant entries, a sanitized accurate list of start-ups was created. The authors personally administered the questionnaire in person or collected data over telephone to all the consenting founders.

To validate that the data collected from founders were representative of the population, the demographic distribution of start-ups data from the Government of India promoted Start-up India web portal (www.startupindia.gov.in), which is considered as a formal source of information on Indian start-ups. The comparisons were made across multiple dimensions, such as age of the technology-based start-up, distribution of start-ups with respect to their location of operations, background of the founders, in terms of their education, their start-up and industry experience among others. The results of the comparison of the start-up data from the government web portal with our data revealed that our sample was representative of the population.

Most of the data used in our study are collected using our research instrument—the questionnaire. The secondary data are collected primarily to obtain the entrepreneur profile. This information is obtained from public and professional websites, such as LinkedIn, Angel List, Facebook and similar websites. We resorted to secondary data collection for the entrepreneur profile, so that we could optimize the time during our interview to focus on the core objectives of the study.

Characteristics of the Data

A preliminary analysis on the data collected reveals that the start-ups in the sample have been operating between 6 and 69 months of time since inception. About 49% of the technology-based start-ups reported that they had achieved the milestone of survival (found their product market fit), while the remaining 51% start-ups reported that they were yet to achieve this milestone. About 90% of entrepreneurs conveyed that they had at least 1 year’s paid or industry experience prior to starting their new ventures. Further, about 63% founders indicated that they had stints in other start-ups either as founders or as employees prior to starting on their own. The range of the entrepreneurs’ age at the time of inception of the start-up firm in the sample varied from 17 to 54 years. As regards entrepreneurs’ education, about 35% of them possessed a non-engineering degree, 53% of sample had obtained an engineering bachelors’ degree and the remaining 12% had masters’ degree or higher academic or educational qualification at the time of starting up their venture.

From a firm-specific perspective, 37% of start-ups reported as not hiring any external personnel for their sales related activities, 31.5% of start-ups reported the presence of sales personnel, but with no revenues as on date of data collection, and the remainder of 31.5% indicated as generating revenue through these sales personnel. In terms of R&D capabilities of start-ups, about 18% of them reported as not hiring any external personnel for their R&D, about 66% of start-ups indicated that they had hired external personnel to pursue R&D activities, and the remaining 16% of start-ups reported as having developed a customer demonstrable prototype using their R&D personnel. In our sample, about 63% of the start-ups were not externally funded.

Results and Discussion

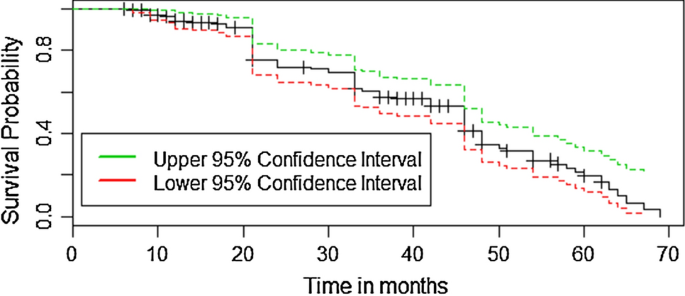

The statistical analysis of the data was initiated with a visual inspection of estimators of survival probability using non-parametric KM plots. To begin with, the survival probability and cumulative probability of survival of entire sample against time is plotted (Fig. 2) to understand the distribution of survival time of the start-ups. From the Fig. 2, we can infer that after incorporation of a start-up, as time elapses, the probability of survival begins to decrease. For example, from the data in our sample a start-up has about 99% probability of survival if it is formally incorporated only in the past six months. However, if a start-up has been incorporated since four years (48 months) the probability of survival of such start-up reduces to about 50%.

As a next step, to arrive at the right model to analyze the objectives of our study, we tried the tests of proportionality on the Cox proportional hazards model. The diagnostic results of the application of the Cox model are summarized in Table 2. The results from Table 2 indicate that the proportionality assumption for all the independent variables does hold. The high p values for all the independent variables used in the model indicate that they are suited for usage or analysis using the Cox model. The visual evaluation of proportionality was also carried out to ensure that the Cox proportional hazards model was best suited for our analysis.

The test results of our analysis using the overall optimized model is presented in Table 3. The test results indicate that this model fits better than the null model which indicate that the results from this model could be used for the analysis.

The results from the overall model indicate that among the entrepreneur-related factors, none of the factors has an influence on increasing the likelihood of competitiveness of technology-based start-ups in the pre-growth stages. Among the firm-specific factors, sales and R&D capabilities of the start-ups have shown to be of paramount importance in influencing the probability of survival of technology-based start-ups. Further, among the external entrepreneurial environment attributes, ‘SDP growth’ in the region is shown to have a major impact on the competitiveness of technology-based start-ups. Following the precedent of Chandrashekar and Bala Subrahmanya (2017), the impact of the ‘SDP growth’ attribute which is borderline significant has been discussed in the next section, although in normal circumstances this specific treatment would be avoided. The results of the analysis have important implications in the context of the lifecycle studies of technology-based start-ups and their competitiveness. From a firm-specific resources perspective, the results indicate that it is of paramount importance to have a demonstrable product offering very early in the lifecycle using which feedback could be obtained on aspects that need to be addressed before getting to product market fit. Further, the aspect of lack of revenue early on for the start-up affecting its chances of survival reinforce the findings from past literature. The external environment factors namely the SDP growth (borderline significant, from the results indicated in Table 3) indicate the need for a healthy macro-economic and technology-based start-up friendly ecosystem in the region, which in turn would result in enabling a higher survival rate and therefore enhanced level of competitiveness of start-ups in the region.

From these results, we also need to understand and interpret the factors which usually are attributed to influence survival and firm competitiveness—but have not come out as significant in ensuring the same. Notable among them are the entrepreneur-specific factors considered in this study.

As regards education not appearing significant in any of the models, this result can be explained on account of the information that all the founders considered in the analysis had a minimum or basic level education of a degree (graduation). Therefore, the results show that with basic minimum education, these founders are likely to exploit entrepreneurial opportunities. Similar results were noted by Yin et al. (2019) as well as by Ahn and Kim (2019) based on their assessment of performance of technology-based start-ups in Korea.

The prior start-up experience or prior industry experience of the entrepreneur has not come out as an important influence on the survival of technology-based start-ups. Prior research noted that for tasks that are well defined, repeated often, and feedback is provided in a timely and correct manner, entrepreneurial judgment can be improved (Hayward et al., 2006; Wright, 2001). In these conditions of pure uncertainty, where the range of activities and the uncertainty in pursuing every new entrepreneurial activity does not lend itself to repeatability, the aspects of prior firm start-up experience or prior industry work experience may be of little help.

From a firm-specific resources’ perspective, the aspect of funding or capitalization of the start-up does not come out as a significant factor that influences start-up competitiveness at the pre-growth stages. This result also might be viewed as contrary to existing findings, if taken at face value. This result can be explained as follows. Viewed in isolation, funding or capital infusion to a firm at any time of its lifecycle is considered a necessary factor input. In the case of technology-based start-ups, particularly in the IT sector, the nature of the industry structure is such that costs of entry for a new venture is very minimal, since there is no need to invest in any physical assets that invite capital expenditure. The only investment comes by way of intellectual and technical capital—which all of the founders of this sample possess—by way of educational pedigree.

Implications

This study makes two contributions to theory on competitiveness. First, it examines the combined impact of entrepreneurial, firm-specific and external environment-related factors on technology-based start-up competitiveness in a holistic manner. This end-to-end perspective of evaluation using a conceptual framework derived from the RBV and Assets-Processes-Performance (APP) models has enabled the verification on how, certain factors, in the presence of other influencing factors will contribute or hinder competitiveness of technology-based start-ups. Second, this study has attempted to examine firm-level competitiveness of technology-based start-ups which are in the pre-growth stages operating from an emerging economy. In doing so, it has established the applicability of the APP model to evaluate competitiveness of technology-based start-ups. It is well established that research outputs from developed economies cannot be generalized to the context of emerging economies (Boyacigiller and Adler, 1991). Hence, this study fills this gap by examination of factors that matter in the context of India.

For the practitioners, the results from this study indicate the need for having a strong R&D capability for technology-based start-ups to increase their probability of survival and enhanced competitiveness. Further, irrespective of whether the start-up focuses on B2B or B2C markets, the results indicate that a lean sales team with the founders or co-founders taking on the role of sales enablement would enhance the chances of start-up survival. Further, the results from our study indicates that from a macro-economic perspective, start-up survival probability increases in regions where there is good economic growth—implying that presence of an addressable market is very important for ensuring technology-based start-up competitiveness.

Limitations and Scope for Future Work

While our study has attempted to add knowledge in the scope defined for the study, a few limitations are to be noted. This study examines the phenomenon of start-up survival as a milestone for examining competitiveness, considering only one sector of the technology-based industry and in one country, and therefore the results are applicable to this limited context. Extending the scope of the study to include a couple more technology-based sectors in the same region, or a cross-country comparison of one particular sector would provide deeper insights that can be broadly applicable. Further, due to the focus on the pre-growth technology-based start-ups, only the C-Assets aspect of the competitiveness has been explored in the study. An evaluation of technology-based start-ups in growth or post-growth stages would enable a much more complete assessment of competitiveness using the entire APP framework. These suggested extensions of scope will lead to creation of new knowledge and insights related to competitiveness of technology-based start-ups.

Key Questions Reflecting Applicability in Real Life

-

What are the entrepreneur-specific factors that influence the firm-level competitiveness of early-stage start-ups?

-

What firm-specific factors impact the competitiveness of start-ups?

-

What are the external environment-related factors that influence the competitiveness of early-stage start-ups?

-

What frameworks and models can be used to assess competitiveness of start-ups that are in the pre-growth stages?

Change history

03 August 2021

A Correction to this paper has been published: https://doi.org/10.1007/s42943-021-00030-y

References

Aalen, O. O., Borgan, Ø., & Gjessing, H. K. (2008). Survival and event history analysis: A process point of view. Springer-Verlag.

Acquaah, M., & Yasai-Ardekani, M. (2008). Does the implementation of a combination competitive strategy yield incremental performance benefits? A new perspective from a transition economy in Sub-Saharan Africa. Journal of Business Research, 61(4), 346–354

Adler, P., Florida, R., King, K., & Mellander, C. (2019). The city and high-tech startups: The spatial organization of Schumpeterian entrepreneurship. Cities, 87, 121–130

Ahn, S., & Kim, J. (2019). The effect of managerial characteristics on the performance of technology-based start-ups in Korea. International Journal of Global Business and Competitiveness, 14(1), 11–23

Ajitabh, A., & Momaya, K. (2004). Competitiveness of firms: Review of theory, frameworks and models. Singapore Management Review, 26(1), 45–61

Audretsch, D. B., & Lehmann, E. E. (2004). Financing high-tech growth: The role of banks and venture capitalists. Schmalenbach Business Review, 56(4), 340–357

Bailetti, T. (2012). Technology entrepreneurship: overview, definition, and distinctive aspects. Technology Innovation Management Review, 2(2), 5–12

BalaSubrahmanya, M. H. (2017). Comparing the entrepreneurial ecosystems for technology start-ups in Bangalore and Hyderabad, India. Technology Innovation Management Review, 7(7), 47–62 10th Anniversary Issue.

Boyacigiller, N., & Adler, N. J. (1991). The parochial dinosaur: Organizational science in a global context. Academy of Management Review, 16, 262–290

Brockhaus, R. H. (1982). The psychology of the entrepreneur. In C. A. Kent, D. L. Sexton, & K. H. Vesper (Eds.), Encyclopedia of Entrepreneurship. (pp. 39–56). Prentice-Hall.

Brüderl, J., Preisendörfer, P., & Ziegler, R. (1992). Survival chances of newly founded business organizations. American Sociological Review, 57, 227–242

Cader, A. H., & Leatherman, C. J. (2011). Small business survival and sample selection bias. Small Business Economics, 37, 155–165

Caliendo, M., & Kritikos, A. S. (2010). Start-ups by the unemployed: characteristics, survival and direct employment effects. Small Business Economics, 35, 71–92

Cefis, E., & Marsili, O. (2006). Survivor: The role of innovation in firms’ survival. Research Policy, 35(5), 626–641

Certo, S. T. (2003). Influencing initial public offering investors with prestige: Signaling with board structures. Academy of Management Review, 28(3), 432–446

Cetindamar, D., & Kilitcioglu, H. (2013). Measuring the competitiveness of a firm for an award system. Competitiveness Review: An International Business Journal, 23(1), 7–22

Chandrashekar, D., & BalaSubrahmanya, M. H. (2017). Absorptive capacity as a determinant of innovation in SMEs: A study of Bengaluru high-tech manufacturing cluster. Small Enterprise Research, 24(3), 290–315

Chikán, A. (2008). National and firm competitiveness: a general research model. Competitiveness Review: An International Business Journal, 18(1–2), 20–28

Cox, D. R. (1972). Regression models and life-tables. Journal of the Royal Statistical Society: Series B (Methodological), 34(2), 187–202

Criaco, G., Minola, T., Migliorini, P., & Serarols-Tarrés, C. (2014). To have and have not: Founders’ human capital and university start-up survival. The Journal of Technology Transfer, 39(4), 567–593

Estrin, S., Meyer, K. E., & Bytchkova, M. (2006). Entrepreneurship in transition economies. In M. Casson, B. Yeung, A. Basu, & N. Wadeson (Eds.), The Oxford handbook of entrepreneurship.Oxford University Press.

Furdas, M., Kohn, K. (2011). Why is startup survival lower among necessity entrepreneurs? A decomposition approach. Preliminary Version, April 2011.

Giraudo, E., Giudici, G., & Grilli, L. (2019). Entrepreneurship policy and the financing of young innovative companies: Evidence from the Italian Startup Act. Research Policy, 48(9), 103801

Hayward, M. L. A., Shepherd, D. A., & Griffin, D. (2006). A hubris theory of entrepreneurship. Management Science, 52(2), 160–172

Kim, P. H., Aldrich, H. E., & Keister, L. A. (2006). Access (Not) denied: The impact of financial, human and cultural capital on entrepreneurial entry in the United States. Small Business Economics, 27, 5–22

Kirchhoff, B. A., & Spencer, A. (2008). New High Tech Firm Contributions to Economic Growth. Proceedings of international council for small business world conference, 2008. Halifax.

Koleson, J. (2020). TikTok is on the clock, will democracy stop?

Krishna, H. S. (2019). High-tech internet start-ups in India. Cambridge University Press.

Lloyd-Ellis, H., & Bernhardt, D. (2000). Enterprise, inequality and economic development. Review of Economic Studies, 67, 147–168

McClelland, D. C. (1961). The Achieving Society. Van Nostrand.

Mesquita, L., Lazzarini, S. G., & Cronin, P. (2007). Determinants of firm competitiveness in Latin American emerging economies: Evidence from Brazil’s auto-parts industry. International Journal of Operations and Production Management, 27(5), 501–523

Meyer-Stamer, J. (2008). Systematic competitiveness and local economic development discussion paper. Mesopartner.

Millán, J. M., Congregado, E., & Román, C. (2012). Determinants of self-employment survival in Europe. Small Business Economics, 38(2), 231–258

Momaya, K. (2001). International competitiveness: Evaluation and enhancement. Hindustan Publishing Corporation.

Momaya, K. S. (2019). The past and the future of competitiveness research: A review in an emerging context of innovation and EMNEs. International Journal of Global Business and Competitiveness, 14(1), 1–10. https://doi.org/10.1007/s42943-019-00002-3.

NASSCOM Start-up Report. (2019). Indian Tech Start-up Ecosystem—Leading Tech in the 20s.

Politis, D. (2008). Does prior start-up experience matter for entrepreneurs’ learning? Journal of Small Business and Enterprise Development, 15, 472–489

Ronstadt, R. (1988). The corridor principle. Journal of Small Business Venturing, 3(1), 31–40

Schwab, K. (2019). The global competitiveness report 2019. World Economic Forum.

Singh, S. K., & Gaur, S. S. (2018). Entrepreneurship and innovation management in emerging economies. Management Decision., 56(1), 2–5

Start-up Genome. (2012). Start-up Ecosystem Report 2012, USA.

Stinchcombe, A. L. (1965). Social structure and organizations. In J. G. March (Ed.), Handbook of organization. (pp. 142–193). Rand McNally.

Storey, D. J. (1982). Entrepreneurship and the new firm. Beckenham.

Viola, L. A. (2020). US strategies of institutional adaptation in the face of hegemonic decline. Global Policy, 11, 28–39

Wiklund, J., Nikolaev, B., Shir, N., Foo, M. D., & Bradley, S. (2019). Entrepreneurship and well-being: Past, present, and future. Journal of Business Venturing, 34(4), 579–588

Wiklund, J., Patzelt, H., & Shepherd, D. A. (2009). Building an integrative model of small business growth. Small Business Economics, 32, 351–374

Wright, W. F. (2001). Task experience as a predictor of superior loan loss judgments. Auditing, 20(1), 147–156

Wu, L. Y., Wang, C. J., Chen, C. P., & Pan, L. Y. (2008). Internal resources, external network, and competitiveness during the growth stage: A study of Taiwanese high–tech ventures. Entrepreneurship Theory and practice, 32(3), 529–549

Yin, W., Moon, H. C., & Lee, Y. W. (2019). The success factors of Korean global start-ups in the digital sectors through internationalization. International Journal of Global Business and Competitiveness, 14(1), 42–53. https://doi.org/10.1007/s42943-019-00003-2

Acknowledgements

The authors gratefully acknowledge and thank all the anonymous reviewers and the editors, and the Editor-in-Chief Kirankumar S. Momaya in particular for their valuable and detailed feedback which has enabled the authors to significantly improve the quality of the paper.

An earlier version of this paper was presented at the IIMB-SJSU International Conference on Transnational Entrepreneurs and International SMEs in Emerging Economies: Drivers and Strategies, organized by Indian Institute of Management Bangalore (IIMB), India, in collaboration with San José State University (SJSU), California, USA, held at Indian Institute of Management Bangalore, India from May 20–22, 2015.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

This article was published online first on 17 May 2021 with a wrong file as Supplementary Information. This has now been corrected.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Satyanarayana, K., Chandrashekar, D. & Mungila Hillemane, B.S. An Assessment of Competitiveness of Technology-Based Startups in India. JGBC 16, 28–38 (2021). https://doi.org/10.1007/s42943-021-00023-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42943-021-00023-x