Abstract

The COVID-19 pandemic has corroborated environmental degradation and climate change as two important problems of the twenty-first century. To turn environmental challenges into opportunities, we need environmentally friendly, green financial technologies. This article aims to shed light on the studies within this field, by building a bridge between financial technology (FinTech) and cryptocurrencies. A cashless society is expected to be fostered as digital currencies become more widespread, which will result in the eventual replacement of notes and coins. When considered from this point of view, cryptocurrencies could be regarded as environmentally friendly. On the other hand, the large amount of energy consumed in the mining process of cryptocurrencies questions their environmental friendliness. Therefore, analyzing whether cryptocurrencies are environmentally friendly or not conducted in a holistic approach.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Global warming has become a deep symptom of a systemic crisis in a global society. Environmental problems such as floods, wildfires, the ozone hole, and plastic pollution have become more prominent common in recent years. This is evident as technology has allowed space for a reduction within global emissions. Additionally, financial technologies enable stimulation of economic growth, resulting in reduction of inequality, poverty, and environmental destruction in society. In essence, there is a need for an increase of Green Financial Technology to solve global warming and combat climate change effects (Mulay, 2019).

Fintech includes the application of technological innovations in the finance and banking industry. These innovations are mobile wallets, application programming interface (API), open banking, digital payments, Robo-advisers, cryptocurrencies, etc. Fintech is related to various members who partake in the usage of mobile banking applications, in regard to internet user consumption and general mobile internet usage (Statista, 2021). Blockchain, cryptocurrencies, crowdfunding and digital money are the main pillars of FinTech tools in finance. FinTech has evolved and certainly changed the financial sector toward the decentralization of economic activities and as well as the increasing speed of transactions. In addition, FinTech developments have enhanced efficiency and have managed to maintain a reduction to costs of financial activities. Green Fintech tools and techniques such as the use of blockchain, mobile phones, open banking, big data analysis can aim for sustainable development goals (Bank, 2018). These goals are evidently reducing poverty, reducing inequality, protecting the environment, and using green energy sources (Nations, 2021). Access to digital financial services will have a positive impact on addressing poverty. FinTech companies present access to banking services and money transfers at lower cost, positively impacting poverty reduction.

This paper is structured as follows: in the first section, an overview of Green Fintech and its applications around the world will be expressed. In addition, a literature review will be carried in relation to the sustainability of Bitcoin and energy consumption of Bitcoin. The second section will be an empirical analysis part; empirical results and discussions are presented in this section. The environmental sustainability of cryptocurrencies will be examined in the empirical section. In the final section, the conclusions and empirical results will be implicitly highlighted.

2 Green FinTech definition

Fintech refers to innovative financial services such as big data analysis, AI (artificial intelligence), Blockchain, DEFI (decentralized finance), and mobile internet bring innovative solutions to financial services (Phadke, 2020). Banks embrace the AI technologies that have commenced from FinTech innovation. Fintech applications that are used by banks and Fintech companies have the power to transform customer communication and analyze customer demands and experiences. Chatbots and predictive analysis can assist with this process and change the way that banks interact with customers (Mohan, 2020).

Green FinTech aims to protect the environment and reduce poverty by providing lower-class citizens access to finance at a reduced cost. Green FinTech includes artificial intelligence, big data analysis, internet of the things, and blockchain technology, which are all essential technology and considerate wages for reducing poverty. Alternatively, payments offered with cryptocurrencies can help boost access to finance for unbanked individuals and SMEs in the world (Wilson Jr, 2017). Green FinTech, which is environmentally friendly, can manage many people with big data analysis, internet of the things (IoT), machine learning, artificial intelligence, mobile payment technologies, and using their benefits without charging additional costs. Green FinTech companies have various constructive environmental impacts by reducing CO2, helping shared vehicles, dissemination, while also reducing carbon consumption through sharing economy model (Mi & Coffman, 2019). One example of Green FinTech is a peer-to-peer food sharing company in London, that is aimed at preventing waste of food production and green gas emissions (Makov et al., 2020).

Green FinTech also has the potential to decrease waste generation, greenhouse gas emissions, and water consumption in online food distribution (Zhou et al., 2015). Cryptocurrencies also combine monitoring technology with a big data analysis to realize rural development, serving as a critical approach to finance small farmers and increase investment in agribusiness (Hinson et al., 2019). In addition, green financial technologies can support financial intermediaries effectively, monitoring and selecting green projects and calculating their environmental impact (Yang et al., 2020).

The main purpose of this paper is to answer the following question: “Is Bitcoin Green FinTech?”. In this respect, we will examine the environmental sustainability of cryptocurrencies. Bitcoin, which was introduced in 2009, is the first cryptocurrency, which now has the largest market share in cryptocurrencies as of 2021. Bitcoin is the largest, by market capitalization as well as the most widely traded (Pedersen, 2020). Bitcoins are generated through mining, and this activity demands a significant amount of electrical energy. Thus, as a cryptocurrency that has the largest market share and demands electricity to increase its supply. Bitcoin serves as an excellent tool to test the environmental friendliness of cryptocurrencies. The majority of the studies in the literature bear the finding that the price increases in cryptocurrencies increase Bitcoin mining, causing more energy consumption and increasing CO2 emissions (Rauchs & Hileman, 2017; Mishra et al., 2017; Naughton, 2017; O'Dwyer & Malone, 2014). At this stage, the relationship between the income of Bitcoin miners and Bitcoin electricity consumption will be examined by employing the Dynamic Conditional Correlation—Generalized Autoregressive Conditional Heteroskedasticity (DCC-GARCH) methodology introduced by Engle (2002).

To the best of our knowledge, this will be the first study that analyzes the environmental sustainability of cryptocurrencies and considers their Green FinTech role using the aforementioned methodology.

3 Literature review

Bitcoins are generated through mining and this activity demands a significant amount of electrical energy. Bitcoin’s energy consumption is estimated by employing hash rate data. Hash rate, in essence, is the total combined hardware power used to mine Bitcoin and process transactions. The energy needed to mine cryptocurrencies in a proof-of-work scheme is measurable in the hash rates of the network. Hash rates are the number of hash functions performed on the network in seconds (Krause & Tolaymat, 2018). Then, the energy need of the hardware that miners are using is calculated using the hash rate estimate. The problem is, we can estimate the amount of energy consumed, but we are unaware of how the energy is overall generated. There is a possibility it could emerge from renewables or coal. In addition, there’s also a distinction between how much energy the system absorbs and how much carbon it emits. Calculations for the percentage of shares Bitcoin mining uses appear to be a wide renewable energy change of 39–70%—the large amount of energy consumed in the mining process of cryptocurrencies questions their environmental friendliness. Therefore, analyzing whether cryptocurrencies are environmentally friendly or not should be done in a holistic manner.

The relationship between the income of Bitcoin miners and Bitcoin electricity consumption was examined by employing the Dynamic Conditional Correlation—Generalized Autoregressive Conditional Heteroskedasticity methodology introduced by Engle (2002). We used Time-Varying Vector Autoregression (TVP-VAR) introduced by Primiceri (2005) and Time-varying Granger Causality (TV-GC) by Shi et al. (2018). DCC-GARCH model allows calculating dynamic correlations between two series. Depending on what kind of energy is used during mining, we hope to say a few things about the environmental friendliness of BTC. We aim to complement our findings using TVP-VAR and TV-GC models.

4 DCC GARCH model

Correlation measures the linear relationship between two random variables. According to the standard definition in the literature: if the X and Y variables are random variables, the correlation between them is measured as follows.

The obtained correlation coefficient ρ takes a value between −1 and + 1. This measure of correlation does not change in univariate linear transformations of the two variables. The correlation coefficient for x∗ = α + βx and y∗ = γ + δy will be the same as the correlation between y and x. For nonlinear transformations, the correlation will usually convert; as a result, two perfectly dependent random variables may still have a correlation less than 1, because they are non-linearly related (Engel, 2009). This is often observed in the prices of financial assets. In the project, the relationship between the Bitcoin price series and the energy consumption index is measured by dynamic conditional correlation. Engle (2002) expand the constant correlation model (CCC) to the dynamic conditional correlation (DCC) model where C is in time differing, but not stochastic. To calculate and predict the varying volatilities, we may apply any type of univariate GARCH model (Alexander, 2008).

DCC-GARCH model was introduced by (Engle, 2002), it comprises mean and variance equations. The mean equation is stated as:

where rt is the vector of the error terms, \({\mu }_{t}\) is the conditional mean vector and \({e}_{t}\) is the vector of residuals. Furthermore, the variance is estimated with the next formula.

where \({h}_{t}\) is conditional variance and c is a constant term, \(a\) is the parameter of ARCh effect and shows the short term endurance of shocks to conditional variance, in addition, \(\beta\) is the parameter of the GARCH effect which shows the long-term endurance of shocks (Akkoc & Civcir, 2019).

The dynamic conditional correlation model utilizes standardized regression errors and calculates the correlation matrix. This provides tremendous elasticity for the regression. When the variables move parallel, the correlation coefficient could be increased, and however, the correlation coefficient moves in the opposite way, the correlations could be decreased. It can be increased by some volatile times, such as falling markets or economic news (Engel, 2009).

DCC GARCH Model aims to calculate the dynamic conditional correlation and it considers heteroscedasticity. There are two stages in the calculation of the DCC-GARCH model:

(1) Estimating A Univariate GARCH Model.

(2) Obtaining Time-Varying Conditional Correlations.

This research aims to calculate the dynamic conditional correlation between two variables. To examine the relationship, we consider the miner’s revenue as the dependent variable. This research uses the Daily data for Bitcoin prices, Bitcoin Trade Volume, Bitcoin Miners’ Revenue which has been extracted from https://www.blockchain.com. The independent variable is Bitcoin’s energy consumption index. Cambridge Bitcoin Electricity Consumption Index has been utilized as a proxy of Bitcoin energy consumption. Our sample spans from 02.07.2014 to 23.07.2021 yielding a total of 2580 daily observations. Variables that are used in this paper are illustrated in Table 1.

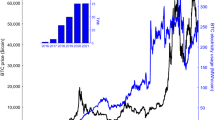

DCC GARCH model results imply a positive correlation between the BTC (Bitcoin) miners’ revenue and the Bitcoin electricity consumption index. According to Fig. 1, the correlation points toward 20–30% during 2014 but increased consistently until the end of 2017. It fluctuated heavily between 2017Q1 and 2018Q2. The average correlation was around 50 percent during the entire sample, yet it appears to be higher during boom periods where BTC prices surge. Miners seem to increase mining activities when prices increase (or when they are expected to increase). A second rise in the conditional correlations between the Bitcoins miner revenue and the Bitcoin electricity consumption index has been seen after the COVID-19 rally effect on cryptocurrencies. If the cost of Bitcoin mining is higher than the price of Bitcoin, in that case, mining will be unprofitable, and miners tend to produce less Bitcoin. Figure 1 denotes the dynamic conditional correlation between Bitcoin miners' revenue and Bitcoin electricity consumption. The time-varying correlation coefficients are obtained by employing DCC-GARCH Model, rather than using the traditional correlation coefficient. All series are made stationary after first differencing, and autocorrelation is not a concern since I do not run an OLS regression.

Bitcoin has gone through several boom-bust cycles over the years. Since its 2017 December peak, nearly $19.900, the price of Bitcoin fell below $ 3200 in December 2018, a clear decline of 84% in the year. Despite the volatility, Bitcoin remains of the most liquid and widely used cryptocurrency (Pedersen, 2020). Thus, several considerable decreases can be observed in the correlation. The maximum value of the correlation is about 0.69 at the beginning of 2020, and the minimum value is 0.026 in October 2014. The correlation between miners' revenue and the consumption of electricity varies between a maximum of 0.69 and a minimum of 0.0256.

The DCC analysis suggests, not surprisingly, a positive correlation between Bitcoin’s hash rate and electricity consumption. The hash rate demonstrates the amount of electrical power used by crypto miners to create blocks from the devices they use for Bitcoin. The conditional correlation has increased heavily between 2015Q1 and 2017Q2. A second rise in the conditional correlations with Bitcoin Hash rate and Bitcoin Electricity consumption index following the COVID-19 rally for cryptocurrencies. The correlation between Bitcoin hash rate and the consumption of electricity varies between a maximum of 0.77 and a minimum of 0.19. The relationship between the Bitcoin hash rate and the consumption of electricity is strong and always positive.

Bitcoin mining needs notable expensive hardware power and fast internet, which requires electricity consumption as well. It will be profitable for those with the most efficient hardware and energy with the cheapest electrical power. For instance, if you have sustainable energy resources like wind farms or solar panel arrays, you might be able to mine bitcoins profitably (Barski & Wilmer, 2014) (Fig. 2).

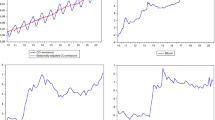

Figure 3 shows the time-varying conditional correlation between miners' revenue—average electricity consumption and miners' revenue—minimum electricity consumption and miners' revenue—maximum electricity consumption. The dynamic correlations between the miners' revenue and electricity consumption are positive for three alternative calculations. We observe the time-varying correlation between Bitcoin miners and the Bitcoin electricity consumption index, with a sharp volatility observed between October 2014 and April 2017. DCC GARCH analysis of BTC miners’ revenue and BTC energy consumption shows us evidence of positive relationship dynamics during the period 2014–2021.

5 Conclusion

Green FinTech aims to protect the environment and reduce poverty by providing lower class citizens access to finance at a reduced cost. Digital currencies, including central bank digital currencies, blockchain and cryptocurrencies, are the main pillars of fintech. Cryptocurrencies could be regarded as environmentally friendly. On the other hand, the large amount of energy consumed in the mining process of cryptocurrencies questions their environmental friendliness. This paper deals with the analysis of the dynamic relationship between Bitcoin miners' revenue and Bitcoin electricity consumption. Our sample spans from 02.07.2014 to 23.07.2021 yielding a total of 2580 daily observations. Dynamic correlation model results imply a positive correlation between the BTC (Bitcoin) miners’ revenue and the Bitcoin electricity consumption index. The average correlation was around 50 percent during the entire sample, yet it appears to be higher during boom periods where BTC prices surge. Miners seem to increase mining activities when prices increase (or when they are expected to increase).

The DCC analysis suggests, not surprisingly, a positive correlation between Bitcoin’s hash rate and electricity consumption. The conditional correlation has increased heavily between 2015Q1 and 2017Q2. A second rise in the conditional correlations with Bitcoin Hash rate and Bitcoin Electricity consumption index following the COVID-19 rally for cryptocurrencies. The relationship between the Bitcoin hash rate and the consumption of electricity is strong and always positive.

The results of this paper are important for policymakers and for investors worried about the environmental effects of their investment. Fintech and Blockchain technology have a number of practical implications and big potential to transform the finance sector. The electricity consumption of Bitcoin has become one of the main areas of criticism, raising the question of “Bitcoin is a green FinTech or not? According to empirical results, there is a positive correlation between the BTC (Bitcoin) miners’ revenue and the Bitcoin electricity consumption index. Miners seem to increase mining activities when prices increase (or when they are expected to increase). Bitcoin miners' energy consumption relies on coal, so it contributes to the high CO2 emissions and greenhouse gases. Bitcoin miners should be switching the type of energy for mining to more sustainable alternatives like solar, wind, and geothermal instead of fossil resources. Eco-friendly cryptocurrencies which are more green and have low carbon footprints will have more opportunities in terms of green finance in the future. Cryptocurrencies that are most efficient in terms of their energy requirements must be analyzed in future studies.

References

Akkoc, U., & Civcir, I. (2019). Dynamic linkages between strategic commodities and stock market in Turkey: Evidence from SVAR-DCC-GARCH model. Resources Policy, 62, 231–239.

Alexander, C. (2008). Market risk analysis, practical financial econometrics (Vol. 2). Wiley.

Bank, A. (2018). Harnessing technology for Moe inclusive and sustainable finance in Asia and the Pacific.

Barski, C., & Wilmer, C. (2014). Bitcoin for the befuddled: No starch press.

Engel, R. (2009). Anticipating correlations: A new paradigm for risk management; the econometric and Tinbergen institutes lectures. Princeton University Press.

Engle, R. (2002). Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics, 20(3), 339–350.

Hinson, R., Lensink, R., & Mueller, A. (2019). Transforming agribusiness in developing countries: SDGs and the role of FinTech. Current Opinion in Environmental Sustainability, 41, 1–9.

Krause, M. J., & Tolaymat, T. (2018). Quantification of energy and carbon costs for mining cryptocurrencies. Nature Sustainability, 1(11), 711–718.

Makov, T., Shepon, A., Krones, J., Gupta, C., & Chertow, M. (2020). Social and environmental analysis of food waste abatement via the peer-to-peer sharing economy. Nature Communications, 11(1), 1–8.

Mi, Z., & Coffman, D. M. (2019). The sharing economy promotes sustainable societies. Nature Communications, 10(1), 1–3.

Mishra, S., Jacob, V., & Radhakrishnan, S. (2017). Bitcoin mining and its cost. University of Texas at Dallas-Naveen Jindal School of Management.

Mohan, D. (2020). The financial services guide to Fintech: Driving banking innovation through effective partnerships. Kogan Page Publishers.

Mulay, A. (Ed.). (2019). Economic renaissance in the age of artificial intelligence (1st ed.). Business Expert Press.

Nations, U. (2021). Sustainable development goals report 2021. Retrieved from New York.

Naughton, J. (2017). The trouble with BITCOIN and big data is the huge energy bill. TheGardian.com. https://www.theguardian.com/commentisfree/2017/nov/26/trouble-with-bitcoin-big-datahuge-energy-bill. Accessed 12 June 2019 (2019).

O'Dwyer, K. J., & Malone, D. (2014). Bitcoin mining and its energy footprint.

Pedersen, N. (2020). Financial Technology: Case Studies in Fintech Innovation. Kogan Page Publishers.

Phadke, S. (2020). FinTech future: The digital DNA of finance. Sage Publications.

Primiceri, G. E. (2005). Time varying structural vector autoregressions and monetary policy. The Review of Economic Studies, 72(3), 821–852.

Rauchs, M., & Hileman, G. (2017). Global cryptocurrency benchmarking study. Retrieved from: Cambridge Centre for Alternative Finance.

Shi, S., Phillips, P. C., & Hurn, S. (2018). Change detection and the causal impact of the yield curve. Journal of Time Series Analysis, 39(6), 966–987.

Statista. (2021). Number of Fintech startups worldwide from 2018 to November 2021. https://www.statista.com/statistics/893954/number-fintech-startups-by-region/.

Wilson, J. D., Jr. (2017). Creating strategic value through financial technology. Wiley.

Yang, G., Li, Y., & Jiang, X. (2020). Research on the impacts of green finance towards the high-quality development of China’s economy—Mechanisms and empirical analysis. Theoretical Economics Letters, 10(06), 1338.

Zhou, W., Arner, D. W., & Buckley, R. P. (2015). Regulation of digital financial services in China: Last mover advantage.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kabaklarlı, E. Green FinTech: sustainability of Bitcoin. Digit Finance 4, 265–273 (2022). https://doi.org/10.1007/s42521-022-00053-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42521-022-00053-x