Abstract

The ifo Institute is Germany’s largest business survey provider, with the ifo Business Climate Germany as one of the most important leading indicators for gross domestic product. However, the ifo Business Survey is not solely limited to the Business Climate and also delivers a multitude of further indicators to forecast several important economic variables. This paper gives a literature overview over existing studies that deal with the forecasting power of various ifo indicators both for gross domestic product and further economic variables such as exports. Overall, the various indicators from the ifo Business Survey can be seen as leading indicators for a multitude of variables representing the German economy, making them a powerful tool both for an in-depth business cycle diagnosis and for applied forecasting work.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The usage of business survey indicators is common in applied forecasting work. Also the existing academic literature certifies business surveys to be powerful tools for economic forecasting or tracking economic activity. However, most of the studies focus on a rather small number of economic aggregates such as gross domestic product (GDP), (un-)employment or inflation (see, for example, Hansson et al., 2005; Claveria et al., 2007; Angelini et al., 2011; Martinsen et al., 2014; Österholm, 2014; Lehmann and Weyh, 2016; Basselier et al., 2018; de Bondt, G. J., 2019). Furthermore, most of the media attention is gained by the headline indices of a business survey. Nevertheless, the bulk of business surveys do not only provide leading indicators for the most obvious macroeconomic aggregates, they rather comprise a large pool of indicators that mirror the development of other economic variables at hand.

The aim of this paper is to illustrate the large possibilities a business survey offers for economic forecasting both from an academic and an applied perspective. In the following case study for Germany, I do so by giving a systematic overview over existing studies that evaluate the forecasting power of the indicators provided by the German ifo Institute. Its very old and accepted ifo Business Survey is mainly known for one of the most important leading indicators for German GDP growth: the ifo Business Climate Germany. In contrast to rather traditional literature overviews, I do not focus on one question for one economic aggregate across several countries, but present the large universe of indicators one survey for one country offers for academics and practitioners. In the end, my overview tries to accomplish that any user of the ifo Business Survey might go beyond the usual applications for rather standard macroeconomic aggregates such as GDP.

This overview is not the first to evaluate the forecasting power of the ifo Business Survey: two major literature reviews are provided by Abberger and Wohlrabe (2006) and Seiler and Wohlrabe (2013), both written by researchers that have been employed at the ifo Institute at that time. Both articles have in common that they exclusively focus on studies for the performance of the ifo Business Climate Index to forecast either German GDP or industrial production (IP). But to date, a large body of literature exists that either studies the forecasting properties for other economic variables (for example, export growth) or focus on the regional level. The survey at hand aims to enhance the existing literature reviews with respect to two dimensions. First, I list all articles that have been published until or are in preparation at the end of December 2021. And second, I will also review the studies that go beyond GDP or IP in order to point up to the variety the ifo Business Survey offers in terms of questions, sectors, or even regions.

The surveyed articles are divided in seven categories: (1) GDP, IP, and turning points; (2) expenditure components of GDP (for example, exports) and prices; (3) labor market outcomes; (4) variables for manufacturing and trade; (5) service sector outcomes; (6) regional economic variables; and (7) revisions of economic variables. I allocate the existing studies to at least one category and summarize the main results of each study concerning the forecasting power of the applied ifo indicator(s). For each study, I additionally give a detailed overview of the applied method(s) and the time period under investigation.

In sum, the majority of existing studies certify the ifo indicators a high forecasting power. For German GDP especially the three headline indices (ifo Business Climate, ifo Business Situation, and ifo Business Expectations) either in delimitation of Industry and Trade (sum of manufacturing, construction, and trade) of for Germany (industry and trade plus services) provide accurate forecasts. On the expenditure side of GDP, the ifo indicators are valuable leading indicators (for example, the ifo Export Climate to forecast German export growth). On the production side of GDP, the ifo Institute provides good leading indicators for a multitude of different industries (for example, the ifo Business Climate Manufacturing). Next to these outcome variables, the ifo indicators are also able to accurately forecast labor market variables (for example, the ifo Employment Barometer to forecast employment growth) or inflation (for example, the ifo Price Expectations as leading indicator for producer price development). The good forecasting power of the ifo indicators is not solely confirmed for the German economy but also for three regional entities (the German states Baden-Württemberg and Saxony as well as Eastern Germany) or several sectors. Overall, the ifo Business Survey offers a large variety of indicators that might enter a practitioner’s toolbox.

The literature survey at hand is organized as follows. I briefly introduce the main features of the ifo Business Survey in Sect. 2. Section 3 defines the criteria for the selection of the articles and the subsequent categorization. For each of the seven categories I discuss and present the existing studies in Sect. 4. Section 5 concludes and outlines the possibilities that arise from this overview.

2 The ifo Business Survey

I start by giving a brief introduction to the universe of the ifo Business Survey, which is a monthly survey among German firms that exists since 1949.Footnote 1 The most popular business cycle indicator, that results from this monthly survey, is the ifo Business Climate Germany.Footnote 2 Each month, the ifo Business Climate is based on a relative stable sample incorporating 9,000 answers of German firms. This large pool of answers ensures that the ifo Business Survey is representative on the firm and industrial level, that is, it mirrors the distribution of firm size and industrial composition in the German economy quite well. One of the most important purposes of the ifo Business Survey is to provide fast and almost non-revised indicators to describe the short-term behavior of German macroeconomic variables.

Industrial Coverage The ifo Business Survey provides indicators for the following four main industries: manufacturing, construction, trade, and services. The industrial coverage of the ifo Business Survey has increased over time and started solely with a relatively small sample in manufacturing in 1949 (see Sauer and Wohlrabe, 2020). At the beginning of the 1950s, the survey has been extended to the German trade sector (retail trade: 1950, wholesale: 1951); the construction sector followed in 1956. The service sector has been added in 2001 with a monthly annotation since 2005. Based on these four main industries one would argue that the ifo Business Survey covers all economic activities in Germany. However, not all industries are surveyed each month. Section A in the Supplementary Material presents a detailed description of the Classification of Economic Activities of the German economy together with the coverage of the ifo Business Survey. Overall, the ifo Business Survey comprises industries that account for approximately 74% of total German gross value added (GVA) in 2018. The small industries not covered by the monthly survey are agriculture, mining and quarrying as well as electricity, gas and water supply that represent 4% of total German GVA. The ifo Business Survey also does not comprise banking and insurance activities with a similar weight to that of the smaller industries. As the ifo Institute only surveys market-traded activities, the whole public sector, with a weight of roughly 20%, is missing, too. However, the ifo Business Survey is constructed to gain cyclical signals of the German economy and one can argue that public services do not have any pronounced business cycle at all.

Questionnaire The monthly survey is divided into standard and special questions; Section B in the Supplementary Material provides a comprehensive overview of the monthly questionnaire in each industry. Each of these questions can serve as potential indicator for forecasting macroeconomic variables. Whereas the standard questions are asked each month, the special questions follow a specific timely pattern.Footnote 3 With the exception of a small number (for example, capacity utilization in manufacturing), all questions are of qualitative nature, thus, the firms are exclusively asked for tendencies. The standard questions are divided into four time categories: questions focusing on (i) the current situation, (ii) the tendencies in the previous month, (iii) the expectations for the next three months, and (iv) the expectations for the next six months. For all industries it is common to ask the firms for their assessment of their current business situation, their orders at hand, their demand situation, their price developments and expectations, their employment developments and expectations, their business expectations, and the development and expectation for a industry-specific output variable (for example, the production in manufacturing, the construction activity, orders in wholesale and retail trade, and turnover in the service sector).

The special questions vary across industries of the economy and the months within a quarter. Per industry, however, they follow a specific pattern. Each special question is asked four times a year, either in the first, the second, or the third month of a quarter. For example, each January, April, July, and October, the German manufacturing firms are asked on their capacity utilization (CU): ‘The current utilization of our equipment (customary full use of the capacity = 100%) amounts to [...]’. Each firm can choose from eleven given answers ranging from 30% to 100% or have the possibility to state a number by their own if capacity utilization reaches a level above 100%.

Aggregation and Presentation For the aggregation of the firm-individual answers, the ifo Institute applies two weights: one based on firm-specific and the other based on industry-specific information. The first weight ensures the aggregation of firm-individual answers to specific economic indicators (for example, the current business situation). The second weight serves as the basis for industrial aggregations.

For the different industries either the number of employees (manufacturing, construction) or the amount of turnover (trade, services) serve as the firm-specific weight. Section C in the Supplementary Material presents an aggregation example for this first stage. Overall, larger firms are more important for business cycle fluctuations compared to rather small firms.

The second weights applied by the ifo Institute are based on official gross value added data. Each firm and product can be assigned to an industry on a 2-digit level. For example, a single car manufacturer is directly assigned with its firm-specific weight to division WZ08-C-29 – manufacture of motor vehicles, trailers and semi-trailers of the German Classification of Economic Activities, Edition 2008. A restaurant, instead, is assigned with its firm-specific weight to division WZ08-I-56 – food and beverage service activities (see Section A in the Supplementary Material). To each industry its weight in total gross value added is applied (for example, the 2017 weight of the sector WZ08-C-28 – manufacture of machinery and equipment is 15.4% in total manufacturing) to calculate the main industrial aggregates (manufacturing, construction, retail trade, wholesale, and services). As for the firm-specific aggregation, smaller industries also get a lower weight.Footnote 4

The application of the two weights leads to a high aggregation flexibility of the answers. Only to name a few, the ifo Institute has the possibility to calculate indicators for:

-

each industry (for example, the manufacturing of motor vehicles),

-

the main industrial groupings (intermediate goods, capital goods, consumer durables, and consumer non-durables; see Section A in the Supplementary Material),

-

each aggregation of industries (for example, consumption-oriented services),

-

each aggregation based on specific firm characteristics (for example, all firms with more than 500 employees),

-

regional aggregates (for example, all 16 German states),

-

...

Generally, all indicators of the ifo Institute are either presented in raw balances of positive and negative answers or these balances are transformed to indices that refer the current balance to an average value of a specific base year (see Section C and Section D in the Supplementary Material for more details). The construction of balance statistics ensures that each indicator can be treated as stationary by construction. In the media, the ifo Institute only publishes seasonally-adjusted indicators. X-13ARIMA-SEATS serves as the seasonal adjustment procedure. However, the unadjusted values are also available upon request or on usual platforms such as Macrobond. The seasonal adjustment is the only source for small revisions of the indicators over time, but the unadjusted values never change after a firm has responded.

Interpretation The main purpose of the ifo Business Survey is to provide timely, almost non-revised and leading business cycle indicators. A business cycle indicator is mainly characterized by its ability to describe the economic development appropriately. For example, the ifo Business Climate can serve as such a leading business cycle indicator if it signals changes in the dynamics of the German economy at an early stage. The main challenge, however, is to define on which reference or target series the business cycle indicator should focus on; this differentiation is very important for the following assessment of the forecasting power of the survey results. In case of the ifo Business Climate a public debate was ongoing in 2017, challenging its validity as leading indicator for the German economy. This is why Wohlrabe and Wollmershäuser (2017a) reacted to the upcoming critique by clarifying how the ifo Business Climate can be interpreted. In Section D in the Supplementary Material, I stick to this discussion by taking a deeper look in the existing literature. As the example I use German GDP and the ifo Business Climate. However, the argumentation also holds for other target series, for example, industrial production. In the end, the ifo indicators should be used in levels if the target series is the cyclical component of a macroeconomic variable. Or the indicators should be transformed in the same way as the variable to be forecasted (for example, quarterly changes).

Another issue raised on the interpretation of survey-based or sentiment indicators is what they really measure. For example, Algaba et al. (2020) show how one can use econometric techniques to transform qualitative information into quantitative measures. In the end one can ask which source of information firms use to formulate their qualitative answers. If they only value past information of macroeconomic aggregates such as GDP, the indicators might only be imperfect approximations of the firms’ sentiment. This means that the indicators generate no additional benefit compared to past values of the macroeconomic aggregate. If they, however, use firm-specific information, then the sentiment indicators might mainly reflect economic fundamentals. A newer literature on the firms’ formation of expectations clearly show that firm-specific information are more important than aggregate information (see Buchheim and Link, 2017; Born et al., 2022a; b; Dovern et al., 2022). Therefore, the survey indicators really add value to past information of several macroeconomic variables.

3 Article Selection and Categorization

A literature survey typically starts by a systematic collection of existing studies. This also comprises the examination of whether these studies have relevance for the underlying question of the literature survey or not. In this section, I discuss the criteria defined to select the articles at hand. I furthermore present the categories that I have decided to use to structure the selected studies. Due to the large dimensions and heterogeneity of the articles I refrain from conducting a meta-analysis and only count the studies that are in favor of the ifo indicators and those that are not. As the main objective of this overview article is to show both academics and practitioners the large possibilities of the ifo Business Survey, the narrative approach is also appropriate.Footnote 5

Forecasting Performance I will only present those studies that explicitly investigate the forecasting performance of the various indicators provided by the ifo Institute. I define the phrase ’forecasting performance’ in a rather broad sense. Each study that either concentrates on in-sample (for example, the examination of the leading properties of various indicators by applying cross-correlations), out-of-sample (for example, studies with an explicit forecast experiment) or both forms of analysis will be part of the pool of studies in this survey. From my point of view, this is a crucial differentiation. Whereas out-of-sample studies explicitly examine the forecasting power of the respective indicator(s), in-sample analyses are especially valuable to assess the validity of the indicator(s) for a business cycle diagnosis, which is usually done prior to each forecast. A forecaster might only be able to formulate good forecasts by initially investigating in which phase of the business cycle the economy currently is; this investigation is usually the main part of a business cycle diagnosis. Based on the definition of what forecasting performance means, I do not consider a study that satisfies at least one of the following four criteria:

-

1.

articles that periodically and exclusively comment new releases of the survey results,

-

2.

studies that examine large sets of indicators and that do not primarily focus on the performance of ifo indicators,

-

3.

articles with a methodological focus (see, among others, Carstensen et al., 2020), and

-

4.

studies that focus on the evaluation of microfounded macroeconomic theory by using the business survey outcomes.

Time Period One of my purposes is to shed light on newer articles. This is why I only survey articles that have been published between 1997 and 2021, which is a period of more than 20 years of intensive research and that might be a good approximation of the newer literature. A large part of the following surveyed articles have also been published in two larger collections of the ifo Center for Macroeconomics and Surveys (see Abberger et al., 2007; Wollmershäuser and Nierhaus, 2016). These two publications, however, do not comment on the forecasting power of the survey results.

Categorization The literature survey at hand comprises 93 studies that have either been published in refereed journals, in non-refereed periodicals, or as discussion papers. As the main purpose of this survey is to present the large possibilities the ifo Business Survey offers, it would be misleading to mix up all studies and arrange them in a timely manner. I therefore decided to group the articles into the following categories, with studies that comprise:

-

1.

gross domestic product, industrial production, or turning points,

-

2.

expenditure components of GDP (for example, exports) and prices,

-

3.

labor market outcomes,

-

4.

manufacturing and trade,

-

5.

service sector,

-

6.

economic variables at the regional level, and

-

7.

revisions of economic aggregates.

Most of the existing studies concentrate on either GDP, IP, or the identification of turning points. This is not surprising as, for example, GDP gains the largest medial attention and is the most comprehensive measure for a country’s economic activity. The IP is the most important indicator for quarterly GDP due to its monthly availability. Each economic variable will be discussed in separate sub-sections because of the large number of studies. These studies are complemented by articles that explicitly focus on variables from either the expenditure or production approach of GDP calculation.

I decided to separate the studies focusing on the service sector. The main reason is the relative novelty of the business survey results. Whereas the surveys in manufacturing, construction, retail trade and wholesale have a very long tradition, the survey in the service sector was only established in 2001 with a monthly annotation since October 2005.

Next to the provision of survey results for Germany, the ifo Institute also supplies indicators for regional entities such as the German states. On the one hand there is increasing interest of regional policy-makers in early signals of the state of the regional economy. And on the other hand, the Dresden Branch of the ifo Institute regularly publishes forecasts of regional activity in Saxony and Eastern Germany. Based on these two arguments, I decided that the regional results should be discussed in a separate section.

The last group of studies can be indicated as rather exotic in the pool of studies in this review. Whereas all other studies focus on the performance of the indicators for forecasting economic aggregates, the studies in group number seven are aimed at forecasting revisions of economic variables over time. Large revisions over time usually take place because of missing information or new methodologies. The first estimates of economic variables are based on samples that might not coincide with the population of firms in the economy. The ifo sample, on the opposite, is rather fixed and, as described before, representative for the German economy. This is one reason why a small strand of the literature has focused on forecasting revisions with the ifo indicators and grows since the beginning of the 2010s.

4 Forecasting Performance

Each table in the following sections has a similar structure based on six columns: (i) the article, (ii) the target series to forecast and its transformation, (iii) the period under investigation, (iv) the ifo indicator(s) used, (v) the applied method(s), and (vi) the main results. To present each table on one single page, it was necessary to introduce meaningful abbreviations which are mentioned in the notes to each table. I also indicate the studies that solely use in-sample techniques (\(*\)), out-of-sample methods (\(\dagger\)), or apply both forms of analyses.

4.1 Gross Domestic Product

The main economic indicator that receives the highest medial attention is gross domestic product. As GDP is the most comprehensive indicator to measure economic activity of a country, most of the existing studies that evaluate the forecasting power of the ifo indicators focus on this variable. The majority of existing studies attest the ifo indicators a very good or high forecasting power for real GDP growth (see Table 1).

By screening the articles in Table 1, three ifo indicators seem to be best suited to forecast German GDP: the ifo Business Climate Industry and Trade, the ifo Business Situation Industry and Trade and the ifo Business Expectations Industry and Trade. Earlier studies solely focus on Western Germany. Recent studies test the performance of the ifo indicators for Germany and confirm the results from earlier contributions on Western Germany.

Next to the high relative forecast performance, which has also increased during the global financial and economic crisis 2008/2009 according to Drechsel and Scheufele (2012b), the studies by Schumacher and Dreger (2004), Kholodilin and Siliverstovs (2006) and Drechsel and Scheufele (2012a) underpin the outstanding ability of the ifo indicators to forecast German GDP growth. On the one hand, simple time series models including either the ifo Business Climate or one of its two components (ifo Business Situation and ifo Business Expectations) are competitive compared to forecast pooling or factor models.Footnote 6 On the other hand, the main ifo indicators are regularly selected by the algorithms to enter the factor.

Two of the most recent studies, Henzel and Rast (2013) and Heinisch and Scheufele (2019), evaluate the evolution of the ifo indicators’ forecasting power for different information sets during the quarter. In general, quantitative indicators from official statistics (for example, industrial production) have a publication lag of one or more months while survey indicators are readily available at the end of each month. Survey indicators are moreover not heavily revised over time, which is clearly another advantage compared to hard data (see Sect. 4.9 for a discussion on the forecasting properties of the ifo indicators for revisions). This informational advantage should naturally lead to a higher forecast performance of the ifo indicators in comparison to hard indicators published by the Federal Statistical Office of Germany. Both studies indeed show that the ifo Business Climate Industry and Trade and the ifo Business Expectation Industry and Trade generate the smallest forecast errors for GDP when the forecast is calculated at the beginning of a quarter. However, after the first publication of industrial production for a specific quarter, the ifo indicators are, on average, no longer able to beat IP. By turning to one-quarter-ahead forecasts, the ifo Business Expectations exhibit the smallest forecast errors and ranked first across the pool of investigated indicators. Heinisch and Scheufele (2019) also show that a model incorporating industrial production and one of the ifo indicators simultaneously increase the forecasting power of simple one-indicator models. All in all one can summarize that the prominent monthly survey indicators by the ifo Institute have very good leading properties for the development of German GDP.

The pool of studies also reveals two articles that rate the forecasting performance of the ifo indicators as rather bad: Hinze (2003) and Langmantel (2004). Whereas Hinze (2003) finds that the ifo Business Expectations—despite the fact that they serve as leading indicator—produce higher forecast errors than the OECD Leading Indicator, the ifo Business Situation and the ifo Business Expectations for the Western German manufacturing sector both exhibit a lower forecasting performance than an autoregressive benchmark (see Langmantel, 2004).

4.2 Industrial Production

One major disadvantage that comes along by investigating GDP as business cycle indicator is its rather low publication frequency. This disadvantage can partially be eliminated by using industrial production. Despite the fact that the German industryFootnote 7 only accounts for approximately 25% of total German GDP, manufacturing is commonly identified as the cycle-maker of the German economy (see Abberger and Nierhaus, 2008a) . Since industrial production is one of the main primary statistics that enter the calculation of GDP by the Federal Statistical Office of Germany (see Hartmann et al., 2005), both variables show a high correlation coefficient in their growth rates. The previous section has also shown that industrial production plays a crucial role for an unbiased forecast of German GDP. It is thus not surprising that a multitude of studies evaluate the forecasting power of the ifo indicators for industrial production; Table 2 lists 10 articles.

Five articles attest the ifo indicators a high forecasting power, four studies argue in the opposite direction and one article assesses the performance across different forecasting situations. A comparison of the studies is rather difficult as the articles vary in various dimensions. Next to different methods and time periods applied, the studies also vary in the question which ifo indicators should be evaluated. As especially the indicators from German manufacturing should be applied, I start by presenting their results first. Fritsche (1999), Fritsche and Stephan (2002) as well as Abberger (2006b) certify the ifo indicators, and here especially the ifo Business Climate Manufacturing and its two sub-indices, to have very good leading properties that can be utilized to formulate point forecasts. Vogt (2007) confirms this result for the latest vintage of data. However, if he applies real-timeFootnote 8 data for industrial production, the ifo indicators lose their performance for short-term predictions; for longer horizons they are still superior. This issue is again discussed in Sect. 4.9.

The remaining studies apply the survey results for the aggregate Industry and Trade that also incorporates—next to manufacturing—the survey results from construction and the trade sector; this is also the case for most of the articles focusing on GDP. These studies approximate the development in manufacturing by economic signals stemming from manufacturing, construction, and trade and are mainly the ones that find a rather bad forecasting performance of the ifo indicators. Breitung and Jagodzinski (2001) state that the ifo Business Climate Industry and Trade and the ifo Business Expectations Industry and Trade have the worst power in their applied forecast experiment; Dreger and Schumacher (2005) also find that the most prominent ifo indicators are not able to beat a benchmark model. These results are especially confirmed by Hüfner and Schröder (2002a, 2002b) for the ifo Business Expectations Industry and Trade, that exhibit a lower forecasting power compared to the ZEW Indicator of Economic Sentiment. With reference on these results, the argumentation by Benner and Meier (2004) exactly goes in the opposite direction; they state that the ifo Business Expectations Industry and Trade has a better forecasting performance compared to the ZEW Indicator of Economic Sentiment. The main difference between both studies is the applied empirical model. Whereas Hüfner and Schröder (2002a, 2002b) use a VAR framework, Benner and Meier (2004) expand the VAR by an error correction term for the survey indicators; the three articles are based on the same set of indicators and investigated time period.

Finally, Nierhaus and Sturm (2004) find a high forecasting power of the ifo Business Climate Industry and Trade, the ifo Business Situation Industry and Trade and the ifo Business Expectations Industry and Trade for industrial production. A major difference between Nierhaus and Sturm (2004) and the previous mentioned studies is the transformation of industrial production. Whereas all the other studies calculate growth rates of industrial production in advance (either to the previous month or the month of the previous year), the forecasting experiment by Nierhaus and Sturm (2004) focuses on the cyclical component of industrial production. The differentiation between growth rates and the business cycle of an economic time series is crucial. However, this issue is insufficiently discussed in the literature to date. The ifo indicators are leading indicators for the German business cycle as also the questionnaire suggests. A calculation of growth rates instead distorts the cyclical signal as these growth rates are still superimposed by the trending behavior of the original series and it suppresses the leading characteristics of the indicator(s). The more the trend growth rate of industrial production varies over time, the more lose the ifo indicators their power to forecast growth rates of industrial production. In such cases it seems preferable to set up a forecasting experiment that focuses on the cyclical component of the target series.

4.3 Turning Points

One of the major tasks for an applied forecaster is the early detection of turning points. This is, however, the most challenging task in applied forecasting work, especially if the turning point occurs relatively late in the forecasting horizon. As each applied forecast is subject to various assumptions (for example, stable political conditions), qualitative leading indicators only deliver an important contribution to detect business cycle turning points in the very short-run. Most of the studies in Table 3 find evidence that either the ifo Business Climate Industry and Trade or the ifo Business Climate Manufacturing are able to early detect a change in the speed of cyclical growth or turning points. The second finding is confirmed by an ex-post comparison of realized turning points in the ifo indicators and indicators from official statistics that were filtered by suitable approaches.

At this stage in the paper, I again have to explicitly bring forward the differentiation between in-sample and out-of-sample analyses. The ability of an indicator to detect ex-post turning points in realized data does not necessarily lead to the conclusion that this indicator is able to accurately forecast turning points ex-ante. This is the main reason why various studies with other methods present different results or conclusions. The listing of studies in Table 3 underpins this general guess.

The existing literature for Germany from the 2000s and 2010s was significantly shaped by Klaus Abberger and Wolfgang Nierhaus. Based on proven in-sample approaches (for example, the Bry-Boschan-Algorithm, several correlation coefficients and simple Markov-Switching-Models), both authors show in several studies that the ifo Business Climate Industry and Trade is a reliable leading indicator to date business cycle turning points for either German GDP or industrial production. The ifo Business Climate Industry and Trade exhibits an average lead of one to two quarters of the turning points in German GDP. Again this is a matter of transformation as already brought forward in the industrial production section. In all studies by Abberger and Nierhaus the cyclical component is analyzed instead of a transformation in growth rates. This choice seems reasonable as the ifo survey indicators focus, by construction, on the business cycle signal.

The article by Hott et al. (2004) is worth mentioning as the authors test several “Turning-Point-Rules” for their capability to early detect economic turning points. One of the most prominent representatives is the well-established “Threefold-Rule” by Vaccara and Zarnowitz (1978). Once the ifo Business Climate falls (rises) three times in a row, these movements are interpreted as upper (lower) turning points of the German economy. Hott et al. (2004) indeed find that the “Threefold-Rule” leads to remarkable good dating results. Only a small fraction of wrong signals are emitted by the ifo Business Climate. Nierhaus and Abberger (2014) also evaluate the “Threefold-Rule” and compare its capability with a simple Markov-Switching-Model. They conclude for the cyclical component of German industrial production that the ifo Business Climate early detects turning points in manufacturing. All in all, the “Threefold-Rule” is appropriate to date turning points, even though that the Markov-Switching-Model is superior at upper turning points of the German economy.

Fritsche and Kuzin (2005) underpin these in-sample findings by a forecast experiment based on Probit models and Markov-Switching-Models. Especially the ifo Business Expectations of Intermediate Goods Producers—one of the main industrial groups introduced in Section 2—show a lead to forecast recessions in industrial production growth. However, it has to be stated that a large number of quantitative indicators such as long-term interest rates deliver at least the same or even better results compared to the business survey indicators. From their article follows that the ifo indicators have in general a good performance to detect turning points, but they are less competitive compared to data from official statistics. This is also more or less the result of the articles by Funke (1997), Döpke (1999) and Bandholz and Funke (2003) which certify the ifo indicators less good or even bad properties to early detect and forecast turning points. For German GDP, the ifo Business Climate Industry and Trade exhibits worse power either compared to other variables or a diffusion index based on a factor model. The same holds true for industrial production and the ifo Business Climate Manufacturing and its two sub-indices. Thus, the literature indicates that the ifo indicators are especially able to early detect ex-post turning points but lose their power when it comes to forecasting a cyclical change in the German economy.

An unerring forecast of business cycle turning points in general and recessions in particular is for sure the most difficult task for an applied forecaster. The recent literature, however, takes a step forward to increase the forecast performance of detecting recessions in advance by more elaborate methods (see Carstensen et al., 2020). In this literature the ifo indicators play a major role as they are regularly selected from a large pool of qualitative and quantitative indicators to calculate, for example, a factor that enters a well-specified empirical model.

4.4 Expenditure Components of GDP and Prices

In the 2010s a large academic literature evolved that focus on other economic variables rather than GDP or industrial production. Table 4 summarizes the 16 articles in this category. The literature comprises seven economic aggregates: investment (4 articles), exports (4 articles), imports (2 articles), private consumption (1 article), inventories (2 articles), business and property income as well as gross value added (1 article), and prices (2 articles). With the exceptions of Knetsch (2005) and Abberger and Nierhaus (2011) all remaining studies use an evaluation period from the beginning of the 1990s till the recent available data at that time. Most studies apply cross-correlations or forecast experiments.

One of the most important but difficult to forecast economic variables are price-adjusted equipment investments. This might be the reason for the small number of articles published. Five ifo indicators seem to be well-suited to forecast equipment investments: the ifo Business Climate Investment Good Producers, the ifo Business Expectations Leasing, the ifo Business Expectations Investment Goods Producers, the ifo Investment Indicator Leasing, and the ifo Investment Indicator. All five indicators show leading properties with equipment investments and are able to retrace its development over time. Billharz et al. (2012) find that the indicators mirroring the mood of investment goods producers deliver the highest forecast performance for one-quarter-ahead predictions.

The most important economic variable for Germany are exports as the German business model is characterized by selling investment goods abroad. But the same holds true as for equipment investment: the high volatility in export growth makes this economic variable very difficult to predict. The most important indicators are the ifo Export Expectations and the ifo Export Climate. Ruschinski (2005) and Grimme and Wohlrabe (2014) mainly apply in-sample techniques such as cross-correlations, whereas Elstner et al. (2013) and Grimme and Lehmann (2019) apply a forecast experiment. Overall, the ifo indicators are very beneficial instruments for German export growth. On the one hand, they show leading properties and early signal turning points. On the other hand, they generate smaller forecast errors compared to official monthly data such as special trade figures.

Along the lines of export growth, German import growth is also characterized by a high volatility, thus, leading to large forecast errors. Additionally, there are no leading indicators for imports available to date. Therefore, Grimme et al. (2018, 2021) established the so-called ifo Import Climate and tests its forecasting properties with well-established indicator models. For the current and next quarter, the ifo Import Climate produces the smallest forecast errors and is therefore superior to official data such as special trade figures.

One study exists that focuses on the largest expenditure component of German GDP: private consumption (Lehmann et al., 2016). As the ifo survey focuses on the firm side of the economy, it seems unusual at first to extract indicators to forecast consumer spending. However, if the survey participants from wholesale and retail trade are rational and able to formulate an unbiased assessment of their markets, the ifo indicators from these two branches of the German economy might be helpful to forecast private consumption. Despite the fact that the article by Lehmann et al. (2016) focuses on the evaluation of the ifo-internal forecasting approach IFOCAST (see Carstensen et al., 2009), the results reveal a special pattern of the indicators’ forecasting performance. The best performing indicators are the ifo Business Expectations Retail Trade Non-Durable Goods and the ifo Business Expectations Retail Trade Durable Goods. Thus, also the business survey results can be used to formulate unerring forecasts of private consumption.

Many variables that are calculated within the arithmetic of national accounts are not even recognized by academics or the public. One prominent example are inventories that, despite its low level of attention, play a crucial role for regular business cycle diagnoses or analyses. On the one hand, inventories measure the discrepancy between demand and supply. On the other hand, inventories are a central element in business cycle theory. Despite its crucial role, no reliable (leading) indicators for inventories are available which is why this variable is heavily revised over time. Two studies exist that developed and tested an indicator for inventories based on the ifo Business Survey results (see Knetsch, 2005; Abberger and Nierhaus, 2015). The ifo Stock of Finished Products indicator, an aggregation of survey results relating to firm-specific stock-keeping in manufacturing and trade, shows leading properties compared to inventories published by the Federal Statistical Office of Germany. The authors follow from their results that the ifo indicator can be used to forecast inventories of the current and next quarter.

Not only inventories are disregarded in the academic and public debate, also the firms’ profits are not recognized or analyzed. The main reason might be the missing information on firms profits by the Federal Statistical Office of Germany. Profits are currently calculated as the residual of national income and aggregate wages. As profits are a precarious variable, the ifo Institute consciously asks for business situation and business expectations and let the firms decide how to interpret these two rather abstract concepts. Nevertheless, the ifo Institute wanted to know which economic variable the firms attach to business situation and business expectations. It therefore asked its firms about their associations, which is called the “ifo Meta Survey” (see Abberger et al., 2009, for results of the German trade sector). The vast majority of respondents declare that they either think of their profit situation or the development of their turnover by answering the ifo questions concerning business situation or business expectations. Based on these insights, Abberger and Nierhaus (2011) studied the statistic connection between the ifo Business Climate Industry and Trade and firms’ profits measured as business and property income from German sector accounts. It turns out that the ifo Business Climate Industry and Trade has leading properties for the cyclical component of these profits.

The last economic variable in this category are prices either for the whole German economy or its main industries. It is indisputable that inflation is, next to GDP, the most central variable for an economy. One question in the pool of ifo’s survey questionnaire is the assessment of firms regarding their price development over the next three months. Two studies exist that test the suitability of this question as leading indicator for the price development of either upstream stages of production (for example, producer price indices in manufacturing) or the consumer price index. Abberger (2005a) as well as Lehmann and Wollmershäuser (2017) conclude that the ifo Price Expectations are a suitable indicator to forecast either producer prices in different industries or core inflation for Germany.

4.5 Labor Market Outcomes

The academic literature on forecasting German labor market variables is rather small compared to the studies focusing on GDP. One well-established leading indicator is the ifo Employment Barometer as Table 5 shows. Existing studies (to date: 7 articles) mainly focus on three labor market variables: the number of employees subject to social security, the total number of employees and the number of unemployed persons. Vacancies and the unemployment rate only play a minor role. The existing studies apply a large set of methods to investigate the leading properties of the ifo Employment Barometer. They range from simple cross-correlations, over non-parametric regression methods up to forecast experiments.

Overall, the studies focusing on employment development in different industries find a lead of the ifo Employment Barometer for manufacturing; the highest correlation in construction and trade can be found contemporaneously. The ifo Employment Barometer Industry and Trade or for the total German economy (incl. services) is a leading indicator for both the number of employees subject to social security and the total number of employees.

A very interesting debate on the suitability of the ifo Employment Barometer as leading indicator comprises the studies by Henzel and Wohlrabe (2014), Hutter and Weber (2015) and Lehmann and Wohlrabe (2017b). The most recent study by Lehmann and Wohlrabe (2017b) applies the ifo Employment Barometer and the newly established IAB Labour Market Barometer to forecasting both the number of employees subject to social security and the total number of employees. Both authors find that the ifo Employment Barometer produces, on average, lower forecast errors than the IAB Labour Market Barometer. Henzel and Wohlrabe (2014) instead find via cross-correlations that the statistical relationship between ifo Employment Barometer and the unemployment rate is weaker compared to the relationship between the IAB Labor Market Barometer and the unemployment rate. This result is confirmed by Hutter and Weber (2015) whose forecast experiment reveals that the ifo Employment Barometer is in general a reliable indicator to forecast the unemployment rate but shows larger forecast errors compared to the IAB Labour Market Barometer. All three studies are very plausible as the ifo Employment Barometer focuses on labor demand of German firms, whereas the questionnaire of the IAB Labour Market Barometer asks for the development of the number of unemployed persons. It follows from these studies that the applied forecaster might focus on the ifo Employment Barometer when it comes to forecasting the number of employees and the IAB Labour Market Barometer when the focus lies on the unemployment rate.

4.6 Manufacturing and Trade

The main focus in the following section lies on variables representing the sectors manufacturing and trade of the German economy. This is mainly motivated by the reason that the ifo Institute surveys firms and therefore collects a large number of production-side (leading) indicators. The differences compared to Sects. 4.1 to 4.3 are that the following studies do not exclusively focus on either GDP or total industrial production. This section rather captures studies evaluating industry-specific variables (for example, machinery and equipment production), studies that focus on domestic trade or articles that examine further production-side variables (for example, new orders in manufacturing). Table 6 lists the corresponding studies.

The ten existing studies can be classified into three groups. The first group of studies concentrates on the development in the two industries wholesale and retail trade. The second group is characterized by studies focusing on the performance of industry-specific ifo indicators for economic variables in manufacturing. The third and last group is only represented by the study of Abberger and Nierhaus (2008a) that also concentrates on manufacturing, but applies one of the few quantitative indicators from the ifo Business Survey: capacity utilization of the German manufacturing sector.

Abberger (2005b, 2005c) started to establish the literature in the first group of studies that tackles the issue of leading indicators for German domestic trade. Both studies investigate the leading properties of ifo indicators and the cyclical component of trade turnover by a graphical analysis. The ifo Business Climate Retail Trade and the ifo Business Climate Wholesale are characterized as leading indicators for the cyclical component of the corresponding turnover series. The latter result has been partially confirmed by Rumscheidt (2017), who investigates via a cross-correlation analysis the relationship between ifo indicators and prices, employment and turnover in wholesale. She finds the strongest connection between ifo indicators and employment growth. For wholesale prices, the relationship is much weaker. For turnover development it has to be stated that the relationship is very weak, which stands in sharp contrast to Abberger (2005c) who attests the ifo Business Climate wholesale leading properties and thus a qualification as leading indicator. The main reason might be again the differences between the transformation of the series. Whereas Abberger (2005c) applies the cyclical component of turnover in wholesale, Rumscheidt (2017) calculates growth rates to the month of the previous year.

The second group comprises the studies for German manufacturing. An early contribution is the article by Goldrian (2003a) that applies a large set of ifo indicators from manufacturing to forecast new orders for total manufacturing and two sub-industries. His main result is that ifo indicators are very helpful to formulate short-term forecasts for the new orders series for total manufacturing as well as the industry-specific development. Much more comprehensive is the article by Scharschmidt and Wohlrabe (2011). Both authors test the forecasting properties of industry-specific ifo indicators for twenty-two 2-digit-level industries of the German manufacturing industry. It turns out that the industry-specific indicators beat a simple autoregressive benchmark model. The next three articles in this second group (see Kudymowa and Wohlrabe, 2014a; 2014b; Litsche and Wojciechowski, 2016) can be attributed to the 2014 newly established series “ifo Business Survey at a Glance”.Footnote 9 The three articles exclusively focus on the following industries: printing and reproduction of recorded media (WZ08-C-18—German Classification of Economic Activities, Edition 2008), manufacture of rubber and plastic products (WZ08-C-22—German Classification of Economic Activities, Edition 2008) and manufacture of machinery and equipment (WZ08-C-28—German Classification of Economic Activities, Edition 2008). All three studies apply cross-correlations, either for the whole sample or in a rolling fashion, as method to detect leading properties of the ifo indicators. The most important leading indicator in the articles by Kudymowa and Wohlrabe (2014a, 2014b) is the ifo Business Climate Manufacturing. For the sector manufacture of rubber and plastic products also the indicators ifo Production Development and ifo New Orders are classified as leading indicators. Litsche and Wojciechowski (2016) find for the production index of manufacture of machinery equipment, one of the German key industries, leading properties of the indicator ifo New Orders. The last article in this group is the one by Lehmann and Reif (2021) who compare the real-time forecasting power of the ifo headline indices for manufacturing with the Manufacturing PMI by IHS Markit. In a forecast experiment they find that the ifo headline indices (ifo Business Climate Manufacturing, ifo Business Situation Manufacturing and ifo Business Expectations Manufacturing) are superior to the Manufacturing PMI in the nowcast situation and for one-quarter-ahead predictions.

Abberger and Nierhaus (2008a) builds the last group in this section. Remarkable at this article is the application of one of the few quantitative survey results—capacity utilization in manufacturing—from the ifo Business Survey, whereas the other studies focus on the qualitative results. The authors test the leading properties of capacity utilization for the cyclical component of real gross value added in manufacturing. Based on a graphical analysis, cross-correlations and a spectral analysis they find that the ifo Capacity Utilization Manufacturing reliably signals turning points and has a high contemporaneous correlation with gross value added in manufacturing. Since capacity utilization is available at the beginning of each quarter, the high contemporaneous correlation becomes a technical lead as official statistics exhibit a considerable publication lag.

4.7 Service Sector

This section exclusively focuses on the forecast performance of ifo indicators for the German service sector. One could argue that an integration of these studies in Sect. 4.6 would make sense. However, the service sector still takes a special role in the ifo Business Survey. On the one hand, the service sector survey has been first established in 2001, whereas the other industries are part of the monthly survey for a much longer period. On the other hand, the ifo Institute distinguished between the ifo Business Climate Industry and Trade and the ifo Business Climate Services in its monthly press releases until April 2018. Since then the ifo solely comments on the ifo Business Climate Germany which is the aggregation of the two former mentioned indices (see Sauer and Wohlrabe, 2018a; b). Moreover, the literature on the forecasting power of ifo’s service indicators is very young as the time series were too short to estimate meaningful econometric models or to apply standard forecasting techniques.

The small strand of the literature started with the extensive studies by Wohlrabe (2011, 2012). However, I will not summarize these two extensive studies as the number of presented ifo indicators and forecasted series from official statistics are nearly overwhelming. Nevertheless, it can be stated that the ifo indicators for the German service sector exhibit a high forecasting power. Four identified studies followed the articles by Wohlrabe. These are listed in Table 7.

Wohlrabe and Wojciechowski (2014) again focus on the total service sector. For the period 2005-Q1 to 2014-Q2 they test the forecasting performance of several ifo indicators for real turnover and the number of employees in the service sector. The methods they apply are a graphical analysis and cross-correlations. Overall, the ifo indicators show leading properties and can thus be used for forecasting. The ifo Business Expectations Services show the highest correlation with real turnover at a lead of two quarters. By investigating the number of employees it turns out that the ifo indicators have the highest correlation contemporaneously. As the statistics for the German service sector are also exposed to large publication lags, the high contemporaneous correlation technically becomes a lead in applied forecasting.

The next two studies for the service sector are those by Wojciechowski (2015a, 2015b). The first of the two articles focuses on gross value added for the sector information and communication (WZ08-J—German Classification of Economic Activities, Edition 2008). Based on cross-correlations, the article reveals that the ifo Business Climate Information and Communication has the highest correlation with sectoral gross value added at a lead of one quarter. As highly contemporaneous correlated indicators, the ifo Business Situation Information and Communication and the ifo Employment Expectations Information and Communication are preferable. The second article by Wojciechowski tests the leading properties of ifo indicators for German accommodation and food service activities (WZ08-I – German Classification of Economic Activities, Edition 2008). Again based on cross-correlations, the ifo Turnover Expectations Hotel and Restaurant Industry shows leading properties to year-over-year growth of official turnover in this sector.

The latest article is the one by Lehmann and Reif (2021) which tests the ifo headline indices for the service sector in real-time and compare their performance with the Business Activity Index of IHS Markit. Based on a real-time forecast experiment, it turns out that the IHS Markit indicator for services is better than the ifo headline indices for one-quarter-ahead predictions. In the nowcast situation, the ifo indicators slightly outperform the IHS indicator. Overall, the small number of studies for this sector bear the potential for additional research activities in the future.

4.8 Sub-national Variables

Forecasts for sub-national entities are rather scarce in Germany and not as common as the prediction of German GDP. Also the academic literature was underdeveloped for a long period of time.Footnote 10 Nevertheless, sub-national forecasts are important because of, for example, the budget planning of the German states. A state-specific approximation by the total German development might be misleading because of sharp differences in the economic structure across the German states (see Lehmann and Wohlrabe, 2015; Lehmann and Wikman, 2022).

The ifo Institute provides a large set of indicators for several German states or regional aggregates (see Lehmann et al., 2019). All studies that focus on sub-national entities are listed in Table 8. Based on this compilation, three regions are analyzed in the existing literature: Baden-Württemberg, the Free State of Saxony and Eastern Germany. Goldrian (2003b) investigates the leading properties of ifo indicators for official data for Baden-Württemberg, namely, new orders in manufacturing, nominal turnover in wholesale, current orders in building construction and the number of employees subject to social security in manufacturing. The industry-specific ifo indicators—the ifo Demand Development Manufacturing Baden-Württemberg, the ifo Turnover Development Wholesale Baden-Württemberg, the ifo Current Orders Construction Baden-Württemberg and the ifo Employment Expectations Manufacturing Baden-Württemberg—serve as leading indicators for the industry-specific target series. Moreover, the indicators early detect turning points.

Compared to the previous mentioned studies that focus on Baden-Württemberg, Vogt (2008) and Lehmann et al. (2010) test the performance of ifo indicators for the Free State of Saxony. Both articles are based on graphical analyses and cross-correlations. Vogt (2008) introduces an ifo Employment Barometer for Saxony. He finds that this barometer for Saxony shows a high contemporaneous correlation with the monthly year-over-year growth rate of Saxon employment subject to social security. Nevertheless, the analysis reveals that the correlations remain high until a lead of the ifo Employment Barometer Saxony up to six months, which is why the indicator can also be used for forecasting purposes. Lehmann et al. (2010) explicitly focus on the period around and in the great recession (2007-M1 to 2009-M12). They ask whether the ifo indicators for Saxon manufacturing lose their leading properties in this period of time or not. The results reveal that both the ifo Business Climate Manufacturing Saxony and the ifo Business Climate Machinery and Equipment Saxony remain reliable leading indicators during the crisis. For total Saxon manufacturing, the ifo indicator shows a lead of one month to new orders and two months to turnover. The lead becomes three months to turnover in the Saxon machinery and equipment sector. In contrast, the ifo indicators shows lagging properties for new orders in the Saxon machinery and equipment sector. This lag is, nevertheless, compensated by the early availability of the ifo indicators.

The last two studies that are assigned to this section are the ones by Lehmann (2010) and Lehmann et al. (2014). Both studies can be seen as follow-up articles to Vogt (2008) and Lehmann et al. (2010). The idea of an ifo Employment Barometer Saxony is transferred to Eastern Germany in Lehmann (2010). Indeed he finds that the ifo Employment Barometer Eastern Germany is a leading indicator for local employment growth. The highest correlation is observable at a lead of three months to the monthly year-over-year growth rate of Eastern German employment subject to social security. Lehmann et al. (2014) modify the study by Lehmann et al. (2010) in two dimensions. First, they relinquish on the exclusive focus on the global 2008/2009 economic crisis. Second, they additionally broaden the focus of the study on Eastern Germany and the construction sector. Overall, the regional ifo indicators have leading properties, whereas the statistical connection is higher for Eastern Germany compared to the Free State of Saxony. The highest correlations for the manufacturing sector can be found for the ifo Business Expectations Manufacturing Eastern Germany or the ifo Business Expectations Manufacturing Saxony. The connection between the ifo indicators and official statistics become weaker by focusing on the construction sector. Nevertheless, the user might focus on the ifo Business Situation Construction Eastern Germany or ifo Business Situation Construction Saxony.

Next to the leading properties of the ifo indicators, they also play a key role for regional economic analysis. On the one hand, important business cycle indicators such as industrial production are not regularly published by official statistics for all German states. On the other hand, regional statistics exhibit a higher publication lag compared to their German counterpart. Political decision-maker, however, need early and reliable sources for the current economic development. Such a source might be the regional ifo Business Survey as it produces early available leading indicators to assess the local business cycle development.

4.9 Data Revisions

In this section I do not focus on the forecasting performance of the ifo indicators for official statistics but rather on their revisions over time. Revisions of economic variables usually take place because of incomplete information of the Federal Statistical Office of Germany. The reasons for revisions are manifold and not only driven by incomplete information: new classifications, protection of data privacy, new aggregation methods etc. In advance, one can ask why we should focus on this strand of the literature and why should there be a connection between revisions and leading indicators. One answer lies in the composition of the samples. In case that the ifo sample is representative for the German economy but the sample of the Federal Statistical Office of Germany for its first release is not, the ifo indicators should be able to track each revision taking place due to new data entering the official series. This suggestion seems to be supported by looking at the articles in Table 9.

Jacobs and Sturm (2005) as well as Bührig and Wohlrabe (2015, 2016) analyze the revisions in industrial production for different time periods. Strictly speaking, the articles by Bührig and Wohlrabe are follow-up studies to the one by Jacobs and Sturm as they explicitly rely on that article. This is why Bührig and Wohlrabe can investigate whether the results of Jacobs and Sturm are stable over time or only hold for their investigated time period. All three studies find that the ifo Business Situation Manufacturing is the best indicator to forecast revisions in industrial production, thus, Bührig and Wohlrabe confirm the findings of Jacobs and Sturm as they also apply the same methodological approaches.

Boysen-Hogrefe and Neuwirth (2012) focus on quarterly GDP growth instead of monthly IP growth. They show that the ifo Business Situation Industry and Trade exhibits a high informative content for revisions in German GDP and can thus be used to early asses and forecast its changes due to new data material.

The last article in this section is the one by Wollmershäuser (2016). In Sect. 4.4 I presented the studies that focus on the forecasting performance of ifo indicators for changes in quarterly inventories. Wollmershäuser (2016), however, analyzes the indicators’ power to predict the revisions in inventories. He bases his analysis on cross-correlations and a battery of regressions and shows that the ifo Stock of Finished Products Manufacturing indicator has high explanatory power for the patterns in inventory revisions.

Similar to the service sector, using survey data to forecasting revisions seems to be a promising field of research in the future. The mentioned articles also perfectly fit into the developing literature on (forecasting) revisions. For the German case, Strohsal and Wolf (2020, p.1252) find that national accounts figures are “biased, large and predictable”.Footnote 11 Thus, the results from Table 9 are not surprising in that way. Several attempts in the literature have been made to explicitly model and forecast data revisions; a recent survey on how revisions can be treated for economic forecasting is provided by Clements and Galvão (2019). Hogrefe (2008) applies mixed-frequency models (for example, MIDAS) to improve forecasts of revisions to US GDP. Kishor and Koenig (2012) model revised data and data revisions separately and link both approaches via the Kalman Filter to forecast ’true’ values of US macroeconomic variables. An interesting approach called ’Release-Augmented Dynamic Factor Model (RA-DFM)’ is provided by Anesti et al. (2022). With this class of models the user can simultaneously formulate nowcasts on first data releases of GDP as well as its subsequent revisions. Due to the factor structure of the model, a bunch of economic indicators can also be included to deliver valuable signals for forecasting. In case of UK GDP, Anesti et al. (2022) find their approach improving the standard dynamic factor model and especially survey data help to forecast first revisions. Their results together with the findings from Table 9 reveal the potential of the ifo Business Survey to improve revision forecasts for several macroeconomic aggregates. Furthermore, the results from the ifo Business Survey might also be used to replace heavily revised and unobservable variables such as the output gap which then enter the fiscal or monetary decision process (see, for an application to structural budget balances, Göttert and Wollmershäuser, 2021).

5 Conclusion

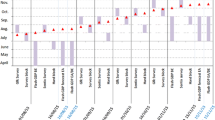

The overall conclusion on the forecasting power of the ifo indicators turns out to be very positive. Table 10 summarizes the main ifo indicators that have been proven in the literature to be good leading indicators. The spectrum of economic variables that can be forecasted by using ifo indicators ranges from GDP over expenditure and production components up to labor market outcomes and sector-specific figures. Apart from the performance for the German economy, the ifo Institute also publishes its indicators for the German states. A small but growing literature certifies the regional ifo indicators a high forecasting performance.

What follows from this overview is that both academics and practitioners might enrich their interests and toolboxes by additional survey indicators. The dimension of possibilities is quite large and a lot of questions are under-explored or even not recognized at all (see, Sauer, 2020, for an overview over the existing questions). Furthermore, the results at hand might even initiate the calculation of new indicators by combining two or more questions. For example, the combination of business and employment expectations leads to an indicator that possibly approximates productivity development of the firm. Together with realizations one might also construct productivity shocks from micro data or a new macroeconomic measure. Another example is the article by Wohlrabe and Wollmershäuser (2017b) that introduces an economy-wide capacity utilization measure to track the output gap of the German economy.

The literature survey at hand might also trigger academics or practitioners to deeply investigate the large universe of the Joint Harmonized EU Programme of Business and Consumer Surveys, for which the ifo Institute delivers the German data. For each of the European member states a large set of survey indicators is readily available and it is reasonable to ask whether these indicators do a good job in other countries as well. So this literature survey for Germany might also be seen as a blueprint for other economies and their applied forecasters.

Furthermore, this overview is also addressed to readers that seek for new data sources, for example, at the regional level. The data availability at the regional level in Germany is quite unsatisfactory as, for example, GDP is only released at an annual basis and important monthly indicators such as industrial production are only available for a small number of regions. For this reason, the business survey results might deliver regional decision-makers correct assessments of the current economic stance and its future development.

Data Availability

Not applicable.

Code Availability

Not applicable.

Notes

A detailed and comprehensive introduction to the ifo Business Survey has been published as German-speaking collection (see Sauer and Wohlrabe, 2020). An English-speaking version will be available in the future.

In April 2018, the famous ifo Business Climate Industry and Trade has been replaced by the ifo Business Climate Germany (see Sauer and Wohlrabe, 2018a; b; Sauer et al., 2018; Weber, 2019). One of the main reasoning for the replacement is the growing importance of the service sector for total output. The ifo Institute therefore decided to update its Business Climate Index which now also includes the service sector, next to industry, construction, and trade.

Next to the standard and special questions, the ifo Institute also asks for firm-specifics on a bi-annual and annual basis. It is also possible—after consulting the ifo Institute—to ask single questions for specific purposes or research activities. Only to name a few: questions on the influence of climate change on the firm’s business activity (see Auerswald and Lehmann, 2011; Berlemann and Lehmann, 2020), the influence of the 2014 Ukraine-conflict (see Grimme et al., 2014), the influence of the US tax reform in 2018 (see Krolage and Wohlrabe, 2018), the German ’Mittelstand’ (see Berlemann et al., 2018; 2021), the extent and benefits from homeoffice (see Alipour et al., 2021), subjective uncertainty (see Bachmann et al., 2021), the Corona crisis (see Buchheim et al., 2022), or the influence of the Russian invasion of Ukraine (see Bachmann et al., 2022; Sauer and Wohlrabe, 2022).

The calculation of the ifo Business Climate Germany is based on constant weights and described in more detail in Section D in the Supplementary Material.

Stanley (2001) argues in favor of a meta-analysis mainly because of its ability to formulate objective results that are secured in a statistical sense. However, meta-analyses are not free of criticism as discussed by, for example, Borenstein et al. (2009) and Greco et al. (2013). I mainly refrain from a meta-analysis because of the difficulties arising from the variety of studies and the summation of these different results. The overview at hand is dealing with the forecasting (out-of-sample) and leading (in-sample) properties of the various ifo indicators. Whereas the forecast accuracy can be examined with any kind of average forecast error, the leading properties are mostly communicated as zero/one decision. Either an indicator has leading properties or not. Mixing both figures to one in a meta-analysis is not appropriate due to the different dimensions (continuous vs. discrete measurement). The separation of both topics would instead result in a small number of observations for each category and thus in a sharp reduction of statistical power of the meta-analysis.

Pooling is a technique that densifies a multitude of competing forecasts from different models to one specific figure based on a selected weighting scheme. If, for example, 100 competing forecasts for GDP are available, the forecaster can apply a simple mean or median to calculate one single weighted forecast for GDP. On the opposite, factor models are applied to the data before a forecast is formulated. The competing indicators are densified to a small number of so called factors beforehand and enter the applied forecasting model afterwards. One prominent representative of factor models are principal components.

In this delimitation, industry is the sum of manufacturing, mining and quarrying and energy. The construction sector is not included.

A real-time forecast situation is characterized by the solely application of information a forecaster had at a specific point in time. Most of the existing studies focus on the latest vintage of data that were revised by the Federal Statistical Office of Germany several times. In real-time, these revisions are, however, unknown to the forecaster and might change the current assessment of the business cycle phase and the estimated empirical model that is used to calculate the forecasts.

It has to be mentioned that the article by Rumscheidt (2017) officially counts to this new series of publications. As it focuses on the first group of production-side articles, I decided to assign it to this group.

In the last decade the literature on regional GDP forecasting has noticeably evolved (see Kholodilin et al., 2008; Kopoin et al., 2013; Henzel et al., 2015; Lehmann and Wohlrabe, 2014a, 2014b, 2015, 2017a; Gil et al., 2019; Chernis et al., 2020; Claudio et al., 2020; Koop et al., 2020; Kuck and Schweikert, 2021).

References

Abberger, K. (2004). Nonparametric regression and the detection of turning points in the Ifo Business Climate, CESifo Working Paper No. 1283.

Abberger, K. (2005). Ein Vergleich der Zeitreihen der Erzeugerpreise und der Preiserwartungen im ifo Konjunkturtest für das verarbeitende Gewerbe. ifo Schnelldienst, 58(14), 50–51.

Abberger, K. (2005). Eine Anmerkung zum ifo Geschäftsklima im Einzelhandel. ifo Schnelldienst, 58(3), 31–32.

Abberger, K. (2005). Eine Anmerkung zum ifo Geschäftsklima im Großhandel. ifo Schnelldienst, 58(21), 47–48.

Abberger, K. (2005). ifo Konjunkturtest zeigt noch kein Ende des Beschäftigtenabbaus im verarbeitenden Gewerbe an. ifo Schnelldienst, 58(7), 44.

Abberger, K. (2006). ifo Geschäftsklima und Produktionsindex im verarbeitenden Gewerbe. ifo Schnelldienst, 59(21), 42–45.

Abberger, K. (2006b). Qualitative Business Surveys in Manufacturing and Industrial Production – What can be Learned from Industry Branch Results?, ifo Working Paper No. 31.

Abberger, K. (2007). Qualitative business surveys and the assessment of employment: A case study for Germany. International Journal of Forecasting, 23(2), 249–258.

Abberger, K. (2008). Das ifo Beschäftigungsbarometer: Ein Druckmesser für den deutschen Arbeitsmarkt. ifo Schnelldienst, 61(9), 19–22.

Abberger, K., Birnbrich, M., & Seiler, C. (2009). Der "Test der Tests" im Handel - eine Metaumfrage zum ifo Konjunkturtest. ifo Schnelldienst, 62(21), 34–41.

Abberger, K., Flaig, G. & Nierhaus, W. (eds.) (2007). ifo Konjunkturumfragen und Konjunkturanalyse: Ausgewählte methodische Aufsätze aus dem ifo Schnelldienst. ifo Forschungsberichte No. 33, ifo Institute, Munich.

Abberger, K., & Nierhaus, W. (2007). Das ifo Geschäftsklima: Ein zuverlässiger Frühindikator der Konjunktur. ifo Schnelldienst, 60(5), 25–30.

Abberger, K., & Nierhaus, W. (2007). Das ifo Geschäftsklima und Wendepunkte der deutschen Konjunktur. ifo Schnelldienst, 60(3), 26–31.

Abberger, K., & Nierhaus, W. (2008). Die ifo Kapazitätsauslastung - ein gleichlaufender Indikator der deutschen Industriekonjunktur. ifo Schnelldienst, 61(16), 15–23.

Abberger, K., & Nierhaus, W. (2008). Die ifo Konjunkturuhr: Ein Präzisionswerk zur Analyse der Wirtschaft. ifo Schnelldienst, 61(23), 16–24.

Abberger, K., & Nierhaus, W. (2008). Markov-Switching und ifo Geschäftsklima. ifo Schnelldienst, 61(10), 25–30.

Abberger, K., & Nierhaus, W. (2010). Die ifo Konjunkturuhr: Zirkulare Korrelation mit dem Bruttoinlandsprodukt. ifo Schnelldienst, 63(5), 32–43.

Abberger, K., & Nierhaus, W. (2010). Markov-switching and the Ifo Business Climate: The Ifo Business cycle traffic lights. OECD Journal: Journal of Business Cycle Measurement and Analysis, 7(2), 1–13.

Abberger, K. & Nierhaus, W. (2010c). The Ifo Business Cycle Clock: Circular Correlation with the Real GDP, CESifo Working Paper No. 3179.

Abberger, K., & Nierhaus, W. (2011). ifo Geschäftsklima, Produktion und Ertragslage in der gewerblichen Wirtschaft. ifo Schnelldienst, 64(3), 21–24.

Abberger, K., & Nierhaus, W. (2015). Vorratsinvestitionen im Spiegel der Statistik. ifo Schnelldienst, 68(15), 33–37.

Abberger, K., & Wohlrabe, K. (2006). Einige Prognoseeigenschaften des ifo Geschäftsklimas - Ein Überblick über die neuere wissenschaftliche Literatur. ifo Schnelldienst, 59(22), 19–26.

Algaba, A., Ardia, D., Bluteau, K., Borms, S., & Boudt, K. (2020). Econometrics meets sentiment: An overview of methodology and applications. Journal of Economic Surveys, 34(3), 512–547.

Alipour, J.-V., Fadinger, H., & Schymik, J. (2021). My home is my castle - The benefits of working from home during a pendemic crisis. Journal of Public Economics, 196, 104373.

Anesti, N., Galvão, A. B., & Miranda-Agrippino, S. (2022). Uncertain Kingdom: Nowcasting gross domestic product and its revisions. Journal of Applied Econometrics, 37(1), 42–62.