Abstract

In this work, we make the ansatz that economic production is reduced to the energy made available to the economy. In (Illig and Schindler, BioPhys Econ Resour Qual 2(1):1, 2017) the price of oil was expressed as a function of the size of the economy, the cost share of oil, and the quantity of oil extracted. We clarify assumptions needed to use this explicit price equation to study prices. Using the current extraction rate, the previous year’s extraction rate, and interest rates of the Federal Reserve we use linear regression to give a model for oil prices from 1966 to 2018. The model verifies that deductions made from the explicit price equation are consistent with empirical data over the given time period. Our analysis indicates that the contraction phase of world oil extraction began in 2020 and that it will be characterized by relatively low oil prices. We present some challenges and opportunities for building a future economy if our assumptions prove valid.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Does economic growth cause energy production Footnote 1 or is economic production enabled by energy production? Ayres and Warr (Ayres and Warr 2009) suggested that economic growth was a function of technological innovation, regarding energy applied to the production process, although authors such as (Solow 1956; Romer 1986; Romer 1990) belonging to the neoclassical economic mainstream considered that energy growth was exogenous, that is, they did not take energy flows into account as an explanation of the production process. They assumed that economic growth is perpetual and in equilibrium. Economic agents were assumed rational and able to process relevant information about the economic system. This led to a great confidence in markets: if there is a shortage of energy, the price will rise and the market will find an optimal solution in the Pareto sense (Pukite 2012, p. 16).

However, there are other authors who consider that the production of energy (conversion of energy efficiency to useful work) is an endogenous variable that explains the growth applied to economic production, among which are (Cantillon 1755; Jevons 1866; Meadows 1974; Mollison and Holmgren 1978; Fraser and Rimas 2011; Reynolds 2002; Montgomery 2007; Hamilton 2009; Ayres and Warr 2009; Kümmel 2011,Montgomery, 2007,Hamilton 2013; Illig and Schindler 2017; Charlez 2017; Schindler and Schindler 2018; Hall and Kittgard 2018).

In (Diamond 1998; Wolfson 2002), the authors attribute a large part of technological progress to opportunity. This view inverts causality: technological progress is enabled by energy production rather than energy production being a consequence of technological progress. In this work we make the ansatz that economic growth is reduced to energy production. This leads to quite different conclusions regarding prices than in the standard neoclassical growth model. With our ansatz, our analysis indicates low prices post peak oil, supporting findings in (Reynolds 1999), and giving a price based justification for the Seneca effect, or fast decline, observed empirically in agrarian economies (Bardi 2017). A physical justification can be found in (Tartaglia 2020).

Oil is a finite resource. Oil extraction has been increasing since 1853. It will one day peak and go into decline. Agents involved in the oil market would like to know when the peak will occur and what the economic consequences will be (Soldo 2012). Recent estimates as to when that peak will occur vary from 2018 to beyond 2050 (Babusiaux and Bauquis 2017). The primary dispute among these estimates is with respect to the classification of resources as reserves or not. Resources are defined as the quantity of oil in place, reserves are (roughly, see (Babusiaux and Bauquis 2017) for a precise definition) the subset of resources that can be profitably be extracted. The divergence of opinions is most significant with respect to unconventional and frontier oil. In a nutshell: most of these oils were known to exist for over 50 years, the price of their extraction prevented their classification as reserves until recently, and their extraction produces more contingent pollution.

In section Some Non-standard Economic Theory we clarify our assumptions and make an economic definition of permaculture.

In section The Economics of Oil we study the oil cycle to date. We investigate an empirical model for oil prices based on historical extraction rates and interest rates of the Federal Reserve funds rate. The model supports our theoretical analysis. We make observations which question commonly held economic beliefs with respect to the efficiency of markets and the role of the financial sector. We briefly look at the oil cycle with units of energy rather than currency.

Our ansatz implies that peak oil production will cause economic contraction. The current economic system functions during periods of economic growth but in the case of chronic contraction there will be difficulties in the financial sector. We discuss our economic expectations in section Expectations for the Contraction Phase. Rather than trying to patch the current financial system, in section Designing the Future Economy, we give some guidance for designing a financial system robust with respect to economic decline that might better serve humanity than the present system which tends to destroy ecosystem services (IPBES 2019).

The correct term is oil extraction, however, the oil industry and our data refers to oil production. We use the terms interchangeably.

Some Non-standard Economic Theory

Foundations

Let \(Y\) be a measure of economic production expressed in currency. Throughout this work we assume

-

Ass1

Economic production \(Y\) is an increasing function of the useful work performed by energy.

From the definition of useful work (3.4), \(Y\) is an increasing function of energy production. Let \(p\) be the average price per unit of energy, and \(q\) be the quantity of energy (including food) produced in some unit. We define

where \(Y_E\) is the cost of energy and \(C\) is the cost share of energy or proportion of the economy devoted to energy, sometimes called energy intensity. At an individual level, the cost share of energy is a measure of the diversity of the economy. The lower the cost share of an individual (with respect to his income), the more of his income he can consecrate to things other than energy. One has to be careful about generalizing this principle to the entire economy because its diversity depends also on how wealth is distributed. If 1% of the population controls 50% of the wealth, \(C\) can be small, but the economy is less diverse than in an economy in which in which \(C\) is larger but the wealth is evenly distributed because in the former economy the median cost share is higher.

Remark 2.1

-

1.

All quantities are time dependent which we have omitted from the equations.

-

2.

The cost of extraction \(c\) can exceed the market price of the energy if energy is produced at a loss or is subsidized. So that \(c > pq\). This is equivalent to using the amount of money \(X=c-pq \subset Y_{E^\complement }\) to produce energy.

-

3.

It is immediate from the above that producing energy at a loss reduces the diversity of the economy.

-

4.

Energy produced at a loss reduces the price of energy because money from the market for energy,\(Y_{E^\complement }\), is spent producing energy.

Solving (2.3) for \(p\) we obtain

The following assumption inverts neoclassical economic thinking:

-

Ass2

The means of economic production are enabled by energy production.

It is immediate from Ass2 that (2.4) expresses the demand for oil and offers an alternative to neoclassical equilibrium theory to study prices. Common economic causality expresses quantity as a function of price and would correspond to solving (2.3) for \(q\) and the quantity produced is caused by the price. At an individual level, this corresponds to an agent earning a revenue via his work, technology, capital, etc. The price the agent pays then determines how much energy is produced. We object to this causality on the grounds that the ability to work, use capital, etc. is determined by the amount of exergy available. Assumption Ass2 on the other hand corresponds to having a revenue determined by the current energy production, technology, capital, etc. and determining the price of energy via the cost share.

Solving (2.3) for \(Y\) we obtain:

Taking the log and then the derivative with respect to \(q\) in (2.5) we obtain the dynamic production function equation:

Note that if the left hand side of (2.6) is large, so is the right hand side. To make the right hand side large it is clear that it helps if \(\dfrac{\partial {p}}{\partial {q}} >0\) and \(\dfrac{\partial {C}}{\partial {q}}<0\) so we expect these relationships if energy is an important factor in economic production.

We state the following principles:

-

P1

Decreasing (increasing) energy cost share means there are increasing (decreasing) opportunities in the economy because \(Y_{E^\complement }\) increases (decreases).

-

P2

At constant salary, a decreasing (increasing) cost share of energy increases (decreases) living standards.

-

P3

In The Price Equation (2.4), the effect of marketing is on the cost share \(C\).

-

P4

When the cost share of energy is small (large), people use it inefficiently (efficiently) increasing (decreasing) demand.

-

P5

If the cost share of energy falls at constant salary, people tend to find more ways of using energy thus increasing demand.

-

P6

At constant salary, if the cost share of energy rises, people will look for ways of using energy more efficiently to reduce the cost share decreasing demand.

-

P7

In a growing economy sectors of the economy which grow faster than the economy contribute less to economic growth than sectors that grow slower than the economy.

Principles P1-3 are immediate. From (2.4) we see that if energy is wasted the cost share is greater than necessary, thus P4. Principle P5 is commonly known as Jevons paradox. See the discussion in (Illig and Schindler 2017). Principle P6 is an empirical observation, when the cost of fuel rises, so do the sales of fuel efficient vehicles. Principle P7 is suggested by the dynamic production function equation (2.6) and is consistent with the analyses in (Veblen 1899; Graeber 2018).

Remark 2.2

Note that P5-6 damp whatever trend cost share might have in an economy.

Oil represents about a third of world energy production. It is impossible to separate the part of the economy dependent on oil, \(Y_{\mathrm {oil}}\), from the the remainder of the economy. However, the remainder of the economy has no effect on the price of oil, so if we replace \(Y\) by \(Y_{\mathrm {oil}}\) and \(p\) by \(p_{\mathrm {oil}}\) where \(p_{\mathrm {oil}}\) is the average price of oil, in (2.4) by Remark 2.2 we have an indirect window on \(Y_{\mathrm {oil}}\). Using the Implicit Function Theorem (Buffoni and Toland 2003), it is mathematically valid to use \(p_{\mathrm {oil}}\) and \(Y\) (see section An Empirical Study of Oil Prices). The fact that oil prices are so strongly correlated to economic production suggests that oil’s role in economic production is greater than its proportion in energy production. There are two reasons that could justify the importance of oil. One is that oil has a very high energy density and is a liquid at atmospheric pressure and ambient temperature making it particularly easy to convert into work producing economic growth. The second is that our model uses a finite difference, or discrete derivative to explain price and via (2.4) economic production. A comparative study of the derivatives of different energy sources is thus necessary to compare their relative importance in the economy.

Permaculture and Economics

Permaculture is an important cultural movement gaining popularity in the world which cannot be modeled by standard utility theory. To integrate this movement into economic theory we make an economic definition (for a more complete definition see (Holmgren 2002)):

Definition 2.1

The fundamental economic problem is to earn enough money to live the way one wants.

Definition 2.2

The dual fundamental economic problem is to live the way one wants with as little money as possible.

Definition 2.3

Permaculture design is system science used to solve the dual fundamental economic problem in units of energy (see section The Oil Cycle Viewed from Units of Energy).

For completeness we include the core values of permaculture: protect the earth, protect humans, and share.

Remark 2.3

-

1.

Permaculture encourages economic contraction through decreased energy use.

-

2.

Because system science is used, fossil fuels are eschewed in permaculture design. From (2.4) it immediately follows that permaculture solutions decrease the price of fossil fuels because the cost share of fossil fuels are decreased.

From remark 2.3 we deduce:

-

P8

Permaculture solutions are generally deflationary a fortiori with respect to fossil fuels.

We distinguish system science from what we call myopic technology. Myopic technology is a technological fix to a problem that does not take the entire system into account resulting in problems either elsewhere in the system or at a future date. Myopic technology abounds in the current economic system because selling myopic technology is a good way to accumulate wealth. System science is usually a poor way to accumulate wealth but a good way to improve general well being. Flush toilets and sewage mains used to solve the problem of human excrement are a good example of myopic technology. Excrement in water is a pollution so the solution moved the problem from one place (where people live) in the system to another (aquatic environments). Moreover excrement is essential to maintain healthy soil for plant growth. So the myopic technology solution causes future problems through soil degradation and erosion. A permaculture solution is to use composting to eliminate the odors and pathogens in excrement transforming it into a valuable resource (Jenkins 2019, Országh, Országh).

Remark 2.4

-

1.

As cost share rises, P4-5 imply the economy becomes deflationary as solving the dual problem becomes more attractive than solving the fundamental problem.

-

2.

Increased wealth inequality is deflationary because the median cost share rises encouraging a large number of people to adopt dual problem solutions.

The Economics of Oil

We have two goals in studying the economics of oil. One is to update the scenarios for oil production and prices considered in (Illig and Schindler 2017), the other is to draw general economic conclusions for building a future economy.

An Empirical Study of Oil Prices

We use statistical linear regression using a small number of key variables to see how well they can explain the price dynamics of oil. The goal is to use this understanding to guess the price dynamics during the contraction phase of oil extraction.

The idea behind the price model in (Illig and Schindler 2017) was that since the primary source of wealth is energy production, much of current price should be determined by the time series generated solely by production. This was very successful during the growth phase of oil production from 1937 to 1970 when oil extraction rates grew at a roughly constant rate of more than 7% per year. During the stagflationary phase of oil from 1965 to 2019 which include several oil shocks resulting in price volatility, the first- and second-order finite differences of the time series were added as variables. The idea was that the economic production in (2.4) depended more on previous years extraction rate rather than the current year so that \(Y_t \approx \overset{\sim }{Y}_t(q_{t-1},q_{t-2})\). The fit was however only satisfactory. Many authors have written on the relationship between interest rates and oil prices for example (Likvern 2015; Tverberg 2015, 2017). We thus include the Federal Reserve rate with the time series of oil extraction in the new model. We use the Federal Reserve rate \(\tau _t\) as a proxy of interest rates on oil because the U.S. dollar is the primary currency in which oil was traded in the studied time period. When interest rates were added, the second-order finite difference was found to be redundant and discarded to make the model more robust. Thus \(Y_t = Y(q_{t-1}, \tau _t)\).

We worked with data from BP’s Statistical Review (Staff 2019a) and from the effective federal funds rate 2018 available at the following url: https://fred.stlouisfed.org/series/FEDFUNDS We used prices and extraction data from the BP’s data set:

-

Annual crude oil prices in 2018 US dollars per barrel (deflated using the Consumer Price Index for the US) available from 1861 to 2018.

-

Annual world oil production expressed as a daily mean in millions of barrels per day (MMbbl per day) from 1965 to 2018. These data include crude oil, shale oil, oil sands and NGLs (natural gas liquids - the liquid content of natural gas where this is recovered separately). However, these data exclude liquid fuels from other sources such as biomass and derivatives of coal and natural gas.

Remark 3.1

All data we use is very approximate. Jean Laherrére (Laherrére 2014) has exhaustively documented incoherence in extraction data from all standard sources. We use a single price for the price of oil provided by BP, but there is a large spectrum of prices for oil of different densities, chemistry, and provenance (Laherrére 2015). BP groups extraction data for crude oil, condensate, and NGL’s, a large spectrum of products not all used for the same purpose and of course with different prices. The fact that our regression analysis works suggests that there are correlations within the data and averaging going on.

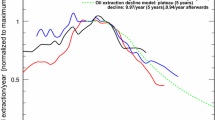

In Figure 1 we show the extraction rate in millions of barrels per day (MMbbl per day) from 1965 to 2018. In Figure 2 we represent the federal funds rate.

In light of Remark 3.1, our aim is not to get the best fit possible, but to understand factors that influence price.

Let \(\left( P_t\right) _{t}\) denote the time series of oil prices (in 2018 dollars adjusted for inflation) from year 1965 to year 2018 and \(\left( Q_t\right) _{t}\) the time series of quantities of oil extracted (in million barrels daily) from year 1965 to year 2018 for BP data.

Price Explained by Oil Extraction and Interest Rates

The approach we consider here is structural. We try to derive information on the price from the time series of oil extraction, \(Q_t\) and interest rates. The Implicit Function Theorem essentially implies that if \(\overset{\sim }{P}_{t}= \overset{\sim }{P}_{t}(Q_{t},V_t)\) where \(V_t\) represents other variables, then at a given time \(t_0\), under very general conditions there is a time interval \(I=(t_0-\delta , t_0+\delta )\) where \(\delta >0\) is unknown and a function \(P_t(Q_t)\) such that \(P_t(Q_t)=\overset{\sim }{P}_t(Q_t,V_t) \) for \(t \in I\). Using bifurcation theory, it is frequently possible to extend the time interval \(I\) (Buffoni and Toland 2003). From Figure 3, one sees that it is not possible to extend the interval \(I\) to the entire time interval in which we are interested because the price-quantity curve parameterized by time intersects itself. For this reason, we use, in addition to \(Q_t\) and the interest rate \(\tau _t \), the lag-1 difference and of the series \((Q_t)_t\) at year t:

We consider the following model:

where a, b, c are coefficients determined by the linear regression and \((\epsilon _t)_t\) is a centered second-order stationary process. Defining \(P_t\,{\mathop {=}\limits ^{\mathrm{{def}}}}\,\exp (p_t)\), equation (3.2) is equivalent to

The dependency of price \(P_t\) on these variables is non-linear. As the logarithm function flattens large values, the model takes into account the inelasticity of oil prices. That is, small changes in the supply provoke large changes in price.

The R output for the linear regression with the data starting at year 1965 is given in Appendix A. Note that we have lost a year because of the lag-1 differences \((\nabla Q_t)_t\) that are only available form year 1966 with the data set starting in 1965. Adjusted R-squared being almost 0.99 means that the model explains the variation in price as well as can be hoped for given the quality of the data. From the stars in the R output, we obtain that all coefficients in the model are significant. Note that statistical inference does not prove causality. What we have shown is that the heuristic theory we began with is consistent with empirical data.

An analysis of the residuals showed a non constant variance in the data so a generalized regression was performed using ARMA(2,1). Figure 4 shows the generalized regression fit with the data.

Because the goal is to predict future prices we tested the stability of the coefficients by trying the regression in different subintervals. We found the coefficients of \(Q\) and \(\nabla Q\) to be relatively stable but the coefficient of interest rates was not, see Figure 5. All coefficients were more stable than in the model studied in (Illig and Schindler 2017). It is clear that the model cannot be used to estimate future prices because we do not know what future interest rates will be. We can however make scenarios based on different interest rate policies from the Federal Reserve and more generally, central banks, if we can understand the role of interest rates.

Interpretation of the Results

The interest rate coefficient replaces both the constant term and the second derivative term in the model used in (Illig and Schindler 2017) while improving the fit. It thus contains a great deal of information with respect to the price.

In the current economic system, the primary source of money creation is credit through debt creation (Dalio 2015,Thorpe, 2014). We distinguish between the financial economy and the real economy where the real economy is the amount of goods and services in the economy and the financial economy is based on currency exchanges. If too much money is in circulation, inflation increases. If on the other hand, too little money is in circulation, the financial economy can smother the real economy because not enough money circulates causing deflation leading to a negative feedback loop with respect to investment (Dalio 2015). We add the following principle:

-

P9

Decreasing (increasing) interest rates stimulates (damps) borrowing which increases (decreases) the money supply stimulating (damping) the financial economy.

In light of P9, it is significant that the coefficient of interest rates is positive in the global model and in the split periods, though the coefficient is close to 0 in the last period. This could be because causality is inverted. From 1973 to 1986 high oil prices were accompanied with high inflation which triggered the Federal Reserve to raise interest rates when oil prices were high. Later, low oil prices were associated with stagnant economic growth (see (2.4)) so that low oil prices triggered lower interest rates. It is also possible that inflation rates were lower after 2000 because of greater wealth inequality (Piketty 2013) and thus higher median cost share of oil and P4. In this period the coefficient is closer to that expected in view of P9. Note that this is the period in which the fitted complete model has the worst fit. We note also that central banks have been using more than interest rates since the financial crisis in 2008 to stimulate the economy. Central banks have been buying financial assets, mostly bonds, but also stocks and in 2018 owned approximately 10% of all financial assets, bought with freshly created money (Prins 2018) which lowers effective rates. We therefore believe that the official Federal Reserve rate since 2008 is high relative to what the true borrowing rate of the economy is.

Note that the coefficient of \(Q_t\) is positive in the global model as well as in each subinterval. so that \(\dfrac{\partial {p}}{\partial {q}} >0\) is consistent with having an important role in the economy from Equation (2.6). In (Illig and Schindler 2017) it was speculated that oil production was less important during the 1990s, where the coefficient was negative. The current model suggests that interest rates were the factor damping oil prices during this time.

The coefficient of the derivative term is negative and greater than the coefficient of quantity explaining why prices rise when extraction rates fall (at least initially).

We note that the interest rate of the Federal Reserve is correlated to margins in the fossil fuel industry (Damodaran 2015). The preceding correlation leads us to the following conjecture:

Conjecture 3.1

-

1.

The “best” rate for the Federal Reserve to fit the real economy with the financial economy is the margin for energy production.

-

2.

Three years of energy production data coupled with the margins of the energy sector give a more informative measure of the economy than the world GDP.

In other words, we postulate that the margins of energy production give interest rates which fulfill the Federal Reserve’s mandate rather than vice-versa.

The model might underestimate the real price in the period 2010-2014 because the model does not take into account the stimulus brought on by the money creation of quantitative easing (Thorpe, 2014).

Note that our model overestimates prices in the last few years. We attribute this, at least partially, to low wages (in great part due to globalization) contributing to greater wealth inequality (see Remark 2.4) and malinvestment (see Remark 2.1). Moreover the increase in U.S. oil extraction has caused an international dollar shortage. When the U.S. was purchasing vast amounts of oil on international markets, dollars left the U.S. and international dollar denominated debt could be paid. With the drop in U.S. imports, it has become more difficult to both service debt and pay for oil. Developing these ideas is beyond the scope of this paper.

The Oil Cycle and its Lessons

We use the vocabulary from (Turchin and Nefedov 2009) to describe the oil cycle. The growth phase of the oil cycle was from 1945 to 1973, during which oil extraction rates increased at roughly 7% per year. The stagflation phase has lasted from 1973 to 2019. This phase is characterized by increasing extraction costs and slower, more erratic increases in extraction.

The primary economic actors in oil extraction are: the royalty owner, the working interest, and the financial sector. Governments play regulatory roles. Today the working interest is usually split between oil companies and oilfield service companies. At times some or all the primary actors have been fused though in general this is not the case (Auzanneau 2016). The royalty owners receive money from the extracted oilFootnote 2. The working interest extracts the oil, but in most cases requires financing. The finance industry searches for financial returns. Historically a great deal of money was required up front to locate oil and install infrastructure which provided revenues for a long period of time permitting the payment of interest, etc. to the financial sector. We observe:

-

Obs1

During the growth phase of oil extraction the capital intensiveness of the industry worked well with a monetary system in which money is created through interest bearing debt.

The growth phase is characterized by increased extraction rates and a decreasing cost share of oil and energy and increasing salaries (see P1 and (Turchin and Nefedov 2009)). The salary increases earned these years the name: the trentes glorieuses because of the dramatic increase in living standards of the French workers.

The stagflation phase has been marked by a slower and less consistent increase in extraction rates, a stagnation in salaries, and greater wealth inequality (Piketty 2013). The cost share of oil and energy continued to decrease, at a slower rate, until 2000 due to greater efficiency. Median cost share decreased more slowly due to greater wealth inequality.

The Role of Marketing

Marketing plays an important role both in the supply of oil and in the demand for oil. A major weakness in the model (3.3) is that there is no obvious parameter that can be influenced by marketing (on the demand side) other than the coefficients themselves implying that the coefficients are time dependent.

On the supply side, the working interests’ job is to extract oil. If the working interest cannot convince the financial sector to lend money, they are unemployed, so they engage in a marketing campaign to obtain financing to work. In 2012 two remarkable articles were written on Light Tight Oil (LTO) extraction (Likvern 2012; Maugeri 2012). Likvern wrote about the high decline rates and the fact that LTO extraction was cash flow negative meaning that the phenomenal rate of increase in extraction rates depended on a constantly increasing infusion of money. Maugeri wrote that LTO was an oil game changer and that increasing LTO extraction rates would cause a price collapse in oil by 2017. Those who read Likvern’s article were highly skeptical of Maugeri’s assertions, but the LTO working interests used Maugeri’s paper to market the financial industry. Investors have poured money into LTO. Over the 10 years ending in 2019, the LTO industry spent $189 billion more than it generated selling oil and gas (Williams-Derry et al. 2020). As of June 30, 2020, Haynes and Boone has tracked 231 North American bankruptcies concerning $152 billion worth of debt since the beginning of 2015 (Staff 2020). Until this date, those who have gained from LTO extraction have been the mineral rights owners and management. Management has done well because the first thing one does after obtaining financing is to pay one’s own salary.

On the demand side, if consumers believed oil would soon be in short supply, they would modify the way they lived so as not to depend on a resource soon to run out which would translate into lower demand. The oil industry has worried about supply shortages since 1928. Peak oil was discussed at the famous meeting in Achnacarry where the largest oil companies, or 7 sisters, met to discuss reducing extraction rates to raise prices (Auzanneau 2016). Knowledge of human behavior has kept the oil industry from sharing concerns about supply with their customers. The estimates of the date of peak oil by the oil industry are among the furthest in the future.

Lessons From the Oil Cycle

We make some empirical observations on the economics of the oil cycle.

The law of supply and demand The standard law of supply and demand tells us that if the price is high quantity will increase so that \(\dfrac{\partial {q}}{\partial {p}} >0\). However, in the case of scarcity, the price will rise so that \(\dfrac{\partial {p}}{\partial {q}} < 0\). Mathematically this is impossible because when they both exist \(\dfrac{\partial {q}}{\partial {p}}= 1/\dfrac{\partial {p}}{\partial {q}}\). To resolve this conundrum, two curves are introduced, the positive derivative corresponds to supply, the negative to demand. An examination of Figure 3 shows that the law of supply and demand does not contribute to understanding the price of oil over the last 50 years. The price remained low as production increased from 1965 until 1973 with a slight increase between 1970 and 1973. In 1974, production was identical to that of 1973 and the price more than doubled. In 1975 production declined as well as the price. As the time line is continued, many more price events occur that are not suggested by the law of supply and demand. The law of supply and demand is not violated, it is defined in such a way as to always be satisfied, making it a poor tool for predicting either future prices, or future supply as is evidenced by the inability of economists working for official energy agencies to foresee any volatility in oil prices over the past 50 years. When oil prices are studied using the law of supply and demand, the law is not used directly, rather add hoc reasons are given for why demand either increased or decreased. The law of supply and demand does not explicitly take into account the size of the economy. For a quantity which is important in economic production, the Dynamic Production Function Equation (2.6) tells us to expect globally that \(\dfrac{\partial {p}}{\partial {q}} >0\). Equation (2.4) does take into account the size of the economy. Our model for prices is consistent with \(\dfrac{\partial {p}}{\partial {q}}>0\) and tells us that scarcity rent is explained by the coefficient of \(\nabla Q_t\). We do not require separate curves for supply and demand.

The law of supply and demand also gives credence to the idea that free markets somehow optimally adjust supply to demand and thus need no regulation. Historically, unregulated oil prices have always resulted in boom bust cycles. Before 1973, oil discovery raced ahead of production (Bentley and Bentley 2015). This led to repeated boom bust cycles characterized by low prices. The oil industry itself fought oversupply using monopolistic or cartel anti-competitive techniques, Standard Oil in the late 19th and early 20th century or the 7 sisters in 1928 (Auzanneau 2016). From the mid 1930s to 1973, the Texas Railroad Commission regulated U.S. production to the relief of both the oil industry and consumers (Auzanneau 2016). In the early 1970s, U.S. oil extraction peaked rendering the Texas Railroad Commission obsolete. Regulatory power shifted to OPEC which had lobbied for higher oil prices since its inception in 1960. The high prices of 1974 to 1981 permitted the development of higher priced sources of oil which finally led to a bust in 1986 as participants chased after market share. The capital infrastructure investments made between 1974 and 1981 permitted continued increase in extraction rates until a plateau in the extraction rate in world oil supply began in 2005 (Auzanneau 2016). Between 2000 and 2013, oil industry capital expenses increased by almost 11% per year (Kopits 2014; Mushalik 2016). The sustained investment permitted oil extraction rates to increase through 2018. The price drop in late 2014 rendered much of this investment unprofitable (Cunningham 2019).

If the working interest can secure financing, it will extract as much oil as possible (because that’s their job) whether or not the oil is profitable. Historically the working interest has been very good at securing financing.

We make the following observation:

-

Obs2

In the oil cycle, the low cost oil was extracted first.

Remark 3.2

The general principle that low cost (or high quality) resources are extracted is shared by many authors, for example (Solow and Wan 1976).

It is important to remember that supply is not based on the price today. There is a lag between investment and supply. Offshore projects can take as long as 10 years to complete. The lag between investment and supply is much shorter for LTO, on the order of several months. We make the following observation:

-

Obs3

Final investment decisions are based on projections for future prices which could be wrong.

Because of Obs3 low prices might need to be sustained to reduce supply as investors might make poor decisions. We note that LTO was poised to be the perfect swing producer in 2015 when oil prices crashed. Because of steep decline curves, LTO does not require being shut in to rapidly decrease production, all that is needed is to decrease investment. Because of a relatively short investment cycle, LTO can be brought online quickly once prices recover. Though there was a small decline in LTO extraction from 2015-2016 in the midst of many bankruptcies, LTO extraction began increasing again in 2017 as bankruptcies continued at a slower rate. In early 2020 bankruptcies were expected to continue at least through 2022 if West Texas Intermediate (WTI) remained below $60/barrel (Staff 2020).

We make the following observation from (Babusiaux and Bauquis 2017):

-

Obs4

During bust (boom) phases wages and costs decrease (increase).

Remark 3.3

-

1.

From Obs4 we conclude that the effective investment is less (greater) than the dollar increase (decrease) in investment during a boom (bust) phase accentuating the slow reaction of actual supply to price changes in the absence of regulation.

-

2.

From Obs4, we see that higher (lower) wages during growth (contraction) phases leads to greater (lesser) equality in revenue.

-

3.

Many economists assert that a carbon tax is an effective method of reducing greenhouse gas emissions. It is clear that limiting investment in fossil fuel extraction would be a far more effective than counting on the law of supply and demand.

The Role of the Financial Sector From 1930 to the present, the cost share of the financial sector has grown significantly as the economy grew. Principle P7 indicates that the financial sector is inefficient at creating wealth because the sector captures wealth at a greater rate than it creates wealth. The expanding cost share of the financial sector has translated to increased political power through political donations. The political power translates into vast amounts of government support when the sector runs into financial difficulties (Taibbi 2020). Generally we observe:

-

Obs5

Sectors of the economy that grow faster than the economy in a growing economy acquire political power in the stagflationary phase.

Observation Obs5 is consistent with the findings in (Piketty 2019) where examples of inequalities justified by wealth distribution are documented.

It is postulated in (King 2015) that a global minimum in the cost share of energy occurred around 2000 due to increased extraction costs. The dynamic production function equations indicate consequential slower economic growth. The first industry to suffer from slower economic growth should be the financial industry which depends on economic growth to make returns. In the view of many, this led to the financial crisis of 2008 see for example (Hamilton 2009). To save the financial sector, the crisis was followed by unprecedented money creation by central banks which used the money to buy financial assets (mostly bonds). In 2018 central banks owned $22 trillion worth of assets which were purchased from money created ex nihilo (Prins 2018). Obviously this increases the price of financial assets contributing to wealth inequality (Metcalf and Kennedy 2019) while encouraging financial bubbles (Ayres 2014). Another consequence was to lower interest rates to unseen levels. These low interest levels facilitated the LTO industry in obtaining financing as investment managers in search of investment vehicles producing a reasonable return more easily succumbed to the LTO marketing mantra.

Note that the standard computation of net present value encourages debt financed oil extraction to front load projects (Hagens 2020).

We note also that over the last 10 years the worst performing investment sector has been energy (Staff 2019b). Despite poor returns the sector has attracted close to 1/3 of all investment funds with approximately 1/6 going towards oil and gas extraction and 1/6 towards electric power generation (Lepetit 2020). We observe that

-

Obs6

The financial sector makes sub optimal investment choices. Without central bank interventions the sector would be performing poorly.

-

Obs7

Fiscal policy significantly contributed to increasing oil extraction rates through 2018 by enabling financing (money creation) to extract oil.

The marginal barrel The standard teaching is that in the case of a bust, the most expensive oil will be the first to come offline. In the oil industry, this should be amended to “will eventually come offline if prices stay low long enough”. It can take several years. In the case of a steep price decline, financial stress occurs. Financial stress leads to short term thinking (Mullainathan and Shafir 2013). Short term thinking means producing as much as possible immediately to pay creditors regardless of the market price and putting off long term development projects and prospecting. Unprofitable wells are not shut in until Lifting Operating Expenses (LOE) are below market prices. But LOE are much lower than the capital expenses that have already been spent. Costs are reduced: workers are fired, wages are cut, maintenance is postponed (see Obs4). If bankruptcy is declared this actually brings in more capital to maintain the supply of expensive barrels. The original share holders lose money because the old shares are canceled. There is no money to pay creditors so they become the owners of new shares. Debt is erased. The company emerges from Chapter 11 (or the equivalent) with wells, a streamlined workforce, and no debt so becomes attractive to a new set of oil investors ready to “buy low”.

There are over 300,000 stripper wells in the U.S. many of which are lower cost producers than LTO (Staff 2015). Most of the owners of these wells do not have access to financial markets, they are run either from cash flow or bank loans. The low price environment can push these wells out of operation before higher priced LTO which has access to capital markets.

Historically if there is an immediate decline in supply due to low prices, this decline in supply has come from low price suppliers who are less stressed: Texans before the U.S. peak and OPEC afterwards (primarily Saudi Arabia).

Feedback cycles

We see a long term feedback cycle not suggested by the law of supply and demand superposing it. It has been said that the oil industry used to extract oil and turn it into money, today the industry takes money and turns it into oil. The sentence expresses our feedback cycle in a nutshell.

During the growth phase in oil extraction, workers received good wages, investors made good returns, and governments received tax revenues. This was reflected in the decreasing cost share of oil. Thus oil grew \(Y_{E^\complement }\). As U.S. oil extraction peaked in the early 1970s and the cost of extraction slowly ratcheted up financial problems arose, \(Y_{E^\complement }\) continued to grow, but at a lower rate. Growth in oil extraction slowed. The economy used the oil more efficiently. Salaries began to stagnate which resulted in increased wealth disparity (Piketty 2013). The extraction industry was creating “less money” for workers. The next phase up was when conventional oil extraction peaked in 2005-8 resulting in higher extraction costs. Now, not only were workers making lower wages, but the financial industry began making lower returns. Fiscal policy was adjusted to send money to the financial sector (see Obs5). But during the 2010s returns in oil were low. The industry began paying lower taxes (Staff 2014) encouraging the government to decrease spending. So \(Y_{E^\complement }\) grows more slowly than \(Y_E\). Because of greater wealth inequality the median cost share grows faster than the cost share (see Remark 3.3). This lowers oil prices as extraction costs rise so that the oil industry becomes less profitable. For example Exxon Mobil used to be one of the industry’s most solid companies is borrowing money to pay dividends. The company has invested heavily in LTO, but from their financial report they are spending large amounts of capital on LTO for small returns. In other words, the feedback cycle that led to increasing oil extraction rates can go into reverse with lower extraction rates leading to lower prices because the \(Y_{\mathrm {oil}}\) is contracting as median cost share rises (see Equation (2.5)).

To summarize, as the contraction phase from (2.4), Obs4, and P4 will contribute to lower prices than many people expect making the absolute value of the negative slope in the contraction phase of oil production greater than the positive slope that occurred in the growth phase. This feedback cycle is consistent with empirical results in previous contraction phases (Bardi 2017).

Remark 3.4

-

1.

From P1-2 and the fact that growth is associated with increased equality, it is easy to understand why in general growth phases are associated with optimism and positive outcomes (Turchin and Nefedov 2009).

-

2.

Frequently leaders are faulted with stagflation when in fact dissatisfaction with stagflation leads the people to favor alternate politicians.

The Oil Cycle Viewed from Units of Energy

Changing units often gives an interesting perspective. We briefly discuss the oil cycle in units of energy making references for interested readers.

A source of energy most often requires some energy input to exploit. For example a plant needs to input the energy required to create leaves in order use energy from the sun. Let \(E_i\) be the energy input required to obtain the output energy \(E_o\) that the economy uses. If \(E_i = E_o\), we don’t need an economy because all energy is spent obtaining food. Let \(E_a\,{\mathop {=}\limits ^{\mathrm{{def}}}}\,E_o-E_i\) be the energy available for things besides food. We can then define

as the useful work performed by energy in the economy where \(0<e<1\) is efficiency. Useful work was studied in (Ayres and Warr 2006).

One can of course make the above definitions with respect to individual sources of energy which we now do with respect to oil. The metric to evaluate the quality of a resource is Energy Return on Investment (EROI) where

The equivalent of the cost share in units of energy would be

If \(e = 1\), \(C_E = 1/\mathrm {EROI}\). In (Ayres and Warr 2006) efficiency in 2000 was estimated to be on the order of 0.2, coupling that value with an EROI of 11 yields \(C_E = 1/3\).

Initially oil extraction was inexpensive which translated into very high EROI (Hall and Kittgard 2018). However, this very high EROI resource was used very inefficiently. As time progressed, the EROI decreased and efficiency increased (Ayres and Warr 2009; Chavanne 2013). Innovative uses were found for all this energy. Productivity (the amount of work performed per hour of labor) increased because machines using the vast amount of energy contained in extracted oil performed the work rather than a humans.

Permaculture, an abbreviated concatenation of permanent and agriculture, originated in the 1970s from an EROI assessment of industrial agriculture. It was noted that industrial agriculture had high productivity in the sense that few people could produce a great deal of food, but an EROI less than one (Mollison and Holmgren 1978) (see also (Trainer et al. 2019) and the discussion of milk production in (Hagens 2020)). Moreover industrial agriculture uses a great deal of myopic technology. Myopic technology is not new to agriculture. Myopic technology in agriculture dates back millennia and has been related to the collapse of past empires (Fraser and Rimas 2011). However, the use of myopic technology in agriculture has reached unprecedented levels (Wise 2019).

Expectations for the Contraction Phase

It is unusual to be able to test economic theory rapidly. The COVID 19 pandemic offers us a chance to test our theory and analysis. What our theory says is that, because of reduced economic activity due to the pandemic, oil availability is not a constraint on economic growth. Prices are low and \(\dfrac{\partial {p}}{\partial {q}} < 0\): production must fall to raise prices. Investment in oil extraction has fallen dramatically in 2020 (Rystad Energy 2020) from levels the International Energy Agency (IEA) deemed too low to keep up with demand since 2015 (Staff 2019c). Eventually oil extraction capacity will fall enough for oil to become a constraint on growth after which our model says there will be a temporary spike in prices followed by \(\dfrac{\partial {p}}{\partial {q}} > 0\). In other words, oil prices will never rise high enough long enough to enable the investment required to attain the extraction levels of 2018 and 2019. Our model says we have entered the contraction phase of oil extraction. In (Pukite et al. 2018) careful, rigorous analysis estimated the peak to occur between 2023 and 2027, but prices are assumed to be higher than our model suggests.

The high price period from 1974 to 1985 enabled infrastructure investments that enabled sustained production for many years at low prices with low investment. This is not the case for the high price period from 2005 to 2014. The continued high extraction rates from 2015 to 2019 required high investment.

The pandemic accelerated a trend already apparent: The oil economy was spiraling down as was evidenced by the 13% decline in prices in 2019 as extraction rates were flat. Central banks began creating liquidity in September 2019 to counter this trend with only marginal success before the pandemic collapsed demand for oil.

In our economic system, the end of any mineral extraction business is financial failure. The two extreme options are:

-

Op1

Funding stops leading to a cessation of extraction.

-

Op2

Money is created (from \(Y_{E^\complement }\)) and extraction continues until wages fall so low that workers quit.

Evidence of Op1 are the 60,000 abandoned mines in Australia (Campbell et al. 2017). Both Op1 and Op2 have been observed recently in Venezuela. Foreign investors stopped dollar investments causing a precipitous fall in oil production. Inflation in the local currency caused workers in the oil industry to walk off their jobs because they were not able to feed their families (Buitrago and Ulmer 2018).

The preceding indicate a deflationary debt spiral in which economic entities decide the best investment is to pay down debt rather than to invest in increased production. In our economic system this leads to a decreasing money supply which suppresses economic activity leading to lower prices.

The money creation by central banks since the 2008 is countering this tendency but is exacerbating the natural wealth disparities encountered in stagflationary periods (see Remark 3.3).

Central banks are using the current pandemic as an excuse to create unprecedented quantities of money. So there are two conflicting tendencies: deflationary because of the lack of profitability of the extraction industry and inflationary because of central banks money creation. But much of this money creation is not being vehicled to consumers in need (Taibbi 2020) so the deflationary tendency will dominate for oil prices. Disruption in labor markets will likely alter money flows in the economy for the foreseeable future causing economic and political problems.

With a shrinking economy it will be impossible to pay off the existing dollar denominated debt. There are two extreme cases:

-

1.

Debt is defaulted or forgiven.

-

2.

Money is created to pay off the debt.

In the first case, money disappears from the system and the system essentially is reinitialized and starts over from scratch. This is similar to what happened when the Soviet Union collapsed and citizens were informed that 90% of their savings were simply gone (Egorov 2000). In the second case when money is created concurrently with shortages, hyperinflation is to be expected. Financial instability can of course lead to government instability and governments can collapse. we expect policy to be closer to the second policy option to try to save banks.

We predict that the pandemic will drag on because of heterogeneous tactics to abate it. Travel will be restricted until the slowest means of combating the virus succeeds. There will probably be many start ups and slow downs.

We predict that our price model will overestimate oil prices in the future. In addition to the feedback cycle discussed in Paragraph 3.3.2 depressing prices, reopening the economy will be problematic (Tverberg 2020), the probability of armed conflict is increasing (Turchin and Nefedov 2009; Cirillo and Taleb 2015) as is the probability of more pandemics (Turchin 2008).

Designing the Future Economy

In 2011, many people had heard about permaculture, few people knew what it was (Schindler 2011). Many people confuse permaculture with its techniques such as restorative agriculture. However, increased interest in restorative agriculture for food security and to combat climate change (Wise 2019; Trainer et al. 2019; Toensmeier 2016) are raising awareness of permaculture concepts. Increased interest in collapsology also has people looking at permaculture for solutions.

Designing an economy robust in the face of economic contraction, that respects the environment, and favors systemic solutions over myopic technology is beyond the scope of this work. However, the principles and observations in this work should be used in its conception if Ass2 proves valid. This will obviously be a cooperative effort that should unite researchers from many different fields: anthropologists, economists, ecologists, sociologists, legal scholars, historians, and more.

The current economic system functioned during the growth phase of fossil fuels but will function poorly during a prolonged economic contraction because it is easier to repay debt when the economy is growing (Tverberg 2012). Money creation through interest bearing debt exacerbates whatever trend is current in the economy be it growth or contraction. Bankruptcy costs, excessive diversification may result in shocks being amplified, rather than dampened and dissipated as assumed by central bank and predicted by the standard models. The main policy tool in crisis prevention today centers around preventing the financial sector from undertaking excessive risks and ensuring the stability of the financial system (Stiglitz 2018, p. 79).

In (Hansen and Prescott 2002) the authors provide a model of profit maximizing firms responding to technological progress in modern industrial economies creating virtually endless growth in living standards. However, they do not take into account resource scarcity nor problems associated with climate change and the destruction of ecological services. Rather than trying to patch the current economy to meet such challenges, it is perhaps better to use knowledge and technology obtained in the last 100 years for a complete new design. In particular, it may be better to design a system emphasizing cooperation rather than competition. Some work in this direction can be found in (Hopkins 2008) who adapts permaculture principles to cities and (Raworth 2018). Anthropologists have studied more sustainable economies of other cultures such as the gift economy (Bollier 2002) providing examples to build on in the design.

The source of money has always had a very strong impact on culture. It also has an immense impact on values. The Romans (among others) minted coins to pay their soldiers and then taxed their conquests in the same currency to force its acceptance. This obviously encouraged prostitution and created a military industrial complex because of what soldiers typically buy (Graeber 2014). In our current system money is created to extract fossil fuels. Obviously this has contributed to creating a thriving fossil fuel based economy. Careful attention must be given to the origin of money (Lietaer 2001; Grandjean and Dufrêne 2020). In economic decline, wages become an inefficient tool to distribute wealth (Obs4). An old idea to make the economic system more equitable is a universal basic income. It has been suggested that blockchain technology be used to make the basic income the source of future money rather than allowing only banks to create money through credit (Laborde 2012). The june (Ǧ1) is the first prototype of such a currency began circulation in 2017. Users attest that this form of money creation decreases competition in economic interactions and increases collaboration. Such a system would drastically change the financial system as the primary source of finance would then become either government (through taxes) or crowd funding. Money becomes a means rather than an end.

Conclusion

If energy was the driver of economic production over the last 200 years, the growth phase and stagflation phase have ended. Empirical observations of the oil cycle call into question several commonly accepted economic principles. The current economic system is poorly adapted to the contraction phase of the oil cycle. Designing an alternative system offers both challenges and opportunities for building a future economic system better adapted to contracting economic production. Much multidisciplinary work remains to be done.

Notes

Energy cannot be “produced”, it can only change forms. When we say “energy production” we mean energy is made available for economic production.

We have oversimplified. The royalty owner can vary from being an individual to a State. Several types of contracts link the working interest to the royalty owner. These contracts consist of more than simple royalty payments.

References

Auzanneau M (2016) L’Or Noir. La Grande Histoire du Pétrole, La Découverte

Ayres R (2014) The bubble economy is sustainable growth possible?. MIT Press, Cambridge

Ayres R, Warr B (2006). Economic growth, technological progress and energy use in the us over the last century: identifying common trends and structural change in macroeconomic time series. INSEAD

Ayres R, Warr B (2009) The economic growth engine: how energy and work drive material prosperity. Edward Elgar Publishing

Babusiaux D, Bauquis P-R (2017) Oil What Reserves, What Production, at What Price ?. Dunod,

Bardi U (2017) The seneca effect why growth is slow but collapse is rapid. Springer, New York

Bentley R, Bentley Y (2015) Explaining the price of oil 1861–1970: the need to use reliable data on oil discovery and to account for ’mid-point’ peak. Oil Age 1(2):57–83

Bollier D (2002) Silent theft: the private plunder of our Common Wealth. Routledge, London

Buffoni B, Toland J (2003) Analytic theory of global bifurcation: an introduction. Princeton University Press, Princeton

Buitrago D, Ulmer A (2018) Under military rule, Venezuela oil workers quit in a stampede. Reuters. https://uk.reuters.com/article/uk-venezuela-oil-workers-insight/under-military-rule-venezuela-oil-workers-quit-in-a-stampede-idUKKBN1HO0HW?feedType=RSS&feedName=topNews

Campbell R, Lindquist J, Browne B, Swann T, Grudoff M (2017) Dark side of the boom. Technical report, The Australian Institute https://www.tai.org.au/sites/default/files/P192

Cantillon R, (1755) Essai sur la Nature de Commerce en Génénral. Frank Cass and Company LTD

Charlez P (2017) Croissance, énergie, climat – Dépasser la quadrature du cercle. Broché

Chavanne X (2013) Energy efficiency: what it is why it is important and how to assess it. Nova Publishers, Hauppauge

Cirillo P, Taleb N (2015) On the tail risk of violent conflict and its underestimation. Physica A 429:252–260

Cunningham N (2019) A wave of unprofitable oil is about to hit the market. Oilprice.com. https://oilprice.com/Energy/Energy-General/A-Wave-Of-Unprofitable-Oil-Is-About-To-Hit-The-Market.html

Dalio R (2015) How the Economic Machine Works. Bridgewater. http://bwater.com/Uploads/FileManager/research/how-the-economic-machine-works/ray_dalio__how_the_economic_machine_works__leveragings_and_deleveragings.pdf See also the video of the same name

Damodaran A (2015) Total beta by industry sector: risk/discount rate. self published. http://pages.stern.nyu.edu/~adamodar/

Diamond J (1998) Guns, Germs, and Steel: The Fates of Human Societies. Norton, W. W., New York

Egorov Y (2000) Personal communication

Fraser E, Rimas A (2011) Empires of food: feast, famine, and the rise and fall of civilizations. Free Press, New York

Giraud G, Kahraman Z How dependent is growth from primary energy? Output energy elasticity in 50 countries. Working Paper

Graeber D (2014) Debt The First 5000 Years Second Edition. Melville House

Graeber D (2018) Bullshit jobs, a theory. Simon & Schuster, Noida

Grandjean A, Dufrêne N (2020) Une monnaie écologique. Odile Jacob

Hagens N (2020) Economics for the future – beyond the superorganism. Ecological Economics 169. https://doi.org/10.1016/J.ECOLECON.2019.106520

Hall C, Kittgard K (2018) Energy and the Wealth of Nations: An Introduction to Biophysical Economics, 2nd edn. Springer, New York

Hamilton J (2009) Causes and consequences of the oil shock 2007–08. Brookings Papers on Economic Activity

Hamilton J (2013) Handbook of Major Events in Economic History. Chapter Historical oil shocks. Routledge, London

Hansen GD, Prescott EC (2002) Malthus to solow. Am Econ Rev 92(4):1205–1217

Holmgren D (2002) The Essence of Permaculture. David Holmgren, Free download http://holmgren.com.au/downloads/Essence\_of\_Pc\_EN.pdf

Hopkins R (2008) The transition handbook: from oil dependency to local resilience. Chelsea Green Publishing, White River

Illig A, Schindler I (2017) Oil extraction, economic growth, and oil price dynamics. BioPhys Econ Resour Qual 2(1):1

IPBES (2019) Global assessment report on biodiversity and ecosystem services. Technical report, United Nations. https://www.ipbes.net/global-assessment-report-biodiversity-ecosystem-services

Jenkins J (2019) The humanure handbook, 4th edn. Shit in a Nutshell. Joseph Jenkins Inc

Jevons WS (1866) The coal question, 2nd edn. Macmillan and Co., London

King C (2015) The rising cost of resources and indicators of change. American Scientist 103(6): https://www.americanscientist.org/article/the-rising-cost-of-resources-and-global-indicators-of-change

Kopits S (2014) Oil and economic growth a supply constrained view. presentation Columbia University. http://energypolicy.columbia.edu/sites/default/files/energy/Kopits%20-%20Oil%20and%20Economic%20Growth%20%28SIPA,%202014%29%20-%20Presentation%20Version%5B1%5D.pdf

Kümmel R (2011) The second law of economics. Energy Entropy and the Origins of Wealth. Springer, New York

Laborde S (2012) La Théorie Relative de la Monnaie. Galuel. http://www.creationmonetaire.info/2012/11/theorie-relative-de-la-monnaie-2-718.html

Laherrére J (2014) 11). Fiabilité des données énergétiques, Club de Nice treiziéme Forum annuel

Laherrére J (2015) Tentitives d’explication du prix du pétrole et du gaz. ASPO France. http://aspofrance.viabloga.com/files/JL_Nice2015long.pdf

Lepetit M (2020) Secular stagnation post. Linkden. https://aspofrance.files.wordpress.com/2020/03/version-aspo-secular-stagnation-larry-summers.pdf

Lietaer B (2001) The future of money: creating new wealth work and a wiser world. Random House, New York

Likvern R (2012) Is shale oil production headed for a run with ”the Red Queen”? The Oil Drum. http://www.theoildrum.com/node/9506

Likvern R (2015, 09) The oil price, total global debt, and interest rates. Blog. http://fractionalflow.com/2015/04/05/the-oil-price-total-global-debt-and-interest-rates/

Maugeri L (2012) Oil: the next revolution. Technical report, Harvard Kennedy School Belfer Center

Meadows D (1974) The limits to growth. Universe Books

Metcalf T, Kennedy S (2019) Davos billionaires keep getting richer. Bloomberg. https://www.bnnbloomberg.ca/dimon-schwarzman-and-other-davos-a-listers-add-175-billion-in-10-years-1.1201089

Mollison B, Holmgren D (1978) Permaculture one. Corgi, Earling

Montgomery D (2007) Dirt: the erosion of civilizations. University of California Press, California

Mullainathan S, Shafir E (2013) Scarcity: Why Having Too Little Means So Much. Penguin UK

Mushalik M (2016) IEA in Davos warns of higher oil prices. blog. http://crudeoilpeak.info/iea-in-davos-2016-warns-of-higher-oil-prices-in-a-few-years-time

Országh J. Eautarcie: Sustainable water management in the world. Internet. http://eautarcie.org/

Piketty T (2013) Capital in the 21st Century [Capital au XXIe siécle]. Seuil

Piketty T (2019) Capital et idéologie. Édition du Seuil

Prins N (2018) Collusion: how central bankers rigged the world. Nation Books

Pukite P (2012) The Oil Conundrum. Pukite. http://theoilconundrum.com

Pukite P, Coyne D, Challou D (2018) Mathematical geoenergy: discovery, depletion, and renewal. AGU

Raworth K (2018)Doughnut economics : seven ways to think like a 21st-century economist. Cornerstone

Reynolds DB (1999) The mineral economy: how prices and costs can falsely signal decreasing scarcity. Ecol Econ 31:155–166

Reynolds DB (2002) Scarcity and growth considering oil and energy: an alternative neo-classical view. The Edwin Mellen Press, New York

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94(5):1002–1037

Romer PM (1990) Endogenous technological change. J Polit Econ 98(5, Part 2):S71–S102

Rystad Energy (2020, July). Oil and gas drilling set for at least a 20-year low in 2020, unlikely to recover to 2019 levels soon. Press Release. https://www.rystadenergy.com/newsevents/news/press-releases/oil-and-gas-drilling-set-for-at-least-a-20-year-low-in-2020-unlikely-to-recover-to-2019-levels-soon/

Schindler I, Schindler J (2018) Physical limits to economic growth: perspectives of economic, social, and complexity science. Chapter Strategies for an Economy Facing Energy Constraints. Routledge Publisher, London

Schindler J (2011) What is permaculture? a handful of opinions given under the shadow of environmental crises. Master’s thesis, Agrocampus Ouest, Rennes

Soldo B (2012) Forecasting natural gas consumption. Appl Energy 92:26–37

Solow R (1956) A contribution to the theory of economic growth. Q J Econ 70:65–94

Solow R, Wan F (1976) Extraction costs in the theory of exhaustible resources. Bell J Econ 7(2):359–370

Staff, (2014) Effective tax rate for oil and gas companies: Cashing in on special treatment. Technical report, Taxpayers for Common Sense

Staff (2015) Stripper wells accounted for 10% of u.s. oil production in 2015. Technical report, Energy Information Administration. https://www.eia.gov/todayinenergy/detail.php?id=26872

Staff (2019a) Bp statistical review of world energy. Technical report, BP. https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

Staff (2019b) Sharp rise in number of investors dumping fossil fuel stocks. Financial Times. https://www.ft.com/content/4dec2ce0-d0fc-11e9-99a4-b5ded7a7fe3f

Staff (2019c) World energy outlook. Technical report, International Energy Agency. https://www.iea.org/reports/world-energy-outlook-2019

Staff (2020) Oil patch bankruptcy monitor. Technical report, Haynes and Boone. https://www.haynesboone.com/-/media/files/energy_bankruptcy_reports/oil_patch_bankruptcy_monitor.ashx?la=en&hash=D2114D98614039A2D2D5A43A61146B13387AA3AE

Stiglitz JE (2018) Where modern macroeconomics went wrong. Oxford Rev EconPolicy 34(1–2):70–106

Taibbi M (2020) Bailing out the bailout. Rolling Stone, New York

Tartaglia A (2020) Growth and inequalities in a physicist’s view. Biophys Econ Sustain. https://doi.org/10.1007/s41247-020-00071-6

Thorpe S The 50 biggest banks: \$67.6 trillion in assets but only \$772 billion in capital Blog. https://simonthorpesideas.blogspot.com/2014/08/the-50-biggest-banks-676-trillion-in.html

Toensmeier E (2016) The Carbon Farming Solution A Global Toolkit of Perennial Crops and Regenerative Agriculture Practices for Climate Change Mitigation and Food Security. Chelsea Green Publishing

Trainer T, Malik A, Lenzen M (2019) A comparison between the monetary, resource and energy costs of the conventional industrial supply path and the “simpler way” path for the supply of eggs. BioPhys Econ Resour Qual 4(3):9

Turchin P (2008) Globalization as Evolutionary Process: Modeling Global Change, Chapter Modeling periodic waves of integration in the Afro-Eurasion world system, pp. 163–191. Routledge, London

Turchin P, Nefedov S (2009) Secular Cycles. Princeton University Press, Princeton

Tverberg G (2012) Oil supply limits and the current financial crisis. Energy 37(1):27–34

Tverberg G (2015) Oops! low oil prices are related to a debt bubble. http://ourfiniteworld.com/2015/11/03/oops-low-oil-prices-are-related-to-a-debt-bubble/

Tverberg G (2017) Falling interst rates have postponed ”peak oil”. Blog. https://ourfiniteworld.com/2017/06/12/falling-interest-rates-have-postponed-peak-oil/41943

Tverberg G (2020) Economies won’t be able to recover after shutdowns. Blog. https://ourfiniteworld.com/2020/03/31/economies-wont-be-able-to-recover-after-shutdowns/

Veblen T (1899) The theory of the leisure class: an economic study of institutions. Macmillan, New York

Williams-Derry C, Hipple K, Sanzillo T (2020) Shale producers spilled \$2.1 billion in red ink last year. Technical report, Institute for Energy Economics and Financial Analysis

Wise T (2019) Eating tomorrow agribusiness, family farmers, and the battle for the future of food. The New Press, New York

Wolfson MH (2002) Minsky’s theory of financial crises in a global context. J Econ Issues 36(2):393–400

Acknowledgements

The authors would like to thank Dr. Roger Bentley and the two anonymous referees for their valuable, thought provoking comments and criticisms which substantially improved the quality of this work. The third author would like to thank his colleagues at ASPO France for all they have taught him about the oil industry.

Funding

I. Schindler: Ian Schindler acknowledges funding from ANR under grant ANR-17-EURE-0010 (Investissements d’Avenir program).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

R output

Rights and permissions

About this article

Cite this article

Garcia, L.E., Illig, A. & Schindler, I. Understanding Oil Cycle Dynamics to Design the Future Economy. Biophys Econ Sust 5, 15 (2020). https://doi.org/10.1007/s41247-020-00081-4

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s41247-020-00081-4