Abstract

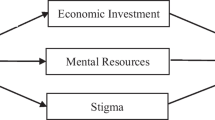

Do income shocks affect educational investment? Can self-help groups or Savings and Credit Cooperative Organizations (SACCOs) mitigate the impact of shocks on educational investment? Using nationally representative panel data from Tanzania, I find that educational investment suffers because of income shocks. On a whole, I find that income shock is negatively correlated with educational investment measured in per school-age child educational expenditure. However, I find no strong evidence to suggest that self-help groups and SACCOs buffer against income shocks. This suggests that locally available buffering mechanisms such as self-help groups and SACCOs do not necessarily help households to cushion against income shocks partly because many of the shocks affect most people in a given locality. Therefore, relying solely on the local mitigating mechanisms may not be a good option. This calls for a need to design policies that would enable households to insure themselves beyond their local insurance mechanisms. Public insurance and social safety nets programs may help households to overcome income shocks.

Similar content being viewed by others

Notes

In this paper, shocks refers to negative shocks and income shock refers to fall in (loss of) income resulting from exposure to a negative shock.

Self-help groups are informal associations whose members have some strong social cohesion that is built on friendship, neighbourhood, workers of the same institutions or same sector in a locality, or people of the same social background. They operate on mutual insurance kind of—as long as there is potential for reciprocity, it is easier to maintain them. SACCOs are member-owned institutional models entrusted to provide financial services to members. Members are simultaneously owners and users (Abay et al. 2017).

The government has played a key role in urging people to establish SACCOs.

Prior joining Standard I, children have to complete 1–3 years of pre-primary education.

This is the official age as per the 1995 Tanzania Education Policy (United Republic of Tanzania (URT) 2018)).

Fortunately, we have one wave conducted in 2019/2020 after the introduction of the fee-free policy. We use this data to check what the situation is after the introduction of the policy.

The data shows that nonfees account for 85% of the education expenditure and fee takes only 15%. In the data, the costs that parents incur (other than school fee) include books, uniforms, transport, extra tuition, other contributions, and cost of meals. The components and their average expenditure are shown in Table 8.

LSMS-ISA supports governments in seven Sub-Saharan African countries to generate nationally representative, household panel data with a strong focus on agriculture and rural development.

The NBS was advised on technical issues related to survey design and implementation by experts from World Bank, DFID, UNICEF, UNFPA, and JICA. It also received management and technical support from the LSMS Team in the Development Economics Research Group of the World Bank.

Tanzania is the union of Zanzibar and the then Tanganyika (now Tanzania Mainland); Dar es Salaam is the largest business city. Therefore, one would be interested to analyse these strata separately on top of urban versus rural analysis.

The list of the events is given in footnote 15.

In this paper, a recent shock is any shock that occurred in the past 24 months. I use information on timing of the shocks to create lagged (past) income shock variables, which I use to check whether past income shocks affect current educational investment.

The data contain different types of shocks—drought or floods, crop disease or crop pests, loss of livestock, household business failure, loss of salaried employment or non-payment of salary, large fall in sale prices for crops, large rise in price of food, large rise in agricultural input prices, severe water shortage, loss of land, chronic illness or accident of household member, death of a household member, death of other family member, break-up of the household, jailed, fire, robbery/burglary, and dwelling destroyed. Because each of these counts for a small percentage (Table 9), none of them can in isolation provide an extensive picture of the shocks households experience. Besides, if I were to focus on one specific shock, I would remain with a small sample size. That is why I combine them and look at the dummy of whether the shocks led to income loss. The extent of income loss would have been well captured if information on amount of income lost was available. Unfortunately, this is not available. The dummy variable I use, however, has some advantages. First, the sample consists of rural and urban households. For the former, agriculture is the main economic activity. Common shocks rural households face are drought, floods, crop disease or pests, loss of livestock, large fall in sale prices for crops, large rise in agricultural input prices, severe water shortage and loss of land which in turn reduce household income. Regarding urban households, common shocks they experience include business failure, loss of salaried employment or non-payment of salary and large rise in price of food. Therefore, the dummy variable I use allows me to get a comprehensive picture of the effect of income shock regardless of the type of the shock. Although the shocks listed above are not homogenous, they have one thing in common—they can lead to loss in household income—the main focus of the paper. However, for robustness check I differentiate the shocks by grouping them into three main categories–agricultural-related shocks (crop disease or pests, loss of livestock, large fall in sale prices for crops and large rise in agricultural input prices); weather-related shocks (drought or floods and severe water shortage); and, health-related shocks (chronic/severe illness or accident of household member, death of a member of household and death of other family member). We ignore minor shocks that affected only a few households.

However, I do not use the 2010/2011 wave because community data has no cluster (enumeration area) id. Likewise, I do not use the 2014/15 wave because it has different sampling frame—after the Population and Housing Census of 2012, the sample in the 2014–2015 wave was refreshed to take into account any changes in administrative boundaries, demographic shifts, or updated population information. The sampling frame of the earlier three waves was the 2002 Population and Housing Census. Also, I do not use the 2019/2020 wave in the main analysis because its sample is smaller than the previous waves. It targeted only a subsample of households from the initial NPS cohort originating in 2008/09 and subsequently surveyed in all four consecutive rounds. This consisted of 989 households from the 2014/15 sample to be tracked and interviewed in 2019/20. It also included complete households that could not be interviewed in 2014/15, excluding those households that had refused to be interviewed in 2014/15. This constituted an additional 8 households.

Since I use balanced panel data, I only use the original sample households and exclude new and split-off households.

In total, 1800 observations of original balanced panel data (6244) have no any school-age child. In 2008 and 2012, a total of 978 and 813 households had no any school-age child, respectively. All these households were excluded. Moreover, because a household may have a school-age child in one round and not the other, I drop such households in order to remain with a balanced panel of households with at least one child of school age in both rounds.

For more insights on the extent of household expenditure on education, Table 10 shows education expenditure by wealth status. Exchange rate 1 USD = 2310 TZS.

I prefer the fixed effect model over random effect model because the latter makes assumes that individual characteristics that remain constant over time (time-invariant characteristics) are uncorrelated with explanatory variables for every t. This is very a strong assumption, and if it fails to hold, random estimator is inconsistent. Fixed effects estimation allows time-invariant characteristics to be correlated with explanatory variables. Its key assumption is that any unobserved time-invariant household characteristics that may cause bias to our estimates will be cancelled out.

Sources mentioned by respondents include commercial banks, micro-finance institution, insurance companies, building societies, local merchant, money lender, employer, religious institution, and NGOs.

However, reverse causality is unlikely here because households generally do not experience shocks because they spent less in their children’s schooling.

I use household per capita expenditure to categorize households into four quintiles: very poor, poor, moderate, and rich: The household is categorized as very poor if its per capita expenditure is less or equal to 25 percentile, poor if it is above 25 percentile but less or equal to 50 percentile, moderate if it is above 50 but less or equal to 75 percentile, and rich if it is above 75 percentile. To understand the differential impact of negative shock at different income levels, I interact the income shock variable with the wealth status variables.

This reasoning is supported by the data as shown in Table 14, which shows responses to survey question “how disperse was the shock?”. The responses indicate that 35.1% and 30.2% of the shocks affected only the responding household in 2008 and 2012, respectively. 10.2% and 13.2% of the shocks in 2008 and 2012 affected some other households in the community; 44.6% and 43.5% affected most of the households in the community in 2008 and 2012, respectively; and, 10.1% and 13.1% affected all households in the community in 2008 and 2012, respectively.

See the details of this wave in Footnote 16.

References

Abay KA, Koru B, Abate G, Berhane G (2017) Alternative formation of rural savings and credit cooperatives and their implications: evidence from Ethiopia. F-32302-ETH-1

Angrist JD, Pischke J-S (2009) Mostly harmless econometrics: an empiricist’s companion. Princeton University Press, Princeton

Bandara A, Dehejia R, Lavie-Rouse S (2015) The impact of income and non-income shocks on child labor: evidence from a panel survey of Tanzania. World Dev 67:218–237

Becker GS (1962) Investment in human capital: a theoretical analysis. J Polit Econ 70(5):9–49

Beegle K, Dehejia RH, Gatti R (2006) Child labor and agricultural shocks. J Dev Econ 81:80–96

Belzil C, Leonardi M (2007) Can risk aversion explain schooling attainments? Evidence from Italy. Labour Econ 14(6):957–970

Björkman-nyqvist M (2013) Income shocks and gender gaps in education: evidence from Uganda. J Dev Econ 105:237–253

Bursztyn L, Ederer F, Ferman B, Yuchtman N (2014) Understanding mechanisms underlying peer effects: evidence from a field experiment on financial decisions. Econometrica 82(4):1273–1301

Cameron AC, Miller DL (2015) A practitioner’s guide to cluster-robust inference. J Hum Resour 50(2):317–372

Card D (2001) Estimating the return to schooling: progress on some persistent econometric problems. Econometrica 69(5):1127–1160

Chechi D, Fiorio CV, Leonardi M (2014) Parents’ risk aversion and children’s educational attainment. Labour Econ 30(3):164–175

Cogneau D, Jedwab R (2012) Commodity price shocks and child outcomes: the 1990 cocoa crisis in Cote d’Ivoire. Econ Dev Cult Change 60(3):507–534

Cooper DJ, Rege M (2011) Misery loves company: social regret and social interaction effects in choices under risk and uncertainty. Games Econom Behav 73(1):91–110

Dasgupta B, Ajwad IM (2011) Income shocks reduce human capital investments: evidence from five East European countries. World Bank Policy Research Working Paper 5926

Dercon S (2002) Income risk, coping strategies, and safety nets. World Bank Res Obs 17(2):141–166

Dercon S (2005) Insurance against poverty. Oxford University Press, Oxford

Duryea S, Lam D, Levison D (2007) Effects of economic shocks on children’s employment and schooling in Brazil. J Dev Econ 84:188–214

Ferreira FHG, Schady N (2009) Aggregate economic shocks, child schooling, and child health. World Bank Res Obs 24(2):147–181

Garbero A, Muttarak R (2013) Impacts of the 2010 droughts and floods on community welfare in rural Thailand: differential effects of village educational attainment. Ecol Soc 18(4):27

Gertler P, Levine DI, Ames M (2004) Schooling and parental death. Rev Econ Stat 86:211–225

Glick P, Sahn DE (1997) Gender and education impacts on employment and earnings in West Africa: evidence from Guinea. Econ Dev Cult Change 45(4):793–823

Glick PJ, Sahn DE, Walker TF (2016) Aggregate shocks and education investment in Madagascar. Oxford Bull Econ Stat 6:792–813

Hoddinott J, Kinsey B (2001) Child growth in the time of drought. Oxford Bull Econ Stat 63(4):409–436

Jacoby HG, Skoufias E (1997) Risk, financial markets, and human capital in a developing country. Rev Econ Stud 64:311–335

Jensen R (2000) Agricultural volatility and investments in children. Am Econ Rev 90(2):399–404

Kazianga H (2012) Income risk and household schooling decisions in Burkina Faso. World Dev 40(8):1647–1662

Kazianga H, Udry C (2006) Consumption smoothing? Livestock, drought and insurance in rural Burkina Faso. J Dev Econ 79(2):413–446

Khalili N, Arshad M, Farajzadeh Z, Keachele H, Müller K (2020) Effect of drought on smallholder education expenditures in rural Iran: implications for policy. J Environ Manag 260:11013

Lucas RE (1988) On the mechanics of economic development. J Monet Econ 22:3–42

Mankiw NG, Romer D, Weil DN (1992) A contribution to the empirics of economic growth. Q J Econ 107(2):407–437

Morduch J (1994) Poverty and vulnerability. Am Econ Rev Pap Proc 84:221–225

Mottaleb A, Mohanty S, Hoang H, Rejesus RM (2013) The effects of natural disasters on farm household income and expenditures: a study on rice farmers in Bangladesh. Agric Syst 121:43–52

Mottaleb AK, Mohanty S, Mishra KA (2015) Intra-household resource allocation under negative income shock: a natural experiment. World Dev 66:557–571

Murendo C, Wollni M, De Brauw A, Mugabi N (2017) Social network effects on mobile money adoption in Uganda. J Dev Stud 54(2):327–342

Newman C, Tarp F, Van Den Broeck K (2014) Social capital, network effects, and savings in Rural Vietnam. Rev Income Wealth 60(1):79–99

Psacharopoulos G (1981) Returns to education: an updated international comparison. Comp Educ 17(3):321–341

Psacharopoulos G (1994) Returns to investment in education: a global update. World Dev 22(9):1325–1343

Psacharopoulos G, Patrinos HA (2018) Returns to investment in education: a decennial review of the global literature. Educ Econ 26(5):445–458

Schultz TW (1961) Investment in human capital. Am Econ Rev 51(1):1–17

Schultz PT (1993) Investments in the cchooling and health of women and men: quantities and returns. J Hum Resour 28(4):694–734

Shah M, Steinberg BM (2017) Drought of opportunities: contemporaneous and long-term impacts of rainfall shocks on human capital. J Polit Econ 125(2):527–561

Tabetando R (2018) Parental risk aversion and educational investment: panel evidence from rural Uganda. Rev Econ Household 17:647–670

United Republic of Tanzania (2014) Sera ya Elimu na Mafunzo. Ministry of Education and Vocational Training, Dar es Salaam

United Republic of Tanzania (2015a) Waraka wa Elimu Namba 5 wa Mwaka 2015a: Kufuta Ada kwa Elimu ya Sekondari Kidato cha Kwanza mpaka cha Nne kwa Shule za Umma na Michango yote Katika Elimu Msingi. Wizara ya Elimu, Sayansi na Teknologia, Dar es Salaam. 21 Nov 2015a

United Republic of Tanzania (2015b) Waraka wa Elimu Namba 6 wa Mwaka 2015b Kuhusu Utekelezaji wa Elimumsingi bila Malipo. Wizara ya Elimu, Sayansi naTeknolojia, Dar es Salaam. 10 Dec 2015b

United Republic of Tanzania (2018) Pre-primary, primary, secondary, adult and non-formal education statistics. URT, Dodoma

Vijverberg WPM (1993) Educational investments and returns for women and men in Côte d’Ivoire. J Hum Resour 28(4):933–974

Wooldridge JM (2010) Econometric analysis of cross section and panel data. MIT Press, Cambridge

Acknowledgements

The first draft of this paper was written when I was a Visiting Research Fellow at the Institute of Developing Economies (IDE), Japan. I would therefore like to thank the IDE for generous financial support that enabled me to spend two months in Japan and concentrate on writing this paper. I am also grateful to Yuya Kudo who hosted me during my two months stay at the IDE.

Funding

This work did not benefit from any funding except the personal funds of the researcher.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Tables 8, 9, 10, 11, 12, 13, 14, 15 and 16.

Rights and permissions

About this article

Cite this article

Mugizi, F.M.P. Stronger together? Shocks, educational investment, and self-help groups in Tanzania. J. Soc. Econ. Dev. 24, 511–548 (2022). https://doi.org/10.1007/s40847-022-00183-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40847-022-00183-3