Abstract

Currently, there is no consensus on the real properties of Bitcoin. The discussion comprises its use as a speculative or safe haven asset, while other authors argue that the augmented attractiveness could end up accomplishing money’s properties that economic theory demands. This paper explores the association between Bitcoin’s market price and a set of internal and external factors by employing the Bayesian structural time series approach (BSTS). The idea behind BSTS is to create a superposition of layers such as cycles, trend, and explanatory variables that are allowed to vary stochastically over time, additionally, it is possible to perform a variable selection through the application of the Spike and Slab method. This study aims to contribute to the discussion of Bitcoin price determinants by differentiating among several attractiveness sources and employing a method that provides a more flexible analytic framework that decomposes each of the components of the time series, applies variable selection, includes information on previous studies, and dynamically examines the behavior of the explanatory variables, all in a transparent and tractable setting. The results show that the Bitcoin’s price is negatively associated with the price of gold as well as the exchange rate between Yuan and US Dollar, while positively correlated to stock market index, USD to Euro exchange rate and diverse signs among the different countries’ search trends.

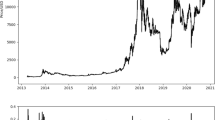

Source: Blockchain’s official website

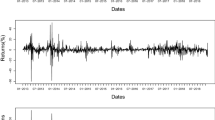

Source: Google trends

Similar content being viewed by others

Notes

The People’s Bank of China.

These variables will be explained in detail in the data section.

Increasing risks in financial markets have established the need to invest in another type of assets, precious metals being the most frequent ones.

Dynamic Time Warping (DTW) is a technique to find optimal alignment between time-dependent sequences. This method is particularly useful to measure similarity and, by extension in classification problems. For a broader explanation and application of this method read the reviews of Kate (2016) and Vaughan (2016).

MCMC samplers must be checked in order to prove the distributional assumptions about the simulation, and it has to be stable over several draws. In most cases reduce by thinning (eliminating the burn-in iterations in compliance with parameter stability).

Among the discrete version, we have the forward/backward stepwise selection that filters through all possible subsets, nevertheless is computationally costly when the number of predictors becomes large. On the other side, penalized shrinkage methods such as LASSO (Tibshirani 1996) or Ridge (Hoerl and Kennard 1970) are more generally recommended, especially in high-dimensional settings.

The symmetric mean absolute percentage error (sMAPE) is an accuracy measure based on relative errors, it is evaluated as: \(\frac{100}{n}\mathop \sum \nolimits_{t = 1}^{n} \frac{{|\widehat{{Y_{t} }} - Y_{t} |}}{{(|Y_{t} | - |\widehat{{Y_{t} }}|)}}\).

The mean absolute error (MAE) is as its name describes \(\frac{{\mathop \sum \nolimits_{t = 1}^{n} |\varepsilon_{i} |}}{n}\).

The mean squared error (MSE) is represented as \(\frac{{\mathop \sum \nolimits_{t = 1}^{n} \varepsilon_{i}^{2} }}{n}\).

Stability of the further simulation was proved given the update of the priors (Fig. 13).

Extension of the process is described in detail in Xi et al. (2016).

References

Antonopoulos, A. M. (2014). Mastering Bitcoin: Unlocking digital cryptocurrencies. Newton: O’Reilly Media, Inc.

Athey, S., Parashkevov, I., Sarukkai, V., & Xia, J. (2016). Bitcoin pricing, adoption, and usage: theory and evidence (No. 17-033). IDEAS working paper series from RePEc. St. Louis. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2826674.

Baek, C., & Elbeck, M. (2015). Bitcoins as an investment or speculative vehicle? A first look. Applied Economics Letters 22(1), 30–34. https://doi.org/10.1080/13504851.2014.916379.

Baur, D. G., & Lucey, B. M. (2010). Is Gold a Hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review, 45(2), 217–229. https://doi.org/10.1111/j.1540-6288.2010.00244.x.

Baur, D. G., & McDermott, T. K. (2010). Is gold a safe haven? International evidence. Journal of Banking and Finance, 34(8), 1886–1898.

Bjerg, O. (2016). How is Bitcoin money? Theory, Culture and Society, 33(1), 53–72. https://doi.org/10.1177/0263276415619015.

Böhme, R., Christin, N., Edelman, B., & Moore, T. (2015). Bitcoin: Economics, technology, and governance. Journal of Economic Perspectives, 29(2), 213–238. https://doi.org/10.1257/jep.29.2.213.

Bouoiyour, J., & Selmi, R. (2016). Bitcoin: A beginning of a new phase? Economics Bulletin, 36(3), 1430.

Bouoiyour, J. & Selmi, R. (2017). Are Trump and Bitcoin Good Partners? https://arxiv.org/abs/1703.00308.

Bouri, E., Gupta, R., Tiwari, A. K., & Roubaud, D. (2017). Does Bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions. Finance Research Letters. https://doi.org/10.1016/j.frl.2017.02.009.

Brodersen, K. H., Gallusser, F., Koehler, J., Remy, N., & Scott, S. L. (2015). Inferring causal impact using bayesian structural time-series models. Annals of Applied Statistics, 9(1), 247–274. https://doi.org/10.1214/14-AOAS788.

Cheah, E. T., & Fry, J. (2015). Speculative bubbles in Bitcoin markets? An empirical investigation into the fundamental value of Bitcoin. Economics Letters, 130, 32–36. https://doi.org/10.1016/j.econlet.2015.02.029.

Chipman, H., George, E. I., Mcculloch, R. E., Clyde, M., Foster, D. P., & Stine, R. (2014). The practical implementation of Bayesian Model selection. Lecture Notes—Monograph Series. IMS. https://doi.org/10.1214/lnms/1215540964.

Ciaian, P., Rajcaniova, M., & Kancs, D. (2016a). The digital agenda of virtual currencies: Can BitCoin become a global currency? Information Systems and e-Business Management, 14(4), 883–919. https://doi.org/10.1007/s10257-016-0304-0.

Ciaian, P., Rajcaniova, M., & Kancs, D. (2016b). The economics of Bitcoin price formation. Applied Economics, 48(19), 1799–1815. https://doi.org/10.1080/00036846.2015.1109038.

Ciner, C., Gurdgiev, C., & Lucey, B. M. (2013). Hedges and safe havens: An examination of stocks, bonds, gold, oil and exchange rates. International Review of Financial Analysis, 29, 202–211.

Durbin, J., & Koopman, S. J. (2012). Time series analysis by state space methods. Oxford: Oxford University Press. https://doi.org/10.1017/cbo9781107415324.004.

Dwyer, G. P. (2015). The economics of Bitcoin and similar private digital currencies. Journal of Financial Stability, 17, 81–91. https://doi.org/10.1016/j.jfs.2014.11.006.

Dyhrberg, A. H. (2016). Bitcoin, gold and the dollar—a GARCH volatility analysis. Finance Research Letters, 16, 85–92. https://doi.org/10.1016/j.frl.2015.10.008.

Franco, P. (2014). Understanding Bitcoin: Cryptography, engineering and economics. Oxford: Wiley.

Garcia, D., Tessone, C. J., Mavrodiev, P., & Perony, N. (2014). The digital traces of bubbles: Feedback cycles between socio-economic signals in the Bitcoin economy. Journal of the Royal Society Interface The Royal Society, 11(99), 16. https://doi.org/10.1098/rsif.2014.0623.

George, E. I., & McCulloch, R. E. (1993). Variable selection via Gibbs sampling. Journal of the American Statistical Association, 88(423), 881–889. https://doi.org/10.1080/01621459.1993.10476353.

Georgoula, I., Pournarakis, D. Bilanakos, C., Sotiropoulos, D. & Giaglis, G. (2015). Using time-series and sentiment analysis to detect the determinants of Bitcoin prices. https://doi.org/10.2139/ssrn.2607167.

Glaser, F., Zimmermann, K., Haferkorn, M., Weber, M. C., & Siering, M. (2014). Bitcoin—asset or currency? Revealing users’ hidden intentions. In Twenty Second European Conference on Information Systems (pp. 1–14).

Greenland, S., Maclure, M., Schlesselman, J. J., Poole, C., & Morgenstern, H. (1991). Standardized regression coefficients: A further critique and review of some alternatives. Epidemiology, 2(5), 387–392.

Halaburda, H. (2016). Beyond Bitcoin. The economics of digital currencies. New York: New York University. https://doi.org/10.1057/9781137506429.

Harvey, A. C. (1990). Forecasting, structural time series models and the Kalman filter. London: Cambridge University Press.

Hoerl, A. E., & Kennard, R. W. (1970). Ridge regression: Biased estimation for nonorthogonal problems. Technometrics, 12(1), 55–67. https://doi.org/10.1080/00401706.1970.10488634.

Ishwaran, H., & Rao, J. S. (2005). Spike and Slab variable selection: Frequentist and Bayesian strategies. The Annals of Statistics, 33(2), 730–773. https://doi.org/10.1214/009053604000001147.

Kaminski, J. (2014). Nowcasting the Bitcoin market with Twitter signals. Cambridge. Retrieved from http://arxiv.org/abs/1406.7577.

Kate, R. J. (2016). Using dynamic time warping distances as features for improved time series classification. Data Mining and Knowledge Discovery, 30(2), 283–312. https://doi.org/10.1007/s10618-015-0418-x.

Kim, Y. B., Kim, J. G., Kim, W., Im, J. H., Kim, T. H., Kang, S. J., et al. (2016). Predicting fluctuations in cryptocurrency transactions based on user comments and replies. PLoS One, 11(8), 1–18. https://doi.org/10.1371/journal.pone.0161197.

Koop, G., Poirier, D. J., & Tobias, J. L. (2007). Bayesian econometric methods. Cambridge: Cambridge University Press.

Kristoufek, L. (2015). What are the main drivers of the Bitcoin price? Evidence from wavelet coherence analysis. PLoS One, 10(4), 1–19. https://doi.org/10.1371/journal.pone.0123923.

Luther, W. J. (2016). Bitcoin and the future of digital payments. Independent Review, 20(3), 397–404. https://doi.org/10.2139/ssrn.2631314.

Merlise, A. (1999). Bayesian model averaging and model search strategies. Bayesian Statistics, 6, 157–185.

Mitchell, T. J., & Beauchamp, J. J. (1988). Bayesian variable selection in linear regression. Journal of the American Statistical Association, 83(404), 1023. https://doi.org/10.2307/2290129.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Retrieved from: https://bitcoin.org/bitcoin.pdf.

Nimon, K. F., & Oswald, F. L. (2013). Understanding the results of multiple linear regression. Organizational Research Methods, 16(4), 650–674. https://doi.org/10.1177/1094428113493929.

Owusu, R. A., Mutshinda, C. M., Antai, I., Dadzie, K. Q., & Winston, E. M. (2016). Which UGC features drive web purchase intent? A Spike-and-Slab Bayesian variable selection approach. Internet Research, 26(1), 22–37. https://doi.org/10.1108/intr-06-2014-0166.

Parmigiani, G., Petrone, S., & Campagnoli, P. (2009). Dynamic linear models with R. New York: Springer.

Raskin, M., & Yermack, D. (2016). Digital Currencies, descentralized ledgers, and the future of Central Banking (NBER Working Paper No. 22238). Cambridge.

Ročková, V., & George, E. I. (2014). Negotiating multicollinearity with Spike-and-Slab priors. Metron, 72(2), 217–229. https://doi.org/10.1007/s40300-014-0047-y.

Rogojanu, A., & Badea, L. (2014). The issue of competing currencies. Case study—Bitcoin. Theoretical and Applied Economics, 21(1), 103–114.

Scott, S. L., & Varian, H. (2013). Bayesian variable selection for nowcasting economic time series. NBER Working Paper Series. Cambridge. https://doi.org/10.3386/w19567.

Shumway, R. H., & Stoffer, D. S. (2010). Time series analysis and its applications: With R examples. Berlin: Springer.

Simser, J. (2015). Bitcoin and modern alchemy: In code we trust. Journal of Financial Crime, 22(1), 155–169. https://doi.org/10.1108/JFC-11-2013-0067.

Smith, G. (2017). How a China Crackdown Caused Bitcoin’s Price to Plunge. http://fortune.com/2017/01/05/bitcoin-plunge-china-currency/. Retrieved 29 June 2018.

Tibshirani, R. (1996). Regression shrinkage and selection via the Lasso. Journal of the Royal Statistical Society 58(1), 267–288.

Vaughan, N. (2016). Comparing and combining time series trajectories using dynamic time warping. Procedia Computer Science, 96(January), 465–474. https://doi.org/10.1016/j.procs.2016.08.106.

West, M., & Harrison, J. (2006). Bayesian forecasting and dynamic models (Second). New York: Springer Science & Business Media. https://doi.org/10.1007/b98971.

Wisniewska, A. (2015). Bitcoin as an example of a virtual currency. Institute of Economic Research Working Papers. Torun. Retrieved from: https://www.researchgate.net/profile/Anna_Wisniewska10/publication/317304290_Bitcoin_as_an_example_of_virtual_currency/links/593122caa6fdcc89e78ca1be/Bitcoin-as-an-example-of-virtual-currency.pdf.

Xi, R., Li, Y., Yiming, H., et al. (2016). Bayesian quantile regression based on the empirical likelihood with Spike and Slab priors. Bayesian Analysis, 11(3), 821–855.

Yelowitz, A., & Wilson, M. (2015). Characteristics of Bitcoin users: An analysis of Google search data. Applied Economics Letters, 4851(January), 1–7. https://doi.org/10.1080/13504851.2014.995359.

Yermack, D. (2013). Is Bitcoin a real currency? An economic appraisal. National Bureau of Economic Research.

Yildirim, I. (2012). Bayesian inference: Gibbs sampling. Technical Note, University of Rochester, New York.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper has won the “Best Paper Award” in the 23rd EBES Conference held in Madrid on September 27–29, 2017.

Appendices

Appendix 1: Standardized coefficients effects on interpretation

Standardization of both sets of regressors and independent variables leads to several changes in interpretation and results. Here we present some of the very common:

-

1.

The coefficient between \(x\) and \(y\) standardized variables will be equal to the covariance of them.

$$\beta_{yx}^{*} = \frac{{cov(z_{y} ,z_{x} )}}{{var(z_{x} )}} = \frac{{cov(z_{y} ,z_{x} )}}{1} = cov(z_{y} ,z_{x} )$$ -

2.

As expected, the covariance of \(x\) on \(y\) is equal to the covariance of \(y\) and \(x\)

$$\beta_{xy}^{*} = \beta_{yx}^{*}$$ -

3.

The covariance between two standardized variables is equal to the correlation between them

$$\rho_{xy} = \frac{{cov(z_{y} ,z_{x} )}}{{\sigma (z_{x} )\sigma (z_{y} )}} = cov(z_{x} ,z_{y} )$$

Appendix 2: Gibbs sampling

Gibbs sampling generates posterior samples by smoothly moving through each variable to sample from its conditional distribution with the remaining variables fixed. The algorithm does not sample from the posterior directly, instead, it simulates samples from one random variable at a time. According to MCMC theory, the Gibbs sampler will converge to the target posterior (Yildirim 2012). For \(X_{D}\) random variables the algorithm works as:

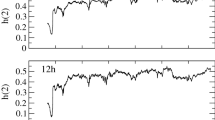

Appendix 3: Extra graphics

Rights and permissions

About this article

Cite this article

Poyser, O. Exploring the dynamics of Bitcoin’s price: a Bayesian structural time series approach. Eurasian Econ Rev 9, 29–60 (2019). https://doi.org/10.1007/s40822-018-0108-2

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-018-0108-2