Abstract

This paper presents a model of health-conscious consumer behavior under the assumption that health, produced by consumption, enters the utility function and affects simultaneously the income earning capacity of the consumer through its impact on the efficiency of work performance, hence the budget constraint. We demonstrate that the optimization requires that the total marginal utility of a good, arising partly from the good itself and partly from an induced gain of health, equal the implicit utility value of its effective price, which is calculated from the market price by adjusting it for an incremental income due to an induced gain in health. This explains why health-enhancing goods are treated favorably and health-harming ones are avoided as well as why the knowhow regarding how to produce and maintain health affects consumer choice. We offer new interpretations of the Slutsky Equation and Shephard’s Lemma in relation to the Hicks–Samuelson theory as the reference model. Both static and dynamic cases are analyzed with or without leisure, to elucidate the exact working of the equi-marginal principle in each case and to draw implications on several theories including the permanent income hypothesis and the efficiency wage hypothesis.

Similar content being viewed by others

Notes

Loeppke et al. (2009), for instance, explored a link between health and productivity, by measuring the health-related productivity loss using a regression analysis to estimate the associations of health conditions (such chronic conditions as depression/anxiety, obesity, arthritis, and back/neck pain) with absenteeism and presenteeism. Finding that the health-related productivity loss far exceeds medical and pharmacy costs, they argue that an integrated investment approach should be taken to health-capital management. In 2011, departing from the traditional occupational safety and health protection programs, the National Institute of Occupational Safety and Health launched the Total Worker Health Program as an integrated approach to worker safety/health and well-being. The Program is defined as policies, programs, and practices that integrate protection from work-related safety and health hazards with promotion of injury and illness prevention efforts to advance worker well-being. This approach recognizes that the risk factors in the workplace contribute to health problems of workers, which are costly to firms, community, and economy as well as to individuals. The Program, therefore, advocates a more holistic approach to worker safety, health, and well-being, by combining protection of worker safety and health with advancement of the overall well-being of workers. In this regard, see Parkinson (2013) for an employer health and productivity roadmap strategy, which is comprised of six interrelated and integrated core elements. The strategy aims at building a framework of shared accountability for both employers and health and productivity partners for improvement of health, so as to maximize productivity and to reduce excessive costs. It is suggested that the strategy is most effective if linked to a financially incentivized health management program or to a consumer-directed health plan insurance benefit design. See also Prochaska et al. (2011) for a well-being approach to presenteeism. For a comprehensive study of the health-related lost productivity, the 2012 publications by the Standard Insurance Company are helpful: “Productivity Insight #2: Health-Related Lost Productivity: The Full Cost of Absence” and “Productivity Insight #3: Understanding Presenteeism.” The first report is on the productivity loss caused by employees who are absent from work due to medical reasons (absenteeism and disability), and the second one is on the productivity loss caused by employees who come to work despite medical conditions (presenteeism).

See the report by the World Economic Forum and the Harvard School of Public Health, “The Global Economic Burden of Non-Communicable Diseases” (2011), the report by the World Health Organization, “Scaling up Action against Noncommunicable Diseases: How Much Will It Cost?” (2011), and the combined report, “From Burden to ‘Best Buys’: Reducing the Economic Impact of Non-Communicable Diseases in Low- and Middle-Income Countries” (2011). See also United Nations’s 2011 declaration: “Political declaration of the High-level Meeting of the General Assembly on the Prevention and Control of Non-communicable Diseases.” Bloom et al. (2014a) estimated the economic impact of the five main NCDs in China and India for the period 2012–2030. The estimates are: US$ 27.8 trillion for China and US$ 6.2 trillion for India (in 2010 US$), with cardiovascular disease and mental health being most costly, followed by respiratory disease.

Suen and Mo (1994) presented a simple analytics of productive consumption by isolating goods (including leisure) that contribute to utility and income at the same time. The same analytics was also applied to goods that are harmful to health. They demonstrated why and how the demand for such productive goods may be less responsive to prices and income than in the pure preference model, as well as why the labor supply may be less responsive to wage and income if work in the market causes fatigue, than when leisure does not contribute to income. Our paper takes a more general approach to health-conscious consumer behavior, by relating consumption and leisure to health through a health production function and by allowing the health status to affect the work-efficiency, hence the income-earning capacity, in static and dynamic contexts.

The notion that income earning is a positive function of health is found in Grossman’s model (1972a, b), which allows health to reduce sick time, thereby to increase the working time under the base wage rate not affected by health. This is followed in Galama (2011, Ch. 2, Ch. 5). Galama (2011, Ch. 3) stipulates, more explicitly, that income equals the (age-dependent) base wage plus the extra wage induced by health. It is also found in Case and Deaton (2005), where it is stated that income increases with health. Galama (2011, Ch. 5) distinguishes between healthy and unhealthy consumption and let such consumption and the preventive care affect the biological aging rate, while assuming that income equals the wage rate times the amount of time spent on working (where this amount is equated to what remains after the time spent on such things as curative and preventive care, healthy and unhealthy consumption, and the sick leave as a declining function of health are subtracted from the total time endowment). In his formulation, healthy and unhealthy consumption does not directly affect the health production function, although they do affect utility. This study was preceded by Forster (2000), who studied the implications of different terminal conditions on the life-span and the paths of consumption and health while distinguishing healthy and unhealthy consumption in the utility function and allowing health to yield a higher income stream. In a similar vein, an interesting question has been addressed by Kuhm et al. (2015) and Bloom et al. (2014b), among others, on a related question of the health-longevity-retirement nexus. In these treatments, health affects the asset accumulation equation by influencing the mortality rate while allowing the income earning to be affected by health; on the utility side, health enters the utility function through the disutility of working which is affected by the state of health. All of these studies that came after Grossman (1972a, b) make use of control theory based on more aggregate quantities (such as medical services and consumption), and health capital is a stock that depreciates slowly over time and is replenished by investment in health (e.g., purchase of medical services). The Hamiltonian and the Lagrangian allow us to write the conditions along the optimal paths of control variables, and these conditions resemble the optimality conditions in our analysis, except that capital, in control theory, is treated as a state variable that changes as a result of investment whereas purchases of medical services and other consumption goods are control variables. If capital depreciates fast and must be replenished constantly, these conditions will converge to ours, but such convergence hides the importance of distinguishing health in the medical sense and health in the efficiency sense. The former is analyzed in the health-production literature. Our disaggregate analysis deals with health in the efficiency sense, i.e., with quasi health capital that depreciates fast and needs to be replenished on a daily basis in accordance with a health-production function. If this capital is neglected, one may be healthy in a medical sense, but such health may not last long unless care is taken daily and the efficiency of daily work performance suffers with a consequent fall in wage earning. How to stay healthy and remain efficient in productive activities is a daily concern, and our model makes explicit the logic of optimal choice that is made to meet this concern, in terms of the generalized marginal rate of substitution and the effective price ratio, in direct comparison with the traditional theory of consumer choice, and makes it possible to work with the generalized Slutsky equation. Thus, our model complements the literature on the health-production function.

There is a strain of literature, partly known as the health-wealth gradient that deals with the question of a two-way relationship between health and income/wealth, which is compounded by education, innovation, socioeconomic status, inequality in various dimensions, reference groups, time preferences, etc. (see Deaton 2002, 2003), and partly known as the health-economic growth link dealing with the effect of health on wages and income growth based on the notion that healthy people are more productive (see, e.g., Schultz 2002; Weil 2007; Bloom and Canning 2005). Also, see Stiglitz (1976) and Bliss and Stern (1978) for efficiency units of labor. Weil (2007) considered composite labor \(H\)written as \(H = hvL\) where \({h}\,\) stands for education, \(v\) for health status, and \({L}\,\) for labor. If the production function is written as \(Y = AK^{\alpha } H^{1 - \alpha } = AK^{\alpha } \left[ {\left( {hv} \right)^{1 - \alpha } L^{1 - \alpha } } \right]\), this composite labor gives the output growth equation: \(\frac{\dot{Y}}{Y} = \frac{\dot{A}}{A} + \alpha \frac{\dot{K}}{K} + \left( {1 - \alpha } \right)\frac{\dot{h}}{h} + \left( {1 - \alpha } \right)\frac{\dot{v}}{v} + \left( {1 - \alpha } \right)\frac{\dot{L}}{L}\), which shows that the Solow residual can be disaggregated further by considering the effect of health and education on top of technical change. While Weil considers that the wage \(W\) paid to a unit of composite labor is its marginal product, i.e., \(W = Y_{H} = A\left( {1 - \alpha } \right)\left( {{K \mathord{\left/ {\vphantom {K H}} \right. \kern-0pt} H}} \right)^{\alpha }\), in which case this wage falls with health status v (i.e., \(\left( {\partial /\partial v} \right)[A\left( {1 - \alpha } \right)\left( {K/H} \right)^{\alpha }] = A\left( {1 - \alpha } \right)\alpha \left( {K/H} \right)^{\alpha - 1} \left( { - K/H^{2} } \right)hL < 0\)), we may alternatively assume that the wage is paid to a unit of labor L in accordance with its marginal product, i.e., \({{W = Y_{L} = A\left( {hv} \right)^{1 - \alpha } K^{\alpha } \left( {1 - \alpha} \right)L^{ - \alpha } }}\), which implies that the paid wage increases with health status \(v\). The latter is more consistent with Solow’s treatment of technical change (1957). One can think of health and education as part of technical change or as constituting the efficiency of labor. In our model, we capture this effect as the efficiency of labor, which increases or decreases with health status, which, in turn, depends on what is consumed. One can make this point explicit by letting the production function be written as \(Y = AK^{\alpha } \left[ {e\left( {v\left( {x_{1} , \ldots ,x_{n} } \right),h} \right)L} \right]^{1 - \alpha }\) where \(e\left( {v\left( {x_{1} , \ldots ,x_{n} } \right),h} \right)\) is the efficiency of labor that depends on health v, which is affected by what is consumed, \(x_{1} , \ldots ,x_{n}\), as well as by the level of education \(h\). Then the marginal product of labor paid as the wage, that is, \(W = AK^{\alpha } \left[ {e\left( {v\left( {x_{1} , \ldots ,x_{n} } \right),h} \right)} \right]^{1 - \alpha } \left( {1 - \alpha } \right)L^{ - \alpha }\), increases with this efficiency. Such a formulation of the production function establishes a link between consumption on the one hand and health and income on the other, and delineates the effects of health-enhancing goods and health-harming goods on the wage earned. This is in line with the approach taken in this paper. Our paper departs by viewing consumption activities as playing a dual role of consumption and investment in health, thereby capturing a two-way relationship between consumption and income, which is mediated by health affecting the work efficiency. Because balanced nutrition including essential micronutrients, avoidance of excessive consumption of alcohol and smoking, regular physical exercise, avoidance of stressful situations, and so on contribute to mental and physical health, individuals need to remain mindful of what they take in each day, be it consumption or stress, in order to keep their productive and income-earning capacity intact as well as to enjoy the utility of health.

The health-conscious individual knows that a healthy life, ceteris paribus, is more productive and promises higher lifetime earnings. This implies that as far as planning is concerned, his wealth (as the discounted present value of lifetime earnings) and permanent income (as the real interest return on such wealth) are within a partial control of his decisions (despite the fact that there are contingencies that cannot be controlled), which is an extension of Friedman’s initial conceptualization (1957). Such endogeneity of wealth and permanent income implies that higher wages paid by firms may motivate workers to monitor their health more closely in order to perpetuate their earnings over the lifetime. It also implies that firms may have incentives to pay higher wages in order to secure healthy and efficient work force over time. A simple capitulation of efficiency wages by Stiglitz (1976) and Solow (1979) can demonstrate that if the production function of work efficiency as a function of real wages shifts with improvement in health, and if workers respond to higher wages by improving health, which enhances their work efficiency even more, the efficiency wages should be set by considering the effect of real wages on health as well. Focusing on asymmetric information, Shapiro and Stiglitz (1984) showed how equilibrium unemployment may emerge as an unintended consequence of a wage-setting game played by individual firms so as to keep workers from shirking. Management cannot be indifferent to the health-status of workers for an obvious reason that absenteeism and presenteeism are costly to the firm as they reduce the performance of workers, collectively as well as individually, and are quite demoralizing. But, how health-conscious workers are is part of private information prior to hiring, except that their medical history reveals part of this information. Knowing that deterioration of health is costly to the productivity of firms and raises uncertainty on the return from investing in on-the-job training, they may choose to offer certain health-wage-packages (that include benefits for health-enhancement efforts combined with monitoring requirements on health status), not only to keep workers from shirking but also to induce them to be extra health-conscious. Firms can, thereby, secure a much more reliable flow of efficient work over time while workers get a steady flow of higher income and higher utility from both better health and quality life over time, although higher wages paid as an added incentive may aggravate equilibrium unemployment for the economy as a whole if health-promoting wage packages add substantially to the cost of employment. Thus, health-conscious choice and health-friendly wages affect wealth and permanent income as defined by Friedman (1957), partly because health-enhancement efforts, by both individuals and firms, change the life- and work-expectancy and partly because better health changes the future income-earning profile through higher productivities. With health-conscious choice, therefore, the income generating process facing individuals and wealth imputed therefrom are no longer entirely exogenous to individual consumers.

The proposition that educated people are better able to produce health has been an important part of the health-production literature since its inception by Grossman (1972a, p. 225), who, from the list of the environmental variables on which the health production function depends, identifies education as the most important variable. Our modeling of health-conscious behavior is in line with this proposition since a health production function that relates consumption of goods and services to health, hence to work efficiency, is knowledge-based, which implies that a production function founded on better scientific knowledge is more efficient in producing health than those that are based on out-dated or biased knowledge. Deaton (2002, 2003) also discussed the role of education in a dual causality between income and health, and Weil (2007) treated education as complementing the role of health in economic growth through composite labor, as noted in footnote 4.

By using age-specific mortality rates and ten particular causes of death as the proxies of health, Ruhm (2000) examined how macroeconomic conditions (proxied by the average unemployment rate) affect health, and documented a strong inverse relationship. This study also includes a microdata analysis taken from the Behavioral Risk Factor Surveillance System, which indicated that people respond to changes in economic conditions by changing their lifestyles. For our purpose, notable findings in the microdata analysis, among others, are: (1) smoking is procyclical, (2) alcohol consumption increases with a rise in unemployment—which is different from what is reported in Ruhm (1995) and Ruhm and Black (2002) where alcohol consumption was found to be procyclical, (3) obesity falls when the economy stagnates, mainly because people exercise more and prepare healthy meals. The fact that the opportunity cost of time falls in recessions plays a crucial role in temporary improvement of health. Our model can help explain these findings. Consider a static model with leisure entered the utility function and the health production function, which is given in Appendix A, and suppose that a recession, for simplicity, is represented by a fall in the wage rate, which can account for a reduction in income that plays an important role in Ruhm’s study. For a health-conscious consumer behavior, what matters is the effective price of a good or leisure where this price is defined as the market price adjusted for an induced change in income due to the fact that health raises the efficiency of work performance; see conditions (A-12) and (A-13), or (50) and (51). With a fall in the wage rate, the effective price of a healthy good rises because the (positive) health effect on income falls, and the effective price of an unhealthy good falls because the (negative) health effect on income falls. Thus, consumption of healthy good falls and consumption of an unhealthy good rises. These effects tend to worsen health. But, these two effects are accompanied by a rise in leisure due to a fall in its effective price, so that the total net effect of a fall in the wage rate on health is a composite of the three effects: \(dh = h_{{x}_{i}} dx_{i} + h_{{x}_{j}} dx_{j} + h_{l} dl\,\,(here\,x_{i} \,is\,a\,healthy\,good;\,x_{j} \,is\,an\,unhealthy\,good;\,l\,is\,leisure).\) Since \(h_{{x_{i} }} > 0\), \(h_{{x_{j} }} < 0\), and \(h_{l} > 0\), the first two effects are negative with a fall in \(x_{i}\) and a rise in \(x_{j}\), but the third effect may overtake these negative effects and improve health temporarily if leisure increases sufficiently. As Ruhm stresses, increased leisure is used for physical exercise, preparation of healthy meals, and other health-enhancing activities. As a corollary, if a boom is represented by a rise in the wage rate, the exact opposite will happen. That is, if the effect of a reduction in leisure dominates the positive impact of the changes in the effective prices of healthy and unhealthy goods, health deteriorates in temporary booms. These results are consistent with Ruhm’s argument that health is affected by cyclical fluctuations partly through income changes (p. 636). From a dynamic point of view, a temporary rise in leisure in response to a fall in the wage rate and a temporary fall in leisure in response to a rise in the wage rate are part of intertemporal substitution of leisure, that is highlighted in (B-7) which summarizes the equi-marginal principle working across different periods. That is, if a wage rate at time t falls while the rest of the wages remain the same, the effective price of a healthy good at time t increases, so that the marginal utility per dollar of the effective expenditure falls at time t, which will be met by a decrease in its consumption to restore the balance with the generalized marginal utility of wealth. The effective price of an unhealthy good, on the other hand, falls, and this means a rise in the marginal utility per dollar of the effective expenditure, which is, therefore, met by a rise in its consumption. These changes tend to worsen health temporarily. But, leisure increases with a fall in the wage rate at time t because the effective price of leisure falls. If the health effect of leisure dominates, health may improve temporarily at time t, in response to a fall in the wage rate. The exact opposite will happen with a rise in the wage rate at time t, so that health may worsen with this change. Thus, our model can help explain a temporary phenomenon, anomalous as it may appear to be, that health may improve in bad times and worsen in good times. If an economy shows a sustained growth, wages will rise over time, and the demand for goods and leisure will show smooth paths over time. A sustained rise in wages will increase wealth, and, in response to this, leisure will increase through the wealth effect on leisure, and increased leisure contributes to health. With a rise in wealth, the opportunity cost of not making a health-conscious decision also increases, hence the consumer will be even more health-conscious to perpetuate an even higher income stream by their own endogenous effort, which, in turn, raises wealth and pushes the demand for leisure even further for better health. Thus, sustained growth leads to improvement of health over time. Positive effects of sustained economic growth on health are also noted by Ruhm (2000) as documented in the literature of the health-wealth gradient.

Adding leisure to the health-conscious behavior gives another ground for the efficiency wage hypothesis. If the management recognizes that a health-production function includes leisure as one of its arguments, then a health-based efficiency wage may be approximated by the relation: \(W^* = \sum\limits_{i = 1}^{n} {p_{i} x_{i} ^*(h^*;p_{1} ,\ldots,p_{n} ,W^*) + W^*l^*}(h^*;p_{1} ,\ldots,p_{n} ,W^*)\), hence \(W^* = \frac{{\sum\limits_{i = 1}^{n} {p_{i} x_{i}^ *(h^*)} }}{{1 - l^*(h^*;p_{1} ,\ldots,p_{n} ,W^*)}}\), where \(x_{i}^*(h^*;p_{1} ,\ldots.,p_{n} ,W^*)\) and \(l^*(h^*;p_{1} ,\ldots.,p_{n} ,W^*)\) are the solutions that minimize the cost of achieving the level of health, \(h*\), at which the elasticity of a health-production function with respect to health equals one.

References

Akerlof, G. A. (1982). Labor contracts as partial gift exchange. Quarterly Journal of Economics, 97, 543–569.

Becker, G. S., & Murphy, K. M. (1988). A theory of rational addiction. Journal of Political Economy, 96, 675–700.

Becker, G. S., & Murphy, K. M. (1993). A simply theory of advertising as a good or bad. Quarterly Journal of Economics, 108, 941–964.

Bliss, C., & Stern, N. (1978). Productivity, wages and nutrition, part I: The theory. Journal of Development Economics, 5, 331–362.

Bloom, D. E., & D. Canning. (2005). Health and economic growth: Reconciling the micro and macro evidence. Working paper 42, Center on Democracy, Development, and The Rule of Law, Stanford Institute on International Studies.

Bloom, D. E., Cafiero, E. T., McGovern, M. E., Prettner, K., Stanciole, A., Weiss, J., Bakkila, S., & Rosenberg, L. (2014a). The macroeconomic impact of non-communicable diseases in China and India: Estimates, projections, and Comparisons,” Journal of the Economics of Ageing 4: 100–111 and NBER Working Paper 19335 (August 2013).

Bloom, D. E., Canning, D., & Moore, M. (2014b). Optimal retirement with increasing longevity. Scandinavian Journal of Economics, 116, 838–858.

Case, A. and Deaton A. (2005). Broken down by work and sex: How our health declines. In D. A. Wise (Ed.), Analyses in the economics of aging (pp. 185–205). Chicago: The University of Chicago Press.

Cooper, R., & John, A. (1988). Coordinating coordination failures in Keynesian models. Quarterly Journal of Economics, 103, 441–463.

Deaton, A. (2002). Policy implications of the gradient of health and wealth. Health Affairs, 2, 13–30.

Deaton, A. (2003). Health, inequality, and economic development. Journal of Economic Literature, 41, 113–158.

Forster, M. (2000). The meaning of death: Some numerical simulations of a model of healthy and unhealthy consumption. NEP-HEA Working Paper No. 2000-08-07.

Friedman, M. (1957). A Theory of the Consumption Function. Princeton, NJ: Princeton University Press.

Galama, T. (2011). A theory of socioeconomic disparities in health, Ph.D thesis, University of Tilburg, The Netherlands.

Grossman, M. (1972a). On the concept of health capital and the demand for health. The Journal of Political Economy, 80, 223–255.

Grossman, M. (1972b). The demand for health: A theoretical and empirical investigation. New York: NBER, distributed by Columbia University Press.

Grossman, M. (2000). The human capital model. In A. J. Culyer & J. P. Newhouse (Eds.), Handbook of health economics (Vol. 1, pp. 347–408). Amsterdam: Elsevier Science.

Hall, R. (1978). Stochastic implications of the life cycle-permanent income hypothesis: theory and evidence. Journal of Political Economy, 86, 971–987.

Hicks, J. R. (1939). Value and capital. New York: Oxford University Press.

Koopmans, T. C. (1960). Stationary ordinal utility and impatience. Econometrica, 28, 287–309.

Kuhm, M., Wrzaczek, S., Prskawetz, A., & Feichtinger, G. (2015). Optimal choice of health and retirement in a life-cycle model. Journal of Economic Theory, 158, 186–212.

Lancaster, K. (1966). A new approach to consumer theory. Journal of Political Economy, 74, 132–157.

Loeppke, R., Taitel, M., Haufle, V., Parry, T., Kessler, R. C., & Jinnett, K. (2009). Health and productivity as a business strategy: A multiemployer study. Journal of Occupational and Environmental Medicine, 51, 411–428.

Lucas, R. E., Jr. (1976). Econometric policy evaluation: A critique. Carnegie-Rochester Conference Series on Public Policy, 1, 19–46.

Mas-Colell, A., Whinston, M. D., & Green, J. R. (1995). Microeconomic theory. New York: Oxford University Press.

Parkinson, M. D. (2013). Employer health and productivity roadmap™ strategy. Journal of Occupational and Environmental Medicine, 55(12 Supplement), S46–S51.

Pollak, R. A. (1970). Habit formation and dynamic demand functions. Journal of Political Economy, 78, 745–763.

Prochaska, J. O., Evers, K. E., Johnson, J. L., Castle, P. H., Prochaska, J. M., Sears, L. E., et al. (2011). The well-being assessment for productivity: A well-being approach to presenteeism”. Journal of Occupational and Environmental Medicine, 53, 735–742.

Ruhm, C. J. (1995). Economic conditions and alcohol problems. Journal of health economics, 14, 583–603.

Ruhm, C. J. (2000). Are recessions good for your health? Quarterly Journal of Economics, 115(2), 617–650.

Ruhm, C. J., & Black, W. E. (2002). Does drinking really decrease in bad times? Journal of health economics, 21, 659–678.

Ryder, H. E., Jr., & Heal, G. M. (1973). Optimum growth under intertemporally dependent preferences. Review of Economic Studies, 40, 1–33.

Samuelson, P. A. (1947). Foundations of economic analysis. Cambridge, MA: Harvard University Press.

Schultz, T. P. (2002). Wage gains associated with height as a form of health human capital”. American Economic Review, 92, 349–353.

Shapiro, C., & Stiglitz, J. E. (1984). Equilibrium unemployment as a worker discipline device. American Economic Review, 74, 433–444.

Solow, R. M. (1979). Another possible source of wage stickiness. Journal of Macroeconomics, 1, 79–82.

Standard Insurance Company (2012). Productivity insight #2: Health-related lost productivity: The full cost of absence and Productivity insight #3: Understanding presenteeism.

Stigler, G. J., & Becker, G. S. (1977). De gustibus non est disputandum. The American Economic Review, 67, 76–90.

Stiglitz, J. E. (1976). The efficiency wage hypothesis, surplus labor, and the distribution of income in L.D.C.s. Oxford Economic Papers, 28, 185–207.

Suen, W., & Mo, P. (1994). Simple Analytics of Productive Consumption. Journal of Political Economy, 102, 372–383.

Tuchman, A. E., Nair, H. S., & Gardete, P. M. (2015). Complementarities in consumption and the consumer demand for advertising. Stanford Graduate School of Business Working Paper No. 3288, Stanford University.

United Nations. (2011). Political declaration of the high-level meeting of the general assembly on the prevention and control of non-communicable diseases.

Weil, D. (2007). Accounting for the effect of health on economic growth. Quarterly Journal of Economics 122: 1265–1306. NBER Working Paper 11455 (July 2005).

World Economic Forum and Harvard School of Public Health. (2011). The global economic burden of non-communicable diseases.

World Health Organization. (2011). Scaling up action against noncommunicable diseases: How much will it cost?; From “burden to best buys”: Reducing the economic impact of non-communicable diseases in low- and middle-income countries.

Yellen, J. (1984). Efficiency wage models of unemployment. American Economic Review, 74, 200–205.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: When leisure enters both the utility function and the production function of health

Consider the following static model of consumer choice. The total time endowment is normalized at 1, which is divided between leisure \(l\) and working time \(1 - l\). The market wage rate is set at \(W\) The consumer’s choice space and the price space (including the wage rate) are the nonnegative orthants of the Euclidean \(n + 1\) space. Health \(H\) is produced from consumption of goods and leisure. This production function is written as

We assume that the income earning capacity, \(I\), is determined as

where \(F\left( H \right)\) is the efficiency of labor. The utility function of the consumer is written as

The optimization problem is specified as

With (A1) substituted in, the problem is reduced to

With the Lagrangian written as

the Kuhn–Tucker conditions give

Assuming that the solutions are interior, these conditions can be written as

The second order conditions are given by the principle minors of the following matrix alternating in sign.

where

(The subscripts denote the partial derivatives of the respective functions.)

The true cost of purchasing a unit of good \(x_{i}\), at the margin, is given by \(p_{i} - W\left( {1 - l} \right)F_{h} h_{{x_{i} }}\) (the market price \(p_{i}\) adjusted for the effect of the good on the income earning capacity, \(W\left( {1 - l} \right)F_{h} h_{{x_{i} }}\)). Likewise, the true cost of taking a unit of time for leisure, at the margin, is given by \(WF\left( {h\left( {x_{1} ,x_{2} , \ldots ,x_{n} ,l} \right.} \right) - W\left( {1 - l} \right)F_{h} h_{l}\) (the effective wage under the state of health \(H\), i.e., \(WF\left( H \right)\), adjusted for the impact of leisure on the income earning capacity \(W\left( {1 - l} \right)F_{h} h_{l}\)). If the consumer purchases a unit of good \(x_{i}\) or leisure, his utility increases, at the margin, by

That is, the total marginal utility on the left-side is comprised of the direct marginal utility and the indirect marginal utility through the impact on health. Hence, the total marginal utility per effective cost of purchasing one unit of a good or leisure at the margin is given by

Alternatively, we may write conditions (A12) and (A13) as

Purchasing one unit of good \(x_{i}\) or leisure yields utility in three ways: the direct marginal utility, the indirect marginal utility, and the implicit utility value of an incremental or decremental income accruing to health. The sum of these utilities equals the implicit utility value of the market price or the wage rate. Thus, the consumer’s decision can be thought of either adding the implicit utility value of an incremental or decremental income (via the income earning capacity affected by health) to the total marginal utility or subtracting this income from the market price in order to get the true (effective) cost of purchasing a good or leisure.

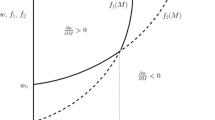

In the case in which a good enhances health, it holds that \(U_{h} h_{{x_{i} }} > 0\) and \(W\left( {1 - l} \right)U_{h} h_{{x_{i} }} > 0\). Hence, the true cost of purchasing one unit of good \(x_{i}\) is less than its market price \(p_{i}\), and the implicit utility value of an extra income through health is positive. On the other hand, if a good is detrimental to health, the opposite holds, causing the true purchasing cost to be higher than the market price. In the case of leisure, if leisure enhances health, hence the income earning capacity, the true cost of leisure will be less than the effective wage rate \(WF\left( H \right)\).

Turning to the price effect and the wage effect, we first observe that conditions (A12), (A13), and (A14) constitute a system of simultaneous equations in \(n + 2\) variables, \(\left( {x_{1} ,x_{2} , \ldots ,x_{n} ,l,\lambda } \right)\). We assume that all of the functions are continuously differentiable. Let \(\left( {\overline{{x_{1} }} ,\overline{{x_{2} }} , \ldots ,\overline{{x_{n} }} ,\bar{l},\bar{\lambda }} \right)\) be an interior solution to this system under the market prices and wage rate, \(\left( {\overline{{p_{1} }} ,\overline{{p_{2} }} , \ldots ,\overline{{p_{n} }} ,\overline{W}} \right).\) By the second order condition, the determinant of the Jacobian \(J\) of the matrix in (A15) evaluated at this solution is non-zero. By the implicit function theorem, therefore, there exist continuously differentiable functions:

such that \(\overline{{x_{i} }} = D^{i} \left( {\overline{{p_{1} }} ,\overline{{p_{2} }} , \ldots ,\overline{{p_{n} }} ,\overline{W} } \right),i = 1,2, \ldots ,n;{\bar{l}} = L\left( {\overline{{p_{1} }} ,\overline{{p_{2} }} , \ldots ,\overline{{p_{n} }} ,\overline{W} } \right)\), and condition (A12), (A13), and (A14) are satisfied for some neighborhood of \(\left( {\overline{{x_{1} }} ,\overline{{x_{2} }} , \ldots ,\overline{{x_{n} }} ,\overline{l} ,\overline{\lambda } } \right)\).

Totally differentiating the first order conditions, (A12), (A13), and (A14), gives the following fundamental equations of comparative statics.

Solving this system for \(dx_{i} ,i = 1,2, \ldots ,n,dl\) and \({d\lambda }\) gives

where \(D_{ji}\) is the cofactor of an element in the j-th row and the i-th column of the matrix. These solutions yield the following comparative statics.

With these substituted in, (A26) and (A28) can be rewritten as

The terms, \(\lambda D_{li} /D\) and \(\lambda D_{j,n + 1} /D\), in (A34) and (A35), can be shown to equal the comparative statics of the solution to the minimization problem:

Hence, they can be interpreted as the generalized substitution effects. The second terms in (A34) and (A35) represent the generalized income effects, which are comprised of the direct wage effects, \(\partial x_{i} /\partial W\) and \(\partial l/\partial W\) and the combined effects of an increase in the wage rate on the purchases of goods and leisure, hence on health and income. Thus, the Slutsky equation holds, in that the generalized price effects in (A34) and (A35) can be decomposed into the generalized substitution effects and the generalized income effects.

Appendix B: Intertemporal health-conscious consumer behavior with leisure

Let the model above be extended to the following intertemporal model with an infinite horizon, where the choice made in period \(t\) affects health within the same period.

With the Lagrangian written as

the Kuhn–Tucker conditions give

Assuming that the solution is interior, we see that choices in all periods are connected by the generalized marginal utility of wealth λ.

The denominators are the cost of acquiring one unit of a good or the cost of taking one unit of leisure in terms of foregone income, adjusted for an incremental or decremental income accruing to the income earning capacity affected by health. Hence, the marginal rates of substitution, between \(x_{i}^{t}\) and \(x_{j}^{{t^{\prime}}}\), between \(l^{t}\) and \(l^{{t^{\prime}}}\), and between \(x_{i}^{t}\) and \(l^{{t^{\prime}}}\), where \(t < t^{\prime}\), are given as follows:

We note that the wealth of the consumer at the beginning of period t is an endogenous variable that depends on his optimal choice of goods and leisure over the planning horizon. That is,

The only exogenous variable here is the market wage rate W, although the supply of labor time, under an endogenous choice of leisure and goods, will be affected so that the wage rate cannot remain entirely exogenous to the system as a whole.

Appendix C: Shephard’s Lemma

To prove the lemma, first consider the following minimization problem:

The Lagrangian is written as

Under the assumption that the solutions are interior, the Kuhn–Tucker conditions give

where \(U^{o}\) is a given required utility. Replacing \(U^{o}\) with u, let the solutions be written as

Then, let the effective expenditure function be defined by

Taking the partial derivative of (C7) with respect to p i gives

From the first order condition (C4) we know

Substituting (C9) into (C8) gives

We also know that

Hence, differentiating this identity with respect to p j gives

Thus, with (C12) substituted into (C10), Shephard’s Lemma holds:

Rights and permissions

About this article

Cite this article

Hayakawa, H. Health-conscious consumer behavior. Eurasian Econ Rev 7, 1–31 (2017). https://doi.org/10.1007/s40822-016-0059-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-016-0059-4