Abstract

The study explains the flow of knowledge in the circular economy model enterprises. We analyze the impact of managerial decisions on the absorptive capacity, which is new product development, considering the role of critical elements of strategic orientation (innovation and costs) in the textile industry. Based on the verification of hypotheses by employing the SEM method, innovation orientation is a mediator between adaptability-oriented decisions and transformation, and between adaptability-oriented decisions and exploitation. Ambidexterity-oriented decisions affect absorptive capacity. These findings semanticize and extend previous research, indicating that strategic activities focused on eco-innovations are transformed into the process of creating a new product.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Circular economy (CE) is a relatively new concept. From the point of view of economic sciences, it is treated as an economic system, while such concepts are named by Chizaryfard et al. (2020) as a systemic change in companies and industries. Contemporary researchers point in their review articles to many networks of topical topics appearing in publications, such as business models, circular economy, circular business models, value, supply chain, transformation, resources, waste, and reuse (Ferasso et al. 2020; Alcayaga et al. 2019).

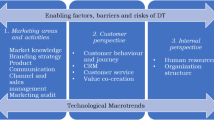

Management process in the CE model enterprise is analyzed rarely (Ferasso et al. 2020), mainly from the perspective of waste management (Hidalgo et al. 2019; Spišáková et al. 2022); sustainable strategic management (Grzebyk and Stec 2015; Takacs et al. 2022); supply chain management (Kazancoglu et al. 2020; Geissdoerfer et al. 2018); or environmental innovation (Prieto-Sandoval et al. 2019; Krawczyk-Sokolowska et al. 2021). Research connected with innovations shows that innovation is a crucial component of a circular business model in at least seven primary areas (Suchek et al. 2021), such as strategic alliances and a multi-tiered approach (e.g., Rajala et al. 2018); business model innovations (Ghadimi et al. 2020); eco-innovations (Jakhar et al. 2019); dynamic possibilities (Ramakrishna et al. 2020); technology; transition to CE (e.g., Järvenpää et al. 2020); and CE in the biological cycle (e.g., Ladu et al. 2020).

The prerequisite for introducing innovations to an organization is its absorptive capacity (Gebauer et al. 2012; Lane et al. 2006). Cohen and Levinthal (1990, 128) defined absorptive capacity as “the company's ability to recognize valuable new external information, assimilate it, and use it for commercial purposes”. In this research, we propose its analysis from the perspective of the four dimensions of acquisition, assimilation, transformation and exploitation (Zahra and George 2002, 185–203), which fully describe the pattern for processing outside knowledge into activities related to the functioning of an enterprise in the CE model. As the formulated strategies must be consciously implemented by top managers to enable better results (Dess 1987), we assume that the suggested positive impact of ambidexterity-oriented decisions on absorptive capacity depends on their strategic orientation. The consequence of implementing external knowledge for processes in the CE model is an action aimed not only at maintaining a closed loop of raw materials used in the production but, above all, at creating and introducing a new environmentally friendly product to the market.

Innovation implementation in enterprise is preceded by management’s decision-making processes, whose consequence is a new product development (Elenkov and Manev 2005; Kleinschmidt et al. 2007). Analyses undertaken in related subject literature, however, show that decisions are made in the context of ambidexterity (Fondas and Wiersema 1997). This context is taken into account in the current study, assuming that “in the perspective of adaptability-oriented decisions”, it determines the extent and effectiveness to which a firm adapts to changes in the environment, while alignment-oriented decisions specify how efficiently internal activities can be aligned to support the overall objective of the firm (Gibson and Birkinshaw 2004; Kortmann 2015, 667). We propose to combine the adaptability-oriented decisions context with innovations which, as previously shown, are the main components of strategic orientation of companies operating based on the CE model. We propose to combine the alignment-oriented decisions context with costs, which in the CE model are an important constituent that must be taken into account in operational activities.

Each company, including those operating in the CE model, has strategic orientation, which is a complex construct (Bhuian et al. 2005) that fosters a better understanding of the organization's behavior. Taking this premise into account in the analysis of enterprises operating on the basis of the CE model, introduction of the second component of strategic orientation, adequate to exploitative innovation behaviors, namely cost orientation (Chen et al. 2010; Olson et al. 2005), appears to be intended. In analyzing the context of alignment-oriented decisions, we agree with Kortmann (2015), and propose to combine it with costs, which in enterprises based on the CE model are important at the operational level, because such enterprises, like any other, must be competitive and profitable.

In light of the assumptions presented, our goal is to analyze the impact of managerial decisions on the absorptive capacity, which results in new product development, taking into account the role of key elements of strategic orientation (innovation and costs) in an enterprise operating in the CE model. To confirm our considerations, we conducted empirical research at VIVE Textile Recycling Ltd., which operates in the CE business model in the textile industry. Based on data obtained from 138 representatives of the managerial staff, we analyze the impact of innovation orientation and cost orientation on the relationship between ambidexterity orientation decisions and absorptive capacity.

Our research broadens the existing knowledge on the positive impact of management staff on innovation (through the implemented strategic orientation) and its performance (new product development) by including the ambidexterity perspective (Cooper and Kleinschmidt 1995; Elenkov and Manev 2005; Kleinschmidt et al. 2007; Li 2014). The analysis of the indicated dependencies in a company from the textile industry, operating in the CE model, where knowledge and managerial decisions are focused on activities related to environmental protection in the process of new product development is a novelty.

Secondly, this study contributes to ambidexterity literature by integrating strategic process theory. In particular, it was established that managerial decisions in terms of ambidexterity and the perspective of a two-element strategic orientation (innovation and costs) in a textile company operating in the CE model are antecedents of absorptive capacity, which transforms the newly acquired knowledge into the process of building a new product.

Theoretical background and hypotheses development

Ambidexterity-oriented decisions and absorptive capacity

According to the theory of strategic processes, every organization, including the one representing the circular economy model, operates in two areas: strategy formulation and its implementation (Bourgeois and Brodwin 1984). The logic of such actions is identified by the concept of ambidexterity, which indicates the key role of top management, who, due to their position are “able to balance adaptability and alignment-oriented decisions, can implement ambidextrous organizational behavior, and thus, sustainable competitive advantage, is to be achieved” (O’Reilly and Tushman 2004, 81). Identification of managerial decisions from the perspective of ambidexterity allows one to capture “capability of top management teams to manage contradictory strategic directions, namely adaptability and alignment” (Kortmann 2015, 667). The distinction between two types of decisions made from the perspective of different organizational contexts allows for full identification of the decision-making process essential for the proper functioning of enterprises.

Ambidexterity-oriented decisions ensure continuity of resources in the organization (Smith et al. 2010). From the perspective of companies operating in the CE model, one of the most important resources is external knowledge that allows for the acquisition and implementation of innovations. These processes can occur thanks to the absorptive capacity (AC), which is treated in the literature as a complex variable. Zahra and George (2002) and Jansen et al. (2005) conceptualize the sequence as a linear relationship between acquisition, assimilation, transformation, and exploitation, whereas Todorova and Durisin (2007) interpret assimilation and transformation as two parallel elements. In considerations herein, we adopt the concept of absorptive capacity by Zahra and George (2002). We assume, similarly as Kortmann (2015), that ambidexterity-oriented decisions act as antecedents of phenomena occurring at the organizational level (Kortmann 2015). We also assume that ambidexterity and absorptive capacity play a leading role in shaping business models (Kranz et al. 2016). We want to check whether the relationship between ambidexterity-oriented decisions and absorptive capacity functions in practice in an enterprise operating in the CE model.

H 1

There is a positive relationship between ambidexterity-oriented decisions and absorptive capacity.

Strategic orientations in the context of ambidexterity-oriented decisions and absorptive capacity

Strategic orientation is one of the key variables in strategic management. Some researches see it as a representation of an organization’s adaptive culture which steers its interaction with its environment (Noble et al. 2002), while others see it as “principles that direct and influence the activities of a firm and generate the behaviors intended to ensure its viability and performance” (Gatignon and Xuereb 1997; Hakala 2011, 199). In the literature, strategic orientation is analyzed from various perspectives. Some authors distinguish three (Deutscher et al. 2016), and others, four main strategic orientations (Hakala 2011). The main research approach that relates with market orientation is considered an important element of the company's success and results, related in particular to the needs and value for the client (Cano et al. 2004; Grinstein 2008; Hunt and Lambe 2000; Kirca et al. 2005; Shoham et al. 2005). Another research approach is the entrepreneurship orientation, which reflects a wide spectrum of activity, from the degree of risk-taking, company proactivity and innovation (Covin and Slevin 1989; Lumpkin and Dess 1996) to adaptation, i.e., better adaptation to the environment (Hult et al. 2004; Wiklund and Shepherd 2005). Innovation is one of the key elements in the first three strategic orientations, i.e., market, entrepreneurial and adaptive orientations. It is important because of competitiveness and adaptability (Gatignon and Xuereb 1997). In the literature on the subject, the concept of learning orientation can also be indicated. It is perceived as the propensity of an organization to learn, not only as a commitment to science, but also as a process of acquiring new technologies, products or processes (Sinkula et al. 1997; Huber 1991; Calantone et al. 2002).

When analyzing the strategies of companies operating in the CE model, it can be noticed that innovation is a key element of these strategies (Konietzko et al. 2020; Awan et al. 2021). Other researchers point to additional elements such as environmental impact, resource scarcity and economic benefits (Ellen MacArthur Foundation 2013). In practice, this translates into “maintaining the highest level of economic value of products, components and materials while ensuring that their environmental impact is minimal over time” (Balkenende et al. 2017, 1–19). From these perspectives, two basic components of strategic orientation of companies operating in the CE model emerge, namely, innovation orientation and cost orientation. Innovation orientation guides the company's strategy, knowledge acquisition and functional interaction toward creating innovation (Siguaw et al. 2006). Innovation orientation is defined as “openness to new ideas as an aspect of the company's culture” (Hurley and Hult 1998, 44), which develops and renews competitive advantage by creating and implementing innovations (Olson et al. 2005, 52). However, companies that overemphasize innovation orientation may lose sight of the costs associated with innovation, thus compromising efficiency (Simpson et al. 2006, 1138). Therefore, a sustainable approach to innovation requires additional attention for costs from managers, which increases efficiency in all parts of the value chain and supports the use of existing positions in the product market (Caerteling et al. 2011; Olson et al. 2005). We assume that both elements of strategic orientation are supported by ambidexterity-oriented decisions.

H 2

There is a positive relationship between ambidexterity-oriented decisions and both innovation orientation (H2A) and cost orientation (H2B)

Creating innovation requires knowledge that the company absorbs from the environment. The literature confirms the influence of absorptive capacity on innovation (Liao et al 2007; Chen et al. 2009). In companies operating in the CE model, external knowledge is important not only in the context of new technologies but also sustainable development trends (Dzhengiz and Niesten 2020). The research shows that “a contextualized process model of absorptive capacity in explaining the unique challenges in circular product innovation” (Schmitt and Hansen 2018).

By analyzing the relationship, we attempt to indicate that absorptive capacity benefits from innovation orientation in enterprises with the CE model. It is related to the consideration of openness to new ideas, innovative approaches to a product, process or technology in all phases of absorptive capacity. Cost orientation can influence the absorption of knowledge through innovation orientation, which is important at the strategic level. This is justified because the focus on innovation in strategic terms should be balanced with operational efficiency (Boyd and Salamin 2001; Kortmann 2015).

H 3

There is a positive relationship between both innovation orientation (H3A), cost orientation (H3B) and absorptive capacity

The subject of innovation is, in respect of the business activity, identified in the literature as the concept of new product development (NPD). It is analyzed as a process whose model captures the relevant stages that emphasize the use of innovation (Griffin and Page 1993; Molina-Castillo and Munuera-Aleman 2009) or is understood as a knowledge-intensive activity (Nonaka and Takeuchi 1995; Pisano and Wheelwright 1995). The research results show that knowledge integration and innovation exert significant positive effects on new product performance (Yang 2005; Iamratanakul et al. 2008).

In the CE concept, the meaning of “new product development” (NPD) is relative to its impact on the environment. The process of creating a new product model in a circular economy requires changing the set of rules, strategies and adapting methods (Hollander et al. 2017; Pinheiro et al. 2019).

Literature research confirms that innovation orientation is an important element influencing the development of a new product (Veryzer 1998; Zhang and Duan 2010). In line with considerations herein, we assume that NPD is influenced by both dimensions of strategic orientation, identified for the purposes of the analyses. Developing NPD at the strategic level involves innovation orientation relative to adaptability-oriented decisions (Lester 1998). This phenomenon concerns incremental innovations that improve existing product-market positions (Danneels 2002; Jansen et al. 2006). At the operational level, NPDs shape costs that can limit innovative ideas while maintaining operational efficiency (Olson et al. 2005).

H 4

There is a positive relationship between both innovation orientation (H3A), cost orientation (H3B) and new product development.

Sample and data collection

The adopted research objective determined the choice of the research object. A circular economy-oriented enterprise was required to determine the impact of managerial decisions and strategic orientation on the ability to absorb knowledge on the elimination of generated waste. This circular economy model is not yet widespread in Poland, and it isn't easy to find a sufficiently large sample of companies that the experience and maturity of the analyzed phenomenon would characterize. Solving this difficulty related to the credibility of the research, we decided to verify our model at VIVE Textile Recycling Ltd. It is a Polish company that strives to maximize the use of waste by recycling (textiles and second-hand clothes) in four areas: second-hand clothing stores, composite textile production, production of alternative fuel and industrial wipers. VIVE Textile Recycling Ltd. is a leader in the recycling of textiles and used clothing in Poland. Its products are exported to many countries in Europe, Africa, Asia, as well as North and South America. The choice of this company as a research subject with unique characteristics is justified from the perspective of achieving the aim of the article and the adopted research assumptions (Ariño and Ring 2010).

Quantitative research was used to verify the existing theory by testing the hypotheses. The use of this type of research in the analyzed case study is justified due to the context of the analysis (Byrne and Ragin 2009) and the formulated research model (Tight 2017), the purpose of which is to identify the relationships between the analyzed variables.

We collected the data using the Paper and Pen Personal Interview method (PAPI). The research tool was a questionnaire. We measured variables using a seven-point Likert scale with a neutral middle value. We assigned responses numerical values from one (strongly disagree) to seven (strongly agree).

The invitation to the survey was sent to all directors and managers of VIVE Textile Recycling Ltd. The group of respondents was made up of 138 persons. Ultimately, 78 observations were included in the statistical data analysis. The response rate was 57%. The sample of 78 respondents consisted of 44% women and 34% men. 56.4% of the respondents were between 26 and 40 years of age. 38.4% of people were between 41 and 50 years of age. Others were younger than 25 (2%) or older than 50 (2%). The most numerous group of respondents (43%) on the day of the survey had been holding managerial positions at VIVE Textile Recycling Ltd., for no longer than two years. More than one-third of the respondents (36%) were people who had been in management positions for 3–5 years. The other directors and managers had been working at VIVE Textile Recycling Ltd. for over 6 years (including only 4 people over 12 years). Additionally, almost 70% of the respondents had higher education.

We adopted the following operational definitions of the variables included in the study. Absorptive capacity is ability to acquire, assimilate, transform, and exploit external knowledge (Zahra and George 2002, 185–203; Todorova and Durisin 2007, 774–786; Stelmaszczyk 2020, 18). We define the new product development (NPD) as bringing a new product to marketplace (Wei et al. 2014, 832–847). Managerial decisions are the ability of enterprise management to make adaptability-oriented decisions and alignment-oriented decisions (Gibson and Birkinshaw 2004, pp. 209–226; Kortmann 2015, 671; Stelmaszczyk 2020, 247). Strategic orientation consists of two elements: innovation orientation and cost orientation (Kortmann 2015, 666–684).

We used existing scales to measure each of the variables. They are used by a large number of researchers conducting empirical research in various types of organizations around the world. These scales are therefore considered to be fully adequate for measuring the variables that we included in the research model. We measured the enterprise's absorptive capacity using a 14-item scale developed by Flatten et al. (2011). It covers the acquisition (3 items), assimilation (4 items), transformation (4 items), and exploitation (3 items) of external knowledge. We used a 9-item scale developed by Kortmann (2015) to measure ambidexterity-oriented managerial decisions. Out of the 9 items, 4 were related to adaptability-oriented decisions and 5 alignment-oriented decisions. For the purpose of this study, we used an 11-item scale for measuring strategic orientations proposed by Hult et al. and Olson et al., where 6 items were assigned to innovation (Hult et al. 2004) and another 5 to cost orientation (Olson et al. 2005) was adopted. In turn, the scale was formulated by Wei et al. (2014).

We subjected the empirical material to a statistical analysis, applying the AMOS program. We analyzed basic descriptive statistics, the Shapiro–Wilk (S–W) normality test and modeling structural equations (SEM) using the maximum likelihood method. We also checked the significance of indirect effects using the bootstrapping method. For interpretation of the results, the significance level p was assumed to be 0.05.

Analysis and results

We started the analysis with scales validation used in the final measurement tool. For this purpose, we first checked the reliability of the scales used. We measured reliability using the composite reliability ratio (CR) and Cronbach's internal consistency alpha. In the case of the CR coefficient, we assumed that values above 0.7 are acceptable values and indicate a satisfactory level of reliability (Peterson and Kim 2013). In turn, Cronbach's alpha value means correct reliability if it is in the range between 0.7 and 0.96 (Tavakol and Dennick 2011). In the case of this research, all R coefficients reached satisfactory levels above 0.7 and all Cronbach's alpha coefficients took the desired values from 0.738 to 0.922 (Table 1). This proves the consistency and reliability of the applied measurement scales.

The next step in the validation of the variable measurement methodology was to check the convergent validity and the discriminant validity. For this purpose, we used the procedure of Fornell and Larcker (1981). In this study, we confirmed the convergent validity / convergent validity of each of the variables. Their AVE values were higher than 0.5 and lower than the CR coefficient (Table 1). On the other hand, a satisfactory level of differential accuracy was achieved by ambidexterity-oriented managerial decisions and strategic orientations. The Average Variance Extracted (AVE) value was higher than Maximum Shared Variance (MSV). Regarding absorptive capacity, we confirmed the differential validity for acquisition and transformation. Due to the fact that the AVE value in the case of assimilation and exploitation was lower than MSV, we conducted an additional analysis of the Heterotrait-Monotrait Ratio of Correlations (HTMT) (Henseler et al. 2015, pp. 115–135). The value of the HTMT coefficient for each of the sub-dimensions of the absorptive capacity exceeded the threshold of 0.850 (Table 2). This means that the differential validity criterion for acquisition, assimilation, transformation and exploitation has been achieved. Thus, we confirmed the convergent validity and the differential validity of all scales used in the measuring tool.

In the second stage of the analysis, we calculated the basic descriptive statistics and performed the Shapiro–Wilk distribution normality test (Table 3). The results show that adaptability-oriented decisions, absorptive capacity, exploitation, cost orientation and new product development have a distribution different from the Gaussian curve. The value of skewness and kurtosis of these variables did not exceed 0.8. Its means that the deviation is not significant and the distribution of these variables is relatively symmetrical to the mean (George and Mallery 2010). On the other hand, the value of skewness and kurtosis for ACass may prove that the distribution of this variable is inconsistent with the normal distribution. Nevertheless, a visual inspection of the resulting histogram shows that it is symmetrical and resembles a normal distribution more than any other known distribution.

In the third stage, we started testing the research hypotheses. The analyzed model was well suited to the data (χ2(1) = 1.43; p = 0.231; CMIN/DF = 1.432; CFI = 0.998; GFI = 0.993; RMSEA = 0.075; SRMR = 0.016). The obtained results show that ambidexterity-oriented decisions have a strong and positive impact on the absorptive capacity (H1) and cost orientation (H2B), as well as strongly influence the innovation orientation (H2A). The H1 and H2 hypotheses can therefore be considered as positively tested. Moreover, the absorptive capacity is positively and weakly influenced by the innovation orientation (H3A). On the other hand, the impact of the cost orientation on absorptive capacity of the studied enterprise turned out to be insignificant (H3B). Therefore, the obtained results indicate the necessity to reject the hypothesis (H3). The conducted analyses show that new product development is associated with a positive, moderate impact with the innovation orientation (H4A) and a positive and weak impact with the cost orientation (H4B). So one may consider the H4 hypothesis to be positively tested. The results of structural equation modeling are presented in Fig. 1 and Table 4.

The tested structural model enabled the empirical verification of the research hypotheses. The obtained results prompted us to deepen the analytical research. Of particular interest was the earlier falsification of the H3 hypothesis due to the rejection of the H3B hypothesis. For this purpose, we constructed and tested a detailed model (A1). We included two sub-dimensions of ambidexterity-oriented decisions (adaptability-oriented decisions and alignment-oriented decisions) and four sub-dimensions of absorptive capacity (acquisition, assimilation, transformation and exploitation). The detail model A1 turned out to be a good fit for the data (χ2(5) = 2.971; p = 0.704; CMIN/DF = 0.59; CFI = 1.000; GFI = 0.992; RMSEA < 0.001; SRMR = 0.030).

The analysis of direct effects showed that innovation orientation influences one of the four stages of the absorptive capacity, i.e., exploitation (H3A). On the other hand, cost orientation affects the acquisition of knowledge (H3B). This means that the H3 hypothesis can be considered partially confirmed. Moreover, the direct impact of adaptability-oriented decisions on transformation and innovation orientation and alignment-oriented decisions on assimilation, exploitation and cost orientation is visible. NPD is directly influenced by innovation orientation, cost orientation and operation (Fig. 2; Appendix, Table 6). The analysis of direct effects confirmed the previously obtained results (Fig. 1, Table 4), on the basis of which we adopted the hypotheses H1, H2 and H4. Additionally, we observed two significant mediation effects. It turned out that innovation orientation is a mediator of the relationship between adaptability-oriented decisions and transformation, and between adaptability-oriented decisions and operation. Detailed results of indirect effects are presented in Table 7 (Appendix).

Results of structural equation modeling (model A1). Note MDada, adaptability-oriented decisions; MDali, alignment-oriented decisions; IO, Innovation orientation; CO, Cost orientation; AC, absorptive capacity; ACacq, acquisition; ACass, assimilation; ACtra, transformation; ACexp, exploitation; NPD, new product development

The results of the A1 model estimation confirmed the results of testing the H1, H2 and H4 hypotheses. There are no grounds to reject them, so they can be considered positively tested. The H3 hypothesis was rejected as a result of model A estimation. However, the detailed recognition of the relationships between the innovation orientation, cost orientation and individual stages of the absorptive capacity showed that this hypothesis should be considered as partially tested (model A1). There is a simultaneous impact of the innovation orientation and cost orientation on the absorptive capacity, but it has a special form. Cost orientation affects acquisition, while innovation orientation affects the exploitation of new external knowledge (Table 5).

Discussion and implication

Assigning a specific role to ambidexterity-oriented decisions in acquiring the knowledge necessary to create innovation extends the existing research on management support for innovation with an ambidexterity perspective (Cooper and Kleinschmidt 1995; Elenkov and Manev 2005; Kleinschmidt et al. 2007). By balancing adaptability and adaptation-oriented decisions, top management (A1 model) influences the elements of absorptive capacity. In the analyzed enterprise, the acquisition and use of knowledge are affected by decisions aimed at adaptation, while the transformation of knowledge is significantly influenced by decisions focused on adaptation.

It should be emphasized that the analyzed dependencies refer to the enterprise operating under the CE, oriented on innovation and costs. The literature shows that cost dependence can significantly inhibit innovation development, especially in enterprises in the SME sector (Upstill-Goddard et al. 2016). We have proved that cost orientation influences the acquisition of new knowledge. Innovation orientation affects the use of knowledge in practice, i.e., creating innovation.

Acquisition mechanisms in absorption capacity are like a gateway to knowledge (Gluch et al. 2009; Hashim et al. 2015). We explained this mechanism in the example of their case study. VIVE Textile Recycling will only be able to translate new external knowledge into new product development if this new knowledge passes through all stages of the absorption capacity.

Managers decide what type and amount of CE knowledge will be acquired through the company's cost orientation prism. In other words, the amount and kind of new knowledge will depend on decisions aimed at the current needs of the enterprise, which will continuously be assessed in terms of the costs that the enterprise can bear.

However, the mere acquisition of new knowledge does not yet impact the development of new products. New knowledge must be assimilated, i.e., understood and acquired at the level of the organization, which will always depend on its current activities and resources. Then the new knowledge has to be transformed. It consists in combining new knowledge with knowledge already possessed. Adaptation-oriented managerial decisions already shape this stage. That is, one incorporates new knowledge with the existing one in such a way that the company can react to changes in the environment. Our reasoning is confirmed by the results of research conducted in Sweden, which shows that “organizations can influence their ability to absorb green innovation and improve business results by focusing on three predictors of a company's ecological advantage: acquisition, assimilation, and transformation” (Gluch et al. 2009). Knowledge at this stage still does not influence the development of a new product. The company must use this knowledge in practice (operational phase). Only then one will start developing new products. The use of knowledge directly depends on management decisions regarding the company's current operations and management decisions regarding adaptation to changes in the environment.

CE-related issues such as waste reduction, emissions, and supply risk, i.e., strategic eco-innovation activities, are transformed into a new product development process (Ingemarsdotter et al. 2019). Using new knowledge for business purposes will generate a new product and initiate the process of introducing it to the market.

Limitation and direction for future research

Our study provides important information on the role of strategic orientations and ambidexterity-oriented decisions in building the company's ability to absorb CE knowledge and transform it into NPD. Still, it has a few limitations. First of all, we carried out in one large enterprise. The selected research facility fits perfectly into the CE model, using recycling to maximize the use of waste and being a leader in the recycling of textiles and used clothing in Poland. In this case, it was a conscious action tailored to the situation (Yin 2003). The results obtained based on the applied research strategy can be treated as a verification of the theoretical concept (Lee 1989.). The analysis of this exemplary enterprise in terms of our research assumptions allows us to generalize the conclusions to other cases characterized by similar circumstances (Wójcik 2013).

Secondly, the analysis carried out by us has been limited to the impact of ambidexterity-oriented decisions (antecedents at the individual level) and antecedents at the organizational level on the ability to absorb valuable external knowledge and transform it into a new product development process. Absorptive capacity plays a very important role in transforming business models (Kranz et al. 2016). In order for more and more enterprises from the textile and clothing industry to operate in CE, they must make changes to their existing models. The verification of the assumptions of the business model is a way to take action in the CE area, i.e., to eliminate generated waste, reduce the consumption of water, energy and harmful chemicals. Since absorptive capacity plays an important role in making this type of change, it seems reasonable to look for other factors (antecedents) that affect it. Identifying antecedencies of absorptive capacity and their verification in empirical research, although undertaken by researchers (e.g., Volberda et al. 2010; Schweisfurth and Raasch 2018; Stelmaszczyk 2020), are still fragmented. Their identification is the direction of future research.

References

Alcayaga A, Wiener M, Hansen EG (2019) Towards a framework of smart-circular systems: an integrative literature review. J Clean Prod 221:622–634. https://doi.org/10.1016/j.jclepro.2019.02.085

Ariño A, Ring PS (2010) The role of fairness in alliance formation. Strateg Manag J 31(10):1054–1087. https://doi.org/10.1002/smj.846

Awan U, Sroufe R, Shahbaz M (2021) Industry 4.0 and the circular economy: a literature review and recommendations for future research. Bus Strategy Environ 30(4):2038–2060. https://doi.org/10.1002/bse.2731

Balkenende R, Bocken N, Bakker C (2017) Design for the circular economy. In: Egenhoefer RB (ed) The Routledge handbook of sustainable design. Routledge, London, pp 1–19

Bhuian SN, Menguc B, Bell SJ (2005) Just entrepreneurial enough: the moderating effect of entrepreneurship on the relationship between market orientation and performance. J Bus Res 58(1):9–17. https://doi.org/10.1016/S0148-2963(03)00074-2

Bourgeois LJ III, Brodwin DR (1984) Strategic implementation: five approaches on an elusive phenomenon. Strateg Manag J 5(3):241–264. https://doi.org/10.1002/smj.4250050305

Boyd BK, Salamin A (2001) Strategic reward systems: a contingency model of pay system design. Strateg Manag J 22(8):777–792. https://doi.org/10.1002/smj.170

Byrne D, Ragin CC (2009) The Sage handbook of case-based methods. Sage Publications, Thousand Oaks

Caerteling JS, DiBenedetto CA, Doree AG, Halman JM, Song M (2011) Technology development projects in road infrastructure: the relevance of government championing behaviour. Technovation 31(5/6):270–283. https://doi.org/10.1016/j.technovation.2011.02.001

Calantone RJ, Cavusgil ST, Zhao Y (2002) Learning orientation, firm innovation capability, and firm performance. Ind Mark Manag 31(6):515–524. https://doi.org/10.1016/S0019-8501(01)00203-6

Cano CR, Carrillat FA, Jaramillo F (2004) A metaanalysis of the relationship between market orientation and business performance: evidence from five continents. Int J Res Mark 21(2):179–200. https://doi.org/10.1016/j.ijresmar.2003.07.001

Chen YS, Lin MJJ, Chang CH (2009) The positive effects of relationship learning and absorptive capacity on innovation performance and competitive advantage in industrial markets. Ind Mark Manag 38(2):152–158. https://doi.org/10.1016/j.indmarman.2008.12.003

Chen J, Damanpour F, Reilly RR (2010) Understanding antecedents of new product development speed: a meta-analysis. J Oper Manag 28(1):17–33. https://doi.org/10.1016/j.jom.2009.07.001

Chizaryfard A, Trucco P, Nuur C (2020) The transformation to a circular economy: framing an evolutionary view. J Evol Econ 31(2):475–504. https://doi.org/10.1007/s00191-020-00709-0

Cohen W, Levinthal D (1990) Absorptive capacity: a new perspective on learning and innovation. Adm Sci Q 35(1):128–152. https://doi.org/10.2307/2393553

Cooper RG, Kleinschmidt EJ (1995) Benchmarking the firm’s critical success factors in new product development. J Prod Innov Manag 12(5):374–391. https://doi.org/10.1111/1540-5885.1250374

Covin JG, Slevin DP (1989) Strategic management of small firms in hostile and benign environments. Strateg Manag J 10(1):75–87. https://doi.org/10.1002/smj.4250100107

Danneels E (2002) The dynamics of product innovation and firm competences. Strateg Manag J 23(12):1095–1121. https://doi.org/10.1002/smj.275

Dess GG (1987) Consensus on strategy formulation and organizational performance: competitors in a fragmented industry. Strateg Manag J 8(3):259–277. https://doi.org/10.1002/smj.4250080305

Deutscher F, Zapkau FB, Schwens C, Baum M, Kabst R (2016) Strategic orientations and performance: a configurational perspective. J Bus Res 69(2):849–861. https://doi.org/10.1016/j.jbusres.2015.07.005

Dzhengiz T, Niesten E (2020) Competences for environmental sustainability: a systematic review on the impact of absorptive capacity and capabilities. J Bus Ethics 162(4):881–906. https://doi.org/10.1007/s10551-019-04360-z

Elenkov DS, Manev IM (2005) Top management leadership and influence on innovation: the role of socio-cultural context. J Manag 31(3):381–402. https://doi.org/10.1177/0149206304272151

Ellen MacArthur Foundation (2013) Towards the circular economy: economic and business rationale for an accelerated transition. Ellen MacArthur Foundation, London

Ferasso M, Beliaeva T, Kraus S, Clauss T, Ribeiro-Soriano D (2020) Circular economy business models: the state of research and avenues ahead. Bus Strateg Environ 29(8):3006–3024. https://doi.org/10.1002/bse.2554

Flatten TC, Engelen A, Zahra SA, Brettel MA (2011) Measure of absorptive capacity: scale development and validation. Eur Manag J 29(2):98–116. https://doi.org/10.1016/j.emj.2010.11.002

Fondas N, Wiersema M (1997) Changing of the guard: the influence of CEO socialization on strategic change. J Manage Stud 34(4):561–584. https://doi.org/10.1111/1467-6486.00063

Fornell C, Larcker DF (1981) Evaluating structural equation models with unobservable variables and measurement error. J Mark Res (JMR) 18(1):39–50. https://doi.org/10.2307/3151312

Gatignon H, Xuereb JM (1997) Strategic orientation of the firm and new product performance. J Mark Res 34(1):77–90. https://doi.org/10.2307/3152066

Gebauer H, Worch H, Truffer B (2012) Absorptive capacity, learning processes and combinative capabilities as determinants of strategic innovation. Eur Manag J 30(1):57–73. https://doi.org/10.1016/j.emj.2011.10.004

Geissdoerfer M, Morioka SN, de Carvalho MM, Evans S (2018) Business models and supply chains for the circular economy. J Clean Prod 190:712–721. https://doi.org/10.1016/j.jclepro.2018.04.159

George G, Mallery M (2010) SPSS for Windows step by step: a simple guide and reference. Pearson, Boston

Ghadimi P, O’Neill S, Wang C, Sutherland JW (2020) Analysis of enablers on the successful implementation of green manufacturing for Irish SMEs. J Manuf Technol Manag 32(1):85–109. https://doi.org/10.1108/JMTM-10-2019-0382

Gibson CB, Birkinshaw J (2004) The antecedents, consequences, and mediating role of organizational ambidexterity. Acad Manag 47(2):209–226. https://doi.org/10.5465/20159573

Gluch P, Gustafsson M, Thuvander L (2009) An absorptive capacity model for green innovation and performance in the construction industry. Constr Manag Econ 27(5):451–464. https://doi.org/10.1080/01446190902896645

Griffin A, Page AL (1993) An interim report on measuring product development success and failure. J Prod Innov Manage 10(4):291–308. https://doi.org/10.1016/0737-6782(93)90072-X

Grinstein A (2008) The relationships between market orientation and alternative strategic orientations: a metaanalysis. Eur J Mark 42(1/2):115–134. https://doi.org/10.1108/03090560810840934

Grzebyk M, Stec M (2015) Sustainable development in EU countries: concept and rating of levels of development. Sustain Dev 23(2):110–123

Hakala H (2011) Strategic orientations in management literature: three approaches to understanding the interaction between market, technology, entrepreneurial and learning orientations. Int J Manag Rev 13(2):199–217. https://doi.org/10.1111/j.1468-2370.2010.00292.x

Hashim R, Bock AJ, Cooper S (2015) The relationship between absorptive capacity and green innovation. Int J Ind Manuf Eng 9(4):1065–1072. https://doi.org/10.5281/zenodo.1099940

Henseler J, Ringle CM, Sarstedt M (2015) A new criterion for assessing discriminant validity in variance-based structural equation modeling. J Acad Mark Sci 43(1):115–135. https://doi.org/10.1007/s11747-014-0403-8

Hidalgo D, Martín-Marroquín JM, Corona F (2019) A multi-waste management concept as a basis towards a circular economy model. Renew Sustain Energy Rev 111:481–489

Hollander MC, Bakker CA, Hultink EJ (2017) Product design in a circular economy: development of a typology of key concepts and terms. J Ind Ecol 21(3):517–525. https://doi.org/10.1111/jiec.12610

Huber GP (1991) Organizational learning: the contributing processes and the literatures. Organ Sci 2(1):88–115. https://doi.org/10.1287/orsc.2.1.88

Hult GTM, Hurley RF, Knight GA (2004) Innovativeness: Its antecedents and impact on business performance. Ind Mark Manag 33(5):429–438. https://doi.org/10.1016/j.indmarman.2003.08.015

Hunt SD, Lambe CJ (2000) Marketing’s contribution to business strategy: market orientation, relationship marketing and resource-advantage theory. Int J Manag Rev 2(1):17–43. https://doi.org/10.1111/1468-2370.00029

Hurley RF, Hult GTM (1998) Innovation, market orientation, and organizational learning: an integration and empirical examination. J Mark 62(3):42–54. https://doi.org/10.1177/002224299806200303

Iamratanakul S, Patanakul P, Milosevic D (2008) Innovation and factors affecting the success of NPD projects: literature explorations and descriptions. Int J Manag Sci Eng Manag 3(3):176–189. https://doi.org/10.1080/17509653.2008.10671045

Ingemarsdotter E, Jamsin E, Kortuem G, Balkenende R (2019) Circular strategies enabled by the internet of things—a framework and analysis of current practice. Sustainability 11(20):5689. https://doi.org/10.3390/su11205689

Jakhar SK, Mangla SK, Luthra S, Kusi-Sarpong S (2019) When stakeholder pressure drives the circular economy: measuring the mediating role of innovation capabilities. Manag Decis 57(4):904–920. https://doi.org/10.1108/MD-09-2018-0990

Jansen J, Van Den Bosch FAJ, Volberda HW (2005) Managing potential and realized absorptive capacity: how do organizational antecedents matter? Acad Manag J 48(6):999–1015. https://doi.org/10.5465/AMJ.2005.19573106

Jansen JJP, van den Bosch FAJ, Volberda HW (2006) Exploratory innovation, exploitative innovation, and performance: effects of organizational antecedents and environmental moderators. Manag Sci 52(11):1661–1674. https://doi.org/10.1287/mnsc.1060.0576

Järvenpää A-M, Kunttu I, Mäntyneva M (2020) Using foresight to shape future expectations in circular economy SMEs. Technol Innov Manag Rev 10(7):41–50. https://doi.org/10.22215/timreview/1374

Kazancoglu I, Kazancoglu Y, Yarimoglu E, Kahraman A (2020) A conceptual framework for barriers of circular supply chains for sustainability in the textile industry. Sustain Dev 28(5):1477–1492. https://doi.org/10.1002/sd.2100

Kirca AH, Jayachandran S, Bearden WO (2005) Market orientation: a meta-analytic review and assessment of its antecedents and impact on performance. J Mark 69(2):24–41. https://doi.org/10.1509/jmkg.69.2.24.60761

Kleinschmidt EJ, de Brentani U, Salomo S (2007) Performance of global new product development programs: a resource-based view. J Prod Innov Manag 24(5):419–441. https://doi.org/10.1111/j.1540-5885.2007.00261.x

Konietzko J, Bocken N, Hultink EJ (2020) A tool to analyze, ideate and develop circular innovation ecosystems. Sustainability 12(1):417. https://doi.org/10.3390/su12010417

Kortmann S (2015) The mediating role of strategic orientations on the relationship between ambidexterity-oriented decisions and innovative ambidexterity. J Prod Innov Manag 32(5):666–684. https://doi.org/10.1111/jpim.12151

Kranz JJ, Hanelt A, Kolbe LM (2016) Understanding the influence of absorptive capacity and ambidexterity on the process of business model change—the case of on-premise and cloud-computing software. Inf Syst J 26(5):477–517. https://doi.org/10.1111/isj.12102

Krawczyk-Sokolowska I, Pierscieniak A, Caputa W (2021) The innovation potential of the enterprise in the context of the economy and the business model. RMS 15(1):103–124

Ladu L, Imbert E, Quitzow R, Morone P (2020) The role of the policy mix in the transition toward a circular forest bioeconomy. For Policy Econ 110:101937. https://doi.org/10.1016/j.forpol.2019.05.023

Lane PJ, Koka BR, Pathak S (2006) The reification of absorptive capacity: a critical review and rejuvenation of the construct. Acad Manag Rev 31(4):833–863. https://doi.org/10.5465/AMR.2006.22527456

Lee AS (1989) Case studies as natural experiments. Human Relat 42(2):117–137

Lester DH (1998) Critical success factors for new product development. Res Technol Manag 41(1):36–43. https://doi.org/10.1080/08956308.1998.11671182

Li CR (2014) Top management team diversity in fostering organizational ambidexterity: examining TMT integration mechanisms. Innovation 16(3):303–322. https://doi.org/10.1080/14479338.2014.11081990

Liao SH, Fei WC, Chen CC (2007) Knowledge sharing, absorptive capacity, and innovation capability: an empirical study of Taiwan’s knowledge-intensive industries. J Inf Sci 33(3):340–359. https://doi.org/10.1177/0165551506070739

Lumpkin GT, Dess GG (1996) Clarifying the entrepreneurial orientation construct and linking it to performance. Acad Manag Rev 21(1):135–172. https://doi.org/10.5465/AMR.1996.9602161568

Molina-Castillo F-J, Munuera-Aleman J-L (2009) The joint impact of quality and innovativeness on short-term new product performance. Ind Mark Manage 38(8):984–993. https://doi.org/10.1016/j.indmarman.2008.06.001

Noble CH, Sinha RK, Kumar A (2002) Market orientation and alternative strategic orientations: a longitudinal assessment of performance implications. J Mark 66(4):25–39. https://doi.org/10.1509/jmkg.66.4.25.18513

Nonaka I, Takeuchi H (1995) The knowledge-creating company: how Japanese companies create the dynamics of innovation. Oxford University Press, Oxford

O’Reilly CA, Tushman ML (2004) The ambidextrous organization. Harv Bus Rev 82(4):74–81

Olson EM, Slater SF, Hult GTM (2005) The performance implications of fit among business strategy, marketing organization structure, and strategic behavior. J Mark 69(3):49–65. https://doi.org/10.1509/jmkg.69.3.49.66362

Peterson RA, Kim Y (2013) On the relationship between coefficient alpha and composite reliability. J Appl Psychol 98(1):194–198. https://doi.org/10.1037/a0030767

Pinheiro MAP, Seles BMRP, Fiorini PDC, Jugend D, de Sousa Jabbour ABL, da Silva HMR, Latan H (2019) The role of new product development in underpinning the circular economy. Manag Decis 57(4):840–862. https://doi.org/10.1108/MD-07-2018-0782

Pisano GP, Wheelwright SC (1995) The new logic of high-tech R&D. Long Range Plan 28(6):128–128

Prieto-Sandoval V, Jaca C, Santos J, Baumgartner RJ, Ormazabal M (2019) Key strategies, resources, and capabilities for implementing circular economy in industrial small and medium enterprises. Corp Soc Responsib Environ Manag 26(6):1473–1484. https://doi.org/10.1002/csr.1761

Rajala R, Hakanen E, Mattila J, Seppälä T, Westerlund M (2018) How do intelligent goods shape closed-loop systems? Calif Manag Rev 60(3):20–44. https://doi.org/10.1177/0008125618759685

Ramakrishna S, Ngowi A, De Jager H, Awuzie BO (2020) Emerging industrial revolution: symbiosis of industry 4.0 and circular economy: the role of universities. Sci Technol Soc 25(3):505–525. https://doi.org/10.1177/0971721820912918

Schmitt JC, Hansen EG (2018) Circular innovation processes from an absorptive capacity perspective: the case of cradle-to-cradle. Acad Manag Ann Meet Proc. https://doi.org/10.5465/AMBPP.2018.16814abstract

Schweisfurth TG, Raasch C (2018) Absorptive capacity for need knowledge: antecedents and effects for employee innovativeness. Res Policy 47(4):687–699. https://doi.org/10.1016/j.respol.2018.01.017

Shoham A, Rose G, Kropp F (2005) Market orientation and performance: a meta-analysis. Mark Intel Plan 23(5):435–454. https://doi.org/10.1108/02634500510612627

Siguaw JA, Simpson PM, Enz CA (2006) Conceptualizing innovation orientation: a framework for study and integration of innovation research. J Prod Innov Manag 23(6):556–574. https://doi.org/10.1111/j.1540-5885.2006.00224.x

Simpson PM, Siguaw JA, Enz CA (2006) Innovation orientation outcomes: the good and the bad. J Bus Res 59(10/11):1133–1141. https://doi.org/10.1016/j.jbusres.2006.08.001

Sinkula JM, Baker WE, Noordewier T (1997) A framework for market-based organizational learning: linking values, knowledge, and behavior. Acad Mark Sci J 25(4):305–318. https://doi.org/10.1177/0092070397254003

Smith WK, Binns A, Tushman ML (2010) Complex business models: managing strategic paradox simultaneously. Long Range Plan 43(2–3):448–461. https://doi.org/10.1016/j.lrp.2009.12.003

Spišáková M, Mandičák T, Mésároš P, Špak M (2022) Waste management in a sustainable circular economy as a part of design of construction. Appl Sci 12(9):4553

Stelmaszczyk M (2020) How absorptive capacity and organisational learning orientation interact to enable innovation capability? An empirical examination. Entrep Bus Econ Rev 8(1):8–32

Suchek N, Fernandes CI, Kraus S, Filser M, Sjögrén H (2021) Innovation and the circular economy: a systematic literature review. Bus Strateg Environ 1:1–7. https://doi.org/10.1002/bse.2834

Takacs F, Brunner D, Frankenberger K (2022) Barriers to a circular economy in small-and medium-sized enterprises and their integration in a sustainable strategic management framework. J Clean Prod 362:132227

Tavakol M, Dennick R (2011) Making sense of Cronbach’s alpha. Int J Med Educ 2:53–55. https://doi.org/10.5116/ijme.4dfb.8dfd

Tight M (2017) Understanding case study research: small-scale research with meaning. Sage, Thousand Oaks

Todorova G, Durisin B (2007) Absorptive capacity: valuing a reconceptualization. Acad Manag Rev 32(3):774–786. https://doi.org/10.5465/AMR.2007.25275513

Upstill-Goddard J, Glass J, Dainty A, Nicholson I (2016) Implementing sustainability in small and medium-sized construction firms: the role of absorptive capacity. Eng Constr Archit Manag 23(4):407–427. https://doi.org/10.1108/ECAM-01-2015-0015

Veryzer RW Jr (1998) Discontinuous innovation and the new product development process. J Product Innov Manag Int Public Product Dev Manag Assoc 15(4):304–321. https://doi.org/10.1111/1540-5885.1540304

Volberda HW, Foss NJ, Lyles MA (2010) Absorbing the concept of absorptive capacity: how to realize its potential in the organization field. Organ Sci 21(4):931–951. https://doi.org/10.1287/orsc.1090.0503

Wei Z, Yi Y, Guo H (2014) Organizational learning ambidexterity, strategic flexibility, and new product development. J Prod Innov Manag 31(4):832–847. https://doi.org/10.1111/jpim.12126

Wiklund J, Shepherd D (2005) Entrepreneurial orientation and small business performance: a configurational approach. J Bus Ventur 20(1):71–91. https://doi.org/10.1016/j.jbusvent.2004.01.001

Wójcik P (2013) Znaczenie studium przypadku jako metody badawczej w naukach o zarządzaniu. E-Mentor 48(1):17–22

Yang J (2005) Knowledge integration and innovation: Securing new product advantage in high technology industry. J High Technol Manag Res 16(1):121–135. https://doi.org/10.1016/j.hitech.2005.06.007

Yin RK (2003) Case study research: design and methods. Sage, Newbury Park

Zahra SA, George G (2002) Absorptive capacity: a review, reconceptualization, and extention. Acad Manag Rev 27(2):185–203. https://doi.org/10.2307/4134351

Zhang J, Duan Y (2010) Empirical study on the impact of market orientation and innovation orientation on new product performance of Chinese manufacturers. Nankai Bus Rev Int 1(2):214–231. https://doi.org/10.1108/20408741011052609

Acknowledgements

Financial support from research project no. SUPB.RN.23 entitled “Ambidexterity-oriented decisions and absorptive capacity in the circular business model enterprise” by Jan Kochanovski University in Poland is gratefully acknowledged.

Funding

This study was funded by Jan Kochanovski University (Grant numbers SUPB.RN.23).

Author information

Authors and Affiliations

Contributions

Conceptualization: [MS, AP]; Methodology: [MS, AP]; Formal analysis and investigation: [MS, AP]; Writing—original draft preparation: [MS, AP, DA]; Writing—review and editing: [MS, AP, DA]; Funding acquisition: [MS]; Resources: [MS, AP].

Corresponding author

Ethics declarations

Conflict of interest

The authors declare they have no conflict of interest.

Financial interests

The authors declare they have no financial interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Stelmaszczyk, M., Pierscieniak, A. & Abrudan, D. Managerial decisions and new product development in the circular economy model enterprise: absorptive capacity and a mediating role of strategic orientation. Decision 50, 35–49 (2023). https://doi.org/10.1007/s40622-023-00336-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40622-023-00336-1

Keywords

- Managerial decisions

- Ambidexterity

- Absorptive capacity

- Product development

- Circular economy

- Structural equation modeling