Abstract

The option of organizing E-auctions to purchase electricity required for anticipated peak load period is a new one for utility companies. To meet the extra demand load, we develop electricity combinatorial reverse auction (CRA) for the purpose of procuring power from diverse energy sources. In this new, smart electricity market, suppliers of different scales can participate, and homeowners may even take an active role. In our CRA, an item, which is subject to several trading constraints, denotes a time slot that has two conflicting attributes, electricity quantity and price. To secure electricity, we design our auction with two bidding rounds: round one is exclusively for variable energy, and round two allows storage and non-intermittent renewable energy to bid on the remaining items. Our electricity auction leads to a complex winner determination (WD) task that we represent as a resource procurement optimization problem. We solve this problem using multi-objective genetic algorithms in order to find the trade-off solution that best lowers the price and increases the quantity. This solution consists of multiple winning suppliers, their prices, quantities and schedules. We validate our WD approach based on large-scale simulated datasets. We first assess the time-efficiency of our WD method, and we then compare it to well-known heuristic and exact WD techniques. In order to gain an exact idea about the accuracy of WD, we implement two famous exact algorithms for our constrained combinatorial procurement problem.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

1.1 Scope and problem

The electrical sectors in many countries are currently undergoing reformations, particularly in the form of deregulation of the markets and privatization of power retailers [1, 2]. Furthermore, there has been a substantial increase in the number of online electricity auctions over the last decade due to their ability to improve allocative efficiency and to foster competition among power suppliers [1, 3, 4]. Auctions can be technology specific (one or more renewable energy) or neutral (past and new technology) [5]. Renewable energy, especially wind and solar, has performed successfully in the markets, and its usage is increasing rapidly due to the environmental concerns [6]. For instance, renewable energy grew by 66.4% in 2012 in the Brazilian market [7], and by 60% in 2013 in the Spanish market [3]. In some countries, such as Brazil and Germany, a good portion of electricity is generated from wind energy, which has almost no marginal costs [8]. Consequently, wind is preferred to other energy sources [8]. It has also been shown that the entry of new energy sources into the markets is a catalyst for economic growth [3]. Numerous governments have adopted renewable energy auctions, and their number has increased from 9% in 2009 to 44% by the beginning of 2013 [2]. A common type of electricity auctions is for awarding contracts for the construction of new renewable energy facilities [1]. The target of all these auctions is to attract new investors (small and large) [5]. Existing electricity auctions are mostly oriented towards awarding long-term contracts, typically with one or two suppliers over many months or years [2, 5, 9], with very few focusing on short-term contracts (few hours) [1, 10]. Nonetheless, most of the literature on electricity markets does not disclose and describe the auction design and features, bidding strategies and winner-determination methods. The literature mainly reports on the benefits and the economic impact of electricity auctions that have been implemented in certain countries.

Electricity consumption is rapidly increasing due to the growth of populations, infrastructures, and economies. This growth in demand has created a very real challenge for public utility companies, particularly with respect to avoiding serious service problems, such as power outages during high demand like in hot summer days and cold nights. In order to meet the additional load during peak periods, utility companies may need to procure electricity from other sources. To this end, they can organize an online auction to purchase electricity that has been generated from diverse sources of renewable energy. To the best of our knowledge, organizing electricity auctions in order to address peak load problems is a new strategy. Indeed, all prior attempts to manage the demand load have been based on recommendation systems for controlling electricity consumption on the customer side [7]. The recommendations are generated based on the behavior, life style and feedback of the consumer. In our point of view, this approach is not only an invasion of the consumer’s privacy, but it may also be untenable as consumers may not be able to comply with the recommendations.

1.2 Contributions

For the sole purpose of offsetting anticipated extra demand load, we introduce a new type of electricity auction tailored for Consumer-to-Business and Business-to-Business contexts. Utility companies may procure the needed power simultaneously from other available sources. Our electricity auction differs substantially from those that have been previously proposed and implemented for the following reasons:

-

1)

We devise an auction for the specific purpose of avoiding power outages during peak load periods. Our auction is defined by very short-term contracts with terms that range from minutes to hours.

-

2)

We contract electricity from diverse sources, such as variable energy (solar and wind), active controllable load (like battery storage, battery of electric vehicles, and heat storage), and controllable renewable energy (like hydroelectricity, biomass, and geothermal heat).

-

3)

We encourage homeowners to be involved in our new electricity market. Indeed, these small players will have an active role. The authors in [11] claimed that suppliers of varying sizes will be involved in the electricity markets of the future.

In the present study, we introduce an electricity combinatorial reverse auction (CRA). Designing an appropriate auction format in the electricity sector is a challenging task [4]; thus, in designing our particular CRA, we have attempted to determine the most relevant features and solving mechanisms that produce the best outcome in terms of solution quality and time-efficiency. Our auction consists of several items, each representing a time slot of 15 minutes. Each item possesses two negotiable attributes, electricity price and quantity, and several trading constraints as well. However, the two attributes are in conflict, as the buyer’s objective is to simultaneously realize lower prices and increased quantities. Limited studies have been conducted on electricity combinatorial auctions despite the fact that they match demand and supply very efficiently (price-wise) and maximize the buyer’s revenue [12]. Still, these studies have several limitations. For example they usually consider only the price attribute but not the other attributes that are also important for trading. Moreover, these studies take into account very few or no constraints of the buyers and sellers.

The mechanism of electricity CRA leads to a complex winner-determination (WD) problem. Searching for the best solution (a set of winning sellers) in traditional CRAs (i.e. multiple items and single attribute) is already difficult due to computational complexity [12]. Past studies have adopted exact algorithms to find the optimal solution in CRAs, but these algorithms were accompanied by an exponential time cost [13], which is unpractical in real-life auctions. To address this time issue, researchers introduced evolutionary optimization techniques, such as genetic algorithms (GAs), which produce high-quality solutions (sometimes the optimal solutions) with an excellent time efficiency [14]. Furthermore, dealing with several conflicting attributes makes finding the best solution even more difficult and time consuming. Consequently, evolutionary multi-objective optimization (EMOO) methods have been proposed as the best way of finding the best trade-off solution that minimizes cost and time. In our study, we customize our GA-based EMOO WD algorithm introduced to accommodate CRAs with multiple units, multiple attributes, and conflicting objectives [15]. Our WD technique returns a solution that consists of several winning suppliers who are chosen to provide electricity for multiple time slots. In theory, this solution should satisfy all the buyer requirements as well as supplier constraints and offers. In addition, this solution represents the best combination of suppliers for lowering the price and increasing the quantity. The way we produce the winning solution ensures that the buyer gets power for each time slot. With the help of our electricity CRA, grid companies will be able to obtain the needed power at a good price due to the highly competitive nature of auctions.

Moreover, we conduct a real case study to illustrate the feasibility of our electricity procurement auction, WD method, and generated solution. Afterwards, we validate the WD approach using simulated data by generating large-scale instances of our advanced electricity CRA problem. The goal of the experiments is twofold: first, to assess the time-efficiency of our WD method, and second, to compare its performance to well-known heuristic and exact WD techniques that have been proposed for much simpler CRAs. The execution time is not the only critical auction requirement; the quality of the winning solution is important as well. Therefore, we fully implement two famous exact algorithms to solve our complex combinatorial procurement problem in order to evaluate the accuracy of our WD method (how close the produced solution comes to being optimal).

There are several significant benefits of our new electricity CRA. First, our auction represents a key solution to the extra demand load problem. Second, designing an auction with 15-minute intervals allows for greater equality of opportunity between small players (such as residents) and big players (plants). Third, our smart electricity market will greatly benefit utilities and their consumers both environmentally and economically. Fourth, this market will encourage the expansion of renewable energy facilities especially home-based technologies that are accessible to customers, such as solar panels and plug-in electric vehicles.

2 Related works

In most of the literature on electricity markets, auction design and features, bidding strategies, and winner determination methods are not described. The literature mainly reports on the benefits and the economic impacts of electricity auctions that have been implemented in certain countries. There are few studies about the underlying mechanisms of electricity auctions, and most of them have several limitations. Researchers limit the auction features and parameters to reduce the complexity of the WD methods because the processing time is a real challenge for these optimization procedures. In this section, we also show that evolutionary algorithms are appropriate in the context of combinatorial auctions.

2.1 Electricity auctions

Here we examine the few studies regarding the design of electricity combinatorial auctions. There are limited electricity combinatorial auctions despite the fact they provide a very efficient resource allocation and maximise the revenue of the auctioneer. Even though the WD in these types of auctions is a complex task, CRAs have been successfully adopted in other domains for both governmental and private sectors [16].

Reference [17] introduced a new double combinatorial auction protocol called the probability bidding mechanism (PBM) that takes into account several constraints to minimize the price and to maximize the trading quantities. The authors considered multiple attributes, such as the electricity price, transmission cost, network congestion and technology constraints. They implemented an agent-based system to develop and validate PBM and also to compare it with the high-low matching bidding mechanism. They claimed that PBM significantly optimizes electricity procurement and promotes economic growth. However, PBM is just an ideal model and has not been yet applied to real electricity markets. In another study [8], the authors tackled combinatorial reverse auctions with multiple units for both single and multiple items in the context of electricity retail market. They allowed partial bidding to maximize the auctioneer profit. They exposed the optimal single-item and multi-item clearing WD algorithms (based on brute-force technique) with constrained bidding. Daily auctions are held where the utility companies compete for 24 items (each item is 1 hour long). The authors utilized Vickrey-Clarke-Groves bidding format because in this protocol the dominant strategy of bidders is to submit their true valuation of the items. They validated the two WD methods by comparing them with an existing optimal exact WD algorithm. More recently, [16] developed a Web-based CRA (single unit and single attribute) with user interfaces for the electricity retail market to minimize consumer expenditures. This auction allows consumers to open auctions, define hourly consumption amounts and choose suppliers with the cheapest power acquisition. The authors claimed that this flexibility of consumers creates more competition among suppliers, and ultimately increases the number of suppliers and the profit of consumers. They employed the well-known optimizer IBM CPLEX to determine the auction winners. They proved that their protocol produces efficient allocation of electricity usage because consumers purchase electricity from several companies to minimize their expenditures. Nevertheless, this auction system was not tested yet with real markets.

2.2 Economic impact

Most of recent reports are about wholesale electricity markets in South America (e.g. Brazil) and Europe (e.g. Germany and UK). Over the years, many countries embraced renewable energy, especially wind and solar. Reference [3] showed that in Brazil, the largest producer of electricity from renewable energy, auctions play a huge role to recover the energy costs with profit. The authors discussed the long-term incentive policies of renewable energy markets and long-term auctions. Reference [18] analyzed the markets of most of the European countries by focusing on the day ahead, intra day and balance markets. This paper compared these markets based on several bidding mechanisms, price formation and timing. The target of these auctions is to reduce the management cost. The authors mentioned that a good knowledge of the electricity markets is the key to gain profit from a single or a portfolio of power plants. They also analyzed the projects conducted by the European electricity agencies in order to harmonize the wholesale markets in the continent. Moreover, according to one of the agencies, integrating wholesale balance electricity auction markets can save hundred million dollars per year. In [2], the authors are interested in auction design, information structure and bidding behavior that influence the market outcome when bidders do not fully know about their competitor costs. They examined the market circumstances and addressed the market efficiency that is enhanced when the number of steps of bid-schedules is restricted. According to their research, market transparency also plays an important role in the auction market efficiency. The authors developed multi-unit procurement auctions where suppliers have uncertain costs and production units. Lastly [19] discussed the European transition to green energy in the market. The authors concluded that auctions are the best option in the electricity market because they achieve considerable cost savings. As an example, they mentioned the success of UK that droved down the electricity price using renewable energy sources.

2.3 Evolutionary WD techniques

Reference [20] demonstrated that evolutionary algorithms are suitable and perform well in the context of combinatorial auctions. The authors exposed an Evolutionary Iterative Random Search Algorithm defined for auctions with multiple units and multiple rounds. They showed that their protocol achieved Nash Equilibrium in the following way: assume all the bidders offer the same price at the begining; if any bidder bids higher, the utility value of his bid will decrease; otherwise, the utility value will be zero. The same case holds for sellers. This situation indicates that the market is in Nash Equilibrium. Reference [21] presented a GA-based optimal resource allocation approach for combinatorial auctions with multiple units and multiple rounds. This method, shown to be feasible and effective through simulation, is able to maximize the total trading amounts of sellers and to reduce the processing time in the context of WD problem. Reference [21] claimed that when the resource allocation problem has feasible solutions, then Nash equilibrium is always guaranteed. Moreover, in [6], the authors proposed a Nash Equilibrium Search Approach (NESA) that consists of a local search procedure and an evolutionary algorithm. They solved the WD problem in the context of standard combinatorial auctions, and validated the WD procedure by measuring the performance of their Nash-Equilibrium solution based on revenue performance, anytime performance and optimal solution comparison. NESA is able to produce near to optimal solutions. Moreover [6] showed that NESA performs pretty well for large (2000 bidders and 200 items) and small (1000 bidders and 100 items) scale settings. They also discussed the stability of Nash Equilibrium to solve the WD problem in combinatorial auctions. After a certain time, the equilibrium is established and then remains in the equilibrium position.

3 Auctioning electricity from diverse sources

3.1 Auction features

We design the electricity CRA mechanism with relevant features described below.

-

1)

Reverse. The distribution company (buyer) purchases electricity from multiple suppliers. This electricity is needed for the under-supply period, which is usually one or two hours. A supplier could be a resident or a plant. We contract electricity from diverse energy sources that fall into two main classes: renewable energy and active controllable load (also called storage). The former has two sub-classes: variable energy (not controllable due to its unpredictable nature) and non-intermittent renewable energy.

-

2)

Combinatorial. The auction consists of multiple items, each one representing a time slot of fifteen minutes within the demand period. In this way, residents will be able to sell energy to the grid company, as they will be able to generate enough electricity to satisfy the demand of a 15-minute window.

-

3)

Two conflicting objectives. Suppliers compete on two attributes, quantity and price of electricity. These attributes are in conflict because the utility company’s objective is to simultaneously reduce the price and increase the quantity.

-

4)

Trading constraints. The buyer must decide on certain trading requirements, such as the demand period, power quantity and set price. Providers must also indicate their own requirements, such as the minimum price and operational constraint, which depend on the energy type and its production costs. Electricity price may vary throughout the day in a free retail market.

-

5)

Sealed bidding. Our auction is sealed-bid that is it does not reveal any information about the competitors’ offers in order to protect their privacy. With a sealed-bid protocol, truth telling is the dominant bidder strategy [8]. Sealed auctions are simple, foster competition among bidders and prevent their collusion [17, 22]. It has been shown in the literature that sealed auctions attract more participants than ascending open auctions.

-

6)

Two bidding rounds. In the first round, suppliers of variable energy are given a chance to compete on items for which they can provide electricity according to the weather forecast. Wind and solar sources have greatly contributed to the Brazilian electricity market during the winter and summer months, respectively [3]. In long-term auctions, wind energy has proven its market potential due its good performance [3]. To secure any remaining power demand following the first round, the other non-intermittent sources, like controllable load and renewable energy, participate in the second round. For instance, storage can accommodate the need of the power system at any time.

3.2 Auction process

Our electricity auction is conducted with six major phases, which are described in the following sections. Figure 1 presents an example of the electricity procurement scenario.

3.2.1 Auction demand

The utility company specifies its needs with the following requirements:

-

1)

Demand period. The time interval of the needed electricity (peak period), which is split into slots of fifteen minutes (called items).

-

2)

Electricity quantity. The electricity that is required for the demand period; the electricity quantity is defined in terms of a minimum electricity amount (to avoid a blackout) and a maximum electricity amount (to avoid an excess).

-

3)

Constraints on items. Each item is described in terms of three hard constraints: minimum and maximum electricity amount, and maximum allowable price.

3.2.2 Supplier registration

Potential power suppliers (those already connected to the electric grid via smart meters) are then invited to the auction, and buyer requirements are fully disclosed to them. Smart metering enables a supplier to transfer electricity to the grid. Interested suppliers, including residents and plants, can register to provide electricity according to the auction demand.

3.2.3 Supplier constraints and bids

Suppliers differ in terms of electricity production costs and also the constraints on how electricity can be generated and transmitted. The price of electricity depends on production costs, which may also increase as more electricity is produced. Prior to bidding, participants submit two constraints:

-

1)

The minimum price of each selected item. The supplier is not willing to sell less than this price.

-

2)

The operational constraint, or how long the supplier will be able to stay active during the delivery period after switching their status from OFF to ON.

Once the constraints have been established, suppliers compete independently for one or more time slots (a bundle of items). They bid on two attributes for each item: quantity and price. Each bid should respect the buyer’s requirements. If a seller commits for a certain item, he should fully realize the contract if he is the winner of that item. To help mitigate the uncertainties associated with variable energy, we design our auction with two bidding rounds (each one lasts 20 minutes).

Round 1: This round is for the suppliers of variable energy. Only these providers are allowed to submit partial bids because they might not be able to generate electricity all the time. Besides, it has been shown that partial bidding increases the buyers’ gains [8]. When these suppliers bid for an item, we assume that they are able to allocate the electricity according to the weather forecast.

Round 2: In the event that there is still unsatisfied demand following round one, the remaining items are bid upon by controllable energy providers (renewable energy and storage). The items in round two are either: items that do not have any placed bids, and/or items that did not receive a winning offer during the first round.

3.2.4 Winner determination

Our WD algorithm searches efficiently for the best trade-off solution, which is the solution that satisfies all the buyer requirements as well as supplier constraints and valid bids. The solution represents the best combination of suppliers that results in the lowest price and greatest quantity of electricity. More precisely, it consists of a set of winning suppliers, their prices, quantities and schedules. There will be several winners for the auction and one winner for each item. Our WD is described in details in Sect. 4.

3.2.5 Trade settlement

The winning suppliers allocate the required electricity with regard to the trading schedule and placed bids. To conduct a successful delivery of power, we consider the following assumptions:

-

1)

All suppliers are in the OFF mode at the beginning of the demand period.

-

2)

Switching every fifteen minutes between suppliers will not be an issue for the power grid.

-

3)

We have full power output from the electricity sources.

4 Auction winner determination

In [23], an efficient GA-based EMOO algorithm was introduced to solve CRAs with multiple items, units, attributes and objectives. We customize this algorithm [23] specifically for our electricity auction: multiple items, single unit, two attributes and two conflicting objectives. For more details, refer to [23]. In Algorithm 1, we give an overview of our WD approach for both rounds. All the submitted bids (quantity and price values) should be first validated using (1) and (2) to make sure they respect all the stated constraints.

where Demand

min,i

is the minimum demand of buyer for item i; Quantity

si

is the quantity supplied by seller s for item i; Demand

max,i

is the maximum demand of buyer for item i; Price

min,si

is the minimum price of seller s for item i; Price

si

is the bid price of seller s for item i; Price

max,i

is the maximum price of buyer for item i.

In our multi-objective optimization problem, the target is to maximize the fitness function of the solutions by respecting the buyer and sellers constraints in (1) and (2). Even though we have a mixture of maximization and minimization objectives, our WD approach converts it into a maximization objective. At first the WD algorithm generates the initial population of solutions based on uniform distribution. The solutions are chosen randomly from the entire solution space. More precisely, WD selects randomly a seller for each item, and then checks whether this selection is feasible or not by verifying two equations: the chosen seller has indeed bided for that item in (3), and the supply of seller is possible because he is still active for that time slot since he started transferring electricity to the buyer in (4). In case of an infeasible selection for an item, the algorithm tries another seller.

where Bid si = true if seller s has placed a bid for item i, false otherwise; ActiveDuration s is the operational constraint of seller s; CertainTime is the time slot being processed within the delivery period; StartingTime s is the time when seller s turned ON from OFF status.

In each iteration, the fitness value of a solution is calculated based on two utility functions for quantity maximization and price minimization. The first function detects the difference between the maximum demand of the buyer and the quantity offered by the seller whereas the second function calculates the difference between the bid price and the minimum price set by the seller. Afterwards, based on their quality measurement i.e. their fitness value, the method improves the current population of solutions with three GA operators: selection (Gambling-Wheel Disk [4]), crossover (Modified Two-Point [14]) and mutation (Swap Mutation [13]. To prevent the population from having many similar solutions, the algorithm uses the diversity mechanism based on the enhanced crowding distance method given in [23]. In this variant, a relative fitness function is derived to calculate the distance between two candidate solutions. By doing so, we prevent our WD algorithm from converging prematurely to local optimal. Elite solutions are the top-ranked solutions found in each generation. Thus, we utilize the elitism technique to store these solutions in an external population. The target here is to avoid losing good solutions and help our algorithm to converge to the global optimal. Now, from the two populations of previous and current generation, the method selects the top ranked solutions as the participants for the next generation. After repeating this optimization process for a certain number of times, it returns the first ranked solution (sometimes optimal). The way we produce the winning solution ensures that the buyer gets power for each time slot by respecting all the trading constraints.

Our method is able to return a high quality solution in a very efficient time as demonstrated in the experiment section. The time complexity is a real challenge for optimization problems. For instance, in our electricity CRA if 100 sellers compete for 8 items with two attributes, then the solution space is \(2 \times 100^{{2^{8} }}\), which is very large. Exact algorithms become infeasible because they deal with the entire solution space, and even heuristic ones take a certain amount of time. This is not practical in real-life applications like online auctions. Our method, which processes a subset of the solution pool, is able to improve the fitness quality in a very short time.

5 Case study

We have implemented the proposed WD algorithm in Java using NetBeans IDE 8.0.2 and execute it on an Intel (R) core (TM) i3-2330M CPU with 2.20 GHz processor speed and 4 GB of RAM. Here we illustrate electricity CRA with a small-scale market (8 items and 5 sellers). The utility would like to secure electricity for the period of 11:00 to 13:00 with a minimum of 700 kW and a maximum of 850 kW. The buyer also specifies his needs for each item shown in Table 1. Since we are dealing with two conflicting attributes (quantity and price), the buyer needs to rank them to be able to find a trade-off solution. He might prefer one attribute over another. In our present scenario, quantity has a higher importance than price for the 8 items.

Let us assume we have in total five grid-connected power sources (2 wind, 1 hydroelectricity, 1 battery storage and 1 solar-resident) that registered to this auction in Fig. 1. The variable energy suppliers compete in the first round. First, they submit their minimal prices, and how long they can stay active shown in Table 2. For example, S1 might supply electricity for Item1 at the minimum price of $18 and after getting ON, S1 remains active for 2 hours. The symbol ‘–’ means that during that time interval, there would be no power generation from the seller. Next the three sellers submit qualified bids for the items of their choice shown in Table 3. For instance, S1 bided only for three items; for Item1, he can supply 105 kW for $20. We can see that there are no bids for Item8.

Our WD algorithm solves the combinatorial problem above for the first round. Table 4 shows the breakdown of one of the candidate solutions. This solution is invalid since it does not satisfy the two feasibility conditions ((3) and (4)). Indeed, S3 has been selected for Item3 and again for Item7, which means that source must be active for 75 minutes but the active duration of S3 is only 1 hour. Also, S1 has been chosen for Item4 but did not bid for it. The WD algorithm tries other sellers for Item4 and Item7. After a certain number of generations (here 100), WD returns the best solution of the first round, which is still not complete because there is no feasible supplier found for Item7 and no placed bids for Item8 shown in Table 4.

For the next round, hydro and battery storage compete for the remaining two items. Table 5 exposes their constraints and valid bids. Supplier S5 and S4 are the winners of Item7 and Item8 respectively. In Table 6, we expose the details of the final winning solution consisting only of eligible offers. The utility will obtain 617 kW from variable energy with a price of $109, and 199 kW from the non-intermittent renewable energy with $32.

6 Validation and comparison

We analyze the auction outcome in terms of two quality metrics: solution optimality and time-complexity. We perform several experiments with five artificial datasets.

6.1 Simulated datasets

We generate randomly five instances of the electricity combinatorial procurement problem. In Table 7, we give the details of the artificial datasets by varying the number of sellers, items and generations.

The maximum value of each attribute is randomly chosen from [100, 1000], and the minimum value from [10% of maximum value, 50% of maximum value]. The ranking of the two attributes is also done randomly. Regarding the parameters of the GA algorithm (in total 5), we perform several parameter tuning tests, and based on the results, we use the following best configuration: the number of solutions is 500, the crossover rate is 0.6, mutation rate is 0.01, number of elite solutions = number of participant solutions and elite solution rate = 0.2. All the results returned by the WD method represent the average value of 20 runs.

6.2 Statistical analysis

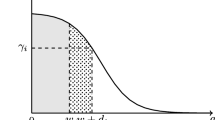

We examine statistically the WD algorithm based on dataset 1. Figure 2 presents the average of the quality measurement values for rounds 1 and 2 and by including the maximum and minimum values of generations. Also these figures depict the error bars with a confidence level of 95%. It is noticeable that after a certain number of generations, the maximum fitness value remains constant. This means that the best solution found by WD might be the optimal one. It is also obvious that WD is able to control the solution variations and their differences after a certain number of generations.

6.3 Computational time evaluation

The goal here is to assess the time-efficiency of our WD algorithm. We utilize dataset 2 by varying the number of items shown in Fig. 3, and dataset 3 the number of sellers shown in Fig. 4. From the results, we may say that the required computational time is not exponential but rather polynomial. It is clear that the execution time increases linearly with the increase of items and sellers.

6.4 Comparison with heuristic algorithms

We compare the computational time of WD with three other well-know heuristic WD methods: improved ant colony (IAC), enumeration algorithm with backtracking (EAB), and genetic algorithms for multiple instances of items in combinatorial reverse auctions (GAMICRA). All these optimization methods return one best solution. The comparison is based on dataset 4. Table 8 provides the processing time of IAC, EAB and GAMICRA for much simpler combinatorial reverse auctions. The first two were taken directly from [24] and the last one from [15]. As we can see WD is significantly superior to all of them.

6.5 Comparison with exact algorithms

In order to gain an exact idea about the accuracy of WD, we have fully implemented in Java two exact procedures to solve our constrained electricity CRA problem:

-

1)

Brute Force that guarantees the solution optimality since it checks the entire solution space.

-

2)

Branch and Bound [25] that is the most time-performing exact algorithm.

We compare WD with these two exact algorithms based on two performance qualities: time-efficiency and accuracy (how near is the solution to the optimal). Equation (5) depicts how we measure the accuracy. We employ datasets 4 and 5 where the former dataset (relatively smaller) is for Brute Force and the latter dataset is for Branch and Bound.

Regarding dataset 4, 60 sellers compete for 24 items in round 1, and 40 sellers for 8 items in round 2. After applying Brute Force (BF) on the first dataset, we obtain the following results. In round 1, the accuracy of WD is 87.3% and in round 2, 93.3%. The accuracy of BF is 100% in both rounds. So we can conclude that our WD method is able to return near to optimal solutions. On the other hand, our method generates the solution in 0.182 s in round 1 and 0.063 s in round 2 whereas BF takes more than 1 day in round 1 and almost 1 day in round 2. In summary, WD takes only 0.245 s whereas BF approximately 2 days.

Now we discuss the second exact technique that we apply to dataset 5. In round 1600 sellers bid for 15 items. The accuracy of WD is 91.32% and WD produces the best solution in 10.271 seconds. Branch and Bound (BB) takes 39.687 min. In round 2400 sellers compete for 5 items. The accuracy of WD is 95.62% and a solution is returned in 0.231 s whereas BB takes 33.375 s. So, in total WD takes only 10.502 s whereas BB 40.243 min.

All the results are summarized in Table 9. It is clear that exact algorithms become unreasonable with the increased values of the auction parameters (items and sellers). In conclusion, we have demonstrated that our WD method not only produces the solution in a very efficient processing time but also generates near-to-optimal solutions.

7 Conclusion

To avoid power outages during anticipated peak load periods, state utility companies can procure electricity from other suppliers (in aggregate) with the help of online auctions. The required electricity may be purchased from diverse renewable energy sources. We have presented an electricity combinatorial reverse auction that has been specifically designed for very short-term resource procurement. To be able to secure electricity, our auction consists of two bidding rounds: in the first round, variable energy suppliers bid on bundle of items; in the second round, storage and controllable renewable energy suppliers bid on any items still remaining. Our new, smart market makes it possible for power suppliers of all sizes to compete, including homeowners. We have solved our constrained combinatorial procurement problem (multiple items, two attributes and two conflicting objectives) by using an evolutionary multi-objective optimization technique to be able to find the best trade-off solution. The latter represents the best combination of sellers that results in the lowest cost and highest quantity of electricity. Designing an auction with 15-minute intervals allows for greater equality of opportunity between small players (such as residents) and big players (plants). We believe that the proposed electricity auction will promote the expansion of renewable energy plants as well as home-based generation as new technologies become more and more accessible to residents (electric vehicles and solar panels). In summary, our electricity auction is a new concept in terms of: ➀the problem being addressed (the anticipated peak demand load); ➁features of our smart electricity market; ➂auction design (characteristics, bidding strategies and winner determination).

Through several experiments, we have demonstrated that our WD method can not only determine the winners while maintaining a very efficient execution time, but it can also generate near-to-optimal solutions. We view our electricity allocation as a set of multiple optimal allocations, each corresponding to an item for which the constraints of the auction demand is met and for which a more profitable allocation is not possible. Reference [21] pointed out that combinatorial auctions that achieve the desired resource allocation (because feasible solutions always exist) ultimately fulfil the Nash Equilibrium (one type of market equilibrium). Therefore, we can claim that our WD algorithm also satisfies the market equilibrium.

In order to adopt our new electricity auction, public utilities and their decision makers must establish policies for contracting electricity with private companies and individuals. Additionally, utilities should investigate in practice the economic efficiency of the proposed market.

References

Ciarreta A, Espinosa MP, Pizarro-Irizar C (2017) Has renewable energy induced competitive behavior in the Spanish electricity market? Energy Policy 104:171–182

Holmberg P, Wolak F (2015) Electricity markets: designing auctions where suppliers have uncertain costs. Cambridge Working Papers in Economics 1541. https://www.repository.cam.ac.uk/handle/1810/255325

Aquila G, Pamplona EDO, Queiroz ARD et al (2016) An overview of incentive policies for the expansion of renewable energy generation in electricity power systems and the Brazilian experience. Renew Sustain Energy Rev 70:1090–1098

Gong J et al (2007) A GA based combinatorial auction algorithm for multi-robot cooperative hunting. In: Proceedings of international conference on computational intelligence and security, Harbin, China, 15–19 Dec 2007, pp 137–141

Lucas H, Ferroukhi R, Hawila D (2013) Renewable energy auctions in developing countries. International Renewable Energy Agency (IRENA), Abu Dhabi

Tsung C, Ho H, Lee S (2011) An equilibrium-based approach for determining winners in combinatorial auctions. In: Proceedings of the IEEE 9th international symposium on parallel and distributed processing with applications (ISPA), Busan, South Korea, 26–28 May 2011, pp 47–51

Aritoni O, Negru V (2011) A multi-agent recommendation system for energy efficiency improvement. e-Technol Netw Dev 171:156–170

Penya YK, Jennings NR (2005) Combinatorial markets for efficient energy management. In: Proceedings of IEEE/WIC/ACM international conference on intelligent agent technology, Compiegne, France, 19–22 Sept 2005, pp 626–632

Marambio R, Rudnick H (2017) A novel inclusion of intermittent generation resources in long term energy auctions. Energy Policy 100:29–40

Shil SK, Sadaoui S (2017) Combinatorial reverse electricity auctions. In: Canadian conference on artificial intelligence, Springer, pp 162–168

Vale ZA, Morais H, Khodr H (2010) Intelligent multi-player smart grid management considering distributed energy resources and demand response. In: Proceedings of IEEE power and energy society general meeting, Providence, RI, USA, 25–29 July 2010, pp 1–7

Praktiknjo A, Erdmann G (2016) Renewable electricity and backup capacities: an (un-) resolvable problem? Energy J 37 (Bollino-Madlener Special Issue)

Eiben AE, James ES (2003) Introduction to evolutionary computing. Springer, Heidelberg

Shil SK, Mouhoub M, Sadaoui S (2013) Winner determination in combinatorial reverse auctions. In: Ali M, Bosse T, Hindriks KV, Hoogendoorn M, Jonker CM, Treur J (eds) Contemporary challenges and solutions in applied artificial intelligence, Springer, Heidelberg, pp 35–40

Shil SK, Mouhoub M, Sadaoui S (2015) Winner determination in multi-attribute combinatorial reverse auctions. In: Proceedings of 22nd international conference on neural information processing (ICONIP), Istanbul, Turkey, 9–12 Nov 2015, pp 645–652

Colak B, Gokmen MA, Kilic H (2015) A web-based auction platform for electricity retail markets. In: Proceedings of IEEE 14th international conference on machine learning and applications (ICMLA), Miami, FL, USA, 9–11 Dec 2015, pp 1148–1152

Han D, Sun M (2015) The design of a probability bidding mechanism in electricity auctions by considering trading constraints. Simulation 91(10):916–924

Mazzi N, Lorenzoni A, Rech S et al (2015) Electricity auctions: a European view on markets and practices. In: Proceedings of 12th IEEE international conference on the European energy market (EEM), Lisbon, Portugal, 19–22 May 2015, pp 1–5

Newbery DM (2016) Towards a green energy economy? The EU Energy Union’s transition to a low-carbon zero subsidy electricity system—lessons from the UK’s Electricity Market Reform. Appl Energy 179:1321–1330

Tabandeh S, Michalska H (2009) An evolutionary random search algorithm for double auction markets. In: Proceedings of the IEEE congress on evolutionary computation, Trondheim, Norway, 18–21 May 2009, pp 2948–2955

Wang XW, Wang XY, Huang M (2012) A resource allocation method based on the limited english combinatorial auction under cloud computing environment. In: Proceedings of the 9th international conference on fuzzy systems and knowledge discovery (FSKD), Sichuan, China, 29–31 May 2012, pp 905–909

Maurer LTA, Barroso L (2011) Electricity auctions: an overview of efficient practices. World Bank, Washington, DC

Shil SK, Sadaoui S (2016) Winner determination in multi-objective combinatorial reverse auctions. In: Proceedings of 28th international conference on tools with artificial intelligence (ICTAI), San Jose, CA, USA, 6–8 Nov 2016, pp 714–721

Qian X, Huang M, Gao T et al (2014) An improved ant colony algorithm for winner determination in multi-attribute combinatorial reverse auction. In: Proceedings of IEEE congress on evolutionary computation (CEC), Beijing, China, 6–11 July 2014, pp 1917–1921

Gonen R, Lehmann D (2000) Optimal solutions for multi-unit combinatorial auctions: branch and bound heuristics. In: Proceedings of 2nd ACM conference on electronic commerce, Minneapolis, MN, USA, 17–20 Oct 2000, pp 13–20

Author information

Authors and Affiliations

Corresponding author

Additional information

CrossCheck date: 17 September 2017

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

SHIL, S.K., SADAOUI, S. Meeting peak electricity demand through combinatorial reverse auctioning of renewable energy. J. Mod. Power Syst. Clean Energy 6, 73–84 (2018). https://doi.org/10.1007/s40565-017-0345-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40565-017-0345-5