Abstract

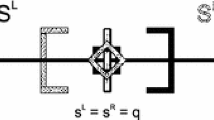

A perplexing problem in spatial modelling—going back to Hotelling’s linear market—is whether firms will cluster together or separate themselves. Maximal differentiation is the prevailing equilibrium when travel costs are quadratic and minimal differentiation results when price competition is limited. The reality for most markets is that the force that draws firms together (maximize demand) and the force that causes them to separate (avoid price competition) are both present. In many cases, this makes the characterization of an equilibrium difficult. The vast majority of research using the Hotelling model is based on the assumption that all potential consumers buy, yet the reality of many markets is that there are some consumers who seriously consider not buying. When allowing for the possibility that some consumers would consider not buying from either firm, we are able to identify equilibrium locations for firms that first choose locations and then prices in a Hotelling market with linear travel costs. Following the discussion above, we consider ranges of consumers’ willingness to pay for the products relative to the outside good such that the market is not necessarily covered for all location choices. The analysis demonstrates the existence of a pure-strategy location equilibrium, supported by a pure-strategy pricing equilibrium, where firms are moderately differentiated and the market is covered.

Similar content being viewed by others

Notes

Eaton and Lipsey [4] highlight the difficulties of identifying pure strategy location equilibria in the context of the Hotelling market.

This is important for the consumers located near the edge of the market. If a consumer is located exactly halfway in between the firms and they earn equal utility from both firms, one can set up any arbitrary rule, such as purchasing from each firm with a 50 % probability.

The location of A is normalized to be less than the location of B. There is another equilibrium where the locations of the firms are switched.

Said differently, the focus is on situations where the individual rationality constraint does not affect the solution.

These inequalities are actually strict because the only case where the equality would hold is for V = 3/4, but then 1 − V represents the equilibrium location.

Alternatively, note that profits are decreasing in ã, but once ã becomes small enough that consumers at 0 make a purchase, the previous first-order condition on locations comes into effect, so profits must be smaller.

References

d’Aspremont C, Gabszewicz JJ, Thisse J-F (1979) On Hotelling’s ‘stability in competition’. Econometrica 47(5):1145–1150

Dasgupta P, Maskin E (1986) The existence of equilibrium in discontinuous economic games, I: theory. Rev Econ Stud 53(1):1–26

Davis P (2006) Spatial competition in retail markets: movie theaters. RAND J Econ 37(4):964–982

Eaton C, Lipsey RG (1975) The principle of minimum differentiation reconsidered: some new developments in the theory of spatial competition. Rev Econ Stud 42(1):27–49

Grossman GM, Shapiro C (1984) Informative advertising with differentiated product. Rev Econ Stud 51(164):63–81

Hotelling H (1929) Stability in competition. Econ J 39(153):41–57

Iyer G (1998) Coordinating channels under price and non-price competition. Mark Sci 17(4):338–355

Kotler P, Keller K (2012) Marketing management. Prentice Hall, New York, pp 314–317

Osborne MJ, Pitchik C (1987) Equilibrium in Hotelling’s model of spatial competition. Econometrica 55(4):911–922

Author information

Authors and Affiliations

Corresponding author

Additional information

Amit Pazgal, David Soberman and Raphael Thomadsen contributed equally to this work.

Proof that None of the Location Deviations Listed in Section 4 Lead to Increased Profits

Proof that None of the Location Deviations Listed in Section 4 Lead to Increased Profits

Suppose firm A deviates to a location \( \tilde{a}< \max \left(V-\raisebox{1ex}{$2$}\!\left/ \!\raisebox{-1ex}{$3$}\right.,1-V\right) \). Then, in the second period, firm B will charge the same price, \( V-b=\raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$2$}\right. \), and A will charge either (1) V − (1 − ã − 2b) = 3V − 2 + ã (kink point where consumers at a point between firms A and B get 0 utility when p B = V − b) or (2) set a price such that all of the firm’s consumers get positive surplus.

If A charges (1) p A = 3V − 2 + ã, there are two cases. If ã ≥ 1 − V, the market will not be covered, and A’s profits will be 2(2 − 2V − ã)(3V − 2 + ã). This is maximized at \( \tilde{a}=2-\frac{5V}{2} \), but at that point, ã < 1 − V, so we can consider the case where ã = 1 − V. At that point, profits will be \( -4{V}^2+6V-2\le \raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$4$}\right. \). If ã < 1 − V, then, profits will be 2(1 − V)(3V − 2 + ã). This is increasing in ã, so it is maximized at ã = 1 − V, where it again will be \( -4{V}^2+6V-2\le \raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$4$}\right. \).Footnote 5 Alternatively, if the firm prices according to option (2), then, firm A’s profits are \( {\pi}^A={p}_A\left(\frac{1+a-b-{p}_A+{p}_B}{2}\right) \). The first-order conditions for A reveal that \( {p}_A=\frac{3}{4}+\frac{\tilde{a}-V+{p}_B}{2}\ge 1-\frac{V}{2}+\frac{\tilde{a}}{2} \), where the inequality holds because \( {p}_B\ge V-b=\raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$2$}\right. \). This latter inequality holds because the corresponding condition for B is that if consumers at 1 get a positive surplus, B would raise its prices until either consumers at 1 get zero surplus or \( {p}_B=\frac{1}{4}+\frac{V-\tilde{a}+{p}_A}{2}>\frac{1}{2}+\frac{p_A}{2}>\frac{1}{2} \). Given this, \( {p}_A=\frac{3}{4}+\frac{\tilde{a}-V+{p}_B}{2}\ge 1-\frac{V}{2}+\frac{\tilde{a}}{2}>V-\tilde{a} \) whenever \( \tilde{a}>V-\raisebox{1ex}{$2$}\!\left/ \!\raisebox{-1ex}{$3$}\right. \), so we need only to consider the case where \( \tilde{a}<V-\raisebox{1ex}{$2$}\!\left/ \!\raisebox{-1ex}{$3$}\right. \). In such a case, the profits for A will be \( {\pi}^A=\frac{{\left(2+\tilde{a}-V\right)}^2}{8}<\frac{1}{4} \) in the relevant range.

We next consider deviations towards the competing firm into a region where the second-stage pricing game involves another pricing equilibrium. There are two potential types of pricing strategies that we could consider: (a) a pure strategy where consumers located at 0 choose the outside option (which can happen when \( V<\raisebox{1ex}{$41$}\!\left/ \!\raisebox{-1ex}{$50$}\right. \)) or (b) a mixed-strategy. If firm A moves to a location where the consumers at 0 choose the outside option and the firms play a pure-strategy pricing equilibrium, then, firm A’s profits are \( {\pi}^{\tilde{A}}={p}_A\left(\left(V-{p}_A\right)+\left(\frac{1+\tilde{a}-b-{p}_A+{p}_B}{2}-\tilde{a}\right)\right) \). Setting \( \frac{\partial {\pi}^{\tilde{A}}}{\partial a}=0 \) yields \( {p}_A=\frac{1-\tilde{a}-b+{p}_B+2V}{6} \) and profits of \( {\pi}^{\tilde{A}}=\frac{{\left(1-\tilde{a}-b+{p}_B+2V\right)}^2}{24} \). Note that because \( b=V-\frac{1}{2} \) and \( {p}_B=\frac{1}{2} \) (see above), \( \tilde{a}\ge V-\frac{2}{5} \) or else consumers at 0 would obtain a positive utility from firm A. Plugging these three conditions back into the profit function reveals that \( {\pi}^{\tilde{A}}\le \frac{6}{25}<\frac{1}{4} \), so such a deviation is not profitable.Footnote 6

Finally, A might move so close to B that there is a mixed-strategy pricing equilibrium. Note that the set of reasonable prices to charge is bounded by V. Consider the highest prices charged by each firm in any mixed-strategy equilibrium. First, the highest prices for each firm must be within 1 − ã − b of each other or the firm with the higher maximum price would sell nothing at that price. Thus, the amount that firm A could sell at its maximum price, p AMax , is bounded from above by \( \min \left\{\left(V-{p}_{\mathrm{Max}}^A\right)+\left(\frac{1+\tilde{a}-b-{p}_{\mathrm{Max}}^A+{p}_{\mathrm{Max}}^B}{2}-\tilde{a}\right),\frac{1+\tilde{a}-b-{p}_{\mathrm{Max}}^A+{p}_{\mathrm{Max}}^B}{2}\right\} \). Firm B faces a similar set of conditions. Note that \( {p}_{\mathrm{Max}}^B\le \raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$2$}\right. \) whenever p BMax ≥ p AMax . To see this, note that if \( {p}_{\mathrm{Max}}^B>\raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$2$}\right. \) then, the profit for firm B whenever it charges p BMax is \( {\pi}^{\tilde{B}}={p}_{\mathrm{Max}}^B\left[\left(V-{p}_{\mathrm{Max}}^B\right)+\left(\frac{1-\tilde{a}-b-{p}_{\mathrm{Max}}^B+E\left({p}_A\left|{p}_A\right.>{p}_{\mathrm{Max}}^B-\left(1-\tilde{a}-b\right)\right)}{2}\right)\right] \Pr \left({p}_A>{p}_{\mathrm{Max}}^B-\left(1-\tilde{a}-b\right)\right) \).

where we substituted \( b=V-\frac{1}{2} \). Both terms are negative when \( {p}_{\mathrm{Max}}^B\ge \frac{1}{2} \) because p BMax ≥ p AMax ensures that the first term is negative.

We can then calculate an upper limit for firm A’s profits in any mixed-strategy equilibrium. Suppose \( {p}_{\mathrm{Max}}^A=V-\tilde{a}<\raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$2$}\right. \). A’s profits are then \( {p}_{\mathrm{Max}}^A\frac{1+\tilde{a}-b-{p}_{\mathrm{Max}}^A+E\left(\left.{p}_B\right|{p}_B>{p}_{\mathrm{Max}}^A-\left(1-\tilde{a}-b\right)\right)}{2}\cdot \Pr \left({p}_B>{p}_{\mathrm{Max}}^A-\left(1-\tilde{a}-b\right)\right)<{p}_{\mathrm{Max}}^A\frac{2+\tilde{a}-V-{p}_{\mathrm{Max}}^A}{2} \). This is maximized when \( {p}_{\mathrm{Max}}^A=\frac{2+\tilde{a}-V}{2} \), but because we only consider the case where p AMax ≤ (V − ã), plugging in p AMax = (V − ã) reveals that profits will never be above \( \left(V-\tilde{a}\right)\left(1-\left(V-\tilde{a}\right)\right)<\raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$4$}\right. \), where the inequality holds because the maximum of x(1-x) is 1/4. Suppose instead p AMax > V − ã. Then, profits are less than \( {p}_{\mathrm{Max}}^A\left[\left(V-{p}_{\mathrm{Max}}^A\right)+\left(\frac{1+\tilde{a}-b-{p}_{\mathrm{Max}}^A+{p}_{\mathrm{Max}}^B}{2}-\tilde{a}\right)\right]<{p}_{\mathrm{Max}}^A\frac{2-\tilde{a}-3{p}_{\mathrm{Max}}^A+V}{2} \), where we substituted \( b=V-\frac{1}{2} \) and \( {p}_{\mathrm{Max}}^B\le \raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$2$}\right. \). \( {p}_{\mathrm{Max}}^A\frac{2-\tilde{a}-3{p}_{\mathrm{Max}}^A+V}{2} \) is maximized when \( {p}_{\mathrm{Max}}^A=\frac{2+V-\tilde{a}}{6} \), which is only greater than V − ã when \( \left(V-\tilde{a}\right)<\raisebox{1ex}{$2$}\!\left/ \!\raisebox{-1ex}{$5$}\right. \). Plugging \( {p}_{\mathrm{Max}}^A=\frac{2+V-\tilde{a}}{6} \) into \( {p}_{\mathrm{Max}}^A\frac{2-\tilde{a}-3{p}_{\mathrm{Max}}^A+V}{2} \) yields \( \frac{{\left(2+V-\tilde{a}\right)}^2}{24}\le \frac{6}{25}<\frac{1}{4} \). If \( \left(V-\tilde{a}\right)>\raisebox{1ex}{$2$}\!\left/ \!\raisebox{-1ex}{$5$}\right. \), we can plug in p AMax = V − ã into \( {p}_{\mathrm{Max}}^A\frac{2-\tilde{a}-3{p}_{\mathrm{Max}}^A+V}{2} \), which gives a value of \( \left(V-\tilde{a}\right)\left(1-\left(V-\tilde{a}\right)\right)<\raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$4$}\right. \).

We can rule out that A would deviate to the other side of B. Note that because the most profits A can earn at any price is 2p A (V − p A ), we need not consider deviations where A would charge a price above \( \frac{V}{2}+\frac{\sqrt{4{V}^2-2}}{4} \), which is the highest price where \( 2{p}_A\left(V-{p}_A\right)>\frac{1}{4} \). Looking at B’s incentives, at the highest price it would ever charge in a mixed- or pure-strategy equilibrium, it would earn a profit of \( {p}_{\mathrm{Max}}^B\left(V-{p}_{\mathrm{Max}}^B+\frac{d+{p}_{\mathrm{Max}}^A-{p}_{\mathrm{Max}}^B}{2}\right) \), where d is the distance between A and B. Thus, the most B would ever potentially charge, plugging in \( {p}_{\mathrm{Max}}^A=\frac{V}{2}+\frac{\sqrt{4{V}^2-2}}{4} \), is \( {p}_{\mathrm{Max}}^B=\frac{4d+10V+\sqrt{4{V}^2-2}}{24} \). Given that, A’s profits are bounded to be below \( {p}_A\left(V-\frac{1}{2}-\frac{d+pa-pb}{2}\right) \). The price that maximizes this upper bound for A is \( {p}_A=\frac{58V+\sqrt{4{V}^2-2}-24-20d}{48} \), and the bound on profits is \( \frac{{\left(58V+\sqrt{4{V}^2-2}-24-20d\right)}^2}{4608} \). Given the bounds on V and d, this is increasing in V and decreasing in d. Evaluating this upper bound at \( V=\frac{7}{8} \) and d = 0 reveals that A’s profits are less than \( \frac{{\left(107+\sqrt{17}\right)}^2}{73728}\approx 0.17 \). Thus, there is no profit-increasing deviation to the right of B.

The case where \( V\in \left(\frac{1}{2},\frac{3}{4}\right) \) follows a similar logic. Firms locate at a distance ¼ from the endpoints, charge \( p=\left(V-\frac{1}{4}\right) \), and earn profits of \( \raisebox{1ex}{$V$}\!\left/ \!\raisebox{-1ex}{$2$}\right.-\raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$8$}\right. \). One can easily confirm that these prices form an equilibrium given the locations. Confirming that deviating to another location is not optimal follows the same logic as the case where \( V\in \left(\frac{3}{4},\frac{7}{8}\right) \) for most of the analysis. However, when one considers deviations that involve the mixed-strategy equilibria, we need to adjust the consideration for the case where p AMax ≤ (V − ã). We instead note that the profits from this price are less than min[(V − ã)(1 − (V − ã)), 2(V − ã)ã], which is always less than the profits earned by the firm of \( \raisebox{1ex}{$V$}\!\left/ \!\raisebox{-1ex}{$2$}\right.-\raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$8$}\right. \) whenever \( \tilde{a}>\raisebox{1ex}{$3$}\!\left/ \!\raisebox{-1ex}{$8$}\right. \). Deviations to \( \tilde{a}<\raisebox{1ex}{$3$}\!\left/ \!\raisebox{-1ex}{$8$}\right. \) will not involve mixed-strategy pricing equilibria.

Rights and permissions

About this article

Cite this article

Pazgal, A., Soberman, D. & Thomadsen, R. Maximal or Minimal Differentiation in a Hotelling Market? A Fresh Perspective. Cust. Need. and Solut. 3, 42–47 (2016). https://doi.org/10.1007/s40547-015-0054-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40547-015-0054-z