Abstract

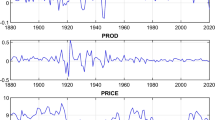

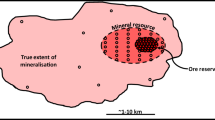

This paper challenges the widely held hypothesis, considered in some circles as accepted scientific consensus, that modern industrial society is rapidly exhausting non-renewable resources. We argue that this paradigm is amiss and use copper availability as an example to demonstrate the problems with this consensus. In the 80 years for which reasonably reliable estimates of copper reserves and reserve life are available, there is no evidence of resource exhaustion. In addition, an analysis of the economics of resource exploration indicates that mining companies will treat exploration as an inventory control problem and trade off using limited capital resources between expanding inventories of reserves and generating current revenue through production. In the case of the copper industry, it is argued that there is little incentive for major copper producers to explore for more resources. Non-producers, exploration companies do have an incentive for expanding reserves, but this does not change the conclusion that new copper resources are effectively not worth looking for. We also conjecture that, except for in rare and temporary circumstances, this conclusion is applicable to many non-renewable resources. Ultimately, this implies that aggregate reserve-life calculations for all types of non-renewable resources are inherently flawed.

Similar content being viewed by others

Notes

For simplicity, we limit the discussion to metalliferous minerals although the analysis can possibly be extended to carbon-based minerals such as coal, oil, and natural gas.

USGS, personal communication with Daniel Edelman, USGS Copper Specialist.

So note, for example, that there are no estimates for the period during WWII, and estimates are not available on an even five-year basis. Also, the definition of “reserves” was broadened slightly in the 1980s to “reserve base” which can include some sub-economic materials.

Julian Simon was an early proponent of this view. See, for example, The Resourceful Earth: A Response to "Global 2000" (1984), Julian Simon & Herman Kahn, eds.

Hotelling’s model for non-renewable resources predicts long-run rising prices of commodities to allow continued production from lower-grade materials. As Julian Simon’s famous bet with Paul Ehrlich demonstrated, the opposite has occurred—inflation-adjusted prices of non-renewable resources have declined over time.

References

Arrow K, Dasgupta P, Goulder L, Daily G, Ehrlich P, Heal G, Levin S, Maler K, Schneider S, Starrett D, Walker B (2004) Are we consuming too much? J Econ Perspect 18(3):147–172

Bradley R (2006) Resourceship: an Austrian Theory of Mineral Resources. Rev Austrian Econ 20(1):63–90

Bullis HR (2001) Gold deposits, exploration realities, and the unsustainability of very large gold producers. Explor Min Geol 10(4):313–320

Crowson P (2011) Mineral reserves and future minerals availability. Miner Econ 24:1–6

Dolbear B (2013) 2013 Ranking of countries for mining investment: “Where not to invest” [press release] retrieved from http://www.dolbear.com/announcements/2013-ranking-of-countries-for-mining-investment-or-where-not-to-invest

Hotelling H (1931) The economics of exhaustible resources. J Polit Econ 39:137–175

Hubbert MK (1956) Nuclear energy and the fossil fuels, M.K. Hubbert, Presented before the Spring Meeting of the Southern District, American Petroleum Institute, Plaza Hotel, San Antonio, Texas

Humphreys D (2013) Long-run availability of mineral commodities. Miner Econ (Forthcoming)

Krautkraemer JA (1998) Nonrenewable resource scarcity. J Econ Lit 36(4):2065–2107

Leherrere J (2010) Copper peak. Retrieved at http://dev.energybulletin.net/node/52234 on 21 Sept 2013

Manske S, Paul A (2002) Geology of a major new porphyry copper center in the Superior (Pioneer) District, Arizona. Econ Geol 97(2):197–220

May D, Prior T, Cordell D, Giurco D (2012) Peak minerals: theoretical foundations and practical applications. Nat Resour Res 21(1)

Simon J (1996) The ultimate resource 2. Princeton University Press, Princeton

Simon J, Kahn H (eds) (1984) The resourceful earth: a response to “Global 2000”. Blackwell, UK

Skinner B (2001, April) “Exploring the resource base”. Keynote talk presented at the workshop on “The Long-Run Availability of Minerals,” sponsored by Resources for the Future and the Mining, Minerals and Sustainable Development Project. Washington, D.C

Tilton J (2003) On borrowed time? Resources for the future. Washington D.C

U.S. Bureau of Mines, U.S. Geological Survey (1980) U.S. Geological Survey Circular 831. U.S. Geological Survey, Retrieved at http://pubs.er.usgs.gov/publication/cir831 on 21 Sept 2013

US Energy Information Administration, Crude Oil Production, http://www.eia.gov/dnav/pet/pet_crd_crpdn_adc_mbblpd_a.htm, retrieved May 1, 2014

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Dobra, J., Dobra, M. Another look at non-renewable resource exhaustion. Miner Econ 27, 33–41 (2014). https://doi.org/10.1007/s13563-014-0044-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13563-014-0044-x