Abstract

Using Norwegian registry data, we investigate the effect of paternity leave on fathers’ long-term earnings. If the paternity leave increased long-term father involvement, then we should expect a reduction in fathers’ long-term earnings as they shift time and effort from market to home production. For identification, we use the Norwegian introduction of a paternity-leave quota in 1993, reserving four weeks of the total of 42 weeks of paid parental leave exclusively for the father. The introduction of the paternity-leave quota led to a sharp increase in rates of leave-taking for fathers. We estimate a difference-in-differences model that exploits differences in fathers’ exposure to the paternity-leave quota by the child’s age and year of observation. Our analysis suggests that four weeks of paternity leave during the child’s first year decreases fathers’ future earnings, an effect that persists through our last point of observation, when the child is 5 years old. A battery of robustness tests supports our results.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

During the last decades, the role of the father in his children’s lives has become an important focus in European family policy. In particular, Finland, Iceland, Norway, and Sweden have reserved a part of the paid parental leave exclusively for the father. Moreover, in March 2010, the European Parliament adopted a directive stipulating the minimum requirements for parental leave, including a nontransferrable paternity-leave quota of four weeks (European Union: Council Directive 2010/18/EU). Paternity leave might affect a father’s long-term involvement through at least two different mechanisms (Tanaka and Waldfogel 2007). First, a father’s care for his infant may facilitate father-child bonding. Second, paternity leave could make it easier for the father to be more involved as the child grows older by preventing the mother from gaining exclusive expertise in child-caring during the child’s first year.

In this article, we investigate the effect of paternity leave on fathers’ long-term earnings. If the paternity leave increases long-term father involvement, we should expect a reduction in fathers’ long-term earnings as they shift time and effort from market to home production (Becker 1985). For identification, we use the Norwegian introduction of a paternity-leave quota in 1993. Beginning in 1993, 4 of the total of 42 weeks of paid parental leave were reserved exclusively for the father. With few exceptions, the family would lose those 4 weeks of paid parental leave if not taken by the father. The introduction of the paternity-leave quota led to a sharp increase in the participation rate of paternity leave. In our sample of full-time working fathers, the participation rate was less than 3 % prior to 1993 but increased to about 60 % by 1995. We refer to fathers whose youngest child was born after 1994 as treated, and to fathers whose youngest child was born in 1993 and 1994 as treated in the phase-in period.

Our empirical analysis employs a comprehensive, longitudinal registry database containing annual records of earnings for every person in Norway. We estimate the effects of the paternity-leave quota on fathers’ earnings in a difference-in-differences (DD) model, which exploits differences in fathers’ exposure to the paternity-leave quota across the child’s age and year of observation. More specifically, we look at the difference in earnings in a given year between treated and nontreated fathers, and compare this with the earnings difference between fathers of children of similar ages in a year prior to the introduction of the paternity-leave quota. The deviation between these two differences is attributed to the paternity-leave quota. The identifying assumption is that absent the reform, time trends in earnings would be similar for fathers of children of various ages. Our analysis suggests that four weeks of paternity leave during the child’s first year decreases fathers’ future earnings by 1.4 %. Assuming that the treatment effect is generated only by fathers actually taking leave, adjusting this intention to treat (ITT) estimate for relevant uptake rates gives a treatment of the treated (TOT) estimate of 2.2 %. This effect persists up until our last point of observation, which is when the child is 5 years old. A battery of robustness tests supports our results and the validity of our identifying assumption.

A large and recent economic literature has investigated the effects of parental-leave legislation on mothers (see, e.g., Baker and Milligan 2008a, b, 2010; Carneiro et al. 2011; Dustmann and Schönberg 2012; Han et al. 2009; Kluve and Tamm 2013; Lalive and Zweimüller 2009; Ruhm 1998, 2004; Schönberg and Ludsteck forthcoming). The mechanisms through which parental leave affects earnings are likely different for fathers than for mothers. The alternative to parental leave for the father is typically employment, whereas for the mother, the alternative is more often a temporary or permanent exit from the labor market in order to care for the child. As such, studies investigating the relationships between parental leave and different outcomes for mothers are likely not informative about the same relationships for fathers.

The evidence on how parental leave affects fathers is scant. Using U.S. survey data, Han et al. (2009) demonstrated that fathers typically take short leaves or none at all, and leave laws are correlated with increased leave-taking only during the birth month. Moreover, Nepomnyaschy and Waldfogel (2007) and Haas and Hwang (2008) documented a positive association between paternity leave and father involvement. Our study is particularly related to recent studies that have investigated how fathers are affected by the introduction of a paternity-leave quota. Ekberg et al. (2013) investigated the Swedish Daddy Month Reform introduced in 1995, finding that the reform had no effects on father’s leave taken for the care of sick children. Using the same Swedish reform for exogenous variation, Johansson (2010) found (consistent with our results) negative effects on fathers’ earnings, but the estimates were not statistically significant. Similarly, studying the 1993 Norwegian paternity-leave quota reform, Cools et al. (2011) found (also consistent with our results) a negative effect on father’s earnings, but the estimates were (with a few exceptions) not statistically significant. Notably, the empirical strategy in Johansson (2010) and in Cools et al. (2011) focused on the differences between fathers with children born a few weeks prior to and a few weeks after the introduction of the paternity-leave quota. The relatively few fathers immediately responding to the reform may represent a selected sample of fathers, potentially those already most involved in their children’s lives. Our DD approach focuses on the effect of paternity leave when uptake has increased by nearly 50 percentage points.

In a study closely related to ours, Kotsadam and Finseraas (2011) investigated how the 1993 Norwegian paternity-leave quota reform affected the division of household labor using survey data from the 2007/2008 Life Course, Generation and Gender study. The authors demonstrated that 14–15 years after the reform, respondents whose youngest child was born after the reform (aged 13–15 years in 2007/2008) reported a more equal division of household tasks than respondents whose youngest child was born before the reform (aged 15–17 years in 2007/2008). Notably, because the authors had access to only one period of observation, they could not control for the age of the youngest child given that it was then perfectly correlated with treatment. As such, the estimated effect may simply be that parents with children of different ages share household work differently. Alternatively, the estimated effects may be due to trends in father involvement. Within the limitations of the survey data set, the authors attempt to address these issues through several placebo analyses and robustness tests. Our longitudinal registry data allow us to address these issues more directly by including fixed effects for the age of the youngest child and year of observation in a DD analysis. Moreover, the longitudinal data set allows us to investigate whether time trends in earnings differ across fathers of children of various ages, which is a crucial identifying assumption.

The remainder of this article is organized as follows. In the next section, we portray the paternity-leave quota and other relevant family policies. We then describe our registry data, followed by a discussion of our empirical strategy. Results are presented, and then we conclude.

Institutional Settings

The Paternity-Leave Quota

Fathers in Norway have been eligible for parental leave since 1978. On April 1, 1993, Norway introduced a paternity-leave quota regarding paid parental leave. The intentions were to facilitate father-child bonding and to strengthen fathers’ role at home, thereby strengthening women’s role in the labor market. Four weeks of the total of 42 weeks of paid parental leave were reserved exclusively for the father.Footnote 1 With few exceptions, the family would lose those four weeks of paid parental leave if not taken by the father. Apart from the paternity-leave quota of four weeks and the nine weeks reserved for the mother around the time of birth, parents could share the parental leave between them as they desired. Although paid maternity leave was contingent only on the mother working at least 50 % of full-time prior to birth, paid paternity leave was contingent on both parents working at least 50 %. Income compensation was based on the earnings of the person on leave, but fathers’ income compensation was reduced proportionally if the mother did not work full-time prior to birth.Footnote 2

The introduction of the paternity-leave quota led to a sharp increase in uptake rates. Based on our analytical sample of full-time employed fathers, Fig. 1 shows that less than 3 % of the fathers whose child was born prior to 1993 used parental leave. After the paternity-leave quota was introduced in 1993, about 30 % of fathers made use of their right to paternity leave, increasing to 51 % in 1994 and 59 % in 1995. In 2000, more than 70 % of full-time employed fathers took paternity leave. As Fig. 1 reveals, the paternity-leave quota had low uptake during the first years after implementation, particularly for children born in 1993 and 1994. We will consequently refer to the fathers of these two cohorts as treated in the phase-in period.

Fathers were entitled to use their right to paternity leave up until the child turned age 3. However, nearly all (95 %) fathers who used their right to paternity leave took leave in conjunction with the mothers’ leave during the child’s first year of life. Among fathers taking paternity leave, around 70 % were on leave for four weeks, 20 % took less leave, and the remaining 10 % took more than the designated four weeks of leave.Footnote 3 This picture remained relatively constant during our period of study. Investigating complier characteristics during the period of 1994–1999, we can see that compliance increased with the father and mother’s educational levels and the father’s age, and decreased with birth order (summary statistics available from authors on request).

We will use the introduction of the paternity-leave quota to investigate a causal effect of paternity leave on father involvement. The shadings in Fig. 2 illustrate the nature of the experiment (and, as we explain later, figures in each cell refer to number of weeks of parental leave). Notably, we construct our experiment based on the age of the youngest child because the father of a child born prior to the introduction of the paternity-leave quota may still be treated if the father is on paternity leave with a younger child. Each row in Fig. 2 represents the age of the father’s youngest child, and each column represents a given year. To illustrate, the single cell 1997/3 represents fathers whose youngest child turned age 3 in 1997. Fathers of each cohort enter into multiple cells diagonally in the figure, according to the age of the father’s youngest child. Darkly shaded cells represent fathers treated by the reform after the phase-in period. These are fathers whose youngest child is born after 1994. At this point, nearly 60 % of the fathers used parental leave. Lightly shaded cells represent fathers treated by the reform during the phase-in period in 1993 or 1994. White cells represent nontreated fathers.

Nature of the experimental design, by year and age of the child. Darkly shaded cells represent fathers treated by the reform after the phase-in period, lightly shaded cells represent fathers treated by the reform during the phase-in period, and white cells represent nontreated fathers. Numbers in each cell refer to number of weeks of parental leave with 100 % coverage

Other Work-Family Reforms

In addition to the paternity-leave quota, Norway implemented several work- and family-related policies during our period of study. These policies may have affected mothers’ and fathers’ long-term involvement. In particular, there was a large extension in paid parental leave between 1986 and 1993. In 1986, Norwegian parents were granted 18 weeks of paid parental leave, which was extended to 35 weeks in 1992 and to 42 weeks in 1993. Figure 2 shows how many weeks of paid parental leave parents of different age cohorts were granted. Each cell represents parents of children of a given age in a given year, and parents of a given cohort of children can be followed diagonally in the figure.

Figure 2 shows that in addition to the four weeks designated for the father, general parental-leave rights increased by three weeks in 1993. These additional three weeks were mostly taken fully by the mother; as noted earlier, among the fathers taking leave after 1993, only 10 % took more than the designated four weeks. Although fathers’ direct use of this general parental-leave extension was small, fathers may be indirectly affected through mothers’ leave usage (as discussed later in the article). Moreover, if mothers took unpaid leave prior to 1993, there would be a positive effect on family income, making it possible for the father to devote more time to home production. Given that this is not a permanent income shock, however, we should not expect any long-term effect on fathers’ labor force participation. Moreover, if there are any long-term effects of such a nonpermanent income shock, we would expect to find similar long-term effects of prior extensions of parental leave on fathers’ labor force participation. This will be investigated in our data analysis.

In addition to the extensions in paid parental leave, both parents in 1995 became entitled to job protection during one additional year of unpaid leave. In line with paternity leave prior to 1993, few fathers took advantage of this right.Footnote 4 Moreover, in 1998, a cash-for-care subsidy was introduced for families with 1- or 2-year-olds that did not use governmentally subsidized daycare. The cash-for-care subsidy was a tax-free transfer, and at the time it was introduced, it was equivalent to NOK 3,000, which in 1998 amounted to approximately $400 per month. Nearly 80 % of all families with a 1-year-old or 2-year-old received the subsidy. The cash-for-care subsidy decreased eligible mothers’ labor force participation by 5–6 percentage points but had no effect on fathers’ labor force participation (Drange 2012; Schøne 2004).

In summary, even with Norway’s several implemented work- and family-related policies in addition to the paternity-leave quota, fathers’ direct use of these reforms has been negligible. Notably, however, if any of these reforms decreased mothers’ future labor supply, then this may have indirectly motivated fathers to increase their labor supply because they needed to compensate for the family’s income loss or because they are less needed in household production (Becker 1985). In this way, mothers’ use of extended leave rights may have had a negative impact on father involvement. Consequently, our empirical analyses will investigate whether our estimated effect of the paternity-leave quota is biased by these other policy reforms’ effects on mothers’ labor force participation.

Data and Sample Description

Our empirical analysis uses a combination of several official Norwegian registers, prepared and provided by Statistics Norway. The data set contains records for every Norwegian from 1992 to 2002. The variables include individual demographic information (gender, age, marital status, number of children, children’s birth dates), socioeconomic data (years of education and earnings, municipality of residence), and current employment status (full-time, part-time, minor part-time, self-employed).Footnote 5

We restrict our sample to all fathers whose youngest child was between 1 and 8 years old during the years 1992 to 2000. Constructing our sample based on the age of the youngest child is important because fathers of children born prior to the introduction of the paternity-leave quota may still be treated if they were on paternity leave with a younger child. The purpose of the remaining sample restrictions is to exclude fathers who are not eligible for paternity leave because of a weak attachment to the labor force. First, we limit our sample to fathers who are currently employed full-time.Footnote 6 Our definition of full-time employment allows for considerable variation in working hours. According to the most recent data on men’s labor force participation, of all men working full-time, 10 % work 30–36 hours per week, 75 % work 37–43 hours per week, and 15 % work more than 43 hours per week (Statistics Norway 2010).

Second, because students have a weak attachment to the labor force, we restrict the sample to couples in which both parents were older than 25 when the child was born. This restriction is important because the father’s entitlement to the paternity-leave quota was contingent on the father’s and his spouse’s being occupationally active at least 6 of the 10 months prior to birth. We restrict the sample on the basis of age because we cannot observe student status in our data. Third, we limit our sample to individuals born in Norway to Norwegian-born parents because immigrants generally have substantially weaker labor force attachment (Olsen 2008) and thus are less likely to be entitled to parental leave. Ideally, we would exclude separated couples, since fathers not living with the child’s mother are exempt from the paternity-leave quota. However, marital status is potentially endogenous to the reform, and we do not observe marital status prior to 1992. Among the fathers in our sample, 91 % are living with the child’s mother.

Notably, the full-time employment sample restriction may be endogenous if the reform had an impact on the fathers’ decisions to be employed full-time. We carefully investigate such possible endogeneities in our data analyses. Clearly, the best solution would have been to limit our sample to fathers who were employed full-time at the time of the child’s birth. However, given that we do not observe employment status prior to 1992, we are restricted to using current employment status instead.

The sample selection criteria leave us with a total of 1,126,643 observations for 261,298 fathers of 327,820 children. Our sample contains several earnings observations for each father. For example, a father with a 6-year-old child in 1992 will have a 7-year-old child in 1993 and an 8-year-old child in 1994. Consequently, we will observe his earnings in 1992–1994. (See Fig. 2; a father is followed diagonally.) After 1994, his child is too old to be included in the sample, and we do not observe his earnings. However, if this father has a new child in 1995, he will again enter our sample with a 1-year-old in 1996, a 2-year-old in 1997, and so on. Consequently, we will observe earnings for this father in all years except 1995. We use Stata cluster analysis to correct for multiple observations for each father.

Our data allow us to construct several variables capturing important characteristics of the child, father, and mother. Similarly to employment status, we do not observe prebirth characteristics for fathers of children born prior to 1993; consequently, we construct our covariates from current characteristics, observed in the same year that we observe outcome. We therefore limit covariates to characteristics that are most likely exogenous to the reform. Moreover, our empirical analyses assure that our results are robust to the inclusion and exclusion of different covariates.

In addition to year fixed effects, our analysis uses two sets of covariates:Footnote 7

-

Youngest Child’s Characteristics: number of older siblings (0, 1 . . . 6, >6), child’s age (1, 2 . . . 8), child’s gender, and birth month (1, 2 . . . 12).

-

Father’s and Mother’s Characteristics: age at birth of youngest child (linear and quadratic), age at birth of first child (linear and quadratic), and educational level (high school not completed, high school diploma, university degree).Footnote 8

Summary statistics of all observations of fathers in our sample are presented in Table 1. Fathers in our sample were, on average, age 34 when the child was born. About 9 % of the fathers in our sample had not completed high school, and 32 % had a university degree. The fathers had, on average, 2.3 children.

In Table 2, we present cohort-specific summary statistics for fathers of all children in our sample. In panel A, characteristics are measured one year prior to the child’s birth; in panel B, characteristics are measured when the child is 3 years old. Because we do not observe pre-birth characteristics for fathers of children born prior to 1993, data prior to birth are not included in our analyses but are displayed here for the sake of comparison. In both panels, each father is observed only once for each child. Some cells have missing numbers because data are not available. We cannot observe any discontinuity in characteristics occurring for fathers of the cohort born in 1995, the first fully treated cohort. Neither can we observe any discontinuity in fathers’ earnings measured when the child is 3 years old.

Empirical Strategy

We identify the effect on earnings of being on paternity leave by exploiting variation in exposure across fathers over time and the youngest child’s age in a DD approach. More specifically, we look at the difference in earnings in a given year between treated and nontreated fathers. However, nontreated and treated fathers in a given year have children of different ages, which alone is likely to have an impact on earnings. To control for an effect of child’s age, we compare the earnings difference with a corresponding earnings difference in a year prior to the introduction of the paternity-leave quota. The deviation between these two differences is attributed to the paternity-leave quota. The identifying assumption is that absent the reform, time trends in earnings would be similar for fathers of children of various ages.

To provide a direct test of our identifying assumption and to illustrate that our effect estimates are robust to choice of treatment and comparison group, we estimate variation in earnings for all fathers in our sample during the whole period based on the DD approach described earlier: we estimate the incremental effect on earnings of being a father of a child of a certain age in a specific year (i.e., being a father in a specific cell in Fig. 2), compared with a common reference group, when time and age trends are controlled for by the inclusion of year and age fixed effects. The reference group is age 7–8 in 1992, which is the first year of observations in our data set. Moreover, children aged 7–8 are nontreated during the entire period that we observe the individuals.Footnote 9

Our DD estimates take the following form:

where y = 1993, 1994 . . . 2000; a = 1, 2 . . . 6. The term (I a,y − I 7 − 8,y ) measures in a given year, y, the difference in earnings of fathers of children aged 7–8 and children aged a. The term (I a,1992 − I 7 − 8,1992) measures the corresponding difference, measured in 1992. If treated fathers earn less (more) than nontreated fathers, then our DD estimates (η ay ) for fathers of children born after the reform will be negative (positive).

To estimate the DD coefficients (η ay ) we specify the following regression:

where I iay denotes log earnings for father i of a (youngest) child aged a (a =1, 2 . . . 6) in year y (y = 1993, 1994 . . . 2000). Y y and A a are vectors with year and age dummy variables, where γ y and δ a capture year and age fixed effects. X iy is a vector of father, mother, and child characteristics described in the previous section.

The coefficients of interest in Eq. (2) are captured by the matrix η ay , which measures the incremental change in earnings for fathers of children of a given age, a, in a given year, y, compared with fathers of children aged 7–8 in 1992. Importantly, if the paternity-leave quota had a negative effect on fathers’ earnings, we should be able to identify a pattern associated with treated or nontreated fathers in the estimates of η ay . This pattern should look similar to the stepwise pattern illustrated in Fig. 2. We should see significant negative coefficients for each η ay that corresponds to treated cells (darkly shaded cells in Fig. 2). Moreover, coefficients for each η ay that corresponds to nontreated cells should not be significantly different from zero (cells with no shading in Fig. 2). Significant coefficients in the nontreated cells would be a violation of our identifying assumption: namely, that time trends in earnings are similar for fathers of children of various ages absent the reform. As such, our empirical approach provides a direct test for the validity of our identifying assumption.

There are several reasons for why we should be concerned that time trends in earnings differ across fathers of children of various ages. For example, Bianchi et al. (2007) carefully documented a general trend toward more child-rearing for fathers in the United States. If such trends in fathers’ child-rearing are different for fathers with children of different ages, this could be a violation of our identifying assumption. A decrease in earnings may then have causes other than the paternity-leave quota, such as the development of social norms for fathers being more involved in their children’s lives. As discussed earlier, the estimates in the nontreated cells in the matrix provide some evidence for the validity of the identifying assumption. However, this matrix includes only a few pre-reform cohorts. In a robustness analysis, we extend the analysis six years back to investigate whether underlying trends seem to affect pre-reform fathers. We should not see the distinct step-wise pattern appear until the cohort born in 1995, which is fully treated.

Even if the estimated coefficients in the nontreated cells in our main analysis and in the robustness test are insignificant, our research design may still generate biased estimates if there are unobservable changes in characteristics that are discontinuous, are child cohort–specific, and occur at the time of implementation of the paternity-leave quota and have an effect on earnings. One possible concern, for example, is that the reform induced couples to have children at a younger age—a possibility in line with studies showing that family policies affect fertility patterns (see Gauthier (2007) for a review). If so, then the decrease in earnings among treated fathers may result simply from the younger age of our treated fathers. The richness of our data allows us to investigate such possible sources of bias in several specification analyses.

Because not all fathers took advantage of paternity leave, the treatment is only intentional (ITT). To capture the effect on fathers who are actually taking paternity leave, we calculate the treatment of the treated (TOT) estimates:

where η TOT ay is the TOT effect for fathers of children aged a in year y, η ay is our ITT from (Eq. 2), and υ y − a is the uptake rate for fathers of children born in year y – a.Footnote 10 The TOT estimate rests on the assumption that the paternity-leave quota does not affect earnings of fathers not taking paternity leave. For example, if the reform had an impact on general norms for paternal involvement, this assumption is violated.

An alternative approach to our DD strategy could be to use the discontinuity around the introduction of the paternity-leave quota on April 1 in a regression discontinuity (RD) approach, as Cools et al. (2011) did. The advantage of the RD approach is that it does not rely on the assumption that time trends in earnings are identical across fathers of children of various ages. The disadvantage, however, is that the relatively few fathers actually taking leave immediately after April 1 represent a selected sample of fathers, potentially those who are already the most involved in their children’s lives. As discussed earlier, the uptake of the paternity-leave quota increased from 30 % in 1993 to 59 % in 1995. Our DD approach focuses on the effect of paternity leave after the phase-in-period, when uptake is at least 59 %. In our results, we will indeed see no persisting long-term effects of the paternity-leave quota on the earnings of fathers of the 1993 and 1994 cohorts (treated in the phase-in period).

Results

Main Results

Table 3 presents ordinary least squares (OLS) estimates of the DD coefficients (η ay ). Standard errors (in parentheses) are corrected for heteroskedasticity and nonindependence of residuals across fathers’ earnings observed at different points in time, using the “robust cluster (.)” option in Stata. Year and age fixed effects, as well as relevant control variables for parents and child, are included in the model.

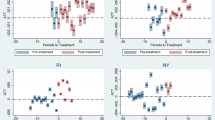

The table reveals a stepwise pattern in incremental effects on log earnings for treated fathers consistent with the shading in Fig. 2. In particular, the DD coefficients of children born after 1994 (treated children) are significant and negative in all years and for all ages of the child. The DD coefficients for fathers of children born in 1993 or 1994 (treated during phase-in period) are negative but are small and are significant only when the child is aged 1–3, which corresponds well with the phase-in period of the uptake documented in Fig. 1. Apart from 2-year-olds in 1994, the DD coefficients are small and not significantly different from zero for children born prior to 1993. This finding is consistent with our identifying assumption that time trends in earnings are similar for fathers of children of various ages absent the reform.

In Fig. 3, we present the estimated treatment effects from Table 3 graphically. The figure plots the treatment effects on earnings (vertical axis) for different age levels. The horizontal axis denotes the child cohort. For the fully treated cohorts (from 1995), we can see negative effects for all ages. Moreover, for the nontreated cohorts (prior to 1992), no systematic effects seem to be present.

Graphical illustration of treatment effects on earnings, by child’s age and cohort (from Table 3). The figure plots the treatment effects on earnings (vertical axis) for different age levels

As noted earlier, 95 % of all fathers who exercised their right to paternity leave took leave in conjunction with the mothers’ leave during the child’s first year of life—that is, either during the year the baby was born or the year the baby turned 1 year old. As such, the estimated treatment effect on fathers of 1-year-olds (first row in Table 3) can be partly explained by less than 100 % earnings compensation when being on leave.Footnote 11 The focus in this article is the estimated treatment effects on fathers of children older than age 1 (second through sixth row in Table 3), which reflects treatment effects of the paternity-leave quota on future earnings. We can see that for a father of a given cohort, the treatment effect decreases somewhat as the child becomes older—that is, diagonally in the matrix—but is still significant when the child is 5 years old. Larger incremental earnings drop for fathers of younger cohorts can be explained largely by the increase in uptake of the reform. Adjusting for this, the earnings drop remains fairly stable across cohorts.

Specification Analyses

The validity of our identifying assumption is supported by the fact that we do not observe significant DD effects on earnings prior to the reform in Table 3. However, this matrix provides limited evidence on pre-reform trends because it includes only a few pre-reform cohorts. In Table 4, we extend the analysis six years back in time. The structure of the regression we run in Table 4 is identical to Table 3, with some few exceptions because of data limitations: for the period 1986–1991, we have only earnings data and therefore cannot include any control variables in the regression. Moreover, instead of restricting the sample to fathers working full-time, we restrict the sample to fathers with earnings above a certain threshold, below which full-time employment can be ruled out. This threshold is defined as four times the annually adjusted basic amount in the Norwegian pension system (which is equivalent to NOK 337,000 and $58,000 in 2013).

Table 4 shows that time trends in earnings for fathers of children of various ages were similar until the introduction of the paternity-leave quota, supporting the validity of our identifying assumption. The stepwise pattern in earnings effects for the treated and those treated in the phase-in period is similar as in Table 3. The effects are somewhat smaller (and insignificant for the 1995 cohort) in Table 4, likely because we are unable to restrict the sample to fathers who are the most likely to be eligible for the paternity-leave quota when we observe only earnings.

Specifically, a concern with our empirical strategy is that our estimate may be biased by several extensions in the parental leave legislation during our period of study, as discussed earlier. In particular, general parental leave increased by three weeks in 1993, in addition to the four weeks designated to the father (see Fig. 2). Table 4 provides no evidence that fathers are responding to the gradual extensions from 18 to 35 weeks of parental leave prior to 1993. If fathers responded, we should have seen significant estimates for some cohorts born prior to 1993 in Table 4. In contrast, time trends in earnings are similar for fathers of these cohorts. Moreover, the general parental-leave extensions prior to the introduction of the paternity-leave quota also did not have a negative short-term effect on father’s earnings: none of the estimates for 1-year-olds in the period 1987–1992 are negative and significant. We conclude that our estimates do not seem to be biased by the general parental leave extensions. In particular, a response to the 1993 extension in general leave rights seems unlikely because fathers’ earnings have not been affected by general extensions in parental leave rights prior to 1993.

Earlier we noted that the introduction of a cash-for-care subsidy in 1998 had a substantial impact on mothers’ but no effect on fathers’ labor supply. Consistent with Drange (2012), Table 4 suggests that the cash-for-care subsidy had no effect on fathers’ labor force participation. If the subsidy had an effect, we would expect to see a change in the DD coefficients for the fathers of 1-year-old and 2-year-old children starting in 1998.

Even if Table 4 provides evidence that pre-reform trends in earnings are similar for fathers of children of various ages, our estimates may still be biased by changes in characteristics that are discontinuous, are child cohort–specific, and occurred at the time of implementation of the paternity-leave quota and had an effect on earnings. In the following discussion, we investigate such possible sources of bias by exploring how our estimates are sensitive to the inclusion of different covariates and different sample restrictions.

We conduct our specification analyses by collapsing all treatment variables of fathers of children born after 1994 (after the phase-in period) to one treatment variable, and all the treatment variables of fathers of children born in 1993 and 1994 (during the phase-in period) to one phase-in-treatment variable. The comparison group consists of fathers of children born before the paternity-leave quota was introduced in 1993. Observations of fathers of 1-year-old children are excluded from the analysis because any treatment effect on these fathers can be partly explained by less than 100 % earnings compensation when being on leave. Figure 2 illustrates the nature of the experiment: darkly shaded cells are collapsed to form the treatment group, and white cells are collapsed to form the comparison group. Lightly shaded cells represent those treated during the phase-in period. All observations from the first row have been dropped.

The results are reported in Table 5. All models include year and age fixed effects. Models 1–5 add covariates stepwise for characteristics of the child, mother, and father as well as municipality fixed effects. We can see that the additional covariates increase the explanatory power of our model (adjusted R 2). However, the treatment estimates remain at around 1.3 % across the different model specifications, suggesting that the treatment effect is not biased by any cohort specific and discontinuous changes in observable characteristics. The corresponding TOT estimate, resting on the assumption that the treatment effect is generated only by fathers actually taking leave, ranges from 2.0 % to 2.2 %. Fathers treated in the phase-in period face, on average, a 0.5 % decrease in earnings.

Models 6 and 7 investigate how the treatment estimate is affected by different sample restrictions. In Model 6, we relax the age restriction that both parents should be older than 25 when the child was born. When including all parents older than 21, the estimated treatment effect drops to 1.0 %. In Model 7, we can see that when we tighten the age restriction to parents who were older than 27 when the child was born, the estimated treatment effect increases to 1.7 %.

One possible concern is that the paternity-leave quota affected fertility. In particular, if the reform increases father involvement, this may motivate couples to have another child that they otherwise would not have had. This, in turn, could have an impact on our estimates of treatment effects because a selected sample of fathers of older children will exit our sample and enter with a younger child. We address this concern in Model 8 by restricting our sample to fathers of one child. The estimated treatment effect remains basically the same. Ideally, we would investigate effects on fertility utilizing a similar framework as in our main analysis investigating effects on fathers’ earnings. However, our DD approach rests on the assumption that trends in the outcome variable are similar for fathers of children of various ages, which does not hold for trends in fertility.

We have limited our sample to full-time employed fathers. As discussed earlier, this restriction is problematic if the reform had an impact on the fathers’ decision to be employed full-time. We investigate this assertion in Table 6. In this table, we drop the sample restriction of full-time employment, and the dependent variable is a dummy variable indicating whether the father is full-time employed. Apart from these changes, Models 1 and 2 correspond to Models 1 and 4, respectively, in Table 5. We can see in both specifications a small and insignificant relationship between the treatment variables and full-time employment.Footnote 12 This is consistent with the hypothesis that the reform did not have an effect on the fathers’ decision to be full-time employed.

We also investigate whether the paternity-leave quota affected mothers’ labor market participation.Footnote 13 The analysis is designed in accordance with the analysis reported in Table 3. The DD coefficients of this analysis (available from authors on request) do not show a stepwise pattern that corresponds to the changes in fathers’ earnings reported in Table 3. We can see a strong decrease in labor supply for mothers of 1-year-olds in 1995, most likely because of the extended job protection implemented the same year. As expected, the table also shows that the cash-for-care subsidy implemented in 1998 decreased the labor supply of women with 1-year-olds (from 1998) and 2-year-olds (from 1999). However, the table does not show that the paternity-leave quota affected mothers’ labor supply.

Subsample Analyses: Father’s Education Level

In Table 7, we investigate the variation in responses to the paternity-leave quota across different levels of education. We use the same collapsed-form specification as Model 4 in Table 5. Comparing across Models 1–3 in Table 7, we can see that the negative response in earnings is significantly larger for fathers with no college degree compared with fathers with a college degree.Footnote 14 Moreover, the effect for university graduates is not statistically significant.

Because uptake rates vary between subgroups, we also report the corresponding TOT estimates, resting on the assumption that the treatment effect is generated only by fathers who actually took leave. Adjusting for relevant uptake rates amplifies the differences and gives us a TOT effect of a 3.3 % drop in earnings for fathers who have not completed high school, compared with 2.7 % for high school graduates and 1.1 % for university graduates. Some studies suggest that less-educated fathers are less involved with their children (Yeung et al. 2001), and our findings may reflect that the paternity-leave quota has a stronger effect on the group where the potential increase in involvement is largest. Alternatively, our findings may reflect that highly educated fathers have a higher opportunity cost of spending more time at home and are consequently less responsive to the paternity-leave quota. Empirical findings on the association between education level and father involvement are inconclusive (see, e.g., Yeung et al. (2001) for an overview of the literature).

Conclusion

In this article, we investigate the effects of paternity leave on fathers’ future earnings. We use variation in exposure to the nontransferable paternity-leave quota of the parental leave as a source of exogenous variation in leave-taking. Our analysis suggests that the paternity-leave quota had a significant negative effect on fathers’ earnings. The effect persists up until our last point of observation when the child is 5 years old. The incremental effects on earnings for treated fathers lie in the range of 1 % to 3 %, suggesting that fathers, on average, earn 1 % to 3 % less as a direct consequence of the paternity-leave quota. Assuming that the treatment effect is generated only by fathers who took leave, adjusting the ITT estimate for relevant uptake rates gives a TOT effect on earnings ranging from 1.8 % to 4.5 %. As a comparison, estimated effects on earnings of an additional year of education normally range from 5 % to 10 % (see Cahuc and Zylberberg (2004) for an overview of empirical findings).

The drop in earnings is consistent with increased father involvement, as fathers shift time and effort from market to home production. However, we cannot rule out other reasons for why the quota affects fathers’ future earnings. For example, taking paternity leave may serve as a signal of being more family-oriented than career-oriented. Employers may consider such employees as being less devoted and less reliable, and thus may be less likely to offer them promotions and pay raises. This signaling story does not seem plausible, however, because the uptake of the reform was very high within a few years. Alternatively, the quota may affect fathers’ future earnings because paternity leave reduces the accumulation of work experience and work-related human capital. However, it is hard to imagine that four weeks of forgone human-capital accumulation can have an impact on earnings four years later.

Interestingly, we do not find any effect of the paternity-leave quota on mothers’ labor supply. One implication of Beckers’ theory of household specialization is that a father’s greater contribution to home production and reduced contribution to market production decreases the need for mother’s time at home and increases the need for her time at work. We do not see such a despecialization in the family. Instead, it seems likely that paternity-leave quota leads to an increase in overall home production.

Increasing empirical evidence suggests that the involvement of a father in his children’s lives is important for the children’s cognitive and socioemotional outcomes (see, e.g., Lamb (2010) and Tamis-LeMonda and Cabrera (2002)). This article provides suggestive evidence that paternity leave may increase father involvement, particularly for fathers with low education. An important question for future research is how paternity leave affects the children. Several studies suggest that family income is important for child development (Carneiro et al. 2011; Dahl and Lochner 2012; Duncan et al. 2010; Yeung et al. 2002). As such, it is not clear whether paternity leave is positive for children, even if the leave leads to increased father involvement. Perhaps the negative effect of reduced family earnings outweighs the benefit of increased father involvement. This may especially be the case for children of fathers with low educational levels, for whom we found a particularly strong effect of paternity leave on earnings. One study links paternity leave and child outcomes: Cools et al. (2011), studying the same reform as we do in this article, found that paternity leave has no significant effect on children’s school performance at grade 10. However, in some specifications, they found positive and significant effects on children in families in which the father has a higher educational level than the mother. One reason for the imprecise estimates may be the narrow time frame; the analysis focuses on the differences between fathers with children born a few weeks prior to and a few weeks after the introduction of the paternity-leave quota. The relatively few fathers taking paternity leave immediately after the reform was implemented may represent a selected sample of fathers, potentially those who were already most involved in their children. The DD approach presented in our article focuses on the effect of paternity leave on fathers when uptake is well above 50 %. Within a few years, all the children of these fathers will have graduated from compulsory school. Then we can use a similar DD approach, as presented in this article, to study the effect of parental leave on child outcomes.

Notes

Alternatively, parents could take 52 weeks of parental leave at 80 % pay. The government does not compensate for earnings above 6 times the annually adjusted basic amount in the Norwegian pension system (around NOK 505,000 and $87,000 in 2013). Around 17 % of all women (48 % of men) older than 17 earn more than this earnings ceiling. However, most employers (private and public) compensate for earnings above this ceiling.

After 2000, a father’s income compensation was reduced only if the mother worked less than 75 % of full-time prior to birth. Since 2005, a father’s income compensation has been independent of how much the mother worked prior to birth, but it has been contingent on the mother being occupationally active while he is on leave.

Numbers were obtained from the Norwegian Labour and Welfare Administration.

Only 5 % of fathers of children born in 2007 exercised their right to unpaid leave. The majority of these (54 %) were on unpaid leave for two weeks or less (Grambo and Myklebø 2009). Corresponding numbers for 1995–2000 are not available.

We have earnings records for the period 1967–2008. Notably, we do not have information on hourly wage or number of hours worked. Data on hours worked is available only from the Labor Force Survey, which provides information about children for women only.

A worker is recorded as full-time employed if he is registered as full-time employed (at least 30 hours work per week) at the end of the year and had earnings greater than an indexed minimum of two times the basic amount in the Norwegian pensions system (about NOK 168,000 and $29,000 in 2013). We add the earnings restriction because firms are often late in reporting changes in employment status after a work spell has ended.

Parenthetical documentation on any control variable indicates the ranges of the series of categorical variables, which characterize the specific trait.

Educational level is potentially endogenous to the reform. However, less than 1 % of the fathers in our sample attained a higher education during our period of study.

An exception is fathers of 7-year-olds in 2000. These children were born in 1993, and the fathers are consequently partly treated. This may raise some scepticism about the 2000 estimates. However, we see no effect on this cohort prior to year 2000. (See the results in Table 3.) Consequently, we consider it unproblematic to use children aged 7–8 as the reference group for the year 2000 estimates. Furthermore, a specification test (not reported here) in which only 8-year-olds constitute the comparison group, produces similar but less precise results.

The TOT estimates are somewhat underestimated because there was also a certain uptake of paternity leave in the comparison group. Unfortunately, we cannot adjust for this because we have no individual-level data on the use of parental leave prior to 1992. However, the uptake was very low prior to the reform—at less than 3 % for the full population of fathers. As such, adjusting for the fact that about 3 % of fathers were also taking leave prior to the reform would not change our results substantially.

See footnote 1.

Analyzing this relationship within the same research design as Table 3, we find no pattern in the probability of being employed full-time that could be related to the introduction of the paternity-leave quota (data not reported).

Because many mothers do not work or they work part-time, marginal changes in mothers’ earnings are not good measures of mothers’ labor market responses. Instead, we investigate how the reform affected the mothers’ likelihood of working. Our analytical sample is the spouses of the fathers in our main analysis. A mother is coded as employed in a given year if she is registered at year-end as employed with at least 20 hours of work per week.

Using the suest command in Stata, we find that the treatment effect for college graduates is significantly different from the treatment effect for high school graduates (at the 5 % level) and for high school drop-outs (at the 10 % level).

References

Baker, M., & Milligan, K. (2008a). How does job-protected maternity leave affect mothers’ employment? Journal of Labor Economics, 26, 655–691.

Baker, M., & Milligan, K. (2008b). Maternal employment, breastfeeding, and health: Evidence from the maternity leave mandates. Journal of Health Economics, 27, 871–887.

Baker, M., & Milligan, K. (2010). Evidence from maternity leave expansions of the impact of maternal care on early child development. Journal of Human Resources, 45, 1–32.

Becker, G. (1985). Human capital, effort, and the sexual division of labor. Journal of Labor Economics, 3, S33–S58.

Bianchi, S. M., Robinson, J. P., & Milkie, M. A. (2007). Changing rhythms of American family life. New York: Russell Sage Foundation.

Cahuc, P., & Zylberberg, A. (2004). Labour economics. Cambridge, MA: MIT Press.

Carneiro, P., Løken, K., & Salvanes, K. G. (2011). A flying start? Maternity leave benefits and long run outcomes of children (IZA Discussion Paper No. 5793). Bonn, Germany: Institute for the Study of Labor.

Cools, S., Fiva, J., & Kirkebøen, L. (2011). Causal effects of paternity leave on children and parents (Discussion Papers No. 657). Oslo: Statistics Norway.

Dahl, G., & Lochner, L. (2012). The impact of family income on child achievement: Evidence from changes in the Earned Income Tax Credit. American Economic Review, 102, 1927–1956.

Drange, N. (2012). Crowding out of dad? Labor supply responses of the cash for care subsidy. Unpublished manuscript, Research Department, Statistics Norway, Oslo.

Duncan, G., Ziol-Guest, K. M., & Kalil, A. (2010). Early-childhood poverty and adult attainment, behavior and health. Child Development, 81, 306–325.

Dustmann, C., & Schönberg, U. (2012). Expansions in leave coverage on children’s long-term outcomes. American Economic Journal: Applied Economics, 4, 190–224.

Ekberg, J., Eriksson, R., & Friebel, G. (2013). Parental leave—A policy evaluation of the Swedish “Daddy-Month” reform. Journal of Public Economics, 97, 131–143.

Gauthier, A. H. (2007). The impact of family policies on fertility in industrialized countries: A review of the literature. Population Research and Policy Review, 26, 323–346.

Grambo, A. C., & Myklebø, S. (2009). Moderne familier—Tradisjonelle valg [Modern families—Traditional choices] (Report 2/2009). Oslo: The Norwegian Labour and Welfare Administration.

Haas, L., & Hwang, P. (2008). The impact of taking parental leave on fathers’ participation in childcare and relationships with children: Lessons from Sweden. Community, Work and Family, 11, 85–104.

Han, W., Ruhm, C., & Waldfogel, J. (2009). Parental leave policies and parents’ employment and leave taking. Journal of Policy Analysis and Management, 28, 29–54.

Johansson, E.-A. (2010). The effect of own and spousal parental leave on earnings (IFAU Working Paper 2010:4). Uppsala, Sweden: Institute for Evaluation of Labour Market and Education Policy.

Kluve, J., & Tamm, M. (2013). Parental leave regulations, mothers’ labor force attachment and fathers’ childcare involvement: Evidence from a natural experiment. Journal of Population Economics, 26, 983–1005.

Kotsadam, A., & Finseraas, H. (2011). The State intervenes in the battle of the sexes: Causal effects of paternity leave. Social Science Research, 40, 1611–1622.

Lalive, R., & Zweimüller, J. (2009). How does parental leave affect fertility and return to work? Evidence from two natural experiments. Quarterly Journal of Economics, 124, 1363–1402.

Lamb, M. E. (2010). The role of father in child development. Hoboken, NJ: Wiley.

Nepomnyaschy, L., & Waldfogel, J. (2007). Paternity leave and fathers’ involvement with their young children. Community, Work and Family, 10, 427–453.

Olsen, B. (2008). Innvandrerungdom og etterkommere i arbeid og utdanning [Work and education among immigrant youths and their descendants] (Report 2008/33). Oslo: Statistics Norway.

Ruhm, C. J. (1998). The economic consequences of parental leave mandates: Lessons from Europe. Quarterly Journal of Economics, 113, 285–317.

Ruhm, C. J. (2004). Parental employment and child cognitive development. Journal of Human Resources, 39, 155–192.

Schönberg, U., & Ludsteck, J. (Forthcoming). Expansions in maternity leave coverage and mothers’ labor market outcomes after childbirth. Journal of Labor Economics.

Schøne, P. (2004). Labour supply effects of a cash-for-care subsidy. Journal of Population Economics, 17, 703–727.

Statistics Norway. (2010). Labour Force Survey. Oslo: Statistics Norway.

Tamis-LeMonda, C. S., & Cabrera, N. (2002). Handbook of father involvement: Multidisciplinary perspectives. Mahwah, NJ: Erlbaum.

Tanaka, S., & Waldfogel, J. (2007). Effects of parental leave and work hours on fathers’ involvement with their babies. Community, Work and Family, 10, 409–426.

Yeung, J. W., Linver, M. R., & Brooks-Gunn, J. (2002). How money matters for young children’s development: Parental investment and family processes. Child Development, 73, 1861–1879.

Yeung, J. W., Sanberg, J. F., Davis-Kean, P. E., & Hofferth, S. L. (2001). Children’s time with fathers in intact families. Journal of Marriage and the Family, 63, 136–154.

Acknowledgments

The authors are grateful to Eric Bettinger, Nina Drange, Jon Fiva, Venke F. Haaland, Ariel Kalil, Magne Mogstad, Kjetil Telle, Mark Votruba, participants at the 2009 University of Stavanger Workshop “Economics of the Family and Child Development,” the 2010 Harris School/University of Chicago Workshop “Social Policy and Family Influence on Children,” the 2010 Max Planck Institute workshop on Taxation, seminar participants at the University of Bergen and the Norwegian School of Business Administration, and conference participants at the EEA 2009 and EALE 2009 for helpful comments. Financial support from the Norwegian Research Council (194347) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

About this article

Cite this article

Rege, M., Solli, I.F. The Impact of Paternity Leave on Fathers’ Future Earnings. Demography 50, 2255–2277 (2013). https://doi.org/10.1007/s13524-013-0233-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13524-013-0233-1