Abstract

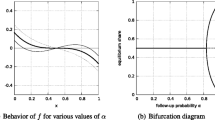

Following A Model of Sales by Varian (Am. Econ. Rev. 70(4):651–659, 1980) I study a model, in which shops compete for two different types of customer, informed and uninformed. I show that under these assumptions price cycles can occur and also show that these cycles are attracting. It turns out that these cycles do not have to correspond with the best response cycle for the game. But as simulations for higher dimensions suggest the occurring cycle is always unique.

Similar content being viewed by others

References

Benaïm M, Hofbauer J, Hopkins E (2009) Learning in games with unstable equilibria. J Econ Theory 144:1694–1709

Burdett K, Judd KL (1983) Equilibrium price dispersion. Econometrica 51:955–969

Cason TN, Friedman D (2003) Buyer search and price dispersion: a laboratory study. J Econ Theory 112:232–260

Cason TN, Friedman D, Hopkins E (2010) Testing the TASP: an experimental investigation of learning in games with unstable equilibria. J Econ Theory 145:2309–2331

Doyle J, Muehlegger E, Samphantharak K (2010) Edgeworth cycles revisited. Energy Econ 32:651–660

Edgeworth FY (1925) The pure theory of monopoly. Pap Relat Polit Econ 1:111–142

Hahn M (2009) Shapley polygons. PhD thesis, University College London

Hahn M (2010) Shapley polygons in 4×4 games. Games 1(3):189–220

Hofbauer J, Sigmund K (1998) Evolutionary games and population dynamics. Cambridge University Press, Cambridge

Hopkins E, Seymour RM (2002) The stability of price dispersion under seller and consumer learning. Int Econ Rev 43(4):1157–1190

Horn R, Johnson C (1985) Matrix analysis. Cambridge University Press, Cambridge

Lahkar R (2007) Essays in evolutionary game theory. PhD thesis, University of Wisconsin-Madison

Lahkar R (2011) The dynamic instability of dispersed price equilibria. J Econ Theory. doi:10.1016/j.jet.2011.05.014

Matsui A (1992) Best response dynamics and socially stable strategies. J Econ Theory 57(2):343–362

Maynard Smith J, Brown RLW (1986) Competition and body size. Theor Popul Biol 30:166–179

Noel MD (2007) Edgeworth price cycles, cost-based pricing, and sticky pricing in retail gasoline markets. Rev Econ Stat 89(2):324–334

Salop S, Stiglitz JE (1977) Bargains and ripoffs: a model of monopolistically competitive price dispersion. Rev Econ Stud 44(3):493–510

Varian HR (1980) A model of sales. Am Econ Rev 70(4):651–659

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hahn, M. An Evolutionary Analysis of Varian’s Model of Sales. Dyn Games Appl 2, 71–96 (2012). https://doi.org/10.1007/s13235-011-0031-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-011-0031-6