Abstract

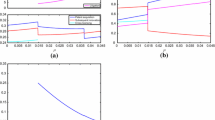

This article examines the coordination of inventor, trader, and innovator decisions through a market in contracts on patents with prices, focusing on the willingness to search (WTS) for new and uncertain patentable technology, using a controlled laboratory experiment. Typically an implicit hierarchical approach, i.e., coordinating inventor and innovator decisions in a single firm, is assumed or used in analyzing these relationships, in particular in Arrow (1962) where allocation of resources for invention is discussed under neoclassical conditions of perfect information and competitive commodity (not technology) markets. Schumpeter also assumes a hierarchy as coordinating mechanism, as entrepreneurial firms disrupt incumbents (1934) or intrapreneurs create disruptive product and service innovations within firms ( 1942) treating technology as an exogenous force. In this analysis, coordination takes place between specialized agents through a design market based on the principles and practices of real world patent systems. WTS is compared between three institutional designs with different demand side bidding language, in environments with “weak” and “strong” patents in a 3 × 2 design. Technology “tastes” is here a learning process through prices (“price signals”) and can be altered (discovered) by the inventor agent within a searchable area. The results indicate that WTS appears more sensitive to mechanisms (institutional design) than patent validity (environment) in this dynamic economic system. This main finding thus suggests that policy efforts ought to be placed on institutional mechanisms together with environment such as enforcement, where the mechanisms with richer demand-side bidding language appear to matter more than enforcement in explaining WTS, i.e., risk taking. Regarding economic performance, patent validity was (naturally) of major importance, but (surprisingly) no significant effect of institutions (at least long run). These results may provide elements to expand economic theory of the patent system when it comes to treatment of risk.

Similar content being viewed by others

Notes

“Bidding language” is here referred to the “messages” (here: bid, ask, accept/reject) that each agent can send in an auction to determine prices. See Smith (1982, I.A.2.a, p. 925). In this experiment, the seller always asks a fixed fee and a royalty for a contract on patent(s) with a two-part tariff (fixed fee and royalty) and the buyers bid: (i) in both dimentions; (ii) only in royalty with the seller, for all practical purposes, setting a reserve value for the fixed fee; or (iii) only accepts/rejects the ask.

This is the way most, if not all, patent systems are construed, from the first in Venice in 1474 to the WTO TRIPS agreement in 1994, 520 years (!) later, indicating a very stable system. This system appears to have been economically motivated by trade, to import new technology, not local monopolies, and to “bust” the guilds (the local monopolies) (Ullberg 2009) (Ullberg 2012, Ch 1.).

Compare: the Solow residual.

The system description S = ( e, I ) is expanded to specify technology as a knowledge discovery activity (inventing patentable subject matter) and included as part of the economic environment (e) and a legal environment (the patent system) included as part of institutions (I). p. 924 “… if learning is to be part of the economic process, then one must specify agent preferences and technology in terms of learning (or sampling or discovery) activities. In this case, the fixed environment would specify the limitations and search opportunities for altering tastes and knowledge in an economy with changeable tastes and resources.”

A patent is made up of two parts: description and claims. The description part, which discloses the invention to the public at a level where a “man skilled in the art” can reproduce it, is here reduced to the “technology area.” The claims contain what specific use will be exclusive and transferrable and licensable; the fields of use may be multiple, here “A” and “B.” The patent may then be validated in several jurisdictions or “geographic markets.” In this experiment, there is only one geographic market or one “patent family” consisting of all validated patents in all geographic markets (jurisdictions). Future experiments may include a diversification of these “patent families.”

“The challenge that remains.” Ref. to (Krugman 1990) Endogenous innovation, international trade and growth.

It is illegal to license a patent that one suspects to be invalid, putting an often conciderable cost of “pre-license validation” on the sellers when presumed validity is low.

There are initiatives of auctions such as bancruptcy auctions, government initiatives (Japan), and private organizations (USA), but not yet an organized market with prices.

The software is a modified version of the software used for experiment on prices and dynamic gains from trade through multiple use of patents. The software is specially developed for these experiments and a considerable effort was put into its development, including pilots and tests. The graphic interfaces for the different roles were adjusted with input from subjects regarding ease of use, intuitive look and special functions.

Other distributions were discussed in the ref. design article (a Poisson distribution).

This is different from a typical one-dimensional double auction where the auction is started when the contract is listed. The buyer or seller can send in the first bid/ask.

In experiments, we do not want to impose our rationality on subject, hence, bidding with negative values, where a high fixed fee could be trade-off for a negative royalty is concievable, aught to be allowed.

In the experimental auction literature, typically three to four rounds (at a minimum) are needed to create common expectations and reach a theoretical price or stable trading pattern in a one-commodity market.

The factor 1.5 is choosen in order to have different values for A and B contracts in order to be able to distinguish these prices, a “robustness” test of the institutions. In real-world cases, different fields of use of the same patented technology are rarely equal in value. 1.5 is also sufficient to reap a reward for a trader.

Compare Arrow’s definition of rationality: “Rationality and knowledge of rationality is a social and not only an individual phenomonon.” (Arrow 1986).

Discussing the problem of limited willingness to search with Prof. Vernon Smith he though that these particular subjects just might not be willing to jump in there, adding that “entrepreneurial activity is a rare flower.”

This is argued in Ullberg (2010a) to be consistent with prospect theory and “loss aversion.”

An end-state in this game would depend on who is the winner in each auction, how the contact is used, etc., creating millions of paths to such an end-state. By having only one highest value innovator and highest NPV contract use, only one such path was the optimal. The actual end-state outcome could then be divided with this optimal end-state to create a measure of the institutional performance.

References

Arrow, J.K. (1962). Economic welfare and the allocation of resources for invention. Rand Corp.

Arrow, K. J. (1986). Rationality of self and others in an economic system. J Bus, 59, S385–S399.

Benassi, M., & Di Minin, A. (2009). Playing in between: patent brokers in markets for technology. Rd Manag, 39, 68–86.

Griliches, Z. (1998). Patent statistics as economic indicators: a survey, in: R&D and Productivity: The Econometric Evidence. University of Chicago Press, pp. 287–343.

Griliches, Z. (1981). Market value, R&D, and patents. Econ Lett, 7, 183–187.

Griliches, Z., Nordhaus, W. D., & Scherer, F. M. (1989). Patents: recent trends and puzzles. Brook Pap Econ Act Microecon, 1989, 291–330.

Horn, K.I. (2009). Roads to wisdom, conversations with ten Nobel Laureates in economics.

Kamien, M. I. (1992). Patent licensing. Handb Game Theory Econ Appl Book, 1, 331–354. doi:10.1016/S1574-0005(05)80014-1.

Kamien, M. I., Oren, S. S., & Tauman, Y. (1992). Optimal licensing of cost-reducing innovation. J Math Econ, 21, 483–508.

Kamien, M. I., & Tauman, Y. (1986). Fees versus royalties and the private value of a patent. Q J Econ, 101, 471–492.

Krugman, P. (1990). Endogenous innovation, international trade and growth.

Lamoreaux, N. R., & Sokoloff, K. L. (2001). Market trade in patents and the rise of a class of specialized inventors in the 19th-century United States. Am Econ Rev, 91, 39–44.

Millien, R., & Laurie, R. (2007). A summary of established & emerging IP business models, in: proceedings of the Sedona conference, Sedona. AZ pp, 1–16.

Monk, A. H. (2009). The emerging market for intellectual property: drivers, restrainers, and implications. J Econ Geogr, 9, 469–491.

Nordhaus, W. (1969a). An economic theory of technological change. Am. Econ. Rev. Vol. 59, Papers and Proceedings of the Eightyfirst Annual Meeting of the American Economic Association (May, 1969), pp. 18–28.

Nordhaus, W. (1969b). Invention, growth and welfare. MIT Press.

Plant, A. (1934). The economic theory concerning patents for inventions. Economica, 1, 30–51.

Robinson, J. (1977). What are the questions? J Econ Lit, 15, 1318–1339.

Schumpeter, J.A. (1942). Capitalism, socialism and democracy.

Schumpeter, J. A. (1934). The fundamental phenomenon of economic development. Schumpeter Theory Econ Dev, 57–94.

Shapiro, C. (1985). Patent licensing and R & D rivalry. Am Econ Rev, 75, 25–30.

Silipo, D. B. (2005). The evolution of cooperation in patent races: theory and experimental evidence. J Econ, 85, 1–38.

Smith, V. L. (1982). Microeconomic systems as an experimental science. Am Econ Rev, 72, 923–955.

Ullberg, E. (2012). Trade in ideas: performance and behavioral properties of markets in patents. New York: Springer Inc..

Ullberg, E. (2010a). From personal to impersonal exchange in ideas: an experimental study of patent markets with transparent prices. CESIS Work Pap Ser, 230.

Ullberg, E. (2010b). Du passage d’un système d’échanges “personnels” à un système d’échanges “impersonnels” des idées: une étude expérimentale (Encadré 3). Guellec Madiès T J-C Prag. Eds Marchés Brev. Dans Léconomie Connaiss. Rep. Econ. Couns. Prime Minist. Paris 2010.

Ullberg, E. (2010c). The problem of trading patents in organized markets: a dynamic experimental microeconomic system model and informal price theory. CESIS Work. Pap. Ser., 229.

Ullberg, E. (2009). From personal to impersonal exchange in ideas—experimental study of trade in organized Markets for Patents. KTH TRITA-TEC-PHD, 09-006, 180.

von Hayek, F. (1979). Law, legislation and liberty, volume 3 (University of Chicago Press Economics Books). University of Chicago Press.

Wang, A. W. (2010). Rise of the patent intermediaries. Berkeley Technol Law J, 25, 159–200.

Zizzo, D. J. (2002). Racing with uncertainty: a patent race experiment. Int J Ind Organ, 20, 877–902. doi:10.1016/S0167-7187(01)00087-X.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ullberg, E. Coordination of Inventions and Innovations Through Patent Markets with Prices. J Knowl Econ 8, 704–738 (2017). https://doi.org/10.1007/s13132-016-0418-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-016-0418-0