Abstract

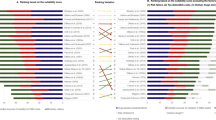

In the pharmaceutical industry, costs attributed to manufacturing are a major part of a company’s total expenses. In this paper, trends in various expense and income categories of pharmaceutical companies have been analyzed with particular emphasis on manufacturing costs to gain an insight into their relationships and how they may differ among types of pharmaceutical companies such as brand name, generics, and biotechs. The study includes data published in the annual reports of leading pharmaceutical companies from 1994 to 2005. Twenty-two pharmaceutical companies were selected based on the annual revenues. The set was further divided into three groups: brand names, generics, and biotechs. The analysis shows that, between 1994 and 2005, manufacturing costs (as a percentage of total sales) are different for the three groups of companies listed above. Additionally, each group of companies differs in how savings are leveraged strategically. The data on brand-name pharmaceutical companies also indicate that there is a strong correlation between the reduction of the cost of goods sold (COGS) and the increase in R&D expenditure. This suggests the validity of Vernon’s theory that for brand-name companies, a reduction in COGS will likely have a positive impact on investments in R&D, presumably resulting in much needed innovations and future health benefits for the society.

Similar content being viewed by others

References

Reinhardt UE. Perspectives on the pharmaceutical industry. Health Aff. 2001;20(5):1363–70.

Kaiser Family Foundation Report, September 2007.

Suresh P, Basu PK. Improving pharmaceutical product development and manufacturing: impact on cost of drug development and cost of goods sold of pharmaceuticals. Pharmaceutical Technology & Education Center, Purdue University, February 2006.

PhRMA Report. What goes into the cost of a prescription drug? 2006.

Abboud L, Hensley S. Factory shift: new prescription for drug makers. The Wall Street Journal 2003;September 3.

IMS. Global pharmaceutical market forecast. 2008.

Vernon JA, Keener HW, Trujillo AJ. Pharmaceutical manufacturing efficiency, drug prices, and public health: examining the casual links. Drug Inf J. 2007;41:229–39.

Wharton Research Data Services (WRDS). Compustat. http://wrds.wharton.upenn.edu/.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Appendix 1: Anomalies in the Data

The data for various categories for Merck & Co. are shown in Fig. 8. The COGS% increased steadily from 36% to 60% from 1994 to 2002 but dropped sharply to 15% in 2003 and stayed close to that value for the next 2 years. Also, the value of 15% in the past 3 years is significantly different from the industry average. General expenses, operating income, and R&D% showed an increase after 2002.

Although no explanation has yet been provided for the sharp changes in the trends for Merck, the following factors may have contributed these deviations. In 2001, the divestiture of Medco Health Solutions (MHS) from Merck and Co. was completed. The COGS% data for MHS is shown in Fig. 9. As MHS is primarily focused on distribution of drugs, the most important part of its expenses is COGS (more than 90%). Therefore, before the divestiture Merck’s COGS% was significantly higher than the industry average and after the divestiture, it reduced significantly. However, that does not explain why the COGS% was reduced below the industry average after 2002.

In 2004, Merck withdrew Vioxx from the market due to the revelation of potentially life-threatening side effects. It is also possible that, because of Vioxx withdrawal, the company may have made certain decisions to safeguard against large litigation costs. We expect that, over an extended period, the various expenses will stabilize to industrial averages.

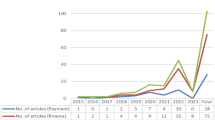

Figure 10 shows the R&D% and general expense for biotechs. There is a sudden rise in the R&D% and dip in general expenses in the year 2002 due to high R&D% expenses from Amgen Inc. We have not uncovered any explanation for this variation. This data point was considered as an outlier and excluded from the calculation of the overall R&D% and general expenses for biotechs.

As shown by the time series data in Fig. 11, Bristol Meyers Squibb also experienced a similar setback in 2001, resulting in higher manufacturing costs in that year. This anomaly was apparently due to accelerated depreciation, asset impairment, and restructuring expenses, as explained in the 2004 annual report.

The 1996–1997 Effect

An anomaly was observed for some of the generics during the years 1996 and 1997 (Fig. 12). In this period, these companies had sharp increase in COGS% and a corresponding decrease in operating income.

The plots show a dramatic change in COGS% and earnings in 1996–1997. Some companies have provided explanations in their annual reports. For example, IVAX Corporation has provided the following explanation:. “During 1996, certain national drug wholesalers instituted programs designed to provide cost savings to independent retail pharmacies on their purchases of certain Generic pharmaceutical products. Pursuant to the programs, independent retail pharmacies generally agreed to purchase their requirements of Generic pharmaceutical products from one wholesaler and permitted the wholesaler to select the product suppliers. Each wholesaler encouraged Generic drug suppliers to participate in its program by offering to purchase the wholesaler’s requirements of particular products from a single supplier. The programs encouraged Generic drug suppliers to aggressively bid to be the exclusive supplier of products under the programs. The existence of the programs also resulted in reduced prices to non-wholesaler customers. As a result, the Generic drug industry experienced a significant reduction in the prices charged by suppliers for many of its products during the second and third quarters of 1996. Other wholesalers have commenced or are expected to implement similar programs, and such programs may be expanded to other product lines and customer groups. Also during 1996, the Company experienced increased competition some of its more important domestic Generic pharmaceutical products as a result of product approvals obtained by competitors.” Although not explicitly stated, this explanation may be applicable to all generic drug manufacturers.

For IVAX, the increase in COGS is also marked by a restructuring program, which may explain the gradual decrease in COGS over the following years. Although the above summaries appear to be reflective of what has occurred, a compelling explanation backed by numerical analysis is yet to be seen.

Appendix 2: Trend Analysis

Rights and permissions

About this article

Cite this article

Basu, P., Joglekar, G., Rai, S. et al. Analysis of Manufacturing Costs in Pharmaceutical Companies. J Pharm Innov 3, 30–40 (2008). https://doi.org/10.1007/s12247-008-9024-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12247-008-9024-4