Abstract

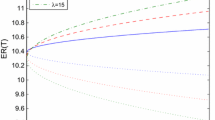

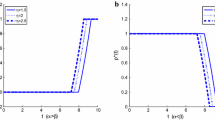

In this paper, we study the optimal reinsurance and investment problem in a financial market with jump-diffusion risky asset. It is assumed that the insurance risk model is modulated by a compound Poisson process, and that the jumps in both the risky asset and insurance risk process are correlated through a common shock. Under the criterion of maximizing the expected exponential utility, we adopt a nonstandard approach to examine the existence and uniqueness of the optimal strategy. Using the technique of stochastic control theory, closed-form expressions for the optimal strategy and the value function are derived not only for the expected value principle but also for the variance premium principle. Also, we investigate the effect of the common shock parameter as well as some other important parameters on the optimal strategies. In particular, a numerical example shows that the optimal investment strategy decreases as the degree of common shock dependence increases but the optimal insurance retention level does not behave the same.

Similar content being viewed by others

References

Alvarez E, L.H.R., Matomäki, P., Rakkolainen, T.A.: A class of solvable optimal stopping problems of spectrally negative jump diffusion. SIAM J. Control Optim. 52(4), 2224–2249 (2014)

Bai, L., Guo, J.: Optimal proportional reinsurance and investment with multiple risky assets and no-shorting constraint. Insur. Math. Econ. 42, 968–975 (2008)

Bi, J., Guo, J.: Optimal mean–variance problem with constrained controls in a jump-diffusion financial market for an insurer. J. Optim. Theory Appl. 157, 252–275 (2013)

Bi, J., Liang, Z., Xu, F.: Optimal mean–variance investment and reinsurance problems for the risk model with common shock dependence. Insur. Math. Econ. 70, 245–258 (2016)

Bernanke, B.S.: Irreversibility, uncertainty, and cyclical investment. Q. J. Econ. 89, 85–103 (1983)

Bernard, C., Tian, W.: Optimal reinsurance arrangements under tail risk measures. J. Risk Insur. 76(3), 709–725 (2009)

Browne, S.: Optimal investment policies for a firm with random risk process: exponential utility and minimizing the probability of ruin. Math. Oper. Res. 20, 937–958 (1995)

Cai, J., Tan, K.: Optimal retention for a stop-loss reinsurance under the VaR and CTE risk measures. ASTIN Bull. 37(1), 93–112 (2007)

Cai, J., Tan, K., Weng, C., Zhang, Y.: Optimal reinsurance under VaR and CTE risk measures. Insur. Math. Econ. 43, 185–196 (2008)

Centeno, M.: Measuring the effects of reinsurance by the adjustment coefficient. Insur. Math. Econ. 5, 169–182 (1986)

Centeno, M.: Excess of loss reinsurance and Gerber’s inequality in the Sparre Anderson model. Insur. Math. Econ. 31, 415–427 (2002)

Fleming, W., Soner, H.: Controlled Markov processes and viscosity solutions, 2nd edn. Springer, New York (2006)

Gerber, H.: An introduction to mathematical risk theory. In: S.S. Huebner Foundation Monograph, Series No. 8. R.D. Irwin, Homewood (1979)

Hald, M., Schmidli, H.: On the maximization of the adjustment coefficient under proportioal reinsurance. ASTIN Bull. 34(1), 75–83 (2004)

Irgens, C., Paulsen, J.: Optimal control of risk exposure, reinsurance and investments for insurance portfolios. Insur. Math. Econ. 35, 21–51 (2004)

Kaluszka, M.: Optimal reinsurance under mean–variance premium principles. Insur. Math. Econ. 28, 61–67 (2001)

Kaluszka, M.: Mean–variance optimal reinsurance arrangements. Scand. Actuar. J. 1, 28–41 (2004)

Landriault, D., Li, B., Li, D., Li, D.: A pair of optimal reinsurance–investment strategies in the two-sided exit framework. Insur. Math. Econ. 71, 284–294 (2016)

Liang, Z.: Optimal proportional reinsurance for controlled risk process which is perturbed by diffusion. Acta Math. Appl. Sin. Engl. Ser. 23, 477–488 (2007)

Liang, Z., Bayraktar, E.: Optimal proportional reinsurance and investment with unobservable Markov-modulated compound Poisson process. Insur. Math. Econ. 55, 156–166 (2014)

Liang, Z., Bi, J., Yuen, K.C., Zhang, C.: Optimal mean–variance reinsurance and investment in a jump-diffusion financial market with common shock dependence. Math. Methods Oper. Res. 84, 155–181 (2016)

Liang, Z., Guo, J.: Optimal proportional reinsurance and ruin probability. Stoch. Models 23, 333–350 (2007)

Liang, Z., Guo, J.: Upper bound for ruin probabilities under optimal investment and proportional reinsurance. Appl. Stoch. Models Bus. Ind. 24, 109–128 (2008)

Liang, Z., Yuen, K.C., Guo, J.: Optimal proportional reinsurance and investment in a stock market with Ornstein–Uhlenbeck process. Insu. Math. Econ. 49, 207–215 (2011)

Liang, Z., Yuen, K.C., Cheung, K.C.: Optimal reinsurance and investment problem in a constant elasticity of variance stock market for jump-diffusion risk model. Appl. Stoch. Models Bus. Ind. 28, 585–597 (2012)

Luo, S., Taksar, M., Tsoi, A.: On reinsurance and investment for large insurance portfolios. Insur. Math. Econ. 42, 434–444 (2008)

Promislow, D., Young, V.: Minimizing the probability of ruin when claims follow Brownian motion with drift. N. Am. Actuar. J. 9(3), 109–128 (2005)

Schmidli, H.: Optimal proportional reinsurance policies in a dynamic setting. Scand. Actuar. J. 1, 55–68 (2001)

Schmidli, H.: On minimizing the ruin probability by investment and reinsurance. Ann. Appl. Probab. 12, 890–907 (2002)

Yang, H., Zhang, L.: Optimal investment for insurer with jump-diffusion risk process. Insur. Math. Econ. 37, 615–634 (2005)

Yuen, K.C., Liang, Z., Zhou, M.: Optimal proportional reinsurance with common shock dependence. Insur. Math. Econ. 64, 1–13 (2015)

Zhang, X., Meng, H., Zeng, Y.: Optimal investment and reinsurance strategies for insurers with generalized mean–variance premium principle and no-short selling. Insuar. Math. Econ. 67, 125–132 (2016)

Zheng, X., Zhou, J., Sun, Z.: Robust optimal portfolio and proportional reinsurance for an insurer under a CEV model. Insuar. Math. Econ. 67, 77–87 (2016)

Acknowledgements

The research of Zhibin Liang and Caibin Zhang was supported by the National Natural Science Foundation of China (Grant No.11471165) and Jiangsu Natural Science Foundation (Grant No. BK20141442). The research of Kam Chuen Yuen was supported by a grant from the Research Grants Council of the Hong Kong Special Administrative Region, China (Project No. HKU17329216).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Liang, Z., Yuen, K.C. & Zhang, C. Optimal reinsurance and investment in a jump-diffusion financial market with common shock dependence. J. Appl. Math. Comput. 56, 637–664 (2018). https://doi.org/10.1007/s12190-017-1119-y

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12190-017-1119-y

Keywords

- Exponential utility

- Hamilton–Jacobi–Bellman equation

- Common shock dependence

- Investment/reinsurance

- Jump-diffusion process