Abstract

The firm’s price policy decision is a central issue in spatial economics. Previous results show, e.g., that the specification of consumers’ demand functions is pivotal but mostly mill and uniform pricing are compared in a monopoly setting with constant marginal costs. The results in this paper highlight that some conclusions of prior work do not hold if the monopolist operates under non-constant marginal production costs. For instance, the optimal price is no longer independent of transport costs, and the welfare ranking of mill and uniform pricing also depends on the shape of the cost function.

Similar content being viewed by others

1 Introduction

The strategic choice of the price policy is one of the most important business decisions in an industry (Thisse and Vives 1988). In a spatial context, the firm’s price policy determines how transport costs are reflected in local prices with increasing distance to the firm’s location. If the spatial price schedule follows the development of transport costs, i.e., local prices decrease as transport costs increase with distance, the firm uses mill or non-discriminatory pricing. However, if local prices do not reflect the transport cost difference between two locations, there is spatial price discrimination (Phlips 1983). One important instance of spatial price discrimination is uniform (delivered) pricing where the firm charges the same price to all consumers irrespective of their location.

The firm’s pricing decision crucially affects profit, output, and social welfare (Beckmann 1976; Greenhut et al. 1987). Yet the ranking of alternative spatial price strategies (based on economic benefits) depends, e.g., on the shape of individual consumer demand functions (Smithies 1941; Cheung and Wang 1996) or whether the firm is able to optimize its market area (Hsu 2006). Always, however, conclusions are derived for the case of constant marginal costs. The objective of this paper is to relax this assumption and to examine the effect of variable marginal costs on the ranking of uniform and mill pricing in a general monopoly framework. We focus on these two pricing options because they are easy to administer (Espinosa 1992), important in different markets and regions (Greenhut 1981), most previous studies (including Hsu 1983; Cheung and Wang 1996; Hsu 2006; Lederer 2012) compare these options, which provides a point of reference, and both price strategies represent the limits of no (mill pricing) and full (uniform pricing) freight costs absorption.

Before the investigation of mill and uniform pricing in a general monopoly setting, I briefly review the most relevant literature. The subsequent presentation and discussion of the results illustrate that, in contrast to prior work focusing on constant marginal costs, the monopolists optimal price is not independent of transport costs and that mill pricing does not always provide higher consumer surplus within the optimal market area.

2 Related work

In an early contribution, Smithies (1941) concludes that the monopolist’s profit is lower (higher) under uniform than mill pricing if the individual demand function is convex (concave) while the firm is indifferent between the two pricing options under linear demand. For this case, Beckmann (1976) shows that output and profit are identical but the average price of consumers is lower and welfare is higher under mill compared to uniform pricing if the market region is fixed. Hsu (1983) extends this analysis to a general consumer distribution over space and the monopolist is free to decide on the market area. Regardless of the consumer density function, profit, output, and the market extent are identical but social welfare is lower under uniform pricing.

Considering an exogenously given market area, Cheung and Wang (1996) use general formulations for demand, consumer distribution, and transport costs. Their findings show that for convex consumer demand functions, the profit, average delivered price, output, and welfare are larger under mill than uniform pricing. The opposite is true if consumer demand is concave. However, Hsu (2006) shows that these results do not generally hold in a framework of endogenous market size, where mill pricing is always superior to uniform pricing in terms of consumer surplus and uniform pricing provides higher social welfare only if consumer demand is sufficiently concave.Footnote 1

The literature on spatial pricing displays a broad range of model specifications and corresponding (often contradicting) conclusions. All of the aforementioned results, however, are invariably derived under the assumption of constant marginal production costs.Footnote 2 This assumption is usually introduced for analytical convenience as it considerably simplifies the analysis. In most if not all industries, however, economies of scale play an important role. Thus, it is pivotal to examine the consequences of alternative specifications of the cost function. This paper aims in this direction. In doing so, it extends previous findings and complements a small body of literature that investigates spatial pricing and location under non-constant marginal costs. For instance, Claycombe (1990) introduces a long-run cost function into a model of mill pricing and shows that this affects welfare per area under monopolistic competition. Greenhut and Norman (1986) consider non-constant marginal costs in a trade model and emphasize that the degree of price discrimination is determined by the shape of individual demand functions but independent of the marginal cost function.

In location models, non-constant marginal costs are first considered by Gupta (1994) who found that firms deviate from social cost-minimizing locations under increasing marginal costs. Recent work extends this analysis, including the investigation of mergers (Heywood and Wang 2014), distortions of downstream location by an upstream monopoly (Courey 2016), or sequential location (Courey 2018). In each of these models, demand is assumed to be perfectly price inelastic and the firms engage in price discrimination such that the most cost efficient firm prices at the (total) marginal costs of the next efficient firm at each market point (Lederer and Hurter 1986).

Most relevant to the present paper is the work by Cheung and Wang (1996) and Hsu (2006) because of their general formulations of individual demand functions under spatial monopoly. While I generally follow Hsu (2006) by allowing the firm to optimize its market area, I also investigate the fixed market setting studied by Cheung and Wang (1996). The critical deviation from these and other papers, however, is the introduction of a general cost function by comparing mill and uniform pricing.

3 A model of spatial monopoly pricing

Assume that a firm is located at \(x =0\) of a line market with \(x =[0, \infty ]\). Consumers are uniformly distributed across x with density normalized to one. There is a constant transport rate \(\delta\) per unit of product and distance. Accordingly, \(\delta x\) represents transport costs per unit from the firm to the consumer’s location, where P(x) is the local price of the good. With R being the positive consumers’ reservation price, individual (net) demand is:

Following Mérel and Sexton (2010), we define \(w(P)=[R-P(x)]^\beta\) with demand parameter \(\beta \ge 0\). Accordingly, (1) nests convex (\(\beta > 1\)) and concave (\(0< \beta <1\)) individual demand with perfectly price inelastic demand (\(\beta =0\)) as limit and linear demand (\(\beta = 1\)) as a special case. The aggregated demand Q over the market radius s is:

Deviating from prior work, the firm’s cost function is:

where \(\alpha\) and c are positive parameters and F are fixed costs. Hence, we account for constant (\(\alpha =1\)), decreasing (\(\alpha < 1\)), and increasing (\(\alpha > 1\)) marginal costs. We define a general profit function of the firm’s spatial pricing problem similar to Greenhut et al. (1987, p.183):

Substitution of w(P(x)) and C(Q) yields:

3.1 Mill pricing

If the firm offers a common mill price p to consumers and local prices P(x) differ by transport costs, the spatial price function is:

The optimal market radius \(s_p^*\) is determined by the zero-demand conditionFootnote 3:

This reduces (8) to:

Considering (10) in (7), differentiation with respect to p, and rearrangement of the first order condition yields the implicit function:

Before we examine this in more detail, the second price strategy is presented.

3.2 Uniform pricing

Contrary to mill pricing, consumers pay the same (local) price u irrespective of their distance to the firm:

Inserting this in (5) gives:

Differentiating (13) with respect to u and rearranging the obtained first order condition yields:

Because transport costs increase and profits decrease with distance under uniform pricing, the firm will only offer to sell up to the optimal market radius \(s_u^*\). From (13), \(\partial \pi _u / \partial s = 0\) yields:

which is equivalent to:

With \(s=s_u^*\), we can isolate \(\alpha c \left[ s_u^* (R-u)^{\beta }\right] ^{\alpha -1}\) in (15) as well as (16) and solve the resulting system for \(s_u^*\):

Considering this in (15), we obtain the implicit function:

4 Results and discussion

Obviously, (11) and (18) are quite similar, an observation consistent with Beckmann and Ingene (1976) who showed that both price strategies can be transferred into each other under linear demand. In fact, the monopolist’s optimal mill price \(p^*\) can be expressed as a function of the optimal uniform price \(u^*\) and vice versa.Footnote 4

Depending on the values of \(\alpha\) and \(\beta\), (11) and (18) can yield multiple solutions for \(p^*\) and \(u^*\). The second-order necessary conditions for a profit maximum under both price regimes are derived in “Appendix 1”. It is easy to verify that both (11) and (18) accommodate standard solutions for constant marginal costs (\(\alpha =1\)) (cf. Greenhut et al. 1987). In case of perfectly price inelastic demand (\(\beta =0\)), the optimal mill price and market radius is \(p^* = (R+c)/2\) and \(s_p^* = (R-c) / \delta\), while \(p^* = (R+2c)/3\) and \(s_p^* = 2(R-c)/3\delta\) if individual demand is linear (\(\beta =1\)). Under uniform pricing, we obtain from (16) \((u^*, s_u^*) = (R, (R-c)/ \delta )\) if \(\beta =0\), and \((u^*, s_u^*)= \left( (2R+c)/3, 2(R-c)/3\delta \right)\) if \(\beta =1\).Footnote 5

In contrast to prior work, (11) and (18) directly illustrate that optimal prices (\(p^{*}\) and \(u^{*}\)) depend on \(\beta\) (the shape of demand functions) and on \(\delta\) (per unit transport costs) as long as \(\alpha \ne 1\).

Proposition 1

Independent of the shape of the demand function, the optimal mill \(p^*\) and uniform price \(u^*\) of the monopoly increases with transport costs \(\delta\) under decreasing (\(0< \alpha <1\)) marginal production costs. Both prices decrease with \(\delta\) under increasing marginal costs (\(\alpha > 1\)).

Proof

Differentiation of (11) as well as (18) with respect to \(\delta\) can be expressed as:

Because \(\varOmega _1 \ge 0\) and \(\varOmega _2 \ge 0\) under both price strategies, \(\partial f(\cdot ) / \partial \delta\) is always negative if \(\alpha >1\). If \(0<\alpha < 1\), \(\partial f(\cdot ) / \partial \delta\) can be positive if \(\varOmega _1+\varOmega _2/\alpha (\alpha -1)c < 0\). Rearrangement yields \(\alpha (\alpha -1)>-\varOmega _2/c\varOmega _1\). Because the left hand side of this inequality has its minimum at \(\alpha =1/2\), the condition is always satisfied if the second-order necessary condition for a profit maximum is satisfied (\(\partial \pi ^2(f)/\partial f^2<0\)) and transport costs are sufficiently small, formally:

\(\square\)

Proposition 1 extents previous findings (e.g. Greenhut et al. 1987; Hsu 2006) by showing that the monopolist’s optimal prices are only independent of transport costs if marginal costs are constant. Under variable marginal costs, however, optimal prices change with the level of transport costs.

In order to rank both price strategies, we compare social welfare, i.e., the sum of firm profit and consumer surplus, \(SW=\pi +CS\). Given the optimal market radius \(s^*\) under mill (9) and under uniform pricing (17), respectively, consumer surplus (CS) is:

Unfortunately, the general framework presented here prevents analytical (closed-from) solutions for profits and consumer surplus without further restrictions on \(\alpha\) and \(\beta\). Instead of the formal investigation of a more specific setting, we present numerical investigations that contradict previous findings but we also highlight, that these deviations occur under specific conditions only.

First note that if demand is convex (\(\beta >1\)), profits and consumer surplus are higher under mill than uniform pricing (Cheung and Wang 1996; Hsu 2006). This result is independent of the cost function and qualitative results from prior literature (as the welfare ranking of both price strategies) persist.Footnote 6

Accordingly, we can restrict the analysis to concave (local) demand functions \(\beta <1\) because profits are higher but consumer surplus is lower under uniform compared to mill pricing (Hsu 2006) and non-constant marginal costs might affect the relation of profit to consumer surplus under both price policies.

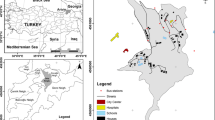

Figure 1 presents results of numerical simulations based on the stated equations for optimal prices, profits, consumer surplus, social welfare and the welfare difference \(\varDelta SW=SW_u - SW_p\) between uniform and mill pricing. These results are obtained for \(\alpha =\{1/4,1,4\}\), \(\beta =1/4\), \(R=1\), \(c=R/10\), and \(F=0\). While the last three assumptions are non-restrictive, the parametrization of \(\alpha\) and \(\beta\) is crucial.

Optimal prices, profits, consumer surpluses, and the difference in social welfare between uniform (black) and mill pricing (gray) dependent on (per unit) transport costs \(\delta\) under decreasing (\(\alpha =1/4\)), constant (\(\alpha =1\)), and increasing (\(\alpha =4\)) marginal costs and concave demand (\(\beta =1/4\))

The figure highlights that independent of the cost function, profits are usually higher but consumer surplus is usually lower under uniform pricing. An exception occurs for the case of decreasing marginal costs, i.e., the left column of Fig. 1, and sufficiently high transport costs. With uniform pricing, the firm is able to realize positive profits and generate positive consumer surplus even though high transport costs prevent mill pricing from being profitable.Footnote 7 Even though uniform pricing presents high local prices (low local demand), it enables a sufficiently large market radius (even under high transport costs) to take advantage of decreasing production costs.Footnote 8

The second column of Fig. 1 depicts the case of constant marginal costs and hence presents known results for the sake of comparison. The third column represents the case of increasing marginal costs. Here, the ranking between both price strategies in terms of social welfare changes with \(\delta\), although cost and demand specifications are identical. Apparently, the reason is that the mill price \(P(x=0)\) stronger falls with \(\delta\), which translates into a stronger increase of consumer welfare, compared to uniform pricing. For sufficiently high and increasing \(\delta\), both \(p^*\) and \(u^*\) reach (almost) constant levels. Because (local) consumer prices P(x) increase under mill but not under uniform pricing, which translates into a stronger decrease of consumer surplus in case of mill pricing, the net benefits of mill relative to uniform pricing are eventually eliminated with increasing \(\delta\).

The overall pattern of the price, profit, and consumer surplus curves survive variations in the shape of consumer demand functions over a range of \(\beta\) as shown in Fig. 4 of "Appendix 2". Figure 4 also highlights that once \(\beta\) exceeds a critical value \({\hat{\beta }}\), i.e., demand is not sufficiently concave (\(0\le \beta \le {\hat{\beta }} < 1\), e.g., in the case of \(\beta =1/2\)), social welfare is (typically) higher under mill compared to uniform pricing. This is in-line with the conclusion of Hsu (2006) under constant marginal costs. Nevertheless, uniform pricing still provides higher welfare within a range of \(\delta\) where mill pricing is not profitable.

While transport costs are typically the most important variable in spatial models, the shape of the cost function is of particular interest in the present paper. The previous results provide a first indication that the welfare ranking of uniform and mill pricing also depends on \(\alpha\). This is confirmed by numerical simulations for fixed levels of \(\delta\) where \(\alpha\) is the independent variable. Figure 2 summarizes the welfare difference for endogenous and exogenous market size while detailed results concerning prices, profits, and consumer surplus are presented in Figs. 5 and 6 of "Appendix 2".

Figure 2 shows that, if the monopolist is able to optimize its market area and marginal costs are constant or decreasing (i.e., \(\alpha \le 1\)), uniform pricing provides higher social welfare than mill pricing. Under increasing marginal costs, the ranking of both price policies depends on the curvature of the cost and demand functions as well as the level of transport costs. If transport costs are sufficiently high, uniform pricing is superior to mill pricing independent of the cost function (cf. the black curve in the left graph of Fig. 2).Footnote 9

If the monopoly operates in a fixed market area (\(s=1\)) mill pricing is superior to uniform pricing for sufficiently low transport costs (the right graph in Fig. 2).Footnote 10 If transport costs are too high, mill pricing is not profitable under decreasing marginal costs. As above, therefore, the monopolist would defray fixed costs but does not produce in a mill price setting. This causes the discontinuity in Fig. 2 and that price discrimination (uniform pricing) is beneficial for consumers in the absence of production under mill pricing (cf. also Fig. 6).Footnote 11

The difference in social welfare between uniform and mill pricing dependent on the curvature \(\alpha\) of the cost function for different levels of transport costs from low (gray) to high (black) with \(\delta =\{1/4, 1/2, 2/3, 2\}\) (variable market area), \(\delta =\{1/10, 3/10, 6/10, 9/10\}\) (fixed market area), and concave demand (\(\beta =1/4\))

With the analysis of mill and uniform pricing in the present paper, it is worthwhile to briefly reflect on one common alternative often discussed alongside these price policies, namely optimal spatial price discrimination (OD). Under OD pricing the firm maximizes profits at each single location, and therefore, OD pricing typically represents the optimal pricing choice of the monopoly (Smithies 1941; Beckmann 1976).Footnote 12 In a framework of non-constant marginal costs, however, the profit maximizing price at any location depends on the demand at other locations. Greenhut and Norman (1986) and Greenhut et al. (1987) approach this problem with optimal control theory. In these presentations, however, the discussion of OD pricing is rather generic and the presented application (incidence of taxes on imports) is limited to a two-country framework, i.e., only two locations are considered. Contrary, the present work deals with continuous space and a different class of demand functions, which prevents a detailed analysis of OD pricing in this paper for two reasons. On the one hand, Greenhut and Norman (1986) highlight that the shape of the cost function does not affect the degree of price discrimination but the level of local prices. On the other hand, the spatial price schedule P(x) under OD pricing is not linear for the class of demand functions as specified in Eq. (1) (cf. Greenhut and Greenhut 1975). Hence, we cannot readily evaluate whether OD pricing provides higher or lower benefits to consumers and eventually larger or lower welfare compared to mill and uniform pricing. Because of its very nature, however, OD pricing enables the firm to maximize local and overall profits as well as the market area (Greenhut et al. 1987; Anderson et al. 1992), which makes OD pricing beneficial from the perspective of the monopoly. This superiority relative to mill and uniform pricing persists under a framework of non-constant marginal costs.

5 Conclusion

The firm’s choice between mill and uniform pricing and the economic benefits of this decision are exclusively studied under a framework of constant marginal costs. Prior literature established that the shape of individual demand functions (Cheung and Wang 1996) or whether the firm can optimize its market area (Hsu 2006) are crucial conditions to determine if one or the other price strategy yields higher profits, consumer surplus, or social welfare.

Whether the marginal costs specification impacts the ranking of both price policies was not yet investigated. The present paper fills this gap. I present a monopoly framework that accommodates general demand and cost functions. The results in this paper exemplify that the welfare ranking of mill and uniform pricing also depends on the level of transport costs and the shape of the cost function. Crucial in this regard is the finding that optimal mill and uniform prices increase (decrease) with transport costs under decreasing (increasing) marginal production costs. Some results, including that uniform pricing yields higher (lower) profits than mill pricing if demand is concave (convex), transfer to a framework of variable marginal costs. A complete generalization is not possible though. For instance, our findings deviate from prior literature if individual demand is sufficiently price-inelastic. In this case, uniform (or discriminatory) pricing can be beneficial also for consumers because production under mill pricing would not be profitable, e.g., in the case of decreasing marginal costs and high transport costs in a fixed market area. Moreover, while uniform pricing provides higher welfare than mill pricing under decreasing marginal costs in a variable market setting, the opposite might be true under increasing marginal costs and sufficiently low transport costs.

Notes

Lederer (2012) also emphasizes that profits are higher under uniform than mill pricing if the correlation between demand elasticity and transportation cost is positive enough.

In this paper, marginal costs include all (variable) costs other than transport costs.

The result can also be obtained by maximizing (7) with respect to s.

If \(\beta =0\), (13) is monotonic increasing in u and by setting the uniform price equal to the consumers’ reservation price R, the firm captures the full consumer surplus at every location it serves.

Note, the first graph (top left) depicts the lower part of the parabola (i.e., profit maximizing mill and uniform prices) as shown in Fig. 3 of the appendix up to the break-even point, i.e., the critical value of \(\delta\) where \(\pi (p^*)=0\) and \(\pi (u^*)=0\), respectively. The discontinuity of both price curves reflects the fact that the monopoly prefers to set prices equal to the consumers’ reservation price R (\(\pi (R)=0\)) instead of incurring negative profits.

For \(\beta =1/4\), the critical value for \(\delta\) is \({\hat{\delta }} \approx .712\).

If the market extent s is exogenous to the firm, the effective demand is given by Eqs. (8) and (14) for mill and uniform pricing, respectively. The normalization of s is not restrictive because normalized transport costs \(\delta\) solely represent the relation of the consumers’ reservation price R, the market size s, and transport costs (Mérel and Sexton 2010).

Note that the class of demand functions in this paper does not satisfy the condition \(w'w'''=(w'')^2\) as stated in Corollary 2 of Cheung and Wang (1996) except for the cases of \(\beta =0\) and \(\beta =1\). Accordingly, our results do not match their Proposition 5 (“If demand is concave, then welfare under uniform pricing is greater than welfare under mill pricing [...]”).

Despite the profit maximizing feature of OD pricing, the monopoly might prefer to adopt mill or uniform pricing. One reason is that the implementation of OD pricing can be challenging and costly (Espinosa 1992). Cheung and Wang (1996) further argue that uniform pricing is often tolerated by antitrust authorities, but perfect price discrimination is not.

This is Eq. (11) in the main text.

Note the term in parenthesis on the right hand side of (28) are the sum of (a portion \(\alpha\)) of average variable cost and average transport costs less the uniform price. This term is zero for \(\alpha =0\).

References

Anderson, S.P., dePalma, A., Thisse, J.F.: Discrete Choice Theory of Product Differentiation. MIT Press, Cambridge (1992)

Beckmann, M.J.: Spatial price policies revisited. Bell J. Econ. 7(2), 619–630 (1976)

Beckmann, M.J., Ingene, C.A.: The profit equivalence of mill and uniform pricing policies. Reg. Sci. Urban Econ. 6(3), 327–329 (1976)

Cheung, F.K., Wang, X.: Mill and uniform pricing: A comparison. J. Reg. Sci. 36(1), 129–143 (1996)

Claycombe, R.J.: Economies of scale and entry in spatial markets. J. Reg. Sci. 30(2), 269–280 (1990)

Courey, G.: Spatial price discrimination, monopoly upstream and convex costs downstream. Lett. Spat. Resour. Sci. 9(2), 137–144 (2016)

Courey, G.: Spatial price discrimination, sequential location and convex production costs. Lett. Spat. Resour. Sci. 11(2), 223–232 (2018)

Espinosa, M.P.: Delivered pricing, FOB pricing and collusion in spatial markets. Rand J. Econ. 23(1), 64–85 (1992)

Greenhut, J., Greenhut, M.L.: Spatial price discrimination, competition and locational effects. Econometrica 42(168), 401–419 (1975)

Greenhut, M.L., Norman, G.: Spatial pricing with a general cost function; the effects of taxes on imports. Int. Econ. Rev. 27(3), 761–776 (1986)

Greenhut, M.L.: Spatial pricing in the United States, West Germany and Japan. Economica 48(189), 79–86 (1981)

Greenhut, M.L., Hwang, M., Ohta, H.: Observations on the shape and relevance of the spatial demand function. Econometrica 43(4), 669–682 (1975)

Greenhut, M.L., Norman, G., Hung, C.S.: The Economics of Imperfect Competition: A Spatial Approach, 2nd edn. Cambridge University Press, Cambridge (1987)

Gupta, B.: Competitive spatial price discrimination with strictly convex production costs. Reg. Sci. Urban Econ. 24(2), 265–272 (1994)

Heywood, J.S., Wang, Z.: Spatial price discrimination and mergers with convex production costs. Lett. Spat. Resour. Sci 7(1), 1–8 (2014)

Hsu, S.: Pricing in an urban spatial monopoly: A general analysis. J. Reg. Sci. 23(2), 165–175 (1983)

Hsu, S.: Simple monopoly price theory in a spatial market. Ann. Reg. Sci. 40(3), 531–544 (2006)

Lederer, P.J., Hurter, A.P.: Competition of firms: Discriminatory pricing and location. Econometrica 54(3), 623–640 (1986)

Lederer, P.J.: Uniform spatial pricing. J. Reg. Sci. 52(4), 676–699 (2012)

Mérel, P.R., Sexton, R.J.: Kinked-demand equilibria and weak duopoly in the Hotelling model of horizontal differentiation. BE J. Theor. Econ. 10(1), 1–34 (2010)

Phlips, L.: The Economics of Price Discrimination. Cambridge University Press, Cambridge (1983)

Smithies, A.: Monopolistic price policy in a spatial market. Econometrica 9(1), 63–73 (1941)

Thisse, J.F., Vives, X.: On the strategic choice of spatial price policy. Am. Econ. Rev. 78(1), 122–137 (1988)

Acknowledgments

The author thanks the editor, Amitrajeet A. Batabyal, and the two anonymous reviewers for helpful comments and suggestions. Financial support by the German Research Foundation (GR 4415/2-1) is also gratefully acknowledged. Open Access funding provided by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix 1: A Second-order necessary condition for a profit maximum under mill and uniform pricing

1.1 Mill pricing

The profit and aggregated demand function of the firm is given by Eqs. (10) and (7) in the main text, respectively, and restated here:

Derivation of (19) with respect to p and reformulating the first order condition yieldsFootnote 13:

The second derivation of (19) with respect to p is:

\(\bar{C_p}\) represents average variable costs (\(C(Q_p)/Q_p\)). \(Q_p'\) and \(Q_p''\) are the first and second derivative of the aggregated demand function (20) with respect to p. From the second order condition for a profit maximum we obtain:

We can verify that this condition is always met for \(\alpha \ge 1\) because \(Q_p'<0\) and \(Q_p''>0\), i.e., aggregated demand is convex, which is true independent of the shape of individual demand (Greenhut et al. 1975). Furthermore, the difference between average variable costs and the price must be negative. If \(0<\alpha <1\), there is a critical price \({\hat{p}}\) such that \(p < {\hat{p}}\) satisfies (22) with

Figure 3 illustrates this graphically. The solid, gray curve in the figure displays Eq. (21), while the dashed, gray curve represents the critical price \({\hat{p}}\) that is obtained from \(\partial ^2 \pi _p /\partial p^2 =0\). Accordingly, any price above this curve does not satisfy the second-order necessary condition for a profit maximum and optimal mill prices depending on \(\delta\) are described by the lower part of the parabola only.

1.2 Uniform pricing

From Eq. (13) in the main text, the profit of the monopoly under uniform pricing is:

With the aggregated demand \(Q_u\) and the market area s given by:

Substitution for \(Q_u\) and s in (24), differentiation with respect to u and rearranging the first-order condition yields the implicit function (18) in the main text:

The second derivation of (24) with respect to u is:

Again \(\bar{C_u}\) represents average variable costs (\(C(Q_u)/Q_u\)). \(Q_u'\) denote the first and \(Q_u''\) the second derivation of (25) with respect to u. From the second-order condition for a profit maximum we yield:

As in the case of mill pricing \(Q'<0\), \(Q''>0\), and the right hand side is negative if \(\alpha >0\).Footnote 14 If \(0<\alpha <1\), there is a critical price \({\hat{u}}\) such that (28) is satisfied for \(u<{\hat{u}}\), which we obtain from \(\partial ^2 \pi _u /\partial u^2 =0\):

The solution to (27) as well as \({\hat{u}}\) are depicted in Fig. 3 as solid and dashed black curves, respectively. Similar to mill pricing, the lower part of the parabola shows solutions to (27) that satisfy the second-order necessary condition for a profit maximum.

The optimal mill (solid gray) and uniform (solid black) price according to Eqs. (11) and (18), respectively, as well as the critical price \({\hat{p}}\) (dashed gray) and \({\hat{u}}\) (dashed black). The second-order necessary condition is satisfied for \(p^* < {\hat{p}}\) and \(u^* < {\hat{u}}\). The graphs are drawn for \(\alpha =\beta =1/4\), \(R=1\) and \(c=1/10\)

Appendix 2: Additional results

The difference in social welfare between uniform and mill pricing dependent on (per unit) transport costs \(\delta\) under decreasing (\(\alpha =1/4\)) and increasing (\(\alpha =4\)) marginal costs and varying levels of demand concavity with \(\beta =[0, 1/10, 1/5, 1/3, 1/2]\) from light gray, where uniform pricing is always superior, to black, where mill pricing is typically superior

Optimal prices, profits, consumer surpluses, and the difference in social welfare between uniform (black) and mill pricing (gray) dependent on the curvature of the cost function \(\alpha\) under low (\(\delta =1/4\)), moderate (\(\delta =1\)), and high (\(\delta =4\)) transport costs and concave demand (\(\beta =1/4\))

Optimal prices, profits, consumer surpluses, and the difference in social welfare between uniform (black) and mill pricing (gray) dependent on the curvature of the cost function \(\alpha\) under low (\(\delta =1/10\)), moderate (\(\delta =1/2\)), and high (\(\delta =9/10\)) transport costs and concave demand (\(\beta =1/4\)) in a fixed market area (\(s=1\))

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Graubner, M. Spatial monopoly pricing under non-constant marginal costs. Lett Spat Resour Sci 13, 81–97 (2020). https://doi.org/10.1007/s12076-020-00246-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12076-020-00246-1