Abstract

Despite the rising interest for backshoring strategies by mass media, policy makers and public debates, academic research on the topic is relatively recent and still characterised by significant research gaps. Empirical evidence is scarce and often anecdotal, with a lack of studies focusing on specific industries and small-sized firms. Theoretical explanations are also fragmented with many unanswered questions. In particular, much of the existing literature has explored backshoring as a stand-alone phenomenon, independently from other production location strategies. In an attempt to fill these research gaps, we rely upon data from an original survey with around 700 firms from the UK textile and apparel industry to investigate different interrelated factors that influence backshoring strategies relative to offshoring and staying at home choices, within an analytical framework drawn from different international business perspectives, including operations and supply chain management. The paper contributes to the extant literature on backshoring by providing new empirical evidence based on originally collected firm-level data and focused on a single country and industry where smaller (and less studied) firms tend to prevail. Moreover, it helps strengthen the understanding of the phenomenon from a perspective which takes into consideration internationalisation as a non-linear process where firms adjust production location strategies based on a variety of changing conditions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the last thirty years, offshoring – the relocation of activities outside a company’s home country, typically entailing production moved to low-labour cost locations – has become one of the most common strategies implemented by firms in advanced economies to enhance their competitiveness (Larsen et al. 2013). Although offshoring is far from declining, over the last decade there have been increasing examples of firms bringing all or parts of production back home (Dachs et al. 2019; Fratocchi et al. 2014). A growing number of large multinational enterprises (MNEs), such as Apple, Boeing, Bosch, Ford, and General Electric, have publicly announced their intention of bringing manufacturing back to the domestic economy. This has given high visibility to the trend, which has however been observed in firms of all sizes previously engaged in international production (Di Gregorio et al. 2009; Gray et al. 2017; Srai and Ané 2016; Wan et al. 2019b). Although a variety of labels have been proposed to define this reversal process (e.g., reshoring, reverse offshoring, homeshoring), here we adopt the term “backshoring” to indicate a firm’s location decision (Ellram et al. 2013; Gray et al. 2013) involving a revision of a previous offshoring choice and the total or partial relocation of production activities from either offshore wholly-owned facilities or suppliers to either home own facilities or suppliersFootnote 1 (Ancarani et al. 2019; Fratocchi et al. 2016; Kinkel 2014).

Since the 2010s, policy makers in advanced countries – particularly the US and the UK – have looked with interest at backshoring as a strategy for promoting manufacturing renaissance, increasing employment, and rebalancing economies in response to the 2008 global economic and financial crisis (Elia et al. 2021; Pegoraro et al. 2022; Reshoring Initiative 2021; UK Government 2014). More recently, adverse trade shocks linked to the rise of populist and protectionist rhetorics (e.g., Brexit, Trump’s trade wars), as well as the Covid-19 pandemic, have contributed to a growing scepticism towards globalisation, and strengthened interest in backshoring as a tool for overcoming the risks, drawbacks, and vulnerability of global value chains (GVCs) (Barbieri et al. 2020).

While it is unlikely that backshoring will turn into a large-scale trend, the geography of global production is expected to change and become more regionally concentrated over time (Contractor 2021; De Backer et al. 2016; Strange 2020; UNCTAD 2020). Manufacturing offshoring, and firm location decisions more generally, are inherently complex and depend on a multitude of dynamic factors which tend to vary in importance over time and across geography, industries, and activities, thus changing locations’ attractiveness and competitive advantages (Kinkel and Maloca 2009; McIvor 2013; Vissak and Francioni 2013).

Economic downturns and rising market volatility, declining cost advantages of emerging economies, growing demand for customised and more sustainable products, as well as the “Industry 4.0” shift, are some of the forces leading firms to rethink manufacturing location and to adopt more diversified strategies by combining global and local sourcing and production (Barbieri et al. 2022; Fratocchi and Di Stefano 2020; Macchion et al. 2015; Tate et al. 2014). In this unstable context, offshoring and backshoring are not antithetical, but coexist to optimise the trade-off between cost-saving offshore and the benefits associated with proximity to final markets. Hence, backshoring can be defined as a step in a non-linear internationalisation process where firms increase or decrease international activities adjusting to changing conditions (Fratocchi et al. 2015). This has implications for the evolving configuration of production and the competitive landscape of internationalisation strategies, representing a new challenge for international business (IB) as well as operations and supply chain management research (Bettiol et al. 2020; Contractor 2021; Manning 2014).

Scholarly work on backshoring is relatively recent and therefore still characterised by significant research gaps.

First, empirical evidence is scarce and often anecdotal, making it very difficult to assess the actual importance and trend of the phenomenon. In most cases, data on backshoring are not available in official statistics and firms are usually reluctant to disclose their strategies, especially when these may be the outcome of unsuccessful offshoring initiatives (Albertoni et al. 2017; Gray et al. 2013; Kinkel 2012). While surveys are arguably the most adequate methodological tool, the relatively small scale of backshoring requires large sample sizes to only gather few observations. To date, there have been a handful of studies reporting quantitative information (e.g., Canham and Hamilton 2013; Dachs et al. 2019; Johansson and Olhager 2018; Srai and Ané 2016; Stentoft et al. 2018; Tate et al. 2014): most of these works draw on secondary data such as cases collected from newspapers, business magazines, and research articles, rather than on originally collected firm-level data. Moreover, they mostly focus on large firms rather than small firms, which however seem to have an equal if not higher propensity to backshore due to the scarcity of resources and difficulties in coping with foreign environments (Boffelli and Johansson 2020; Merino et al. 2021). In addition, there is also a lack of studies focusing on specific industries.

Second, while conceptual papers and case studies tend to prevail, theoretical explanations underlying backshoring are still fragmented and many questions remain unanswered (Barbieri et al. 2018; McIvor and Bals 2021; Wiesmann et al. 2017). Previous research has mainly explored backshoring as a discrete event independent of previous offshoring decisions, which however are key in providing a full understanding of the firm-level reversal strategy, given the dynamic nature of global manufacturing (Boffelli and Johansson 2020; Boffelli et al. 2020; Di Mauro et al. 2018; Stentoft et al. 2018). Moreover, comparing the motivations of firms which have never offshored and those that have decided to bring production back home is crucial for understanding firm strategies (Pal et al. 2018; Tate and Bals 2017; Theyel et al. 2018). Indeed, firms might decide to backshore for similar reasons other companies stay at home and do not offshore. However, very little research has so far examined and compared backshoring with offshoring and staying at home production location strategies (e.g., Canham and Hamilton 2013; Stentoft et al. 2018; Stentoft and Rajkumar 2020). Furthermore, the implementation mode, consequences and type of production activities involved in manufacturing relocations have received relatively scant attention (Benstead et al. 2017; Moore et al. 2018; Wan et al. 2019b), as well as factors affecting backshoring, which seem to vary across sectors, firms, and products (e.g., Młody and Fratocchi 2022).

In an attempt to fill these research gaps, we conducted an explorative industry-level study to analyse firms’ production location strategies with a particular focus on backshoring and within an analytical framework drawn from different IB perspectives, including operations and supply chain management. To do this, we drew upon data from an original firm-level survey with around 700 firms amongst manufacturers, retailers, and designers operating in the UK textile and apparel (T&A) industry. T&A, a highly globalised, consumer-driven, and labour-intensive sector that has experienced extensive offshoring, has seen one of the largest numbers of manufacturing backshoring decisions over the last decade (Delis et al. 2017; Eurofound 2019; Vanchan et al. 2018; Wan et al. 2019a). In particular, this trend has received considerable attention in the UK, with many examples of renowned fashion brands and retailers announcing to increase domestic sourcing or production at the expense of offshoring (Ashby 2016; Robinson and Hsieh 2016). However, evidence on backshoring in the T&A industry remains largely circumstantial (Moradlou et al. 2022): most research has focused on the shoes business rather than the broader T&A sector, which has been only partially investigated (Baraldi et al. 2018; Di Mauro et al. 2018; Merino et al. 2021). To the best of our knowledge, this is the first survey conducted in the industry with the aim of exploring manufacturing location strategies with a focus on backshoring.

A multiple-step analysis explores production location strategies in relation to a variety of factors at different levels of analysis. Backshoring strategies are compared to “only-offshoring” in relation to several characteristics of firms, products, production processes as well as offshoring modes and their motivations. Backshoring is conceptually analysed as a subsequent decision of a previous internationalisation choice and investigated in terms of type of activities brought back, implementation mode and implications of the strategy. Firm motivations for keeping production at home (i.e., staying at home) and backshoring are also contrasted in search of differences in the motivation to produce domestically in the two different strategies. Firm perceptions of industry’s difficulties are explored to highlight opportunities for future growth in the sector. Findings are discussed in light of previous research on the topic as well as IB theories discussed in the conceptual framework.

The paper contributes to the extant literature on backshoring by providing new empirical evidence based on originally collected firm-level survey data and focused on a single country and industry where smaller (and less studied) firms tend to prevail. Moreover, compared to most research in the field, backshoring is not explored as a stand-alone phenomenon but compared to other production location strategies in relation to different firm- and industry-level factors and motivations. This helps strengthen the understanding of the phenomenon from a perspective which takes into consideration internationalisation as a non-linear process where firms adjust production location strategies based on a variety of changing conditions. The paper also contributes to academic research by analysing backshoring through a combination of IB approaches with an analysis of an under-studied sector in this field.

The remainder of the paper is structured as follows. Section 2 proposes a conceptual framework that reviews the extant literature on backshoring through the lens of different IB theories previously applied to offshoring. It also considers the backward trend in the T&A industry with a focus on the UK context. The design, distribution, and validation of the original survey, and the three-step analysis conducted are explained in Section 3. Section 4 presents the findings, while Section 5 discusses the main results within the proposed conceptual framework, suggesting some policy implications and avenues for future research.

2 Research background

2.1 Backshoring: a conceptual framework

In the IB literature, including operations and supply chain management, both transaction cost economics (TCE) and resource-based view (RBV) theories have provided sound theoretical explanations of why firms locate their production activities across national borders. The overarching Dunning’s eclectic paradigm has included under its Ownership-Localization-Internalisation (OLI) framework all the most relevant theoretical underpinnings to explain international production and manufacturing offshoring. Contingency theory and GVC approaches have also been adopted in offshoring research. While there is no distinct IB theory on backshoring, several scholars have recently drawn upon existing conceptualisations to describe this trend as a reverse or subsequent location decision of a previous offshoring or internationalisation choice (e.g., Ciabuschi et al. 2019; Ellram et al. 2013; Wiesmann et al. 2017). The outsourcing and offshoring literature concludes that no single theory can fully explain these phenomena, arguing instead for the adoption of theoretical pluralism (Schmeisser 2013). The combination of different perspectives can also help define a more comprehensive framework for the entire backshoring process, which involves various influencing factors at different levels of analysis (e.g., location, industry, firm, product) (Albertoni et al. 2017; Bals et al. 2015). A review of these theories and their application to backshoring strategies is summarised in Table 1.

In the TCE perspective (e.g., Williamson 1975, 1985), firms’ location strategies are seen as the outcome of the comparison between costs and benefits of organising transactions internally relative to conducting market transactions: the decision to internalise activities thus provides a rationale for both horizontal and vertical integration of cross-border activities. TCE offers a rich understanding of internationalisation in terms of firm behaviour, contracts, and asset specificity (Williamson 1985). Its focus is on the overall organisational capability of the firm, and on the intra- versus extra- firm linkages across activities and functions: internalisation and integration are strictly intertwined. On the other hand, TCE’s main emphasis is on the firm as an alternative to the market: this has been challenged by the growth of alliance and network capitalism, as outsourcing and offshoring, asset-augmenting foreign investment, global value chains and production networks, strategic collaborations, and partnerships, have all greatly affected the nature and scope of firm internalisation processes (Cantwell and Narula 2001). The importance attributed by TCE to organisational and relational issues, as well as the opportunity costs associated with internal transactions and external exchanges, makes this approach suitable for identifying firm location and relocation choices (Iammarino and McCann 2013; Manning et al. 2008; Roza et al. 2011). TCE implies that firms tend to move away from higher- to lower- cost regions, all else being equal (Ellram et al. 2013), and that value chain activities involving routinary tasks, standardised transactions or modularity are more likely to be performed offshore (Ancarani et al. 2019; Ketokivi et al. 2017). Thus, higher than expected coordination and monitoring costs offshore can lead firms to bring all or parts of production stages back home, both by integrating activities within the firm, and by sourcing domestically. Relationship failure or opportunistic behaviour of offshore suppliers, physical and cultural distances, rising market volatility, lower quality of production, higher levels of interdependencies between processes, increases in the frequency and specificity of transactions or in the overall complexity of production activities (e.g., degree of customisation, differentiation, product innovation, blending of manufacturing and services) are amongst the factors causing excessive coordination and monitoring costs at the foreign location (Kinkel 2014; Martínez-Mora and Merino 2014; McIvor 2013). Therefore, manufacturing backshoring stems from reduced gaps in the unit costs associated with the coordination and execution of activities between the offshore and home location.

While transaction costs are considered drivers of backshoring, firms base this manufacturing relocation decision also on value-related aspects, including quality, flexibility, and access to skills and knowledge (Johansson and Olhager 2018; Kinkel 2012; Kinkel and Maloca 2009). According to Canham and Hamilton (2013), the backshoring phenomenon further emphasises that firms do not consider only transaction costs, being very much concerned with competences and capabilities in their search for competitive advantage.

Built on the seminal work of Edith Penrose (1959) and on evolutionary views of technological change, the RBV (e.g., Barney 1991; Wernerfelt 1984) sees firms as bundles of resources differently employed for achieving a long-term sustainable competitive advantage (McIvor 2009; Roza et al. 2011). Firms invest in key strategic areas where they have distinctive valuable tangible and intangible resources and capabilities (e.g., proprietary technologies, tacit know-how, specialised assets, organisational capacity, reputation). Competencies created in one location can be used in another, so that there may be multi-directional cross-border flows of knowledge, information, and products. Over time, firms have adopted more sophisticated means of coordination (internally and externally) to continually maintain their local and global knowledge advantage.

In the RBV perspective, backshoring can be motivated by changes in the competitive strategies and priorities that affect the value of the offshored activity, as well as the upgrading of internal capabilities or the firm's ability to develop critical assets or effectively exploit resources abroad (Canham and Hamilton 2013; McIvor and Bals 2021). For example, backshoring can be driven by the importance of co-locating production and R&D (Pisano and Shih 2012), increased digitalisation or availability of new competences and skills domestically (Di Mauro et al. 2018), more effective protection of intellectual property rights (Wiesmann et al. 2017), need of exploiting the “made-in effect” (Grappi et al. 2018). In other words, firms bring production back home to pursue higher levels of performance and strengthen their competitive advantage (Martínez-Mora and Merino 2014; McIvor 2009, 2013).

Both TCE and RVB approaches, amongst others, were subsumed under the eclectic OLI paradigm, explaining international production and firms’ internationalisation strategies (Dunning 1980, 1988, 2009). While ownership and internalisation advantages are linked respectively to RBV and TCE and focus particularly on firm-level aspects, location advantages are external to the firm and based on resources, networks, and institutional structures specific to a certain context (Rugman 2010). The three types of advantages are assumed to be unevenly spread across countries, industries, and firms. In our framework, backshoring is considered a dynamic reorganisation and relocation of production activities following a deterioration, change or wrong assessment of location motivations in the host country or their improvement in the home country (Ellram et al. 2013; Foerstl et al. 2016; Fratocchi et al. 2016).

Being backshoring a location-related decision (Gray et al. 2013), of particular relevance here is Dunning’s classification of the four main types of internationalisation strategies (Dunning 1993, 1994) – built on the earlier Behrman’s typology (1972) – grouping the motivations underlying the establishment of operations abroad according to the locational advantages offered by the host economyFootnote 2 (Dunning and Lundan 2008). Resource (or asset)-seeking strategies focus on opportunities for accessing tangible or intangible resources such as raw materials, labour, technology, and skills, unavailable at home or available in the host location at a lower cost. Market-seeking strategies are motivated either by the emergence or growth of new or existing markets, which include the presence of related firms, the quality of national and local infrastructure, macro-economic and macro-organisational policies, increased need of being close to consumers, or the growing importance of promotional activities by local development agencies. Efficiency-seeking international expansion aims at rationalising and restructuring previous investments, which were either resource- or market- led, taking advantage of elements such as international differences in factor costs and endowments, dynamic specialised industry clusters, removal of trade barriers, or industrial policies to restructure economic activity or upgrade human resources. Finally, strategic asset–seeking firms engage in operations abroad usually aiming at improving their long-term objectives in terms of global capabilities and competitiveness, as well as at achieving opportunities for exchange of localised tacit knowledge, ideas and learning by accessing different cultures, institutions, systems, consumers demands and preferences (Ancarani et al. 2015; Dunning 2009; Iammarino and McCann 2013). These different types of internationalisation strategies are not mutually exclusive as they can and increasingly do belong simultaneously to all four categories, implying very different types of geographies.

In this view, backshoring can, for example, be explained by increases in labour costs or decreases in labour productivity at the offshore location, new availability of skills or increased digitalisation in the home country, changes in government policies both at the foreign and home location, and/or a combination of different factors pushing internationalised firms to restructuring the division of labour in their value chains. A list of motivations for bringing production back home (including motives for solely producing domestically, deciding not to offshore) is identified by drawing upon a review of the extant literature on offshoring and backshoring (e.g., Johansson et al. 2019; Kinkel and Maloca 2009; Moore et al. 2018; Wiesmann et al. 2017). More specifically, in our framework, backshoring (and staying at home) motivations were grouped into four main broad categories partially overlapping Dunning’s location motivations: assets-driven (resource-seeking), proximity-driven (market-seeking), cost-driven (efficiency-seeking) and value-driven (strategic-seeking).

Furthermore, some studies have recently advocated the use of contingency theory (e.g., Pennings 1992), already used in offshoring research (Mukherjee et al. 2013; Zorzini et al. 2014), to consider more in depth the contextual factors that influence backshoring (Bals et al. 2016; Foerstl et al. 2016; Fratocchi et al. 2016; Tate et al. 2014). Research has emphasised how backshoring varies across industries, firms and products based on different types of conditions (Barbieri et al. 2018; Tate and Bals 2017; Theyel et al. 2018).

Unlike other IB theoretical perspectives – which (to the best of our knowledge) have been scarcely used in academic research on backshoring in the T&A industry – the contingency approach has been particularly adopted in studies focusing on this sector. For example, Benstead et al. (2017) explored a variety of contingencies affecting the decision to backshore, including company-related (e.g., firm’s size, ownership mode, government policy, capital intensiveness), product-related (e.g., market segments, price point, bulkiness, and customisation of products) as well as behavioural-related factors (e.g., emotional aspects). All these contingencies were found to be relevant in a case study on a UK textile firm. Moore et al. (2018) studied the relationships between several contingency factors (e.g., firm’s size, geography, market segment, production category, year of backshoring) and backshoring drivers in the US T&A industry. Only a few statistically significant relationships (i.e., market segment with manufacturing process and production category with sustainability) were found. Merino et al. (2021) examined why footwear companies prefer either the back- or near-shoring option by analysing the contingency factor related to firms’ size. They found that backshoring companies are generally smaller.

In our framework, contingency factors include the characteristics of firms embarking in backshoring, such as their size, sourcing relationships, strategies, and capabilities as well as their type of production, market segment and price point. GVC stages or functions (or, more broadly, roles in the GVC) are also deemed as critical drivers of firms’ location strategies. The combination of contingency theory and GVC views focused on business functions (Gereffi and Fernandez-Stark 2016; Sturgeon 2013) is key to providing additional insights for the investigation of backshoring. Moreover, contingency encompasses the characteristics of the offshore initiative such as geography, motivations, and governance mode (Boffelli and Johansson 2020). For example, previous studies suggest that offshore outsourcing initiatives are more likely to be relocated back home because of their lower fixed costs and higher flexibility in ending the relationship with the foreign service provider compared to captive offshoring, which instead involves larger direct investments and full ownership offshore (Di Mauro et al. 2018).

This paper draws upon these different theoretical and conceptual insights to investigate the factors influencing production location strategies with a particular focus on backshoring: TCE and RBV are particularly important for looking at firm-level changes; the OLI paradigm for exploring locational factors at both origin and destination; the contingency theory/GVC framework for investigating the characteristics of firms and offshore choices that affect their location decisions. In the next sub-section, we discuss the evolving structure, configuration, and geography of the T&A value chain. Moreover, a quick overview of this industry in the UK and its relevance in relation to the analysis of backshoring is provided.

2.2 The evolving configuration of production in the T&A value chain

T&A is typically defined as one of the most globalised and key export industries in the world, as well an important engine of economic growth in both advanced and developing economies (Gereffi and Frederick 2010). A complicated and geographically fragmented “buyer-driven” value chain characterises this industry, where lead firms (e.g., retailers, designers, brand manufacturers) play an important role in the organisation of global production. Over time T&A, due to its labour-intensive and low-technology nature, has experienced extensive offshoring of production to suppliers (or manufacturing firms) usually located in developing economies and mainly pursuing cost-related advantages (Gereffi and Memedovic 2003). As concerns retailers, they tend to “offshore” the entire production through offshore outsourcing. While lead firmsFootnote 3 carry out the most valuable activities in the value chain (e.g., design, branding, marketing), suppliers are usually involved in different stages of the production process in accordance to lead firms’ requirements.

Over time, the decrease of communication and transportation costs, as well as trade policies and rules, have contributed to the global dispersion of the industry (Pickles et al. 2015). Between 1974 and 2004, under the Multi-Fibre Arrangement and its successor, the Agreement on Textiles and Clothing (ATC), the industry was characterised by limitations on the volume of certain imports, with the aim of protecting domestic production in the US and the EU from low-cost highly competitive suppliers. Nevertheless, these trade restrictions encouraged the geographical spread of production in many low-income countries, fuelling the global dispersion of value chains, the increasing importance of branding, and the strengthening of the retail end of the chain (Fernandez-Stark et al. 2011).

Later, the elimination of the quota system under the ATC in 2005, in addition to the 2008/2009 economic crisis, the saturation of mature and traditional markets and intensified international competition in the industry led to a process of international reorganisation of production, with firms realigning their manufacturing and sourcing strategies with the new economic reality (Gereffi and Frederick 2010; Lane and Probert 2006). On the one hand, lead firms have restructured their sourcing linkages by establishing longer and more stable relations with a limited number of more efficient and strategically located suppliers (Pickles et al. 2015). On the other hand, organisational learning processes resulting from these relations have helped suppliers to “upgrade” into higher value activities and improve their position in the GVC.

Supply network relationships have become increasingly complex due to rising labour costs, increasing competition in high manufacturing competences, growth of consumer markets in emerging economies, and technological improvements in advanced countries (McKinsey and Company 2018). In this context, not only labour costs but also product quality, production control, minimisation of counterfeiting risk and intellectual property theft, as well as compliance with rising environmental and social standards, have become key factors for competitiveness (Pal et al. 2018; Robinson and Hsieh 2016). The development of fast fashion systems and the rapid increase in online shopping with a highly volatile demand have made operational flexibility, shorter lead times, small production runs, lower inventory levels, and proximity to final markets gradually more relevant (Fratocchi and Di Stefano 2019; Hammer and Plugor 2016; Moradlou et al. 2022).

Scholarly research has shown that T&A is one of the industries with the higher number of firms bringing production activities back to their home country (De Backer et al. 2016; Eurofound 2019; Fratocchi et al. 2016; Vanchan et al. 2018; Wan et al. 2019a). In addition to exemplary backshoring cases of renewed large fashion brands and retailers such as Prada, Armani, and Ralph Lauren (European Reshoring Monitor 2021; Reshoring Initiative 2021; Robinson and Hsieh 2016), the reversal trend seems to also involve smaller firms, which have dominated this industry in advanced countries since the massive offshoring by large firms (Dana et al. 2007; Pal et al. 2018).

2.2.1 The UK T&A industry: towards a manufacturing renaissance?

While T&A historically symbolised the 1st industrial revolution and used to be a dominant employer in the UK manufacturing, since the 1970s it has suffered from a “catastrophic” decline as production was extensively offshored to low-labour cost locations (Abecassis-Moedas 2007; Lane and Probert 2006). This led to a massive loss of firms and jobs in the industry, with employment falling from more than 700,000 in the late 1970s to less than 100,000 in the early 2010s. The UK has continued to play a key role in both fashion design and retailing, but large-scale domestic apparel manufacturing has gradually disappeared, with the sector now being mostly populated by micro and small firms (Froud et al. 2018).

However, in the aftermath of the 2008 economic and financial downturn, the sector has experienced a renewed growth, driven also by increasing domestic demand (Hammer and Plugor 2016; Robinson and Hsieh 2016; The Alliance Project 2017). Between 2009 and 2015, national production raised from £7.6 to £9.1 billion, Global Value Added (GVA) from £2.5 billion to £3.3 billion, and employment from 82,000 in 2013 to 109,000 in 2017 (UKFT 2018). Many examples of fashion brands and retailers both in mass- and middle-market (e.g., Top Shop, Asos, John Lewis, Marks & Spencer) and high-end sector (e.g., Barbour, Burberry, Mulberry, Paul Smith) have relocated production to the UK or increased the volume of items produced domestically (Ashby 2016; Robinson and Hsieh 2016).

While the UK T&A manufacturing is gaining momentum, evidence on backshoring strategies remains mainly anecdotal. Moreover, since 2016, uncertainty linked to Brexit has begun to affect sourcing and production strategies in the industry (Casadei and Iammarino 2021), which over the last years have been further disrupted by the signing of the new UK-EU trade agreement and the COVID-19 pandemic (The Guardian 2020; UKFT 2021). In this respect, the UK represents a unique and interesting context for the investigation of sourcing and production strategies in a rapidly changing context and in an industry that has recently experienced a revitalisation.

3 Data and methodology

3.1 Survey design and distribution

The empirical analysis draws upon an original firm-level survey. We cross-referenced data from the Orbis database (by Bureau van Dijk) and business directories from industry associations to identify a target population of UK manufacturing firms, retailers, and fashion designers. The group of firms retrieved from Orbis included the Standard Industrial Classification (SIC) 2007 categories linked to T&A production and fashion retailingFootnote 4, encompassing foreign subsidiary companies. The definition of the final target population – 13,505 firms (3,941 manufacturers and 9,564 retailers)Footnote 5 – was partially constrained by the difficulties in retrieving firms’ missing email addresses.

Because of the configuration of the T&A value chain discussed above, the survey – designed using the software Qualtrics and according to the methodological procedures of survey research (Forza 2002) – was structured to separately target with different sets of questions 1) retailers and designers – i.e., companies that are involved in the most valuable activities of the value chain – and 2) manufacturing firms, which perform production activities to meet the needs of the former. Since there are no specific SIC codes associated with fashion design activities, which are included amongst the categories dedicated to textile and apparel manufacturing, we asked firms to choose one of the two categories and provide a definition of their company. Respondents described themselves as high street retailers, online retailers, boutiques/shops, fashion houses, brand manufacturers, and bespoke tailors, in addition to general retailers and independent fashion designers.

We reviewed the extant literature on the theme to define 62 survey questions with branching – i.e., conditional paths for participants based on their answers. Firms were asked about their characteristics, type of products, organisation, and stages of production, in addition to ownership, supply chain relationships, offshoring strategies and backshoring initiatives. Through Likert-scale questions on a three-point scales, respondents were asked to rate the importance of a variety of factors driving their decision of producing domestically (for firms that had never offshored) or relocating manufacturing back to the UK (for firms that had implemented an offshoring strategy). Moreover, all respondents were asked to optionally leave comments regarding the main difficulties and strengths of the industry, and desirable recommendations for future policy support.

The survey was pre-tested with a sample of 10 firms from the target population as well as industry experts to ensure the quality of the questions. The test panel recommended only minor corrections, which were included in the final version of the questionnaire. Between June 2019 and January 2020, we distributed the survey electronically to randomised samples from the target population in different periods of time and solicited non-respondents with four reminders. Additional offline data collection was executed on the 29th and 30th of May 2019 during the Make It British event, a London-based trade show that hosted many firms from our population. The UK Fashion & Textile Association (UKFT) supported and sponsored the entire survey distribution. A total of 1,006 responses was collected, thus achieving a satisfying response rate (i.e., 7.5%), particularly given the sensitive topic and the lack of incentives to participants (Harzing et al. 2012). The sample was then cleaned to remove partially completed and duplicated responses, as well as replies from firms wrongly classified as T&A. We also excluded retailers selling only other designers’ brands and not involved in any sourcing or production strategy (i.e., mere shops). The final sample included 688 valid completed responses, 199 from manufacturing firms and 489 from retailers and designers.

3.2 Data validation

The final sample was tested for non-response bias by comparing answers from early and late respondents (Armstrong and Overton 1977; Lambert and Harrington 1990). This technique assumes that late respondents have replied because of the increased stimulus through reminders and are therefore expected to be like non-respondents. Late respondents were defined operationally as those firms that replied following the third reminder, when the number of completed surveys dropped noticeably compared to those received after the first two reminders. A t-test for comparison of means was used to compare the answers of early and late respondents on primary variables of interest; no significant differences between early and late respondents were found, suggesting that non-response bias is unlikely to be a serious concern for external validity. Following Armstrong and Overton (1977), we also compared our final sample with known features of the target population, showing that the two groups have similar characteristicsFootnote 6. Moreover, the final sample was qualitatively checked and validated by the UKFT. The combination of these tests increased our confidence about the (cautious) generalisability of our research findings to the final target population.

3.3 Data analysis

The paper draws on a three-step explorative investigation, which we performed separately for manufacturing firms and retailers/designers, given the different role played by these companies in the organisation of production in the GVC. While we were able to collect a relatively high number of responses, the relatively small number of offshoring and backshoring firms deterred us from examining data through regression analysis. The choice of studying separately manufacturing firms and retailers/designers further restricts the size of the backshoring sample. Therefore, a qualitative investigation seemed the most appropriate first step for exploring a still relatively small phenomenon on which previous evidence is scanty at both industry and context levels. First, a descriptive picture of backshoring strategies (versus “only-offshoring” initiatives) is provided in relation to several characteristics of firms, products, production processes and offshoring initiatives. This first step also involves a focus on backshoring in terms of type of activities brought back, implementation mode and strategy implications. The second step includes a comparative exploration of the motivations that led firms to opt for producing domestically or returning all or parts of production back home from offshore. The importance of staying at home and backshoring drivers are analysed through descriptive statistics and compared using a t-test for equality of meansFootnote 7. This second section is supported by textual data from firms that further explained their reasons for keeping manufacturing domestically or backshoring. The third step entails an analysis of the large number of further open-ended responses, which include comments on the weaknesses of the industry as well as suggestions for policy initiatives in support of domestic production and the sector. Each response was coded to explore the main industry’s difficulties that have affected manufacturing location decisions, and to understand the future potential for the UK T&A manufacturing.

4 Findings

4.1 Descriptive analysis: offshoring, backshoring and staying at home

Table 2 shows the percentage of offshoring and backshoring firms in the sample. In manufacturing, approximately 24% of firms went abroad, of which 21% implemented backshoring and 2% planned to move production back to the UK. As concerns retailers/designers, around 43% of companies offshored and, amongst these, nearly 24% decided to bring manufacturing back (with 15% having already implemented backshoring). Therefore, almost one quarter of offshoring firms in the sample reassessed the location of manufacturing by bringing (or at least planning to bring) it back home. This confirms the presence of a backshoring trend in the UK T&A industry.

Table 3 summarises the main characteristics of manufacturing firms. These companies are mostly micro (< 10 employees), set up before the 1990s, and specialised in the activities ranging from product design and development to the supply of finished products, especially high-end textile, apparel, outwear and accessories for both domestic and international markets. Amongst them, there is a high share of Original Design Manufacturers (ODM), which carry out all stages involved in the production of a finished product, including design and product development processes. Looking at differences in the characteristics of the firms that retained production domestically and those that offshored, the latter have a higher portion of older businesses established before the financial crisis (when offshoring in the industry was still largely the preferred strategy). These firms target more the mass- and middle- market compared to the high-end segment, which usually requires higher quality, supervision of production and dependency to suppliers that make companies more inclined to keep manufacturing at home (e.g., Benstead et al. 2017).

Amongst those manufacturers that offshored production, businesses that planned or implemented backshoring have a higher percentage of both micro and large firms. This is in line with the existing literature (e.g., Boffelli and Johansson 2020; Merino et al. 2021), which highlights how, in addition to large firms, very small companies have the same if not higher propensity to bring production back because of scarce financial resources and difficulties in coordinating foreign facilities. Backshoring firms are also less specialised in textiles and more in apparel, outwear and sportswear compared to only-offshoring firms, as textile production is more capital-intensive (Taplin 2006), less dependent on manual labour (Moore et al. 2018) and therefore less suitable for being offshored (and backshored). With respect to the sportswear sector, backshoring might be motivated by the need of co-locating production with R&D, which is particularly key in this type of products often relying on highly innovative new materials (e.g., Lica et al. 2020). A similar explanation can be provided for the outwear sector. Moreover, backshoring firms have a higher portion of ODM firms producing high-end products, where manufacturing processes are inherently more complex to monitor and coordinate cross-boundaries (e.g., Martínez-Mora and Merino 2014).

Turning to the characteristics of the offshoring initiatives (Table 4), manufacturers mostly offshored activities ranging from sample development to product finishing, in addition to fabric manufacturing, to Asia (particularly China) due to labour cost savings, as well as access to skills and knowledge through outsourcing to foreign suppliers. Firms that moved production back to the UK had a higher share of product making and finishing stages offshore; they located less in China compared to the only-offshoring firms, with a slightly higher share of firms that had originally shifted production abroad because of trade facilitations and access to raw materials. Thus, in the case of manufacturing firms, offshoring motivations seem mostly driven by resource- and efficiency-seeking motivations both in the case of only-offshoring and backshoring firms, reflecting a combination of both TCE and RBV theoretical perspectives. These motives – labour cost saving and access to skills and knowledge – are among the main drivers of international production activities emphasised in previous studies on offshoring (e.g., Canham and Hamilton 2013; Javalgi et al. 2009; Manning et al. 2008; Mihalache and Mihalache 2016).

Turning to retailers/designers (Table 5), these are mostly micro firms specialised in high-end apparel, accessories, outwear and footwear, and focusing on the design, development, and delivery of products. Firms that offshored have a higher share of larger companies (> 10 employees) and a lower proportion of very young firms; they are more specialised in apparel, as well as in in-house activities of design and development of products. Unsurprisingly, a lower share of such firms is targeting only the domestic demand and a higher portion serves both domestic and international markets. By looking at differences in the characteristics of only-offshoring and backshoring companies, the latter are younger, smaller, and slightly more specialised in sportswear – like manufacturing firms – than in footwear. Indeed, several respondents emphasised how the UK footwear industry has gradually been eroded by large-scale offshoring, making it difficult to manufacture products domestically. Moreover, relative to only-offshoring, backshoring firms focus more on high-end products, with a slightly lower portion of companies specialised in design and development activities and a higher share targeting both domestic and international markets. This supports previous research on the sector, which emphasised how backshoring is unlikely to occur in low-cost market segments (Fratocchi and Di Stefano 2019).

Looking at firms that offshored (Table 6), these mostly moved abroad the stages ranging from prototype preparation to the finishing of products to Asia (especially China), because of access to skills and knowledge and labour cost savings by mainly outsourcing to foreign Cut Make Trim (CMT) and Original Equipment Manufacturing (OEM) firms. Indeed, as seen above, offshoring firms are more specialised in in-house activities of product design and development, thus mostly relying on suppliers for the subsequent production stages, including sampling and prototyping activities. If we split the offshoring sample, backshoring companies offshored less to Eastern Europe and more to Asia (excluding China) and Western Europe. The Eastern EU context offers the possibility of combining cost advantages, specialised skills, and proximity to the final market: firms might thus be less inclined to move production back from this area. In this regard, Eastern Europe has been also identified as a popular “nearshoring” (i.e., relocation of production to nearby rather than home countries) geographical area for firms in Western Europe (e.g., Merino et al. 2021).

Backshoring firms were also slightly less motivated by trade facilitations and more by access to advanced machinery and equipment when offshoring production: the availability of new technologies in the UK might be behind the choice to re-consider domestic production (e.g., Ancarani et al. 2019; Hasan 2018). More generally, as for manufacturers, offshoring motivations were overall mainly linked to resource- and efficiency-seeking location strategies and based on both cost- and value- related aspects, in line with TCE and RBV determinants. Thus, our results are in line with the academic literature which often describes offshoring as an international strategy aimed at reducing costs and/or accessing specialised and productive resources (e.g., Jensen and Pedersen 2011). Backshoring firms are also more prone to outsource to CMT and OEM, rather than to suppliers performing also design and branding: firms less dependent on the relationship with suppliers (as in the case of CMT and OEM, where the offshoring company remains in control of high value stages) are indeed more likely to bring production back domestically (e.g., Di Mauro et al. 2018).

Looking at the backshoring process (Table 7), manufacturing firms mostly brought back the stages of product making and finishing using own domestic facilities. This strategy generally resulted in increases of product quality, acquisition of new clients and recruitment of new skilled workforce linked to the higher volumes of production manufactured in-house. Retailers/designers predominately brought back activities ranging from sample development to product finishing by outsourcing to external domestic suppliers. The main consequences for backshoring firms have been an increase in product quality and innovation-related activities, and investments in new competences and skills.

4.2 Staying at home and backshoring: same drivers?

This section is based on the assumption that motivations for originally keeping production at home (i.e., not offshoring) are similar to those pushing firms to bring manufacturing back; yet, we expect to find different incentives according to the GVC role, i.e., manufacturers and retailers/designers. To the best of our knowledge, there is only one study exploring the motivations behind retaining production at home versus backshoring (Canham and Hamilton 2013): the study focuses more generally on consumer and industrial goods sectors in New Zealand.

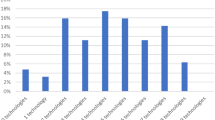

As shown in Fig. 1 (details in Table 10 in the Appendix), according to survey responses of both manufacturers and retailers/designers (i.e., the full sample), the most important reasons for keeping production domestically are the “Made in Britain” label, shorter lead times/delivery reliability, the possibility of monitoring production, and lower purchase order rigidity. Respondents indicated production control as the most important driver for bringing manufacturing back to the UK, followed by shorter lead times/delivery reliability, lower rigidity with orders, as well as higher operational flexibility and responsiveness. Environmental and social sustainability were deemed as an important theme for both staying at home and backshoring firms. The only factor with a statistically significant higher rating for backshoring firms is proximity to R&D and product development, while brand’s reputation through the “Made in Britain” label matters relatively more for companies who never internationalised production. Similarly, Canham and Hamilton (2013) found that reasons for staying at home are very similar to those that give rise to backshoring. These are the “made in” effect, a sense of patriotism, production control, small production runs, flexibility and ability to deliver quickly as well as higher quality.

Key drivers of staying at home and backshoring strategies. Source: Authors’ own elaboration. Notes: Drivers highlighted in bold are those with a statistically significant higher rating in the comparison (performed using a t-test for equality of means) between staying at home and backshoring motivations. For example, as concerns the full sample, the Made in Britain label shows a statistically significant higher rating for staying at home companies (compared to the backshoring ones), while proximity to R&D and product development has a statistically significant higher rating for backshoring firms (compared to the staying at home ones)

For staying at home manufacturers, the “Made in Britain” label, production control, shorter lead times/delivery reliability and access to qualified skills and knowledge are the most important drivers. The key factors leading manufacturers to move production back to the UK are access to skills and knowledge and the possibility of monitoring production. Three motivations have a statistically significant higher rating for staying at home compared to backshoring in manufacturing: the “Made in Britain” label, shorter lead times/delivery reliability as well as physical and cultural proximity. Staying at home retailers/designers are mostly motivated by lower purchase order rigidity, the “Made in Britain” label, and shorter lead times/delivery reliability, whilst production control is the most important driver for bringing manufacturing back to the UK. Both staying at home and backshoring retailers/designers regarded environmental and social sustainability as an important driver for operating at home. A few factors have a statistically significant higher rating for backshoring compared to staying at home retailers/designers: operational flexibility and higher responsiveness, product innovation, higher quality and customisation of products, proximity to R&D and product development, as well as availability of infrastructure.

To summarise, proximity forces, partially overlapping with market-seeking motivations, seem to represent the main reasons for producing in the UK rather than abroad, both for staying at home and backshoring firms. In this respect, the latter firms could be driven either by the possibility of reducing coordination or monitoring costs offshore (a TCE-based explanation) or by changes in the firm’s competitive priorities (aligning to a RBV perspective). However, in our study, value-related factors, which are more linked to strategic asset-seeking motivations, differ in the two strategic decisions.

On the one hand, the “Made in Britain” label is more important for staying at home firms. Previous research has emphasised how the “Made-in effect” seems to be particularly relevant as a key source of distinctive competitive advantage in the T&A industry (Barney 1991). Consumers tend to associate product quality with a positive image of the production country, particularly in terms of competences’ availability, traditional craftsmanship, greater attention to ethical values or, more generally, patriotic feelings (Ancarani et al. 2015; Grappi et al. 2018; Macchion et al. 2015). Over the last decade, there has been an increasing demand for the “Made in Britain” brand linked to tradition and higher quality (The Alliance Project 2017). In the open-ended replies, most staying at home firms justified domestic production as a way of investing in local skills and competences, as well as of supporting employment, creativity, heritage, authenticity, and the “national” image of the UK T&A industry. In this regard, firms that have decided to not offshore and produce domestically might value even more the symbolic connection between their products and the home country.

On the other hand, the possibility of being closer to R&D and product development operations is more significant for backshoring companies. In fact, backshoring retailers and designers give more weight to innovation, quality, and customisation of products. In accordance with the RBV view, these firms might have changed their competitive priorities through a search for a higher quality of products in the UK compared to offshore. Scholarly research has shown how consumer demand has become growingly sophisticated in search for higher quality, innovative and customised products, encouraging the relocation of manufacturing activities close to the most strategic stages of design and development (Bailey and De Propris 2014; Pisano and Shih 2012). Monitoring production is also deemed as particularly important by those retailers and designers who decided to bring manufacturing back home. This may be explained by the need of reducing the transaction costs of monitoring and coordinating production offshore.

For manufacturers, firms that have never offshored value more cultural proximity (classifiable as a strategic asset-seeking factor), while all firms (particularly those backshoring) emphasise the access to domestic skills and knowledge, following a resource-seeking motivation. In the open-ended responses, some of these companies remarked the existence of specific highly specialised local skills difficult to find elsewhere (e.g., knitting). Unsurprisingly, cost-driven factors are amongst the least rated as motives for producing domestically both by manufacturers and retailers/designers.

In the general transition from mere cost-related motivations to a greater focus on knowledge, intangible assets, and value creation for determining the location of manufacturing (Albertoni et al. 2017; Cantwell 2009; Dunning 2009; Ellram et al. 2013), market- and strategic asset-seeking advantages have been identified by the literature as the main determinants of backshoring (Ancarani et al. 2015; Arlbjørn and Mikkelsen 2014). Our findings, however, highlight also some heterogeneity between staying at home and backshoring motivations, further emphasised by the different GVC function played by the firms.

4.3 Firm-level perceptions of industry’s difficulties and policy intervention

Here we analyse the comments provided by 41% of the total 688 respondents in an optional question at the end of the survey. Table 8 shows a summary of the main industry’s difficulties and recommendations identified by both manufacturers and retailers/designers.

A sharp disconnection seems to emerge according to the firms’ value chain function. On the one hand, manufacturers complained of being ignored by domestic retailers, who often offshored production rather than supporting domestic producers. Furthermore, a widespread feeling amongst them, particularly micro firms, is that of being inadequately supported by the government through financial funding and training for depleting manufacturing skills (e.g., pattern, grading, sewing, cutting) – particularly threatened by the lack of young people interested in learning such competences – and the absence of investment to boost employment and the industry image. Some of their comments were: “Due to lack of government support for small businesses and lack of training in the UK, skills are depleted with the last generation”; “UK manufacturing needs more recognition and an image boost. Anyone studying fashion in the UK should see manufacturing as an attractive career option”; “The UK has an amazing capacity for innovation and more support for this should be in place through better financial support”; “The government does not realise how big this industry is and I hope for our young generation that this industry is taken seriously”.

On the other hand, retailers and designers justified their decisions to offshore production mainly because of the scarcity of domestic manufacturing facilities and specialisations in components (e.g., laces, elastics, trims, waterproof textiles), products (e.g., footwear, hats, gloves, faux fur) and production stages (e.g., printing, embroidery, trimming). Although most of them claimed to be highly willing to source manufacturing from UK producers, the extremely high costs and large volumes of production often required have prevented them from relying on local manufacturing. For example, firms wrote: “We are a very small business manufacturing high quality shoes in Portugal, if there was an option to manufacture in the UK we would have followed this route, but the footwear industry has been steadily eroded in the country”; “We would like to manufacture in the UK, but we feel that the skills and machinery are not here”; “I would love to manufacture products in the UK and have done a lot of research into this. The main issue is cost. With labour costs on the rise, we simply cannot manufacture products for the price a customer wants to pay”; “We design and produce samples in the UK, but to complete the garments in bulk we have no choice but to manufacture abroad”; “A lot of factories are closing because a lot of work is outsourced and the few that are left prefer bigger dockets, so smaller brands are finding it very hard to get factories that would take small production runs”.

Generally, retailers and designers display a negative perception of domestic manufacturing, which is defined not only as expensive compared to overseas, but also often characterised by lower quality and production standards. According to retailers/designers’ comments, the lack of manufacturing skills, technical expertise, innovation, machineries and equipment are all severe constraints: many expressed frustration in dealing with local manufacturers because of inefficiency, lack of availability or very slow response, late deliveries, and poor flexibility with designs and orders. Some comments were: “There is a huge issue of producing high-quality products in UK. The skills and equipment have been lost since most of manufacturing has moved abroad”; “There is a need to invest in technology and skillset. The UK factories are often behind in these areas as well as in quality. A lot of factories do not have enough space to fully operate, leaving it a bit unorganised and resulting in late delivery”; “We would love to have access to affordable local, national manufacturing facilities for our designs. However, the lack of skills and of affordable fabrics in the UK make this a hobby project rather than a commercially sound trajectory”.

Both manufacturers and retailers/designers ask for government financial incentives and support in encouraging a “Made in Britain” label for T&A production, towards which awareness amongst customers over the last decade has increased: “There is a shift in domestic consumers valuing made in UK. We should have British-made makers mark again and would like the government to encourage this”. All firms raise the key issue of sustainability with a request for financial incentives to help producers to adopt more socially and environmentally responsible practices. In this respect, both media and scholars have recently pointed out how some manufacturers reduce labour costs through labour exploitation (e.g., informal subcontracting and employment), with the aim of maintaining profit levels and meeting the need of domestic retailers and designers (Hammer and Plugor 2016; The Guardian 2020).

To conclude, many industry’s difficulties are currently preventing firms from producing or moving manufacturing back to the UK, with backshoring being regarded as an attractive, but rarely feasible option to pursue. In a few cases, firms even regretted the choice of bringing production back: “We moved all production to the UK in light of Brexit to make us a 100% British brand. However, this has been the worst decision ever. The costs have increased, and the quality is far from what we were getting overseas”. The implications of Brexit for domestic sourcing/production seem to be contrasting amongst firms, with a few manufacturers reporting an increasing number of orders from UK clients, and several retailers and designers declaring to have planned to move production back home or to offshore (Casadei and Iammarino 2021).

5 Discussion and conclusion

Over the last decade, some firms have moved all or parts of production back to the home country. The small extent and confidentiality of the relocation strategy have made it difficult to identify the actual relevance and modalities of the phenomenon. While large-scale production is unlikely to come back to advances economies, changes in a variety of dynamic factors such as costs, demand, technologies, and political and trade relationships may result in manufacturing becoming increasingly geographically concentrated, with firms opting for selecting or potentially combining offshore and at home production based on different conditions. Indeed, offshoring, backshoring and staying at home decisions are inherently complex and dependent on features highly heterogenous across countries, industries, firm functions, and products.

Our findings show the presence of a backshoring phenomenon in the UK T&A industry, uncovering differences in the strategies of firms playing different GVA functions. In line with recent research, both micro and large firms seem to be more likely to move manufacturing back; backshoring firms are also more focused on the high-end market, compared to offshoring firms that target more the mass- and middle- market. From a TCE perspective, mass-market production, usually characterised by lower quality and hence lower monitoring and coordination costs, may be more likely to be performed offshore. Backshoring firms are less specialised in textiles – relatively more capital-intensive, thus less suitable for being offshored – and more in apparel, outwear and sportswear. In this respect, the relocation choice responds also to the need of reinforcing particular technological competencies through proximity between production and R&D.

Overall, offshoring and backshoring are both mostly linked to resource/asset- and efficiency- seeking motivations, particularly labour-cost savings in the first case and restructuring in the latter. Combining TCE and RBV perspectives, firms seem to base their offshoring decision on both cost- and value- related aspects; retailers/designers appear to be more likely to bring production back domestically.

The few backshoring manufacturing firms mostly brought back the activities of product making and finishing using own domestic facilities, with the purpose of increasing product quality and acquiring new clients. Retailers/designers predominately brought back more stages of the garment production process by outsourcing to domestic suppliers, with an increase in product quality and innovation-related activities, in addition to investments in new competences and skills.

Our results show also important differences between staying at home and backshoring incentives. Whilst proximity explanations – i.e., being closer to the final market – represent the main reasons for producing in the UK for both types of firms, value-related factors strictly linked to strategic asset-seeking motivations differ across the two groups: the “Made in Britain” label is more important for firms who never internationalised production, while being closer to R&D and product development activities is more significant for backshoring companies. Particularly backshoring retailers and designers appear to search for innovation, quality, customisation of products and production monitoring, driven by the need of reducing offshore coordination costs in line with the TCE approach. Manufacturers (particularly those backshoring) emphasise more the possibility of accessing skills and knowledge domestically, responding to resource-seeking motivations.

Previous literature has highlighted how restoring industrial competitiveness in advanced economies which have long relied upon offshoring strategies might not be an easy process, particularly in labour-intensive industries such as T&A. Our findings clearly indicate that current shortages of domestic manufacturing facilities and specialisations, skills and technical competences, machineries and equipment, are all regarded by retailers and designers as severe constraints to home production. Most firms pointed to significant obstacles to producing domestically, making backshoring a largely unfeasible option.

Brexit represents a further alarming factor: firms urge prompt interventions in support of manufacturing, particularly those that now need to source production domestically because of constrains in European and international production networks (Financial Times 2021). Firms ask the government to support manufacturing through financial incentives and training for depleting skills and capabilities – threatened by an ageing labour force – and call for new investments in employment, the “Made in Britain” label, and in industry sustainability, which has been recently threatened by worrying evidence on labour exploitation. In a scenario where businesses will increasingly combine domestic manufacturing and offshoring to meet the trade-off between shorter value chains and low labour costs, public support to the industry is deemed urgent and essential. While some products or inputs require little innovation or intellectual property protection and can be produced at the lowest possible cost offshore, others, more complex, need constant innovation, benefitting from proximity to the final market (Kano 2018).

Our research has several limitations. While we were able to collect a high number of replies, we could only explore a low number of backshoring cases, and we opted for a qualitative description of our information. A further validation of the associations observed between production strategies – and particularly backshoring – and firms characteristics is needed, possibly on a larger sample. Moreover, the survey was conducted in a period characterised by huge uncertainty linked to Brexit and the fears of leaving the EU without a deal, which undoubtedly biased firms’ perceptions. A replication of the same study post-Brexit – in progress at the moment of writing – would help grasping important insights on the implications of the final UK’s withdrawal from the EU on backshoring and the potential for domestic production. Future research should also replicate the study in a different industry and/or country to further the understanding of contingencies, drivers, and obstacles to the backshoring phenomenon.

5.1 Disclosure statement

The authors have no competing interests to declare that are relevant to the content of this article.

Data availability

The survey data that support the findings of this study are not available due to the sensitive nature of the research and the inclusion of information that could compromise the privacy of research participants.

Notes

Here we also use the terms 1) “in-house production”, 2) “domestic sourcing”, 3) “offshore outsourcing”, 4) “captive offshoring”, and 5) “staying at home” to respectively indicate firms that 1) carry out all or parts of production within the company, 2) source all or parts of production from domestic suppliers, 3) source all or parts of production from foreign suppliers, 4) establish a foreign subsidiary in an offshore location, and 5) have never offshored by keeping production domestically both in-house and through domestic sourcing.

While Dunning’s classification focuses on MNEs, our sample mainly includes micro and small firms which operate abroad through both offshore outsourcing and captive offshoring. Foreign subsidiaries in our sample account for 6% of retailers and 12% of manufacturing firms (information on them were retrieved from Orbis and validated and integrated with two questions of the survey).

In our survey, we analyse retailers and designers (in addition to other types of firms such as brand manufacturers that are not listed for the ease of writing) separately from manufacturing firms. While in the literature there is not a clear definition of these two categories from a value chain perspective, we associate these two groups with lead firms and suppliers respectively, in relation to the type and value of activities that are mostly performed along the value chain (e.g., higher value-added such as design, marketing, and distribution versus low value-added focused on production).

Manufacturing firms were identified according to the 3-digit codes 13.1 Preparation and spinning of textile fibres, 13.2 Weaving of textiles, 13.3. Finishing of textiles, 14.1 Manufacture of wearing apparel, except fur apparel, 14.2 Manufacture of articles of fur, 14.3 Manufacture of knitted and crocheted apparel, 15.1 Tanning and dressing of leather; manufacture of luggage, handbags, saddlery, and harness; dressing and dyeing of fur, 15.2 Manufacture of footwear. The category 13.9 Manufacture of other textiles was excluded to focus the analysis on the fashion-related industry. Retailers were identified according to the 4-digit codes 47.71 Retail sale of clothing in specialised stores, 47.72 Retail sale of footwear and leather goods in specialised stores and 47.82 Retail sale via stalls and markets of textiles, clothing and footwear (SIC 2007).

Official statistics from the Inter-Departmental Business Register (IDBR - Office for National Statistics, 2019) show that manufacturing firms under the same SIC 2007 codes account for 5,825 whereas retailers for 14,415 firms (see Table 9 in the Appendix).

Results are available upon request from the authors.

A long debate exists on the use of parametric versus non-parametric tests for statistically analysing Likert-scale ordinal data. However, recent research has shown the equivalent power of both, and the robustness of parametric tests even with small sample sizes and non-normal distributions (Murray 2013).

References

Abecassis-Moedas C (2007) Globalisation and regionalisation in the clothing industry: survival strategies for UK firms. Int. J. of Entrepreneurship Small Bus. 4(3):291–304

Albertoni F, Elia S, Massini S, Piscitello L (2017) The reshoring of business services: Reaction to failure or persistent strategy? J. World Bus. 52(3):417–430

Ancarani A, Di Mauro C, Fratocchi L, Orzes G, Sartor M (2015) Prior to re- shoring: A duration analysis of foreign manufacturing ventures. Int J Prod Econ 169(C):141–155

Ancarani A, Di Mauro C, Mascali F (2019) Backshoring strategy and the adoption of Industry 4.0: Evidence from Europe. J World Bus 54(4):360–371

Arlbjørn J, Mikkelsen O (2014) Backshoring manufacturing: Notes on an important but under-researched theme. J. Purch. Supply Manag. 20(1):60–62

Armstrong JS, Overton TS (1977) Estimating nonresponse bias in mail surveys. J Mark Res 14(3):396–402

Ashby A (2016) From global to local: reshoring for sustainability. Oper Manag Res 9:75–88

Bailey D, De Propris L (2014) Manufacturing reshoring and its limits: The UK automotive case. Cambridge J Reg Econ Soc 20(1):66–68

Bals L, Daum A, Tate W (2015) From offshoring to rightshoring: Focus on the backshoring phenomenon. AIB Insights 15(4):3–8

Bals L, Kirchoff JF, Foerstl K (2016) Exploring the reshoring and insourcing decision making process: Toward an agenda for future research. Oper Manag Res 9(3–4):102–116

Baraldi E, Ciabuschi F, Lindahl O, Fratocchi L (2018) A network perspective on the reshoring process: The relevance of the home- and the host-country contexts. Ind Mark Manag 70:156–166

Barbieri P, Boffelli A, Elia S, Fratocchi L, Kalchschmidt M, Samson D (2020) What can we learn about reshoring after Covid-19? Oper Manag Res 13:131–136

Barbieri P, Boffelli A, Elia S, Fratocchi L, Kalchschmidt M (2022) How does Industry 4.0 affect international exposure? The interplay between firm innovation and home-country policies in post-offshoring relocation decisions. Int Bus Rev 31(4):102992

Barbieri P, Ciabuschi F, Fratocchi L, Vignoli M (2018) What Do We Know about Manufacturing Reshoring? J Glob Oper Strateg 11(1):79–122

Barney J (1991) Firm Resources and Sustained Competitive Advantage. J Manag 17(1):99–120

Benstead AV, Stevenson M, Hendry LC (2017) Why and how do firms reshore? A contingency-based conceptual framework. Oper Manag Res 10(3–4):85–103

Bettiol M, Chiarvesio M, Di Maria E, Di Stefano C, Fratocchi L (2020) What happens after offshoring? A comprehensive framework. In: Van Tulder R, Verbeke A, Jankowska B (eds) International business in a VUCA world: the changing role of states and firms. Emerald Publishing Limited, United Kingdom, pp 227–249

Boffelli A, Golini R, Orzes G, Dotti S (2020) Open the box: A behavioural perspective on the reshoring decision-making and implementation process. J Purch Supply Manag 26(3):100623

Boffelli A, Johansson M (2020) What do we know about reshoring? Towards a comprehensive framework based on a meta-synthesis. Oper Manag Res 13(1–2):53–69

Canham S, Hamilton RT (2013) SME internationalisation: Offshoring, “backshoring”, or staying at home in New Zealand. Strategic Outsourcing: An International Journal 6(3):277–291

Cantwell J (2009) Location and the multinational enterprise. J Int Bus Stud 40(1):35–41

Cantwell J, Narula R (2001) The eclectic paradigm in the global economy. Int J Econ Bus 8(2):155–172

Casadei P, Iammarino S (2021) Trade policy shocks in the UK textile and apparel value chain. Firm perceptions of Brexit uncertainty. J Int Bus Policy 4(2):262–285

Ciabuschi F, Lindhal O, Barbieri P, Fratocchi L (2019) Manufacturing reshoring: A strategy to manage risk and commitment in the logic of the internationalization process model. Eur Bus Rev 31(1):139–159

Contractor FJ (2021) The world economy will need even more globalization in the post-pandemic 2021 decade. J Int Bus Stud 53(1):156–171

Dachs B, Kinkel S, Jäger A (2019) Bringing it all back home? Backshoring of manufacturing activities and the adoption of Industry 4.0 technologies. J World Bus 54(6):101017

Dana LP, Hamilton RT, Pauwels B (2007) Evaluating offshore and domestic production in the apparel industry: The small firm’s perspective. J Int Entrep 5(3):47–63

De Backer K, Menon C, Desnoyers-James I, Moussiegt L (2016) Reshoring: Myth or reality? OECD Science, Technology and Industry Policy Papers No. 27

Delis A, Driffield N, Temouri Y (2017) The global recession and the shift to re-shoring: Myth or reality? J Bus Res 103(C):632–643

Di Gregorio D, Musteen M, Thomas DE (2009) Offshoring outsourcing as a source of international competitiveness for SMEs. J Int Bus Stud 40(6):969–988

Di Mauro C, Fratocchi L, Orzes G, Sartor M (2018) Offshoring and backshoring: A multiple case study analysis. J Purch Supply Manag 24(2):108–134

Dunning JH (1980) Towards an eclectic theory of international production: Some empirical tests. J Int Bus Stud 11(1):9–31

Dunning JH (1988) The eclectic paradigm of international production: A restatement and some possible extensions. J Int Bus Stud 19(1):1–31

Dunning JH (1993) Multinational Enterprises and the Global Economy. Addison Wesley, New York

Dunning JH (1994) Multinational enterprises and the globalization of innovatory capacity. Res Policy 23(1):67–88

Dunning JH (2009) Location and the multinational enterprise: a neglected factor? J Int Bus Stud 40(1):5–19

Dunning JH, Lundan S (2008) Multinational enterprises and the global economy. Edward Elgar, Cheltenham

Elia S, Fratocchi L, Barbieri P, Boffelli A, Kalchschmidt M (2021) Post pandemic reconfiguration from global to domestic and regional value chains: The role of industrial policies. Transnatl Corp J 28(2):67–96

Ellram LM, Tate WL, Petersen KJ (2013) Offshoring and reshoring: An update on the manufacturing location decision. J Supply Chain Manag 49(2):14–22

Eurofound, (2019) Reshoring in Europe: Overview 2015–2018. Publication Office of the European Union, Luxemburg