Abstract

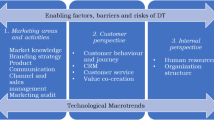

Supply chain resilience (SCR) is crucial for organizational sustainability and growth. This paper explores the factors of digitalization in the banking sector for achieving resilience in the e-commerce service supply chain. Most previous researchers have explored supply chain resilience in e-commerce using structural equation modeling. This study identifies and evaluates the crucial factors of digital banking that improve resilience in the e-commerce service supply chain using the Interpretive Structural Modeling (ISM) and Decision-Making Trial and Evaluation Laboratory (DEMATEL) technique. A conceptual framework is created based on the literature review and technology adoption theory. The framework comprises the critical digital technology adoption factors for the resilient service supply chain in Pakistan’s e-commerce sector. The results show that the most critical driving factors are “performance expectancy (F15),” “e-cost effectiveness (F5),” and “Trust (F8)” The research findings have several implications for decision-makers, and practitioners, providing insights into how digitalization in the banking sector can help in designing resilient supply chains in the e-commerce sector.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Digitization has changed consumer behaviors (Rungsrisawat et al. 2019), and nowadays, consumers are using digital banking services whenever and wherever they want. Digitalization in banking is transforming consumer behavior. Banks can function more effectively and affordably when there is a higher customer involvement through digital channels like e-banking and m-banking. Digital banking enables users to independently produce financial transactions through mobile devices, cellphones, or personal digital assistants, at the time and location of their choice. It is one of the banking industry's most novel and innovative technologies (Alalwan et al. 2016; Obaid 2021). Geebren et al. (2021) report that various banks are motivated to link their digital banking channels with their logistic operations, and numerous resources (financial and technical) are allocated in this regard. This shift has created an avenue for banks to provide good quality services to their customers all over the globe (Zhu et al. 2021). Additionally, by expanding the number of mobile subscribers globally, the potential market for digital banking services is more likely to grow and attract customers, hence, serving customers as well as banks in this regard (Rajaobelina et al. 2021). According to Laukkanen et al. (2007), persuading customers to use this technology to replace traditional channels has become the biggest hurdle for banks. Digital banking is still developing in emerging countries such as Pakistan, and numerous studies (Sheikh et al. 2021; Aslam et al. 2022) have addressed the challenges associated with digital banking.

Internationalization of procurement and distribution, along with accelerated global warming, have increased supply chain disruptions challenges. Consequently, supply networks have become more inflexible and complicated (Kovács and Falagara Sigala 2021). Growing outsourcing and reduced supply bases have resulted in a higher reliance on suppliers while emphasizing rapid turnaround time. Organizations started to recognize the limitations of these strategies due to the increase in the volatile conditions and “leaned out” their operations (Pettit et al. 2019). Academics and industry experts have been interested in supply chain resilience (SCR) since it is directly touched by the variety of disruptive events that might have possible implications for the continuity of a company and its sustainability (Wang and Zhang 2020). The ability of an organization's supply chain to sustain difficult circumstances while simultaneously adapting to those conditions and flourishing as a consequence is referred to as supply chain resilience (SCR) (Dubey et al. 2021). Over the last few decades, there has been a shift toward a greater emphasis on supply chain resilience in response to increasingly vulnerable risks such as astringent regulatory requirements, increasing competition, increasing consumer pressures; uncertain demand; challenging markets; outsourcing; globalization; and a constantly increasing gradient of economic competitiveness (Fahimnia et al. 2019; Dwivedi et al. 2021; Meixell and Luoma 2015).

Traditional and outdated risk management techniques are unable to foster a resilient organization. Global supply chains’ complex and dynamic nature requires constant vigilance to identify potential risks and vulnerabilities and exceptional agility to respond to uncertainties. Thus, SCR helps meet the needs via new innovative technological tools and cultural shifts. SCR is known to minimize the uncertain risks involved in business operations (Zouari et al. 2020). A vigilant SCR mitigates risks through monitoring and maintaining business performance (Bhamra et al. 2011). It is significant to recognize the value of resilience in the supply chain and plan how organizations can mitigate these disruptions in the current era. SCR gained the attention of researchers in 2004. Christopher and Peck (2004) are considered pioneers of the SCR concept. Studies have reported that the business environment has become quite turbulent (Hillmann and Guenther 2021). Organizations need to build SCR as they face disruption due to the turbulent and uncertain environment of the COVID-19 pandemic, which negatively affects the organization’s performance (Ambulkar et al. 2015).

Scholars have examined the impact of digital banking from service operations and information systems perspectives, such as the effect of digital banking systems on automated teller machines, telephone banking, and branch locations. They discovered that acceptance of digital banking led to the development of low-cost self-service alternatives such as mobile and internet banking, as well as a rise in the overall quantity of transactions (Campbell and Frei 2010; Sharma and Sharma 2019). The authors expand on this field of study by looking at the effect on resilience of service supply chain due to digital banking parameters in the e-commerce sector. Our study will also demonstrate the importance of digital banking and its influence in improving performance in resilient supply chains. The following research question (RQ) and objectives are formulated and put forward:

RQ: What are the critical factors of digital banking, and how do they interact to contribute to improved service supply chain resilience?

In order to answer the RQ mentioned above, the objectives of this study are as follows:

-

(i)

To identify and validate the critical factors of digital banking that play a crucial role in improving resilient service supply chains in the e-commerce sector from the literature review and industry experts.

-

(ii)

To analyze the effect of digital banking variables and how they interact to contribute to improved service supply chains through utilizing a theoretical framework.

-

(iii)

To propose theoretical and practical implications on how digital banking can improve resilience in e-commerce service supply chains.

The rest of the paper is divided into the following sections: The relevant literature is examined in Section 2, covering digital banking and digitalization, resilient service supply chain, e-commerce sector, and technology adoption models. Section 3 discussed the identification and selectin of factors, followed by Section 4, in which we discussed methodology. Section 5 provides overview of methods and its implementation. Section 6 discuss our study findings, followed by implications (practical and managerial) and conclusion in Section 7.

1.1 Gaps and contributions of the study

Most of the extant studies are based on disclosing the interface of SCR and sustainability, the impact of digital technology on the resilience of supply chains and achieving SCR through procurement. However, few studies have explored digital banking and resilient service supply chains (Min 2019, Motallem et al. 2020). Moreover, most studies have identified the constructs/variables that may influence SCR. This study will determine the factors that significantly improve service supply chains resilience in the e-commerce sector.

The present research adds to the body of knowledge in many aspects. First, it contributes to the existing literature by employing Technology Acceptance Models on digitalization and resilient service supply chain performance by extracting and validating critical factors for the banking sector. Second, this study is one of the initial studies to examine and explore digitalization adoption from a service sector supply chain perspective. Third, it employs the interpretive structural modeling (ISM) method to analyze the critical elements that may aid in developing a robust supply chain in the services industry through digital banking. Fourth, in this research, the Decision-Making Trial and Evaluation Laboratory (DEMATEL) method is used to identify and prioritize the most important variables that contribute to the performance of a resilient service supply chain (Aboutorab et al. 2018). Hence, this study’s novelty lies in applying critical factors within digitalization banking to study how it will improve resilient services’ supply chains using two different methodological techniques for improved results.

2 Literature review

2.1 Digital banking

Digitalization is referred to as “moving into a digital business and integrating digital technologies into everyday life” (Brennen and Kreiss 2016) for the creation of new business models, improvement of business activities and provision of value-oriented opportunities (Saengchai and Jermsittiparsert 2019). Digitalization is a term used to describe the use of digital technologies. Later, Fichman et al. (2014) also described digitalization as the "technique of taking processes, content, or items that were physical or analog and later, they were digitalized.” Integrating the online platform into banking services is seen as a technical revolution since its main objective is to enhance service quality and help customers (Namahoot and Laohavichien 2018). Digital banking has altered traditional banking practices (Wang et al. 2017; Akhlaq and Ahmed 2013). Digital banking services have efficient, user-friendly and modern systems, contrary to conventional banking. It is a new and innovative information system that transformed old banking services into modern technologies such as the internet and the world wide web (Szopiński 2016; Sahu and Kavita 2020). The advancement in internet technology has caused people to make transactions electronically in less time.

Researchers have used digital banking, synonymous with online and electronic banking. Digital banking allows customers to do transactions electronically at any location, with processing charges lower than traditional banking (Amin 2016; Akbari and Hopkins 2022). Some of the main features of the digital banking system are issuing checks, paying bills, transferring money, check-banking accounts and balances, online shopping and so on (Lee 2009; Martins et al. 2014; Bae and Chang 2020). The trends in the trade have changed, such as increased subcontracting activities, intense international competition, increased demand for timely delivery, advancement in technologies, and short product life cycles (Olson and Wu 2011). The introduction of online platforms makes it easier for companies to manage various buyer–supplier interactions. Digital Banking Services (DBS) provides an efficient and reliable online platform for automating business relationships in today’s competitive business environment. While companies usually travel to bank branches or call bank managers to complete transactions, the internet now offers online channels for banking companies to automate customer relationships. Banks offer DBS to manage cash flow, collections, and company claims (Lai et al. 2013; Claro and Rosa 2016). Advances in technology and the increasing use of the internet have changed the way services are provided in the past few decades (Shaikh and Karjaluoto 2015; Shankar and Jebarajakirthy 2019).

Employing online technologies as economic activity intermediaries (e.g., digital banking and online banking) has altered the consumer–bank engagement paradigms and presented both sides with new possibilities. Digital banking is considered to have several advantages, such as high information transferability and lower costs. Banks offer digital banking services and employ their benefits to foster better customer relationships (Madhani 2019). Several benefits of Digital banking for the resilient supply chain have been discussed in the literature, including cost-effectiveness, competitive edge, and reduced communication gap (Gvozdanovic and Solomon 2016). It provides 24/7 access that helps the customers to make transactions any time and any day of the week. Additionally, digital banking has allowed customers to expand their businesses globally. This has helped organizations deal with suppliers and partners through online transactions, eliminating geographical barriers. It helped mitigate unexpected events by recouping smoothly (Wang et al. 2020). A typical example is the COVID-19 pandemic, where customers can easily make transactions without obstacles. Overall, digital banking minimizes the risks and complexities in supply chain processes. Since supply chain management has considerable significance for every organization, it is essential to deal with it properly. Digital banking can minimize risk in the supply chain, and if found, it would be resolved quickly. All this is possible through modern techniques that will create evenness in overall supply chains by reducing risks (Anbumozhi et al. 2020b).

2.2 Supply chain resilience

SCR can rebuild disrupted or broken supply chains (Brusset and Teller 2017). It responds to supply chain disturbances and interruptions that appear during operational processes. The term disturbance has been described as the foreseen or unforeseen events that may affect the organization’s supply chain operation and sustainability (Barroso et al. 2011). SCR’s importance has increased tremendously due to increasing global supply chain disruptions and high complexity levels (Jain et al. 2017). After globalization, most companies face difficulties manufacturing products due to unexpected events such as political interference, earthquakes, pandemics, and tsunamis (Tukamuhabwa et al. 2015; Chen et al. 2013). Disruptions can badly affect an organization’s financial performance (Tang 2006, Dhiaf et al. 2021, Ivanov 2020). Additional operational challenges that the supply chain faces are mainly dependence on a few suppliers, the inability to respond quickly to uncertainties, the nature of the association between purchaser and supplier, and the channels chosen to conduct transactions. In addition to these challenges, SC is vulnerable to human-made disasters as well as other natural disasters (Muhammad et al. 2021; Uddin and Akhter 2022). In a broader sense, these challenges increase the complexity of products and processes (Piprani et al. 2022). Supply chain managers must adjust their strategies to overcome the complexity and avoid vulnerable issues. This motivates researchers to look for ways to improve SCR by understanding the importance of risk or vulnerability in the SC (Gunasekaran et al. 2015).

Current global events (such as COVID-19) have made researchers and practitioners realize the need to plan and minimize the impact of potentially damaging disruptions by building more resilience in supply chains (Lohmer et al. 2020; Naz et al. 2021; KEK et al. 2022). Today, businesses are becoming riskier due to increased technological changes and globalization (Zhao et al. 2013). The possible effects of disturbances on the company and its SC clearly show how important it is to build sustainability. For example, it has been observed that SC disturbance can seriously influence the company’s profit (Ponis and Koronis 2012). SC disruptions can further reduce the company’s market value and decrease operating profit, sales return, and return on capital (Wamba et al. 2020). In extreme cases, the SC collapses and never recovers from such disruptions (Tang 2006, Xu et al. 2014). Companies need to manage SCR and agility to increase SC flexibility in today’s challenging environment (Braunscheidel and Suresh 2009; Chatterjee and Chaudhuri 2021).

2.3 E-commerce sector of Pakistan

This study has taken Pakistan as the unit of analysis. The current research focuses on a developing country like Pakistan due to its developing economy and rapid economic and political changes (Bank 2017). Pakistan has weak supply chain processes and systems which need support from the industries and Government. Many researchers have conducted studies in developed countries to examine the role and magnitude of digitalized banking; however, digital banking is a relatively new concept in developing countries like Pakistan (Afshan et al. 2018; Raza et al. 2020). Here, the concept of digital banking is only limited to the operational requirements of the banks. Due to low internet efficiency and speed, the banks in Pakistan are prone to risks and security threats. These issues have slowed down the growth of developing countries like Pakistan. However, with time, digital banking is improving in Pakistan.

E-commerce has numerous advantages, including comfort, time efficiency, and the potential to improve the economy (Omian 2020). The volume of Pakistan's e-commerce industry increased by more than 35% in the first quarter of the fiscal year 2021 to Rs 96 billion, up from Rs 71 billion the previous year (Khan 2021). Various research has shown that 18 percent of all retail transactions in Pakistan occurred online in 2018. According to projections, by 2040, 95 percent of all purchases and transactions will be conducted and handled online. Pakistan is one of the world's biggest untapped e-commerce marketplaces (Batada 2020). According to a McKinsey Global Institute study, Pakistan's digital finance potential may reach $36 billion by 2025, leading to a 7% increase in GDP, 4 million new employment, and $263 billion in new deposits (Team 2020). Customer behavior is shifting from conventional ways as consumer trust in mobile applications and digital banking segments increases (Omian 2020). The recent digitalization and supply chain resilience studies are shown in Table 11 in the Appendix.

2.4 Technology adoption models

Technological developments are critical to the success and sustainability of the corporate sector. Carr (1999) characterized technological development as the “stage of selecting a technology for use by an individual or an organization.” Similarly, Oye et al. (2012) argue that technical advancement fosters knowledge distribution. Technology adoption is also defined as people's desire to utilize technology to their advantage (Samaradiwakara and Gunawardena 2014). According to research, technology adoption has developed as a more complicated approach. The technology adoption process involves, in addition to technical factors, elements of the user's attitude and personality (Venkatesh et al. 2012), trust (Gefen et al. 2003) and social influence (Azjen 1980).

2.4.1 Technology acceptance model (TAM)

In 1985, Davis introduced the TAM model. It investigates the technology adoption process by examining consumers' views of its usability and usefulness. TAM takes into account perceived usefulness and perceived ease of use.

2.4.2 Technology readiness index (TRI)

TRI refers to an individual's willingness and capacity to adopt and use new technologies to achieve effective performance (Parasuraman 2000). TRI is “a holistic state of mind arising from a combination of mental facilitators and inhibitors that influence a person's propensity to utilize new technologies.” TRI assesses people's technological views. It is divided into four sub-dimensions: innovation, optimism, insecurity, and discomfort. Innovativeness is described as consumers' proclivity to be technological trailblazers. Optimism is a factor that shows a favorable attitude toward technology and the idea that technology can provide control, flexibility, and efficiency. Insecurity reflects a lack of confidence in technology. Finally, discomfort conveys a sense of being overwhelmed and out of control when utilizing technology.

3 Selection and identification of factors

The authors undertook a comprehensive literature review in which the studies on the research factors of digitalization and supply chain resilience. Additionally, the articles were indexed using the terms “digital banking,” “resilience in services,” “digitalization in banking,” and “resilience in e-commerce.” Authors utilized search engines like Google Scholar, Web of Science, Wiley, Science Direct, Taylor and Francis, and Emerald to look through academic databases etc. (shown in Table 11 in the Appendix).

Initially, twenty-seven factors were identified from the literature review related to digitalization and supply chain resilience. Afterward, one academic and one industry expert were asked to select the most significant factors from these factors in the context of Pakistan’s banking sector to narrow them down. The responses were processed. Both experts’ consensus was reached to retain a total of sixteen factors to build the proposed representation of the elements of digitalization in banking and SCR, as shown in Table 1.

4 Methodology

4.1 Multi-criteria decision making approaches

Multi-Criteria Decision Making (MCDM) is a judgment technique that assists stakeholders in identifying and selecting options depending on their priorities and expectations (Triantaphyllou 2000). It is a heuristic-based technique that utilizes purposive sampling method and experts sampling approach to get the responses from the experts. In this approach less respondents are required for capturing a large quantity of data. There are numerous Multiple-criteria decision methods. For example, the Analytical Hierarchies Process (AHP) invented by Thomas Saaty (Saaty and Vargas 2001) is among the most well-known and broadly utilized modeling techniques for Multiple Attribute Decisions, as it allows for the creation of hierarchical formulations of issues for establishing priority between various attributes. The simple Additive Weighting (SAW) approach is a straightforward methodology frequently used in conjunction with multi-attribute decisions making. It is built on a simple weighted average approach (Fishburn 1967). The technique for Order Preference by Similarity to Ideal Solution (TOPSIS) was developed in the 1980s (Hwang and Yoon 1981). This approach employs the optimum option methodology based on the principle that an optimal situation maximizes value while minimizing overall cost. The ISM method investigates the factors through primary relationships by binary scale, i.e. (0, 1). The DEMATEL method examines cause-effect interrelationships through the scale (0, 1, 2, 3, and 4). The ISM and DEMATEL approaches share many parallels, each examining the cause-and-effect connection between multiple criteria. ISM and DEMATEL methods identify the interrelationships between various attributes (Zhou and Zhang 2008).

The Integrated ISM-DEMATEL method is an efficient and effective tool used in decision-making. It offers relationships between the criteria and establishes a hierarchical model (Shakeri and Khalilzadeh 2020; Farooque et al. 2020). This study combines ISM and DEMATEL methods to achieve valuable outcomes. Until now, there has been limited published research on the integrative ISM-DEMATEL approach, especially in the digitalization of the banking sector. There are several credible instances of the integrative approach; Chuang et al. (2013) proposed that the combined ISM-DEMATEL technique offers the most suitable correlation among the criteria. ISM-DEMATEL approaches complement each other as the weaknesses of the stand-alone techniques can be overcome by using them together (Khan et al. 2021a).

ISM-DEMATEL is a systems analysis method that examines the interrelationships between system components using graph and matrix theory. Combining ISM with DEMATEL allows for a thorough analysis of the system's hierarchical structure and various aspects' influence degree and importance of criteria. For the analysis of complex socioeconomic systems, Warfield (1973) proposed the Interpretive Structural Modeling technique that helps the researchers to organize the information into a model of relationships to comprehend its complexity better. ISM develops a graph that displays the system's components' results, relationships and hierarchical levels.

Applying a model is a common strategy for studying causality issues when they are complicated and challenging to explain or understand. One such method is the DEMATEL model, which enables reliance on objective aspects that can be characterized to conduct analysis, define interdependence between variables, and determine constraint relations, representing the complex system's attributes in depth and their changing patterns. Managers in the field of management can use the approach to examine corporate relationships between departments or different components, illuminating the causal relationships for each issue or factor (Das et al. 2021; Mubarik et al. 2021).

4.2 Research design

Several stakeholders and policymakers utilize the MCDM approach in various decision-making processes. In order to gain insights into various relationships, the MCDM approach is employed. This research provides a complete understanding of the MCDM tools and procedures implemented by utilizing the ISM-DEMATEL method for resolving complex problems. Figure 1 represents the proposed research methodology flowchart.

4.3 Data collection

A non-probability sampling method known as the expert sampling methodology was used in selecting experts. This method is a sub-type of purposive sampling in which the researcher relies on prior knowledge to choose the sample unit. It entails collecting information from a small group of people with a significant amount of knowledge and competence in a certain area of study or research (Khan et al. 2021b). For instance, Bai and Sarkis (2013) used DEMATEL to evaluate business processes control using only three samples, while Xia et al. (2015) used DEMATEL to evaluate the challenges to automotive component reprocessing using the expert's sample size of four. Miao et al. (2022) also used five experts for analyzing the factors of industry 4.0 and knowledge management.

The experts in different banking and e-commerce platforms were selected based on their diverse knowledge, experiences and skills. The authors emailed the selected experts and asked for their consent to participate in this digital banking and service SCR research. Those experts who were interested in participating in the study replied with their consent. The questionnaire was emailed to the experts with instructions on filling the questionnaire correctly. The authors also contacted the experts to provide verbal instructions to capture data accurately.

The MCDM methodology uses experts' judgment to develop a correlation matrix between factors. The research comprises of five experts on various designations and has a minimum of 3 to 14 years of experience in the banking and e-commerce field as indicated in Table 2, these specialists work in the service sector (banking and e-commerce) as General Manager, Manager Operations, Manager Admin, Assistant Manager Admin and Customer Support Officer. They have an experience of 14, 12, 11, 7, and 3 years respectively. The respondents were then requested to rate the factors depending on their opinion. After the evaluations by the experts, a final judgment matrix comprising of the mean scores was established.

5 ISM-DEMATEL technique

This section describes the overview and detailed application of the ISM-DEMATEL techniques.

5.1 Overview of the ISM method

ISM methodology is implemented to simplify complex criteria problems (Digalwar et al. 2020; Sage 1977). Mathiyazhagan et al. (2013) stated that this methodology empowers researchers to build an arrangement of the connections between numerous factors related in an improved way as a framework. (Kumar et al. 2021) used the ISM methodology to evaluate the interrelationship of the factors. The procedure of the ISM approach is as follows:

1st Step

Factors identification that is substantial for the research.

2nd Step

Structural self-interaction matrix (SSIM) is formed through expert analysis by establishing appropriate relationships between the factors mentioned in this research’s objectives.

3rd Step

The SSIM is converted into binary digits to create the Initial Reachability Matrix (IRM).

4th Step

The Final Reachability Matrix (FRM) is formed by employing the IRM transitivity check.

5th Step

Based on FRM, every factor will be partitioned on different levels.

6th Step

ISM hierarchical structure is created in a digraph by interchanging the factor nodes with statements.

5.2 Overview of the DEMATEL method

Geneva research center of the Battelle Memorial Institute introduced the DEMATEL method in 1976. A mathematical approach examines the associations and causal relationships between the factors for resolving management issues (Tzeng et al. 2007). DEMATEL is used to determine a complex relation between the attributes in a hierarchical structure model (Hsu et al. 2013). The DEMATEL process is explained below:

7th Step

Creation of initial direct-relation matrix (IDRM) denoted by (A).

8th Step

The normalized direct-relation matrix (NDRM) is formed, denoted by (D).

9th Step

Calculate the total relation matrix (TRM) denoted by (T).

10th Step

Calculate prominence (r + c) and relation (r − c) values.

11th Step

The development of a causal diagram.

5.3 ISM method application

5.3.1 Structural self-interaction matrix (SSIM) development

The SSIM is formed (as shown in Table 3) and based on the related association among factors’ i’ and ‘j’ on the vertical and horizontal axis through expert analysis. Experts select one of the four symbols for each relation, which describes the relationship direction between the two elements described below.

-

V — factor “i” effects factor “j”

-

A — factor “j” effects factor “i”

-

X — both factors affect one another

-

O — there is no relation between both factors

5.3.2 Initial reachability matrix (IRM)

IRM (as shown in Table 4) is considered as the transformation of the SSIM's codes, i.e., (V, A, X, O) into binary digits, i.e., ('0' and '1'). The rule for the conversion is as follows:

-

"V" on (i. j) axis is '1', and "V" on (j, i) axis is '0'.

-

"A" on (i. j) axis is '0,' and "A" on (j, i) axis is '1'.

-

"X" on (i. j) axis is '1', and "X" on (j, i) axis is '1'.

-

"O" on (i. j) axis is '0', and "O" on (j, i) axis is '0'.

5.3.3 Final reachability matrix (FRM)

The FRM (as shown in Table 5) is formed by using the transitivity rule states that when “Factor A” is linked with “Factor B” and “Factor B” is linked with “Factor C,” then “Factor A” is undoubtedly linked with “Factor C,” by following this rule, the FRM is created. Attribute’s driving power is the total of elements in a row of that factor, while dependence power is the total of all elements in the column of each factor.

5.3.4 Level partitioning

Warfield (1974) stated that each attribute’s antecedent and reachability sets are derived from FRM. The factor’s reachability set is formed by selecting all the elements with “1” in a row. On the other hand, each factor’s antecedent set is formed by selecting all the elements that have “1” in a column. The intersection set of each element is formed by selecting similar elements above both sets. Levels are made in the form of iterations. The elements with similar intersection and reachability sets are selected in iteration level-I. These selected elements will be removed from the whole table. The exact process will be repeated until all the attributes are selected on different levels (as shown in appendix, Tables 12, 13, 14, 15, 16 and 17, in Appendix). Table 6 shows the final iterations levels.

5.3.5 Building the ISM model

The ISM-based hierarchical model is formed (as shown in Fig. 2) after performing level partitioning of factors. It consists of attributes based on various levels. In this study, the ISM model consists of six levels, in which “Performance expectancy (F15)” is on Level-I, having the highest dependence power implying that F15 depends on all other factors placed on other levels. On the other side, “Efficiency (F1)”, “Perceived usefulness (F2),” and “E-service quality (F3)” are the most critical factors which are placed on Level-VI. These factors drive all other factors in the upper hierarchy of ISM. While “E-cost effectiveness (F5)”, “Perceived ease of use (F6),” and “Reliability (F7)” are found on Level-V. These factors are influenced by the bottom factors and affect the upper factors in the hierarchy. There is only one factor in Level-IV: "E-responsiveness (F11)”. This factor is a middle-level factor in the ISM hierarchy. “Supply chain sustainability F4″, “Market sensitiveness (F12),” and “Awareness (F16)” are the factors that are on Level-III. “Trust (F8)”, “Collaboration (F9)”, “Agility (F10)”, “Supply chain risk management (F13)” and “Supply chain uncertainty (F14)” are the factors that are on Level-II on the ISM hierarchy. Level-II, III, IV, and V factors are linkage factors in the ISM hierarchy, with the highest dependency and driving power. The factors on these levels can help achieve better “performance expectancy (F15)”.

5.4 DEMATEL method application

5.4.1 Formation of IDRM

The experts are requested to rate the factors based on the comparison scale to form the pairwise matrix. There are five levels of this scale, which are 0, 1, 2, 3, and 4, which imply (no impact), (low impact), (low impact), (high impact), and (very high impact). Initially, data is collected from the pairwise matrix as a non-negative matrix (n × n) recognized by = \({X}^{k}{x}_{ij}^{k}\). The average IDRM ‘\({a}_{ij}\)’ is based on incorporating all the replies from the “H” respondent (as shown in Table 7). After taking the average of all the responses, the sum of each factor in a row will be taken. The equation for IDRM is as follows:

where K = no. of experts with 1 ≤ k ≤ H, N = no. of attributes.

5.4.2 Formation of NDRM

The normalization of IDRM is implemented by dividing each value in the table with the highest sum value of the row, i.e., 38, as shown in Eq. (2) and Table 8.

5.4.3 Formation of TRM

The TRM is calculated through Eq. (3), as mentioned below.

where I = identity matrix.

Firstly, the normalized matrix (D) values are subtracted from the identity matrix (I) values. The inverse of the resultant matrix is taken, which is then multiplied by the normalized matrix. Thus, forming the total relationship matrix (T) (as shown in Table 9).

5.4.4 Formation of prominence and relation values

The (\({r}_{i}\)) values are derived by taking the sum of all values in the row of each attribute and \(\left({c}_{j}\right)\) values are derived by taking the sum of all values in each attribute’s column, as mentioned in eqs. (4) and (5). The prominence values are the sum of \({r}_{i}\) and \({c}_{j}\), while the relation values are derived by subtracting \({c}_{j}\) from \({r}_{i}\). The ranking will be made by observing (\({r}_{i}+{c}_{j}\)) values in descending order. Similarly, the positive values of (\({r}_{i}-{c}_{j}\)) are the cause of identity and the negative values of (\({r}_{i}-{c}_{j}\)) are the effect identity, as shown in Table 10 below.

5.4.5 Formation of causal diagram

The causal diagram is plotted on a graph in which the values of (\({r}_{i}+{c}_{j}\)) will be placed on the x-axis, and the values of (\({r}_{i}-{c}_{j}\)) will be placed on the y-axis. The factors will be plotted using the values of (\({r}_{i}-{c}_{j}\)), as shown in Fig. 3 below. A threshold value will be calculated by taking the average of TRM. The values greater than the threshold value in each factor’s row will be highlighted, affected by the cause attributes shown in Appendix, Table 18.

The above causal diagram shows the cause-and-effect relationships. It presents the factors that are most important and to be focused on. The driving factors which are more critical with cause identity are “Performance expectancy (F15)”, “E-cost effectiveness (F5)”, “Trust (F8)”, “Perceived ease of use (F6)”, and “Efficiency (F1)”. Factors with high significance that have the effect identity (fundamental problems) include "Reliability (F7)", "E-service quality (F3)", "Supply chain sustainability (F4)", "E-responsiveness (F11)", "Perceived usefulness (F2)", and "Agility (F10)".

6 Discussion

The majority of previous studies used Smart PLS to explore SCR. In this study, concepts established on technology acceptance model were utilized to develop a framework, which was then tested against gathered data. The authors of this study used the MCDM approach to examine the aspects for implementing service SCR through digitalization in banking. The MCDM technique used are ISM and DEMATEL methodologies, which extract various components from the literature and link them based on their significance.

6.1 ISM model

The ISM model in Fig. 2 shows that “Efficiency (F1)”, “Perceived Usefulness (F2)”, and “E-service quality (F3)” are the most significant factors for achieving service SCR through digital banking practices in the e-commerce sector. The literature supports this research’s findings (Chen et al. 2021; Duong and Chong 2020). A clear understanding of “Efficiency (F1)”, “Perceived Usefulness (F2)”, and “E-service quality (F3)” by the e-commerce organizations will help in achieving “E-cost effectiveness (F5)”, “Perceived ease of use (F6),” and “Reliability (F7)”. The study conducted by Wong et al. (2020a) and Mao et al. (2020) also support our research findings. This will support service resilience through digital banking in achieving “E-responsiveness (F11)”. E-responsiveness through means of “Awareness (F16)” and “Market sensitiveness (F12)” will help to improve the “Supply chain sustainability (F4)”. All these factors of Supply chain sustainability (F4), Awareness (F16), and Market sensitiveness (F12) will encourage “Trust (F8),” support collaboration toward digital banking implementation and help maintain “Agility (F10)”. These practices will increase the efficiency of “Supply chain risk management (F13)” and decrease “Supply chain uncertainty (F14)”. The same is also reported by recent studies such as Golan et al. (2020). Therefore, these factors will, in turn, support the implementation of resilience in service supply through digital banking in the e-commerce sector. Achieving and combining all these factors will improve service agility and make the supply chain more resilient, reducing the probability of disruption and thereby increasing the supply chain’s performance (F15).

6.2 DEMATEL model

It is observed from the cause-and-effect Table 10 that the critical attributes which are affecting most of the other factors as causes are “Efficiency (F1)”, “E-cost effectiveness (F5)”, “Perceived ease of use (F6)”, “Trust (F8)”, and “Performance expectancy (F15)”. It indicates that the efficiency attribute on level 6 of the ISM hierarchy is the starting point for efficient internal processes. The e-cost effectiveness attribute on level 5 of the ISM hierarchy provides an alternative for using electronic instead of cash payments. The perceived ease of use attributes at level 5 appeal to the electronic payment method for convenience and comfort. At level 2 of the ISM hierarchy, the trust attribute is vital, without which digital banking adoption is unachievable. Finally, the performance expectancy attribute at level 1 of the ISM hierarchy needs to be achieved as a culmination of all the attributes on different levels to achieve SCR.

Further analysis of Table 10 offers insight into the vital attributes which are affected by other factors in this research as “E-service quality (F3)”, “Supply chain sustainability (F4),” and “Reliability (F7)”. It suggests that the e-service quality attribute on level 6 of the ISM hierarchy is affected due to the efficiency of processes and perceived usefulness. The reliability attribute on level 5 of the ISM hierarchy is affected by enhanced e-cost effectiveness, perceived ease of use and the characteristics on level 6. Similarly, the supply chain sustainability attribute on level 3 is directly affected by development in e-responsiveness and indirectly by market sensitiveness and awareness attributes.

6.3 Top significant digital banking factors interactions with supply chain resilience factors

According to the results, this section discusses the top three most significant digital banking factors and their interactions with service supply chain resilience factors.

The results indicate that E-cost effectiveness (F5) is the most significant factor of digital banking leading to supply chain resilience factors of Efficiency (F1), Supply chain sustainability (F4), Market sensitiveness (F12) and Awareness (F16). E-cost-effectiveness may be attained by selecting adaptive choices to improve Efficiency (F1) and Supply chain sustainability (F4) through consumer e-commerce and by enhancing digital banking services. According to Alzoubi and Yanamandra (2020), E-cost-effectiveness may be accomplished by choosing flexible choices for increasing Efficiency (F1) and Supply chain sustainability (F4) via consumer e-commerce and by upgrading digital banking services. In addition, Market sensitiveness (F12) and Awareness (F16) about new services and varied pricing techniques also play key roles simultaneously.

The second most important factor in improving the SCR in digital banking is Performance expectancy (F15). The results depict that Performance expectancy (F15) promotes Efficiency (F1), Supply chain sustainability (F4), Collaboration (F9), Agility (F10) and Market sensitiveness (F12). The performance expectation of new technology is the degree to which it is anticipated to increase the supply chain's adaptability, sustainability, and operational effectiveness (Huang and Kao 2015). Digital banking users believe that the utilization of technology would boost Agility (F10) and Efficiency (F1) (Wong et al. 2020b).

The findings also conclude that Trust (F8) is the third most significant contributor to supply chain agility (F10) and supply chain risk management (F13). According to studies, trust serves as the shared mediator (Ireland and Webb 2007). The level of trust of partners and their end consumers positively impacts when it comes to supply chain management, trust creates a system in which organizations put the least amount of effort into inter-organizational interactions for the greatest return on investment and where the anticipated benefits of trust-based transactions outweigh the anticipated cost (McCarter and Northcraft 2007).

6.4 Overlapping factors in ISM and DEMATEL techniques

ISM develops a hierarchical model to explain the dependency of one factor on the others (As presented in Fig. 2). This model has six levels, each showing the dependence on the lower level. However, DEMATEL ranks the critical factors based on their significance for implementing SCR in the digital banking sector of Pakistan (Presented in Table 10). In both the techniques, the findings suggest that Performance Expectancy (F15), Efficiency (F1), E-cost effectiveness (F5), Perceived ease of use (F6), and Trust (F8) are the overlapping and crucial factors for attaining service SCR through digitalization in banking.

7 Research implications

7.1 Theoretical implications

Extant literature has studied digital banking and its impact on SCR. However, most of the studies have developed a causal model. This study contributes to the body of knowledge by identifying the critical factors that may help managers in improving the service SCR using ISM-DEMATEL approach. The model representing the critical success factors is developed using expert sampling technique.

The study contributed to literature in numerous ways. The study extends the TAM and TRI model by identifying factors that promote technology acceptance and readiness. The TAM suggests that Efficiency (F1), Perceived usefulness (F2) and E-service quality (F3) are the most critical factors that positively contribute to technology adoption. TRI depicts individuals’ readiness to adopt the technology. TRI identifies trust and Awareness as the key factors that promote an individual’s readiness for technology adoption. This study is the first to examine and discuss the adoption of digitalization in Pakistan’s e-commerce sector for a resilient service supply chain. On the other hand, the study contributes to the literature and extends previous studies (Anbumozhi et al. 2020a; Pournader et al. 2016; Ramezankhani et al. 2018). This research discourses the gap by finding effective digital-resilience supply chain factors from the findings of this study and existing literature and providing strategies to be implemented in Pakistan’s digital banking sector. The study formed the ISM-based hierarchical model of validated attributes to achieve greater performance expectancy in the banking sector. It extends the literature on digitalization and resilient service supply chain performance by extracting and validating critical factors for the e-commerce sector. The study applied the ISM-DEMATEL approach to get efficient resilience supply chain factors to enhance the service supply chain through digital banking so that e-commerce will become resilient to absorb any external disruption, such as the covid-19 pandemic (Oldekop et al. 2020).

7.2 Practical and managerial implications

This research has several practical and managerial implications in getting a better performance expectancy of the digital resilient service supply chain. In the e-commerce of Pakistan, the scope of resilience management in digital banking has increased in the last few years, specifically in the last decade, because of technological advancements such as big data, etc. Digital banking facilitates consumers more than traditional banking, leading to greater performance expectancy (Reydet and Carsana 2017).

For instance, customers often use their time to find upcoming investment plans and targets, so e-commerce can effectively suggest services suitable to their current and potential customers as per their risk factors. Currently, the e-commerce sector not only separately suggests services but also focuses on maintaining relationships with customers through interaction on websites and collecting online customer feedback as it creates more customer demand. Developing a performance-oriented e-commerce system can help this sector minimize service expenses and maximize revenue because it will create a better brand image, customer trust, and loyalty (Larsson and Viitaoja 2017).

An ISM-based digraph eventually supports the commerce platform managers in considering the critical factors for maintaining the service supply chain’s resilience. The study has found the most significant and driving digital-resilience attributes through the ISM-based model, which are “Efficiency (F1)”, “Perceived usefulness (F2),” and “E-service quality (F3)”. Thus, the banking sector should efficiently implement these factors to increase the “performance expectancy (F15)” of the resilience supply chain. These factors can be effectively implemented by encouraging feedback, establishing operative KPIs, evaluating the system regularly, and following the e-service quality standards (Shankar and Jebarajakirthy 2019).

Identifying attributes also helps managers differentiate the most driving and dependent factors and mutual relationships of these factors through the linkage factors. Thus, by implementing the model, managers will get better insights into resilience in their supply chain. The study found some driving factors which are more critical with cause identity from DEMATEL analysis are “Performance expectancy (F15)”, “E-cost effectiveness (F5)”, “Trust (F8)”, “Perceived ease of use (F6),”, “Efficiency (F1)”, “Supply chain risk management (F13)”, “Market sensitiveness (F12)” and “Collaboration (F9)”. The e-commerce platform managers must successfully implement these factors by building strong relationships, communicating correctly on the website and internally in the firm, monitoring and maintaining data, and balancing flexibility through e-cost effectiveness (Chunsheng et al. 2019).

Finally, the study helps e-commerce managers examine the proper resilient supply chain system. This study unlocks a novel aspect of supply chain risk management for academia. It gives supply chain researchers a deep insight into understanding a resilient system as a new tool to minimize disruptions and risks in service supply chains.

7.3 Conclusion

The study gives an overall understanding of digital banking practices in making the service supply chain resilient. The scope of digital banking is now increasing in developing countries. This research has explored the effect of SCR through digital banking in the e-commerce sector. The study aims to examine past literature and determine the essential factors to assess digital banking practices and their impact on improving service SCR. The study found and validated sixteen relevant factors essential to measuring the outcome and understanding the relationship between digitalization in banking and service SCR. The factors’ relationship is determined through the MCDM technique, in which this study employed ISM and DEMATEL approaches. ISM and DEMATEL methods are used because these methods match and fulfill this research’s objectives. These two approaches give the outcomes that achieve service SCR through digital banking adoption. The ISM approach describes the relationship between factors and provides a practically viable framework with the help of a structured hierarchical model. The DEMATEL approach identifies the importance and nature of these relationships. All these factors analyzed in this study were discussed in detail in the implication section. The study offers implications that are very helpful for the management of the banking sector, as SCR can be improved by these factors practically.

7.4 Limitations and future research

Other than the significance of this study, a few limitations could be brought up. First, the ISM model is highly dependent on the judgment of expert opinions so that the Delphi approach can be implemented in future studies for a qualitative enhancement in the expert’s response quality. Likewise, the number of responses can also be increased in future studies. Secondly, only sixteen identified factors for exploring service SCR in the e-commerce sector. More factors can be added in future studies. Third, the ISM-based model gives an understanding of each factor; however, it neglects to measure and test the influence of each factor on service SCR. More relevant factors can be added to the study, and the implementation of MICMAC analysis is recommended. In this research, using the ISM methodology, the study is implemented in Pakistan’s banking sector, but this model has not been statistically validated. The main recommendation is that Structural Equation Modeling (SEM) can be applied in future studies to test the ISM model’s reliability and validity consisting of samples from customers instead of experts. Future studies can apply the identified factors in different sectors and industries or applied to a different developing economy. Future studies can also be tested by examining these factors to understand how digital banking, resilient supply chain factors, and expected performance measures are related.

Data availability

The data was taken in the form of filled questionnaires from respondents and can be submitted on request from the authors.

References

Aboutorab H, Saberi M, Asadabadi MR, Hussain O, Chang E (2018) ZBWM: The Z-number extension of Best Worst Method and its application for supplier development. Expert Syst Appl 107:115–125

Afshan S, Sharif A, Waseem N, Frooghi R (2018) Internet banking in Pakistan: An extended technology acceptance perspective. Int J Bus Inf Syst 27:383–410

Agarwal A, Shankar R, Tiwari M (2007) Modeling agility of supply chain. Ind Mark Manag 36:443–457

Akbari M, Hopkins JL (2022) Digital technologies as enablers of supply chain sustainability in an emerging economy. Oper Manag Res 1–22

Akhlaq A, Ahmed E (2013) The effect of motivation on trust in the acceptance of internet banking in a low income country. Int J Bank Mark

Alalwan AA, Dwivedi YK, Rana NP, Simintiras AC (2016) Jordanian consumers’ adoption of telebanking: Influence of perceived usefulness, trust and self-efficacy. Int J Bank Mark

Alhassany H, Faisal F (2018) Factors influencing the internet banking adoption decision in North Cyprus: an evidence from the partial least square approach of the structural equation modeling. Financ Innov 4:29

Ali A, Mahfouz A, Arisha A (2017) Analysing supply chain resilience: integrating the constructs in a concept mapping framework via a systematic literature review. Supply Chain Manag Int J

Alzoubi H, Yanamandra R (2020) Investigating the mediating role of information sharing strategy on agile supply chain. Uncert Supply Chain Manag 273–284

Ambulkar S, Blackhurst J, Grawe S (2015) Firm’s resilience to supply chain disruptions: Scale development and empirical examination. J Oper Manag 33:111–122

Amin M (2016) Internet banking service quality and its implication on e-customer satisfaction and e-customer loyalty. Int J Bank Mark

Amutha D (2016) A study of consumer awareness towards e-banking. Int J Econ Manag Sci 5:350–353

Ananda S, Devesh S, Lawati AMA (2020) What factors drive the adoption of digital banking? An empirical study from the perspective of Omani retail banking. J Financ Serv Mark 25:14–24

Anbumozhi V, Kimura F, Thangavelu SM (2020a) Global supply chain resilience: vulnerability and shifting risk. Supply Chain Resilience: Reducing Vulnerability to Economic Shocks, Financial Crises, and Natural Disasters 3

Anbumozhi V, Kimura F, Thangavelu SM (2020b) Global supply chain resilience: Vulnerability and shifting risk management strategies. Springer, Supply Chain Resilience

Aslam W, de Luna IR, Asim M, Farhat K (2022) Do the preceding self-service technologies influence mobile banking adoption? IIM Kozhikode Soc Manag Rev 22779752211073552

Azjen I (1980) Understanding attitudes and predicting social behavior. Englewood Cliffs

Bae SY, Chang P-J (2020) The effect of coronavirus disease-19 (COVID-19) risk perception on behavioural intention towards ‘untact’tourism in South Korea during the first wave of the pandemic (March 2020). Curr Issues Tour 1–19

Bai C, Sarkis J (2013) A grey-based DEMATEL model for evaluating business process management critical success factors. Int J Prod Econ 146:281–292

Bank W (2017) World development report 2017: Governance and the law. The World Bank

Barroso A, Machado V, Machado VC (2011) Supply chain resilience using the mapping approach. Supply Chain Manag 161–184

Batada DI (2020) The future of e-commerce. International The News

Bhamra R, Dani S, Burnard K (2011) Resilience: the concept, a literature review and future directions. Int J Prod Res 49:5375–5393

Bigliardi B, Filippelli S, Petroni A, Tagliente L (2022) The digitalization of supply chain: a review. Procedia Comput Sci 200:1806–1815

Braunscheidel MJ, Suresh NC (2009) The organizational antecedents of a firm’s supply chain agility for risk mitigation and response. J Oper Manag 27:119–140

Brennen JS, Kreiss D (2016) Digitalization. Int Encyc Commun Theory Philos 1–11

Brusset X, Teller C (2017) Supply chain capabilities, risks, and resilience. Int J Prod Econ 184:59–68

Campbell D, Frei F (2010) Cost structure, customer profitability, and retention implications of self-service distribution channels: Evidence from customer behavior in an online banking channel. Manag Sci 56:4–24

Carr V Jr (1999) Technology adoption and diffusion. Learn Center Interact Technol

Chatterjee S, Chaudhuri R (2021) Supply chain sustainability during turbulent environment: Examining the role of firm capabilities and government regulation. Oper Manag Res 1–15

Chen J, Sohal AS, Prajogo DI (2013) Supply chain operational risk mitigation: a collaborative approach. Int J Prod Res 51:2186–2199

Chen W-K, Nalluri V, Lin M-L, Lin C-T (2021) Identifying decisive socio-political sustainability barriers in the supply chain of banking sector in India: Causality analysis using ISM and MICMAC. Mathematics 9:240

Christopher M, Peck H (2004) Building the resilient supply chain

Christopher M, Towill D (2001) An integrated model for the design of agile supply chains. Int J Phys Distrib Logist Manag

Chuah SH-W, Rauschnabel PA, Krey N, Nguyen B, Ramayah T, Lade S (2016) Wearable technologies: The role of usefulness and visibility in smartwatch adoption. Comput Hum Behav 65:276–284

Chuang H-M, Lin C-K, Chen D-R, Chen Y-S (2013) Evolving MCDM applications using hybrid expert-based ISM and DEMATEL models: an example of sustainable ecotourism. Sci World J

Chunsheng L, Wong CW, Yang C-C, Shang K-C, Lirn T-C (2019) Value of supply chain resilience: roles of culture, flexibility, and integration. Int J Phys Distrib Logist Manag

Chuttur MY (2009) Overview of the technology acceptance model: Origins, developments and future directions. Work Pap Inf Syst 9:9–37

Claro DP, Rosa RB (2016) Drivers leading firm adoption of internet banking services. Mark Intell Plan 34:336–354

Das D, Datta A, Kumar P, Kazancoglu Y, Ram M (2021) Building supply chain resilience in the era of COVID-19: An AHP-DEMATEL approach. Oper Manag Res 1–19

Dhiaf MM, Atayah OF, Nasrallah N, Frederico GF (2021) Thirteen years of operations management research (OMR) journal: a bibliometric analysis and future research directions. Oper Manag Res 14:235–255

Digalwar A, Raut RD, Yadav VS, Narkhede B, Gardas BB, Gotmare A (2020) Evaluation of critical constructs for measurement of sustainable supply chain practices in lean-agile firms of Indian origin: A hybrid ISM-ANP approach. Bus Strateg Environ 29:1575–1596

Dubey R, Bryde DJ, Blome C, Roubaud D, Giannakis M (2021) Facilitating artificial intelligence powered supply chain analytics through alliance management during the pandemic crises in the B2B context. Ind Mark Manag 96:135–146

Duong LNK, Chong J (2020) Supply chain collaboration in the presence of disruptions: a literature review. Int J Prod Res 58:3488–3507

Dwivedi A, Agrawal D, Jha A, Gastaldi M, Paul SK, D’Adamo I (2021) Addressing the challenges to sustainable initiatives in value chain flexibility: Implications for Sustainable Development Goals. Glob J Flex Syst Manag 22:179–197

Dwivedi YK, Rana NP, Jeyaraj A, Clement M, Williams MD (2019) Re-examining the unified theory of acceptance and use of technology (UTAUT): Towards a revised theoretical model. Inf Syst Front 21:719–734

Fahimnia B, Pournader M, Siemsen E, Bendoly E, Wang C (2019) Behavioral operations and supply chain management–A review and literature mapping. Decis Sci 50:1127–1183

Farooque M, Jain V, Zhang A, Li Z (2020) Fuzzy DEMATEL analysis of barriers to Blockchain-based life cycle assessment in China. Comput Ind Eng 147:106684

Fichman RG, dos Santos BL, Zheng Z (2014) Digital innovation as a fundamental and powerful concept in the information systems curriculum. MIS Q 38:329-A15

Fishburn P (1967) Additive utilities with incomplete product set: Applications to priorities and assignments

Geebren A, Jabbar A, Luo M (2021) Examining the role of consumer satisfaction within mobile eco-systems: Evidence from mobile banking services. Comput Hum Behav 114:106584

Gefen D, Karahanna E, Straub DW (2003) Trust and TAM in online shopping: An integrated model. MIS Quart 51–90

Golan MS, Jernegan LH, Linkov I (2020) Trends and applications of resilience analytics in supply chain modeling: systematic literature review in the context of the COVID-19 pandemic. Environ Syst Decis 40:222–243

Gunasekaran A, Subramanian N, Rahman S (2015) Supply chain resilience: role of complexities and strategies. Taylor & Francis

Gvozdanovic I, Solomon O (2016) The effect of electronic banking in financial supply chain: E-banking in Eritrea. J Glob Econ 4:2

Hillmann J, Guenther E (2021) Organizational resilience: a valuable construct for management research? Int J Manag Rev 23:7–44

Hosseini S, Ivanov D, Dolgui A (2019) Review of quantitative methods for supply chain resilience analysis. Transp Res Part E Logist Transp Rev 125:285–307

Hsu C-W, Kuo T-C, Chen S-H, Hu AH (2013) Using DEMATEL to develop a carbon management model of supplier selection in green supply chain management. J Clean Prod 56:164–172

Huang C-Y, Kao Y-S (2015) UTAUT2 based predictions of factors influencing the technology acceptance of phablets by DNP. Math Probl Eng

Hwang C-L, Yoon K (1981) Methods for multiple attribute decision making. Springer, Multiple attribute decision making

Ireland RD, Webb JW (2007) A multi-theoretic perspective on trust and power in strategic supply chains. J Oper Manag 25:482–497

Ivanov D (2020) Predicting the impacts of epidemic outbreaks on global supply chains: A simulation-based analysis on the coronavirus outbreak (COVID-19/SARS-CoV-2) case. Transp Res Part E Logist Transp Revi 136:101922

Jain V, Kumar S, Soni U, Chandra C (2017) Supply chain resilience: model development and empirical analysis. Int J Prod Res 55:6779–6800

Kek V, Nadeem SP, Ravichandran M, Ethirajan M, Kandasamy J (2022) Resilience strategies to recover from the cascading ripple effect in a copper supply chain through project management. Oper Manag Res 1–21

Khan MI, Khan S, Khan U, Haleem A (2021a) Modeling the Big Data challenges in context of smart cities–an integrated fuzzy ISM-DEMATEL approach. Int J Build Pathol Adapt

Khan MZ (2021) Pakistan’s e-commerce market growing. Dawn

Khan SA, Mubarik MS, Kusi-Sarpong S, Zaman SI, Kazmi SHA (2021b) Social sustainable supply chains in the food industry: A perspective of an emerging economy. Corp Soc Responsib Environ Manag 28:404–418

Khan SAR, Yu Z, Golpîra H, Sharif A, Mardani A (2020) A state-of-the-art review and meta-analysis on sustainable supply chain management: Future research directions. J Clean Prod 123357

Kilay AL, Simamora BH, Putra DP (2022) The influence of e-payment and e-commerce services on supply chain performance: Implications of open innovation and solutions for the digitalization of micro, small, and medium enterprises (MSMEs) in Indonesia. J Open Innov Technol Mark Complex 8:119

Kovács G, Falagara Sigala I (2021) Lessons learned from humanitarian logistics to manage supply chain disruptions. J Supply Chain Manag 57:41–49

Kumar P, Bhamu J, Sangwan KS (2021) Analysis of barriers to industry 4.0 adoption in manufacturing organizations: an ISM approach. Procedia CIRP 98:85–90

Lai J-Y, Ulhas KR, Lin C-T, Ong C-S (2013) Factors driving value creation in online B2B banking. J Glob Inf Manag (JGIM) 21:51–71

Larsson A, Viitaoja Y (2017) Building customer loyalty in digital banking. Int J Bank Mark

Laukkanen P, Sinkkonen S, Kivijärvi M, Laukkanen T (2007) Consumer resistance and intention to use internet banking service. Proc EBRF Conf, Jyväskylä, Finland 25–27

Lee M-C (2009) Factors influencing the adoption of internet banking: An integration of TAM and TPB with perceived risk and perceived benefit. Electron Commer Res Appl 8:130–141

Lichtenstein S, Williamson K (2006) Understanding consumer adoption of internet banking: an interpretive study in the Australian banking context. J Electron Commer Res 7:50

Liu X, Dou Z, Yang W (2021) Research on influencing factors of cross border E-commerce supply chain resilience based on integrated fuzzy DEMATEL-ISM. IEEE Access 9:36140–36153

Lohmer J, Bugert N, Lasch R (2020) Analysis of resilience strategies and ripple effect in blockchain-coordinated supply chains: An agent-based simulation study. Int J Prod Econ 228:107882

Madhani PM (2019) Strategic supply chain management for enhancing competitive advantages: developing business value added framework. Int J Value Chain Manag 10:316–338

Malaquias RF, Hwang Y (2016) An empirical study on trust in mobile banking: A developing country perspective. Comput Hum Behav 54:453–461

Mao X, Lou X, Yuan C, Zhou J (2020) Resilience-based restoration model for supply chain networks. Mathematics 8:163

Martins C, Oliveira T, Popovič A (2014) Understanding the Internet banking adoption: A unified theory of acceptance and use of technology and perceived risk application. Int J Inf Manag 34:1–13

Mason-Jones R, Towill DR (1999) Using the information decoupling point to improve supply chain performance. Int J Logist Manag 10:13–26

Masoud E, Abutaqa H (2017) Factors affecting customers’ adoption of e-banking services in Jordan. Inf Resour Manag J (IRMJ) 30:44–60

Mathiyazhagan K, Govindan K, Noorulhaq A, Geng Y (2013) An ISM approach for the barrier analysis in implementing green supply chain management. J Clean Prod 47:283–297

McCarter MW, Northcraft GB (2007) Happy together?: Insights and implications of viewing managed supply chains as a social dilemma. J Oper Manag 25:498–511

Meixell MJ, Luoma P (2015) Stakeholder pressure in sustainable supply chain management: A systematic review

Miao M, Zaman SI, Zafar A, Rodriguez CG, Ali Zaman SA (2022) The augmentation of knowledge management through industry 4.0: case of aviation sector of emerging economy. Knowl Manag Res Pract 1–20

Min H (2019) Blockchain technology for enhancing supply chain resilience. Bus Horiz 62:35–45

Motallem S, Darbandi M, Kianfar F (2020) Investigation of resilience in the structure of supply chain in the banking system. Proc Int Conf Ind Eng Ind Manag 15–18

Mubarik MS, Kazmi SHA, Zaman SI (2021) Application of gray DEMATEL-ANP in green-strategic sourcing. Technol Soc 64:101524

Muhammad I, Mingzheng W, Naeem A (2021) Correction to: Impact of IT capabilities on supply chain capabilities and organizational agility: a dynamic capability view. Oper Manag Res 14:233–233

Nagar N, Ghai E (2019) A study of bank customer’s reliabilityt towards Electronic Banking (E-Banking) channel’s. Int J Manag Stud 6(1):34–40

Naimi-Sadigh A, Asgari T, Rabiei M (2022) Digital transformation in the value chain disruption of banking services. J Knowl Econ 13:1212–1242

Namahoot KS, Laohavichien T (2018) Assessing the intentions to use internet banking. Int J Bank Mark

Nandi ML, Nandi S, Moya H, Kaynak H (2020) Blockchain technology-enabled supply chain systems and supply chain performance: a resource-based view. Supply Chain Manag Int J

Naz F, Kumar A, Majumdar A, Agrawal R (2021) Is artificial intelligence an enabler of supply chain resiliency post COVID-19? An exploratory state-of-the-art review for future research. Oper Manag Res 1–21

Obaid T (2021) Predicting mobile banking adoption: An integration of TAM and TPB with trust and perceived risk. Available at SSRN 3761669

Oldekop JA, Horner R, Hulme D, Adhikari R, Agarwal B, Alford M, Bakewell O, Banks N, Barrientos S, Bastia T (2020) COVID-19 and the case for global development. World Dev 134:105044

Olson DL, Wu D (2011) Risk management models for supply chain: a scenario analysis of outsourcing to China. Supply Chain Manag Int J 16:401–408

Omian KA (2020) Are we witnessing the awakening of a new world order? [Online]. Middle East forbes: [Accessed]

Oye N, Lahad N, Rahim N (2012) Computer self-efficacy, anxiety and attitudes towards use of technology among university academicians: A case study of university of Port Harcourt-Nigeria. Int J Comput Sci Technol 3:213–9

Ozturk AB, Bilgihan A, Nusair K, Okumus F (2016) What keeps the mobile hotel booking users loyal? Investigating the roles of self-efficacy, compatibility, perceived ease of use, and perceived convenience. Int J Inf Manag 36:1350–1359

Parasuraman A (2000) Technology readiness index (TRI) a multiple-item scale to measure readiness to embrace new technologies. J Serv Res 2:307–320

Pettit TJ, Croxton KL, Fiksel J (2019) The evolution of resilience in supply chain management: a retrospective on ensuring supply chain resilience. J Bus Logist 40:56–65

Piprani AZ, Jaafar NI, Ali SM, Mubarik MS, Shahbaz M (2022) Multi-dimensional supply chain flexibility and supply chain resilience: the role of supply chain risks exposure. Oper Manag Res 1–19

Ponis ST, Koronis E (2012) Supply chain resilience? Definition of concept and its formative elements. J Appl Bus Res 28:921–935

Pournader M, Rotaru K, Kach AP, Hajiagha SHR (2016) An analytical model for system-wide and tier-specific assessment of resilience to supply chain risks. Supply Chain Manag Int J

Prater E, Biehl M, Smith MA (2001) International supply chain agility‐Tradeoffs between flexibility and uncertainty. Int J Oper Prod Manag

Rajaobelina L, Tep SP, Arcand M, Ricard L (2021) The relationship of brand attachment and mobile banking service quality with positive word-of-mouth. J Prod Brand Manag

Ramezankhani M, Torabi SA, Vahidi F (2018) Supply chain performance measurement and evaluation: A mixed sustainability and resilience approach. Comput Ind Eng 126:531–548

Randall S, Crawford T, Currie J, River J, Betihavas V (2017) Impact of community based nurse-led clinics on patient outcomes, patient satisfaction, patient access and cost effectiveness: A systematic review. Int J Nurs Stud 73:24–33

Raza SA, Umer A, Qureshi MA, Dahri AS (2020) Internet banking service quality, e-customer satisfaction and loyalty: the modified e-SERVQUAL model. TQM J

Reydet S, Carsana L (2017) The effect of digital design in retail banking on customers’ commitment and loyalty: The mediating role of positive affect. J Retail Consum Serv 37:132–138

Rungsrisawat S, Joemsittiprasert W, Jermsittiparsert K (2019) Factors determining consumer buying behaviour in online shopping. Int J Innov Creat Change 8:222–237

Saaty TL, Vargas LG (2001) How to make a decision. Models, methods, concepts & applications of the analytic hierarchy process. Springer

Saengchai S, Jermsittiparsert K (2019) Coping strategy to counter the challenges towards implementation of Industry 4.0 in Thailand: role of supply chain agility and resilience. Int J Supply Chain Manag 8:733–744

Sage AP (1977) Methodology for large-scale systems, McGraw-Hill College

Sahu KC, Kavita J (2020) A nonparametric approach to the prioritization of customers’ online service adoption dimensions in Indian banks. Springer, Data Engineering and Communication Technology

Sakthivel N (2008) Customers’ perception of ATM services: A comparative analysis. Professional Banker 3:66–74

Samaradiwakara G, Gunawardena C (2014) Comparison of existing technology acceptance theories and models to suggest a well improved theory/model. Int Tech Sci J 1:21–36

Savage GJ, Carr SM (2002) Interrelating quality and reliability in engineering systems. Qual Eng 14:137–152

Shaikh AA, Karjaluoto H (2015) Mobile banking adoption: A literature review. Telemat Inform 32:129–142

Shakeri H, Khalilzadeh M (2020) Analysis of factors affecting project communications with a hybrid DEMATEL-ISM approach (A case study in Iran). Heliyon 6:e04430

Shankar A, Jebarajakirthy C (2019) The influence of e-banking service quality on customer loyalty. Int J Bank Mark

Sharma R, Singh G, Sharma S (2020) Modelling internet banking adoption in Fiji: A developing country perspective. Int J Inf Manag 53:102116

Sharma SK, Sharma M (2019) Examining the role of trust and quality dimensions in the actual usage of mobile banking services: An empirical investigation. Int J Inf Manag 44:65–75

Sheel A, Nath V (2019) Effect of blockchain technology adoption on supply chain adaptability, agility, alignment and performance. Manag Res Rev

Sheikh AA, Hassan NM, Haneef Z, Nawaz MS (2021) Mediating role of value co-creation and customer commitment between customer trust and customer loyalty in mobile banking of Pakistan. Abasyn Univ J Soc Sci 14

Shojaei P, Haeri SAS (2019) Development of supply chain risk management approaches for construction projects: A grounded theory approach. Comput Ind Eng 128:837–850

Siadat SH, Shokohyar S, Shafahi S (2019) SOA adoption factors in e-banking: An empirical analysis from the practical perspective. Int J Inf Syst Serv Sect (IJISSS) 11:25–39

Szopiński TS (2016) Factors affecting the adoption of online banking in Poland. J Bus Res 69:4763–4768

Tang CS (2006) Robust strategies for mitigating supply chain disruptions. Int J Log Res Appl 9:33–45

Team DP (2020) COVID-19: The catalyst for Pakistan’s e-commerce sector? [Online]. Available from: https://digitalpakistan.pk/blog/covid-19-the-catalyst-for-pakistans-e-commerce-sector/

Tortorella G, Prashar A, Samson D, Kurnia S, Fogliatto FS, Capurro D, Antony J (2022) Resilience development and digitalization of the healthcare supply chain: an exploratory study in emerging economies. Int J Logist Manag

Triantaphyllou E (2000) Multi-criteria decision making methods. Multi-criteria decision making methods: A comparative study. Springer

Tukamuhabwa BR, Stevenson M, Busby J, Zorzini M (2015) Supply chain resilience: definition, review and theoretical foundations for further study. Int J Prod Res 53:5592–5623

Tzeng G-H, Chiang C-H, Li C-W (2007) Evaluating intertwined effects in e-learning programs: A novel hybrid MCDM model based on factor analysis and DEMATEL. Expert Syst Appl 32:1028–1044

Uddin MB, Akhter B (2022) Investigating the relationship between top management commitment, supply chain collaboration, and sustainable firm performance in the agro-processing supply chain. Oper Manag Res 1–19

Um J, Han N (2020) Understanding the relationships between global supply chain risk and supply chain resilience: the role of mitigating strategies. Supply Chain Manag Int J

Venkatesh V, Thong JY, Xu X (2012) Consumer acceptance and use of information technology: extending the unified theory of acceptance and use of technology. MIS Quart 157–178

Wamba SF, Dubey R, Gunasekaran A, Akter S (2020) The performance effects of big data analytics and supply chain ambidexterity: The moderating effect of environmental dynamism. Int J Prod Econ 222:107498

Wang M, Cho S, Denton T (2017) The impact of personalization and compatibility with past experience on e-banking usage. Int J Bank Mark

Wang M, Jie F (2020) Managing supply chain uncertainty and risk in the pharmaceutical industry. Health Serv Manag Res 33:156–164

Wang SW, Ngamsiriudom W, Hsieh C-H (2015) Trust disposition, trust antecedents, trust, and behavioral intention. Serv Ind J 35:555–572

Wang Y, Hong A, Li X, Gao J (2020) Marketing innovations during a global crisis: A study of China firms’ response to COVID-19. J Bus Res 116:214–220

Wang Z, Zhang M (2020) Linking product modularity to supply chain integration and flexibility. Prod Plan Control 31:1149–1163

Warfield JN (1973) Binary matrices in system modeling. IEEE Trans Syst Man Cybern 441–449

Warfield JN (1974) Developing interconnection matrices in structural modeling. IEEE Trans Syst Man Cybern 81–87

Wong CW, Lirn T-C, Yang C-C, Shang K-C (2020a) Supply chain and external conditions under which supply chain resilience pays: An organizational information processing theorization. Int J Prod Econ 226:107610

Wong L-W, Tan GW-H, Lee V-H, Ooi K-B, Sohal A (2020b) Unearthing the determinants of Blockchain adoption in supply chain management. Int J Prod Res 58:2100–2123

Xia X, Govindan K, Zhu Q (2015) Analyzing internal barriers for automotive parts remanufacturers in China using grey-DEMATEL approach. J Clean Prod 87:811–825

Xu M, Cui Y, Hu M, Xu X, Zhang Z, Liang S, Qu S (2019) Supply chain sustainability risk and assessment. J Clean Prod 225:857–867

Xu M, Wang X, Zhao L (2014) Predicted supply chain resilience based on structural evolution against random supply disruptions. Int J Syst Sci Oper Logist 1:105–117

Yang Z, Peterson RT (2004) Customer perceived value, satisfaction, and loyalty: The role of switching costs. Psychol Mark 21:799–822

Zhang H, Jia F, You J-X (2021) Striking a balance between supply chain resilience and supply chain vulnerability in the cross-border e-commerce supply chain. Int J Logist Res Appl 1–25

Zhao L, Huo B, Sun L, Zhao X (2013) The impact of supply chain risk on supply chain integration and company performance: a global investigation. Supply Chain Manag Int J 18:115–131

Zhou D-Q, Zhang L (2008) Establishing hierarchy structure in complex systems based on the integration of DEMATEL and ISM. J Manag Sci China 11:20–26

Zhou T (2012) Understanding users’ initial trust in mobile banking: An elaboration likelihood perspective. Comput Hum Behav 28:1518–1525

Zhu Q, Lyu Z, Long Y, Wachenheim CJ (2021) Adoption of mobile banking in rural China: Impact of information dissemination channel. Socio-Econ Plan Sci 101011

Zouari D, Ruel S, Viale L (2020) Does digitalising the supply chain contribute to its resilience? Int J Phys Distrib Logist Manag

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendices

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article