Abstract

Population aging worries many. Will population aging negatively affect economic output and lead to deflation? Can countries afford to cater for older populations? Can they prevent old-age poverty? Can they pay adequate pensions? Can they address the challenge of population aging by postponing the retirement age? Should they seek to counteract population aging through accelerated immigration and/ or should they focus on maintaining fertility rates above replacement levels? Although some answers to these questions are context-specific, this paper argues that the threat of population aging is overstated. It is hyped by media and too often based on partial analysis. A macroeconomic analysis provides a more adequate and less threatening picture of population aging than the household-focused analysis that underlies most studies on this subject matter. The developed economies that already have a large share of older persons are well positioned to shoulder the economic implications of further population aging, and rapidly developing economies, which see an accelerated rate of population aging, are too. Many countries have the economic conditions to address population aging, but many lack the necessary resolve to implement the required policies. Popular policy responses to population aging are building up to a major wave of income redistribution, following the globalization of finance and the current responses to the global economic crisis.

Similar content being viewed by others

Notes

For a critical discussion of some of these arguments, which are characterized by a lack of economic understanding and empirical foundations, see also Bosbach (2008).

The most pressing challenge that many developing countries, especially the least developed countries, confront is the rather classical challenge of promoting structural change and creating productive employment, amidst an essentially unlimited supply of inexpensive labor (Herrmann and Khan 2008; Basten et al. 2011; UNFPA 2011).

Zoubanov (2000) and United Nations (2001) examine the question of whether replacement migration may help to counteract challenges associated with population ageing. The analysis however is focused on changes in the working-age population and labor force rather than changes in labor force participation and employment, which weakens its conclusions.

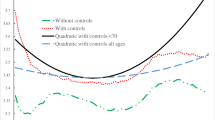

The German Statistical Office calculated that an average annual increase in labor productivity of less than 0.1 per cent is sufficient to address the challenge of population aging if the retirement age was set at 65, and that an average annual increase in labor productivity of less than 0.3 per cent is needed to cater for a growing number of old-age dependents if the retirement age was set at 63 (Bosbach 2008). The actual long-term average labor productivity growth is more than 1.6 per cent (chart 5), which highlights the absurdity of fears of population aging.

This analysis is based on the medium variant of population projections published by the Population Division of the United Nations’ Department for Economic and Social Affairs, which suggests a relatively rapid deceleration of population growth, compared with alternative projections.

Although measures to reduce consumption of health care services are not sensible, measures to reduce the cost of health care services could be. But a reduction of health care costs would ideally be based on a stronger competition between health care providers, rather than a reduction in the coverage or quality of care. The observed rise in health care costs is attributable not only to an increasing demand for health care services—which comes with an ageing population—but also to increasing fees charged by health care providers. The latter results from legislative changes which often place a cumbersome administrative burden on providers, as well as higher profit expectations by providers (UN 2007).

On this issue, see also Oberhauser (1989), who provides an excellent expose on social policy, employment and macroeconomic dynamics.

Accordingly, some analysts emphasize that population ageing will lead to a reduction in private and public assets, and they conclude that that this reduction will lead to a reduction in global wealth (e.g., McKinsey 2005). While the first part of this assessment is correct, the second is not. A reduction in assets does not mean that assets vanish; assets are simply transformed into something else. A reduction in saving means nothing else than an increase in consumption and investment, and both will support rather than undermine economic growth.

Bravo (2005), for example, discuses implications of asset reallocations in Latin America for future generations.

The selection of appropriate discount rates is also a challenge for efforts to account for national wealth more generally. Whereas markets help in the discovery of some discount rates; the identification of discount rates is difficult where functioning markets do not exist. This is the case for numerous public goods, including the earth’s climate. Meaningful restrictions on greenhouse gas emissions and a functioning emissions trading system could help to overcome this challenge.

The role of saving and investment for the financing of development has been widely discussed in the literature. The account identity that saving equal investment does not say anything about causality. Whereas it is often suggested that savings precede investments, it is typically investment that leads saving. It is not the bank that pushes its savings onto entrepreneurs, but rather the entrepreneurs who seek financing for an investment from the bank. Economies finance investments through credit creation, and the investments will create saving in return (e.g., UNCTAD 2008; Dullien 2009; Herrmann 2010).

A sole focus on human capital development suggests that it is the lack of human capital that explains unemployment and thereby this focus effectively puts the blame for unemployment on the unemployed themselves. But more often than not, unemployment is explained by a weak economic development, rather than a lack of education of the unemployed. Accordingly, “Hyman Minsky always argued that public policy that favours education and training over job creation puts “the cart before the horse” and is unlikely to succeed. [..] it lays the blame on the unemployed, which can be demoralizing and can validate public perceptions regarding undesirable characteristics supposedly endemic within the disadvantaged population” (Wray 2007: 5).

References

Basten, S., Herrmann, M., Khan, H. A., & Lochinger, E. (2011 forthcoming). Population dynamics and poverty in LDCs. UNFPA Economic Angle, No. 03/2011, New York, NY.

Bloom, D. E., Canning, D., & Fink, G. (2010a). The graying of global population and its macroeconomic consequences. The WDO-HSG Discussion Paper Series on Demographic Issues, No. 2010/4, University of St. Gallen, St. Gallen.

Bloom, D. E., Canning, D., & Fink, G. (2010b). Implications of population aging for economic growth. Oxford Review of Economic Policy, 26(4), 583–612.

Boersch-Supan, A. (2006). European welfare state regimes and their generosity toward the eledrly. The Levy Economics Institute of Bard College, Working Paper No. 479, Annandale-on-Hudson, NY.

Bosbach, G. (2008). Demografische Entwicklung—Realitaet und mediale Aufbereitung. Papier zum Smposium “Zur politischen Ökonomie des Rentenbetrugs an Jung und Alt”, 22. November 2008, Netzwerk für eine gerechte Rente, Darmstadt.

Bravo, J. (2005). Intergenerational transfers and social protection in Latin America. Paper presented at United Nations Expert Group Meeting on Social and Economic Implications of Changing Population Age Structures, Mexico City, 31 August–2 September 2005.

Dullien, S. (2009). Central banking, financial institutions and credit creation in developing countries. UNCTAD Discussion Paper No. 193, Geneva.

Dychtwald, K. (1999). Ken Dychtwald on the future. San Francisco Cronicle, 15 November 1999.

Elmendorf, D. W., & Sheiner, L. M. (2000). Should America save for its old age? Fiscal policy, population aging and national saving. The Journal of Economic Perspectives, 14(3), Summer, 2000.

Flassbeck, H. (2000). Generationenvertrag versus private Vorsorge: Falsche Alternativen in der Rentendebatte, Handelsblatt, 18 July 2000.

Ghilarducci, T. (2010). The future of retirement in aging societies. International Review of Applied Economics, 24(3), 319–331.

Glyn, A. (2010). Explaining Labor’s Declining Share of National Income, G-24 Policy Brief, no. 4, Washington, DC.

Goldstone, J. A. (2010). The new population bomb: Four mega-trends that will change the world. Foreign Affairs, January/ February 2010.

Guscina, A. (2006). Effects of globalization on labor’s share in national income. IMF Working Paper 06/ 294, Washington, DC.

Herrmann, M. (2010). Financing for Development in Crisis, UNFPA Economic Angle, No. 01/2010, May 2010, New York, NY.

Herrmann, M. (2007). Reflections on globalization. In: Global Youth Action Network (Ed.). Debating globalization: International perspectives on the global economic and social order. Brussels.

Herrmann, M., & Khan, H. A. (2008). Rapid urbanization, employment crises and poverty in African LDCs. Paper prepared for UNU-WIDER Project Workshop “Beyond the Tipping Point: African Development in an Urban World”, 26–28 June 2008, Cape Town, South Africa.

Hewitt, P. S. (2002). Depopulation and ageing in Europe and Japan: the hazardous transition to a labor shortage economy. International Politics and Society, January 2002.

ILO (2008a). World of work report 2008: Income inequality in the age of financial globalization. Geneva.

ILO (2008b). Global wage report 2008/ 2009: Minimum wages and collective bargaining: towards policy coherence. Geneva.

IMF (2007). World economic outlook 2007: Globalization and inequality. Washington, DC.

IMF & ILO (2010). The challenges of growth, employment and social Cohesion, Discussion document, Joint ILO-IMF conference in cooperation with the office of the Prime Minister of Norway, Oslo, 13 September.

Impavido, G., & Tower, I. (2009). How the financial crisis affects pensions and insurance and why the impacts matter. IMF Working Paper 09/151, Washington, DC.

Lee, R., & Mason, A. (Eds.). (2010). Population ageing and the generational economy. London: Edward Elgar.

Lee, R., Lee, S.-H., & Mason, A. (2008). Charting the economic lifecycle. In A. Prskawetz, D. E. Bloom, & W. Lutz (Eds.), Population aging, human capital accumulation, and productivity growth, a supplement to population and development review 33. New York: Population Council.

Mason, A., Lee, R., Tung, A.-C., Lai, M.-S., & Miller, T. (2006). Population aging and intergenerational transfers: introducing age into national accounts. NBER Working Paper No. 12770, December 2006.

Mason, A., Lee, R., Donehower, G., Lee, S.-H., Miller, T., Tung, A.-C., & Chawla, A. (2009). National Transfer Accounts Manual. NTA Working Paper, Vol. 09–08

McKinsey Global Institute (2005). The coming demographic deficit: How aging populations will reduce global savings. Washington, DC.

Novy-Marx, R., & Rauh, J. D. (2008). The intergenerational transfer of public pension promises. University of Chicago Graduate School of Business and NBER, mimeo.

Oberhauser, A. (1989). Sozialleistungen, Kreislaufzusammenhänge und Beschäftigung, in F. Buttler and G. Kuehlewind: Erwerbstätigkeit und Generationenvertrag: Perspektiven bis 2030. Beiträge zur Arbeitsmarkt- und Berufsforschung, 130, Nürnberg.

OECD (2010). International migration outlook 2010. Paris.

OECD (2005). Ageing populations: High time for action, background paper prepared for meeting of G8 employment and labour ministers, 10–11 March 2005. London.

Orenstein, M. A. (Ed.). (2009). Pensions, social security, and the privatization of risk. New York: Columbia University Press.

Peterson, P. G. (1999). Gray dawn: The global ageing crisis. Foreign Affairs, January/ February 1999.

UNCTAD (2008). Trade and development report 2008: Commodity prices, capital flows and the financing of investment. Geneva.

UNFPA (2011). Population dynamics in the LDCs: Challenges and opportunities for development and poverty reduction. New York, NY.

United Nations (2009). World population ageing 2009. New York, NY.

United Nations (2007). World economic and social survey 2007: Development in an ageing world. New York, NY.

United Nations (2001). Replacement migration: Is it a solution to declining and ageing populations? New York, NY.

Wray, L. R. (2007). The Employer of last resort programme: Could it work for developing countries? ILO Economic and Labour Market Paper, No 2007/ 5, August, Geneva.

Zoubanov, A. (2000). Population ageing and population decline: Government views and policies. Background Report prepared for Expert Group Meeting on Policy Responses to Population Ageing and Population Decline, held 16–18 October 2000 in New York, UN DESA/ Population Division, New York, NY.

Author information

Authors and Affiliations

Corresponding author

Additional information

The paper benefited from valuable comments by Detlef Kotte, Andrew Mason and Ingo Pitterle. The views expressed in this paper however are those of the author, and they do not necessarily reflect the views of commentators or UNFPA.

Rights and permissions

About this article

Cite this article

Herrmann, M. Population Aging and Economic Development: Anxieties and Policy Responses. Population Ageing 5, 23–46 (2012). https://doi.org/10.1007/s12062-011-9053-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12062-011-9053-5

Keywords

- Population

- Aging

- Intergenerational transfers

- National transfer accounts

- Pensions

- Macroeconomics

- Structural change