Abstract

Slotting fees and related discounts are important but controversial mechanisms for obtaining shelf space in marketing channels for consumer packaged goods. The theoretical field is divided between the efficient market and the market power schools of thought. Results from empirical studies and analytical models point in different directions. This paper analyzes trends in key macro economic variables to see if the patterns are more consistent with an underlying market efficiency model vs. a market power one. The data span 30+ years and focus on retailers in the marketing channel for food and kindred products. The variables studied include new product introductions, retail selling area, consumer price indices, profitability, cost of goods sold and selling expenditures. Efficient market explanations do not fare well in the analyses in comparison with market power explanations for practically all the variables studied. The paper conlcudes with recommendations for regulators and retail management.

Similar content being viewed by others

Notes

The BATF likened slotting to a consignment sale, noting “that the practical effect of slotting allowances is to refund, in whole or in part, the purchase price of a product that has not been sold, in proportion to the period of time that it remains unsold” (Federal Register 1995).

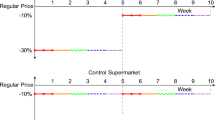

Data on new products and selling area for “all other retailers” (to form a parallel control group) are not available, consequently the hypotheses here are framed only in the context of differences across t1 and t2. Further, data for innovative new products are available only for t2 starting in 1985.

Goodale stated in the Federal Register (1995, p. 6) that slotting allowances accounted “for perhaps more than 10% of after-tax profits” (see also footnote 5 in the article). The Wall Street Journal reported that “slotting fees can represent 20% to 40% of the profits of some chains” (Jenkins 1999). Allain and Chambolle (2005) show that on average 88% of the margins earned by French supermarkets on grocery products in 1999 were of the “hidden kind” (slotting fees and conditional rebates) compared to conventional rebates and margins. Retailers are becoming more open about the relationship between promotional fees, bottom lines and retail prices. Donald Sussman (Executive VP Purchasing, Ahold USA) says: “Every dollar of slotting we generate is a dollar we don’t have to generate” from sales. If slotting fees were not there, “the pressure on prices would rise” (quoted in EITF 00-25, WGR #5, April 4, 2001, p. 18). Mark Polsky (Senior VP, Magruder’s, MD) notes: slotting “goes down to the bottom line”; retailers need the money to manage their bottom lines, and without it “you can either cut your help or raise prices” (quoted in the Washington Post 2004).

The analytical modeling literature is split in its derived theoretical outcomes. Some models show profit shifting to the party with the bargaining power (Chu 1992; Messinger and Chu 1995; Marx and Shaffer 2004). Others show that slotting fees do not grant retailers any excess profit; rather, a fee is offered by the manufacturer only when the retailer faces a high opportunity cost to stock a product (Lariviere and Padmanabhan 1997). Kuksov and Pazgal (2007) show that competition among retailers drives slotting and that in the equilibrium, retailer profits may be negatively correlated with slotting fees (see also Desai 2000).

It is note worthy that in retailers’ accounts COGS has always been recorded net of trade discounts. A study of financial restatements by resellers in response to the FASB (2002) edict shows that practically all of them report they follow this practice and therefore did not retrospectively restate income.

This includes all firms in the following SIC retail groups (after removing internet only and non-U.S. firms): 5,200 Building Hardware Garden, 5,211 Lumber & Building, 5,311 Department Stores, 5,331 Variety Stores, 5,399 Misc. General Merchandise, 5,531 Auto & Home Supplies, 5,600 Apparel & Accessories, 5,621 Women’s Clothing, 5,651 Family Clothing, 5,661 Shoes, 5,700 Furniture & Equip., 5,712 Furniture, 5,731 Radio, TV & Electronics, 5,734 Computer & Software, 5,735 Records & Tapes, 5,912 Drug Stores, 5,944 Jewelry, 5,945 Hobby & Toys, 5,990 Misc. Retail Stores (e.g., Office Depot, PetSmart).

In COMPUSTAT this variable is listed as OIBDA—Operating Income before Depreciation and Amortization. This measure is gaining ground as companies move away from using EBITDA—Earnings before Interest, Taxes, Depreciation and Amortization. The measures are alike except EBITDA includes non-operating income whereas OIBDA does not.

Perron considers three hypothesized process: A–where the interruption event causes a shift in the level of the series, B—the event causes a change in the trend or rate of growth and C—where both level and rate of growth are expected to change. Slotting fees grew gradually over time and are more likely to have resulted in a change in the rate of growth rather than a level shift. Nevertheless the series are first modeled with μ, β, θ and γ, and if one or more are insignificant they are dropped sequentially and the model re-estimated. Equations 2B and 2C and corresponding c.v. in Perron’s Tables V.A and VI.A are found to be applicable in the analyses of unit roots in this study.

Equation 2C gives the following results: ρ = .953, T(ρ-1) = −18.08 and ρ = .952, T(ρ-1) = −18.59 for the CPI-f and CPI-nd respectively. Both fall within the critical value −32.47 for λ = 0.3 (Perron Table VI.A). For the CPI-f and CPI-ab Eq. 2B applies and gives ρ = .968, T(ρ-1) = −10.4 and ρ = .976, T(ρ-1) = −6.5 respectively, within the critical value -28.68, λ = 0.7 (Perron Table V.A).

The best fitting model for ΔCPI-f is k = 6, but all χ2 to lag 24 are significant, and the LM test rejects the null (Obs*R2 = 95.24, df = 24, p = .0000). For ΔCPI-nd the best fit is with k = 5; but six χ 2 are significant although the LM test fails to reject the null χ2 Obs*R2 = 19.84, df = 24, p = .706. In the ΔCPI-f v. ΔCPI-ab analysis, the best fitting model for ΔCPI-f is k = 0 but 15 significant χ2 remain to lag 24 and the LM test rejects the null of no serial correlation (Obs*R2 = 61.11, df = 24, p = .0000). For ΔCPI-ab, k = 1 all χ2 up to lag 8 are significant even though the LM test is insignificant (Obs*R2 = 32.37, df = 24, p = .118).

This perspective is thanks to a reviewer.

Quasi rent is defined as the income earned above the opportunity cost of a sunk investment. If the sunk investment is highly specialized (e.g., a bridge, a patent, or a retail store in a particular location) the next best use may not offer much return. Public policy is sometimes used to ensure that such types of sunk investments earn large quasi rents so that new investments continue to be made in existing and new products of the kind.

It is customary to measure industrial concentration as the market share of the four largest firms. However, a 20-firm ratio is considered more descriptive of concentration in retailing because retail chains continue to be regionally dominant rather than nationally.

For example: “CG companies are struggling with the prospects of having line items and entire brands (in some cases entire companies) delisted from the shelf lineup of large retailers such as Safeway, Kroger, Wal-Mart, Walgreen, 7-Eleven, Target and others. These retailers have been the engine of growth for CG companies for over 20 years. The retailers, following each other and now being followed by mid-tier players are all pursuing at least a two prong strategy to bolster profits and build a stronger bond with their target customer segment. Prong one is the systematic reduction of entire national brands or sizes/flavors of national brands in order to reduce stocking and inventory costs. Prong two is the introduction of a stronger lineup of Private Label items” (Spindler 2010).

U.S.C. Section 13(C): “Payment or acceptance of commission, brokerage or other compensation. It shall be unlawful for any person engaged in commerce, in the course of such commerce, to pay or grant, or to receive or accept, anything of value as a commission, brokerage, or other compensation, or any allowance or discount in lieu thereof, except for services rendered in connection with the sale or purchase of goods, wares, or merchandise, either to the other party to such transaction or to an agent, representative, or other intermediary therein where such intermediary is acting in fact for or in behalf, or is subject to the direct or indirect control, of any party to such transaction other than the person by whom such compensation is so granted or paid.”

A DSP means ρ = 1, and β = γ = θ = 0. But there are DGP where ρ = 1 but β, γ, θ ≠ 0. Further, differencing does not always result in an error stationary model. Differencing can result in a series characterized by a moving average even when the original series do not have a cycle (Maddala and Kim 1998, p. 13). A TSP modeled in first differences leads to overdifferencing; conversely a DSP estimated in levels leads to underdifferencing (Maddala and Kim 1998, p. 88). Maddala and Kim state it is “more important to take the serial correlation structure in both the models into account…”

This is similar to Ben-David and Papell (1995, p. 464) who compare the pre break to the post break series after eliminating an endogenously determined “transition” period.

References

AC Nielsen (1999). New product introduction-successful innovation/failure: Fragile boundary. AC Nielsen BASES and Ernst & Young Global Client Consulting (June 24, 1999).

AC Nielsen (2005). Summary of US trade promotion practices.

Ailawadi, K. L., Borin, N., & Farris, P. W. (1995). Market power and performance: a cross-industry analysis of manufacturers and retailers. Journal of Retailing, 73(3), 211–248.

Allain, M.-L., & C. Chambolle (2005) Loss-leaders banning laws as vertical restraints. Journal of Agricultural & Food Industrial Organization, 3, Article 5.

Andersen Consulting. (1997). The daunting dilemma of trade promotion. Chicago and New York: Anderson Consulting, Strategic Service.

Anderson, G. (2007). Slotting allowances lead to dumbed-down retailing. RetailWire.com, July 5.

Bai, J., & Perron, P. (2003). Critical values for multiple structural change tests. Econometrics Journal, 6, 72–78.

Ben-David, D., & Papell, D. H. (1995). The great wars, the great crash, and steady state growth: some new evidence about an old stylized fact. Journal of Monetary Economics, 36(3), 453–475.

Bloom, P. N., Gundlach, G. T., & Cannon, J. P. (2000). Slotting allowances and fees: schools of thought and the views of practicing managers. Journal of Marketing, 64, 92–108.

Box, G. E. P., & Tiao, G. C. (1975). Intervention analysis with application to economic and environmental problems. Journal of the American Statistical Association, 70, 70–79.

Business Week (1992). “Clout!” December 21, 1992.

Campbell, D. T., & Stanley, J. C. (1966). Experimental and quasi-experimental designs for research. Chicago: McNally.

Cannondale. (2002). Trade promotion spending and merchandising 2002 industry study. Wilton and Evanston: Cannondale.

Cannondale. (2003). Trade promotion spending and merchandising 2003 industry study. Wilton and Evanston: Cannondale.

Chu, W. (1992). Demand signaling and screening in channels of distribution. Marketing Science, 11, 327–347.

Deleersnyder, B., Geyskens, I., Gielens, K., & Dekimpe, M. G. (2002). How cannibalistic is the internet channel? A study of the newspaper industry in the United Kingdom and the Netherlands. International Journal of Research in Marketing, 19(4), 337–348.

Deloitte and Touche (1998). Vision in manufacturing study, Deloitte Consulting and Kenan-Flagler Business School (March 6, 1998).

Desai, P. (2000). Multiple messages to retain resellers: signaling new product demand. Marketing Science, 19(4), 381–389.

Desiraju, R. (2001). New product introductions, slotting allowances, and retailer discretion. Journal of Retailing, 77, 335–358.

Desrochers, D. M., & Wilkie, W. W. (2003). Slotting allowances and fees: practice, influence and trends. Journal of Public Policy and Marketing.

Desrochers, D. M., Gundlach, G. T., & Foer, A. A. (2003). Analysis of antitrust challenges to category captain arrangements. Journal of Public Policy and Marketing, 22(2), 201–215.

Farris, P. W., & Ailawadi, K. L. (1992). Retail power: monster or mouse? Journal of Retailing, 68, 351–369.

FASB (2001). EITF 00-25, Working Group Report No. 5, p. 13, Financial Accounting Standards Board.

FASB (2002). EITF 02-16 and 02-25. Publications of the deliberations, minutes and summaries of the Emerging Issues Task Force of the Financial Accounting Standards Board.

Federal Register (1995). Vol. 60, No. 80, April 26, Rules and Regulations 20409.

Foros, Ø., & Kind H. J. (2007). Do slotting allowances harm retail competition?” Working Paper, Norwegian School of Economics and Business Administration, Bergen, Norway.

FTC, Federal Trade Commission (2003), Slotting Allowances in the Retail Grocery Industry: A Selected Case Study in Five Product Categories. A Report by Federal Trade Commission Staff, November 2003.

Gapper, J. (2007). America’s time-warp supermarkets. Financial Times, June 10.

Hall, T. (1988). For new products, entry fee is high. New York Times, (January 7), A1.

Jenkins, H. W. Jr. (1999). We love slotting fees. The Wall Street Journal, Sept. 22, 1999, p. A23.

Kim, S. Y., & Staelin, R. (1999). Manufacturer allowances and retailer pass-through rates in a competitive environment. Marketing Science, 18(1), 59–76.

Kuksov, D., & Pazgal, A. (2007). The effects of costs and competition on slotting allowances. Marketing Science, 26(2), 259–267.

Lariviere, M. A., & Padmanabhan, V. (1997). Slotting allowances and new product introductions. Marketing Science, 16(2), 112–128.

Linton, Matysiak & Wilkes, Inc. (1997). Marketing, Witchcraft or Science, reported in Frozen Food Digest, Tuesday, July 1, 1997.

Maddala, G. S., & Kim, I. M. (1998). Unit roots, cointegration, and structural change. Cambridge University Press.

Marx, L. M., & Shaffer, G. (2004a). Rent shifting, exclusion and market-share discounts, working paper June 2004, Duke University.

Marx, L. M., & Shaffer, G. (2004b). Slotting allowances and scarce shelf space, working paper November 2004, Duke University.

Marx, L. M., & Shaffer, G. (2006). Upfront payments and exclusion in downstream markets, Rand Journal of Economics, forthcoming.

McCallum, B. T. (1993). Unit roots in macroeconomic time series: some critical issues. Economic Quarterly, Federal Reserve Bank of Richmond, 73, 13–43.

Messinger, P. R., & Chu, W. (1995). Product proliferation and the determination of slotting and renewal allowances. Seoul Journal of Business, 1, 93–115.

Messinger, P. R., & Narasimhan, C. (1995). Has power shifted in the grocery channel? Marketing Science, 14(2), 189–223.

NCA, Norwegian Competition Authority (2005). Payment for Shelf Space, Report 2/05.

Newey, W., & West, K. (1987). A simple positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica, 55, 703–708.

Perron, P. (1989). The great crash, the oil price shock, and the unit root hypothesis. Econometrica, 57(6), 1361–1401.

Rabin, R. L. (2007). Controlling the retail sales environment: Access, advertising, and promotional activities. In R. J. Bonnie, K. Stratton, & R. B. Wallace (Eds.), Ending the tobacco problem: A blueprint for the nation. Washington: Institute of Medicine of the National Academies, National Academic Press.

Rao, A. R., & Mahi, H. (2003). The price of launching a new product: empirical evidence on factors affecting the relative magnitude of slotting allowances. Marketing Science, 22(Spring), 246–268.

Rao, V. R., & McLaughlin, E. W. (1989). Modeling the decision to add new products by channel intermediaries. Journal of Marketing, 53, 80–88.

Rey, P., Thal, J., & Vergé, T. (2006). Slotting allowances and conditional payments, Working Paper, University of Toulouse, Toulouse, France

Shaffer, G. (1991). Slotting allowances and resale price maintenance: a comparison of facilitating practices. The Rand Journal of Economics, 22(Spring), 120–135.

Siguaw, J. A., & Hoffman, K. D. (1992). The role of slotting allowances in retail channel relationships: review and propositions, working paper, The University of North Carolina at Wilmington.

Sloot, L. M., Fok, D., & Verhoef, P. C. (2006). The short- and long-term impact of an assortment reduction on category sales, Marketing Science Institute Working Paper Series, No. 06-0001.

Smith, K. (1989). Slotting fees soar; marketers look away, PROMO: The magazine for promotional marketing (January), p. 10.

Spindler, M. (2010). Life after your SKU has been rationalized. www.brandedpantry.com, April 18.

Stanton, J. L., & Herbst, K. C. (2006). Slotting allowances: short-term gains and long-term negative effects on retailers and consumers. International Journal of Retail & Distribution Management, 34(3), 187–197.

Sudhir, K., & Rao, V. R. (2006). Do slotting allowances enhance efficiency or hinder competition? Journal of Marketing Research, XLIII, 137–155.

Sullivan, M. (1997). Slotting allowances and the marketing for new products. Journal of Law and Economics, 40, 461–493.

Supermarket News (1984). Distributor demand sharpens for new product incentives, (August 27, 1984), 1, 22.

Wilke, J., & Sorvillo, N. (2004). Targeting early adopters-a means for new product success. http://asiapacific.acnielsen.com/pubs/2004.

Zivot, E., & Andrews, D. K. W. (1992). Further evidence on the great crash, the oil price shock, and the unit root hypothesis. Journal of Business and Economic Statistics, 10(3), 251–270.

Acknowledgement

The author gratefully acknowledges graduate research assistants Joo Hwan Seo and Ching-Ju Pan, and individuals in the Bureau of Labor Statistics, Census Bureau, USDA, Food Marketing Institute and Bishop Consulting, for their help in data collection and organization, and thanks the Editor and anonymous reviewers in the development of the paper.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Model selection

The difference between the Box Jenkins and Dickey-Fuller methods is that the former focuses on model selection based on an analysis of the decay patterns in autocorrelograms. The Dickey-Fuller approach first tests for unit roots to determine whether a series should be analyzed in levels or first differences; it provides an explicit statistical test of the unit root hypotheses, and it employs lagged values of ΔY t to account for serial autocorrelations and nuisance variance and ensure the errors are white noise (Maddala and Kim 1998, p. 47).

Typically both approaches give similar results. However, starting with unit root tests is not always advisable. The standard tests do not necessarily resolve the question whether the “true” DGP is trend stationary (TSP) or difference stationary (DSP) and can create problems.Footnote 16 Second, the appropriate unit root test distributions and significance criteria depend on the model being used, particularly when the model involves an analysis of event interruptions in the series or structural breaks (Bai and Perron 2003; Perron 1989). Maddala and Kim sum it up thus: “The problem of choosing between difference-stationary and trend-stationary models has been often approached as a hypotheses testing problem (that of testing for unit roots), but it should properly be approached as a model selection problem” (p. 406). They suggest that it is “more important to take the serial correlation structure in both the models into account…” Likewise McCallum (1993) recommends that the DGP be modeled in both levels and first differences, and the model chosen which requires the smaller amount of correction to remove autocorrelation of the residuals.

Structural breaks and unit roots

If the model selection procedure results in a model without structural break dummies (i.e., there are no significant effects related to the hypothesized event), the unit root tests applied are the standard ADF (Augmented Dickey-Fuller) t and associated critical values, and the PP (Phillips-Perron) t which uses the ADF critical values but adjusts the t statistic. A significant t means no unit root. On the other hand, if the model selected includes a structural break, then the unit root hypothesis that ρ = 1 is tested using Eq. 2A and Perron’s (1989) critical values (c.v.) for T(ρ-1) for λ. λ = (T B-1)/T is the “break fraction,” the ratio of pre-break sample size to total sample. The null hypothesis of a unit root is rejected if T(ρ-1)< c.v.(λ). If the tests indicate a unit root the analysis strategy switches to Eq. 3 to see if the DGP is difference stationary. The test for ρ = 1 not withstanding, if β, γ, θ and δ ≠ 0, the DGP is not clearly trend or difference stationary and thus the models of Eqs. 1 and 3 are compared to see which has better statistical properties, i.e., for which the residual series is clearly white noise, and the estimated parameters and SEs are consistent and reliable. In addition, this study uses the Newey-West covariance estimator that is consistent in the presence of both heteroskedasticity and autocorrelation of unknown form (Newey and West 1987), and is superior to the standard OLS and White methods in estimating the standard errors of the parameters (point estimation and consistency of the parameters themselves are not affected by any of the above methods).

Stationarity and white noise

A series is weakly or covariance stationary if the innovation series is white noise, i.e., there are no remaining correlations among the residuals. This is evaluated by the auto and partial correlation functions (ACF and PACF) relative to the theoretical functions: the former should decay rapidly and fall according to the theoretical function, and the latter should not have any significant spikes after lag 1 (evaluated to L = 24 in this study). Further the residuals are white noise if the Ljung-Box χ2 statistic (also known as the Q statistic) is not significant for all lags up to L, and the Breusch-Godfrey Lagrange Multiplier test (LM test) is insignificant to L. [The Obs*R2 statistic is computed from the regression of the residuals on lagged residuals and the original regressors. Unlike the Durbin-Watson statistic, the LM test is applicable for higher order ARMA errors and for models with lagged as well as nonlagged variables.] When there are alternative models that meet the tests, the best fitting is selected via fit indices—i.e., the model with the smallest Akaike Information Criterion (AIC), Schwartz Bayesian Information Criterion (BIC) and Root Mean Square Error (RMSE).

Cointegration

A well known problem in studying the relationship between two economic time series Yt and Xt arises if both are integrated I(d). A long term relationship, real or spurious, between two trending variables is very likely to be found. One solution is to difference the data until both are I(0). But if there is a true relationship between trending series measured in levels, differencing can cause serious difficulties (lack of a unique long run solution, and noninvertible moving average errors). On the other hand, if there is a genuine economic structure relating two I(d) variables, then there is a linear combination of Yt and Xt that is I(0)—i.e., the variables are cointegrated. In this paper no two series are modeled in the manner Y t = f(Xt), rather Xt is typically a control or reference series. The problems of spurious regression of the kind encountered in Y t = f(Xt) are not an issue here. Nevertheless, where models compare variables that are I(d), the Johansen cointegration test is used and reported. If they are cointegrated there is a genuine relationship between Yt and Xt and inferences relating or contrasting them are valid. Cointegratiom tests are irrelevant where both variables are I(0).

Sensitivity to the break point

A debate in the interrupted time series literature is about the selection of the intervention or break point. Perron used exogenous break points consistent with well known major economic disturbances. Critics argued that this amounted to “pre-testing” because the break points were the result of prior examination of the data. Zivot and Andrews (1992) provide a methodology for determining endogenous break points in a data series by sequentially testing all possible break dates in the series. Although preferable to eye balling for break points, the latter approach is data driven nevertheless.

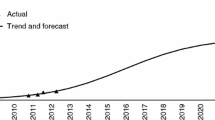

The break point in this paper is determined exogenously, not based on an examination of the data, but from the known chronology of the phenomenon. There are three reasons that favor using an exogenously determined break point. First the orientation of this study is that of assessing the impact of ongoing structural change occurring over many years. The goal is not to find breaks in the data and model the DGP as accurately as possible (e.g., for forecasting purposes) but to see if the data patterns support the theoretical explanation of underlying phenomena. Second, an a priori specified date offers a stronger test of the hypotheses as the results must hold across the early years of the phenomenon (when its effects are likely to be weaker) as well as later years. The data patterns show that visible changes typically occur between 2 to 3 years from the hypothesized start date. Third, selecting a common date for all the data series studied is conceptually more appealing than having different dates for different series determined from the data.

Nevertheless it is useful to test the sensitivity of the results to the exogenously selected event date. Although there is reason to believe that slotting fees emerged in 1982 (Smith 1989; Sudhir and Rao 2006; Sullivan 1997; Supermarket News 1984), some accounts mention a time a couple of years later (Sullivan 1997). To study the sensitivity of the results to the chosen break point, the following analyses were conducted. First, rolling break points were analyzed starting with 1980 and through 1984. Second, the models were estimated after eliminating the data for 5 years from 1980 to 1984.Footnote 17 Overall it seems that 1982 provides a stronger test of the theoretical propositions and is the appropriate break point both exogenously (deductively) and endogenously (inductively).

Rights and permissions

About this article

Cite this article

Achrol, R.S. Slotting allowances: a time series analysis of aggregate effects over three decades. J. of the Acad. Mark. Sci. 40, 673–694 (2012). https://doi.org/10.1007/s11747-011-0260-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11747-011-0260-7