Abstract

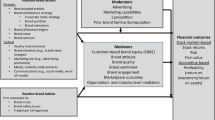

A parsimonious framework linking advertising expenditures and research and development expenditures to brand value, and brand value in turn to firm-level financial performance, was proposed and empirically investigated under four data conditions: data form, brand type, financial performance metric, and lag structure. Using pooled data from 125 firms (848 firm-year observations) over the period 1991–2007, 108 path analyses were conducted to compute five path model output metrics. Data on these metrics were then compared for each of the data conditions by means of analysis of variance. Although significant relationships were generally observed among framework variables, study results differed considerably across three of the four data conditions. The principal take-away from the study is that the impact of marketing activities on firm-level financial performance is likely to be in large part a function of the specific research purpose and methodology employed. As such, the take-away has implications when interpreting value-relevance findings, when constructing theories involving market-based assets, and when designing studies to investigate relationships between marketing and financial performance.

Similar content being viewed by others

Notes

Tobin’s q is defined as the “ratio of the market value of the firm to the replacement cost of its tangible assets, including property, plant, equipment, inventory, cash, and investments in stocks and bonds” (Kerin and Sethuraman 1998, p. 261). Market-to-book ratio is defined as the equity capitalization of a firm (share price multiplied by number of shares) divided by book equity (common stock equity, capital surplus, and retained earnings). Varaiya et al. (1987) and Chung and Pruitt (1994) have demonstrated that Tobin’s q and market-to-book ratio are effectively equivalent measures.

As Wang et al. (2009) have observed, a model (framework) “needs not be technically sophisticated as long as its theoretical rationales can be demonstrated straightforwardly and its insights can be illustrated easily” (p. 134). The proposed framework meets these criteria.

Although many studies incorporated control variables, the effects of such variables generally have not been discussed in the cited research. Consequently they are not discussed here.

Note that the number of studies in subcategories may not sum to the total number of studies due to missing information, more than one analysis per study, or differences in the variables investigated in a study.

Note that in reality Financial World data for the period 1991–1996 were based on Interbrand Group’s methodology and data. In 1995 Financial World slightly changed its brand valuation method based on the Interbrand Group (2002) valuation model approach to estimate more accurately and credibly the equity of brands (Meschi 1995). In 1997 Financial World went out of business. Currently Business Week reports Interbrand Group’s brand value estimates.

Observations with brand values greater than $60,000,000,000 or M/B ratios less than −50.00 or greater than 50.00 were excluded after scrutinizing the scatter plot of brand values and M/B ratios.

References

Aaker, D. A. (1996). Building strong brands. New York: The Free.

Aaker, D. A., & Jacobson, R. (1994). The financial information content of perceived quality. Journal of Marketing Research, 31(2), 191–201.

Ailawadi, K. L., Lehmann, D. R., & Neslin, S. A. (2003). Revenue premium as an outcome measure of brand equity. Journal of Marketing, 67, 1–17.

Ambler, T., & Barwise, P. (1998). The trouble with brand valuation. Journal of Brand Management, 5(6), 367–377.

Anderson, E. W., Fornell, C., & Mazvancheryl, S. K. (2004). Customer satisfaction and shareholder value. Journal of Marketing, 68, 172–185.

Andras, T. L., & Srinivasan, S. S. (2003). Advertising intensity and R&D intensity: differences across industries and their impact on firm’s performance. International Journal of Business and Economics, 2(2), 81–90.

Argenti, P. A., & Druckenmiller, B. (2004). Reputation and the corporate brand. Corporate Reputation Review, 6(4), 368–374.

Balasubramanian, S. K., & Kumar, V. (1990). Analyzing variations in advertising and promotional expenditures: key correlates in consumer, industrial, and service markets. Journal of Marketing, 54, 57–68.

Barth, M. E., Clement, M. B., Foster, G., & Kasznik, R. (1998). Brand values and capital market valuation. Review of Accounting Studies, 3(XX), 41–68.

Bass, F. M., & Wittink, D. R. (1975). Pooling issues and methods in regression analysis with examples in marketing research. Journal of Marketing Research, XII, 414–425.

Ben-Zion, U. (1978). The investment aspect of nonproduction expenditures: an empirical test. Journal of Economics and Business, 30, 224–229.

Bender, D. M., Farquhar, P. H., & Schulert, S. C. (1996). Growing from the top. Marketing Management, 4, 10–19.

Bosworth, D., & Rogers, M. (2001). Market value, R&D and intellectual property: an empirical analysis of large Australian firms. The Economic Record, 77, 323–337.

Boulding, W., & Staelin, R. (1995). Identifying generalizable effects of strategic actions on firm performance: the case of demand-side returns to R&D spending. Marketing Science, 14(3), G222–G236.

Bublitz, B., & Ettredge, M. (1989). The information in discretionary outlays: advertising, research, and development. The Accounting Review, 64, 108–124.

Chan, L. K., Lakonishok, J., & Sougiannis, T. (2001). The stock market valuation of research and development expenditures. Journal of Finance, 56(6), 2431–2456.

Chauvin, K. W., & Hirschey, M. (1993). Advertising, R&D expenditures and the market value of the firm. Financial Management, 22, 128–140.

Cheng, C. S. A., & Chen, C. J. P. (1997). Firm valuation of advertising expense: an investigation of Scaler effects. Managerial Finance, 23(10), 41–62.

Chu, S., & Keh, H. T. (2006). Brand value creation: analysis of the interbrand-business week brand value rankings. Marketing Letters, 17(4), 323–331.

Chung, K. H., & Pruitt, S. W. (1994). A simple approximation of Tobin’s q. Financial Management, 23, 70–74.

Clark, B. H. (1999). Marketing performance measures: history and interrelationships. Journal of Marketing Management, 15(8), 711–732.

Conchar, M. P., Crask, M. R., & Zinkhan, G. M. (2005). Market valuation models of the effect of advertising and promotional spending: a review and meta-analysis. Journal of the Academy of Marketing Science, 33, 445–460.

Connolly, R. A., Hirsch, B. T., & Hirschey, M. (1986). Union rent seeking, intangible Capital, and market value of the Firm. Review of Economics and Statistics, 68(4), 567–577.

Eng, L. L., & Keh, H. T. (2007). The effects of advertising and brand value on future operating and market performance. Journal of Advertising, 36(4), 91–100.

Erickson, G., & Jacobson, R. (1992). Gaining comparative advantage through discretionary expenditures: the returns to R&D and advertising. Management Science, 38, 1264–1279.

Frieder, L., & Subrahmanyam, A. (2005). Brand perceptions and the market for common stock. Journal of Financial and Quantitative Analysis, 40, 57–85.

Glazer, R. (1991). Marketing in an information-intensive environment: strategic implications of knowledge as an asset. Journal of Marketing, 55, 1–19.

Graham, R. C., Jr., & Frankenberger, K. D. (2000). The contribution of changes in advertising expenditures to earnings and market values. Journal of Business Research, 50, 149–155.

Green, J. P., Stark, A. W., & Thomas, H. M. (1996). UK evidence on the market valuation of research and development expenditures. Journal of Business Finance & Accounting, 23, 191–216.

Grullon, G., Kanatas, G., & Weston, J. P. (2004). Advertising, breadth of ownership, and liquidity. The Review of Financial Studies, 17(2), 439–461.

Gupta, S., Lehmann, D. R., & Stuart, J. A. (2004). Valuing customers. Journal of Marketing Research, 41, 7–18.

Han, B. H., & Manry, D. (2004). The value-relevance of R&D and advertising expenditures: evidence from Korea. The International Journal of Accounting, 39, 155–173.

Herremans, I. M., Ryans, J. K., Jr., & Aggarwal, R. (2000). Linking advertising and brand value. Business Horizons, 43, 19–26.

Hirschey, M., & Weygandt, J. J. (1985). Amortization policy for advertising and research and development expenditures. Journal of Accounting Research, 23, 326–335.

Ho, Y. K., Keh, T., & Ong, J. M. (2005). The effects of R&D and advertising on firm value: an examination of manufacturing and nonmanufacturing firms. IEEE Transactions on Engineering Management, 52, 3–14.

Hula, D. G. (1988). Advertising, new product profit expectations and the firm’s R&D investment decisions. Applied Economics, 20, 125–142.

Hyman, M. R., & Mathur, I. (2005). Retrospective and prospective views on the marketing/finance interface. Journal of the Academy of Marketing Science, 33, 390–400.

Interbrand Group (2002) “World’s Most Valuable Brands,” Copy Posted at: < http://63.111.41.5/interbrand/test/html/events/ranking_methodology.pdf> (February 28, 2002)

Jaruzelski, B., Dehoff, K., & Bordia, R. (2005). Money isn’t everything. Strategy + Business, 41, 2–14.

Jedidi, K., Mela, C. F., & Gupta, S. (1999). Managing advertising and promotion for long-run profitability. Marketing Science, 18(1), 1–22.

Jose, M. L., Nichols, L. M., & Stevens, J. L. (1986). Contributions of diversification, promotion, and R&D to the value of multiproduct firms: a Tobin’s q approach. Financial Management, 15, 33–42.

Joshi, A., & Hanssens, D. M. (2010). The direct and indirect effects of advertising spending on firm value. Journal of Marketing, 74, 20–33.

Kallapur, Sanjay, & Kwan, S. Y. S. (2004). The value relevance and reliability of brand assets recognized by U.K. Firms. The Accounting Review, 79(1), 151–172.

Keller, K. L. (1998). Strategic brand management: Building, measuring, and managing brand equity. Upper Saddle River: Prentice Hall.

Kerin, R. A., & Sethuraman, R. (1998). Exploring the brand value-shareholder value nexus for consumer goods companies. Journal of the Academy of Marketing Science, 26, 260–273.

Kimbrough, M. D., & McAlister, L. (2009). Linking marketing actions to value creation and firm value: insights from accounting research. Journal of Marketing Research, 46, 313–319.

Krasnikov, A., & Jayachandran, S. (2008). The relative impact of marketing, research-and-development, and operations capabilities on firm performance. Journal of Marketing, 72, 1–11.

Lev, B., & Sougiannis, T. (1996). The capitalization, amortization, and value-relevance of R&D. Journal of Accounting and Economics, 21, 107–138.

Lev, B., & Sougiannis, T. (1999). Penetrating the book-to-market black box: The R&D effect. Journal of Business Finance & Accounting, 26, 419–440.

Lovett, M. J., & MacDonald, J. B. (2005). How does financial performance affect marketing? Studying the marketing-finance relationship from a dynamic perspective. Journal of the Academy of Marketing Science, 33, 476–485.

Luo, X., & Donthu, N. (2006). Marketing’s credibility: a longitudinal investigation of marketing communication productivity and shareholder value. Journal of Marketing, 70, 70–91.

Lustgarten, S., & Thomadakis, S. (1987). Mobility barriers and Tobin’s q. Journal of Business, 60(4), 519–537.

Madden, T. J., Fehle, F., & Fournier, S. M. (2006). Brands matter: an empirical demonstration of the creation of shareholder value through branding. Journal of the Academy of Marketing Science, 34, 224–235.

Meschi, R. L. (1995). Value added: refinements in our brand valuation methodology. Financial World, 164, 52.

Mizik, N., & Jacobson, R. (2003). Trading off between value creation and value appropriation: the financial implications of shifts in strategic emphasis. Journal of Marketing, 67, 63–76.

Mizik, N., & Jacobson, R. (2009). Financial markets research in marketing. Journal of Marketing Research, 46, 320–324.

Morck, R., & Yeung, B. (1991). Why investors value multinationality. Journal of Business, 64(2), 165–187.

O’Brien, J. P. (2003). The capital structure implications of pursuing strategy of innovation. Strategic Management Journal, 24(5), 415–431.

Pahud de Mortanges, C., & Van Riel, A. (2003). Brand equity and shareholder value. European Management Journal, 21(4), 521–527.

Raggio, R. D., & Leone, R. P. (2007). The theoretical separation of brand equity and brand value: managerial implications for strategic planning. Brand Management, 14, 380–395.

Ramaswami, S., Srivastava, R., & Bhargava, M. (2009). Market-based capabilities and financial capabilities of firms: insights into marketing’s contribution to firm value. Journal of the Academy of Marketing Science, 37, 97–116.

Rao, V. R., Agarwal, M. K., & Dahlhoff, D. (2004). How is manifest branding strategy related to the intangible value of a corporation? Journal of Marketing, 68, 126–141.

Rust, R. T., Ambler, T., Carpenter, G., Kumar, V., & Srivastava, R. K. (2004). Measuring marketing productivity: current knowledge and future directions. Journal of Marketing, 68, 76–89.

Shah, S. Z. A., & Akbar, S. (2008). Value relevance of advertising expenditure: a review of the literature. International Journal of Management Reviews, 10(4), 301–325.

Sheth, J. N., & Parvatiyar, A. (1995). Relationship marketing in consumer markets: antecedents and consequences. Journal of the Academy of Marketing Science, 23, 255–271.

Simon, C. J., & Sullivan, M. W. (1993). The measurement and determinants of brand equity: a financial approach. Marketing Science, 12, 28–52.

Singh, M., Faircloth, S., & Nejadmalayeri, A. (2005). Capital market impact of product marketing strategy: evidence from the relationship between advertising expenses and cost of capital. Journal of the Academy of Marketing Science, 33, 432–444.

Sougiannis, T. (1994). The accounting based valuation of corporate R&D. The Accounting Review, 69, 44–68.

Srinivasan, S., & Hanssens, D. M. (2009). Marketing and firm value: metrics, methods, findings, and future directions. Journal of Marketing Research, 46, 293–312.

Srivastava, R., Shervani, T. A., & Fahey, L. (1998). Market-based assets and shareholder value: a framework for analysis. Journal of Marketing, 62, 2–18.

Srivastava, R., Shervani, T. A., & Fahey, L. (1999). Marketing, business processes, and shareholder value: an organizationally embedded view of marketing activities and the discipline of marketing. Journal of Marketing, 63, 168–179.

Srivastava, R., & Shocker, A. D. (1991). Brand equity: A perspective on its meaning and measurement. Report No. 91–124. Cambridge, MA: Marketing Science Institute.

Tobin, J. (1969). A general equilibrium approach to monetary theory. Money, Credit, and Banking, 1, 15–29.

Varaiya, N., Kerin, R. A., & Weeks, D. (1987). The relationship between growth, profitability, and firm value. Strategic Management Journal, 8(5), 487–497.

Vinod, H. D., & Rao, P. M. (2000). R&D and promotion in pharmaceuticals: conceptual framework and empirical exploration. Journal of Marketing Theory and Practice, 8, 10–20.

Wang, Fang, Xiao-Ping (Steven) Zhang, & Ming, Ouyang. (2009). Does advertising create sustained firm value? The capitalization of brand intangible. Journal of the Academy of Marketing Science, 37, 130–143.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Peterson, R.A., Jeong, J. Exploring the impact of advertising and R&D expenditures on corporate brand value and firm-level financial performance. J. of the Acad. Mark. Sci. 38, 677–690 (2010). https://doi.org/10.1007/s11747-010-0188-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11747-010-0188-3