Abstract

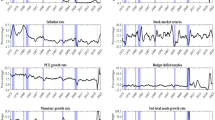

In this paper, we examine the large shocks due to major economic or financial events that affected U.S. macroeconomic time series on the period 1860–1988, using outlier methodology. We show that most of these shocks have a temporary effect, showing that the U.S. macroeconomic time series experienced only few large permanent shifts in the long term. Most of these large shocks can be explained by major recessions and World War II as well as by monetary policy for the interest rate data. We also find that some economic events seem to have the same effect (immediate, transitory or permanent) on a number of macroeconomic series. Finally, we show that most macroeconomic time series do not seem inconsistent with a stochastic trend once we adjusted the data for these shocks.

Similar content being viewed by others

Notes

A number of tests have been then developed to take into account a structural change in which the date of the break is a priori unknown (e.g., Zivot and Andrews 1992; Li 1995; Perron 1997; Sen 2004; Montañés et al. 2005). Vogelsang (1999), Perron and Rodriguez (2003) and Haldrup and Sansó (2008) suggested procedures for detecting multiple additive outliers in non-stationary time series.

See Appendix for selected studies on the estimated break dates in the Nelson–Plosser data set.

Indeed, except for the case of IO, the effects of outliers on the observed series are independent of the model.

From a simulation study, Chen and Liu (1993a) showed that their procedure performs well in terms of detecting outliers and obtaining unbiased parameter estimates.

See Tolvi (2001) for detailed discussion on the outlier detection procedure.

Andreou and Spanos (2003) showed that several estimated models by Nelson and Plosser (1982) could be misspecified, thus potentially biasing the performance of the unit root tests. Based on estimated models which are statistically adequate, they obtained different conclusions on the unit root hypothesis.

The non-linearity displays by the velocity can be explained by the presence of conditional heteroscedasticity.

Note that using the ARIMA(0,1,0) model to improve the power of level shift detection, no level shift is misidentified as innovative outliers.

Carlson (2005) suggested that real economic shocks were important determinants of the nationwide scope of the panic of 1893, however at the local level, liquidity concerns are found to be a more important trigger of bank panics. Temin (1998) believe that this contraction was rather monetary in nature, caused by flirting with devaluation.

Odell and Weidenmier (2004) analyzed links between the 1906 San Francisco earthquake and the panic of 1907. Note that this panic led to an important change in American financial architecture: the creation of the Federal Reserve System in 1913 as well as the National Monetary Commission in 1909.

Friedman and Schwartz (1963) argued that the 1920–1921 recession was quite severe, and the result of monetary restraint. Indeed, with the exception of the Great Depression, the decline in the monetary base from October 1920 to January 1922 was also the largest recorded in so short a period (Homer and Sylla 1991).

The outliers with the higher t-statistics for the interest rate are not located by the various tests as they investigated the Nelson–Plosser data set until 1970.

Darné and Diebolt (2004) studied the sensitivity of the unit root tests to the two-steps tests (correcting outliers and testing unit roots on outlier-adjusted data) from simulation experiments. They showed that this procedure does not affect the presence of unit roots in time series. Osborn et al. (1999) also used this procedure for testing seasonal unit roots.

Ng and Perron (2001) argued that the Akaike and Schwarz information criteria tend to select values of k that are generally too small for unit root tests to have good sizes.

Since the nominal GNP, the industrial production, the nominal wages and the velocity present some non-linearity we also used the non-linear unit root test proposed by Kapetanios et al. (2003). The unit root test developed by Seo (1999) is also applied on the velocity in which conditional heteroscedasticity has been detected. The results obtained from these unit root tests are identical with those from the efficient unit root tests.

From unit root tests with two structural breaks, at the 5% significance level, the null of unit root is rejected for six series (real (p.c.) and nominal GNP, industrial production, employment and unemployment) with the Lumsdaine–Papell test; for four series (industrial production, unemployment, real wage and money stock) with the Lee–Strazicich test; and for three series (real (p.c.) GNP and employment) with the Papell–Prodan test when considering model A in all series and model C for the real wages and the stock prices. Note that Papell and Prodan (2007) did not study the unemployment.

References

Andreou E, Spanos A (2003) Statistical adequacy and the testing of trend versus difference stationarity and comments. Econom Rev 22:217–267

Balke NS (1993) Detecting level shifts in time series. J Bus Econ Stat 11:81–92

Balke NS, Fomby TB (1991) Shifting trends, segmented trends, and infrequent permanent shocks. J Monet Econ 28:61–85

Balke NS, Fomby TB (1994) Large shocks, small shocks, and economic fluctuations: outliers in macroeconomic time series. J Appl Econ 9:181–200

Banerjee A, Urga G (2005) Modelling structural breaks, long memory and stock market volatility: an overview. J Econom 129:1–34

Battaglia F, Orfei L (2005) Outlier detection and estimation in nonlinear time series. J Time Ser Anal 26:107–121

Blanchard O, Simon J (2001) The long and large decline in U.S. output volatility. Brookings Pap Econ Act 1:135–174

Bordo MD, Haubrich JG (2004) The yield curve, recessions, and the credibility of the monetary regime: long-run evidence, 1875–1997. Working Paper No 04-02, Federal Reserve Bank of Cleveland

Box GEP, Tiao GC (1975) Intervention analysis with applications to economic and environmental problems. J Am Stat Assoc 70:70–79

Bradley MD, Jansen DW (1995) Unit roots and infrequent large shocks: new international evidence on output growth. J Money Credit Banking 27:876–893

Brock WA, Dechert WD, Scheinkman JA (1987) A test for independence based on the correlation dimension. Econom Rev 15:197–235

Campbell JY, Clarida RH (1987) The dollar and real interest rates. NBER Working Paper No 2151

Carlson M (2005) Causes of bank suspensions in the panic of 1893. Explor Econ Hist 42:56–80

Carnero MA, Peña D, Ruiz E (2001) Outliers and conditional autoregressive heteroscedasticity in time series. Rev Estad 53:143–213

Chang I, Tiao GC, Chen C (1988) Estimation of time series parameters in the presence of outliers. Technometrics 30:193–204

Chen C, Liu LM (1993a) Joint estimation of model parameters and outlier effects in time series. J Am Stat Assoc 88:284–297

Chen C, Liu LM (1993b) Forecasting time series with outliers. J Forecast 12:13–35

Darné O, Diebolt C (2004) Unit roots and infrequent large shocks: new international evidence on output. J Monet Econ 51:1449–1465

Deutsch SJ, Richards JE, Swain JJ (1990) Effects of a single outlier on ARMA identification. Commun Stat Theory Methods 19:2207–2227

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64:813–836

Engle RF (1982) Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflations. Econometrica 50:987–1007

Franses PH, Haldrup N (1994) The effects of additive outliers on tests for unit roots and cointegration. J Bus Econ Stat 12:471–478

Friedman M, Schwartz AJ (1963) A monetary history of the United States, 1867–1960. Princeton University Press, Princeton

Gómez V, Maravall A (1997) Programs TRAMO and SEATS: instructions for the user (Beta version: June 1997). Working paper No 97001, Ministerio de Economía y Hacienda, Dirección General de Análisis y Programación Presupuestaria

Goodfriend M (2005) The monetary policy debate since October 1979: lessons for theory and practice. Fed Reserve Bank St. Louis Rev (March/April 2005):243–262

Haldrup N, Sansó A (2008) A note on the Vogelsang test for additive outliers. Stat Probab Lett 78:296–300

Homer S, Sylla R (1991) A history of interest rates. Rutgers University Press, New Brunswick

Hsu C-C, Kuan C-M (2001) Distinguishing between trend-break models: method and empirical evidence. Econom J 4:171–190

Kapetanios G, Shin Y, Snell A (2003) Testing for a unit root in the nonlinear STAR framework. J Econom 112:359–379

Koopman SJ, Harvey AC, Doornik JA, Shepard N (2006) STAMP 8: structural time series analyser and modeller and predictor. Chapman & Hall, London

Ledolter J (1989) The effect of additive outliers on the forecasts from ARMA models. Int J Forecast 5:231–240

Lee J, Strazicich MC (2001) Break point estimation and spurious rejections with endogenous unit root tests. Oxford Bull Econ Stat 68:535–558

Lee J, Strazicich MC (2003) Minimum Lagrange multiplier unit root test with two structural break. Rev Econ Stat 85:1082–1089

Leybourne SJ, Mills TC, Newbold P (1998) Spurious rejections by Dickey–Fuller tests in the presence of a break under the null. J Econom 87:191–203

Li H (1995) A re-examination of the Nelson–Plosser data set using recursive and sequential tests. Empir Econ 20:501–518

Lucas A (1995) An outlier robust unit root test with an application to the extended Nelson–Plosser data. J Econom 66:153–173

Lumsdaine RL, Papell DH (1997) Multiple trend breaks and the unit-root hypothesis. Rev Econ Stat 79:212–218

Metz R (2010) Filter-design and model-based analysis of trends and cycles in the presence of outliers and structural breaks. Cliometrica 4:51–73

Maddala GS, Kim I-M (2000) Unit roots, cointegration and structural change. Cambridge University Press, Cambridge

Montañés A, Reyes M (1998) Effect of a shift in the trend function on Dickey–Fuller unit root tests. Econom Theory 14:355–363

Montañés A, Olloqui I, Calvo E (2005) Selection of the break in the Perron-type tests. J Econom 129:41–64

Nelson CR, Plosser CI (1982) Trends and random walks in macroeconomic time series. J Monet Econ 10:139–162

Ng S, Perron P (2001) Lag length selection and the construction of unit root tests with good size and power. Econometrica 69:1519–1554

Odell KA, Weidenmier MD (2004) Real shock, monetary aftershock: the 1906 San Francisco earthquake and the panic of 1907. J Econ Hist 64:1002–1027

Orphanides A (2003) Historical monetary policy analysis and the Taylor rule. J Monet Econ 50:983–1022

Osborn DR, Heravi S, Birchenhall CR (1999) Seasonal unit roots and forecasts of two-digit European industrial production. Int J Forecast 15:27–47

Papell DH, Prodan R (2007) Restricted structural change and the unit root hypothesis. Econ Inq 45:834–853

Peña D (1990) Influential observations in time series. J Bus Econ Stat 8:235–241

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econometrica 57:1361–1401

Perron P (1997) Further evidence on breaking trend functions in macroeconomic variables. J Econom 80:355–385

Perron P, Ng S (1996) Useful modifications to unit root tests with dependent errors and their local asymptotic properties. Rev Econ Stud 63:435–465

Perron P, Rodriguez G (2003) Searching for additive outliers in nonstationary time series. J Time Ser Anal 24:193–220

Petruccelli JD (1990) A comparison of tests for SETAR-type non-linearity in time series. J Forecast 9:25–36

Poole W (1988) Monetary policy lessons of recent inflation and disinflation. J Econ Persp 2:73–100

Rappoport P, Reichlin L (1989) Segmented trends and non-stationary time series. Econ J 99:168–177

Romer C, Romer D (1989) Does monetary policy matter? A new test in the spirit of Friedman and Schwartz. NBER Working Paper No 2966

Schotman P, van Dijk HK (1991) On Bayesian routes to unit roots. J Appl Econom 6:387–401

Sen A (2004) Are U.S. macroeconomic series difference stationary or trend-break stationary? Appl Econ 36:2025–2029

Sen A (2008) Behaviour of Dickey–Fuller tests when there is a break under the unit root null hypothesis. Stat Probab Lett 78:622–628

Seo B (1999) Distribution theory for unit root tests with conditional heteroskedasticity. J Econom 91:113–144

Shin DW, Sarkar S, Lee JH (1996) Unit root tests for time series with outliers. Stat Probab Lett 30:189–197

Taylor JB (1998) An historical analysis of monetary policy rules. Working Paper No 6768, NBER

Temin P (1998) The causes of American business cycles: an essay in economic historiography. Working Paper No 6692, NBER

Tolvi J (2001) Outliers in eleven finnish macroeconomic time series. Finn Econ Pap 14:14–32

Tsay RS (1988a) Outliers, level shifts, and variance changes in time series. J Forecast 7:1–20

Tsay RS (1988b) Non-linear time series analysis of blowfly population. J Time Ser Anal 9:247–263

van Dijk D, Franses PH, Lucas A (1999) Testing for smooth transition nonlinearity in the presence of outliers. J Bus Econ Stat 17:217–235

van Dijk D, Franses PH, Lucas A (2002) Testing for ARCH in the presence of additive outliers. J Appl Econom 14:539–562

Vogelsang TJ (1997) Wald-type tests for detecting breaks in the trend function of a dynamic time series. Econom Theory 13:818–849

Vogelsang TJ (1999) Two simple procedures for testing for a unit root when there are additive outliers. J Time Ser Anal 20:237–252

Yin Y, Maddala GS (1997) The effects of different types of outliers on unit root tests. In: Fomby TB, Hill RC (eds) Advances in econometrics, vol 13. JAI Press, Greenwich

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil price shock and the unit root hypothesis. J Bus Econ Stat 10:251–270

Acknowledgments

We would like to thank the two anonymous referees for very helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Darné, O., Charles, A. Large shocks in U.S. macroeconomic time series: 1860–1988. Cliometrica 5, 79–100 (2011). https://doi.org/10.1007/s11698-010-0052-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11698-010-0052-1