Abstract

In this paper, we introduce a simple and efficient trinomial lattice tree approach for the skew Cox-Ingersoll-Ross (CIR) model and the doubly skewed CIR model. Suffering from the terms of local times and non-constant volatility, we apply two transforms to the skew-extended CIR processes. Then we construct a modified trinomial tree for the transformed processes which are piecewise tractable diffusions with constant volatility. As a result, the tree for the original skew-extended CIR processes can be easily obtained by using the inverse transform. Results of applications to zero-coupon bonds, European and American options demonstrate that our simple tree approach is efficient and satisfactory.

Similar content being viewed by others

Notes

A filtration \(\{\mathcal {F}_t\}_{t\ge 0}\) is said to satisfy the usual conditions if it is right-continuous and \(\mathcal {F}_0\) contains all the P-negligible events in \(\mathcal {F}\).

Moreover, if the Feller condition (see [14]) is satisfied, \(2k\theta \ge \sigma ^2\), a zero bound cannot be reached. But we do not impose the Feller condition, i.e., zero is an attainable regular boundary in this paper.

The first transform \(f(\cdot )\) can be extended to a general skew process \(r_t\),

$$\begin{aligned} {\mathrm {d}}r_t=\mu (r_t){\mathrm {d}}t+\sigma (r_t){\mathrm {d}}W_t +(2p-1){\mathrm {d}}\hat{L}_t^r(a), \end{aligned}$$where \(\mu (r_t)\) and \(\sigma (r_t)\) are functions of \(r_t\) which can ensure the existence and uniqueness of skew process \(r_t\) with some constraints. With the above \(r_t\), the transform \(f(\cdot )\) just need satisfy \(f'(\cdot )=\frac{1}{\sigma (\cdot )}\). Then we have

$$\begin{aligned} X_t=f(r_0)+\int _0^t\left( \mu (r_s)f'(r_s)+\frac{1}{2}\sigma ^2(r_s)f''(r_s)\right) {\mathrm {d}}s+W_t+(2p-1)\hat{L}_t^X(f(a)). \end{aligned}$$When applying to a general skew process \(X_t\),

$$\begin{aligned} {\mathrm {d}}X_t=\mu (X_t){\mathrm {d}}t+\sigma (X_t){\mathrm {d}}W_t +(2p-1){\mathrm {d}}\hat{L}_t^X\left( f(a)\right) , \end{aligned}$$the local time can always be removed if we modify the above transform \(g(\cdot )\) as follows

$$\begin{aligned} g(x)=\left\{ \begin{array}{ll} p(x-f(a))+f(a) , &{}\quad 0<x<f(a), \\ (1-p)(x-f(a))+f(a) , &{}\quad x \ge f(a). \end{array} \right. \end{aligned}$$See the Appendix for more details on the spectral expansion for the skew CIR process as the interest rate model.

As shown in the Appendix, the spectral expansions converge quickly and smoothly to a steady level with respect to the number of roots.

NONOSC includes regular, exist, entrance and NONOSC natural boundary.

References

Appuhamillage, T., Sheldon, D.: First passage time of skew Brownian motion. J. Appl. Probab. 49, 685–696 (2012)

Bass, R.F., Chen, Z.Q.: Brownian motion with singular drift. Ann. Probab. 31, 791–817 (2003)

Beliaeva, N., Nawalkha, S.: A simple approach to pricing American options under the Heston stochastic volatility model. J. Deriv. 17, 25–43 (2010)

Beliaeva, N., Nawalkha, S.: Pricing American interest rate options under the jump-extended constant-elasticity-of-variance short rate models. J. Bank. Financ. 36, 151–163 (2012)

Cantrell, R., Cosner, C.: Diffusion models for population dynamics incorporating individual behavior at boundaries: applications to refuge design. Theor. Popul. Biol. 55, 189–207 (1999)

Corns, T.R.A., Satchell, S.E.: Skew Brownian motion and pricing European options. Eur. J. Financ. 13, 523–544 (2007)

Cox, J.C., Ingersoll, J.E., Ross, S.A.: A theory of the term structure of interest rates. Econom. J. Econom. Soc. 53, 385–407 (1985)

Decamps, M., Schepper, A.D., Goovaerts, M.: Applications of \(\delta \)-perturbation to the pricing of derivative securities. Phy. A Stat. Mech. Appl. 342, 677–692 (2004)

Decamps, M., Goovaerts, M., Schoutens, W.: Asymmetric skew Bessel processes and their applications to finance. J. Comput. Appl. Math. 186, 130–147 (2006a)

Decamps, M., Goovaerts, M., Schoutens, W.: Self exciting threshold interest rates models. Int. J. Theor. Appl. Financ. 9, 1093–1122 (2006b)

Decamps, M., Schepper, A.D., Goovaerts, M., Schoutens, W.: A note on some new perpetuities. Scand. Actuar. J. 2005, 261–270 (2005)

Duffie, D., Singleton, K.: Credit Risk. Princeton University Press, Princeton (2003)

Engelbert, H.J., Schmidt, W.: Strong Markov continuous local martingales and solutions of one-dimensional stochastic differential equations (part III). Math. Nachr. 151, 149–197 (1991)

Feller, W.: Two singular diffusion problems. Ann. Math. 54, 173–182 (1951)

Gairat, A., Shcherbakov, V.: Density of skew Brownian motion and its functionals with application in finance. Math. Financ. pp. 1–20 (2016). doi:10.1111/mafi.12120

Gorovoi, V., Linetsky, V.: Black’s model of interest rates as options, eigenfunction expansions and Japanese interest rates. Math. Financ. 14, 49–78 (2004)

Harrison, J.M., Shepp, L.A.: On skew Brownian motion. Ann. Probab. 9, 309–313 (1981)

Heston, S.L.: A closed form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 6, 327–343 (1993)

Itô, K., McKean, H.P.: Diffusion Processes and Their Sample Paths. Springer, Berlin (1965)

Karatzas, I.: Brownian Motion and Stochastic Calculus. Springer, Berlin (1991)

Kou, S.C., Kou, S.G.: A diffusion model for growth stocks. Math. Oper. Res. 29, 191–212 (2004)

Lang, R.: Effective conductivity and skew Brownian motion. J. Stat. Phys. 80, 125–146 (1995)

Le Gall, J.F.: One-dimensional stochastic differential equations involving the local times of the unknown process. In: Truman, A., Williams, D. (eds.) Stochastic Analysis and Applications. Lecture Notes in Mathematics, vol. 1095, Springer, Berlin (1984)

Lejay, A.: Simulating a diffusion on a graph: application to reservoir engineering. Mt. Carlo Methods Appl. 9, 241–255 (2003)

Lejay, A.: Monte Carlo methods for fissured porous media: a gridless approach. Mt. Carlo Methods Appl. 10, 385–392 (2004)

Li, A., Ritchken, P., Sankarasubramanian, L.: Lattice models for pricing American interest rate claims. J. Financ. 50, 719–737 (1995)

Linetsky, V.: The spectral decomposition of the option value. Int. J. Theor. Appl. Financ. 7, 337–384 (2004)

Nawalkha, S.K., Beliaeva, N.A., Soto, G.M.: Dynamic Term Structure Modeling: The Fixed Income Valuation Course. Wiley, Hoboken (2007)

Nelson, D.B., Ramaswamy, K.: Simple binomial processes as diffusion approximations in financial models. Rev. Financ. Stud. 3, 393–430 (1990)

Nkiforov, A.F., Uvarov, V.B.: Special Functions of Mathematical Physics: A Unified Introduction with Applications. Birkhäuser, Basel (1988)

Ouknine, Y., Rutkowski, M.: Local times of functions of continuous semimartingales. Stoch. Anal. Appl. 13, 211–231 (1995)

Protter, P.E.: Stochastic Integration and Differential Equations. Springer, Berlin (1990)

Rossello, D.: Arbitrage in skew Brownian motion models. Insur. Math. Econ. 50, 50–56 (2012)

Song, S., Xu, G., Wang, Y.: On first hitting times for skew CIR processes. Methodol. Comput. Appl. Probab. 18, 169–180 (2016)

Trutnau, G.: Weak existence of the squared Bessel and CIR processes with skew reflection on a deterministic time-dependent curve. Stoch. Process. Appl. 120, 381–402 (2010)

Trutnau, G.: Pathwise uniqueness of the squared Bessel and CIR processes with skew reflection on a deterministic time-dependent curve. Stoch. Process. Appl. 121, 1845–1863 (2011)

Walsh, J.B.: A diffusion with a discontinuous local time. Astérisque 52, 37–45 (1978)

Weinryb, S.: Homogeneisation pour des processus associes a des frontieres permeables. Ann. lIHP Probab. Stat. 20, 373–407 (1984)

Xu, G., Song, S., Wang, Y.: Some properties of doubly skewed CIR processes. J. Math. Anal. Appl. 434, 1194–1210 (2016)

Xu, G., Song, S., Wang, Y.: The valuation of options on foreign exchange rate in a target zone. Int. J. Theor. Appl. Financ. 19, 1–19 (2016)

Zhang, M.: Calculation of diffusive shock acceleration of charged particles by skew Brownian motion. Astrophys 541, 428–435 (2000)

Author information

Authors and Affiliations

Corresponding author

Additional information

This work is partially supported by the National Natural Science Foundation of China (Nos. 71532001, 11571190) and the Fundamental Research Funds for the Central Universities in UIBE (16QD19).

Appendices

Appendix

Pricing the zero-coupon bond using the spectral expansion method

In this appendix, we apply the spectral expansion approach to value the zero-coupon bond when the term structure of interest rate satisfies the skew CIR process defined in Eq. (1). Following the idea in [34], we assume that

which means the process \(r_{t}\) defined in Eq. (1) satisfies the Feller condition and the state space of \(r_{t}\) is \((0,\infty )\). Define

then the inverse function H(x) of G(x) satisfies

Applying the generalized Itó formula (see e.g., [32]) to \(\eta _{t}=G(r_{t})\), we obtain that

where

The process \(\eta _{t}\) is a diffusion with discontinuous coefficients on \(I^{\eta }=(l_{2},\infty )\). And its path behaves like the shifted CIR process when \(\eta _{t}\ge a\) or \(l_{2}<\eta _{t}<a\) with different coefficients. What’s more, through careful calculations (for more details please see [34]), we know that the boundary \(l_{2}\) is entrance and \(\infty \) is non-attracting natural. This indicates that \(l_{2}\) and \(\infty \) are both NONOSCFootnote 7 natural boundaries for a shifted CIR process. The scale density \(\mathfrak {s}_{\eta }(x)\) and the speed density \(\mathfrak {m}_{\eta }(x)\) of the diffusion \(\eta _{t}\) are

Using the procedure similar to [10], we consider the risk-neutral expectation of the discounted payoff

where \(\mathbb {E}_{x}[\cdot ]=\mathbb {E}[\cdot |r_{0}=x]\). According to the relation between \(r_{t}\) and \(\eta _{t}\), we obtain

where \(g(\cdot )=f(H(\cdot ))\). Define the pricing semigroup \((\mathcal {P}_{t}g)(u)=\mathbb {E}_{u}[\mathrm {e}^{-\int _{0}^{t}H(\eta _{s}){\mathrm {d}}s}g(\eta _{t})]\) as the strongly continuous semigroup of self-adjoint contractions in the Hilbert space \(L^{2}(I^{\eta },\mathfrak {m}_{\eta })\) of real valued, square-integrable functions on \(I^{\eta }\) with the inner product \((f,g)=\int _{I^{\eta }}f(x)g(x)\mathfrak {m}_{\eta }(x){\mathrm {d}}x\). Then the infinitesimal generator of the pricing semigroup \(\{\mathcal {P}_{t}\}\) is self-adjoint operator in \(L^{2}(I^{\eta },\mathfrak {m}_{\eta })\). In this special case, we can use the Spectral Theorem for self-adjoint operators in Hilbert space

where q(t; u, y) is called the state-price density. Since \(l_{2}\) and \(\infty \) are both NONOSC natural boundaries for \(\eta _{t}\), the state-price density q(t; u, y) can be reduced to

where \(\varphi _{n}(x)\) is the normalized eigenfunction associated to \(\lambda _{n}\) and \(\mathfrak {m}_{\eta }(y)\) is the speed density of \(\eta _{t}\). The infinitesimal generator with respect to the semigroup \((\mathcal {P}_{t}g)(u)\) is

The domain of \(\mathcal {G}\) is:

where \(AC_{loc}(I^{\eta })\) is the space of absolutely continuous functions over each compact subinterval of \(I^{\eta }\), and the appropriate boundary conditions at \(l_{2}\) and \(\infty \) are

Now we consider the zero-coupon bond

Define

and

where \(M_{k,m}(z)\) and \(W_{k,m}(z)\) are the Whittaker functions (See more details about the Whittaker functions in [30]). Then we have the following proposition about the value of zero-coupon bond.

Proposition A.1

The zero-coupon bond \( \mathbb {E}_{x}[\mathrm {e}^{-\int _{0}^{t}r_{u}{\mathrm {d}}u}]\) has the following form

where the eigenvalues \(0\le \lambda _{1}<\lambda _{2}<\cdots <\lambda _{n}\rightarrow \infty \) as \(n\uparrow \infty \) are the simple discrete zeros of the Wronskian equation

the normalized eigenfunction \(\varphi _{n}(x)\) has the form

and the coefficients \(c_{n}\) satisfy

where \(\varDelta _{n}=\frac{d\omega (\lambda )}{d\lambda }|_{\lambda =\lambda _{n}}\).

Proof

This proof is similar to Proposition 3.3 and Proposition 5.1 in [16]. \(\square \)

After having this proposition, the value of a zero-coupon bond in spectral expansion form can be obtained. For simulations in this paper, we used \(Mathematica^{\textregistered }\)10.1.0.0 running on a PC (Intel Core i7-6820 @ 2.7GHz with 16GB memory). The eigenvalues \(\lambda _{n}\) are determined by finding zeros of the function \(\omega (\lambda )\) using the built-in function FindRoot. The special functions \(M_{k,m}(z)\) and \(W_{k,m}(z)\) in eigenfunctions \(\varphi _{n}(x)\) are determined using the bulit-in functions WhittakerM[k,m,z] and WhittakerW[k,m,z] and the coefficients \(c_{n}\) are computed numerically using the built-in numerical integration function NIntegrate.

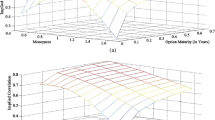

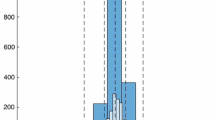

Figure 4 shows the convergence of bond prices under the skew CIR model, using the spectral expansion method. It can be seen that the price converges smoothly and quickly to a steady level. With more than 30 roots, we can have quite accurate evaluations for bond prices.

Convergence of bond prices computed by the spectral expansion method. The top panel shows the bond prices with respect to the number of roots under the skew CIR model when \(p=0.5\). The bottom left panel and the bottom right panel depict the corresponding bond prices when \(p=0.2\) and \(p=0.8\), respectively. The other parameters are given as follows: \(\theta = 8\%\); \(\sigma =0.1\); \(k=0.1\); \(r_0=0.05\); \(a=0.04\); \(T=1\)

In fact, [27] mentioned that the spectral approach requires that the instantaneous discount process should be non-negative. Generally, when modeling the interest rate with the CIR process or the skew CIR process, we can obtain bond or option prices using the spectral approach with some complex calculations. But for some frequently-used process, such as the Ornstein-Uhlenbeck (OU) process and the skew OU process, it is not workable to derive the prices of bond or option with the spectral method since they have negative values. While in these cases tree approach can do. In addition, when only discussing the spectral expansions for some certain models, it is very hard to obtain the spectral expansions for the geometric Brownian motion or stochastic volatility model since they have continuous spectrum. However, these models can be dealt with by tree approach easily.

Rights and permissions

About this article

Cite this article

Zhuo, X., Xu, G. & Zhang, H. A simple trinomial lattice approach for the skew-extended CIR models. Math Finan Econ 11, 499–526 (2017). https://doi.org/10.1007/s11579-017-0192-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-017-0192-1