Abstract

We provide an explicit closed-form strategy for an investor who executes a large order when market order-flow from all agents, including the investor’s own trades, has a permanent price impact. The strategy is found in closed-form when the permanent and temporary price impacts are linear in the market’s and investor’s rates of trading. We do this under very general assumptions about the stochastic process followed by the order-flow of the market. The optimal strategy consists of an Almgren–Chriss execution strategy adjusted by a weighted-average of the future expected net order-flow (given by the difference of the market’s rate of buy and sell market orders) over the execution trading horizon and proportional to the ratio of permanent to temporary linear impacts. We use historical data to calibrate the model to Nasdaq traded stocks and use simulations to show how the strategy performs.

Similar content being viewed by others

Notes

See [4] for a discussion on linear market impact using proprietary execution data.

For the year 2014, \(99\,\%\) of the 5 minute price changes for INTC were within the range [\(-\)0.1,0.1].

It is possible to allow order-flow to be Markov in not only \(\mu ^\pm \) by introducing other exogenous processes that also drive order-flow in a Markov manner, but we opt to leave this generalization out of the current analysis.

It is possible to incorporate dependence, however, the resulting strategy does not change, only the filtration on which strategies are adapted and certain expectations will be computed using this extended filtration. To keep the analysis compact we opt to leave this dependence out.

References

Alfonsi, A., Fruth, A., Schied, A.: Optimal execution strategies in limit order books with general shape functions. Quant. Finance 10(2), 143–157 (2010)

Almgren, R.: Optimal execution with nonlinear impact functions and trading-enhanced risk. Appl. Math. Finance 10(1), 1–18 (2003)

Almgren, R., Chriss, N.: Optimal execution of portfolio transactions. J. Risk 3, 5–40 (2001)

Almgren, R., Thum, C., Hauptmann, E., Li, H.: Direct estimation of equity market impact. Risk 18, 5752 (2005)

Avellaneda, M., Stoikov, S.: High-frequency trading in a limit order book. Quant. Finance 8, 217–224 (2008)

Bechler, K., Ludkovski, M.: Optimal execution with dynamic order flow imbalance. arXiv preprint arXiv:1409.2618 (2014)

Cartea, Á., Donnelly, R., Jaimungal, S.: Algorithmic trading with model uncertainty. SSRN: http://ssrn.com/abstract=2310645 (2013)

Cartea, Á., Donnelly, R.F., Jaimungal, S.: Enhancing trading strategies with order book signals. Available at SSRN 2668277 (2015)

Cartea, Á., Jaimungal, S.: Optimal execution with limit and market orders. Quant. Finance 15, 1279–1291 (2013)

Cartea, Á., Jaimungal, S.: Order-flow and liquidity provision. ARGO 2(5), 7–11 (2015a Winder)

Cartea, Á., Jaimungal, S.: Risk metrics and fine tuning of high frequency trading strategies. Math. Finance 25(3), 576–611 (2015b)

Cartea, Á., Jaimungal, S., Kinzebulatov, D.: Algorithmic trading with learning. SSRN eLibrary, http://ssrn.com/abstract=2373196 (2013)

Cartea, Á., Jaimungal, S., Penalva, J.: Algorithmic and High-Frequency Trading, 1st edn. Cambridge University Press, Cambridge (2015)

Cartea, Á., Jaimungal, S., Ricci, J.: Buy low, sell high: a high frequency trading perspective. SIAM J. Financial Math. 5(1), 415–444 (2014)

Fodra, P., Labadie, M.: High-frequency market-making with inventory constraints and directional bets. arXiv preprint arXiv:1206.4810 (2012)

Frei, C., Westray, N.: Optimal execution of a VWAP order: a stochastic control approach. Math. Finance 25, 612–639 (2013)

Gatheral, J.: No-dynamic-arbitrage and market impact. Quant. Finance 10(7), 749–759 (2010)

Gatheral, J., Schied, A.: Optimal trade execution under geometric brownian motion in the almgren and chriss framework. Int. J. Theor. Appl. Finance 14(03), 353–368 (2011)

Gatheral, J., Schied, A., Slynko, A.: Transient linear price impact and Fredholm integral equations. Math. Finance 22(3), 445–474 (2012)

Graewe, P., Horst, U., Séré, E.: Smooth solutions to portfolio liquidation problems under price-sensitive market impact. arXiv preprint arXiv:1309.0474 (2013)

Guéant, O., Lehalle, C.-A.: General intensity shapes in optimal liquidation. Math. Finance 25, 457–495 (2013)

Guéant, O., Lehalle, C.-A., Fernandez-Tapia, J.: Dealing with the inventory risk: a solution to the market making problem. Math. Financial Econ. 7, 1–31 (2012)

Guilbaud, F., Pham, H.: Optimal high frequency trading with limit and market orders. Quant. Finance 13, 79–94 (2013)

Kharroubi, I., Pham, H.: Optimal portfolio liquidation with execution cost and risk. SIAM J. Financial Math. 1(1), 897–931 (2010)

Lorenz, C., Schied, A.: Drift dependence of optimal trade execution strategies under transient price impact. Finance Stoch. 17(4), 743–770 (2013)

Schied, A.: Robust strategies for optimal order execution in the Almgren–Chriss framework. Appl. Math. Finance 20(3), 264–286 (2013)

Acknowledgments

SJ would like to thank NSERC and GRI for partially funding this work. ÁC acknowledges the research support of the Oxford-Man Institute for Quantitative Finance and the hospitality of the Finance Group at Saïd Business School.

Author information

Authors and Affiliations

Corresponding author

Appendix: Proof of Proposition 1

Appendix: Proof of Proposition 1

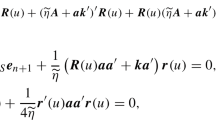

To solve (9) we make the ansatz

and upon substitution of the ansatz in the DPE above we see that \(h(t,{\varvec{\mu }},q)\) satisfies

subject to the terminal condition \(h(T,{\varvec{\mu }},q)=-\alpha \,q^2\), and the optimal liquidation speed in feedback form is

Upon substitution back into the DPE we find that h satisfies the non-linear partial-integral differential equation (PIDE)

Due to the existence of linear and quadratic terms in q in (21), and its terminal conditions, we expect \(h(t,{\varvec{\mu }},q)\) to be a quadratic form in q, and we assume the ansatz

Inserting this into (21) and collecting like terms in q leads to the following coupled system of PIDEs

subject to the terminal conditions

To solve for \(h_2\) we note that since Eq. (22c) for \(h_2\) contains no source terms in \(\mu \) and its terminal condition is independent of \(\mu \), the solution must be independent of \(\mu \), i.e. \(h_2\) is a function only of time. In this case, (22c) is an ODE of Riccati type and can be solved explicitly:

with the constants \(\gamma \) and \(\zeta \):

Now we turn to solving (22b) which is a linear PIDE for \(h_1\) where \(h_2+\tfrac{1}{2}b\) acts as an effective discount rate and \(b\,\mu \) is a source term. The general solution of such an equation can be represented using the Feynman-Kac theorem. Thus we write

which can be simplified to

Finally, we can solve for \(h_0(t,{\varvec{\mu }})\) by again noticing it is a linear PDE with non-linear source term and a straight forward application of Feynman-Kac, and interchanging integration and expectation, we obtain (11c). \(\square \)

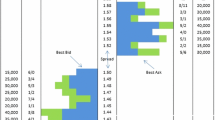

The remainder of the appendix contains tables with estimated parameters and simulation results. See Tables 7, 8, 9, 10, 11, 12.

Rights and permissions

About this article

Cite this article

Cartea, Á., Jaimungal, S. Incorporating order-flow into optimal execution. Math Finan Econ 10, 339–364 (2016). https://doi.org/10.1007/s11579-016-0162-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-016-0162-z