Abstract

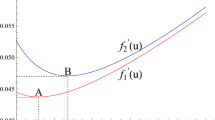

We consider a dividends model with a stochastic jump perturbed by diffusion. First, we prove that the expected discounted dividends function is twice continuously differentiable under the condition that the claim distribution function has continuous density. Then we show that the expected discounted dividends function under a barrier strategy satisfies some integro-differential equation of defective renewal type, and the solution of which can be explicitly expressed as a convolution formula. Finally, we study the Laplace transform of ruin time on the modified surplus process.

Similar content being viewed by others

References

Asmussen S. Ruin Probabilities. Singapore: World Scientific, 2000

Cai J, Dickson D C M. Upper bounds for ultimate ruin probabilities in the Sparre Andersen model with interest. Insurance Math Econom, 2003, 32(1): 61–71

De Finetti B. Su un’ impostazione alternativa dell teoria collettiva del rischio. Transactions of the XVth International Congress of Actuaries, 1957, 2: 433–443

Dufresne F, Gerber H U. Risk theory for the compound Poisson process that perturbed by diffusion. Insurance Math Econom, 1991, 10(1): 51–59

Gao H, Yin C. A perturbed risk process compounded by a geometric Brownian motion with a dividend barrier strategy. Appl Math Comput, 2008, 205: 454–464

Gerber H U. An extension of the renewal equation and its application in the collective theory of risk. Skandinavisk Aktuarietidskrift, 1970, 205–210

Gerber H U, Shiu E S W. Optimal dividends: Analysis with Brownian motion. North Amer Actuarial J, 2004, 8(1): 1–20

Mikhlin S G. Integral Equations. London: Pergamon Press, 1957

Paulsen J, Gjessing H K. Ruin theory with stochastic return on investments. Adv Appl Probab, 1997, 29: 965–985

Revuz D, Yor M. Continuous Martingales and Brownian Motion. Berlin-New York: Springer-Verlag, 1991

Rolski T, Schmidli H, Teugels J. Stochastic Processes for Insurance and Finance. Chichester-New York: John Wiley and Sons, 1999

Wan N. Dividend payments with a threshold strategy in the compound Poisson risk model perturbed by diffusion. Insurance Math Econom, 2007, 40(3): 509–523

Wu R, Wang G J, Wei L. Joint distributions of some actuarial random vectors containing the time of ruin. Insurance Math Econom, 2003, 33(1): 147–161

Yuen K C, Lu Y H, Wu R. The compound Poisson process perturbed by a diffusion with a threshold dividend strategy. Appl Stoch Models Bus Ind, 2009, 25(1): 73–93

Zhang C S, Wang G J. The joint density function of three characteristics on jumpdiffusion risk process. Insurance Math Econom, 2003, 32(3): 445–455

Zhang C S, Wu R. Total duration of negative surplus for the compound Poisson process that is perturbed by diffusion. J Appl Probab, 2002, 39: 517–532

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lu, Y., Wu, R. Differentiability of dividends function on jump-diffusion risk process with a barrier dividend strategy. Front. Math. China 9, 1073–1088 (2014). https://doi.org/10.1007/s11464-013-0313-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11464-013-0313-y

Keywords

- Expected discounted dividends

- ruin time

- integro-differential equation

- Laplace transform

- barrier strategy