Abstract

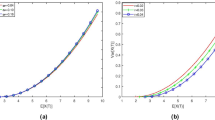

The present paper studies time-consistent solutions to an investment-reinsurance problem under a mean-variance framework. The paper is distinguished from other literature by taking into account the interests of both an insurer and a reinsurer jointly. The claim process of the insurer is governed by a Brownian motion with a drift. A proportional reinsurance treaty is considered and the premium is calculated according to the expected value principle. Both the insurer and the reinsurer are assumed to invest in a risky asset, which is distinct for each other and driven by a constant elasticity of variance model. The optimal decision is formulated on a weighted sum of the insurer’s and the reinsurer’s surplus processes. Upon a verification theorem, which is established with a formal proof for a more general problem, explicit solutions are obtained for the proposed investment-reinsurance model. Moreover, numerous mathematical analysis and numerical examples are provided to demonstrate those derived results as well as the economic implications behind.

Similar content being viewed by others

References

Bai L H, Guo J Y. Optimal proportional reinsurance and investment with multiple risky assets and no-shorting constraint. Insurance Math Econom, 2008, 42: 968–975

Bai L H, Guo J Y. Optimal dynamic excess-of-loss reinsurance and multidimensional portfolio selection. Sci China Math, 2010, 53: 1787–1804

Bai L H, Zhang H Y. Dynamic mean-variance problem with constrained risk control for the insurers. Math Methods Oper Res, 2008, 68: 181–205

Bäuerle N. Benchmark and mean-variance problems for insurers. Math Methods Oper Res, 2005, 62: 159–165

Björk T, Murgoci A. A general theory of Markovian time-inconsistent stochastic control problems. Working paper, http://papers.ssrn.com/sol3/papers.cfm?abstract id=1694759, 2010

Björk T, Murgoci A, Zhou X Y. Mean variance portfolio optimization with state dependent risk aversion. Math Finance, 2014, 24: 1–24

Black F, Scholes M. The pricing of options and corporate liabilities. J Polit Econ, 1973, 81: 637–654

Cai J, Fang Y, Li Z, et al. Optimal reciprocal reinsurance treaties under the joint survival probability and the joint profitable probability. J Risk Insur, 2013, 80: 145–168

Cai J, Tan K S, Weng C, et al. Optimal reinsurance under VaR and CTE risk measures. Insurance Math Econom, 2008, 43: 185–196

Cheung K C, Sung C J, Yam S C P. Risk-minimizing reinsurance protection for multivariate risks. J Risk Insur, 2014, 81: 219–236

Cox J. Notes on Option Pricing I: Constant Elasticity of Diffusions. Stanford: Stanford University, 1975

Davydov D, Linetsky V. The valuation and hedging of barrier and lookback option under the CEV process. Manag Sci, 2001, 47: 949–965

Delong L, Gerrard R. Mean-variance portfolio selection for a nonlife insurance company. Math Methods Oper Res, 2007, 66: 339–367

Dias J C, Nunes J P. Pricing real options under the constant elasticity of variance diffusion. J Futur Mark, 2011, 3: 230–250

Dimitrova D S, Kaishev V K. Optimal joint survival reinsurance: An efficient frontier approach. Insurance Math Econom, 2010, 47: 27–35

Dufresne D. The integrated square root process. Working Paper, Melbourne: University of Melbourne, 2001

Ekeland I, Lazrak A. Being serious about non-commitmetn: Subgame perfect equilibrium in continuous time. Working paper, http://arxiv.org/abs/math/0604264, 2006

Gao J W. Optimal investment strategy for annuity contracts under the constant clasticity of variance (CEV) model. Insurance Math Econom, 2009, 45: 9–18

Geman H, Shih Y F. Modeling commodity prices under the CEV model. J Altern Invest, 2009, 11: 65–84

Grandell J. Aspects of Risk Theory. New York: Springer, 1991

Gu A L, Guo X P, Li Z F, et al. Optimal control of excess-of-loss reinsurance and investment for insurers under a CEV model. Insurance Math Econom, 2012, 51: 674–684

Guo Z J, Duan B X. Dynamic mean-variance portfolio selection in market with jump-diffusion models. Optimization, 2015, 64: 663–674

Hald M, Schmidli H. On the maximisation of the adjustment coefficient under proportional reinsurance. Astin Bull, 2004, 34: 75–83

Hu Y, Jin H Q, Zhou X Y. Time inconsistent stochastic linear-quadratic control. SIAM J Control Optim, 2012, 50: 1548–1572.

Jeanblanc M, Yor M, Chesney M. Mathematical Methods for Financial Markets. London: Springer-Verlag, 2009

Kronborg M, Steffensen M. Inconsistent investment and consumption problems. Appl Math Optim, 2015, 71: 473–515

Kryger E M, Steffensen M. Some solvable portfolio problems with quadratic and collective objectives. Working paper, http://papers.ssrn.com/sol3/papers.cfm?abstractid=1577265, 2010

Li D P, Rong X M, Zhao H. Optimal reinsurance-investment problem for maximizing the product of the insurer’s and the reinsurer’s utilities under a CEV model. J Comput Appl Math, 2014, 255: 671–683

Li D P, Rong X M, Zhao H. Time-consistent reinsurance-investment strategy for an insurer and a reinsurer with mean-variance criterion under the CEV model. J Comput Appl Math, 2015, 283: 142–162

Li Y W, Li Z F. Optimal time-consistent investment and reinsurance strategies for mean-variance insurers with state dependent risk aversion. Insurance Math Econom, 2013, 53: 86–97

Li Z F, Zeng Y, Lai Y Z. Optimal time-consistent investment and reinsurance strategies for insurers under Heston’s SV model. Insurance Math Econom, 2012, 51: 191–203

Lin X, Li Y F. Optimal reinsurance and investment for a jump diffusion risk process under the CEV model. N Am Actuar J, 2011, 15: 417–431

Liu Y, Ma J. Optimal reinsurance/investment problems for general insurance models. Ann Appl Probab, 2009, 19: 1273–1685

Lo C F, Yuen P H, Hui C H. Constant elasticity of variance option pricing model with time-dependent parameters. Int J Theor Appl Financ, 2000, 3: 661–674

Schmidli H. On minimizing the ruin probability by investment and reinsurance. Ann Appl Probab, 2002, 12: 890–907

Shen Y, Zeng Y. Optimal investment C reinsurance with delay for mean-variance insurers: A maximum principle approach. Insurance Math Econom, 2014, 57: 1–12

Shen Y, Zeng Y. Optimal investment C reinsurance strategy for mean-variance insurers with square-root factor process. Insurance Math Econom, 2015, 62: 118–137

Shen Y, Zhang X, Siu T K. Mean-variance portfolio selection under a constant elasticity of variance model. Oper Res Lett, 2014, 42, 337–342

Widdicks M, Duck P W, Andricopoulos A D, et al. The Black-Scholes equation revisited: Symptotic expansions and singular perturbations. Math Financ, 2005, 15: 373–391

Xu L, Wang R, Yao D. On maximizing the expected terminal utility by investment and reinsurance. J Ind Manag Optim, 2008, 4: 801–815

Yong J M. Time-inconsistent optimal control problems and the equilibrium HJB equation. Math Control Related Fields, 2012, 2: 271–329

Yong J M. Linear-quadratic optimal control problems for mean-field stochastic differential equations. SIAM J Control Optim, 2013, 51: 2809–2838

Yong J M. Linear-Quadratic Optimal Control Problems for Mean-Field Stochastic Differential Equations: Time-Consistent Solutions. Providence: Amer Math Soc, 2015

Yong J M, Zhou X Y. Stochastic Controls: Hamiltonian Systems and HJB Equations. New York: Springer-Verlag, 1999.

Zeng Y, Li Z F. Optimal time-consistent investment and reinsurance policies for mean-variance insurers. Insurance Math Econom, 2011, 49: 145–154

Zeng Y, Li Z F, Lai Y Z. Time-consistent investment and reinsurance strategies for mean-variance insurers with jumps. Insurance Math Econom, 2013, 52: 498–507

Acknowledgements

This work was supported by National Natural Science Foundation of China (Grant Nos. 11301376, 71201173 and 71571195), China Scholarship Council, the Natural Sciences and Engineering Research Council of Canada (NSERC), and Society of Actuaries Centers of Actuarial Excellence Research Grant, Guangdong Natural Science Funds for Distinguished Young Scholar (Grant No. 2015A030306040), Natural Science Foundation of Guangdong Province of China (Grant No. 2014A030310195) and for Ying Tung Eduction Foundation for Young Teachers in the Higher Education Institutions of China (Grant No. 151081).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zhao, H., Weng, C., Shen, Y. et al. Time-consistent investment-reinsurance strategies towards joint interests of the insurer and the reinsurer under CEV models. Sci. China Math. 60, 317–344 (2017). https://doi.org/10.1007/s11425-015-0542-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11425-015-0542-7

Keywords

- investment-reinsurance problem

- mean-variance analysis

- time-consistent strategy

- constant elasticity of variance model