Abstract

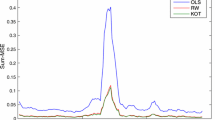

When decisions are based on empirical observations, a trade-off arises between flexibility of the decision and ability to generalize to new situations. In this paper, we focus on decisions that are obtained by the empirical minimization of the Conditional Value-at-Risk (CVaR) and argue that in CVaR the trade-off between flexibility and generalization can be understood on the ground of theoretical results under very general assumptions on the system that generates the observations. The results have implications on topics related to order and structure selection in various applications where the CVaR risk-measure is used. A study on a portfolio optimization problem with real data demonstrates our results.

Similar content being viewed by others

References

Vapnik V, The Nature of Statistical Learning Theory, Springer Science & Business Media, New York, 2013.

Calafiore G and Campi M C, Uncertain convex programs: Randomized solutions and confidence levels, Mathematical Programming, 2005, 102(1): 25–46.

Calafiore G C and Campi M C, The scenario approach to robust control design, IEEE Transactions on Automatic Control, 2006, 51(5): 742–753.

Campi M and Garatti S, The exact feasibility of randomized solutions of uncertain convex programs, SIAM Journal on Optimization, 2008, 19(3): 1211–1230.

Campi M C and Garatti S, A sampling-and-discarding approach to chance-constrained optimization: Feasibility and optimality, Journal of Optimization Theory and Applications, 2011, 148(2): 257–280.

Ramponi F A, Consistency of the scenario approach, SIAM Journal on Optimization, 2018, 28(1): 135–162.

Garatti S, Campi M, and Carè A, On a class of interval predictor models with universal reliability, Automatica, 2019, 110: 108542.

Ramponi F A and Campi M C, Expected shortfall: Heuristics and certificates, European Journal of Operational Research, 2018, 267(3): 1003–1013.

Campi M C and Garatti S, Wait-and-judge scenario optimization, Mathematical Programming, 2018, 167(1): 155–189.

Carè A, Garatti S, and Campi M C, The wait-and-judge scenario approach applied to antenna array design, Computational Management Science, 2019, 16: 481–499.

Carè A, Garatti S, and Campi M C, Scenario min-max optimization and the risk of empirical costs, SIAM Journal on Optimization, 2015, 25(4): 2061–2080.

Rockafellar R T and Uryasev S, Optimization of conditional value-at-risk, Journal of Risk, 2000, 2: 21–42.

Ben-Tal A and Teboulle M, An old-new concept of convex risk measures: The optimized certainty equivalent, Mathematical Finance, 2007, 17(3): 449–476.

Mansini R, Ogryczak W, and Speranza M G, Conditional value at risk and related linear programming models for portfolio optimization, Annals of Operations Research, 2007, 152(1): 227–256.

Artzner P, Delbaen F, Eber J M, and Heath D, Coherent measures of risk, Mathematical Finance, 1999, 9(3): 203–228.

Pflug G C, Some remarks on the Value-at-Risk and the Conditional Value-at-Risk, Probabilistic Constrained Optimization: Methodology and Applications (Ed. by Uryasev S P), Boston, MA: Springer US, 2000, 272–281.

Gotoh J Y and Takeda A, CVaR Minimizations in Support Vector Machines, John Wiley & Sons, Ltd, 2016, 233–265.

Chan T C, Mahmoudzadeh H, and Purdie T G, A robust-CVaR optimization approach with application to breast cancer therapy, European Journal of Operational Research, 2014, 238(3): 876–885.

Nasir H A, Care A, and Weyer E, A randomised approach to flood control using Value-at-Risk, 2015 54th IEEE Conference on Decision and Control (CDC), 2015, 3939–3944.

Filippi C, Guastaroba G, and Speranza M, Conditional value-at-risk beyond finance: A survey, International Transactions in Operational Research, 2020, 27(3): 1277–1319.

Hull J C, Options, Futures and Other Derivatives, Pearson, 2019.

David H A and Nagaraja H N, Order Statistics, Wiley, New York, 2003.

Carè A, Garatti S, and Campi M C, A coverage theory for least squares, Journal of the Royal Statistical Society: Series B (Statistical Methodology), 2017, 79(5): 1367–1389.

Author information

Authors and Affiliations

Corresponding authors

Additional information

This research was partially supported by Regione Lombardia under Grant MoSoRe E81B19000840007.

Rights and permissions

About this article

Cite this article

Arici, G., Campi, M.C., Carè, A. et al. A Theory of the Risk for Empirical CVaR with Application to Portfolio Selection. J Syst Sci Complex 34, 1879–1894 (2021). https://doi.org/10.1007/s11424-021-1229-3

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-021-1229-3