Abstract

In recent years, the international steel market has shown increasingly strong cross-regional correlation. To better understand the price trends of various markets, it is necessary to identify their inherent price spillovers. This paper combines a generalized autoregressive conditional heteroskedasticity Baba–Engle–Kraft–Kroner (GARCH-BEKK) model and complex network motifs to explore the price fluctuations among international steel markets. The study selects steel markets in 12 countries and regions and uses daily data on import and export prices from January 2009 to September 2017 to analyze eight steel products. The results show that spillovers are associated with geographical location, market development, product type and status. Spillovers mostly occur between buyer’s markets; additionally, the Asian market, especially the East Asian market, is in most cases the recipient of spillover, whereas the European Union (EU) market is in most cases the sender of spillover effects. Developed markets have clear spillover effects on emerging markets, sheet steel products have clear spillover effects on profile steel products, and the prices of midstream and downstream products in the industrial chain are the most influenced. This paper examines international steel market relationships from the perspective of price transmission, and the results can help manage and prevent large-scale economic risks.

Similar content being viewed by others

References

Aghabozorgi F, Khayyambashi MR (2018) A new similarity measure for link prediction based on local structures in social networks. Physica A 501:12–23

Bateman IJ, Brouwer R (2006) Consistency and construction in stated WTP for health risk reductions: a novel scope-sensitivity test. Resour Energy Econ 28(3):199–214

Biondi Y, Righi S (2016) What does the financial market pricing do? A simulation analysis with a view to systemic volatility, exuberance and vagary. J Econ Interact Coord 11(2):175–203

Bittner HJ, Guixà-González R, Hildebrand PW (2018) Structural basis for the interaction of the beta-secretase with copper. Biochim Biophys Acta 1860(5):1105–1113

Blázquez L, González-Díaz B (2013) International automotive production networks: how the web comes together. J Econ Interact Coord 11(1):119–150

Bradley S, Dauchy E, Hasegawa M (2017) Investor valuations of Japan’s adoption of a territorial tax regime: quantifying the direct and competitive effects of international tax reform. Int Tax Public Finance 25:581–630

Chandra P (2016) Impact of temporary trade barriers: evidence from China. China Econ Rev 38:24–48

Chen Q, Weng X (2017) Information flows between the US and China’s agricultural commodity futures markets—based on VAR-BEKK-Skew-t model. Emerg Mark Finance Trade. https://doi.org/10.1080/1540496X.2016.1230492

Chevallier J, Pen YL, Sévi B (2011) Options introduction and volatility in the EU ETS. Resour Energy Econ 33(4):855–880

Chi W, Brooks RD, Bissoondoyalbheenick E (2018) Volatility spillover between the Chinese and Australian stock markets. Social Science Electronic Publishing, Rochester

Curran L, Maiza A (2016) Here there be dragons? Analysis of the consequences of granting market economy status to China. J World Trade 50(6):1029–1060

Emon MAB, Manzur T, Yazdani N (2016) Improving performance of light weight concrete with brick chips using low cost steel wire fiber. Constr Build Mater 106:575–583

Fricke D, Lux T (2015) The effects of a financial transaction tax in an artificial financial market. J Econ Interact Coord 10(1):119–150

Gagliardi L, Lemos S (2016) Evidence on immigrants’ assimilation into recipient labour markets using UK longitudinal data between 1981 and 2006. J Econ Geogr 16(3):621–670

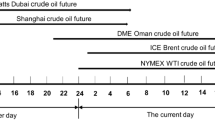

Gao X, Fang W, An F, Wang Y (2017) Detecting method for crude oil price fluctuation mechanism under different periodic time series. Appl Energy 192:201–212

Gomes O (2017) Heterogeneous wage setting and endogenous macro volatility. J Econ Interact Coord 12:27–57

Guthrie RIL, Isac MM (2016) Conventional and near net shape casting options for steel sheet. Ironmak Steelmak 43(9):650–658

Hein O, Schwind M, Spiwoks M (2008) Frankfurt artificial stock market: a microscopic stock market model with heterogeneous interacting agents in small-world communication networks. J Econ Interact Coord 3(1):59–71

Hou W, Liu H, Wang H, Wu F (2018) Structure and patterns of the international rare earths trade: a complex network analysis. Resour Policy 55:133–142

Ignatius Pang CN, Goel A, Wilkins MR (2018) Investigating the network basis of negative genetic interactions in Saccharomyces cerevisiae with integrated biological networks and triplet motif analysis. J Proteome Res 17(3):1014

Itzhack R, Mogilevski Y, Louzoun Y (2007) An optimal algorithm for counting network motifs. Physica A 381(2):482–490

Jiang J, Fortenbery TR (2019) El Nino and La Nina induced volatility spillover effects in the US soybean and water equity markets. Appl Econ 51(11):1133–1150

Kayani GM, Xiaofeng H, Gulzar S (2014) Global financial crisis: an EGARCH approach to examine the spillover effect on emerging financial markets. J Appl Sci 14(20):2622–2627

Lee K, Ki JH (2017) Rise of latecomers and catch-up cycles in the world steel industry. Res Policy 46(2):365–375

Li MX, Palchykov V, Jiang ZQ, Kaski K, Kertész J, Miccichè S, Tumminello M, Zhou WX, Mantegna RN (2014) Statistically validated mobile communication networks: evolution of motifs in European and Chinese data. New J Phys 16(83038):1037–1092

Li H, Qi Y, Li C, Liu X (2019) Routes and clustering features of PM2.5 spillover within the Jing-Jin-Ji region at multiple timescales identified using complex network-based methods. J Clean Prod 209:1195–1205

Liu X, An H, Huang S, Wen S (2017a) The evolution of spillover effects between oil and stock markets across multi-scales using a wavelet-based GARCH-BEKK model. Physica A 465:374–383

Liu X, An H, Li H, Chen Z, Feng S, Wen S (2017b) Features of spillover networks in international financial markets: evidence from the G20 countries. Physica A 479:265–278

Liu Q, Li H, An F, Liu N, Guan Q, Jia J, An P (2018) A motif-based analysis to reveal local implied information in cross-shareholding networks. Complexity 2018, 7519631. https://doi.org/10.1155/2018/7519631

Lu Y, Yang L, Liu L (2019) Volatility spillovers between crude oil and agricultural commodity markets since the financial crisis. Sustainability 11(2):396

Ma N, Li H, Wang Y, Feng S, Shi J, Wang K (2019) Interaction pattern features and driving forces of intersectoral CO2 emissions in China: a network motif analysis. Resour Conserv Recycl 149:391–412

Maluck J, Donner RV (2015) A network of networks perspective on global trade. PLoS ONE 10(7):e0133310

Maluck J, Donner RV, Takayasu H, Takayasu M (2017) Motif formation and industry specific topologies in the Japanese business firm network. J Stat Mech Theory Exp 2017(5):053404

Merwe WRVD, Kleynhans EPJ (2017) Chinese competitiveness and the crisis in the South African steel industry. Tydskrift Vir Geesteswetenskappe 57(2–2):521–541

Milstein I, Tishler A (2015) Can price volatility enhance market power? The case of renewable technologies in competitive electricity markets. Resour Energy Econ 41:70–90

Mumtaz MZ, Smith ZA (2017) Estimation of the spillover effect between patents and innovation using the GARCH-BEKK model. Pac Econ Rev 22(5):772–791

Nakajima K, Nansai K, Matsubae K (2011) Identifying the substance flow of metals embedded in Japanese international trade by use of waste input–output material flow analysis (WIO-MFA) model. ISIJ Int 51(11):1934–1939

Ohnishi T, Takayasu H, Takayasu M (2010) Network motifs in an inter-firm network. J Econ Interact Coord 5(2):171–180

Partridge MD, Dan SR, Olfert MR, Ying T (2016) International trade and local labor markets: do foreign and domestic shocks affect regions differently? MPRA Pap 17(2):lbw006

Peri M, Baldi L (2013) The effect of biofuel policies on feedstock market: empirical evidence for rapeseed oil prices in EU. Resour Energy Econ 35(1):18–37

Persson D, Thierry D, Karlsson O (2017) Corrosion and corrosion products of hot dipped galvanized steel during long term atmospheric exposure at different sites world-wide. Corros Sci 126:152–165

Prichard LRC (2009) Severstal Columbus, a new CSP (R) complex for high-quality steel in the USA—plant technology, commissioning and operational results. J Iron Steel Res Int 16:102–107

Rui L, Teixeira AAC (2012) Innovation diffusion with heterogeneous networked agents: a computational model. J Econ Interact Coord 7(2):125–144

Sato AH (2012) Comprehensive analysis of market conditions in the foreign exchange market. J Econ Interact Coord 7(2):167–179

Tran NT, Mohan S, Xu Z, Huang CH (2014) Current innovations and future challenges of network motif detection. Brief Bioinform 16(3):497–525

Truong TD, Adamowicz WL, Boxall PC (2015) Modeling non-compensatory preferences in environmental valuation. Resour Energy Econ 39(3):89–107

Tsekeris T (2015) Network analysis of inter-sectoral relationships and key sectors in the Greek economy. J Econ Interact Coord 12(2):1–23

Villalba-Diez J, Ordieres-Meré JB (2016) Strategic lean organizational design: towards lean world-small world configurations through discrete dynamic organizational motifs. Math Probl Eng 2016,1825410. https://doi.org/10.1155/2016/1825410

Waights S (2018) The preservation of historic districts—is it worth it? SERC discussion papers

Wang Y, Pan Z, Wu C (2018) Volatility spillover from the US to international stock markets: a heterogeneous volatility spillover GARCH model. J Forecast 37:385–400

Williams JK, Tietze D, Lee M, Wang J, Mei H (2016) Solid-state NMR investigation of the conformation, proton conduction, and hydration of the influenza B virus M2 transmembrane proton channel. J Am Chem Soc 138(26):8143–8155

Wójcik D, Macdonaldkorth D, Zhao SX (2016) The political–economic geography of foreign exchange trading. J Econ Geogr 17:lbw014

Wójcik D, Knight E, Pažitka V (2018) What turns cities into international financial centres? Analysis of cross-border investment banking 2000–2014. J Econ Geogr 18:1–33

Yeh CH (2013) Do price limits hurt the market? J Econ Interact Coord 8(1):125–153

Acknowledgements

This research is supported by grants from the National Natural Science Foundation of China (Grant No. 41701121 and No. 41871202), the Beijing Youth Talents Funds (2017000020124G190), the Fundamental Research Funds for the Central Universities (Grant No. 2-9-2017-041) and the Graduate teaching reform program of China University of Geosciences, Beijing (Grant No. YJG2019002). The authors would like to express their gratitude to Prof. Haizhong An, who provided valuable suggestions, Dr. Sui Guo, Dr. Sida Feng, Dr. Qian Liu, Dr. Qing Guan, Ms. Feng Li, Mr. Haowen Wan and AJE-American Journal Experts who provided professional suggestions about language usage, spelling, and grammar.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Liu, Y., Li, H., Guan, J. et al. The role of the world’s major steel markets in price spillover networks: an analysis based on complex network motifs. J Econ Interact Coord 14, 697–720 (2019). https://doi.org/10.1007/s11403-019-00261-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-019-00261-6