Abstract

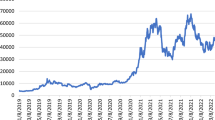

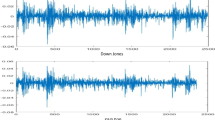

This paper gives the first empirical evidence on the relationships between trading volume and return volatility of the Bitcoin denominated in fifteen foreign currencies by investigating two competing hypotheses, i.e., mixture of distribution hypothesis (MDH) and sequential information arrival hypothesis (SIAH). Allowing for both linear and nonlinear correlation and causality tests, the empirical results mainly show that: first, trading volume and return volatility are negatively correlated, implying a lack of support for the MDH; second, we document significant lead–lag relationships between trading volume and return volatility, which support the SIAH; third, the results are robust to alternative measurements of trading volume, data source and sub-period analysis. Generally speaking, these findings have practical implications for investors, who are interested in investing in Bitcoin market.

Similar content being viewed by others

Notes

For example, the official definition in coinmarketcap.com is “Price is calculated by taking the volume weighted average of all prices reported at each market. Sources for the prices can be found on the markets section on each cryptocurrency page.” (https://coinmarketcap.com/faq/; access date: 2018-08-30). We note that the Bitcoin index of coinmarketcap.com is volume-weighed. One potential issue about the data is that it may not take into account of the exchange rate factors. While our constructed Bitcoin index is valued-weighted and denominated in the same currency, and the potential doubt on exchange rate factors can be avoided naturally. Besides, to alleviate the data issue, we also perform the robustness in Sect. 5.3.

Federal Reserve issues FOMC statement on December 13, 2013. See the news source on the Fed website: https://www.federalreserve.gov/newsevents/pressreleases/monetary20131218a.htm.

Refer to the second question on https://coinmarketcap.com/faq/ (accessed: 2018-08-30).

Trading volume of Bitcoin from coincapmarket.com is not available for about half a year: https://coinmarketcap.com/currencies/bitcoin/historical-data/?start=20130428&end=20180829 (access date: 2018-08-30).

We really appreciate that one reviewer point out this for us. To emphasize the international perspective, we separate this subsection from Sect. 5.2.

We do not report results of other monetary policy events to conserve space, but the full results are available upon request from the corresponding author.

Details of the monetary policy events of Vidal-Tomás and Ibañez (2018) are not lised in this study due to space constraints but we refer the reader to the original paper.

We do not report the full results of GMM to save space as the analysis of a1 and b1 is more important, but the full results are available upon request from the corresponding author.

References

Andersen TG (1996) Return volatility and trading volume: an information flow interpretation of stochastic volatility. J Finance 51(1):169–204

Baek EG, Brock WA (1992) A nonparametric test for independence of a multivariate time series. Stat Sin 2:137–156

Balcilar M, Bouri E, Gupta R, Roubaud D (2017) Can volume predict Bitcoin returns and volatility? A quantiles-based approach. Econ Model 64:74–81

Bariviera AF (2017) The inefficiency of Bitcoin revisited: a dynamic approach. Econ Lett 161:1–4

Bariviera AF, Basgall MJ, Hasperué W, Naiouf M (2017) Some stylized facts of the Bitcoin market. Physica A 484:82–90

Baur DG, Dimpfl T, Kuck K (2018a) Bitcoin, gold and the US dollar—a replication and extension. Finance Res Lett 25:103–110

Baur DG, Hong K, Lee AD (2018b) Bitcoin: medium of exchange or speculative assets? J Int Finan Mark Inst Money 54:177–189

Bekiros SD, Diks CG (2008) The relationship between crude oil spot and futures prices: cointegration, linear and nonlinear causality. Energy Econ 30(5):2673–2685

Bouri E, Gupta R, Tiwari AK, Roubaud D (2017a) Does Bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions. Finance Res Lett 23:87–95

Bouri E, Molnár P, Azzi G, Roubaud D, Hagfors LI (2017b) On the hedge and safe haven properties of Bitcoin: is it really more than a diversifier? Finance Res Lett 20:192–198

Brandvold M, Molnár P, Vagstad K, Andreas Valstad OC (2015) Price discovery on Bitcoin exchanges. J Int Finan Markets Inst Money 36:18–35

Chang C-C, Hsieh P-F, Wang Y-H (2010) Information content of options trading volume for future volatility: evidence from the Taiwan options market. J Bank Finance 34(1):174–183

Cheah E-T, Fry J (2015) Speculative bubbles in Bitcoin markets? An empirical investigation into the fundamental value of Bitcoin. Econ Lett 130:32–36

Chen G, Firth M, Rui OM (2001) The dynamic relation between stock returns, trading volume, and volatility. Finan Rev 36(3):153–174

Ciaian P, Rajcaniova M, Kancs DA (2018) Virtual relationships: short- and long-run evidence from Bitcoin and altcoin markets. J Int Finan Mark Inst Money 52:173–195

Clark PK (1973) A subordinated stochastic process model with finite variance for speculative prices. Econometrica 4:135–155

Cocco L, Concas G, Marchesi M (2017) Using an artificial financial market for studying a cryptocurrency market. J Econ Interact Coord 12(2):345–365

Copeland TE (1976) A model of asset trading under the assumption of sequential information arrival. J Finance 31(4):1149–1168

Copeland TE, Friedman D (1987) The effect of sequential information arrival on asset prices: an experimental study. J Finance 42(3):763–797

Corbet S, Larkin C, Lucey B, Meegan A, Yarovaya L (2017) Cryptocurrency reaction to FOMC announcements: evidence of heterogeneity based on blockchain stack position. Available at SSRN: http://dx.doi.org/10.2139/ssrn.3073727

Corbet S, Lucey B, Yarovya L (2018a) Datestamping the Bitcoin and Ethereum bubbles. Finance Res Lett 26:81–88

Corbet S, Meegan A, Larkin C, Lucey B, Yarovaya L (2018b) Exploring the dynamic relationships between cryptocurrencies and other financial assets. Econ Lett 165:28–34

Darolles S, Le Fol G, Mero G (2017) Mixture of distribution hypothesis: analyzing daily liquidity frictions and information flows. J Econom 201(2):367–383

Darrat AF, Rahman S, Zhong M (2003) Intraday trading volume and return volatility of the DJIA stocks: a note. J Bank Finance 27(10):2035–2043

Darrat AF, Zhong M, Cheng LT (2007) Intraday volume and volatility relations with and without public news. J Bank Finance 31(9):2711–2729

Dickey DA, Fuller WA (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49:1057–1072

Diks C, Panchenko V (2005) A note on the Hiemstra-Jones test for Granger non-causality. Stud Nonlinear Dyn Econ 9(2):1–9

Diks C, Panchenko V (2006) A new statistic and practical guidelines for nonparametric Granger causality testing. J Econ Dyn Control 30(9):1647–1669

Dyhrberg AH (2016a) Bitcoin, gold and the dollar—a GARCH volatility analysis. Finance Res Lett 16:85–92

Dyhrberg AH (2016b) Hedging capabilities of Bitcoin. Is it the virtual gold? Finance Res Lett 16:139–144

Eleanor Xu X, Chen P, Wu C (2006) Time and dynamic volume–volatility relation. J Bank Finance 30(5):1535–1558

Epps TW, Epps ML (1976) The stochastic dependence of security price changes and transaction volumes: implications for the mixture-of-distributions hypothesis. Econometrica 44:305–321

Fleming J, Kirby C (2011) Long memory in volatility and trading volume. J Bank Finance 35(7):1714–1726

Fleming J, Kirby C, Ostdiek B (2006) Stochastic volatility, trading volume, and the daily flow of information. J Bus 79(3):1551–1590

Fry J, Cheah E-T (2016) Negative bubbles and shocks in cryptocurrency markets. Int Rev Finan Anal 47:343–352

Gandal N, Hamrick JT, Moore T, Oberman T (2018) Price manipulation in the Bitcoin ecosystem. J Monet Econ 95:86–96

Ghonghadze J, Lux T (2016) Bringing an elementary agent-based model to the data: estimation via GMM and an application to forecasting of asset price volatility. J Empir Finance 37:1–19

Granger CWJ (1988) Some recent development in a concept of causality. J Econom 39(1):199–211

Guesmi K, Saadi S, Abid I, Ftiti Z (2018) Portfolio diversification with virtual currency: Evidence from bitcoin. Int Rev Finan Anal. https://doi.org/10.1016/j.irfa.2018.03.004

Harris L (1987) Transaction data tests of the mixture of distributions hypothesis. J Finan Quant Anal 22(2):127–141

Hiemstra C, Jones JD (1994) Testing for linear and nonlinear Granger causality in the stock price-volume relation. J Finance 49(5):1639–1664

Jennings RH, Starks LT, Fellingham JC (1981) An equilibrium model of asset trading with sequential information arrival. J Finance 36(1):143–161

Jiang Y, Nie H, Ruan W (2018) Time-varying long-term memory in Bitcoin market. Finance Res Lett 25:280–284

Katsiampa P (2017) Volatility estimation for Bitcoin: a comparison of GARCH models. Econ Lett 158:3–6

Kim T (2017) On the transaction cost of Bitcoin. Finance Res Lett 23:300–305

Kristoufek L (2018) On Bitcoin markets (in) efficiency and its evolution. Physica A 503:257–262

Le V, Zurbruegg R (2010) The role of trading volume in volatility forecasting. J Int Finan Mark Inst Money 20(5):533–555

Lee CF, Rui OM (2000) Does trading volume contain information to predict stock returns? Evidence from China’s stock markets. Rev Quant Finance Acc 14(4):341–360

Lintilhac PS, Tourin A (2017) Model-based pairs trading in the Bitcoin markets. Quant Finance 17(5):703–716

Louhichi W (2011) What drives the volume–volatility relationship on Euronext Paris? Int Rev Finan Anal 20(4):200–206

Lux T (2008) The Markov-switching multifractal model of asset returns: GMM estimation and linear forecasting of volatility. J Bus Econ Stat 26(2):194–210

Magkonis G, Tsouknidis DA (2017) Dynamic spillover effects across petroleum spot and futures volatilities, trading volume and open interest. Int Rev Finan Anal 52:104–118

Mougoué M, Aggarwal R (2011) Trading volume and exchange rate volatility: evidence for the sequential arrival of information hypothesis. J Bank Finance 35(10):2690–2703

Nadarajah S, Chu J (2017) On the inefficiency of Bitcoin. Econ Lett 150:6–9

Park B-J (2010) Surprising information, the MDH, and the relationship between volatility and trading volume. J Financ Mark 13(3):344–366

Säfvenblad P (2000) Trading volume and autocorrelation: empirical evidence from the Stockholm Stock Exchange. J Bank Finance 24(8):1275–1287

Sensoy A (2019) The inefficiency of Bitcoin revisited: A high-frequency analysis with alternative currencies. Finan Res Lett 28:68–73

Shen D, Li X, Zhang W (2018) Baidu news information flow and return volatility: evidence for the Sequential Information Arrival Hypothesis. Econ Model 69:127–133

Shen D, Urquhart A, Wang P (2019) Does twitter predict Bitcoin? Econ Lett 174:118–122

Śmiech S, Papież M (2017) In search of hedges and safe havens: revisiting the relations between gold and oil in the rolling regression framework. Finance Res Lett 20:238–244

Tauchen GE, Pitts M (1983) The price variability-volume relationship on speculative markets. Econometrica 51:485–505

Tiwari AK, Jana RK, Das D, Roubaud D (2018) Informational efficiency of Bitcoin—an extension. Econ Lett 163:106–109

Urquhart A (2016) The inefficiency of Bitcoin. Econ Lett 148:80–82

Urquhart A (2017) Price clustering in Bitcoin. Econ Lett 159:145–148

Urquhart A (2018) What causes the attention of Bitcoin? Econ Lett 166:40–44

Urquhart A, Zhang H (2018) Is Bitcoin a hedge or safe-haven for currencies? An intraday analysis. Available at SSRN: http://dx.doi.org/10.2139/ssrn.3114108

Vidal-Tomás D, Ibañez A (2018) Semi-strong efficiency of Bitcoin. Finan Res Lett 27:259–265

Vidal-Tomás D, Ibáñez AM, Farinós JE (2018) Herding in the cryptocurrency market: CSSD and CSAD approaches. Finance Res Lett. https://doi.org/10.1016/j.frl.2018.09.008

Wagner N, Marsh TA (2005) Surprise volume and heteroskedasticity in equity market returns. Quant Finance 5(2):153–168

Yamamoto R (2011) Volatility clustering and herding agents: does it matter what they observe? J Econ Interact Coord 6(1):41–59

Zhang W, Wang P, Li X, Shen D (2018a) The inefficiency of cryptocurrency and its cross-correlation with Dow Jones Industrial Average. Physica A 510:658–670

Zhang W, Wang P, Li X, Shen D (2018b) Some stylized facts of the cryptocurrency market. Appl Econ 50(55):5950–5965

Acknowledgements

This work is supported by the National Natural Science Foundation of China (71701150, 71790590 and 71790594), Young Elite Scientists Sponsorship Program by Tianjin (TJSQNTJ-2017-09) and the Fundamental Research Funds for the Central Universities (63192237).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there are no conflict of interest regarding the publication of this article.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wang, P., Zhang, W., Li, X. et al. Trading volume and return volatility of Bitcoin market: evidence for the sequential information arrival hypothesis. J Econ Interact Coord 14, 377–418 (2019). https://doi.org/10.1007/s11403-019-00250-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-019-00250-9

Keywords

- Bitcoin

- Trading volume

- Return volatility

- Mixture of distribution hypothesis

- Sequential information arrival hypothesis

- Foreign currencies