Abstract

This paper aims mainly at building artificial stock markets with different maturity levels by modeling information asymmetry and herd behavior. The developed artificial markets are multi-assets, order-driven and populated by agents having heterogeneous behaviors and information. Agents are defined by their information and their herd behavior levels. Agents trade multiple risky assets based on their wealth, their behaviors and their available information which spread among multiple behavioral networks. In a novel contribution to artificial stock markets literature, agents’ behaviors modeling is mixed with social network simulation to reproduce different degrees of information asymmetry and herd behavior based on several assortative topologies. Several simulations validated the proposed model since univariate and multivariate stylized facts were reproduced both for mature and immature stock markets. The proposed artificial stock market can be considered as a first step toward decision and simulation tools for optimal management, strategy analysis and predictions evolution of immature stock markets.

Similar content being viewed by others

Notes

Foster et al. (2010) introduced the measure \(r_{\alpha -\beta }\), where \((\alpha ,\beta ) \in \) (in,out)-edges. A significant positive \(r_{\alpha -\beta }\) reflects \(\alpha -\beta \) assortativity, meaning that nodes with highly \(\alpha \)-degree look for relations with nodes with highly \(\beta \)-degree. A significant negative \(r_{\alpha -\beta }\) indicates that nodes with highly \(\alpha \)-degree look for relations with nodes with low \(\beta \)-degree indicating presence of \(\alpha -\beta \) disassortativity.

Significant assortative measures are found: \(r_{out-in} = -0.123\), \(r_{in-out} = -0.553\), \(r_{in-in} = 0.440\) and \(r_{out-out} = 0.451\).

The Zagreb Stock Exchange (ZSE) and the Mauritius SEMDEX are considered in the MSCI classification as frontier markets which are associated to the most immature markets in our simulation.

References

Alagidede P (2011) Return behaviour in Africa’s emerging equity markets. Q Rev Econ Financ 51:133–140

Alvarez-Ramirez J, Rodriguez E, Alvarez J (2012) A multiscale entropy approach for market efficiency. Int Rev Financ Anal 21:64–69

Amaral LAN, Scala A, Barthélémy M, Stanley HE (2000) Classes of small-world networks. Proc Natl Acad Sci USA 97:11149–11152

Baker M, Wurgler J (2007) Investor sentiment in the stock market. J Econ Perspect 21(2):129–151

Barabási AL, Albert R (1999) Emergence of scaling in random networks. Science 286:506–512

Barber B, Odean T, Zhu N (2009) Systematic noise. J Financ Mark 12(4):547–569

Bekaert G, Harvey C (2003) Emerging markets finance. J Empir Financ 10:3–55

Bikhchandani S, Sharma S (2001) Herd behavior in financial markets. IMF Staff Pap 47(3):279–310

Bollobás B, Borgs C, Chayes T, Riordan O (2003) Directed scale-free graphs. In: Extreme value theory, Proceedings of the 14th ACM-SIAM symposium on discrete algorithms, pp 132–139

Brock W, Hommes C (1998) Heterogeneous beliefs and routes to chaos in a simple asset pricing model. J Econ Dyn Control 22:1235–1274

Brown S, Hillegeist A (2007) How disclosure quality affects the level of information asymmetry. Rev Account Stud 12:443–477

Bushman RM, Smith AJ (2003) Transparency, financial accounting information, and corporate governance. Econ Policy Rev 9(1):65–87

Chiarella C, Iori G, Perello J (2009) The impact of heterogeneous trading rules on the limit order book and order flows. J Econ Dyn Control 33:525–537

Cont R (2001) Empirical properties of asset returns: stylized facts and statistical issues. Quant Financ 1:223–236

De Santis G, Imrohoroglu S (1997) Stock returns and volatility in emerging financial markets. J Int Money Financ 16:561–579

Foster G, Foster D, Grassberger P, Paczuski M (2010) Edge direction and the structure of networks. In: Proceedings of the national academy of sciences. Proceedings of the 14th ACM-SIAM symposium on discrete algorithms, pp 1–6

Guo Q, Zhou T, Liu J, Bain W, Wang B, Zhao M (2006) Growing scale-free small-world networks with tunable assortative coefficient. Phys A 371:814–822

Ionescu C (2012) The herd behavior and the financial instability. Ann Univ Petroşani Econ 12(1):129–140

Jurkatis S, Kremer S, Nautz D (2012) Correlated trades and herd behavior in the stock market. SFB 649 economic risk Berlin discussion paper 2012-035

Kim W, Wei S (2002) Foreign portfolio investors before and during a crisis. J Int Econ 56:77–96

Krichene H, El-Aroui M (2016) Agent-based simulation and microstructure modeling of immature stock markets: case of a single risky asset. Comput Econ. doi:10.1007/s10614-016-9615-y

Laloux L, Cizeau P, Bouchaud JP, Potters M (1999) Noise dressing of financial correlation matrices. Phys Rev Lett 83(7):1467–1470

LeBaron B, Yamamoto R (2008) The impact of imitation on long memory in an order-driven market. East Econ J 34:504–517

Maffett M (2011) Who benefits from corporate opacity? International evidence from informed trading by institutional investors. University of North Carolina (unpublished paper)

Mantegna R, Stanley H (1994) Stochastic process with ultraslow convergence to a gaussian: the truncated lévy flight. Phys Rev Lett 22(73):2946–2949

Mantegna R, Stanley H (1995) Scaling behaviour in the dynamics of an economic index. Nature 376:46–49

Newman M (2002) Assortative mixing in networks. Phys Rev Lett 89:208701

Pan R, Sinha S (2007) Collective behavior of stock price movements in an emerging market. Phys Rev 76(046):116

Pincus S (1995) Approximate entropy (apen) as a complexity measure. Chaos 5(1):17

Ponta L, Pastore S, Cincotti S (2011) Information-based multi-assets artificial stock market with heterogeneous agents. Nonlinear Anal Real World Appl 12:1235–1242

Shen J, Zheng B (2009) Cross-correlation in financial dynamics. Europhys Lett 86(48):005

Tedeshi G, Iori G, Gallegati M (2012) Herding effects in order driven markets: the rise and fall of gurus. J Econ Behav Organ 81:82–96

Wang J (1993) A model of intertemporal asset prices under asymmetric information. Rev Econ Stud 60:249–282

Weron R (2002) Estimating long range dependence: finite sample properties and confidence intervals. Phys A 312:286–299

Yartey C (2008) The determinants of stock market development in emerging economies: is South Africa different? Working paper 08/32, International Monetary Fund, Washington

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Behavioral network algorithm

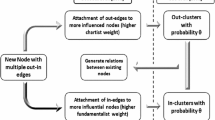

For simplicity, we drop the asset subscript k from all variables. We consider an initial network, \(G_0\) formed by two agents, where the fundamentalist exerts influence on the chartist. At each time step, a new agent i comes. With probability \(\alpha \) it chooses to emit \(m_{out} \in \{0,\dots ,m\}\) out-edges proportional to its fundamentalist weight, by selecting a set of existent agents following their in-strength \(s_j^{in} + \delta _{in}\). \(\delta _{in}\) reflects that even if one agent has no-influence, it has always a chance to receive in-edges from new comers. Then, agent i will select other out-neighbors from in-neighbors set of its out-neighbors, based on their out-strength depending on parameter \(\theta \) (influential agents share private information between them). With probability \(\gamma \), new agent i chooses to receive \(m_{in} \in \{0,\dots ,m\}\) influences proportional to its chartist weight, from existent agents selected based on their out-strength \(s_j^{out} + \delta _{out}\). Therefore, agent i will look for clusters by establishing other in-edges based on the out-neighbors set of its in-neighbors (influenced agents share private information between them). Finally, to enrich the behavioral specificity of the network, with probability \(\beta \), existent agents will exchange connections among them. Indeed, more influential agents will have more chance to exert influence on more influenced agents. Following Bollobás et al. (2003), we define parameters as \(\alpha + \beta + \gamma = 1\), and we favor the probability \(\beta \) rather than \(\alpha \) and \(\gamma \) to promote behavioral out and in connections, instead of randomness. We choose also, \(\alpha = \gamma \) and \(\delta _{in} = \delta _{out}\) in order to introduce symmetry in random \(out-in\) edges.

Appendix 2: Multi-Assets BI-ABM algorithm

By considering agents with their behaviors and multiple traded assets, Algorithm 2 describes the way of forming multiple artificial price series.

Rights and permissions

About this article

Cite this article

Krichene, H., El-Aroui, MA. Artificial stock markets with different maturity levels: simulation of information asymmetry and herd behavior using agent-based and network models. J Econ Interact Coord 13, 511–535 (2018). https://doi.org/10.1007/s11403-017-0191-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-017-0191-6

Keywords

- Agent-based model

- Multi-assets trading

- Immature stock markets

- Information asymmetry

- Herd behavior

- Assortativity