Abstract

This study considers the act of entering into new technological domains for R&D purposes as one of the most intense entrepreneurial activities within large established firms, referring to it as R&D entrepreneurship. Attempting to detect factors that could strengthen (or weaken) the impact of R&D entrepreneurship on innovation performance, I examine the moderating role of three important R&D strategies, namely the knowledge plurality, internal focus, and R&D collaboration. I empirically test the hypotheses developed in this study on secondary, longitudinal economic and patent data from a sample of 139 firms from the industries of pharmaceuticals, biotechnology, and chemicals for a 7-year period, using fixed-effects negative binomial regression models. Findings support that the relationship between R&D entrepreneurship and innovation performance is positively moderated by knowledge plurality but negatively by internal focus and R&D collaboration.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Given the importance of entrepreneurship for societal welfare, one would expect greater scholarly and policy attention to entrepreneurship within established firms, especially when compared with the attention that start-ups have received (Brown et al., 2001; Dess et al., 1999). Although there exist two important streams of literature that address this issue, namely the strategic and corporate entrepreneurship (Covin & Miles, 1999; Glinyanova et al., 2021; Hitt et al., 2001; Ireland et al., 2009; Phan et al., 2009), the amount of research effort that has been devoted to entrepreneurship within large established firms is relatively little if we consider the significant role that this kind of firms plays as social entities and their enormous entrepreneurial potential (Kuratko & Audretsch, 2013).

Identifying and investigating firm activities that incorporate, to a large extent, typical entrepreneurial elements can provide useful insights into the field of entrepreneurship within existing firms. In this study, I consider the act of entering into new to the firm technological domains for R&D purposes as a purely entrepreneurial activity characterized by intense innovativeness, proactiveness, and risk-taking (Rank & Strenge, 2018; Wales et al., 2020; Zahra & Covin, 1995). I refer to it as R&D entrepreneurship to place emphasis on the entrepreneurial dimension of this particular act.

In addition to analyzing the entrepreneurial aspect of entering into new to the firm technological domains, this research investigates what conditions, and in particular what R&D strategies, influence the success of R&D entrepreneurship. More specifically, I develop three hypotheses to theoretically and empirically examine whether the extent to which a firm enriches its knowledge base (i.e., knowledge plurality), builds upon its own prior technological achievements (i.e., internal focus), and collaborates with other partners to develop new inventions (i.e., R&D collaboration) has a moderating effect on the relationship between R&D entrepreneurship and innovation performance.

I test my hypotheses using secondary, longitudinal data on a sample of biotechnology, pharmaceutical, and chemical firms. In particular, I obtained publicly available economic data from the EU Industrial R&D Investment Scoreboard, which I combined with patent data from the Derwent Innovation Index for the period from 2003 to 2009. Findings suggest that although R&D entrepreneurship does result in higher innovation performance, its effect is contingent on the above-mentioned R&D strategies. More specifically, the empirical results show that knowledge plurality positively moderates the relationship between R&D entrepreneurial activities and innovation performance, in contrast to internal focus and R&D collaboration, which exert a negative moderating effect.

By arguing for the recognition of entry into new technological areas as one of the most representative manifestations of entrepreneurial spirit, this research contributes to addressing the problem of lack of established measures of entrepreneurship in large firms (Brown et al., 2001; Covin & Wales, 2019). A second contribution is that it provides empirical evidence concerning certain R&D strategies that firms could use to create favorable conditions for their R&D entrepreneurial activities.

The examination of how firms can create value by identifying and pursuing unexploited opportunities is important not only for scholars but also for practitioners and policy-makers (Hitt et al., 2011). By considering R&D entrepreneurship as a strategy for significant corporate rejuvenation and by creating conditions under which R&D entrepreneurship can increase its effect on innovation performance, managers could succeed in developing new ventures within their firms that will lead to new competitive advantages and growth. In addition, because policy-makers view entrepreneurship as a powerful stimulus for economic wealth creation (Ireland et al., 2003), being aware of key entrepreneurial activities and their favorable conditions is essential for forming effective entrepreneurship policies (Ahmad & Seymour, 2008).

I begin by analyzing R&D entrepreneurship and investigating its theoretical connections with existing conceptual frameworks. I then present the hypotheses, the methodology, and the results of the regression models. A discussion of the findings follows and the paper ends with the conclusions, limitations, and directions for future research.

Theoretical background

The dominant view of entrepreneurship as a field of research is that it examines how, by whom, and with what effects previously unexploited opportunities entailing the discovery of new means-ends relationships are identified and exploited (Hitt et al., 2001; Shane & Venkataraman, 2000). These entrepreneurial opportunities are ex-ante highly uncertain, but their recognition and exploitation lead to the creation of businesses with typically higher growth and eventually to higher levels of societal wealth and development, compared to businesses created by all other opportunities for profit, that is, opportunities for the optimization within existing means-ends frameworks (Ahmad & Seymour, 2008; Grégoire & Shepherd, 2012; Ireland et al., 2003; Shane & Venkataraman, 2000).

It is widely accepted that entrepreneurship is not limited to individual entrepreneurs and their ventures, but it can also emerge in large firms, as evidenced by the growing body of entrepreneurship literature that focuses on the firm level of analysis (Alvarez & Busenitz, 2001; Ireland et al., 2005; Salvato et al., 2009). Two are the major streams of literature that provide insights into entrepreneurial phenomena within established firms: the corporate entrepreneurship and the strategic entrepreneurship research (Ireland et al., 2009; Kuratko & Audretsch, 2009).

Corporate entrepreneurial activities aim at identifying and exploiting new opportunities beyond firms’ core businesses, either through the birth of new businesses or through the rebirth of existing ones (Corbett et al., 2013; Dunlap-Hinkler et al., 2010; Sharma & Chrisman, 2007; Stopford & Baden-Fuller, 1994; Veciana, 2007). According to corporate entrepreneurship logic, established firms must achieve a balance between activities that are based on existing knowledge and new activities created for the pursuit of unexploited opportunities that will lead to their rejuvenation (Ahuja & Morris Lampert, 2001; Covin & Miles, 1999; Zahra et al., 1999).

Strategic entrepreneurship adopts an almost identical approach to corporate entrepreneurship but puts more emphasis on the strategic perspective by setting the entrepreneurial actions under the umbrella of strategic management (Glinyanova et al., 2021; Hitt et al., 2001; Kuratko & Audretsch, 2009; Schindehutte & Morris, 2009). More specifically, firms engaging in strategic entrepreneurship are committed to performing advantage-seeking and opportunity-seeking behaviors simultaneously, in order to sustain current competitive advantages and to create new ones, respectively (Ireland et al., 2003; Siren et al., 2012; Zhao et al., 2020). Advantage-seeking activities serve the protection, enhancement, and exploitation of firms’ current competitive positions, whereas opportunity-seeking activities seek to identify and exploit new entrepreneurial opportunities that will lead to new competition arenas (Withers et al., 2018).

Whether viewed through the lens of corporate or strategic entrepreneurship, one of the most important firm-level entrepreneurial activities is innovation (Covin & Miles, 1999; Dunlap-Hinkler et al., 2010; Hitt et al., 2001; Kelley et al., 2009; Schindehutte & Morris, 2009). In general, an entrepreneurial activity “invariably involves the development of a new idea that others have overlooked or chosen not to pursue” (Alvarez & Busenitz, 2001, p. 759). The creation of new knowledge within established firms, as is the case with the invention of a new technology, is undoubtedly a manifestation of an entrepreneurial action (Shane & Venkataraman, 2000). It presupposes that actors within firms, driven by their entrepreneurial spirit, have recognized the value and opportunity of a new knowledge and have organized it in such a way as to result in competitive products or services (Alvarez & Busenitz, 2001; Zahra et al., 1999).

Among all entrepreneurial activities pertaining to innovation, inventing in new technological areas is perhaps the most representative manifestation of entrepreneurial spirit within established firms. I refer to the act of entering into new to the firm technological domains for R&D purposes as R&D entrepreneurship. R&D entrepreneurship involves all three dimensions that characterize entrepreneurial orientation, either at the firm or individual level: innovativeness, proactiveness (i.e., acting in anticipation of future changes), and risk-taking (Covin & Wales, 2019; McKenny et al., 2018; Putniņš & Sauka, 2020; Rank & Strenge, 2018; Wales et al., 2020; Wang et al., 2017). All of these attributes are typical of any R&D activity aiming at new technological inventions, but they become more intense when R&D activity takes place in new technological areas.

Although R&D entry into novel technological fields has not been explicitly considered and studied as a genuine entrepreneurial activity, some researchers have argued that seeking opportunities in novel markets is one of the purest forms of entrepreneurship (Siren et al., 2012; Shankar & Shepherd, 2019). For example, Burgelman (1983) restricts corporate entrepreneurship to diversification into activities that are unrelated, or marginally related, to the firms’ existing domains of competence. Moreover, Ellis and Taylor (1987) view corporate venturing as a strategy of unrelatedness to the firms’ current activities, while Wiklund and Shepherd (2003) suggest that organizations with an intense entrepreneurial orientation are more prone to venture into the unknown. This idea is also consistent with Withers et al.’s (2018) conceptualization of strategic entrepreneurship, according to which firms engaging in strategic entrepreneurship are more apt to recognize and exploit opportunities outside of their current areas of competition. Finally, we refer to Zahra (2008, p. 246) who perceives corporate entrepreneurship as “the set of activities companies and their members undertake to enter new market arenas that offer opportunities for growth and profits”, providing the investments in new R&D fields as an example.

The most common way to approach the entry into new technological domains as an organizational phenomenon is to view it either within the exploration-exploitation or within the distant search context. In particular, many researchers have conceptualized exploration as an activity that stretches in outside domains by relying on entirely new knowledge bases beyond the neighborhood of current known alternatives, aiming at entering new product markets (Anzenbacher & Wagner, 2020; He & Wong, 2004; Rothaermel & Alexandre, 2009; Sidhu et al., 2007; Siren et al., 2012; Vagnani, 2015). Seen from the perspective of distant search, the act of entering into new technological domains involves recombinations of unfamiliar knowledge obtained from domains that are unrelated to firms’ current knowledge areas (George et al., 2008; Lopez-Vega et al., 2016; Phelps, 2010; Rosenkopf & Nerkar, 2001), allowing them to follow novel technological trajectories (Ghosh et al., 2014).

Irrespective of the conceptual approach to R&D entrepreneurship, the majority of the studies in the relevant literature have suggested that R&D entrepreneurship can have a direct positive effect on innovation performance (Freixanet et al., 2021; Ince et al., 2021; Katila & Ahuja, 2002). By combining cognitive elements from known knowledge areas with elements from unfamiliar ones, the entry into new technological domains can lead to knowledge variations that differ from knowledge variations generated within existing domains (George et al., 2008; Sidhu et al., 2007). Their difference lies in the extent of their potential to generate a new technological trajectory, as a consequence of the heterogeneity of knowledge components that are synthesized when entering into novel territories of knowledge. This potential could provide the basis for breakthrough inventions and radical innovations, which in turn can lead to higher innovation performance. Additionally, enriching prior knowledge with knowledge from novel technological domains can provide new insights to solve current problems, improving the innovation output in existing markets (Ahuja & Morris Lampert, 2001; Lopez-Vega et al., 2016). From a strategic perspective, the above positive effects of R&D entrepreneurship on innovation performance could enhance strategic flexibility and adaptability to environmental changes, improving organizations’ long-run financial performance (Bierly & Chakrabarti, 1996; Vagnani, 2015).

However, this positive impact is likely to be contingent on a variety of contextual factors that could enhance or diminish it. This study focuses theoretically and empirically on a specific category of contingency factors, namely firm-level characteristics pertaining to R&D strategy whose intensity depends largely upon the firm’s decisions. In particular, I investigate whether the degree to which a firm enriches its knowledge base (i.e., knowledge plurality), builds upon its own prior technologies (i.e., internal focus), and collaborates with other partners to develop new inventions (i.e., R&D collaboration) exerts a moderating effect on the relationship between R&D entrepreneurship and innovation performance, considering innovation performance as an assessment of the innovation results based on the quantity and quality of the innovation output (Ince et al., 2021). This paper focuses on the moderating rather than the direct effect of these variables on innovation performance, since the aim of the study is to detect favorable R&D strategies that can positively moderate the effect of entry into new technological areas on innovation performance and not to examine their direct impact.

By recognizing the intense entrepreneurial nature of R&D entry into new technological areas, its importance as an organizational phenomenon increases, and thus the identification of favorable strategies for the success of R&D entrepreneurship becomes more crucial not only for managers, who seek growth and competitive advantages, but also for policy-makers. As a purely entrepreneurial activity, when firms expand their R&D activities into new technological domains, they generate employment opportunities and innovations that boost competitiveness, productivity, and job creation. Policy-makers must be aware of the factors that moderate the effect of R&D entrepreneurship on innovation output to design and implement effective entrepreneurship policies.

Hypotheses

Knowledge plurality

Knowledge plurality refers to the extent to which a firm builds upon a large number of different knowledge components to develop new technologies. I argue that numerous knowledge elements create a diverse knowledge base, which, in turn, enhances the firm’s ability to successfully enter new technological domains, pursuing technological and market opportunities.

Knowledge plurality facilitates understanding of unfamiliar information (Zhou & Li, 2012), because the more diverse the knowledge stock, the lower the cognitive distance between new and existing knowledge components. As the number of cognitive elements increases within a firm’s knowledge base, the likelihood that some of them will be closer to the cognitive elements of the new technological domains increases as well. Due to this enhanced ability to comprehend information from unfamiliar knowledge domains, firms are more capable of monitoring changes and detecting opportunities that deserve exploration in areas beyond their own technological boundaries (Siren et al., 2012; Zahra, 2008; Zhang & Baden-Fuller, 2010).

In addition to recognizing promising opportunities, knowledge plurality is essential for the effective assimilation and integration of knowledge from distant fields and, consequently, for the successful development of new technological ideas within the new fields (Quintana-García & Benavides-Velasco, 2008; Siren et al., 2012). The greater the number of knowledge elements, the greater the number of cognitive lenses through which a firm perceives the knowledge from novel domains and integrates it with the existing pool of knowledge. Knowledge plurality increases the number and variety of the “knowledge seeds” transferred from existing knowledge areas to new ones, creating cross-fertilization of ideas, highly novel solutions, and eventually, important exploratory innovations within the new technological domains (George et al., 2008; Phelps, 2010).

When examining the moderating role of knowledge plurality on the impact of R&D entrepreneurship on innovation performance, interesting theoretical insights can also arise from applying the concept of absorptive capacity (Cohen & Levinthal, 1990; Lane et al., 2006). As often argued in the relevant literature, the accumulation of a large number of diverse knowledge components within a firm’s knowledge base strengthens its ability to recognize, assimilate, and apply external knowledge, that is, it strengthens its absorptive capacity (Kumar, 2010; Quintana-García & Benavides-Velasco, 2008; Zhang & Baden-Fuller, 2010). Enhanced absorptive capacity favors R&D entrepreneurial activity because it improves the firm’s ability to recognize, understand, and assimilate potentially valuable external knowledge from unfamiliar technological domains and, by using the assimilated knowledge, to create new knowledge and commercial outputs within these domains (Salvato et al., 2009; Zhang, 2016). Increased absorptive capacity lowers the uncertainty, misunderstanding, and confusion that inevitably emerges when entering a novel knowledge area.

Therefore, I expect that the effect of R&D entrepreneurship on innovation performance will be stronger when the firm’s knowledge base is larger. Hence, based on the above considerations, I posit the following hypothesis:

Hypothesis 1

The effect of R&D entrepreneurship on innovation performance will be positively moderated by knowledge plurality.

Internal focus

In this paper, the notion of internal focus refers to the degree to which a firm draws upon its own prior R&D activities in its effort to generate new innovations (Papazoglou & Spanos, 2018; Sørensen & Stuart, 2000). Strong internal focus indicates an R&D strategy, according to which a firm chooses to rely extensively upon its previous patented inventions to develop new knowledge (Rosenkopf & Nerkar, 2001). I treat internal focus as a moderating factor and I contend that the effect of R&D entrepreneurship on innovation performance diminishes when combined with strong internal focus.

By building to a large degree upon the knowledge created in its previous R&D efforts, a firm strengthens its core competencies, but on the other hand, it increases the risk of core rigidities and traps (Ahuja & Morris Lampert, 2001; Rosenkopf & Nerkar, 2001). When a firm attempts to enter a new technological domain, familiarity traps could reduce its ability to select and evaluate the most promising knowledge areas within the new domain or the areas that best suit its prior stock of knowledge (Hoang & Rothaermel, 2010).

From an organizational learning perspective, a firm with a strong internal focus is expected to face considerable difficulties in absorbing unfamiliar knowledge during its R&D entrepreneurial ventures. By paying relatively limited attention to integrating external developments, a firm is likely to be bounded by its idiosyncratic routines and culture (Hoetker & Agarwal, 2007). This will probably cause serious problems in the knowledge integration process. The inherent cognitive complexity and causal ambiguity associated with the research in unfamiliar knowledge domains will be even greater if internal focus is intense, as will the inappropriate and arbitrary generalizations and inferences (Ghosh et al., 2014).

The high level of cognitive demands required for R&D entrepreneurship will be more difficult to be met in the presence of strong internal focus, as it could be more confusing and complex to successfully identify and assimilate distant knowledge components (Walter et al., 2016). Rigidifying the cognitive capabilities of an organization frames the way its R&D department thinks and interprets issues related to the development of knowledge outside of the organization’s boundaries, hindering the assimilation of discrepant and distant knowledge elements (Walter et al., 2016).

Consequently, it is anticipated that internal focus will impede the successful outcome of searching for opportunities in unfamiliar knowledge territories, and thus, I propose the following hypothesis:

Hypothesis 2

The effect of R&D entrepreneurship on innovation performance will be negatively moderated by internal focus.

R&D collaboration

R&D collaboration is defined here as the number of partners with whom a firm cooperates to develop new patented inventions. Several researchers have argued that by providing access to critical external knowledge and complementary assets, R&D alliances can improve firm learning and innovation performance (Audretsch et al., 2020; Kelley et al., 2009; Lahiri & Narayanan, 2013; Phelps, 2010; Zhu et al., 2021). However, I expect that it is unlikely that the effect of R&D entrepreneurship on innovation performance will remain positive when R&D entrepreneurship interacts with R&D collaboration. Although R&D collaboration gives access to external knowledge, which, in turn, increases knowledge plurality (a positive moderating effect according to Hypothesis 1), I anticipate the negative consequences of the moderating impact of R&D collaboration to prevail over the positive ones.

R&D entrepreneurial activities are cognitively demanding processes that require strong organizational focus. When a firm attempts to assimilate and integrate new knowledge from unfamiliar technological domains, it is more efficient to avoid the excessive use of external, tacit knowledge that is possessed by its R&D partners. Knowledge residing in other firms is, to an extent, rooted in their experience, skills, and know-how. Therefore, its transfer to the R&D entrepreneurial firm is difficult because it is contingent upon the conversion of the tacit into explicit, codified, and articulated knowledge (Bierly et al., 2009; Xu, 2015). The differences between R&D partners in their dominant logics and knowledge bases demand extra cognitive efforts, distracting the organization’s attention from the new entrepreneurial opportunities (Hoang & Rothaermel, 2010).

In addition, integrating novel knowledge from R&D partners often requires changing internal routines and procedures and existing patterns of communication (Lahiri & Narayanan, 2013; Phelps, 2010). Although cognitive distance (i.e., differences in interpretation systems, systems of shared meanings and perception, etc.) between firms engaged in R&D alliances is necessary for creativity (Dunlap-Hinkler et al., 2010; Nooteboom et al., 2007), it nevertheless increases demands on managerial attention, bureaucracy, and transaction costs (Lahiri & Narayanan, 2013). A firm must have frequent interactions and richer communication with its R&D collaborators, which operate under different cultures and norms (Hoang & Rothaermel, 2010), to facilitate the assimilation of their tacit knowledge (Bierly et al., 2009; Hottenrott & Lopes-Bento, 2016; Katila & Ahuja, 2002). However, in cases where the firm is involved in large numbers of R&D alliances and in entering into novel technological domains, the increased communication efforts and transaction costs are likely to negatively affect the relationship between R&D entrepreneurship and innovation performance.

Moreover, considering the organizations’ limited resources, one can argue that when R&D collaboration interacts with R&D entrepreneurship, organizations are likely to be constrained by a lack of resources, since both of them are highly resource-consuming R&D activities (Phelps, 2010; Zhou & Li, 2012). A firm that participates to a large extent in R&D alliances allocates significant amounts of resources in its effort to understand and integrate its partners’ knowledge (Phelps, 2010). However, given the cognitive capacity’s constraints and limitations, working on numerous R&D collaborations may cause insufficient attention to R&D entrepreneurial activities, jeopardizing their positive impact on innovation performance (Zhou & Li, 2012).

Therefore, the above-mentioned important challenges of learning from dissimilar organizations, partnering under conditions of significant knowledge novelty and ambiguity, as is the case with R&D entrepreneurship, lead to the following hypothesis:

Hypothesis 3

The effect of R&D entrepreneurship on innovation performance will be negatively moderated by R&D collaboration.

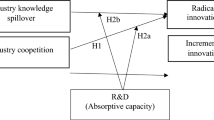

Figure 1 presents in graphical form the moderating effects of knowledge plurality, internal focus, and R&D collaboration (dashed lines) on the relationship between R&D entrepreneurship and innovation performance (solid line). Plus and minus signs next to the dashed lines indicate positive and negative moderating effects, respectively.

Methodology

Research setting and sample

To empirically test the hypotheses, I chose the pharmaceutical, biotechnology, and chemical industries as the research setting. First, within these industries, which are three of the most technology-intensive industries, fierce technological competition takes place, which in turn forces technology to evolve rapidly (De Carolis, 2003; Gittelman & Kogut, 2003). These conditions favor R&D entrepreneurship because, in their pursuit of unexploited opportunities, firms are likely to consider entry into new technological domains as a worthwhile endeavor. Second, the selected industries are characterized by a strong appropriability regime, which motivates firms to patent their technological achievements, offering scholars the opportunity to trace their inventive activity. (Ahuja, 2000; Cozzolino & Rothaermel, 2018; Sørensen & Stuart, 2000). Finally, R&D alliances are prevalent in these industries and, thus, a crucial element of innovation performance (Ahuja, 2000; Anand et al., 2010).

Two sources of data were used in this study. First, the EU Industrial R&D Investment Scoreboard (Scoreboard), which provides economic data of the top corporate R&D investors, accounting for more than 90% of the worldwide business enterprise expenditure on R&D (Filippetti & Archibugi, 2011; Moncada-Paternò-Castello et al., 2010; Wiesenthal et al., 2012). I collected data for 139 firms (29 from biotechnology, 46 from pharmaceuticals, and 64 from chemicals) that were present every year in the Scoreboard (i.e., balanced panel) for the period from 2003 to 2009. For those 139 firms, I collected additional data about their patenting activity from the Derwent Innovation Index Database (DII), which is a database that provides all the information incorporated in a patent document (Alencar et al., 2007; Lettl et al., 2009; Gittelman & Kogut, 2003).

Variables

Dependent variable

I employed forward patent citations (i.e., patent citations received) to proxy innovation performance, considering the usefulness of patented inventions and their impact on future patents as a manifestation of the importance of the innovation outcome (Anzenbacher & Wagner, 2020; Onal Vural et al., 2013; Papazoglou & Spanos, 2021). Forward patent citations, compared to a raw count of patents, offer a qualitative measure of innovation output in addition to the quantitative (Magelssen, 2020; Rothaermel & Alexandre, 2009; Rothaermel & Hess, 2007; Yayavaram & Chen, 2015). Besides, the validity of patent citations as an indicator of the quality and importance of innovations has been empirically supported by “the correlation between the inter-subjective assessment of the importance of patents by technical specialists and the number of citations” (Hagedoorn & Cloodt, 2003, p. 1369). In particular, I measured Innovation Performance as the total number of citations a firm’s patents filed in year t (2003 ≤ t ≤ 2009) received by the end of 2011, excluding self-citations (i.e., applicant’s citations to its own patents).

Independent variable

R&D entrepreneurship

As already noted, R&D entrepreneurship refers to the extent to which a firm is engaged in R&D activities that depart completely from its prior knowledge base, experimenting with technologies that it has not used previously (Stettner & Lavie, 2014). To construct this variable, I employed the international patent classes (IPCs), that is, the technical areas to which the patent examiner assigns each patent. In particular, a firm is considered to be involved in entrepreneurial activities when it enters a new technological domain by applying for a patent in an IPC in which it had not applied in the previous four years, based on the assumption that a technological class in which a firm has not been active for the last four years is considered as unfamiliar to it (Ahuja & Morris Lampert, 2001; Carnabuci et al., 2015). An IPC is regarded as new if its first three alphanumeric symbols (letters and numerals) are different from the corresponding symbols of the IPCs of all patents of the last four years. Thus, for each firm-year observation, I measured R&D Entrepreneurship as the number of patents that include an IPC that is novel to the firm. For robustness, I computed this variable using a five-year and a six-year interval instead of a four-year one. As an additional robustness test, I employed the first four alphanumeric symbols of the IPC instead of the first three, aiming to examine whether the results of the empirical analyses change when the entry into novel technological domains includes cases of entrepreneurial activities in less distant knowledge areas.

Moderating variables

Knowledge plurality

I measured Knowledge Plurality using the number of citations a firm’s patents make to previous patents (i.e., backward patent citations). Backward patent citations indicate the amount of knowledge inputs upon which the new patented inventions have relied (Carnabuci et al., 2015; Jung & Lee, 2016; Operti & Carnabuci, 2014). By being based on backward patent citations, this variable goes beyond just measuring knowledge plurality in terms of innovation output (e.g., number of patents). Instead, it captures all the knowledge that a firm assimilated and employed to develop its inventions. Actually, this knowledge denotes the knowledge base upon which the firm’s absorptive capacity is built. More specifically, for each firm-year observation, I computed Knowledge Plurality as the average number of patents’ backward citations.

Internal focus

I used the number of self-citations to measure Internal Focus, as self-citations can reflect the extent to which a firm builds upon its own prior technological developments (De Carolis, 2003; Hoetker & Agarwal, 2007). In particular, for each firm-year observation, I computed Internal Focus as the log of the total number of self-citations made by the focal firm’s patents.

R&D collaboration

To compute R&D Collaboration, I employed the number of patent co-assignees, that is, the organizations or individuals with whom a firm cooperates to develop and patent new inventions (Sapsalis et al., 2006). More specifically, for each firm-year observation, I measured R&D Collaboration as the average number of co-assignees per patent.

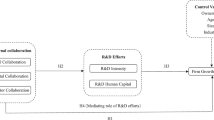

Control variables

It is critical to include in the regression models a number of control variables that could affect forward patent citations. To this end, I controlled for Firm Size, measured as the log of the number of employees (Argyres & Silverman, 2004; Lahiri & Narayanan, 2013), R&D Expenditure, computed as the log of R&D Expenditure (Ahuja & Morris Lampert, 2001; Rothaermel & Alexandre, 2009), and Firm Profitability, measured as the log of operating profit (Ahuja & Morris Lampert, 2001; Yayavaram & Ahuja, 2008).

Moreover, I controlled for a series of patent-based variables that could influence the dependent variable. First, I accounted for Knowledge Stock, measured as the log of the number of patents a firm had applied for in the previous five years (Hoetker & Agarwal, 2007; Quintana-García & Benavides-Velasco, 2008). Second, I controlled for the Number of IPCs, computed as the average number of the distinct IPCs per patent (based on the first four alphanumeric symbols), because literature has shown a positive association between the number of technical classes in which a firm has applied for patents and the citations that these patents have received (Fleming, 2001; George et al., 2008; Sorenson & Fleming, 2004). Third, I included the control variable of Designated States, measured as the log of the average number of states the patent has designated as places in which to take effect, relying on the assumption that the more the designated states of a patent, the greater its impact (Harhoff & Reitzig, 2004). Finally, because DII provides its patent data based on the full patent family and not on single patents (i.e., all the patents that are related to the same invention are considered as one), I controlled for the Patent Family Size, measured as the average number of patents of each patent family, to eliminate the positive bias introduced by counting the same invention multiple times (Gittelman & Kogut, 2003; Lettl et al., 2009).

Additionally, I included dummies to control for country (Lahiri & Narayanan, 2013; Yayavaram & Ahuja, 2008) and industry effects on forward patent citations (Ahuja & Morris Lampert, 2001; Leone & Reichstein, 2012; Nemet & Johnson, 2012). Lastly, I introduced year dummies to control for unobserved time effects (Mayer et al., 2015), and especially to account for citation rates, as the older the patent, the higher the number of its forward citations (Sapsalis et al., 2006; Yayavaram & Ahuja, 2008).

Statistical analysis

The dependent variable is a non-negative, integer, count variable, and although Poisson regression models are appropriate for modeling count data, they are based on the assumption that the dependent variable is drawn from a Poisson distribution, which requires that the mean and variance be equal (Benner & Tripsas, 2012). In cases where this assumption does not hold, data suffers from overdispersion and Poisson regression models could result in biased estimates (Somaya et al., 2007). An alternative to the Poisson regression model is the negative binomial model, which allows the mean and variance to differ and is more appropriate in situations of overdispersion (Guo et al., 2020).

In our case, the variance of the dependent variable is larger than its mean, suggesting the negative binomial distribution as the appropriate model for the statistical analysis. Therefore, I employed a time-series, cross-sectional negative binomial model and a fixed-effects specification to account for the unobserved, time-invariant explanatory variables that may affect the response variable (McFadyen et al., 2009; Onal Vural et al., 2013; Rothaermel & Hess, 2007). In particular, I used the xtnbreg command with the fixed-effects option from Stata 14.0 statistical software. For the estimated coefficients to be comparable, all variables were standardized before including them in the regression models (Carnabuci et al., 2015; Operti & Carnabuci, 2014; Rothaermel & Hess, 2007).

Results

Table 1 depicts the descriptive statistics and correlation matrix for the variables used in the models. Concerning Innovation Performance, a sample firm’s patents filed in a given year received on average 93.41 citations, with a standard deviation of 272.36 and a median of 11. Although the dependent variable is overdispersed and skewed toward zero, this problem was overcome by the negative binomial approach, which produces correct standard errors for count data that are overdispersed (Gittelman & Kogut, 2003; McFadyen et al., 2009). Concerning the presence of multicollinearity, although the three moderators are to an extent conceptually interrelated (e.g., increased R&D collaboration is related to increased knowledge plurality and internal knowledge is part of knowledge plurality), there are no symptoms of multicollinearity among the three moderating variables. The only variables that seem to suffer slightly from it are Internal Focus and Knowledge Stock. However, I calculated the variance inflation factors of all the variables, and their values ranged from 1.33 to 7.80, below the recommended threshold of ten, showing no indication of severe multicollinearity (Vasudeva & Anand, 2011).

Table 2 depicts the results of the fixed-effects negative binomial regressions of R&D Entrepreneurship on Innovation Performance, using the first three alphanumeric symbols of IPC to measure R&D Entrepreneurship. In Models 1, 2, and 3, I report the regression results, considering R&D entrepreneurial activities as inventing in technological domains in which a firm has not been active for the last four, five, and six years, respectively. All regression models include year, country, and industry dummies. The numbers in parentheses are the standard errors and the reported coefficients are the standardized beta coefficients. Finally, as an indication of the models’ goodness-of-fit, the comparison of the log-likelihood statistics suggests that the three models fit the data almost equally.

Before proceeding to the hypotheses, it is noteworthy that R&D Entrepreneurship exerts a positive and statistically significant effect on Innovation Performance in all three models (b = 0.270 in Model 1, b = 0.284 in Model 2, and b = 0.273 in Model 3, all at p < 0.0001 level). This finding supports the argument that, ceteris paribus, the act of entering into new to the firm technological domains for R&D purposes is positively related to an inventive activity that results in important patented inventions, which in turn could lead to commercially successful innovations.

In formulating Hypothesis 1, I proposed that the extent to which a firm builds upon a large number of different knowledge elements to develop new technologies positively moderates the effect of R&D entrepreneurship on innovation performance. In particular, Table 2 shows that the coefficients of the interaction term between R&D Entrepreneurship and Knowledge Plurality are positive and statistically significant in all models (b = 0.073, p < 0.01 in Model 1; b = 0.086, p < 0.001 in Model 2; and b = 0.088, p < 0.001 in Model 3). These results confirm the hypothesis that knowledge plurality favors the innovation success of R&D entrepreneurial activities.

Hypothesis 2 predicted that the degree to which a firm relies upon its previous technological developments to create new knowledge negatively moderates the relationship between R&D entrepreneurship and innovation performance. As Table 1 illustrates, the interaction coefficients between R&D Entrepreneurship and Internal Focus are negative and statistically significant in all models (b = −0.205, p < 0.01 in Model 1; b = −0.236, p < 0.001 in Model 2; and b = −0.229, p < 0.001 in Model 3). These findings support Hypothesis 2, suggesting that firms should avoid building extensively upon their own prior R&D activities when entering into new technological domains.

Finally, in Hypothesis 3, I predicted that the effect of R&D entrepreneurship on innovation performance is negatively moderated by the number of partners with whom a firm collaborates to develop new patented inventions. The results of Table 2 are supportive of the hypothesis. More specifically, the coefficient of the interaction term between R&D Entrepreneurship and R&D Collaboration is negative and statistically significant at p < 0.05 level (b = −0.082) in Model 1, while in Models 2 and 3 the level of significance is at p < 0.10.

It is interesting to note that the moderator with the strongest effect is Internal Focus. Its coefficients are almost triple compared to the coefficients of Knowledge Plurality and R&D Collaboration. This finding indicates the importance of integrating knowledge beyond firm boundaries to innovation performance when engaging in R&D entrepreneurial activities.

For robustness reasons, as noted above, I re-estimated the empirical models using the first four alphanumeric symbols of the IPC instead of the first three, attempting to test whether our results change significantly, if R&D entrepreneurship also incorporates entrepreneurial activities into less unfamiliar knowledge areas. Table 3 presents the results of these empirical models. In support of the main findings, the coefficients and p-values of the independent and moderating variables remain largely at the same levels.

Discussion

Concerning the positive effect of R&D entrepreneurship on innovation performance, the empirical findings corroborate the view that by extending its R&D endeavors beyond its boundaries, a firm enhances recombinant search and expands the variety of possible technological solutions (Vagnani, 2015). The combination of novel knowledge elements from unfamiliar technological domains with knowledge elements from existing domains is probably the key factor of successful innovations, whether they are developed for new or existing markets. However, as the results suggest, there are specific R&D strategies that favor and others that disfavor this particular relationship.

First, knowledge plurality seems to provide effective conditions for the success of R&D entrepreneurship. It could be the plethora of potential knowledge recombinations and technological connections between new and existing knowledge elements, created as a firm enters new technological domains, that boost innovation performance (Jung & Lee, 2016). Or, it could be the synthesis of multiple perspectives and conceptualizations that facilitate the understanding and the creative response to unfamiliar information, stimulating experimentation and generation of new ideas within new domains (Phelps, 2010; Quintana-García & Benavides-Velasco, 2008). Or, finally, using an existing theoretical approach, it could be the increased absorptive capacity, caused by knowledge plurality, that makes a firm capable of exploiting technological opportunities in novel technological areas, first by recognizing their potential and then by developing successful inventions within these domains (Quintana-García & Benavides-Velasco, 2008).

In contrast, internal focus appears to be a barrier to R&D entrepreneurial activities. A firm that relies heavily on its own prior R&D experience is at a relative disadvantage when it comes to entering new technological areas. Without integrating adequate external technological developments, a firm could, to an extent, find itself in a situation of technological isolation, unable to respond effectively to technological change and to technological trajectories that pass outside of its boundaries (Rosenkopf & Nerkar, 2001).

Concerning Hypothesis 3, the results suggest that R&D collaboration creates hurdles to R&D entrepreneurship. In my opinion, the key issue for this moderating effect is the unassimilated knowledge transferred between R&D partners. According to Stettner and Lavie (2014), external sources such as alliances and acquisitions can provide immediate access to new knowledge. However, although knowledge plurality, as measured by citations to prior patents (i.e., assimilated knowledge used to create new inventions), positively moderates the relationship between R&D entrepreneurship and innovation performance, the effect becomes negative when the knowledge is internalized immediately without being adequately assimilated. Even if R&D alliances offer direct access to external knowledge, the resources required for its assimilation are crucial for the success of R&D entrepreneurship. Unassimilated knowledge seems to undermine R&D entrepreneurial efforts.

Conclusions

Pursuing unexploited opportunities and surviving in fast-paced technological environments are probably the most fundamental issues that firms address. By entering into new technological domains for R&D purposes, firms strive, on the one hand, to identify and exploit new entrepreneurial opportunities beyond their boundaries that will lead them to new market areas, and, on the other hand, to cope with and effectively adapt to technological change (McGrath, 2001). In this paper, I consider the R&D activities in new to the firm technological fields as the most representative manifestation of entrepreneurial spirit within large established firms and I refer to it as R&D entrepreneurship.

By viewing R&D entrepreneurship as a purely entrepreneurial activity, it could receive greater managerial attention and be adopted as a strategy that leads to new ventures and growth, creating value for the firm and its stakeholders (Withers et al., 2018). In addition to the growth of individual firms, R&D entrepreneurial orientation could support the growth of an entire economy by enhancing its competitiveness and employment rates (Ireland et al., 2003). As such, R&D entrepreneurship must be taken into serious consideration when designing entrepreneurship policies (Ahmad & Seymour, 2008).

To provide insights into R&D entrepreneurship, this study aimed to detect R&D strategies that influence its efficiency. In particular, I developed three hypotheses attempting to examine whether the degree to which a firm expands its knowledge base (i.e., knowledge plurality), builds upon its own prior R&D endeavors (i.e., internal focus), and participates in R&D alliances (i.e., R&D collaboration) moderates the effect of R&D entrepreneurship on innovation performance. The hypotheses were empirically tested on secondary, longitudinal economic and patent data from the pharmaceutical, biotechnology, and chemical industries.

First of all, the findings corroborated the view that by extending its R&D endeavors beyond its boundaries, a firm improves its innovation outcome, as measured by forward patent citations. Concerning the contingency factors of the effect of R&D entrepreneurship on innovation performance, the empirical results indicated that knowledge plurality exerts a positive moderating effect on this relationship, contrary to internal focus and R&D collaboration, which exert a negative one.

Moreover, the results of the moderating effects may have useful managerial implications. In particular, firms should frequently scan their environment for new and relevant technological developments in order to identify, assimilate, and use important knowledge components that will result in enhanced knowledge plurality, favoring the outcome of their R&D entrepreneurial activities. Additionally, findings suggest that managers must be cautious in collaborating extensively in R&D when entering into new technological areas, to avoid the negative interaction effect on innovation performance.

A key limitation of this study is that it used patent data to track R&D entrepreneurship. However, patent data represent only successful R&D attempts and exclude R&D endeavors that did not result in patents, either because they were unsuccessful or because their outcome remained unpatented as a strategic choice, increasing the possibility of a selection bias (Carnabuci et al., 2015). Another limitation stems from the fact that from the generation of an idea to patent application is a long-lasting process, consisting of numerous actions and sub-processes. As such, it is difficult to assign credit to specific factors at certain points in time for the observed outcome, indicating high levels of causal ambiguity (Ghosh et al., 2014).

I conclude by proposing possible directions for future research. First, this study examined the moderating effect of only three R&D strategies. Future research may consider additional firm-level or industry-level characteristics as potential moderators of the R&D entrepreneurship-innovation performance relationship, advancing our understanding of the favorable conditions for R&D entrepreneurial activities. Second, future efforts could focus on financial performance instead of innovation performance by examining the direct and moderating effects of R&D entrepreneurship on growth and profits. Third, it would also be interesting to expand the research across different industries, in order to investigate whether the results of this study can be generalizable to other research contexts.

As a final note, I hope that this article provides a useful approach to the topic of entrepreneurship within established firms that might be constructive for future relevant research. Managers and policy-makers could reconsider the value of expanding into new knowledge areas for firm growth and survival and for economic wealth, respectively, taking into account which strategies favor and which disfavor R&D entrepreneurship.

References

Ahmad, N., & Seymour, R. G. (2008). Defining Entrepreneurial Activity: Definitions Supporting Frameworks for Data Collection. OECD Statistics Working Papers, 2008/01.

Ahuja, G. (2000). Collaboration networks, structural holes, and innovation: A longitudinal study. Administrative Science Quarterly, 45(3), 425–455.

Ahuja, G., & Morris Lampert, C. (2001). Entrepreneurship in the large corporation: A longitudinal study of how established firms create breakthrough inventions. Strategic Management Journal, 22(6–7), 521–543.

Alencar, M. S. M., Porter, A. L., & Antunes, A. M. S. (2007). Nanopatenting patterns in relation to product life cycle. Technological Forecasting and Social Change, 74(9), 1661–1680.

Alvarez, S. A., & Busenitz, L. W. (2001). The entrepreneurship of resource-based theory. Journal of Management, 27(6), 755–775.

Anand, J., Oriani, R., & Vassolo, R. S. (2010). Alliance activity as a dynamic capability in the face of a discontinuous technological change. Organization Science, 21(6), 1213–1232.

Anzenbacher, A., & Wagner, M. (2020). The role of exploration and exploitation for innovation success: Effects of business models on organizational ambidexterity in the semiconductor industry. International Entrepreneurship and Management Journal, 16(2), 571–594.

Argyres, N. S., & Silverman, B. S. (2004). R&D, organization structure, and the development of corporate technological knowledge. Strategic Management Journal, 25(8–9), 929–958.

Audretsch, D. B., Belitski, M., Caiazza, R., & Lehmann, E. E. (2020). Knowledge management and entrepreneurship. International Entrepreneurship and Management Journal, 16(2), 373–385.

Benner, M. J., & Tripsas, M. (2012). The influence of prior industry affiliation on framing in nascent industries: The evolution of digital cameras. Strategic Management Journal, 33(3), 277–302.

Bierly, P., & Chakrabarti, A. (1996). Generic knowledge strategies in the US pharmaceutical industry. Strategic Management Journal, 17(S2), 123–135.

Bierly, P. E., Damanpour, F., & Santoro, M. D. (2009). The application of external knowledge: Organizational conditions for exploration and exploitation. Journal of Management Studies, 46(3), 481–509.

Brown, T. E., Davidsson, P., & Wiklund, J. (2001). An operationalization of Stevenson's conceptualization of entrepreneurship as opportunity-based firm behavior. Strategic Management Journal, 22(10), 953–968.

Burgelman, R. A. (1983). Corporate entrepreneurship and strategic management: Insights from a process study. Management Science, 29(12), 1349–1364. https://doi.org/10.1287/mnsc.29.12.1349

Carnabuci, G., Operti, E., & Kovács, B. (2015). The categorical imperative and structural reproduction: Dynamics of technological entry in the semiconductor industry. Organization Science, 26(6), 1734–1751.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 128–152.

Corbett, A., Covin, J. G., O'Connor, G. C., et al. (2013). Corporate entrepreneurship: State-of-the-art research and a future research agenda. Journal of Product Innovation Management, 30, 812–820.

Covin, J. G., & Miles, M. P. (1999). Corporate entrepreneurship and the pursuit of competitive advantage. Entrepreneurship Theory and Practice, 23(3), 47–63.

Covin, J. G., & Wales, W. J. (2019). Crafting high-impact entrepreneurial orientation research: Some suggested guidelines. Entrepreneurship Theory and Practice, 43(1), 3–18.

Cozzolino, A., & Rothaermel, F. T. (2018). Discontinuities, competition, and cooperation: Coopetitive dynamics between incumbents and entrants. Strategic Management Journal, 39(12), 3053–3085.

De Carolis, D. M. (2003). Competencies and imitability in the pharmaceutical industry: An analysis of their relationship with firm performance. Journal of Management, 29(1), 27–50.

Dess, G. G., Lumpkin, G. T., & McGee, J. E. (1999). Linking corporate entrepreneurship to strategy, structure, and process: Suggested research directions. Entrepreneurship Theory and Practice, 23(3), 85–102.

Dunlap-Hinkler, D., Kotabe, M., & Mudambi, R. (2010). A story of breakthrough versus incremental innovation: Corporate entrepreneurship in the global pharmaceutical industry. Strategic Entrepreneurship Journal, 4(2), 106–127.

Ellis, R. J., & Taylor, N. T. (1987). Specifying entrepreneurship. In N. C. Churchill, J. A. Hornaday, B. A. Kirchhoff, O.J. Krasner, & K. H. Vesper (Eds.), Frontiers of entrepreneurship research (pp. 527–541). Wellesley, MA: Babson College.

Filippetti, A., & Archibugi, D. (2011). Innovation in times of crisis: National Systems of innovation, structure, and demand. Research Policy, 40(2), 179–192.

Fleming, L. (2001). Recombinant uncertainty in technological search. Management Science, 47(1), 117–132.

Freixanet, J., Braojos, J., Rialp-Criado, A., et al. (2021). Does international entrepreneurial orientation foster innovation performance? The mediating role of social media and open innovation. The International Journal of Entrepreneurship and Innovation, 22(1), 33–44.

George, G., Kotha, R., & Zheng, Y. (2008). Entry into insular domains: A longitudinal study of knowledge structuration and innovation in biotechnology firms. Journal of Management Studies, 45(8), 1448–1474.

Ghosh, A., Martin, X., Pennings, J. M., et al. (2014). Ambition is nothing without focus: Compensating for negative transfer of experience in R&D. Organization Science, 25(2), 572–590.

Gittelman, M., & Kogut, B. (2003). Does good science lead to valuable knowledge? Biotechnology firms and the evolutionary logic of citation patterns. Management Science, 49(4), 366–382.

Glinyanova, M., Bouncken, R. B., Tiberius, V., & Cuenca Ballester, A. C. (2021). Five decades of corporate entrepreneurship research: Measuring and mapping the field. International Entrepreneurship and Management Journal, 17(4), 1731–1757.

Grégoire, D. A., & Shepherd, D. A. (2012). Technology-market combinations and the identification of entrepreneurial opportunities: An investigation of the opportunity-individual nexus. Academy of Management Journal, 55(4), 753–785.

Guo, W., Sengul, M., & Yu, T. (2020). Rivals’ negative earnings surprises, language signals, and firms’ competitive actions. Academy of Management Journal, 63(3), 637–659.

Hagedoorn, J., & Cloodt, M. (2003). Measuring innovative performance: Is there an advantage in using multiple indicators? Research Policy, 32(8), 1365–1379.

Harhoff, D., & Reitzig, M. (2004). Determinants of opposition against EPO patent grants - the case of biotechnology and pharmaceuticals. International Journal of Industrial Organization, 22(4), 443–480.

He, Z. -L., & Wong, P. -K. (2004). Exploration vs. exploitation: An empirical test of the ambidexterity hypothesis. Organization Science, 15(4), 481–494.

Hitt, M. A., Ireland, R. D., Camp, S. M., et al. (2001). Strategic entrepreneurship: Entrepreneurial strategies for wealth creation. Strategic Management Journal, 22(6–7), 479–491.

Hitt, M. A., Ireland, R. D., Sirmon, D. G., et al. (2011). Strategic entrepreneurship: Creating value for individuals, organizations, and society. Academy of Management Perspectives, 25(2), 57–75.

Hoang, H. A., & Rothaermel, F. T. (2010). Leveraging internal and external experience: Exploration, exploitation, and R&D project performance. Strategic Management Journal, 31(7), 734–758.

Hoetker, G., & Agarwal, R. (2007). Death hurts, but it isn't fatal: The postexit diffusion of knowledge created by innovative companies. Academy of Management Journal, 50(2), 446–467.

Hottenrott, H., & Lopes-Bento, C. (2016). R&D partnerships and innovation performance: Can there be too much of a good thing? Journal of Product Innovation Management, 33(6), 773–794.

Ince, H., Imamoglu, S. Z., & Karakose, M. A. (2021). Entrepreneurial orientation, social capital, and firm performance: The mediating role of innovation performance. The International Journal of Entrepreneurship and Innovation, 14657503211055297.

Ireland, R. D., Covin, J. G., & Kuratko, D. F. (2009). Conceptualizing corporate entrepreneurship strategy. Entrepreneurship Theory and Practice, 33(1), 19–46.

Ireland, R. D., Hitt, M. A., & Sirmon, D. G. (2003). A model of strategic entrepreneurship: The construct and its dimensions. Journal of Management, 29(6), 963–989.

Ireland, R. D., Reutzel, C. R., & Webb, J. W. (2005). Entrepreneurship research in AMJ: What has been published, and what might the future hold? Academy of Management Journal, 48(4).

Jung, H. J., & Lee, J. J. (2016). The quest for originality: A new typology of knowledge search and breakthrough inventions. Academy of Management Journal, 59(5), 1725–1753.

Katila, R., & Ahuja, G. (2002). Something old, something new: A longitudinal study of search behavior and new product introduction. Academy of Management Journal, 45(6), 1183–1194.

Kelley, D. J., Peters, L., & O'Connor, G. C. (2009). Intra-organizational networking for innovation-based corporate entrepreneurship. Journal of Business Venturing, 24(3), 221–235.

Kumar, M. V. S. (2010). Differential gains between partners in joint ventures: Role of resource appropriation and private benefits. Organization Science, 21(1), 232–248.

Kuratko, D. F., & Audretsch, D. B. (2009). Strategic entrepreneurship: Exploring different perspectives of an emerging concept. Entrepreneurship Theory and Practice, 33(1), 1–17.

Kuratko, D. F., & Audretsch, D. B. (2013). Clarifying the domains of corporate entrepreneurship. International Entrepreneurship and Management Journal, 9(3), 323–335.

Lahiri, N., & Narayanan, S. (2013). Vertical integration, innovation, and alliance portfolio size: Implications for firm performance. Strategic Management Journal, 34(9), 1042–1064.

Lane, P. J., Koka, B. R., & Pathak, S. (2006). The reification of absorptive capacity: A critical review and rejuvenation of the construct. Academy of Management Review, 31(4), 833–863.

Leone, M. I., & Reichstein, T. (2012). Licensing-in fosters rapid invention! The effect of the grant-back clause and technological unfamiliarity. Strategic Management Journal, 33(8), 965–985.

Lettl, C., Rost, K., & Von Wartburg, I. (2009). Why are some independent inventors 'heroes' and others 'hobbyists'? The moderating role of technological diversity and specialization. Research Policy, 38(2), 243–254.

Lopez-Vega, H., Tell, F., & Vanhaverbeke, W. (2016). Where and how to search? Search paths in open innovation. Research Policy, 45(1), 125–136.

Magelssen, C. (2020). Allocation of property rights and technological innovation within firms. Strategic Management Journal, 41(4), 758–787.

Mayer, M. C. J., Stadler, C., & Hautz, J. (2015). The relationship between product and international diversification: The role of experience. Strategic Management Journal, 36(10), 1458–1468.

McFadyen, M. A., Semadeni, M., & Cannella, Jr, A. A. (2009). Value of strong ties to disconnected others: Examining knowledge creation in biomedicine. Organization Science, 20(3), 552–564.

McGrath, R. G. (2001). Exploratory learning, innovative capacity, and managerial oversight. Academy of Management Journal, 44(1), 118–131.

McKenny, A. F., Short, J. C., Ketchen Jr, D. J., et al. (2018). Strategic entrepreneurial orientation: Configurations, performance, and the effects of industry and time. Strategic Entrepreneurship Journal, 12(4), 504–521.

Moncada-Paternò-Castello, P., Ciupagea, C., Smith, K., et al. (2010). Does Europe perform too little corporate R&D? A comparison of EU and non-EU corporate R&D performance. Research Policy, 39(4), 523–536.

Nemet, G. F., & Johnson, E. (2012). Do important inventions benefit from knowledge originating in other technological domains? Research Policy, 41(1), 190–200.

Nooteboom, B., Van Haverbeke, W., Duysters, G., et al. (2007). Optimal cognitive distance and absorptive capacity. Research Policy, 36(7), 1016–1034.

Onal Vural, M., Dahlander, L., & George, G. (2013). Collaborative benefits and coordination costs: Learning and capability development in science. Strategic Entrepreneurship Journal, 7(2), 122–137.

Operti, E., & Carnabuci, G. (2014). Public knowledge, private gain: The effect of spillover networks on firms' innovative performance. Journal of Management, 40(4), 1042–1074.

Papazoglou, M. E., & Spanos, Y. E. (2018). Bridging distant technological domains: A longitudinal study of the determinants of breadth of innovation diffusion. Research Policy, 47(9), 1713–1728.

Papazoglou, M. E., & Spanos, Y. E. (2021). Influential knowledge and financial performance: The role of time and rivals’ absorptive capacity. Technovation, 102, 102223.

Phan, P. H., Wright, M., Ucbasaran, D., et al. (2009). Corporate entrepreneurship: Current research and future directions. Journal of Business Venturing, 24(3), 197–205.

Phelps, C. C. (2010). A longitudinal study of the influence of alliance network structure and composition on firm exploratory innovation. Academy of Management Journal, 53(4), 890–913.

Putniņš, T. J., & Sauka, A. (2020). Why does entrepreneurial orientation affect company performance? Strategic Entrepreneurship Journal, 14(4), 711–735.

Quintana-García, C., & Benavides-Velasco, C. A. (2008). Innovative competence, exploration and exploitation: The influence of technological diversification. Research Policy, 37(3), 492–507.

Rank, O. N., & Strenge, M. (2018). Entrepreneurial orientation as a driver of brokerage in external networks: Exploring the effects of risk taking, proactivity, and innovativeness. Strategic Entrepreneurship Journal, 12(4), 482–503.

Rosenkopf, L., & Nerkar, A. (2001). Beyond local search: Boundary-spanning, exploration, and impact in the optical disk industry. Strategic Management Journal, 22(4), 287–306.

Rothaermel, F. T., & Alexandre, M. T. (2009). Ambidexterity in technology sourcing: The moderating role of absorptive capacity. Organization Science, 20(4), 759–780.

Rothaermel, F. T., & Hess, A. M. (2007). Building dynamic capabilities: Innovation driven by individual-, firm-, and network-level effects. Organization Science, 18(6), 898–921.

Salvato, C., Sciascia, S., & Alberti, F. G. (2009). The microfoundations of corporate entrepreneurship as an organizational capability. The International Journal of Entrepreneurship and Innovation, 10(4), 279–289.

Sapsalis, E., van Pottelsberghe de la Potterie, B., & Navon, R. (2006). Academic versus industry patenting: An in-depth analysis of what determines patent value. Research Policy, 35(10), 1631–1645.

Schindehutte, M., & Morris, M. H. (2009). Advancing strategic entrepreneurship research: The role of complexity science in shifting the paradigm. Entrepreneurship Theory and Practice, 33(1), 241–276.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25(1), 217–226.

Shankar, R. K., & Shepherd, D. A. (2019). Accelerating strategic fit or venture emergence: Different paths adopted by corporate accelerators. Journal of Business Venturing, 34(5), 105886.

Sharma, P., & Chrisman, S. J. J. (2007). Toward a reconciliation of the definitional issues in the field of corporate entrepreneurship. Entrepreneurship. Springer, pp. 83–103.

Sidhu, J. S., Commandeur, H. R., & Volberda, H. W. (2007). The multifaceted nature of exploration and exploitation: Value of supply, demand, and spatial search for innovation. Organization Science, 18(1), 20–38.

Siren, C. A., Kohtamäki, M., & Kuckertz, A. (2012). Exploration and exploitation strategies, profit performance, and the mediating role of strategic learning: Escaping the exploitation trap. Strategic Entrepreneurship Journal, 6(1), 18–41.

Somaya, D., Williamson, I. O., & Zhang, X. (2007). Combining patent law expertise with R&D for patenting performance. Organization Science, 18(6), 922–937.

Sørensen, J. B., & Stuart, T. E. (2000). Aging, obsolescence, and organizational innovation. Administrative Science Quarterly, 45(1), 81–112.

Sorenson, O., & Fleming, L. (2004). Science and the diffusion of knowledge. Research Policy, 33(10), 1615–1634.

Stettner, U., & Lavie, D. (2014). Ambidexterity under scrutiny: Exploration and exploitation via internal organization, alliances, and acquisitions. Strategic Management Journal, 35(13), 1903–1929.

Stopford, J. M., & Baden-Fuller, C. W. F. (1994). Creating corporate entrepreneurship. Strategic Management Journal, 15(7), 521–536.

Vagnani, G. (2015). Exploration and long-run organizational performance: The moderating role of technological interdependence. Journal of Management, 41(6), 1651–1676.

Vasudeva, G., & Anand, J. (2011). Unpacking absorptive capacity: A study of knowledge utilization from alliance portfolios. Academy of Management Journal, 54(3), 611–623.

Veciana, J. M. (2007). Entrepreneurship as a scientific research programme. Entrepreneurship. Springer, pp. 23–71.

Wales, W. J., Covin, J. G., & Monsen, E. (2020). Entrepreneurial orientation: The necessity of a multilevel conceptualization. Strategic Entrepreneurship Journal, 14(4), 639–660.

Walter, J., Lechner, C., & Kellermanns, F. W. (2016). Learning activities, exploration, and the performance of strategic initiatives. Journal of Management, 42(3), 769–802.

Wang, T., Thornhill, S., & De Castro, J. O. (2017). Entrepreneurial orientation, legitimation, and new venture performance. Strategic Entrepreneurship Journal, 11(4), 373–392.

Wiesenthal, T., Leduc, G., Haegeman, K., et al. (2012). Bottom-up estimation of industrial and public R&D investment by technology in support of policy-making: The case of selected low-carbon energy technologies. Research Policy, 41(1), 116–131.

Wiklund, J., & Shepherd, D. (2003). Knowledge-based resources, entrepreneurial orientation, and the performance of small and medium-sized businesses. Strategic Management Journal, 24(13), 1307–1314.

Withers, M. C., Ireland, R. D., Miller, D., et al. (2018). Competitive landscape shifts: The influence of strategic entrepreneurship on shifts in market commonality. Academy of Management Review, 43(3), 349–370.

Xu, S. (2015). Balancing the two knowledge dimensions in innovation efforts: An empirical examination among pharmaceutical firms. Journal of Product Innovation Management, 32(4), 610–621.

Yayavaram, S., & Ahuja, G. (2008). Decomposability in knowledge structures and its impact on the usefulness of inventions and knowledge-base malleability. Administrative Science Quarterly, 53(2), 333–362.

Yayavaram, S., & Chen, W. (2015). Changes in firm knowledge couplings and firm innovation performance: The moderating role of technological complexity. Strategic Management Journal, 36(3), 377–396.

Zahra, S. A. (2008). The virtuous cycle of discovery and creation of entrepreneurial opportunities. Strategic Entrepreneurship Journal, 2(3), 243–257.

Zahra, S. A., & Covin, J. G. (1995). Contextual influences on the corporate entrepreneurship-performance relationship: A longitudinal analysis. Journal of Business Venturing, 10(1), 43–58.

Zahra, S. A., Nielsen, A. P., & Bogner, W. C. (1999). Corporate entrepreneurship, knowledge, and competence development. Entrepreneurship Theory and Practice, 23(3), 169–189.

Zhang, J. (2016). Facilitating exploration alliances in multiple dimensions: The influences of firm technological knowledge breadth. R&D Management, 46(S1), 159–173.

Zhang, J., & Baden-Fuller, C. (2010). The influence of technological knowledge base and organizational structure on technology collaboration. Journal of Management Studies, 47(4), 679–704.

Zhao, E. Y., Ishihara, M., & Jennings, P. D. (2020). Strategic entrepreneurship's dynamic tensions: Converging (diverging) effects of experience and networks on market entry timing and entrant performance. Journal of Business Venturing, 35(2), 105933.

Zhou, K. Z., & Li, C. B. (2012). How knowledge affects radical innovation: Knowledge base, market knowledge acquisition, and internal knowledge sharing. Strategic Management Journal, 33(9), 1090–1102.

Zhu, S., Hagedoorn, J., Zhang, S., et al. (2021). Effects of technological distance on innovation performance under heterogeneous technological orientations. Technovation, 106, 102301.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Papazoglou, M.E. Favorable strategies for the success of entry into new technological areas: an entrepreneurial perspective. Int Entrep Manag J 19, 403–426 (2023). https://doi.org/10.1007/s11365-022-00828-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-022-00828-z