Abstract

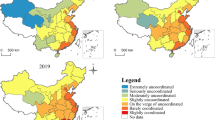

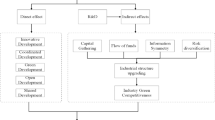

Green finance has become an important reform force to promote the sustainable development of China's economy. Therefore, it has a great significance for in-depth analysis of the advantages and disadvantages of regional green finance development, to further promote it by clarifying and predicting the regional differences and dynamic evolution trends. Based on this, this paper will select the relevant index from 2001 to 2020 to construct China Green Finance Core Network (CGFCN) in different years by using Space-L method at the first, then analyze its network characteristics and spatial evolution pattern in depth, and finally predict the future development trend of CGFCN by link prediction. The research results show that: firstly, the evolution of CGFCN is mainly divided into three stages: rapid development, stable development and optimal development, and the closeness of CGFCN is constantly improving. Besides, two strong relationship networks are gradually forming, that is Beijing-Tianjin region and the Yangtze River Detla region. Secondly, with the development of green finance, the community division has changed. It is mainly divided into four communities, named the Beijing-Tianjin-Hebei leading community, the eastern provincial community, the Yangtze River Delta community and the central and southern joint community. Different communities will have different integration in different periods. Thirdly, the future development direction of green finance network is mainly Beijing-Tianjin-Hebei region and Yangtze River Delta regions, and their outward radiation are mainly shown in the eastern coastal and central regions, which also have strong development potential. In this regard, it is proposed to coordinate development across provinces to speed up the "urban integration" of green finance services; Establish an efficient community development mechanism and promote the interconnection of green finance markets and infrastructure between different regions; Strengthen the resource flow among regions and coordinate the resource competition of green finance.

Similar content being viewed by others

Data availability

The data of this study come from the China Statistical Yearbook, Statistical Yearbook of each province, China Insurance Yearbook and National Bureau of Statistics.

References

Barabási AL, Albert R (1999) Emergence of scaling in random networks. Science 286:509–512. https://doi.org/10.1126/science.286.5439.509

Bargigli L, Di Iasio G, Infante L et al (2015) The multiplex structure of interbank networks. Quant Finance 15(04):673–691. https://doi.org/10.1080/14697688.2014.968356

Battiston S, Catanzaro M (2004) Statistical properties of corporate board and director networks. Eur Phys J B 38(02):345–352. https://doi.org/10.1140/epjb/e2004-00127-8

Borch OJ, Huse M (1993) Informal strategic networks and the board of directors. Entrep Theory Pract 18(01):23–36. https://doi.org/10.1177/104225879301800102

Bracking S (2019) Financialisation, Climate Finance, and the calculative challenges of managing environmental change. Antipode 51(03):709–729. https://doi.org/10.1111/anti.12510

Cao H, Lin T, Li Y et al (2019) Stock price pattern prediction based on complex network and machine learning. Complexity 10(2019):1–12. https://doi.org/10.1155/2019/4132485

Crucitti P, Latora V, Porta S (2006) Centrality in Networks of Urban Streets. Chaos 16(01):015113. https://doi.org/10.1063/1.2150162

Delpini D, Battiston S, Riccaboni M et al (2013) Evolution of Controllability in Interbank Networks. Sci Rep 3(01):1–5. https://doi.org/10.1038/srep01626

Descheneau P, Paterson M (2011) Between desire and routine: Assembling environment and finance in carbon market. Antipode 43(03):662–681. https://doi.org/10.1111/j.1467-8330.2011.00885.x

Ding R, Zhang YL, Zhang T et al (2022) Influence of evolution of urban rail transit networks on urban spatial correlation effect. Railway Transport Econ 44(04):52–58. https://doi.org/10.16668/j.cnki.issn.1003-1421.2022.04.08. 78 In Chinese

Ding R, Zhang YL, Zhou T et al (2022) Influence of evolution of rail transit complex network on urban community division. J Railway Sci Eng 19(11):3168–3178. https://doi.org/10.19713/j.cnki.43-1423/u.t20211330. In Chinese

Ding R, Ujang N, Hamid H B, et al (2019). Application of complex networks theory in urban traffic network researches. Netw Spatial Econ 19(04):. https://doi.org/10.1007/s11067-019-09466-5

Flammer C (2021) Corporate green bonds. J Financ Econ 142(02):499–516. https://doi.org/10.1016/j.jfineco.2021.01.010

Hu HM, Lian SH (2021) The development of green finance and the change of industrial structure in china- a multidimensional perspective based on grey, coupling, and spatial connection networks. Finance Econ 9:51–59. https://doi.org/10.19622/j.cnki.cn36-1005/f.2021.09.006. In Chinese

Hu Y, Zheng J (2022) How does green credit affect carbon emissions in china? A theoretical analysis framework and empirical study. Environ Sci Pollut Res 29:59712–59726. https://doi.org/10.1007/s11356-022-20043-1

Huang XW, Zong SW, Lin YK (2022) Regional Differences and Innovative Effects of Green Finance Development. Stat Dec 38(24):139–142. https://doi.org/10.13546/j.cnki.tjyjc.2022.24.027. In Chinese

Hyun S, Park D, Tian S (2020) The price of going green: the role of greenness in green bond markets. Account Finance 60(01):73–95. https://doi.org/10.1111/acfi.12515

Li YJ, Xiao LM (2021) Analysis on the spatial structure characteristics and influencing factors of china’s green financial network: from the perspective of enterprise-city network retranslation model. World Reg Stud 30(01):101–113. https://doi.org/10.3969/j.issn.1004-9479.2021.01.2019314. In Chinese

Li H, Yuan YC, Wang N (2019) Evaluation on the coupling and coordinated development of regional green finance and ecological environment. Stat Dec 35(08):161–164. https://doi.org/10.13546/j.cnki.tjyjc.2019.08.038 In Chinese

Liu R, Wang D, Zhang L et al (2019) Can green financial development promote regional ecological efficiency? A case study of china. Nat Hazards 95(1–2):1–17. https://doi.org/10.1007/s11069-018-3502-x

Lü L, Zhou T (2011) Link prediction in complex networks: A survey. Physica A 390(6):1150–1170. https://doi.org/10.1016/j.physa.2010.11.027

Lv C, Bian B, Lee CC et al (2021) Regional gap and the trend of green finance development in china[J]. Energy Econ 102:105476. https://doi.org/10.1016/j.eneco.2021.105476

Lv K, Pan JB, Zhou YL et al (2022) Government intervention, green finance and regional innovation capability- evidence from panel data of 30 provinces. Forum Sci Technol China 10:116–126. https://doi.org/10.13580/j.cnki.fstc.2022.10.004 In Chinese

Mahat TJ, Bláha L, Uprety B et al (2019) Climate finance and green growth: reconsidering climate-related institutions, investments, and priorities in nepal. Environ Sci Eur 31:46. https://doi.org/10.1186/s12302-019-0222-0

Migliorelli M (2021) What do we mean by sustainable finance? Assessing existing frameworks and policy risks. Sustainability 13(02):975. https://doi.org/10.3390/su13020975

Newman M (2003) The structure and function of complex networks. SIAM Rev 45(02):167–256. https://doi.org/10.1137/S003614450342480

Nian W, Dong X (2022) Spatial correlation study on the impact of green financial development on industrial structure upgrading. Front Environ Sci 10:1017159. https://doi.org/10.3389/fenvs.2022.1017159

Peng S (2019) Research on the development of green finance from the perspective of financial function. Finance Econ 7:92–96. https://doi.org/10.19622/j.cnki.cn36-1005/f.2019.07.015 In Chinese

Peron T, Costa L, Rodrigues FA (2012) The structure and resilience of financial market networks. Chaos: Interdiscip J Nonlinear Sci 22(01):013117. https://doi.org/10.1063/1.3683467

Ramirez-Marquez JE, Rocco CM, Barker K et al (2018) Quantifying the resilience of community structures in networks. Reliab Eng Syst Saf 169:466–474. https://doi.org/10.1016/j.ress.2017.09.019

Reggiani A (2013) Network resilience for transport security: some methodological considerations. Transp Policy 28:63–68. https://doi.org/10.1016/j.tranpol.2012.09.007

Shahbaz M, Hye QM, Tiwari A et al (2013) Economic growth, energy consumption, financial development, international trade and co2 emissions in indonesia. Renew Sustain Energy Rev 25:109–121. https://doi.org/10.1016/j.rser.2013.04.009

Sterbenz JP, Hutchison D, Çetinkaya EK et al (2010) Resilience and survivability in communication networks: strategies, principles, and survey of disciplines. Comput Netw 54(08):1245–1265. https://doi.org/10.1016/j.comnet.2010.03.005

Strogatz SH (2001) Exploring complex networks. Nature 410(6825):268–276. https://doi.org/10.1038/35065725

Taghizadeh-Hesary F, Yoshino N (2019) The way to induce private participation in green finance and investment. Financ Res Lett 31:98–103. https://doi.org/10.1016/j.frl.2019.04.016

Verdecho MJ, Alfaro-Saiz JJ, Rodriguez-Rodriguez R et al (2012) A multi-criteria approach for managing inter-enterprise collaborative relationships. Omega 40(03):249–263. https://doi.org/10.1016/j.omega.2011.07.004

Walter C (2020) Sustainable financial risk modelling fitting the sdgs: some reflections. Sustainability 12(18):7789. https://doi.org/10.3390/su12187789

Wang Q, Li XD (2021) Research on the impact of green bonds on corporate value. Econ Rev J 9:100–108. https://doi.org/10.16528/j.cnki.22-1054/f.202109100 In Chinese

Wang X, Wang Y (2021) Research on the green innovation promoted by green credit policies. J Manag World 37(06):173–188+11. https://doi.org/10.19744/j.cnki.11-1235/f.2021.0085 In Chinese

Wang C, Peng D, Nie P et al (2017) Green insurance subsidy for promoting clean production innovation. J Clean Prod 48(04):111–117. https://doi.org/10.1016/j.jclepro.2017.01.145

Watts DJ, Strogatz SH (1998) Collective dynamics of “small-world” networks. Nature 393(6684):440–444. https://doi.org/10.1038/30918

Wen SY, Lin ZF, Liu XL (2022) Green finance and economic growth quality: construction of general equilibrium model with resource constraints and empirical test. Chin J Manag Sci 30(03):55–65. https://doi.org/10.16381/j.cnki.issn1003-207x.2020.2173 In Chinese

Wu CS, Ang H (2022) Spatiotemporal Variations in the Efficiency of Green Finance in China and its Enhancement Paths. Resources Sci 44(12):2456–2469. https://doi.org/10.18402/resci.2022.12.06 In Chinese

Yang LJ, Wang J, Yang YC (2022) Spatial evolution and growth mechanism of urban networks in western China: A multi-scale perspective. J Geogr Sci 32:517rnal. https://doi.org/10.1007/s11442-022-1959-8

Yin J, Zhen F, Wang C (2011) Study on the urban network pattern of China based on the layout of financial enterprises. Econ Geogr 31(05):754–759. https://doi.org/10.15957/j.cnki.jjdl.2011.05.009

Yin X, Xu Z (2022). An empirical analysis of the coupling and coordinative development of china's green finance and economic growth. Resources Policy 75:. https://doi.org/10.1016/j.resourpol.2021.102476

Zahan I, Chuanmin S (2021) Towards a green economic policy framework in china: role of green investment in fostering clean energy consumption and environmental sustainability. Environ Sci Pollut Res 28:43618–43628. https://doi.org/10.1007/s11356-021-13041-2

Zheng J Y, Hu Y (2023). Can green credit drive the “Greening” of the financial system and enterprise emission reduction?- based on evolutionary game analysis. Chin J Manag Sci 1–12. https://doi.org/10.16381/j.cnki.issn1003-207x.2022.0762 (In Chinese)

Zheng JY, Hu Y (2021) Is green credit a good tool to achieve “double carbon” goal? based on coupling coordination model and pvar model. Sustainability 13(24):14074. https://doi.org/10.3390/su132414074

Zhou T, Ding R, Du Y et al (2022) Study on the coupling coordination and spatial correlation effect of green finance and high-quality economic development—evidence from china. Sustainability 14(6):3137. https://doi.org/10.3390/su14063137

Funding

This study is supported by Guizhou Key Laboratory of Big Data Statistical Analysis (No.[2019]5103) and the Guizhou University of Finance and Economics 2021 Annual Research Grant for Current Students Project No. (2021ZXSY03).

Author information

Authors and Affiliations

Contributions

Data curation: Shihui Chen, Kexin Wang; Methodology: Linyu Du, Jun Fu; Resources: Wenqian Xiao; Supervision: Lina Peng; Writing-original draft: Yiming Du, Juan Liang; Writing—review & editing: Rui Ding.

Corresponding author

Ethics declarations

Ethical Approval

Written informed consent for publication of this paper was obtained from all authors.

Consent to Participate

all author consent to participate.

Consent to Publish

all author consent to publish.

Competing Interests

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ding, R., Du, Y., Du, L. et al. Green finance network evolution and prediction: fresh evidence from China. Environ Sci Pollut Res 30, 68241–68257 (2023). https://doi.org/10.1007/s11356-023-27183-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-27183-y